Eightcap vs FXCM: Which One Is Best?

In this review, we can see how both brokers’ features and platforms are truly superior to those of other traders in the industry, but Eightcap steals the show due to their impressive list of winning features.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors. Here are five key differences between Eightcap and FXCM:

- Eightcap offers tighter spreads with a minimum of 0.0 pips, compared to FXCM’s minimum of 0.6 pips.

- Eightcap is known for its faster execution speeds and a lower likelihood of slippage.

- FXCM provides a wider range of trading platforms, including Trading Station, MT4, and NinjaTrader.

1. Lowest Spreads And Fees – Eightcap

Both FXCM and Eightcap stand out with their distinct features to traders of all levels. Both brokers offer competitive spreads, a robust list of platforms, and various account options. Let us dig deeper into how these brokers compare on spreads, commission levels, and their standard account fees, AUD, GBP, USD, and EUR.

Spreads

Finding the best spreads is important for minimising trading costs for traders in the market. Eightcap’s RAW spreads are exceptionally low, starting at 0.06 for EUR/USD, 0.23 for GBP/USD, and 0.27 for AUD/USD. FXCM’s spreads, on the other hand, are slightly higher, averaging 0.30, 0.90, and 0.40 for the same pairs. For both brokers’ standard accounts, Eightcap edges out with 1.20 on GBP/USD compared to FXCM’s 1.80.

| RAW Account | Eightcap Spreads | FXCM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.42 | 0.82 | 0.75 |

| EUR/USD | 0.06 | 0.3 | 0.22 |

| USD/JPY | 0.23 | 0.6 | 0.38 |

| GBP/USD | 0.23 | 0.9 | 0.53 |

| AUD/USD | 0.27 | 0.4 | 0.47 |

| USD/CAD | 0.2 | 0.6 | 0.56 |

| EUR/GBP | 0.3 | 0.7 | 0.55 |

| EUR/JPY | 0.59 | 0.8 | 0.80 |

| AUD/JPY | 0.49 | 1.1 | 0.96 |

| USD/SGD | 1.37 | 2 | 2.29 |

Commission Levels

Eightcap offers a competitive rate of $3.50 per lot in USD, AUD, GBP, and EUR, which makes it attractive for traders. FXCM charges slightly more at $4.00 for USD and AUD. They provide slightly less value for the commission-sensitive strategies.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Eightcap | $3.50 | $3.50 | £2.25 | €2.75 |

| FXCM | $4.00 | $4.00 | N/A | N/A |

Standard Account Fees

Standard account fees should align with a trader’s budget and trading style. Eightcap requires a $100 minimum deposit, while FXCM allows for a more accessible entry with just $50. Both brokers stand out with no inactivity fees, enabling a flexible trading experience. Additionally, Eightcap offers a broader range of funding methods.

Comparing each broker’s account commissions and spreads on the most popular currency pairs, Eightcap has lower fees.

Try the Eightcap vs FXCM fee calculator below based on the most popular forex pairs and base currencies.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.20 | 1.00 | 1.00 | 1.10 |

| 0.70 | 0.80 | 1.30 | 1.00 | 1.00 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Our dedicated team surmises that FXCM and Eightcap cater to different trading needs with their unique offerings. For traders focusing on tight spreads and lower commissions, Eightcap is highly recommended. Meanwhile, FXCM’s lower minimum deposit makes it appealing for those starting their forex journey. Our team’s simple advice is: before trading, evaluate your priorities and choose the broker that aligns with your goals.

