FBS Review Of 2026

FBS is a popular forex and CFD broker offering a wide range of trading instruments, competitive trading conditions, and user-friendly trading platforms. This review aims to give traders an in-depth analysis of FBS to help you determine if FBS is the right broker for you.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

FBS Summary

| 🗺️ Regulation | ASIC, CySEC, FSC- BZ |

| 📊 Trading Platforms | MT4, MT5, (AU and EU) FBS Mobile App |

| 💰 Minimum Deposit | $5 |

| 🎮 Demo Account | Yes |

| 🛍️ Instruments Offered | CFDs (Forex, Indices, Metals, Energies, Bonds, ETFs) |

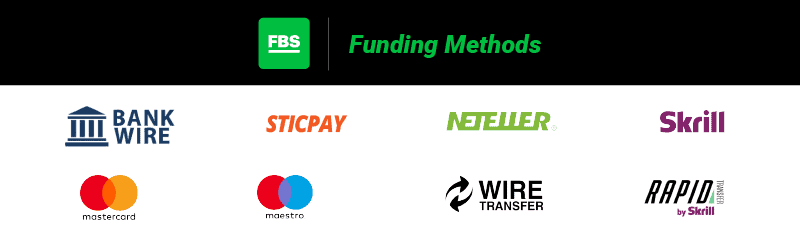

| 💳 Funding Methods | Wire Transfer, Visa, Mastercard, Skrill, Neteller, UnionPay |

Why Choose FBS

I’d recommend FBS because they provide competitive trading conditions with tight spreads from 0.8 pips, leverage options tailored to your region, fast execution speeds starting at 0.01 seconds, and commission-free trading on most accounts.

Apart from that, they have excellent research and education materials, reliable customer support, and offer a user-friendly experience on familiar trading platforms and their proprietary mobile app.

On the downside, The range of commodities like metals and energies is limited and they don’t have soft commodities. Their range of indices and cryptocurrencies is also less than that of many other brokers. The other main weaknesses to note are that they are not regulated by FCA for UK traders and they don’t have a raw style account (except in Australia).

- Competitive spreads

- Fast execution speeds

- Several deposit/withdrawal methods

- Dependable customer support

- Excellent research and education materials

- Slim product range outside Forex

- No MT4 outside Australia

- No RAW account outside Australia

The overall rating is based on review by our experts

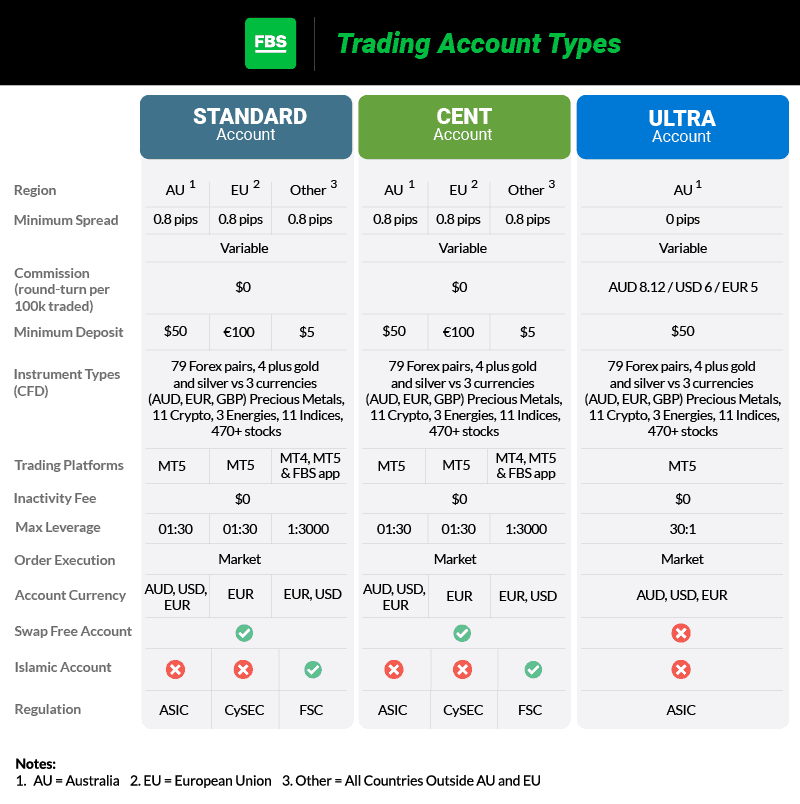

Account Types and Trading Fees

FBS offers different account types depending on your location. There are no deposit/withdrawal fees, account maintenance, or inactivity fees on FBS.

Regional Account Types

Australian Traders can choose from three account types:

- Standard Account: 0.8 pips minimum spread, no commissions, $50 minimum deposit

- Cent Account: 0.8 pips minimum spread, no commissions, $50 minimum deposit, ideal for beginners trading with smaller amounts

- Ultra Account: 0.0 pips minimum spread, AUD 8.12/USD 6/EUR 5 commission per lot round-turn, $50 minimum deposit

European Union Traders can choose from two account types:

- Standard Account: 0.8 pips minimum spread, no commissions, €100 minimum deposit

- Cent Account: 0.8 pips minimum spread, no commissions, €100 minimum deposit, perfect for testing strategies with minimal risk

Rest of World Traders (including UK, Philippines, Thailand, Mexico, and all other countries outside Australia and the EU) have access to:

- Standard Account: 0.8 pips minimum spread, no commissions, $5 minimum deposit

Standard/Cent Account Fees and Spreads

In my review, I found that FBS’s Standard Account spreads are moderate compared to other brokers. For example, FBS lists around 1.3 pips on EUR/USD, 1.8 pips on AUD/USD, and about 2.0 pips on GBP/USD. Their most competitive average spread is 1.3 pips for EUR/GBP.

These are higher than brokers like Pepperstone or Admirals, which often average around 1.0 pip or lower on major pairs. Overall, I found FBS’s spreads to be reasonable for casual trading but not among the most competitive for tight-cost strategies.

A Cent Account is also available. Interestingly, spreads with the Cent Account are the same as the Standard Account, whereas some brokers slightly widen spreads on smaller account types.

The Cent Account is designed primarily for beginners or those testing strategies with minimal risk, as it uses cent-denominated balances and supports micro or mini-lot trading. This allows you to practice with real market conditions while committing only a small amount of actual capital.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.20 | 1.40 | 1.40 | 1.60 | 1.50 |

| 1.10 | 1.20 | 1.50 | 1.40 | 1.40 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 0.94 | 1.48 | 1.45 | 1.68 | 1.90 |

| 1.00 | 1.00 | 1.50 | 2.00 | 1.00 |

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 0.80 | 1.00 | 1.00 | 1.00 | 1.00 |

| 1.00 | 1.20 | 1.00 | 1.00 | 1.10 |

| 1.70 | 1.60 | 1.70 | 2.00 | 1.60 |

| 0.70 | 0.60 | 2.00 | 1.40 | 1.20 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

RAW Account And Commissions (Australia only)

The Ultra Account is available exclusively to Australian clients and offers raw spreads with a fixed commission structure. Spreads can start from 0.0 pips on major pairs like EUR/USD and AUD/USD, which is on par with leading ECN brokers such as Pepperstone, IC Markets, and Eightcap, all of which also quote raw spreads averaging between 0.0 and 0.1 pips on the same instruments.

RAW Account Spread Comparison | |||||

|---|---|---|---|---|---|

| n/a | 0.30 | 0.50 | 0.60 | 0.50 |

| 0.14 | 0.31 | 0.62 | 0.39 | 0.75 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.80 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.10 | 0.10 | 0.90 | 0.70 | 0.60 |

| 0.50 | 0.55 | 1.18 | 0.66 | 0.96 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Commission: FBS charges AUD 8.12 round-turn (AUD 4.06 per side) per standard lot traded. This is slightly higher than the industry average, with brokers like Pepperstone, IC Markets, and Eightcap typically charging around AUD 7.00 round-turn.

