FP Markets Review Of 2026

I recommend FP markets for its low trading fees, such as 1.2 pips average spread for EUR/USD on the standard account. You also have access to trading platforms like MT4, MT5, cTrader and TradingView (plus IRESS and Mottai for Australian traders). Other features include extensive education resources, outstanding live chat support and VPS.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

FP Markets Summary

| 🗺️ Country Regulation | Australia (ASIC), Europe (CySEC) |

| 💰 Trading Fees | Raw and Standard Spreads |

| 📊 Trading Platforms | MT4, MT5, cTrader, TradingView |

| 💰 Minimum Deposit | $100 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | Forex, Shares, Commodities, Indices, Crypto, ETFs, Bonds |

| 💳 Card Deposit | Credit Card, Debit Card |

Why Choose FP Markets

FP Markets impresses with an overall expert score of 86/100. This is a result of consistent strong performance across competitive spreads, platform diversity, and great market access. They also have good regulatory coverage and great customer support.

The broker doesn’t have obvious weaknesses besides a higher minimum deposit. The product range does differ between countries, and my tests did find their execution to be average. I also thought it would be better if FP Markets didn’t limit some products to certain countries.

FP Markets Pros and Cons

- Great variety of trading tools and platforms

- Competitive spreads

- Good customer reviews

- Large range of CFD stocks

- Limited cryptocurrency selection

- Requires $100 initial deposit

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

FP Markets offers two major forex account types and pricing structures, as follows.

Standard Account: No commissions charged on trades; ideal for beginners.

RAW Account: The lowest spread utilizing ECN pricing for the proactive and experienced trader.

1. RAW Account Spreads

FP Markets offer highly competitive ECN pricing, ensuring direct access to institutional-grade spreads. This means that they stream the price feeds directly from their liquidity providers, which helps with reducing spreads

ECN Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.08 | 0.35 | 7.60 | 3.50 | 0.73 |

| 0.06 | 0.27 | 0.49 | 0.30 | 0.59 |

| 0.10 | 0.10 | 0.90 | 0.20 | 1.10 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.09 | 0.13 | 1.70 | 0.14 | 1.40 |

| 0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.10 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

| 0.38 | 0.92 | 0.65 | 0.70 | 0.86 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

With its closest competitor, Eightcap, offering a tight spread for EUR/USD of 0.06 pips, FP Markets still offers a competitive spread of 0.10 pips. We observed that the ECN pricing enables them to match leading competitors like Pepperstone and Admiral Markets with better prices.

| RAW Account Spreads | FP Markets | Average Spread |

|---|---|---|

| Overall | 0.38 | 0.74 |

| EUR/USD | 0.10 | 0.21 |

| USD/JPY | 0.56 | 0.39 |

| GBP/USD | 0.29 | 0.48 |

| AUD/USD | 0.21 | 0.39 |

| USD/CAD | 0.16 | 0.53 |

| EUR/GBP | 0.43 | 0.55 |

| EUR/JPY | 0.3 | 0.74 |

| AUD/JPY | 0.5 | 1.07 |

| USD/SGD | 0.8 | 2.34 |

2. Raw Account Commission Rate

FP Markets has competitive commission fees against other online brokers with similar account types from the class of the ECN Account. RAW Account holders will have to pay a $3 commission per side, per 100k traded, whereas this usually stands at a standard $3.50 for accounts in the same class.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| FP Markets Commission Rate | $3.00 | N/A | £2.25 | €2.75 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

Our testing approach for standard account ensures realistic spread data includes analysis based on real-time forex spreads during the height of trading hours.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| FP Markets Average Spread | 1.2 | 1.5 | 1.4 | 1.3 | 1.4 | 1.2 | 1.4 | 1.6 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

This offers an accurate look into actual trading conditions that would permit an effective and functional comparison of FP Markets with its competitors. As such, it places FP Markets in a favorable position among forex brokerages, as observed in the EUR/USD tight spread example.

When trading FP Markets commission-free spreads, MetaTrader 4 and MetaTrader 5 are available as trading platform options, and for those located outside Australia and the EU, cTrader is also an option.

4. Swap-Free Account Fees

In our research, this type of account does not incur overnight interest charges on positions, in accordance with Islamic finance principles. A small administrative fee is instead charged directly to the account balance. The client needs to open a Standard or Raw Account on either the MT4/MT5 trading platform in order to be provided with an Islamic Account.

Admin Fee applies on first rollover for all products except major currency pairs which have a 5 day grace period. Admin fees range from $1 to $10 for most products with some less popular exotics being even more (ie: GBP/TRY $155).

Admin Fee applies on first rollover for all products except major currency pairs which have a 5 day grace period. Admin fees range from $1 to $10 for most products with some less popular exotics being even more (ie: GBP/TRY $155).

We observed that FP Markets supports Islamic trading principles by offering swap-free accounts in certain countries only. This account is not available for traders in Australia and Europe, and you need to email FP market to get an Islamic account.

5. Other Fees

FP Markets doesn’t have as many hidden fees, the broker has a good reputation for cost transparency.