Our Lowest Spreads and Fees Verdict

Clearly, Eightcap takes the lead in this category owing it to their lowest spreads and fees.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘74% of retail CFD accounts lose money’

2. Better Trading Platform – Eightcap

Eightcap and FXCM offer compelling features and platforms for forex trading, providing them to traders new and seasoned. Meanwhile, Eightcap emphasises advanced MetaTrader options and algorithmic tools; FXCM shines with its proprietary Trading Station platform. Let us explore more of their offerings to understand which broker aligns best with the trader’s needs.

| Trading Platform | Eightcap | FXCM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | No | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

Metatrader

As discussed, MetaTrader is the go-to platform for millions of forex traders worldwide. Eightcap supports MetaTrader 4 and 5, offering users flexibility with advanced analytical tools and seamless trade execution. FXCM, however, only provides MT4, which limits advanced platform choices but remains reliable for traders working on simple strategies.

Advanced Platforms

Advanced trading platforms are important in trading. It enhances the trader’s experience, new or seasoned. Eightcap provides TradingView for detailed charting and Capitalise.ai, enabling beginners to create algorithmic trading strategies without coding. FXCM counters with its proprietary Trading Station platform, which is known for ease of use and versatility, allowing traders to manage forex, stocks, and indices all in one place.

Copy Trading

Copy trading features and platforms are essential when trading in the market. This feature simplifies forex for less experienced traders. Eightcap excels with built-in copy trading features, which enables users to mirror successful strategies effortlessly. FXCM, on the other hand, offers other tools like Capitalise.ai, which lacks robust copy trading options, and it could make it less appealing for those keen on social and copy trading strategies.

Our team’s perspective on this category is that whether it is Eightcap’s robust MetaTrader offerings and advanced tools or FXCM’s user-friendly proprietary platform, both brokers bring unique advantages to the table. Eightcap is ideal for tech-savvy traders keen on innovation, while FXCM appeals to those seeking simplicity and reliability. Our team’s advice is that traders should define their priorities and trade with confidence.

Our Better Trading Platform Verdict

Our team surmises that EightCap outperforms the challenger in this category due to their better trading platform.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘74% of retail CFD accounts lose money’

3. Superior Accounts And Features – Eightcap

Eightcap and FXCM are well-known forex brokers that offer tailored solutions to meet traders’ diverse needs. Both brokers come with competitive spreads, varied account options, and robust trading platforms; they significantly contribute to traders looking for both simplicity and advanced tools. Let us examine how these brokers, Eightcap and FXCM, compare across features, platforms, and trading opportunities.

Eightcap offers superior spreads, such as 1.0 for EUR/USD, lower than FXCM’s 1.3. This provides both RAW and standard accounts, which require a lower minimum deposit of $100 compared to FXCM’s $300. Also, Eightcap excels with MetaTrader 4 and 5, coupled with innovative tools like Capitalise.ai and CryptoCrusher. FXCM, on the other hand, offers MetaTrader 4 and its proprietary Trading Station platform, which is a user-friendly platform for trading various instruments. Eightcap stands out with extensive cryptocurrency options, boasting over 250 assets, compared to FXCM’s limited offering of 7.

Eightcap and FXCM both present a range of account types and features tailored to meet the diverse needs of traders. Here’s a breakdown:

Spreads: Eightcap consistently offers competitive spreads across all forex pairs. For instance, their EUR/USD spread is 1.0, which is notably lower than FXCM’s spread of 1.3 for the same pair.

Account Types: Eightcap provides an STP-style CFD trading account with a ‘raw’ spread, potentially allowing traders to experience no spread fee in certain circumstances. On the other hand, FXCM primarily offers a standard (commission-free) account.

Minimum Deposit: To start trading, Eightcap requires a minimum deposit of $100, which is lower than FXCM’s minimum deposit of $300.

Trading Platforms: Eightcap provides MetaTrader 4 and 5 platforms, enriched with tools like Capitalise.ai and Cryptocrusher. FXCM, however, offers only MetaTrader 4, despite having a proprietary Trading Station platform.

Cryptocurrency Options: Eightcap stands out with its extensive range of over 250 cryptocurrency options, dwarfing FXCM’s offering of just over 7.

| Eightcap | FXCM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | Yes |

Eightcap and FXCM cater to distinct trader profiles. Eightcap’s competitive spreads, advanced platforms, and diverse crypto range appeal to innovative traders. FXCM’s proprietary Trading Station and simplicity make it ideal for beginners or those who give importance to ease of use. We have to say that, to define your goals in trading, choose the broker that aligns truly with your trading principles.