Despite the marginally higher commission, the Ultra Account remains cost-effective for traders seeking low spreads and direct-market pricing, especially for short-term or algorithmic strategies where execution quality and transparency are key.

| Commission | Side-ways (Standard lot) | Round-turn (Standard lot) |

|---|---|---|

| FBS | AUD$4.06 | AUD$8.12 |

| Pepperstone | AUD$3.50 | AUD$7.00 |

| Eightcap | AUD$3.50 | AUD$7.00 |

| IC Markets | USD$3.50 | USD$7.00 |

| Axi | USD$3.50 | USD$7.00 |

| Think Markets | AUD$3.50 | AUD$7.00 |

| Admirals | AUD$4.00 | AUD$8.00 |

| BlackBull Markets | AUD$4.50 | AUD$9.00 |

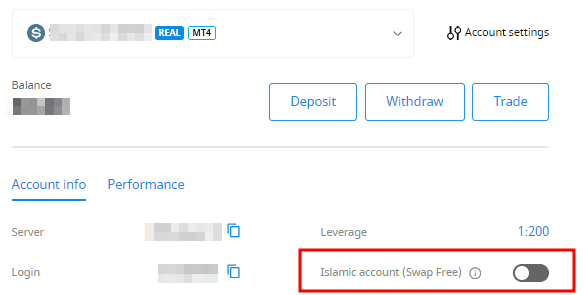

Swap-Free Account and Fees

Swap is the interest charged or earned for holding positions overnight. The table below shows a comparison of the swap fees at FBS and other brokers for one full contract (100,000 units) of the base currency.

| Broker | Asset | Swap long | Swap short |

|---|---|---|---|

| FBS | EUR/USD | -5.46 | 0.61 |

| GBP/USD | -2.91 | -1.15 | |

| ICM Markets | EUR/USD | -6.25 | 2.56 |

| GBP/USD | -1.99 | -0.37 | |

| OANDA | EUR/USD | -0.55 | 0.06 |

| GBP/USD | 0.14 | -0.85 | |

| Pepperstone | EUR/USD | -6.37 | 2.1 |

| GBP/USD | -2.39 | -2.62 |

As per the data above, FBS swap fees are relatively competitive but they aren’t the lowest in the market. You should carefully consider these swap fees in your strategy, especially if you frequently hold long positions overnight specifically on EUR/USD as you might find these fees costly compared to brokers like OANDA, which offers much lower swap costs.

FBS may be a good choice for EUR/USD short traders but less so for frequent long traders or those focused on GBP/USD.

The broker offers a swap-free account which allows you trade without incurring any overnight fees. They are usually for Muslim traders as they don’t charge or earn interest ensuring compliance with Sharia law. Instead of the swap fee, FBS applies a flat administrative fee which they debit from your trading account.

Regional Availability: Swap-free accounts are available for Australian and European traders. Islamic accounts are available for traders in other regions outside Australia and the EU.

3. Other Fees

FBS charges these extra fees:

- Conversion fees: You’ll be charged a nominal fee for converting money between currencies in your account.

- Guaranteed stop order fees: The broker offers guaranteed stop-loss orders to help protect you during market fluctuations and these incur additional fees.

My Verdict On FBS Spreads And Costs

I thought the platform was cost-effective with its tight spreads on major currency pairs like EUR/USD and GBP/USD. That, along with the fair overnight swap fees and no deposit/withdrawal fees or inactivity fees, makes the overall trading costs on FBS low.

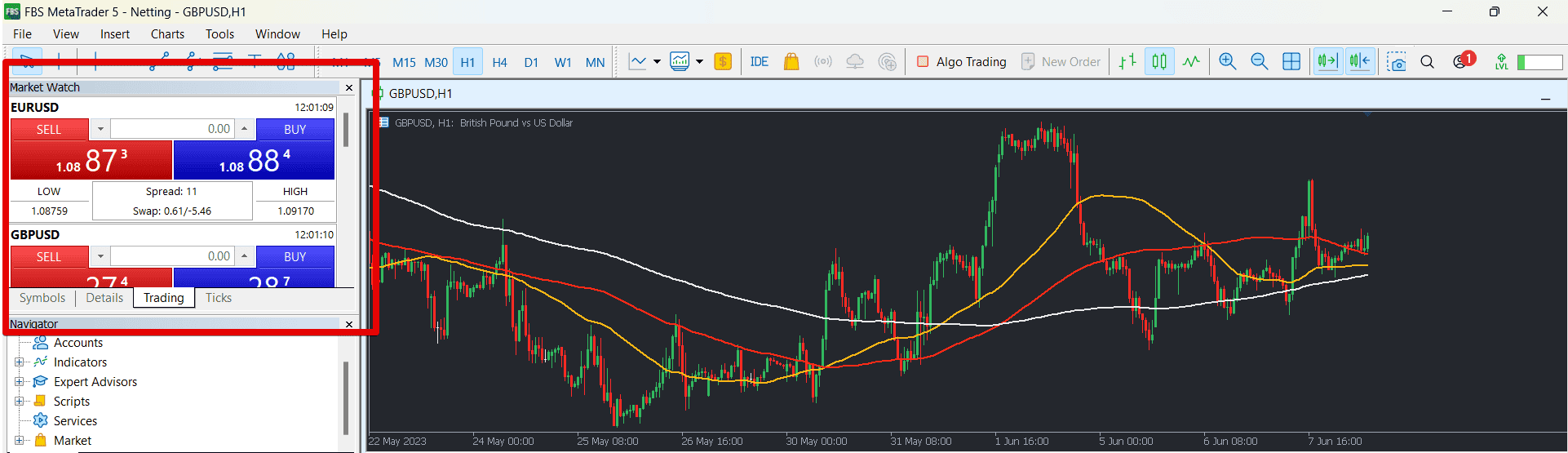

Trading Platforms

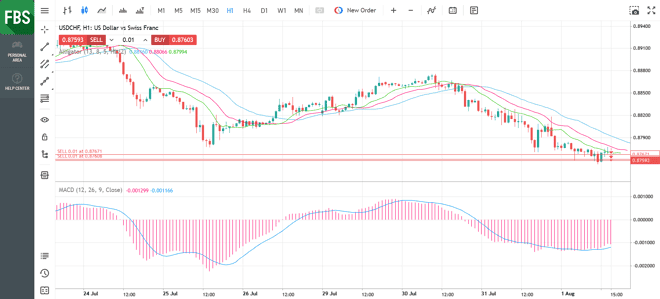

Australian and European traders can only use the MT5 platform, while traders in all other regions have access to MT4, MT5, and the FBS proprietary mobile app.

FBS provides these platforms available for free download on Windows and Mac desktops as well as mobile devices, ensuring a comprehensive trading experience. They also offer WebTrader versions for browser-based trading.