Here is an overview of the fees you might incur:

Overnight Financing (Swap Fees)

If you hold a leveraged position overnight, FP Markets will charge swap fees or overnight financing fees. These may vary depending on the asset in question, market conditions, and time held.

Currency Conversion Fees

A currency conversion fee may apply to the Australian traders that fund their accounts in AUD and trade instruments quoted in other currencies. The FP Markets transactions are processed in major currencies such as the USD, EUR, and AUD, therefore, some extra cost may incur.

Third-Party Deposit and Withdrawal Fees

While FP Markets does not have any deposit or withdrawal fees, some third-party service providers like banks or e-wallets may have transaction fees of their own. Australian traders should check these charges independently with their payment provider in advance.

My Verdict on FP Markets Trading Costs

I rate FP Markets at 8.0 because its Raw account delivers impressively tight spreads around 0.1 pips for EUR/USD paired with low commissions, making it a cost-effective choice for frequent traders. You’ll notice the savings quickly when every trade counts.

Trading Platforms

With all necessary trading resources provided, the following trading platforms are compatible with FP Markets to allow you as an Australian trader to perform trading with convenience.

Here are the available platforms and what I think about each of them as follows:

1. MetaTrader 4

2. MetaTrader 5

3. Iress Trading Platform (Australia only)

4. WebTrader

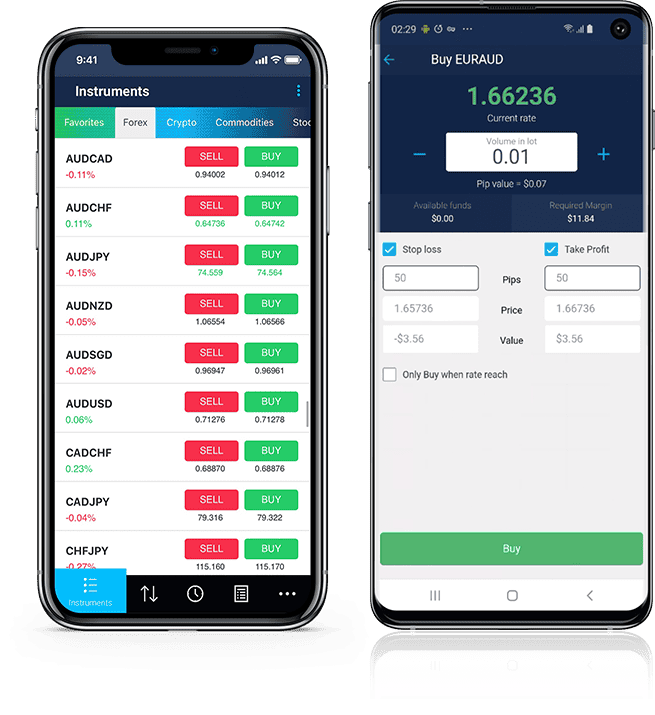

5. Mobile Trading Apps

6. cTrader (Depending on Jurisdiction)