Our Superior Accounts and Features Verdict

Without any doubt, Eightcap rides high in this category by reason of their superior accounts and features.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘74% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Eightcap

Trading experience in the industry is an important feature for traders. In this section, we will discuss how both Eightcap and FXCN are key players in the forex trading industry, they offer unique tools and platforms that cater to various trading needs. Eightcap focuses on platform diversity and automation, while FXCM empahises usability with its proprietary tools. Let us explore further their features and contributions to traders’ success in trading in the forex markets

When it comes to trading, the experience and ease of use are paramount. I’ve personally dabbled with both Eightcap and FXCM, and here’s what stood out to me:

- TradingView Integration: Eightcap takes the cake with its seamless integration with TradingView, enhancing the charting experience.

- Platform Diversity: While both brokers offer MT4, Eightcap goes a step further with its MT5 offering, giving traders more flexibility.

- Automation Capabilities: Eightcap and FXCM have their strengths, but Eightcap’s collaboration with Capitalise.ai is a game-changer for automated strategies.

- Execution Speed: While not explicitly mentioned in our data, a broker’s execution speed can make or break a trade, and both brokers are known for their reliability in this aspect.

Eightcap excels with MetaTrader 4 and 5, providing flexibility for traders leveraging advanced tools. TradingView integration enhances charting while Capitalise.ai simplifies innovation-focused traders. On the other hand, FXCM supports MetaTrader 4, stands out with its proprietary Trading Station platform, which is perfect for traders looking for a straightforward experience across the diverse instruments available. Moreover, execution reliability is a shared strength, reflected in competitive order speeds.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Eightcap | 143ms | 19/36 | 139ms | 17/36 |

| FXCM | 188ms | 28/36 | 189ms | 29/36 |

Our dedicated team easily surmises that Eightcap and FXCM bring valuable advantages to forex trading. Eightcap’s advanced platform variety and automation tools appeal to tech-savvy and innovative traders. FXCM’s user-friendly proprietary platform ensures ease for beginners and straightforward execution. We can only presume that to align with your trading goals, go with the right broker to optimise your path in a successful trading journey.

Our Best Trading Experience and Ease Verdict

Evidently, Eightcap outpaces the other in this category thanks to their best trading experience.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘74% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

In forex trading, establishing a secure and transparent environment relies heavily on strong trust and regulation.

Eightcap Trust Score

FXCM Trust Score

We measure safety by the regulation of the brokers we compare. Here, we see that Eightcap has a better trust score of 85 compared to FXCM, which is 74. The best way for you to stay safe when trading is to use a broker that is regulated in the country you are trading from.

Regulations

Eightcap and FXCM are trusted forex brokers, prioritising trader safety through regulatory compliance. With Eightcap leveraging ASIC and SCB protections and FXCM regulated by five-tier bodies, they ensure a secure trading environment. Let us explore their unique contributions to forex trading, focusing on platforms, with features and regulatory differences.

| Eightcap | FXCM | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) BaFin (Germany) |

| Tier 2 Regulation | FSCA (South Africa) ISA (Israel) | |

| Tier 3 Regulation | SCB (Bahamas) |

Eightcap stands out with regulations from ASIC in Australia and SCB in the Bahamas, this offers security and global accessibility. Its advanced platforms, MetaTraders 4 and 5, empower traders with versatility. FXCM boasts five-tier regulators, including FCA in the UK and IIROC in Canada, reinforcing its global presence. Unfortunately, FXCM primarily offers MetaTrader 4 and its proprietary Trading station, which caters to simplified trading across forex, indices, and stocks. Both brokers emphasise a secure trading experience, with Eightcap focusing on innovative tools and FXCM excelling in regulatory breadth.