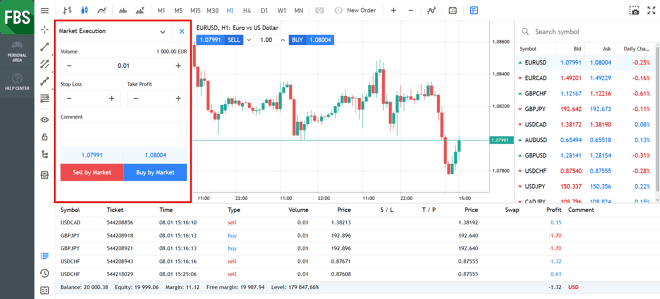

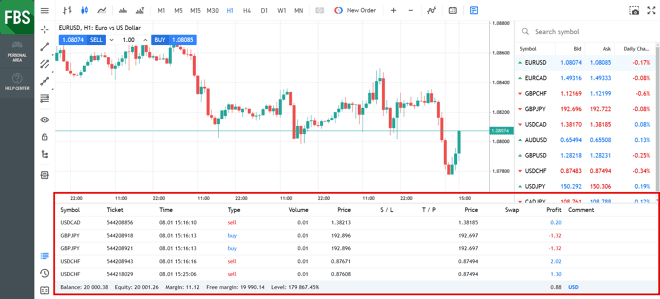

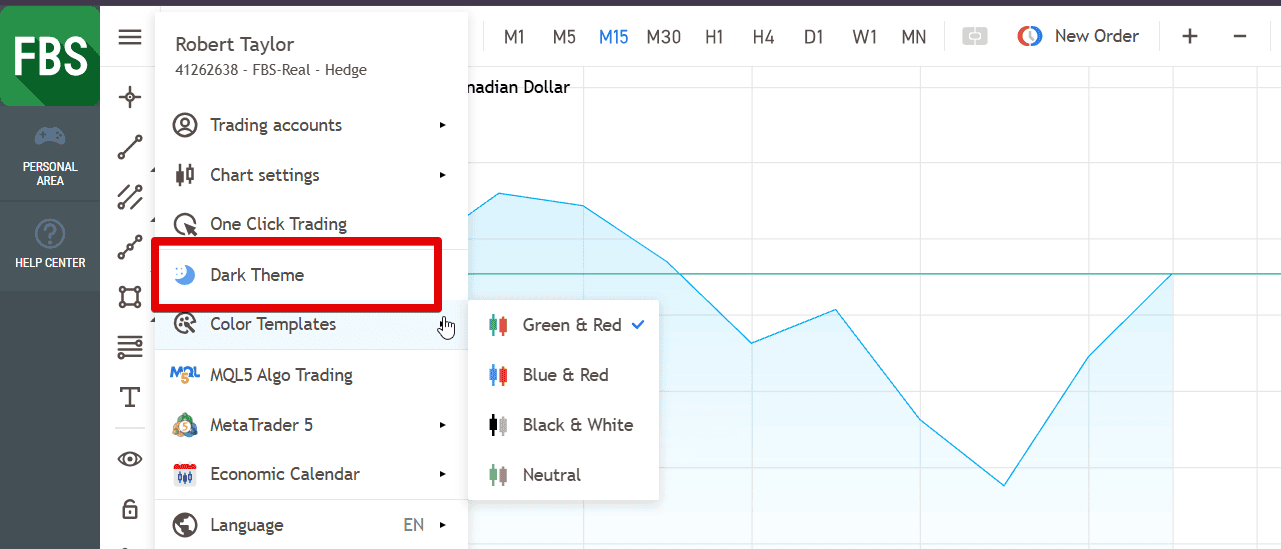

I carried out live tests using the MT5 Windows desktop and WebTrader versions and noticed the web platform to be different, with a more intuitive and user-friendly interface, but fewer tools. Here’s a quick overview of both platform features.

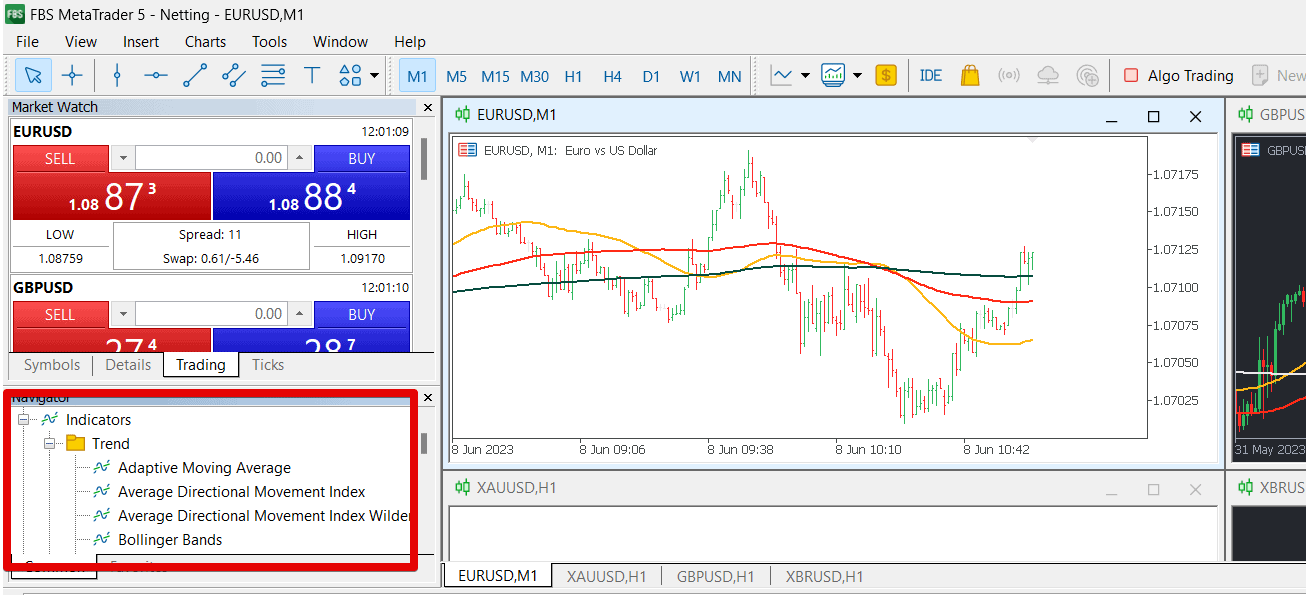

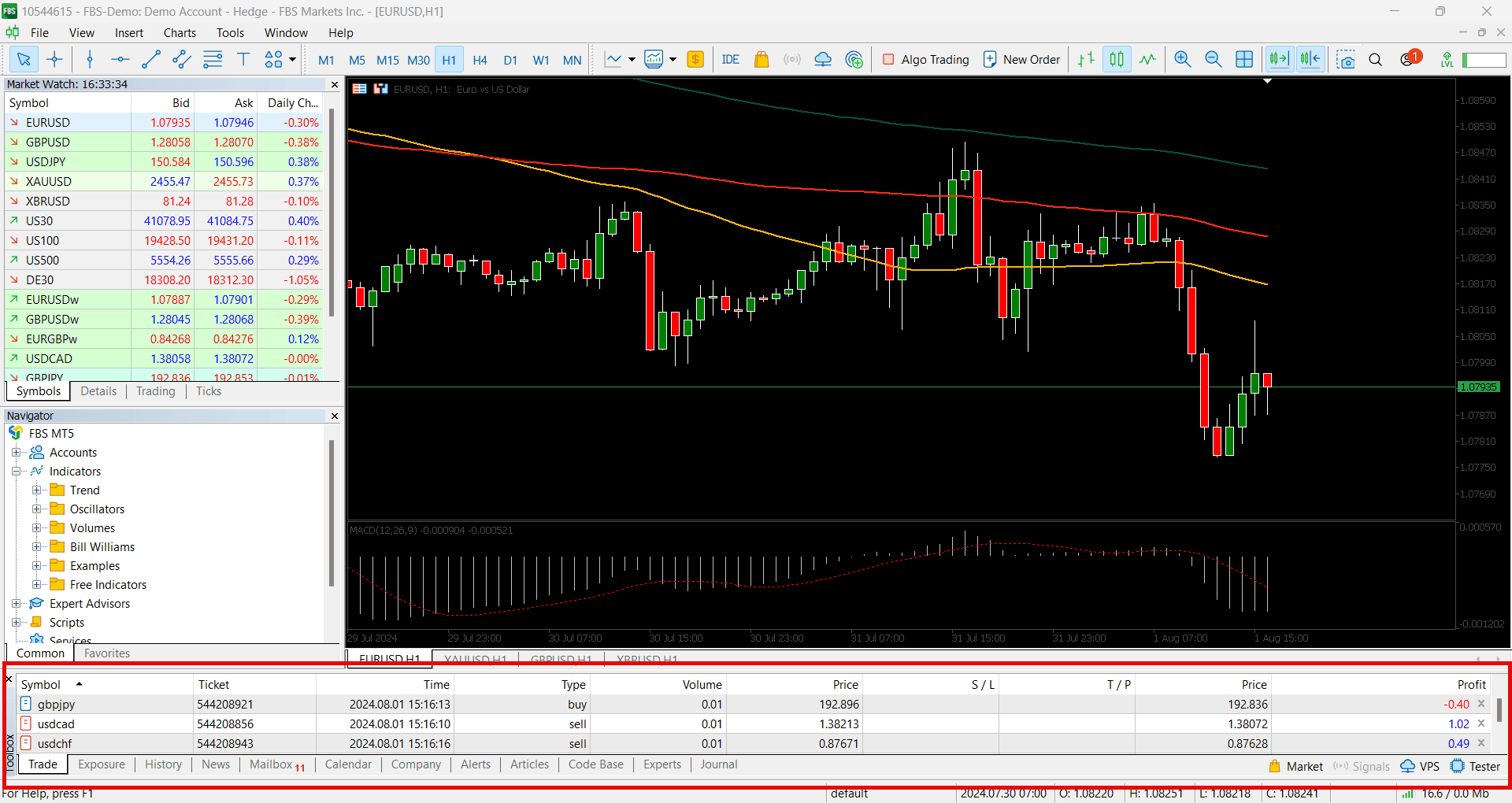

MT5 Desktop Platform Functionality

FBS MT5 Desktop platform has a wide range of advanced trading tools and features including:

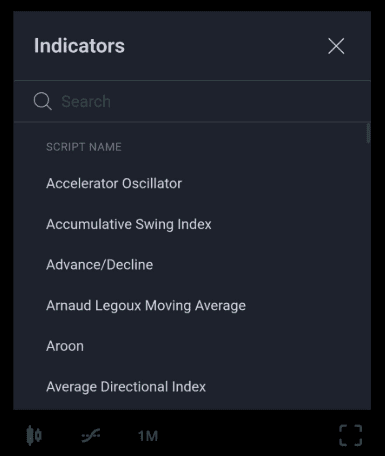

- Indicators: 38 technical indicators including Trend, Volumes, Bill Williams and Oscillators.

