Eightcap vs CMC Markets

This review of Eightcap and CMC Markets will provide a comprehensive analysis of how these two brokers operate in the realm of forex trading. We will thoroughly examine the strengths and weaknesses of each broker, delivering valuable insights for traders who are eager to determine which option best suits their preferences. Let’s take a closer look and discover more about these two brokers.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 16:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do CMC Markets Vs Eightcap Compare?

Our comprehensive comparison covers the 10 most important trading factors to help you make an informed decision between Eightcap and CMC Markets.

- Eightcap offers a Raw Account with STP/ECN-style features.

- Eightcap consistently offers a spread of 1.0 for most forex pairs.

- Eightcap is the leading broker for cryptocurrency CFDs, offering over 250 different options.

- CMC Markets is regulated by more global agencies, offering potentially stronger regulatory protection.

- CMC Markets offers a broader range of trading products, including over 7000 stocks and 338 forex pairs.

- Both brokers offer MetaTrading 4, as well with Social + Copy Trading feature

1. Lowest Spreads And Fees – EightCap

Join us as we explore the ins and outs of Eightcap and CMC Markets and discover its strengths and weaknesses. Let us take a look on their strengths and weaknesses. Brokers with low spreads and fees attract clients, leading to higher trading volumes and revenue. Competitive pricing boosts a broker’s reputation, appealing to cost-conscious traders.

The two most significant costs you may incur when trading forex or other contract-for-differences (CFDs) are the spread cost and commission fees.

On a standard account with forex brokers, you can expect to only pay a spread cost. However, remember to keep in mind that this spread will be above market prices, as your broker artificially increases it as their service fee.

Both EightCap and CMC Markets provide you with a standard account, however, if you trade share CFDs on CMC Markets, you can still expect to pay a commission fee on top of your spread cost.

Some brokers also provide you with access to an STP or ECN-style account. This type of account sees your broker connect all of your trades with their liquidity partners, giving you access to market-price spreads. To facilitate this, brokers will add on a commission fee in lieu of the artificially increased spreads.

CMC Markets does not offer you an STP/ECN-style account, however, it is available with EightCap as their ‘Raw Account’, giving EightCap the win by default in this category.

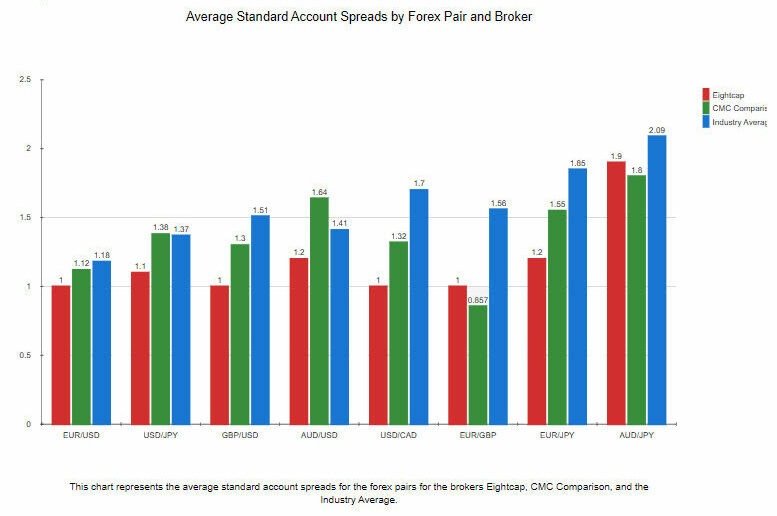

Standard Account Spreads

When it comes to standard account spreads, both Eightcap and CMC Comparison have their own strengths. Looking at the data, Eightcap consistently offers a spread of 1.0 for most of the forex pairs, with the exception of AUD/USD and AUD/JPY, which have spreads of 1.2 on both pairs. This consistency can be appealing to traders who value predictability and stability.