EightCap is regulated by one top-tier regulator and one second-tier regulator. Their top regulatory environment is in Australia, under the Australian Securities and Investments Commission (ASIC). EightCap’s global and second regulator is the Securities Commission of the Bahamas (SCB), ensuring no matter where you are trading from, you have protection.

In comparison, FXCM is regulated by five top-tier regulators but no second-tier ones. The five top regulatory environments FXCM operates in are:

– Australia, with ASIC

– The United Kingdom, with the Financial Conduct Authority (FCA)

– The EU, with the Cyprus Securities and Exchange Commission (CySEC)

– Canada, with the Investment Industry Regulatory Organisation of Canada (IIROC)

– South Africa, with the Financial Sector Conduct Authority (FSCA)

Finally, we can easily say that Eightcap’s robust platform variety and advanced tools cater to tech-driven traders, compared to FXCM’s extensive regulatory coverage which appeals to those prioritising safety. Both brokers contribute significantly to the forex industry, which provides traders with reliable environments and tailored trading solutions. Through our team’s suggestions, choose based on your trading needs and enjoy an optimised experience.

Reviews

Eightcap holds a solid Trustpilot rating of 4.2 out of 5, based on over 3,100 reviews. FXCM has a slightly lower Trustpilot score of 4.1 out of 5, with around 700 reviews. Both brokers are well-regarded. Eightcap, however, has a larger review base, which may reflect broader user engagement.

Our Stronger Trust and Regulation Verdict

Clearly, we can say that it is neck to neck for both FXCM and Eightcap, and this is due to their stronger trust and regulation.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

6. Most Popular Broker – FXCM

FXCM gets searched on Google the same way Eightcap does. On average, FXCM and Eightcap see around 40,500 branded searches each month.