- Graphical tools: 44 analytical tools including lines, channels, Gann, and Fibonacci tools.

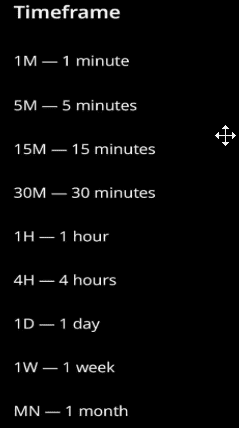

- Timeframes: 21 different time frames ranging from one minute to one month.

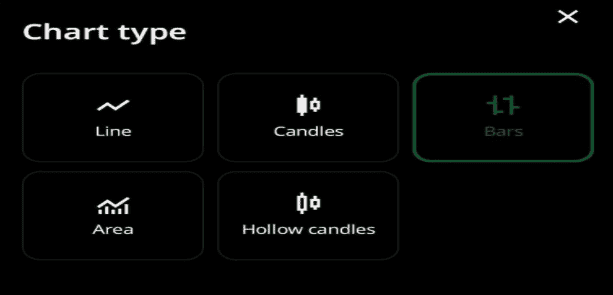

- Chart types: 3 chart types to choose from including Bar, Candlesticks and Line.

- Order types: Several order types including market orders, stop loss orders and more.

- Alerts: Set up and receive notification for specific instruments.

- Market Watch: Monitor your favorite instruments at a glance.

- Trade Panel: Track your open positions, market exposure, trade history and profit/loss figures.

- Trading from the chart: Trade directly from the price chart for maximum precision, speed and convenience.

- Automated trading: Automate trading with Expert Advisors and other accurate trading algorithms.

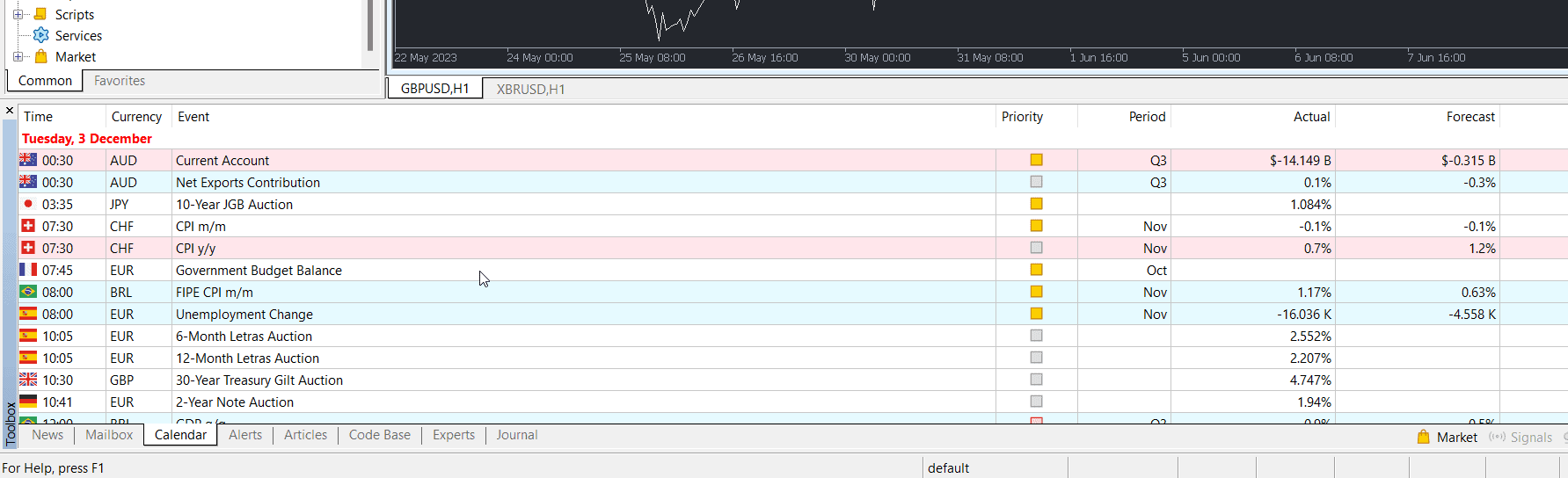

- Economic calendar: Track markets and stay updated on economic events and data.