On the other hand, CMC Comparison offers a more varied range of spreads, from as low as 1.5 for EUR/GBP to as high as 1.5 for AUD/USD. This variation might be indicative of CMC Comparison’s dynamic pricing model, which could potentially offer more competitive spreads depending on market conditions.

| Standard Account | Eightcap Spreads | CMC Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.16 | 1.53 | 1.7 |

| EUR/USD | 1 | 1.3 | 1.2 |

| USD/JPY | 1.2 | 1.3 | 1.5 |

| GBP/USD | 1.2 | 1.5 | 1.6 |

| AUD/USD | 1.2 | 1.5 | 1.6 |

| USD/CAD | 1.2 | 1.5 | 1.9 |

| EUR/GBP | 1.1 | 1.5 | 1.5 |

| EUR/JPY | 1.2 | 1.7 | 2.1 |

| AUD/JPY | 1.2 | 1.9 | 2.3 |

Standard Account Analysis Updated December 2025[1]December 2025 Published And Tested Data

However, when compared to the industry average, both brokers offer competitive spreads. For instance, both brokers offer lower spreads for EUR/USD, USD/JPY, and GBP/USD compared to the industry average. This suggests that both brokers are competitively priced in the market.

In conclusion, if consistency is what you’re after, Eightcap might be the better choice. But if you’re looking for potentially more competitive spreads depending on market conditions, CMC Comparison might be worth considering. But remember, spreads are just one factor to consider when choosing a forex broker. Other factors such as customer service, trading platforms, and overall trading experience should also be taken into account.

EightCap has a cheaper standard account than CMC Markets

The EightCap Standard Account comes without any form of commission fees, with the only trading cost you pay being their bid-ask spread.

Spreads on EightCap start from just 1 pip on major forex pairs such as the EUR/USD. Almost all forex pairs you can trade will have a minimum spread of below 1.5 pips on EightCap.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 0.90 | 1.30 | 1.40 | 1.40 | 1.40 |

| 0.70 | 2.20 | 1.10 | 1.10 | 0.60 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 0.89 | 1.37 | 1.41 | 1.54 | 1.75 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 0.70 | 0.70 | 0.90 | 0.80 | 0.80 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 12/01/2025

CMC Markets only offers a Standard Account if you choose to trade CFD products with them.

Their lowest spreads start from 0.7 pips on the EUR/USD; however, their minimum spread costs are much higher for minor or exotic forex pairs. The lowest spread you can get for the EUR/AUD for example is 1.3 pips.

If you choose to trade share CFDs with CMC Markets, you will also be charged a commission on top of your spread fee. While it varies depending on the market your share CFD is traded on, Australian share CFDs come with a 0.07% commission fee, with a minimum cost of AUD $7.

Check out our other reviews of both Pepperstone or IC Markets if you want spreads with no commission, then you are better off considering these two aforementioned. Both brokers have lower spreads for this type of account.

Our Lowest Spreads and Fees Verdict

EightCap takes the lead in this portion on the account of having the lowest spreads and fees.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

2. Better Trading Platform – Eightcap

A superior forex trading platform features advanced charts, real-time data, and fast execution. It offers a user-friendly interface, customization, and strong security. It also supports automated and social trading, along with access to various financial instruments, improving decision-making and trade execution.

Based on our research, you can access MetaTrader 4 on both EightCap and CMC Markets, but its successor, MetaTrader 5, is only available on EightCap.

CMC Markets also has its own proprietary trading platform, their ‘Next Generation’ CFD platform. They also have a share-specific trading platform for you to use.

| Trading Platform | Eightcap | CMC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

EightCap has a superior MetaTrader 4 offering than CMC Markets

MetaTrader 4 (MT4) is the most popular forex and CFD trading platform in the world, with a reputation for great ease of use and being extremely reliable. It not only has a plethora of tools and functions built into the platform but gives you scope to do much more, adding in your own widgets, and indicators or even utilising different algorithmic trading programs.