| Country | Eightcap | FXCM |

|---|---|---|

| Thailand | 9,900 | 1,000 |

| Canada | 2,400 | 880 |

| Australia | 2,400 | 1,300 |

| United States | 1,900 | 2,900 |

| United Kingdom | 1,600 | 2,900 |

| India | 1,300 | 2,900 |

| Germany | 1,000 | 1,000 |

| Brazil | 1,000 | 480 |

| Malaysia | 880 | 1,300 |

| Spain | 720 | 590 |

| France | 720 | 1,600 |

| Colombia | 720 | 1,000 |

| Italy | 590 | 720 |

| Argentina | 590 | 320 |

| Indonesia | 590 | 1,000 |

| South Africa | 480 | 1,000 |

| Netherlands | 480 | 390 |

| Singapore | 390 | 480 |

| Nigeria | 390 | 880 |

| Mexico | 320 | 480 |

| Sweden | 320 | 170 |

| Pakistan | 320 | 1,000 |

| Dominican Republic | 320 | 140 |

| Poland | 260 | 320 |

| Portugal | 210 | 110 |

| Philippines | 210 | 390 |

| United Arab Emirates | 210 | 480 |

| Morocco | 210 | 480 |

| New Zealand | 210 | 70 |

| Switzerland | 170 | 170 |

| Hong Kong | 170 | 480 |

| Kenya | 170 | 260 |

| Vietnam | 170 | 880 |

| Japan | 140 | 1,300 |

| Austria | 140 | 110 |

| Taiwan | 140 | 590 |

| Peru | 140 | 210 |

| Bangladesh | 140 | 260 |

| Chile | 140 | 210 |

| Turkey | 110 | 480 |

| Ireland | 110 | 70 |

| Algeria | 110 | 260 |

| Ecuador | 110 | 170 |

| Venezuela | 110 | 390 |

| Cyprus | 90 | 140 |

| Egypt | 90 | 390 |

| Greece | 90 | 210 |

| Cambodia | 90 | 170 |

| Uzbekistan | 90 | 70 |

| Ghana | 70 | 110 |

| Saudi Arabia | 70 | 260 |

| Uganda | 70 | 90 |

| Mongolia | 70 | 50 |

| Sri Lanka | 50 | 110 |

| Jordan | 30 | 70 |

| Tanzania | 30 | 90 |

| Costa Rica | 30 | 30 |

| Ethiopia | 30 | 70 |

| Bolivia | 30 | 110 |

| Botswana | 30 | 50 |

| Mauritius | 20 | 40 |

| Panama | 20 | 50 |

9,900 1st | |

1,000 2nd | |

2,400 3rd | |

880 4th | |

2,400 5th | |

1,300 6th | |

1,600 7th | |

2,900 8th |

Similarweb shows a different story when it comes to February 2024 website visits with FXCM receiving 365,000 visits vs. 259,000 for Eightcap.

Our Most Popular Broker Verdict

FXCM is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

7 . Top Product Range And CFD Markets – Eightcap

Eightcap and FXCM are popular forex brokers offering tailored services to meet traders’ diverse needs. Eightcap excels with its extensive cryptocurrency options and MetaTrader platforms, compared to FXCM which provides a solid product range and proprietary tools.

Eightcap offers 46 currency pairs, which include majors like EUR/USD and exotics such as AUD//SGD. It leads in crypto CFDs with 95 options and provides MetaTrader 4 and 5 for their advanced trading. FXCM features 42 pairs on Trading Station and 43 on MT4, with standout tools like its proprietary Trading Station platform. Both brokers support commodities, indices, and share CFDs, but, on the other hand, Eightcap has a significant edge with 586 share CFDs versus FXCM’s 219. Meanwhile, Eightcap focuses on broader market access, FXCM stands out with its niche offerings, such as bonds and treasuries.

On EightCap, you have 46 different currency pairs available to trade. These include major pairs like EUR/USD and GBP/AUD and exotic ones like AUD/SGD.

FXCM, meanwhile, has 42 pairs on Trading Station and 43 forex pairs on MT4. This gives them a slight win with product range.

| CFDs | Eightcap | FXCM |

|---|---|---|

| Forex Pairs | 56 | 42 |

| Indices | 16 | 16 |

| Commodities | 8 Commodities Softs and Metals | 3 Metals 5 Energies 3 Softs |

| Cryptocurrencies | 95 Crypto | 7 |

| Share CFDs | 586 | 219 |

| ETFs | No | No |

| Bonds | No | 1 |

| Futures | No | No |

| Treasuries | No | 1 |

| Investments | No | No |

We can surmise that, Eightcap’s robust platform variety and extensive asset range make it ideal for traders looking for diversification. FXCM proprietary tools and unique bond offerings appeal to traders focused on traditional instruments. Both brokers provide valuable features that enhance their trading strategies. Our team’s suggestion: Select the broker that aligns with your goals for a successful trading experience.

Our Top Product Range and CFD Markets Verdict

Evidentlly, EightCap steals the show in this segment thanks to their top product range and CFD markets.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘74% of retail CFD accounts lose money’

8. Superior Educational Resources – Eightcap

Eightcap and FXCM are renowned forex brokers in the industry, offering traders, new or seasoned, invaluable educational resources and needed tools for growth. Eightcap, on the other hand, prioritises beginner-friendly, interactive learning, while FXCM emphasises advanced strategies and practical skills. Combined, they both contribute significantly to the forex industry by empowering traders with the knowledge to navigate the market with ease.

Eightcap:

- Offers a comprehensive range of educational materials.

- Provides in-depth webinars and tutorials for traders.

- Features a dedicated section for beginner traders.

- Regularly updates its educational content.

- Collaborates with trading experts for content creation.

- Prioritises user-friendly and interactive learning tools.

FXCM:

- Boasts a vast library of educational resources.

- Conducts live seminars and workshops for traders.

- Has a specialised section for advanced trading strategies.

- Offers regular market analysis and insights.

- Provides access to expert-led trading courses.

- Emphasises practical trading skills and knowledge.