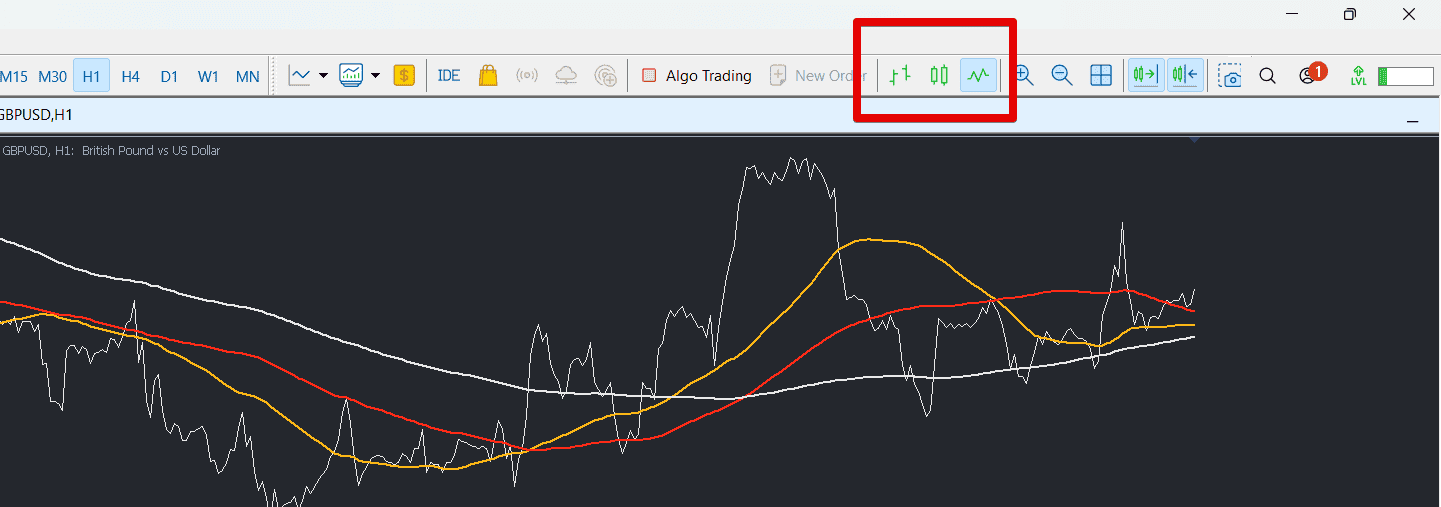

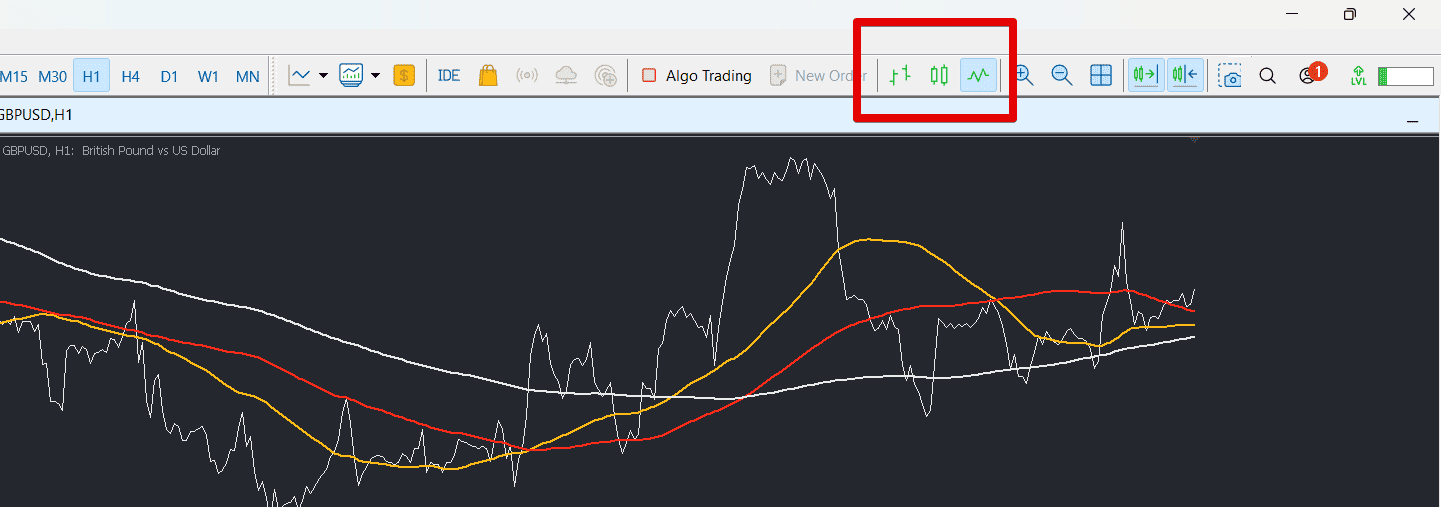

MT5 WebTrader Platform Functionality

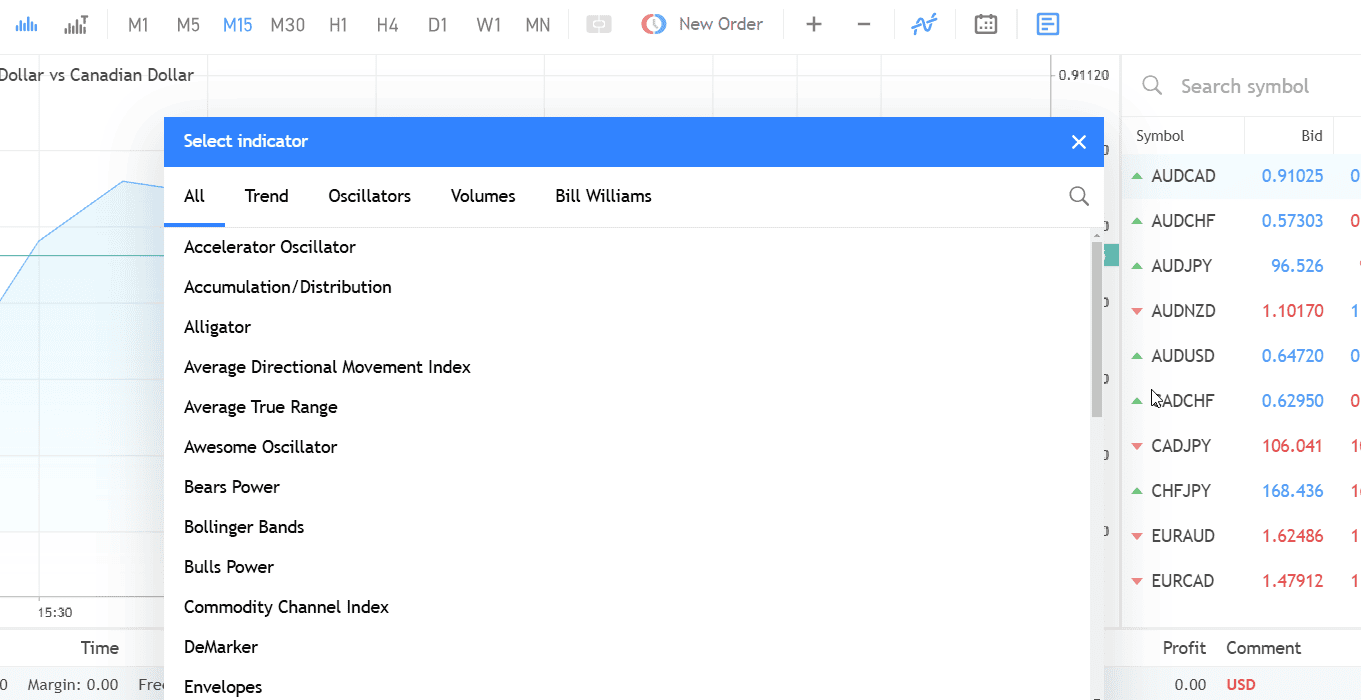

Despite providing the convenience of trading directly from your browser, the FBS MT5 WebTrader version has fewer indicators and analytical objects than the desktop platform. Here’s a rundown:

- Indicators: 31 technical Indicators including Trend, Volumes, Oscillators and Bill Williams.

- Graphical tools: 4 analytical objects including trend lines, regression channels, Gann, and Fibonacci tools.

- Timeframes: 9 timefraes ranging from one minute to one month.

- Chart types: 3 chart types-Bar, Candlesticks and Line.

- Order types: Several order types catering to different trading strategies.

- Trade Panel: You can keep your eyes on your open positions and account balances.

- Depth of Market (DOM): Receive live insights into the market at the click of a button.

- Market Watch: Monitor your favorite instruments at a glance.

- Dark mode: Improves your visual comfort and focus while trading.

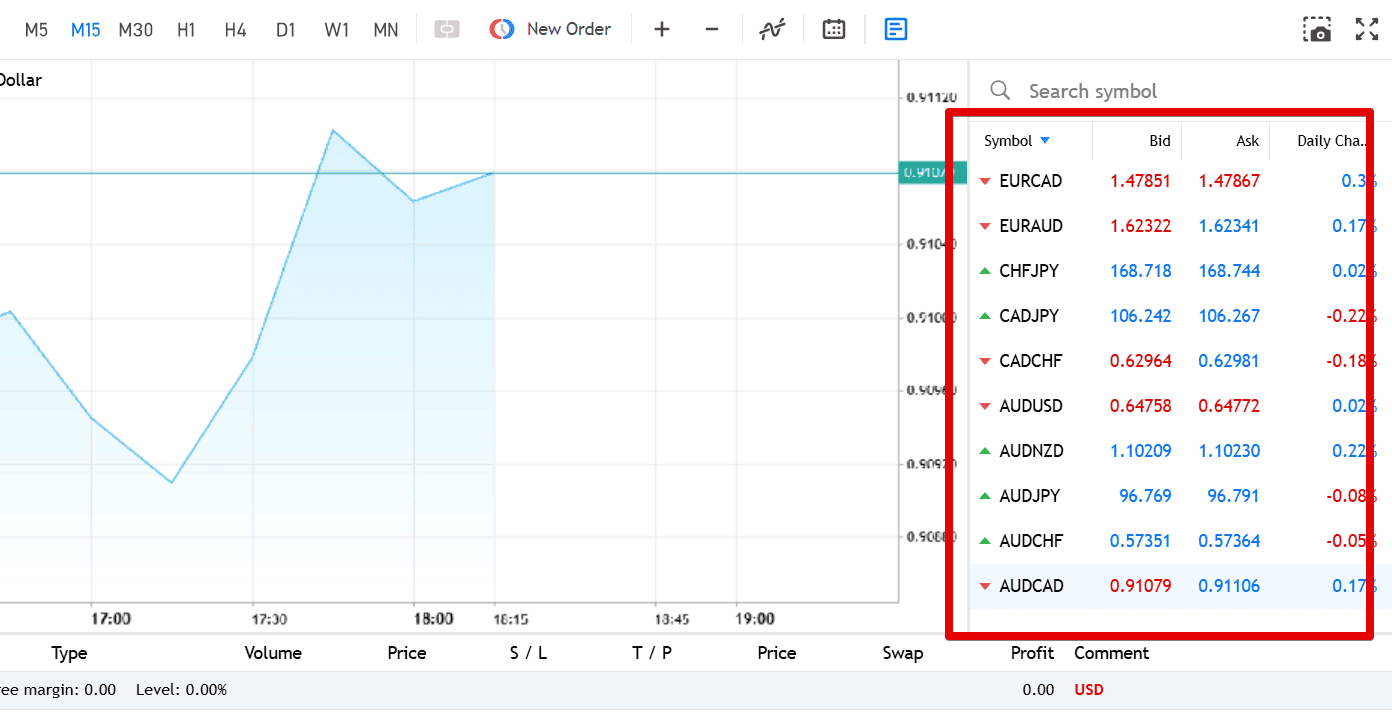

Mobile Trading App

FBS provides a feature-rich proprietary mobile app in addition to the MetaTrader 4 and 5 platforms, allowing you to trade while on the go. It’s available for free download on Android and iOS, and brings the following advanced tools and features to the palm of your hands:

- Indicators: You have access to 90+ technical indicators including Accelerator Oscillator, Bollinger Bands and more.

- Timeframes: 9 timeframes.

- Chart types: Charting features are powered by TradingView, providing you access to 5 chart types- Bar, Candlesticks, Hollow candles, Line and Area.

- Order types: A range of standard order types are available from market and limit to stop-loss orders.

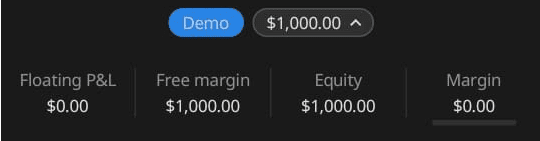

- Trading stats: Monitor your account equity, margin, free margin and floating P&L to estimate your trading opportunities.

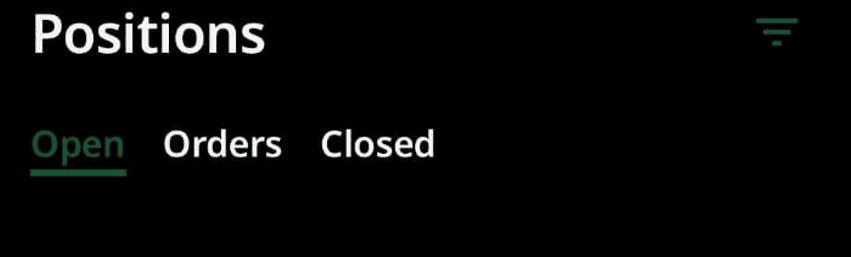

- Positions: Manage open, orders and closed positions.

- One-click trading: Eliminates confirmations for opening and closing positions, saving on time.

- Data security: Your data is kept safe on the platform through data encryption and secure login.

My Verdict On Trading Platforms

In my opinion, the FBS MetaTrader 5 desktop and WebTrader versions have advanced tools and features that are useful for experienced traders but not so much for beginners. For traders in regions outside Australia and the EU, the FBS proprietary mobile app is more beginner-friendly and can be an excellent alternative to the MT4 and MT5 mobile apps.

Is FBS Safe

The safety of a broker should be a big part of your decision-making process when choosing a broker. FBS ticks most boxes in this area, strictly adhering to regulation and employing state-of-the-art encryption technologies to protect clients from hacking and data theft. The main weakness of note is their lack of FCA regulation should you be based in the UK.

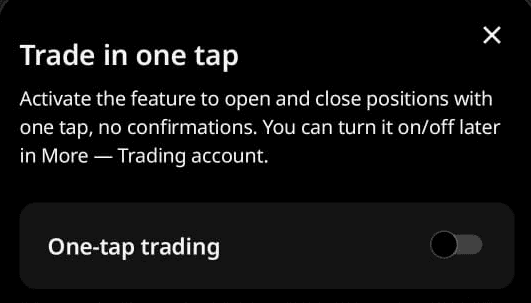

Regulation

FBS doesn’t limit its regulatory compliance to just one region; it has obtained multiple regulatory licenses to provide broader protection for clients worldwide.

Australian traders are protected by FBS Australia, which is regulated and licensed by the Australian Securities and Investments Commission (ASIC).

European Union traders are covered by FBS EU, which is regulated and licensed by the Cyprus Securities and Exchange Commission (CySEC).

FBS is not regulated in the UK by the FCA, and in other notable regions such as the UAE (SCA, DFSA, ADGM), Singapore (MAS), and Canada (Ciro). If you are in these regions (and anywhere outside Australia and Europe) FBS makes use of the Financial Services Commission of Belize (FSC). While this regulator isn’t as stringent as ASIC or CySEC, it still provides a level of protection.

On top of this, FBS provides extra security measures by offering negative balance protection and keeping clients’ funds separate from the company’s operational funds, ensuring the safety of clients’ capital. This is done regardless if the regulator requires this.

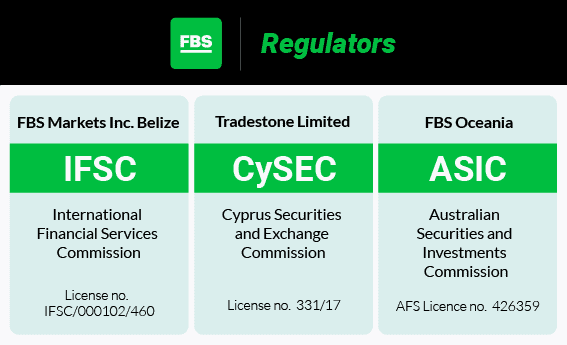

Reputation

FBS has a strong reputation reflected by the impressive number of users they pull in. The platform now serves over 27 million traders worldwide and continues to attract consistent monthly traffic.

The table below highlights FBS’s regional search interest in 2025.

| Country | 2025 Monthly Searches |

|---|---|

| Philippines | 49,500 |

| Colombia | 27,100 |

| Saudi Arabia | 14,800 |

| Argentina | 12,100 |

| Jordan | 12,100 |

| Malaysia | 9,900 |

| Turkey | 9,900 |

| United States | 8,100 |

| South Africa | 6,600 |

| Nigeria | 6,600 |

| Thailand | 3,600 |

| Germany | 3,600 |

| India | 2,900 |

| Bangladesh | 2,400 |

| Singapore | 2,400 |

| Uzbekistan | 2,400 |

| Bolivia | 2,400 |

| Uruguay | 2,400 |

| Algeria | 1,900 |

| Morocco | 1,900 |

| Poland | 1,600 |

| Peru | 1,600 |

| Brazil | 1,300 |

| Chile | 1,300 |

| Taiwan | 1,300 |

| Botswana | 1,300 |

| Indonesia | 1,000 |

| Vietnam | 1,000 |

| United Arab Emirates | 1,000 |

| Pakistan | 1,000 |

| Australia | 1,000 |

| Italy | 880 |

| Hong Kong | 880 |

| Sri Lanka | 880 |

| Switzerland | 880 |

| Ethiopia | 880 |

| Spain | 720 |

| Kenya | 720 |

| United Kingdom | 590 |

| Cyprus | 590 |

| Ecuador | 590 |

| New Zealand | 590 |

| Tanzania | 480 |

| Mexico | 390 |

| Canada | 390 |

| Netherlands | 390 |

| Japan | 390 |

| Sweden | 390 |

| Cambodia | 390 |

| Ireland | 390 |

| Ghana | 320 |

| Venezuela | 260 |

| Costa Rica | 260 |

| Austria | 260 |

| Greece | 260 |

| Portugal | 210 |

| Dominican Republic | 210 |

| Mongolia | 210 |

| Egypt | 140 |

| Mauritius | 110 |

| Uganda | 90 |

| France | 70 |

| Panama | 70 |

49,500 1st | |

27,100 2nd | |

14,800 3rd | |

12,100 4th | |

12,100 5th | |

9,900 6th | |

9,900 7th | |

8,100 8th | |

6,600 9th | |

6,600 10th |

Reviews

FBS has a rating of 4.3 stars on Trustpilot and many users have posted positive reviews about the platform praising them for their competitive trading conditions, responsive customer support, great security features and tons of swift deposit/withdrawal methods.

My Verdict On Trust With FBS

I concluded that FBS is safe because of their strict regulatory compliance and client protection measures. The positive reviews and strong reputation are an added advantage but as always, do your own due diligence and carefully evaluate the broker.

Deposit and Withdrawal

Here’s a closer look at FBS deposit/withdrawal methods, fees and potential challenges involved.