MT4’s best feature is its library of Expert Advisors, EAs. These are automated functions that can help you perform any task you might need when trading- giving you up-to-date news, identifying new trading opportunities, or even executing trading programs you craft up.

As the most popular platform in the world, MT4’s community of traders has curated the largest library of EAs and functional tools out of all trading platforms. This means that should you need a particular EA, there probably is one out there already, built by another trade who had the same problem as you.

EightCap is our recommended broker to use MetaTrader 4 to trade with, rather than CMC Markets. EightCap’s extra tools that they provide you with to enhance your trading experience simply outmatch CMC Markets, meaning you probably be better off trading with EightCap.

One of the biggest reasons why traders don’t utilise automated trading algorithms is because the barrier of knowledge needed to learn how to code effectively is too high. EightCap solves this for you by partnering with Capitalise.ai, which allows you to write a trading algorithm in plain English.

For example, if you want to buy Apple shares every time the SP500 opens up, you simply write that sentence in, and Capitalise.ai will automate your strategy for you.

EightCap provides you with bonus risk management via Amazing Trader. Amazing Trader’s algorithm dynamically adjusts to your risk preferences, and you can turn it on and off at your own discretion.

Most importantly for EightCap’s extensive cryptocurrency offerings, they offer you use of Cryptocrusher. This all-in-one crypto trading tool can give you trading ideas, provide you with sentiment analysis, and even educational resources.

CMC Markets’ main MT4 feature is their partnership with FX Blue Labs (which is also available on EightCap). This is a series of widgets giving you quick access to add-ons ranging from chart analysis to a mini terminal.

However, this is much less than what EightCap provides traders with, making EightCap our preferred broker to use MT4 with.

Only EightCap offers MetaTrader 5

MetaTrader 5 (MT5) was released as the successor to MT4 in 2010. It boasts a range of new features and tools, however most importantly, it allows you to trade on both centralised and decentralised markets. This allows you to trade more stocks and cryptocurrencies, which is unavailable on MT4, as MT4 only gives you access to centralised markets.

Extra functions by MT5 include their 38 in-built technical indicators, more than the 30 in MT4. The processing power of MT5 is 64 bits, much higher than the 32-bit processing power of MT4.

On EightCap, you greatly benefit from the extra advantage provided by MT5, as this allows you to trade more of EightCap’s extensive cryptocurrency range. The power of MT5 makes it even more attractive to use their Raw Spread account to scalp or trade at higher frequencies as well.

You will also still have access to the tools EightCap provides in MT4, such as Cryptocrusher. In fact, these tools will provide even more use for you, as Cryptocrusher can now recommend crypto trading ideas that you couldn’t act upon if you chose to use MT5.

In contrast to EightCap, CMC Markets does not offer MT5, so EightCap automatically wins our MT5 broker category

CMC Markets offers its own CFD trading platform

To compensate for their lack of MT5, CMC Markets have two proprietary platforms available for you to use.

‘Next Generation’ is their exclusive CFD trading platform, and they also have a share trading platform available.

While Next Generation comes with a wide range of in-built tools- over 115 trading indicators and 70 different chart patterns, it is not as flexible as MT4 or MT5, and restricts you to using what CMC Markets provide you with. However, it is a popular platform, with CMC Markets advertising that over 1 million people trade with it.

The CMC Markets share trading platform prides itself on its suite of equity research, with insights from Morningstar provided, as well as ‘CMC TV’, their own daily video series on the financial markets.

Another feature offered by their share trading platform is a partnership with Sharesight, which allows you to track your portfolio more easily and automatically generates tax reports for you.

Clearly, we can see here that when it comes to the trading platform, Eightcap is the standout choice. They offer a MetaTrader 4 platform that is enriched with additional tools and features, making it a more versatile and powerful platform for traders. Whether you’re a beginner or an experienced trader, Eightcap’s MT4 platform provides a more tailored trading experience.