Eightcap shines with its comprehensive range of educational materials, which features webinars, tutorials, and a dedicated section for beginners. Its collaborations with experts ensure updated and engaging content tailored to evolving markets. FXCM complements this with a robust library of educational resources, live seminars and workshops, while focusing on advanced strategies and market insights. both recognise the importance of education in trading success, delivering resources that cater to diverse skill levels, especially for AUD, GBP, and USD currency pairs.

Eightcap and FXCM are vital allies for traders as they offer tailored educational tools and resources. While Eightcap excels in beginner-friendly learning, alternative, FXCM focuses on advanced strategies and practical applications. By equipping traders with knowledge and skills, these brokers help foster better trading experiences and solidify their roles in the forex industry.

Our Superior Educational Resources Verdict

As plain as day, Eightcap ranks highest in this segment owing it to their superior educational resources.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘74% of retail CFD accounts lose money’

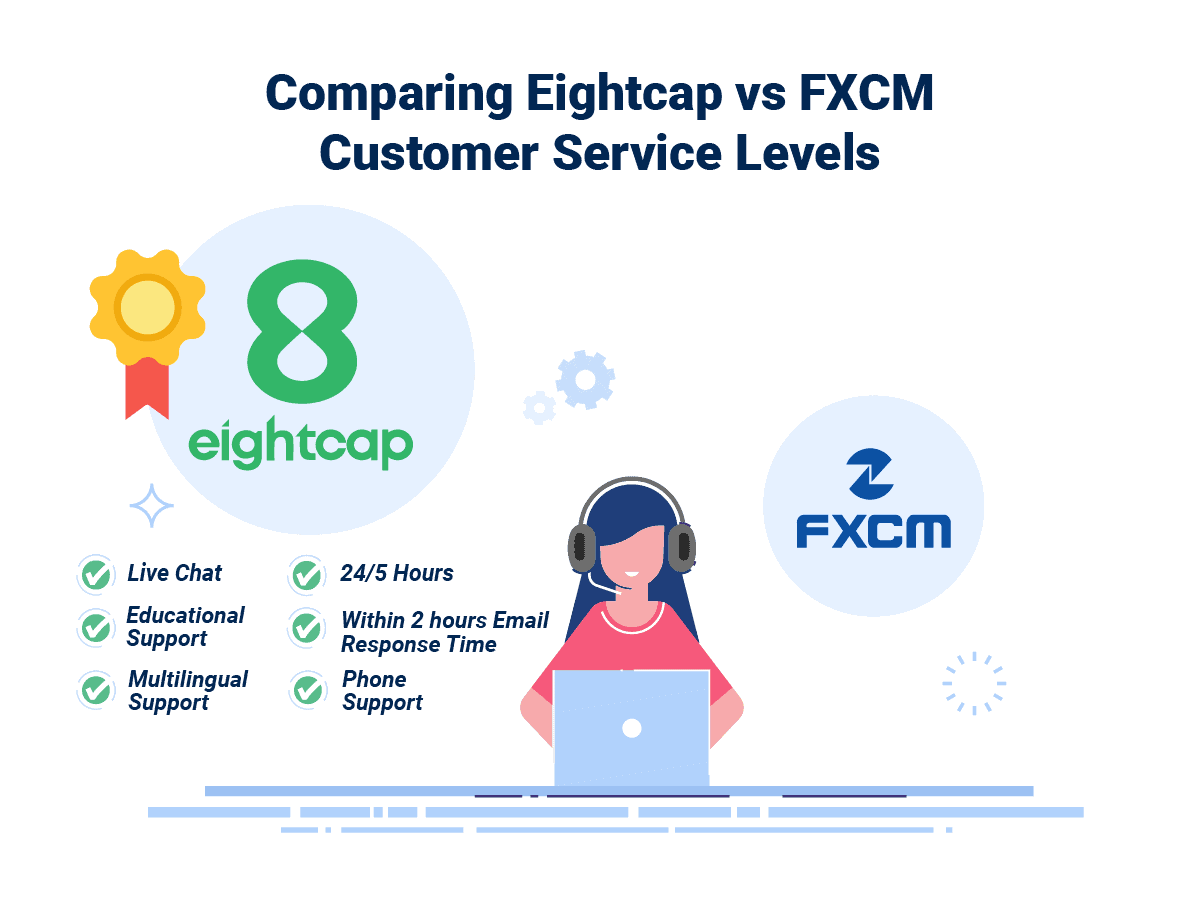

9. Superior Customer Service – Eightcap

The following discussion will highlight both brokers’ superior customer services. Eightcap and FXCM set themselves apart in the forex industry with exceptional customer support that caters to the fast-paced needs of traders, beginner or seasoned. From live chat to multilingual assistance, both brokers prioritise responsive service to ensure seamless trading experiences. Let’s take this deeper on how their features and features empower traders worldwide.

In this case, Eightcap provides a 24/7 support through their live chat, emails, and phone, and offers quick, reliable solutions for traders’ technical or trade-related issues. But at the same time, FXCM complements this with a strong global presence and 24/5 availability, featuring multiple communication channels. Both brokers understand the importance of knowledgeable support, while enhancing traders’ confidence in the fast-paced forex world. Their support teams are equipped to handle inquiries regarding key trading pairs, specifically AUD, GBP, and USD, this ensures traders get more insights and information when it matters most.

Here’s a breakdown of the key customer service features of each broker:

| Feature | Eightcap | FXCM |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Exceptional customer service is the key to a successful trading journey, and both Eightcap and FXCM deliver on this front. Eightcap shines with its 24/7 availability, while FXCM’s extensive global reach ensures traders feel supported across borders. Our professional insight is that choosing the right broker that aligns with your trading schematics and dynamics for a better and optimised trading experience.