7. TradingView

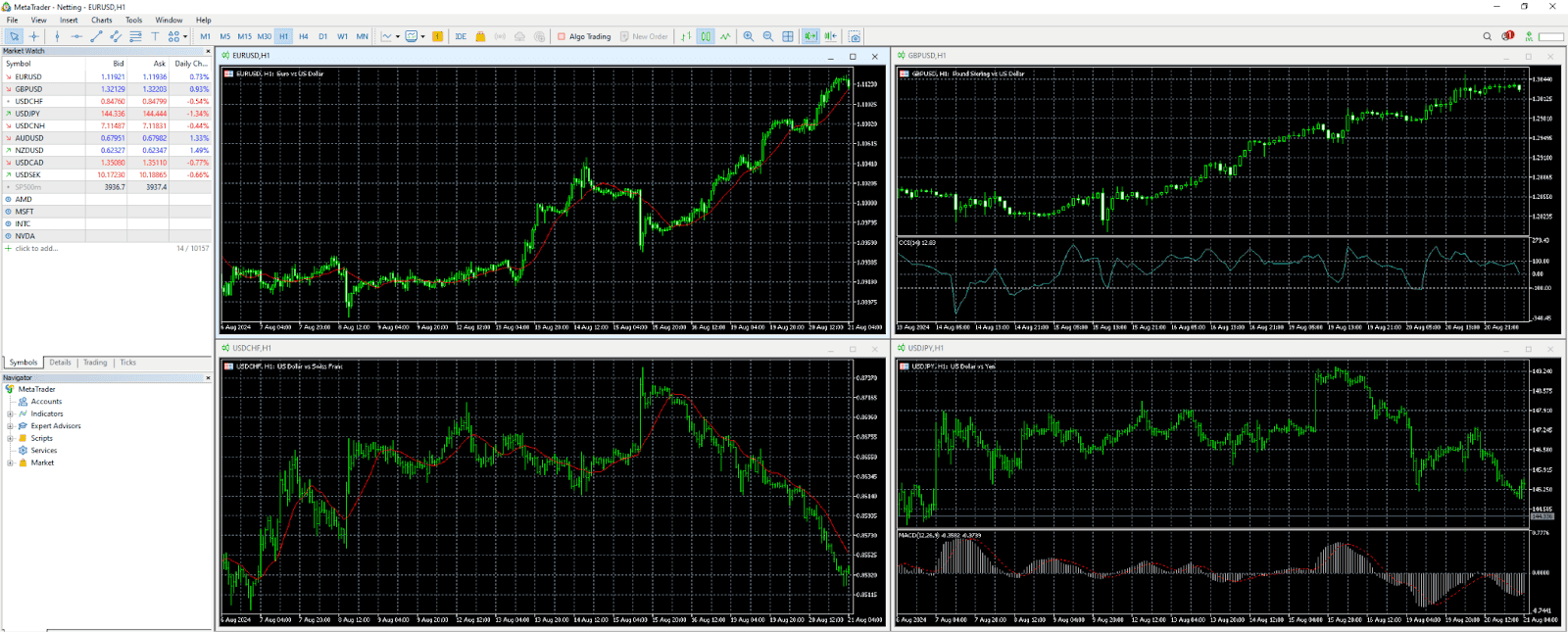

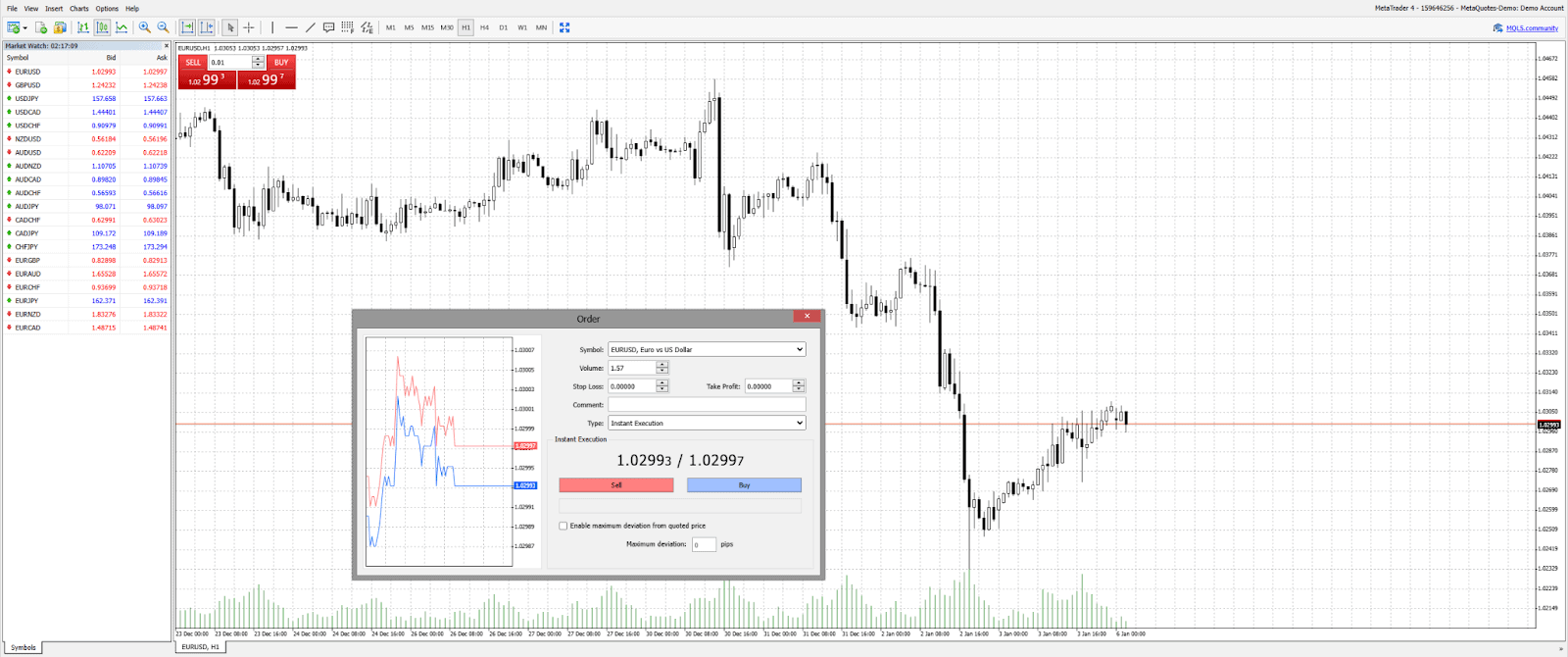

1. MetaTrader 4 (MT4)

In my experience, MT4 is still one of the most sought-after platforms for Australia-based Forex and CFD traders (and also worldwide) due to its ease of use and fully featured functionality.

Its strengths include excellent backtesting and Expert Advisors (EAs), enabling automated 24/7 forex trading.

MT4 is very suitable for new traders with its user-friendly interface and its large community. You can find all the essentials including multi-timeframes and standard indicators for trading analysis. MT4 supports EA(Expert Advisor) trading that can help you run your trading strategy automatically.