Our Better Trading Platform Verdict

Eightcap takes home the crown owing to their better trading platform.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

3. Superior Accounts And Features – Eightcap

Superior forex accounts offer tailored options like competitive spreads, low commissions, and advanced tools. They include demo accounts, swap-free options, and diverse financial instruments. Enhanced features such as social and automated trading and strong customer support improve the trading experience, boosting client satisfaction.

When it comes to accounts and features, both Eightcap and CMC Markets have their own unique offerings, but let’s dig into what sets them apart.

- Eightcap offers a Raw Account with STP/ECN-style features, providing a more direct market access experience.

- CMC Markets offers a Standard Account with no commission but variable spreads.

- Eightcap provides a unique feature of partnering with Capitalise.ai, allowing traders to write trading algorithms in plain English.

- CMC Markets offers a ‘Guaranteed Stop Loss Order’ (GSLO) feature, which is a safety net for traders.

Eightcap’s Raw Account is particularly appealing to those who prefer a more direct market experience. It comes with lower spreads and a commission fee, making it ideal for high-volume traders. On the other hand, CMC Markets offers a more traditional Standard Account with variable spreads and no commission, which might be more suitable for beginners or those who trade less frequently.

| Eightcap | CMC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | No | No |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | Yes |

We presume that if you’re a high-volume trader looking for lower spreads and more advanced features, Eightcap’s Raw Account is the way to go. However, if you’re a beginner or a less frequent trader, CMC Markets’ Standard Account offers a more straightforward trading experience.

Our Superior Accounts and Features Verdict

Eightcap comes out on top in this category due to their superior accounts and feature.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Eightcap

The best forex trading experience includes advanced platforms, quick execution, competitive spreads, and strong support. These features enable informed decisions, smooth trade execution, and effective account management, while a user-friendly interface and educational resources enhance profitability and enjoyment.

When it comes to trading experience, Eightcap takes the cake for me. Their MetaTrader 4 offering is superior, loaded with extra tools that enhance your trading experience. It’s not just about the platform; it’s about how you can make it work for you.

- Eightcap partners with Capitalise.ai, allowing you to write trading algorithms in plain English.

- Amazing Trader is another tool that dynamically adjusts to your risk preferences.

- Cryptocrusher is an all-in-one crypto trading tool offered by Eightcap.

- Eightcap’s MT4 is more feature-rich compared to CMC Markets’ MT4.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| Eightcap | 143ms | 19/36 | 139ms | 17/36 |

| CMC Markets | 138ms | 18/36 | 180ms | 26/36 |

CMC Markets, on the other hand, offers its own ‘Next Generation’ CFD platform. While it comes with over 115 trading indicators, it lacks the flexibility and extensive toolset that Eightcap provides.

We can easily surmise that for the best trading experience and ease of use, Eightcap takes the crown. Their MetaTrader 4 platform is not just about the technicalities; it’s about how seamlessly it integrates with your trading style. With features like Capitalise.ai for algorithmic trading and a more feature-rich environment, Eightcap provides a trading experience that’s hard to beat.

Our Best Trading Experience and Ease Verdict

Eightcap takes the cake in this section thanks to their best trading experience and ease.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – CMC Markets

In forex trading, strong trust and regulation create a secure environment. Regulated brokers follow strict standards, protecting traders and fostering confidence for more investment. Trustworthy brokers attract clients and enhance their reputation.

CMC Markets Trust Score

Eightcap Trust Score

When it comes to trust and regulation, both Eightcap and CMC Markets have their merits. Eightcap is regulated by ASIC, which is a strong regulatory body. However, it doesn’t have the multi-jurisdictional oversight that some traders might be looking for.