What Is the Minimum Deposit At FBS?

The minimum deposit amount at FBS is $5 and there are no deposit fees.

Account Base Currencies

FBS offers base currency options depending on your region. This is important as trading in your local currency eliminates recurrent conversion fees that would otherwise increase your trading costs and eat into profits.

Australian traders can choose from AUD, USD or EUR. European Union traders have EUR available, while traders in all other regions can access USD and EUR as base currencies.

Deposit Options and Fees

FBS offers a wide variety of deposit and withdrawal methods depending on your region. Here’s a quick look at the deposit methods available to traders.

| Method | Commission | Average processing times | Limits |

|---|---|---|---|

| Bank Wire | 0% | 1-5 days | From 1 USD |

| Visa | 0% | Instant | From 4-50,000 EUR |

| Visa, Mastercard | 0% | Instant | From 3-999,999 USD |

| Skrill | 0% | Instant | From 12-500,000 USD |

| BBVA Bancomer | 1.25% | 15-20 min | From 11-1,920 USD |

| Scotiabank | 1.25% | 15-20 min | From 11-2,000 USD |

Here’s how to fund your real trading account:

- In your account in your Personal Area, click on “Finances” in the menu at top of the page.

- Select “Deposit“, choose your preferred payment method and enter the amount of money you want to deposit.

- Click on the “Deposit” button to confirm your transaction.

Withdrawal Options and Fees

FBS provides many instant automated withdrawal methods secured through OTP verification. They include:

| Method | Commission | Average processing times | Limits |

|---|---|---|---|

| Bank Wire | 0% | 1-5 days | From 1 USD |

| Visa | 1 EUR | 15–20 min (max 7 business days) | From 2-30,000 EUR |

| Visa, Mastercard | 0.5 EUR | 15–20 min (max 7 business days) | From 1-50,000 USD |

| Skrill | 1-2% + 0.29 EUR | 15–20 min (max 48h) | From 10-500,000 USD |

| BBVA Bancomer | 1% + 1 USD. | 15–20 min (max 72h) | From 11-5,000 USD |

| AstroPay | 0.5% | 15–20 min (max 48h) | From 5.50-10,000 USD |

| Banco Azteca | 1% + 1 USD | 15–20 min (max 72h) | From 19-5,000 USD |

| Netellar | 2% (min 1 – max 30 USD) | 5–7 min (max 48h) | From 4-25,000 USD |

| Visa, Maestro | 2 EUR | 15–20 min (max 7 business days) | From 5-5,002 EUR |

| Scotiabank | 1% + 1 USD | 15–20 min (max 72h) | From 11-5,000 USD |

| Sticpay | 0% | 15–20 min (max 48h) | From 3-50,000 USD |

To withdraw from the platform:

- Select “Withdraw” from the Finances tab.

- Choose your preferred payment method and type the amount of money you want to withdraw.

- Click on the “Confirm withdrawal” button.

Note: FBS doesn’t charge for deposit or withdrawals. Commissions are applied by the payment system.

My Verdict On Funding With FBS

Depositing and withdrawing is fast, easy and convenient, with many options charging little to no commission fees for transactions.

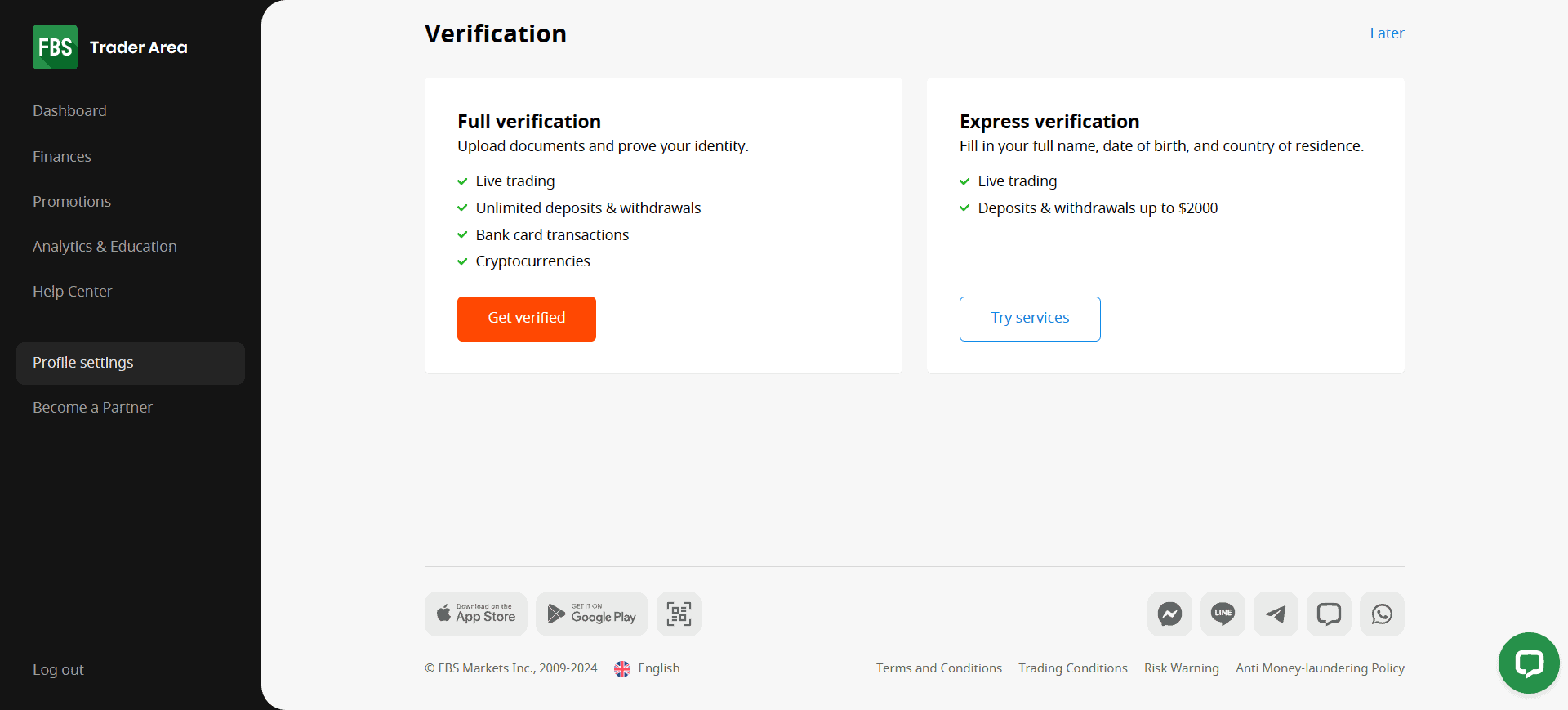

Ease To Open An Account

Opening an FBS account is relatively fast and easy. Simply enter your details in the sign-up page and click “Register as a trader”. You’ll be directed to the client portal to complete a Know Your Customer (KYC) verification process where you’ll need to provide your identification documents e.g driver’s license, ID card, or passport.

The full verification process takes around 10 minutes. If that’s too long for you, you can opt for the quick Express verification that requires you to only enter your name, email and country of residence but keep in mind that you won’t be able to complete bank card transactions.

Note: FBS does not provide account managers.

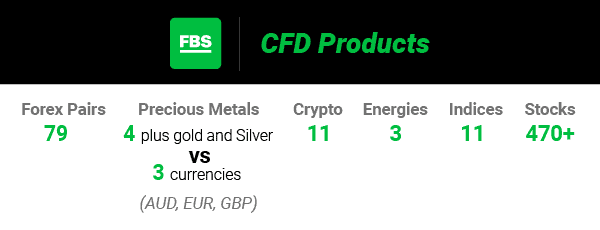

Product Range

You can trade Forex and CFDs on stocks, indices, and commodities at FBS, though the portfolio is limited to these two asset classes.

Note: I found the product range to differ depending if I used desktop, app or web versions.

- Forex: 79 currency pairs including majors, minors, and exotics

The forex selection is comprehensive, covering all the popular majors like EUR/USD, GBP/USD, and USD/JPY, along with a wide range of minors and exotic pairs. This gives you plenty of opportunities to diversify your strategies across different currency correlations and market sessions.