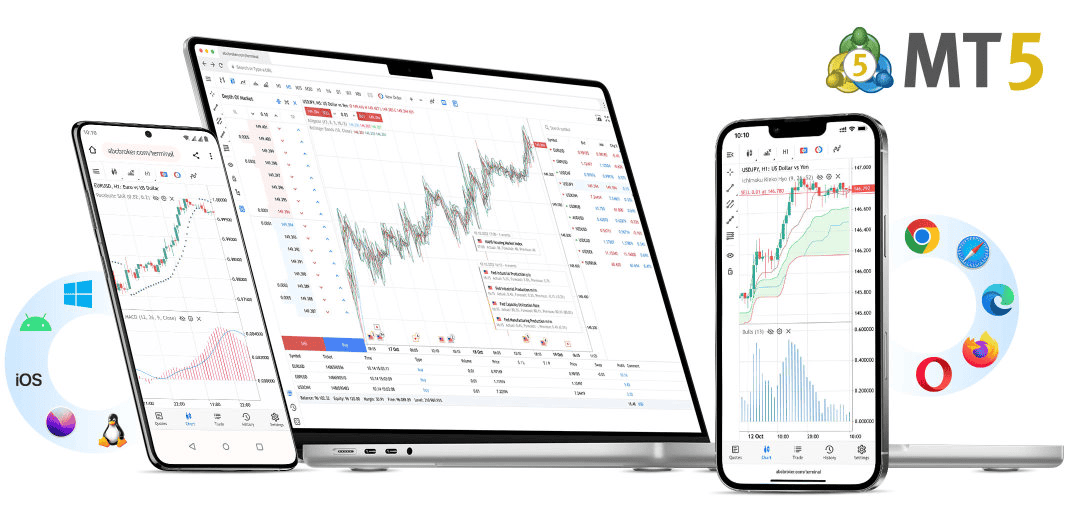

2. MetaTrader 5 (MT5)

If you’re deciding between MT4 and MT5, it’s essential to consider their key differences. While both platforms are excellent for trading forex and other markets, MT5 has an edge in versatility.

In my opinion, MT5 is known as the professional metatrader platform for traders with more trading experience. MetaTrader5 comes with more technical indicators and 21 timeframe options, including a built-in economic calendar that can be helpful for avoiding opening positions during volatile periods.

For high volume traders, MT5 also has 64 bit which is better for forex and CFD trading backtesting. While it offers more advanced features, it also uses a different programming language – MQL5 for those who want automatic trading. Which is slightly more complex than the programming language for MT4 – MQL4.

After years of using MT5, I can comfortably recommend it to more intermediate and advanced Australian traders so you can make full use of its features over MT4.

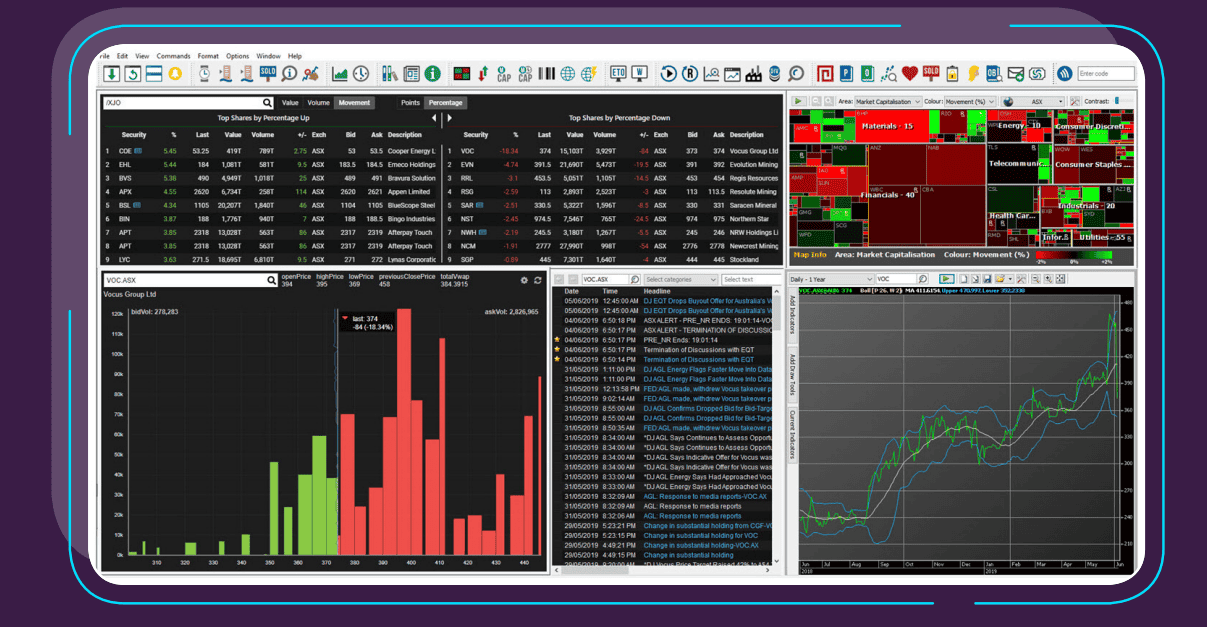

3. Iress Trading Platform

The Iress trading platform is a very nice venue for serious equity traders in need of professional tools and DMA. FP Markets might have additional monthly platform fees with Iress, depending on the trader’s activity.