- Eightcap: Regulated by ASIC

- CMC Markets: Regulated by ASIC and BaFin

- Multi-jurisdictional Oversight: CMC Markets

- Single-jurisdiction Oversight: Eightcap

On the other hand, CMC Markets is not only regulated by ASIC but also by BaFin. This gives it a broader regulatory scope, which can be a significant factor for traders concerned about the safety of their funds. So, if you’re the type of trader who sleeps better knowing your broker is watched over by multiple regulatory bodies, CMC Markets might just be the one for you.

| Eightcap | CMC Markets | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) | ASIC (Australia) FCA (UK) BaFin (Germany) FMA (New Zealand) CIRO (CANADA) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) |

In the world of forex trading, trust and regulation are essential. We can see thatCMC Markets emerges as a top choice among brokers, distinguished by its oversight from both ASIC and BaFin, offering traders a more secure trading environment. Conversely, Eightcap operates under the regulation of ASIC alone. For those prioritizing peace of mind and superior security, CMC Markets is strongly recommended.

Reviews

Eightcap holds a Trustpilot rating of 4.2 out of 5, based on over 3,000 reviews. CMC Markets has a slightly lower Trustpilot rating of 4.0 out of 5, from about 2,300 reviews. Eightcap scores higher in customer satisfaction, while CMC Markets has broader brand recognition and a longer track record. Both are solid choices, but Eightcap may appeal more to traders seeking responsive support and tighter spreads.

Our Stronger Trust and Regulation Verdict

CMC Markets stands out in this category in light of them having stronger trust and regulation.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

6. Most Popular Broker – CMC Markets

CMC Markets gets searched on Google more than Eightcap. On average, CMC Markets sees around 90,500 branded searches each month, while Eightcap gets about 40,500 — that’s 55% fewer.

| Country | Eightcap | CMC Markets |

|---|---|---|

| Australia | 2,400 | 49,500 |

| United Kingdom | 1,600 | 9,900 |

| United States | 1,900 | 4,400 |

| Canada | 2,400 | 4,400 |

| Germany | 1,000 | 3,600 |

| Spain | 720 | 3,600 |

| Singapore | 390 | 2,400 |

| New Zealand | 210 | 1,900 |

| Poland | 260 | 1,600 |

| India | 1,300 | 1,300 |

| Italy | 590 | 880 |

| South Africa | 480 | 720 |

| Nigeria | 390 | 720 |

| France | 720 | 720 |

| Sweden | 320 | 590 |

| Malaysia | 880 | 480 |

| Indonesia | 590 | 480 |

| Hong Kong | 170 | 390 |

| United Arab Emirates | 210 | 390 |

| Austria | 140 | 390 |

| Ireland | 110 | 390 |

| Pakistan | 320 | 320 |

| Netherlands | 480 | 320 |

| Turkey | 110 | 260 |

| Philippines | 210 | 260 |

| Thailand | 9,900 | 210 |

| Vietnam | 170 | 210 |

| Japan | 140 | 210 |

| Switzerland | 170 | 210 |

| Kenya | 170 | 170 |

| Cyprus | 90 | 170 |

| Brazil | 1,000 | 140 |

| Taiwan | 140 | 140 |

| Portugal | 210 | 140 |

| Greece | 90 | 140 |

| Morocco | 210 | 110 |

| Bangladesh | 140 | 110 |

| Mexico | 320 | 90 |

| Egypt | 90 | 90 |

| Algeria | 110 | 90 |

| Saudi Arabia | 70 | 90 |

| Sri Lanka | 50 | 70 |

| Ghana | 70 | 70 |

| Colombia | 720 | 50 |

| Argentina | 590 | 50 |

| Uganda | 70 | 50 |

| Cambodia | 90 | 50 |

| Panama | 20 | 50 |

| Peru | 140 | 40 |

| Ethiopia | 30 | 40 |

| Chile | 140 | 30 |

| Tanzania | 30 | 30 |

| Costa Rica | 30 | 30 |

| Venezuela | 110 | 30 |

| Botswana | 30 | 30 |

| Jordan | 30 | 30 |

| Uzbekistan | 90 | 30 |

| Ecuador | 110 | 20 |

| Dominican Republic | 320 | 20 |

| Mauritius | 20 | 20 |

| Mongolia | 70 | 10 |

| Bolivia | 30 | 10 |

49,500 1st | |

2,400 2nd | |

9,900 3rd | |

1,600 4th | |

4,400 5th | |

2,400 6th | |

2,400 7th | |

390 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with CMC Markets receiving 1,747,000 visits vs. 259,000 for Eightcap.

Our Most Popular Broker Verdict

CMC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – CMC Markets

In forex trading, having a wide product range and diverse CFD markets enable traders to diversify portfolios and seize various market conditions. Brokers with extensive financial instruments, like forex pairs, commodities, indices, and cryptocurrencies, enhance profit opportunities and create a dynamic trading experience.

When it comes to the range of products and CFD markets, Eightcap and CMC Markets offer different strengths. Eightcap is particularly strong in crypto trading, offering a wide range of cryptocurrency pairs that you won’t find with many other brokers.

| CFDs | Eightcap | CMC Markets |

|---|---|---|

| Forex Pairs | 61 | 338 |

| Indices | 16 | 82 |

| Commodities | 8 Commodities Softs and Metals | 124 |

| Cryptocurrencies | 95 Crypto | 19 |

| Shares CFDs | 586 | 10000+ |

| ETFs | No | 11265 |

| Bonds | No | 55 |

| Futures | No | Yes |

| Treasuries | No | 55 |

| Investment | No | Yes |

Based on our studies, when it comes to the range of CFDs and Markets, CMC Markets is the clear winner. They offer a staggering variety of forex pairs, stocks, and other financial instruments. If you’re looking for a one-stop-shop for all your trading needs, CMC Markets is the way to go.

Our Top Product Range and CFD Markets Verdict

CMC Markets ranks highest in the area of expertise thanks to their top product range and CFD markets.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

8. Superior Educational Resources – CMC Markets

High-quality educational resources in forex trading, such as webinars, articles, videos, and structured courses, help traders improve their knowledge and strategies for informed decisions and long-term success.

Eightcap and CMC Markets both offer educational resources, but they differ in quality and depth. Eightcap focuses more on practical trading strategies, while CMC Markets offers a broader range of topics.

- Eightcap offers webinars and tutorials.

- CMC Markets provides eBooks and articles.

- Eightcap has a more user-friendly educational interface.

- CMC Markets offers more in-depth research tools.

- Eightcap provides real-time news updates.

- CMC Markets has a daily video series on financial markets.

We can presume that CMC Markets takes the lead in educational resources, based on our comprehensive testing. They offer a well-rounded educational package that includes eBooks, articles, and even a daily video series. This makes them an excellent choice for traders who are keen on continuous learning.

Our Superior Educational Resources Verdict

CMC Markets dominates this portion by reason of their superior educational resources.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

9. Superior Customer Service – CMC Markets

Superior customer service in forex trading provides timely support, fostering a confident trading experience. This includes 24/7 live chat, phone, email support, and multilingual assistance, helping traders resolve issues quickly and build trust in their broker.

Customer service is essential, so we will provide a detailed comparison of how these two brokers stack up against one another. Eightcap offers excellent customer service, as evidenced by their ‘Excellent’ TrustPilot score. CMC Markets has a ‘Great’ score but with mixed reviews.

| Feature | Eightcap | CMC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Based on our comprehensive testing, CMC Markets takes the lead in educational resources. They offer a well-rounded educational package that includes eBooks, articles, and even a daily video series. This makes them an excellent choice for traders who are keen on continuous learning.

Our Superior Customer Service Verdict

CMC Markets outshines the contender in this portion thanks to their superior customer service.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

10. Better Funding Options – Eightcap

Improved funding options in forex trading offer traders flexibility and convenience through methods like bank transfers, credit cards, digital wallets (PayPal, Skrill, Neteller), and cryptocurrencies. Multiple low or no fee funding methods help traders manage accounts and transactions efficiently, enhancing their trading experience.