Our Superior Customer Service Verdict

Clearly enough, Eightcap is on top of the world right now, this is due to otheir superior customer services.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘74% of retail CFD accounts lose money’

10. Better Funding Options – Eightcap

This part of our review will focus on both brokers’ funding options. Eightcap and FXCM are trusted brokers in the industry offering diverse funding methods to support seamless transactions for forex traders. From traditional bank transfers to modern digital options, these brokers prioritise flexibility and efficiency. Both brokers’ offerings contribute to a more streamlined trading experience, allowing traders to focus on what truly matters, market opportunities.

In this case, Eightcap and FXCM share funding methods such as credit/debit cards, bank transfers, Skrill and Neteller, crypto payments, which ensures accessibility for traders globally. Notably, FXCM includes PayPal among its options, expanding payment convenience. We see here that both brokers deliver reliable processes, although efficiency and speed may differ. The flexibility of funding options ensures traders can manage AUD, GBP, and USD transactions conveniently. Overall, these brokers’ focus on enabling smooth deposits and withdrawals complements their broader goal of enhancing trader satisfaction.

Below is a table that showcases the funding options available with each broker:

| Funding Option | Eightcap | FXCM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Eightcap and FXCM provide robust solutions for managing trading accounts. Eightcap shines with its streamlined processes, while FXCM stands out with its PayPal integration. Both brokers empower traders to access markets effortlessly, which supports a seamless and rewarding trading journey.

Our Better Funding Options Verdict

With out any doubt, Eightcap is having its moment in the spotlight right now this is because of their better funding options.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘74% of retail CFD accounts lose money’

11. Lower Minimum Deposit – FXCM

Now, let us talk about lower minimum deposit. Eightcap and FXCM stand as reliable forex brokers, each offering tailored options for traders for varying expertise. With different minimum deposit requirements and diverse payment methods, both brokers cater to the dynamic demands of the forex markets. Let us study their key features and contributions to the trading industry.