As this platform is highly curated for equity traders, it provides you direct market access to global equity markets. For traders seeking for premium insights, you can even subscribe to Market Data to give your trading strategy a better edge.

I think that this platform is more suitable for advanced Australian traders or those who focus on extensive range of equities/international markets.

4. WebTrader Platform

The WebTrader gives access to the trading accounts of FP Markets directly from a browser without the need for any software downloads or installation. So you can access your MT4/MT5 on any device without worrying about taking up space in your devices.

While you get to use most features on the metatrader platform, some features like EA is not available on the WebTrader platform. This is more suitable for traders who wish to trade without running software on the computer.

5. Mobile Trading Platforms

FP Markets’ mobile apps (MT4, MT5, and Iress) have been developed for traders who require flexibility. The mobile apps can be downloaded on both AppStore and Playstore for free.

You still get to trade on the same amount of timeframes and indicators as the software version, but not the expert advisor. In general, I like how intuitive the MT4/MT5’s app interface is for simple charting and order placing, making trading on the go a breeze.

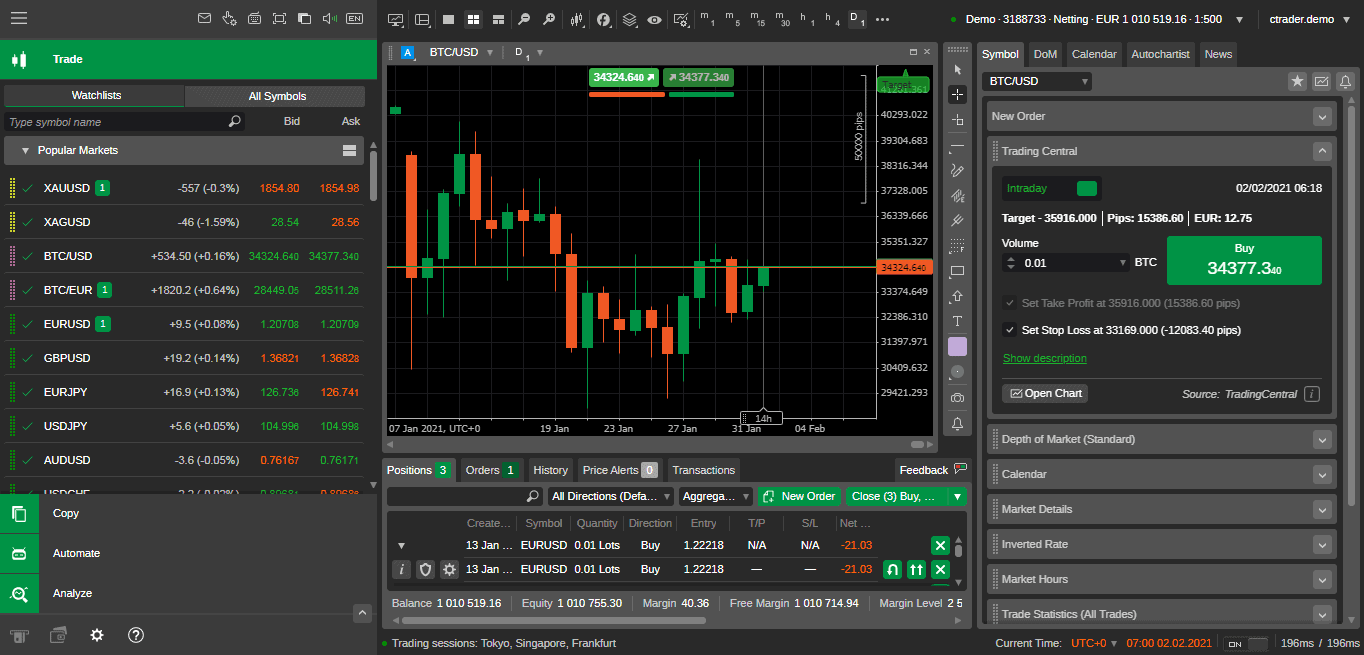

6. cTrader

cTrader was introduced by Spotware System LTD in 2010, available in the form of desktop, web and mobile trading apps. Based on my experience, cTrader provides fast order execution with minimal latency which benefits scalping type traders.

When compare to both MT4 and MT5, cTrader offers 26 different trading timeframes allowing you to perform multi-timeframe analysis better. You will be using the C# language to automate your trading strategy or you can use the one created by others in the cTrader community.

Overall, cTrader’s complex interface and advanced features is most suitable for scalpers that requires good execution speed and stability.