- Metals: 4 precious metals (gold, silver, platinum, palladium) tradeable against 3 currencies (AUD, EUR, GBP)

You can trade popular metals like gold, silver, platinum, and palladium. The ability to trade gold and silver against multiple currencies, including AUD, is particularly useful for Australian traders looking to hedge against local currency movements.

- Energy: 3 energy instruments, including crude oil and natural gas

You get access to key energy commodities that often present high volatility and trading opportunities, especially during geopolitical events or supply disruptions.

- Indices: 11 major global indices

FBS lets you trade CFDs on major indices like the S&P 500, NASDAQ, FTSE 100, and more. This lets you speculate on broader market movements without having to trade individual stocks.

- Stocks: 470 stock CFDs from major and minor markets worldwide

A decent selection of individual stock CFDs spanning the US (NASDAQ, NYSE), European (FWB Frankfurt, ENX Paris) plus England via the London Stock Exchange.

- Crypto: 11 cryptocurrencies

Access to popular cryptocurrencies, including Bitcoin, Ethereum, and other major altcoins. If using Bitcoin Cash you can choose between BCH vs AUD, GBP, CAD, EUR, NZD, CHF, USD While you can also choose between CAD, Ethereum, Gold for Bitcoin.

What’s missing?

While FBS covers the essentials well, the product range is slim compared to competitors. You won’t find ETFs, bonds, options, or futures here but many brokers dont have these, what really is notices is their small range of commodities and indices.

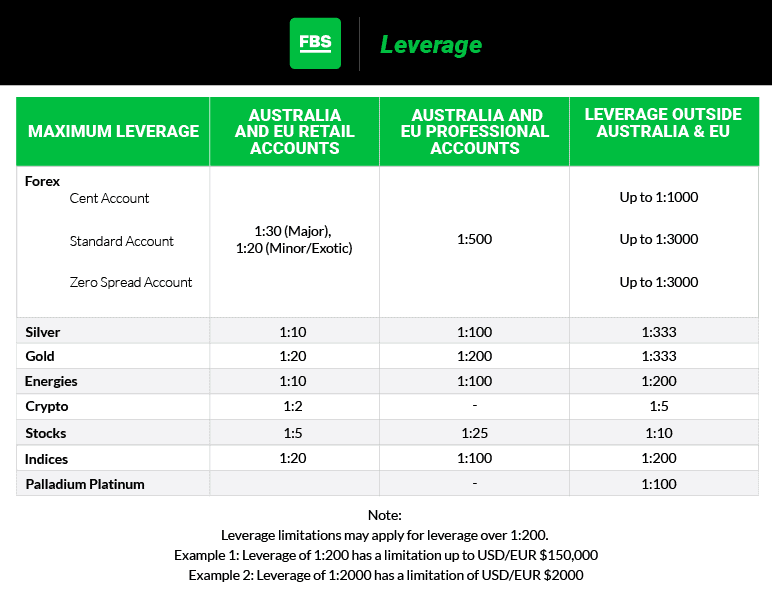

What Leverage Does FBS Offer?

Leverage limits at FBS vary depending on your region due to different regulatory requirements.

Australian & European traders: You’re limited to a maximum leverage of 1:30 across all instruments. This is due to ASIC and CySEC regulations that protect retail traders from excessive risk. You might see this as restrictive compared to offshore brokers, but it’s actually a safety measure that prevents you from overleveraging your account.

All other regions: You have access to much higher leverage, ranging from 1:1 up to 1:3000 for forex instruments. However, the broker will automatically adjust your leverage based on your account equity to manage risk.

The broker provides a wide range of leverages from 1:1 to 1:3000 for forex instruments. Depending on the sum of equity (displayed as available funds), FBS may automatically adjust leverage for open and reopened positions, based on these limitations:

| The sum of equity on your trading account (USD or EUR) | Leverage |

|---|---|

| 0–199 | 1:3000 |

| 200–1,999 | 1:2000 |

| 2,000–4,999 | 1:1000 |

| 5,000–29,999 | 1:500 |

| 30,000–149 999 | 1:200 |

| 150,000 or more | 1:100 1:50 1:25 1:10 1:5 1:1 |

While the maximum leverage of 1:3000 can amplify your profits significantly, it can hurt you just as much. Therefore, only use leverage levels you fully understand and can afford to risk.

My Verdict On Range Of Markets And Leverage

In my opinion, the FBS product range could be more diverse, with the introduction of other popular instruments like ETFs and bonds. As for leverage, I like that they offer a variety of options as they accommodate traders with different risk appetites.

Customer Service

FBS customer support is more reliable than other brokers I’ve dealt with. Contacting them is easy and you can do so by requesting a call back or clicking on the live chat pop-up at the bottom right corner of the screen. I was disappointed, though, with how long I had to wait for a representative (around 15 minutes) yet they claim a 5-minute wait time.

Research and Education

FBS has an excellent research and education section serving both beginners and experienced traders.

Research

Here’s what the FBS research section offers:

Trade Ideas

Trade Ideas provides you with short-term market analysis and expert perspectives to help you seize potential trading opportunities across different currency pairs and financial instruments. This is a great way to learn about technical analysis and current market dynamics.

Market Insights

The Market Insights section provides information on market trends, long-term opportunities and in-depth fundamental and technical analysis from FBS experts. I appreciate the broad coverage across multiple markets, from stocks to forex and commodities.

Other classic research tools on FBS include:

Economic Calendar

The Economic Calendar provides a schedule of major economic and political events affecting the global market, enabling you to anticipate market movements and adjust your trading strategy accordingly.

Trading Calculators

Trade confidently at every step using 3 FBS calculators:

- Trading calculator: Handy tool for calculating the margin needed to open a position, estimating potential profits and losses and seeing how leverage ratios affect the margin and potential profits.

- Profit calculator: Helps estimate potential profits and losses across different instruments.

- Currency converter: Get up-to-date exchange rates for various currency pairs and monitor their movements and volatility.

VIP Analytics

For a one-time sum or installments adding up to $500 or €500, you can receive market news, technical analysis, and trading ideas from FBS experts, straight to your inbox Monday through Friday.

The education section is comprised of the following:

- FBS Academy: Provides beginner and advanced trading courses covering the fundamentals of forex trading in a simple manner.

- Trader’s Blog: Contains articles across various categories including strategy and risk management to provide tips and ideas for a well-balanced trading experience.

- Video tutorials: Short, precise and easily understandable video tutorials on all kinds of topics from Forex basics to MT tutorials.

- Webinars and seminars: FBS hosts interactive webinars and seminars occasionally where participants ask questions and get expert insights.

- Glossary: Contains key terms and definitions to help you understand forex markets and improve your trading skills.

Final Verdict on FBS

FBS offers competitive trading conditions with tight spreads, fair swap fees, and fast execution speeds that work well for both beginners and experienced traders.

I appreciate their strong regulatory oversight across multiple jurisdictions – ASIC for Australian traders, CySEC for EU traders, and FSC Belize for everyone else – as well as their excellent research and education materials.

The platforms are solid, but trader experience varies by region. Australian and EU traders are limited to MT5 only, which is solid but gives you no choice. If you’re outside these regions, you get MT4, MT5, and the FBS mobile app, so there’s more flexibility to find what suits your style.

Australian and EU traders face a 1:30 leverage cap and higher minimum deposits ($50 AUD / €100 EUR) due to local regulations. Traders in other regions can start with just $5 and access leverage up to 1:3000. You’ll also find fewer account types if you’re in Australia or the EU.

The product range is another weakness across all regions. FBS only offers forex and CFDs, so if you’re looking to trade ETFs, bonds, or options, you’ll need to look elsewhere.

Overall, FBS is a solid choice if forex and CFD trading align with your goals, but take time to weigh these regional differences and product limitations before opening an account.

FAQ's

Is FBS a Good Broker?

Yes, FBS is a reputable broker with strong regulatory oversight from ASIC, CySEC, and FSC Belize. They offer competitive spreads, fast execution, and excellent education resources, making them suitable for both beginners and experienced traders.

What Demo Account Does FBS Have?

FBS offers a risk-free demo account with no time limit. You can practice trading with virtual funds and test strategies without risking real money before opening a live account.

What is the Minimum Deposit at FBS?

The minimum deposit varies by region: $5 for traders outside Australia and the EU, $50 for Australian traders, and €100 for European traders.

Alternatives to FBS

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research