When it comes to funding options, both brokers offer a variety of methods. Eightcap even allows cryptocurrency deposits, which is a unique feature.

| Funding Option | Eightcap | CMC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | No |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Evidently, Eightcap offers a more diverse range of funding options, including the unique feature of cryptocurrency deposits. This gives traders more flexibility and convenience, making Eightcap the better choice for those who value a variety of funding options.

Our Better Funding Options Verdict

Eightcap steals the throne in this section owing to their better funding options.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

11. Lower Minimum Deposit – CMC Markets

A lower minimum deposit in forex trading increases accessibility for beginners and traders with limited capital, allowing them to start with smaller investments. This reduces financial barriers, encourages participation, and helps traders gain experience without significant initial costs.

Eightcap requires a minimum deposit, which varies depending on your location and the type of account. CMC Markets, on the other hand, does not require a minimum deposit.

| | Minimum Deposit | Recommended Deposit |

| Eightcap | $100 | $100 |

| CMC Markets | $0 | $100 |

As we base these data in our recent studies, we can say that CMC Markets offers the advantage of no minimum deposit, making it more accessible for traders who are just starting out or those who prefer to trade with smaller amounts. This feature makes CMC Markets the more accommodating broker in terms of initial investment.

Our Lower Minimum Deposit Verdict

CMC Markets brings home the gold in this category thanks to their lower minimum deposit.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: CMC Markets Or Eightcap?

Eightcap is the winner because it offers a more tailored experience for high-volume traders with its Raw Account, lower spreads, and superior customer service. Below is a table that summarises the key information leading to this verdict.

| Criteria | Eightcap | CMC Markets |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platforms | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience | Yes | No |

| Stronger Trust And Regulation | No | Yes |

| CFD Product Range And Financial Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Better Customer Service | No | Yes |

| More Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

Best For Beginner Traders

For beginner traders, CMC Markets is the better choice due to its user-friendly platform and educational resources.

Best For Experienced Traders

For experienced traders, Eightcap is the go-to broker for its lower spreads and advanced trading features.

FAQs Comparing Eightcap vs CMC Markets

Does CMC Markets or Eightcap Have Lower Costs?

Eightcap definitely takes the lead when it comes to lower costs. They offer a Raw Account with spreads starting as low as 0.0 pips, which is a game-changer for high-volume traders. CMC Markets, while competitive, can’t quite match these razor-thin spreads. For a deeper dive into low-cost trading, you might want to check out our comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

When it comes to MetaTrader 4, Eightcap is the broker to beat. They’ve enriched their MT4 platform with additional tools and features, providing a more versatile trading experience. CMC Markets offers MT4 as well, but it’s not as feature-rich as Eightcap’s offering. For more insights, have a look at our Best MT4 Brokers.

Which Broker Offers Social Trading?

Interestingly, neither Eightcap nor CMC Markets offer social or copy trading. If social trading is a must-have for you, you’ll need to look elsewhere. For a list of brokers that do offer this feature, you can visit our best social trading platforms.

Does Either Broker Offer Spread Betting?

In the realm of spread betting, CMC Markets is the one to go for. Eightcap doesn’t offer this feature, so if spread betting is crucial for your trading strategy, CMC Markets is your only option here. For more information, check out our best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap is the superior choice for Australian forex traders. They are ASIC regulated, which adds an extra layer of trust. Plus, their Raw Account is tailored for high-volume trading, making it a great fit for the Aussie trading community. For more insights, you can visit our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK traders, CMC Markets is the standout choice. They are FCA regulated, which is a big tick in the trust column. Plus, they offer a wide range of educational resources, making them a solid choice for traders in the UK. For more details, you can check out our Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What timezone does Eightcap use?

Eightcap has 24/5 support meaning they can assist you any time of day while Forex markets are open.