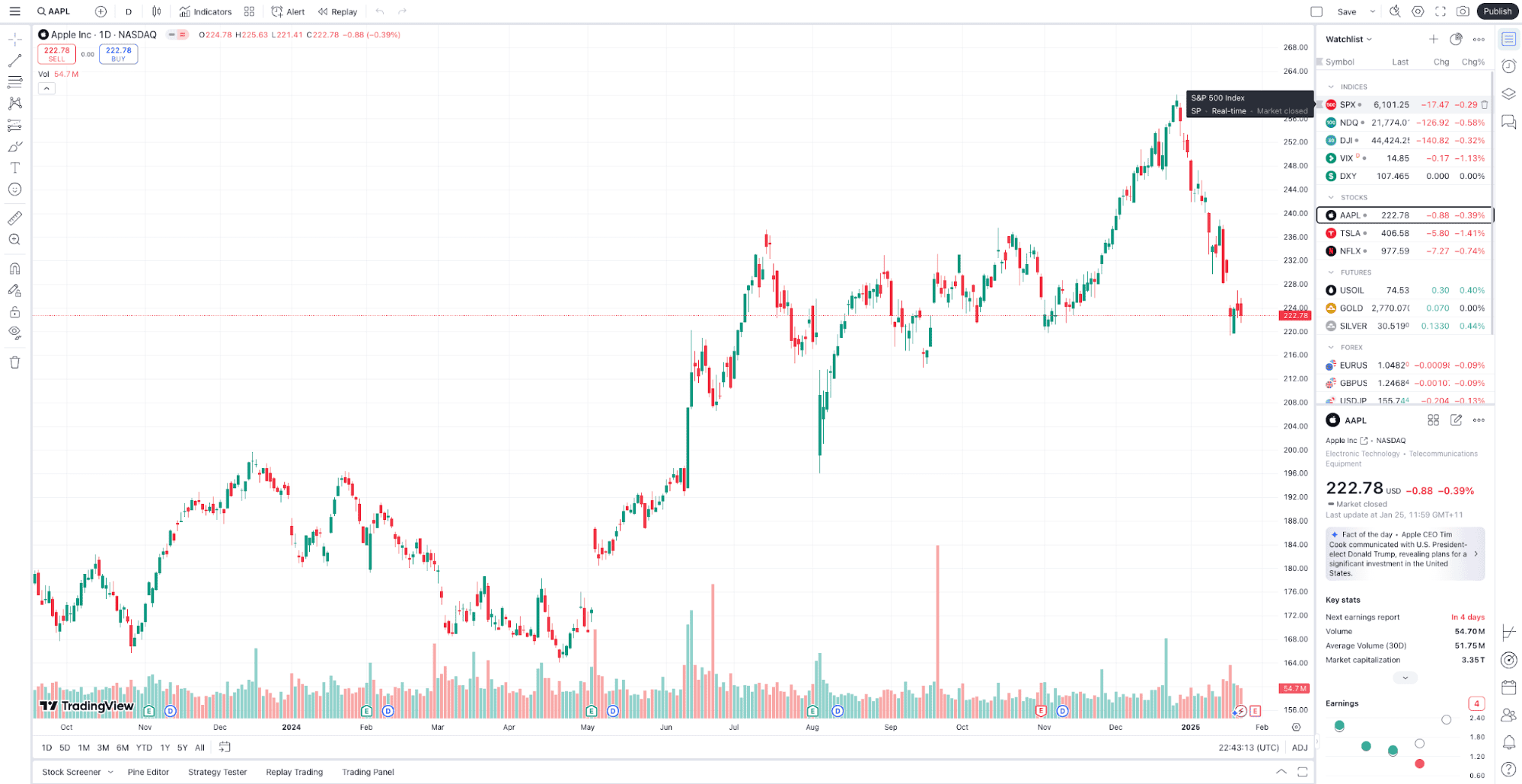

7. TradingView

TradingView is a very popular cloud-based platform that offers advance charting, idea sharing, technical and fundamental analysis to traders of all kinds. TradingView emphasizes more on the social trading aspect more than the other platforms.

I personally would like to describe TradingView as a Facebook for traders and investors. The large trading community enables you to share your trading ideas or subscribe to well-known traders’ ideas. Exchange opinions with the visual advance charting options or create your own custom indicator by using Pine script.

The only downside is that the free version limits the features you can access and have ads pop-up constantly. The paid plans start with Essential: $12.95 per month and goes up to $49.95 per month for premium.

Which trading platform should I choose?

I understand it is not an easy decision to make when it comes to selecting the best platform for your trading. Each platform has its own standout feature that is suitable for different traders in the financial market.

Hence, our team created a trading platform selector so you can work out what software best matches your trading needs. We recommend you complete our short 5 step questionnaire to determine your most suitable platform for your trading.

Trading Add-Ons

FP Markets supplements its trading environment with a range of features and add-ons that support and complement the trading strategies for Australia-based traders.

From advanced tools that enable automated and social trading to services that ensure stability and efficiency in trade execution, these additional tools meet varied trader needs.

The following is an overview of the key features and add-ons available at FP Markets:

- Copy Trading & Myfxbook Autotrade, are services for automated copy trading, whereby traders can copy strategies that professional traders have implemented directly in their trading accounts. This also means access to a wide range of trading strategies and in-depth performance statistics to inform your trade decisions.

- FP Markets Trading App: This is an in-house feature-packed app offer by FP markets to make trading on the go as seamless as desktop trading. Available on all iOS and Android devices.

- VPS: The FP Markets Virtual Private Server ensures your trading strategy runs on a fast, secure, high-performance server. This is an important service to traders who deploy automated trading systems, whereby their strategies are guaranteed to keep on running 24/7 without a personal computer connection.

- Autochartist: This feature provides real-time trading ideas, scanning markets for opportunities across Forex, Metals, Indices, Commodities, and Cryptos. Delivers 1000+ trade setups monthly, supports beginners with visual indicators, and advanced search for experts.

- Traders Toolbox: The Traders Toolbox offers a suite of 12 additional online tools including an economic calendar, news feeds, and various risk management applications like the Correlations Trader and Matrix, Alarm Manager, and Excel RTD.

- Trading Central: As one of the leading financial insights and analysis providers, Trading Central supports FP Markets traders with expert evaluations and recommendations. These insights are invaluable for making informed trading decisions based on technical analysis and market trends.

My Verdict on FP Markets Trading Platform

I award the platforms a strong 9.0 because FP Markets gives you flexible choices MT4, MT5, cTrader, TradingView, and IRESS in certain areas so you can pick what suits your strategy and workflow best.

FP Market Execution Speed

We can agree that execution speed plays a significant role when it comes to trading forex and CFDs. In our execution speed test, FP Markets recorded market order speeds of 96ms, outperforming the industry average of 134ms. However, its limit order speed was slower at 225ms.

Despite this, FP Markets ranked 10th out of 20 brokers, highlighting its solid execution performance. Our rankings are based on thorough testing across various trading scenarios, ensuring accurate and reliable results.

| Overall Rank | Broker | Limit Order Speed (ms) | Market Order Speed (ms) | Execution Type |

|---|---|---|---|---|

| 1 | Blackbull Markets | 72 | 90 | NDD/STP |

| 2 | Fusion Markets | 79 | 77 | NDD/STP |

| 3 | Pepperstone | 77 | 100 | NDD/STP |

| 4 | Hugos Way | 104 | 94 | ECN |

| 5 | TMGM | 94 | 129 | NDD/STP |

| 6 | FXCM | 108 | 123 | Market Maker |

| 7 | City Index | 95 | 131 | Market Maker |

| 8 | FxPro | 151 | 138 | NDD/STP |

| 9 | Axi | 90 | 164 | NDD/STP |

| 10 | FP Markets | 225 | 96 | NDD/STP |

| Industry Average | 127 | 134 |

My Verdict on FP Markets Trading Experience

My 8/10 score reflects that while trading feels reliable and solid overall, it doesn’t quite match the smoothness and polish I have seen with the very top brokers. Still, it is perfectly workable and serves most traders’ needs.

Is FP Markets Safe?

Safety is the number one concern for choosing a broker, and Australian traders are no exception in terms of trading with confidence. FP Markets answers this concern with great regulatory compliance and a strong reputation built over a decade in the industry.

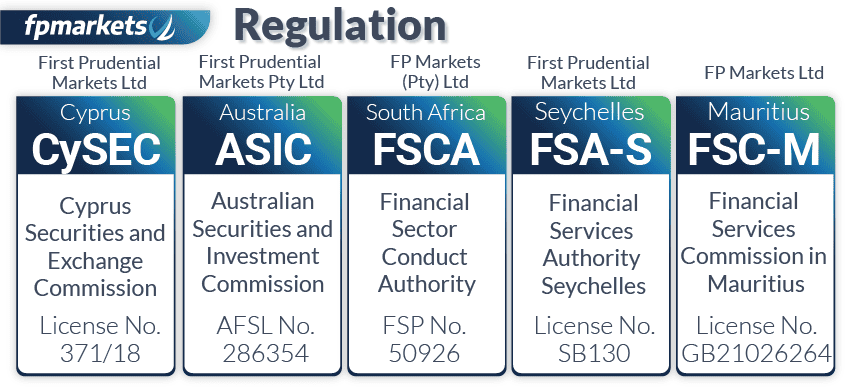

1. Regulation

For Australian traders, it is reassuring to know that FP Markets is regulated by the ASIC (Australian Securities and Investments Commission). Additionally, the broker is regulated by CySEC in Europe and the FSCA in South Africa, ensuring compliance across multiple jurisdictions.

Outside these regions, FP Markets is regulated by the Financial Service Authority (FSA) based in Seychelles.

Furthermore FP Markets provides secure fund segregation, for better trader and customer transparency. This should give you some peace of mind when using the broker.

2. Reputation

FP Markets has gained a reputation globally for reliability and very strong client-focused services. The broker has always received industry accolades in the form of awards for trading technology, customer service, and overall value to traders.