FXCMM outshines Eightcap with a lower minimum deposit of $50, accommodates most payment methods, including credit/debit cards, Skrill and Neteller. On the other hand, Eightcap, while requiring a $100 minimum deposit, provides flexibility with modern options like cryptocurrency transactions, although availability may vary by region. Both brokers empower traders managing AUD, GBP, and USD accounts, ensuring accessibility and efficient fund management across diverse channels.

FXCM has a lower minimum deposit of $50 than Eightcap’s $100 minimum. The minimum set by FXCM is available for most payment methods and major currencies:

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Bank Wire | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Skrill | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Neteller | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

On the other hand, Eightcap offers several payment channels, but they can be unavailable for some regions:

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | N/A | $100 | €100 | N/A |

| Neteller | N/A | $100 | €100 | N/A |

| Minimum Deposit | Recommended Deposit | |

| Eightcap | $100 | $100 |

| FXCM | $50 | $50 |

Wrapping this up, Eightcap and FXCM deliver solutions that enhance traders’ experiences. FXCM’s low deposit threshold suits beginners, while Eightcap’s innovative payment channels cater to modern trading needs. Aligning your trading strategies and dynamics with your preferred broker’s offering ensures you to achieve a seamless, tailored trading journey. While doing so, explore their features and pick the broker that best complements your goals.

Our Lower Minimum Deposit Verdict

When considering the minimum deposit alone, FXCM has the lowest requirement at $50. However, it’s worth noting that FXCM charges $50 per deposit.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

Is Eightcap or FXCM The Best Broker?

Eightcap is the winner because it consistently outperforms FXCM in most of the key areas that traders value the most. The table below summarises the key information leading to this verdict:

| Categories | Eightcap | FXCM |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

Eightcap: Best For Beginner Traders

Eightcap is the ideal choice for beginner traders due to its user-friendly platform and comprehensive educational resources.

Eightcap: Best For Experienced Traders

While Eightcap offers a robust platform and a wide range of features, experienced traders might also appreciate FXCM’s unique offerings and advanced tools. However, Eightcap remains a strong contender in this category.

FAQs Comparing Eightcap Vs FXCM

Does FXCM or Eightcap Have Lower Costs?

Eightcap generally offers lower costs compared to FXCM. Specifically, Eightcap boasts competitive spreads, especially on major pairs like EUR/USD. For instance, their average spread for EUR/USD is notably lower than many competitors. For more detailed insights on low-cost brokers, you can refer to this comprehensive guide on Lowest Spread Forex Brokers.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and FXCM offer MetaTrader 4, but Eightcap provides a slightly enhanced experience with additional tools and integrations. FXCM, on the other hand, has been a long-time supporter of MT4 and offers a stable platform experience. For traders specifically looking for the best MT4 experience, this list of Best MT4 Forex Brokers can be a valuable resource.

Which Broker Offers Social Trading?

Eightcap offers social trading features, allowing traders to copy strategies from experienced traders. This not only simplifies the trading process for beginners but also provides an opportunity to learn from the best. Social or copy trading has gained immense popularity in recent years. If you’re keen to explore more about this, check out the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Eightcap nor FXCM offer spread betting as a primary feature. Spread betting is a unique form of trading popular in the UK and offers tax benefits for traders. If you’re keen on exploring brokers that specialise in spread betting, you might want to check out this list of the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap has a slight edge for Australian forex traders. It’s ASIC regulated, which ensures a high level of trust and security for traders down under. Additionally, while FXCM is a global player, Eightcap was founded in Australia, giving it a home-ground advantage. Both brokers offer a robust trading experience, but there’s something reassuring about trading with a broker that understands the local market nuances. For a broader perspective on Australian forex brokers, you can visit this comprehensive guide on the Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

From my perspective, FXCM stands out for UK forex traders. It’s FCA regulated, ensuring that UK traders have a layer of protection and security. While Eightcap has made significant inroads globally, FXCM has a longer history of serving the UK market. Being FCA regulated also means that FXCM adheres to stringent standards set by the UK’s financial watchdog. For those in the UK looking for more options, here’s a detailed list of the forex brokers in UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert