Eightcap vs Blackbull Markets: Which One Is Best?

As you follow through with this review of BlackBull Markets and Eightcap, you will realise that both broker offer the best trading platform from MetaTrader 4 and 5, while both offering their proprietary trading platforms and social trading options. Find out which broker suits you the best.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most crucial trading factors to help you make an informed decision.

- Eightcap generally offers lower spreads across major forex pairs.

- Eightcap charges a commission of $3.50.

- Blackbull Markets charges a lower commission of $3.00 per lot.

- Blackbull Markets has a slight edge due to its wider range of social trading features.

- Neither broker charges fees for deposits and withdrawals, making it cost-effective for frequent money transfers.

- Both brokers offer MetaTrader 4 and 5, but Blackbull Markets has additional social trading options.

1. Lowest Spreads And Fees – BlackBull Markets

Our featured brokers, BlackBull Markets and Eightcap, have their pros and cons when it comes to spreads and fees. The latter generally offers lower spreads across major forex pairs, making it a cost-effective choice for traders who focus on these markets. While the former

- Eightcap offers lower spreads on major forex pairs.

- Blackbull Markets charges a lower commission of $3.00 per lot.

- Eightcap charges a $3.50 commission per lot on its RAW account.

- Both brokers offer zero deposit and withdrawal fees.

BlackBull Markets, on the other hand, charges a lower commission of $3.00 per lot, which can make a significant difference for high-volume traders. They also offer a more extensive range of CFDs, which might come with different fee structures. The aformentioned also offers a Zero Spread Accounts with tighter spreads starting from 0.1 pips for traders seeking lower spreads.

Our Lowest Spreads and Fees Verdict

Blackbull Markets takes the lead in this category due to its lowest spreads and fees.

BlackBull Markets ReviewVisit BlackBull Markets

2. Better Trading Platform – BlackBull Markets

In this part, we see that both brokers offer a range of trading platforms to cater to different trading styles and preferences.

| Trading Platform | Eightcap | Blackbull Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | Yes |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

MetaTrader 4 and 5

Both Eightcap and BlackBull Markets offer MetaTrader 4 and 5, the most popular trading platforms in the forex industry. These platforms are known for their advanced charting tools, automated trading capabilities, and wide range of available indicators.

cTrader and TradingView

Meanwhile, BlackBull Markets offers both cTrader and TradingView, these platforms are known for their advanced and sophisticated trading tools, and powerful charting tools and technical analysis capabilities. In addition, their MetaTrader offerings should satisfy most traders’ needs.

Social And Copy Trading

Eightcap offers MetaTrader signals for social and copy trading. This feature allows traders to follow and copy the trades of successful traders directly on the MetaTrader platform.

On the other hand, BlackBull Markets offers a more extensive range of social and copy trading options. In addition to MetaTrader signals, they also offer ZuluTrade, Myfxbook, and their proprietary BlackBull Social platform. These platforms provide traders with a variety of options to follow and copy trades from successful traders.

BlackBull Markets apparently wins this portion due to its wider range of social and copy trading options, providing more flexibility for traders interested in these features.

Automated Trading

Eightcap and BlackBull Markets Automated Trading Tools

Eightcap and BlackBull Markets both offer tools for automated trading. These tools can be used to create and implement trading strategies that are executed automatically, without the need for manual intervention.

Overview: Both brokers offer solid options for automated trading. However, Eightcap takes the lead in this category due to its integration with Capitalise.ai, providing its clients with a more comprehensive set of tools for automating their trading strategies.

VPS and Other Trading Tools

Both brokers offer VPS services for traders who use automated trading strategies. They also offer various trading tools such as economic calendars, market news, and analysis.

Our Better Trading Platform Verdict

BlackBull Markets procured first place due to them having better trading platform.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

3. Superior Accounts And Features – BlackBull Markets

Eightcap offers two types of accounts:

- Standard Account and

- Raw Account.

The Standard Account has no commission, but comes with higher spreads, while the Raw Account has lower spreads and a commission per trade. On the other hand, BlackBull Markets offers three types of accounts: the

- Standard Account.

- Prime Account.

- Institutional Account.

The Prime and Institutional accounts are ECN accounts with lower spreads, but comes with a higher minimum deposit requirements.

| Eightcap | Blackbull Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

BlackBull Markets attains recognition with this category due to its superior accounts and features.

4. Best Trading Experience And Ease – BlackBull Markets

When it comes to trading experience, both brokers have their merits. Eightcap takes the lead in automated trading due to its integration with Capitalise.ai. This gives traders like us a more comprehensive set of tools for automating trading strategies.

- Eightcap offers Expert Advisors (EAs) and Capitalise.ai for automated trading.

- Blackbull Markets also offers Expert Advisors (EAs) but lacks Capitalise.ai.

- Blackbull Markets offers a wider range of social and copy trading options.

- Both brokers provide VPS services for automated trading.

Blackbull Markets, on the other hand, excels in social and copy trading. They offer MetaTrader signals, ZuluTrade, Myfxbook, and their proprietary BlackBull Social platform. This gives traders more flexibility and options to follow and copy trades from successful traders. Thus making it more an enriched trading experience, especially for traders looking for social and copy trading options. The additional features provide a more versatile trading environment, making it the better choice for traders seeking a comprehensive trading experience.

Our Best Trading Experience and Ease Verdict

BlackBull Markets scores it big for having the best trading experience and ease.

5. Stronger Trust And Regulation – BlackBull Markets

In forex trading, establishing a secure and transparent environment relies heavily on strong trust and regulation.

BlackBull Markets Trust Score

Eightcap Trust Score

When it comes to trust and regulation, it’s crucial to consider various factors to determine which broker offers a more secure trading environment. Here’s how Eightcap and BlackBull Markets stack up:

| Criteria | Eightcap | Blackbull Markets |

|---|---|---|

| Regulatory Body | ASIC | FCA |

| Segregated Client Funds | Yes | Yes |

| Years in Industry | Since 2009 | Newer but reputable |

| Transparency | Good | Excellent |

| Consumer Protections | Strong | Stronger |

Eightcap is regulated by ASIC, a well-respected regulatory body in the financial industry. On the other hand, BlackBull Markets was founded in 2014 and has a lower Trust score of 63, but only well-known by experienced traders or within New Zealand. The broker does have ‘tier 1’ regulation with the FMA (New Zealand) and a superior TrustPilot score of 4.8 based on over 2,000 reviews.

- Blackbull Markets is regulated by the FCA, another top-tier and highly respected regulatory body.

- Blackbull Markets, although newer, has quickly gained a strong reputation for transparency and reliability.

- Eightcap has been in the industry since 2009, which adds to its credibility.

- Both brokers maintain segregated client funds, adding an extra layer of security.

With this data, we can see that BlackBull Markets has a slight advantage in the area of trust and regulation due to its FCA regulation. The Financial Conduct Authority is renowned for its rigorous regulatory standards and robust consumer protections. While Eightcap’s ASIC regulation is also commendable, the FCA’s reputation for stringent oversight gives Blackbull Markets an extra layer of credibility and security that is highly valued by traders.

| Eightcap | Blackbull Markets | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) | FMA (New Zealand) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | SCB (Bahamas) | FSA-S (Seychelles) |

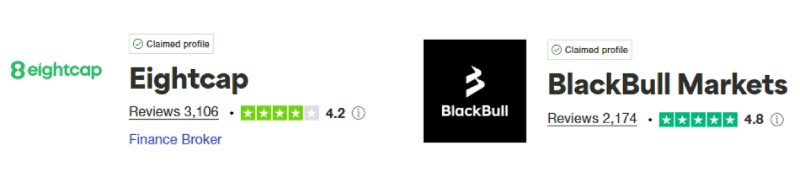

Reviews

Eightcap holds a solid Trustpilot rating of 4.2 out of 5, based on over 3,100 reviews. BlackBull Markets stands out with an impressive Trustpilot score of 4.8 out of 5, drawn from more than 2,100 reviews. While both brokers are well-regarded, BlackBull Markets enjoys a higher overall rating and stronger user sentiment, especially for service quality.

Our Stronger Trust and Regulation Verdict

Blackbull Markets evidently aces this category because of their stronger trust and regulation.

6. Most Popular Broker – Eightcap

Eightcap gets searched on Google more than BlackBull Markets. On average, Eightcap sees around 40,500 branded searches each month, while BlackBull Markets gets about 18,100 — that’s 55% fewer.

| Country | Eightcap | BlackBull Markets |

|---|---|---|

| Thailand | 9,900 | 210 |

| Australia | 2,400 | 1,900 |

| Canada | 2,400 | 590 |

| United States | 1,900 | 880 |

| United Kingdom | 1,600 | 1,600 |

| India | 1,300 | 1,300 |

| Germany | 1,000 | 1,600 |

| Brazil | 1,000 | 110 |

| Malaysia | 880 | 170 |

| Spain | 720 | 480 |

| France | 720 | 210 |

| Colombia | 720 | 170 |

| Italy | 590 | 320 |

| Indonesia | 590 | 140 |

| Argentina | 590 | 170 |

| South Africa | 480 | 720 |

| Netherlands | 480 | 320 |

| Singapore | 390 | 110 |

| Nigeria | 390 | 170 |

| Pakistan | 320 | 210 |

| Sweden | 320 | 140 |

| Mexico | 320 | 480 |

| Dominican Republic | 320 | 40 |

| Poland | 260 | 170 |

| Morocco | 210 | 90 |

| United Arab Emirates | 210 | 140 |

| Philippines | 210 | 50 |

| Portugal | 210 | 70 |

| New Zealand | 210 | 1,900 |

| Kenya | 170 | 110 |

| Switzerland | 170 | 140 |

| Vietnam | 170 | 70 |

| Hong Kong | 170 | 30 |

| Bangladesh | 140 | 70 |

| Taiwan | 140 | 20 |

| Austria | 140 | 210 |

| Japan | 140 | 50 |

| Chile | 140 | 50 |

| Peru | 140 | 50 |

| Turkey | 110 | 90 |

| Algeria | 110 | 50 |

| Venezuela | 110 | 50 |

| Ireland | 110 | 70 |

| Ecuador | 110 | 70 |

| Greece | 90 | 90 |

| Cyprus | 90 | 170 |

| Egypt | 90 | 40 |

| Cambodia | 90 | 10 |

| Uzbekistan | 90 | 30 |

| Saudi Arabia | 70 | 40 |

| Ghana | 70 | 50 |

| Uganda | 70 | 50 |

| Mongolia | 70 | 10 |

| Sri Lanka | 50 | 70 |

| Tanzania | 30 | 30 |

| Ethiopia | 30 | 20 |

| Jordan | 30 | 10 |

| Botswana | 30 | 30 |

| Bolivia | 30 | 30 |

| Costa Rica | 30 | 10 |

| Mauritius | 20 | 10 |

| Panama | 20 | 10 |

9,900 1st | |

210 2nd | |

2,400 3rd | |

1,900 4th | |

1,900 5th | |

880 6th | |

1,300 7th | |

1,300 8th |

Similarweb shows a different story when it comes to February 2024 website visits with Eightcap receiving 259,000 visits vs. 415,000 for BlackBull Markets.

Our Most Popular Broker Verdict

Eightcap is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – BlackBull Markets

| CFDs | Eightcap | BlackBull Markets |

|---|---|---|

| Forex Pairs | 61 | 67 |

| Indices | 16 | 12 |

| Commodities | 8 Commodities Softs and Metals | 10 Metals 3 Energies 7 Soft Commodities 9 Hard Commodities |

| Cryptocurrencies | 95 Crypto | 16 |

| Shares CFDs | 586 | 2,000+ |

| ETFs | No | No |

| Bonds | No | No |

| Futures | No | Yes |

| Treasuries | No | No |

| Investment | No | Yes |

We can see in this list that while both brokers offer a wide range of forex pairs and commodities, Blackbull Markets apparently offers a more extensive range of CFDs, including stocks, bonds, and ETFs, which allows traders to diversify their portfolio more effectively, making it a more versatile option. These aforementioned features are not available with Eightcap.

Our Top Product Range and CFD Markets Verdict

Blackbull Markets comes out on top due to their top product range and CFD market.

8. Superior Educational Resources – BlackBull Markets

We can see in this portion how important infomation is for both BlackBull Markets and EightCap. Apperently, the latter offers basic educational resources, mostly aimed at beginner traders. They provide webinars, articles, and an FAQ section to get you started. While the former provides comprehensive webinars and seminars for both beginners and advanced traders.

- Eightcap offers webinars and articles for beginners.

- Blackbull Markets provides advanced webinars and eBooks.

- Blackbull Markets offers a demo account.

- Blackbull Markets provides more in-depth market analysis.

- Eightcap lacks a demo account for practice.

- Both brokers offer an FAQ section.

Eightcap offers basic educational resources aimed mostly at beginner traders. In contrast to BlackBull Markets’ more comprehensive educational suite, including advanced webinars, eBooks, and in-depth market analysis as well as extensive FAQ section addressing common queries and concerns.

Our Superior Educational Resources Verdict

Blackbull Markets outperforms in this portion owing to their superior educational resources.

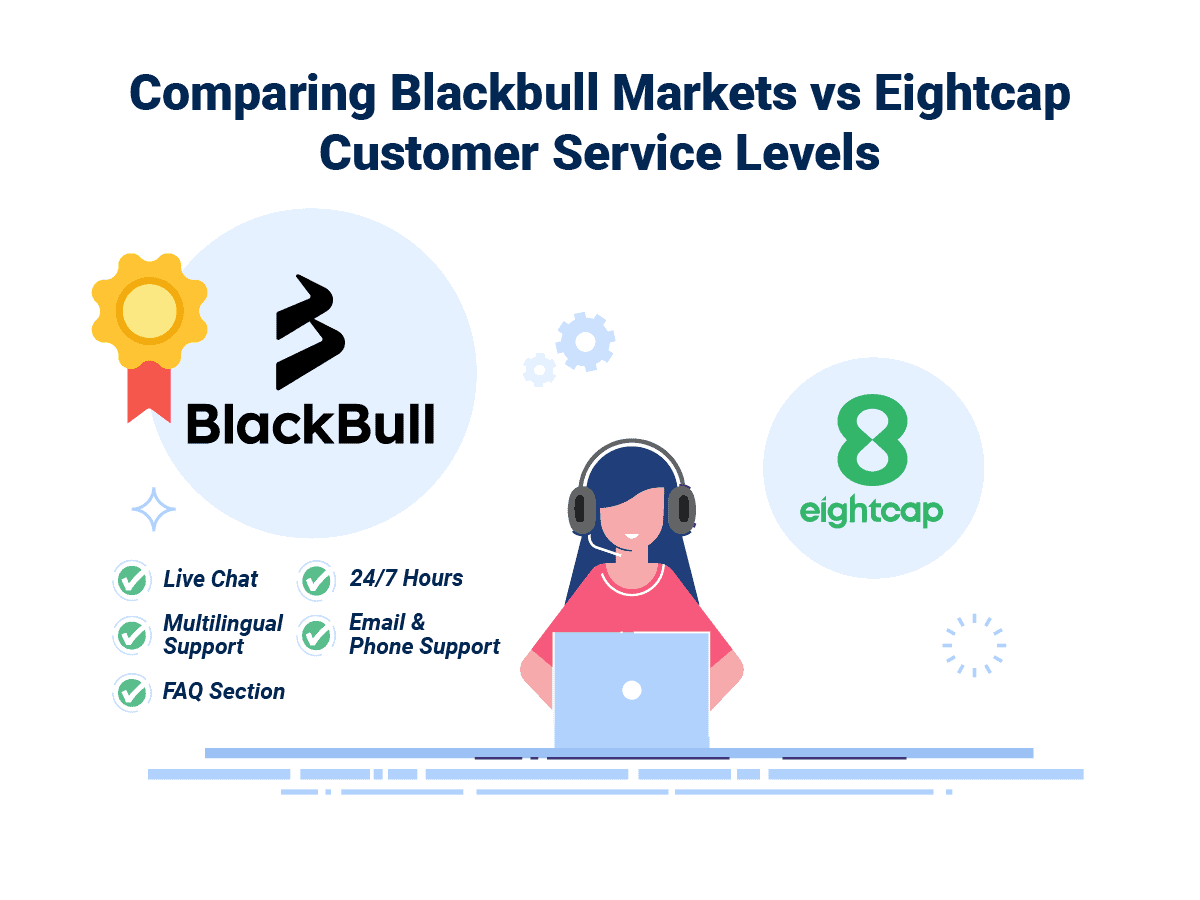

9. Superior Customer Service – BlackBull Markets

Eightcap offers decent customer service, but it’s not 24/7. They’re available during trading hours, which could be a limitation for some traders. Meanwhile, BlackBull Markets provides 24/7 customer support, in which it gives them the upper hand.

| Feature | Eightcap | BlackBull Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/6 |

| Multilingual Support | Yes | Yes |

Eightcap offers decent customer service, but falls short of BlackBull Markets, to which they provide a 24/7 customer support and multiple language options that is more accessible and user-friendly option, particularly for traders who may need assistance outside of standard trading hours.

Our Superior Customer Service Verdict

BlackBull Markets secures first place due to having superior customer service.

10. Better Funding Options – BlackBull Markets

Both BlackBull Markets and Eighcap offer a variety of funding options, but the former apparently takes the lead with more choices, and that they offer more e-wallet options, making it easier for traders to fund their accounts.

| Funding Option | Eightcap | BlackBull Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Both BlackBull Markets and Eightcap offer multiple funding options. However, BlackBull Markets provides a wider variety, including more e-wallet options and cryptocurrencies.

Our Better Funding Options Verdict

BlackBull Markets nails it due to their better funding options.

11. Lower Minimum Deposit – BlackBull Markets

It is evident here that BlackBull Markets has a lower minimum deposit of $0 compared to Eightcap’s $100 minimum deposit. Each broker has different payment channels for funding as well as availability of base currencies. Keep in mind that having lower minimum deposit will show how accessible a broker is for different types of traders, from beginners to seasoned professionals.

BlackBull Markets

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 | $50 | €50 | $50 |

| Bank Wire | £0 | $0 | €0 | $0 |

| Skrill | £50 | $50 | €50 | $50 |

| Neteller | £50 | $50 | €50 | $50 |

Eightcap

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | N/A | $100 | €100 | N/A |

| Neteller | N/A | $100 | €100 | N/A |

Our Lower Minimum Deposit Verdict

BlackBull Markets win by a mile with their lower minimum deposit.

Is Blackbull Markets Or Eightcap The Best Broker?

In this aspect, we see that Blackbull Markets prevails owing to having a more comprehensive range of services, from lower fees to better educational resources. The table below summarises the key information leading to this verdict.

| Criteria | Eightcap | BlackBull Markets |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ❌ | ✅ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

BlackBull Markets: Best For Beginner Traders

BlackBull Markets is better suited for beginner traders due to its lower minimum deposit.

BlackBull Markets: Best For Experienced Traders

Blackbull Markets is the go-to broker for experienced traders, offering a wide range of advanced features.

FAQs Comparing Eightcap vs Blackbull Markets

Does Blackbull Markets or Eightcap Have Lower Costs?

Blackbull Markets generally offers lower costs. They charge a lower commission of $6 per lot, compared to Eightcap’s $7. For more details on low-cost brokers, check out our lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and Blackbull Markets offer MetaTrader 4. However, Blackbull Markets has additional social trading features. For more on MT4 brokers, visit our Best MT4 Brokers.

Which Broker Offers Social Trading?

Blackbull Markets excels in social and copy trading options. They offer platforms like ZuluTrade and Myfxbook. For more on social trading, check out the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Eightcap nor Blackbull Markets offer spread betting. For more on spread betting, you can visit best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap is superior for Australian traders. They are ASIC regulated and founded in Australia. For more information, visit the Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

I believe Blackbull Markets is superior for UK traders. They are FCA regulated and offer a wide range of services tailored for the UK market. For more details, check out Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is Eightcap a market maker?

No, Eightcap has no dealing desk so do not make the market.

Who are BlackBull Markets liquidity providers?

The Liquidity providers for BlackBull Markets are ABN-AMRO, ANZ, Bank of America, Barclays, BNP Paribas, Citibank, CommerzBank, Credit Suisse, Deutsche Bank, HSBC, JPMorgan, Chase Standard Chartered, RBS and UBS.