Established in 2005 in Sydney, Australia, FP Markets has a strong reputation in European and Australian markets despite a moderate monthly search volume.

With approximately 60,500 monthly Google searches, FP Markets ranks as the 28th most popular forex broker among the 65 brokers we analyzed. Similarweb data from February 2024 shows slightly lower positioning, with FP Markets ranking as the 30th most visited broker with 595,199 global visits.

| Country | 2025 Monthly Searches |

|---|---|

| Italy | 12,100 |

| Australia | 5,400 |

| India | 3,600 |

| United Kingdom | 3,600 |

| Germany | 1,900 |

| Spain | 1,900 |

| South Africa | 1,900 |

| United States | 1,600 |

| Canada | 1,600 |

| Greece | 1,600 |

| Pakistan | 1,300 |

| France | 1,000 |

| Indonesia | 880 |

| Malaysia | 880 |

| Poland | 880 |

| Turkey | 720 |

| Singapore | 720 |

| Kenya | 720 |

| Brazil | 720 |

| Cyprus | 720 |

| United Arab Emirates | 590 |

| Philippines | 590 |

| Nigeria | 480 |

| Bangladesh | 480 |

| Thailand | 480 |

| Netherlands | 480 |

| Switzerland | 480 |

| Austria | 480 |

| Morocco | 390 |

| Colombia | 320 |

| Vietnam | 320 |

| Japan | 260 |

| Saudi Arabia | 260 |

| Portugal | 260 |

| Sweden | 210 |

| Mexico | 210 |

| Egypt | 210 |

| Hong Kong | 210 |

| Argentina | 170 |

| Venezuela | 170 |

| Algeria | 170 |

| Cambodia | 170 |

| Dominican Republic | 170 |

| Taiwan | 170 |

| Ireland | 170 |

| Chile | 140 |

| Peru | 110 |

| Sri Lanka | 110 |

| Ecuador | 90 |

| Ghana | 90 |

| Ethiopia | 90 |

| Uganda | 90 |

| Uzbekistan | 70 |

| Tanzania | 70 |

| New Zealand | 70 |

| Jordan | 70 |

| Bolivia | 50 |

| Uruguay | 50 |

| Botswana | 40 |

| Costa Rica | 40 |

| Mauritius | 30 |

| Panama | 30 |

| Mongolia | 10 |

12,100 1st | |

5,400 2nd | |

3,600 3rd | |

3,600 4th | |

1,900 5th | |

1,900 6th | |

1,900 7th | |

1,600 8th | |

1,600 9th | |

1,600 10th |

3. Reviews

The CFD broker boasts a TrustPilot score of 4.8 out of 5 from 8,879 reviews, indicating high levels of client satisfaction and trust in the broker’s services.

Final Verdict on FP Markets Reputation and Security:

I think that the combination of robust regulation, together with the proven reputation over the years, makes FP Markets a strong choice for traders seeking a trusted broker.

My Verdict on FP Markets Trust

At 6.0, this rating takes into account FP Markets’ regulation by ASIC and CySEC and its generally positive reputation, though there’s some room for better transparency depending on the region you are trading from. Trust is foundational, and it is decent but not perfect.

Deposit and Withdrawal

FP Markets provides a range of deposit and withdrawal options for traders in Australia. The broker has transparent fee structures, low minimum deposit requirements, and speedy processing, hence very convenient for traders.

What is the minimum deposit at FP Markets?

The minimum deposit for FP Markets is 100 USD or the equivalent in AUD for both the standard and Raw account types.

Account Base Currencies

FP Markets offers Australian traders a selection of 12 account base currencies including the Australian real (AUD), as well as USD, EUR, GBP, SGD, CAD, CHF, HKD, JPY, ZAR, MXN.

Deposit Options and Fees

The traders of Australia can deposit funds into their accounts using several methods designed to suit the needs of both local and international traders. These include:

- Bank Wire Transfer gives you a direct and secure option, but processing may take 2-5 business days.

- Credit/Debit Card such as Visa and Mastercard are accepted for instant deposits.

- E-Wallets include popular portals like Skrill, Neteller, and PayPal for instant funding.

- Australia-Specific Payment Methods like BPay or Broker to Broker could be available to you, depending on location.

- Crypto funding is available with Finrax, LetKnowPay and M2P crypto (outside Australia, Europe)

- Funding options outside Australia including: Xpay, AstroPay, MoneyTix Wallet(Asia only)

Be aware that FP Markets does not usually charge any fees for deposits. However, Australian traders should check with their own payment provider or any intermediary banks for any fees charged.

Withdrawal Options and Fees

Withdrawals are efficiently processed with similar options as deposits:

- Bank wire transfer for larger amounts, which can take from 2-5 days

- Credit/debit card refunds, if applicable

- E-wallet instant transfers, including Skrill and Neteller

Processing Fees and Times

FP Markets strives to offer fee-free withdrawals. However, there will be a small fee with certain methods. Examples include a fee for processing over international bank transfers.

The actual time of the withdrawal processing will depend upon the method used; e-wallets are generally the fastest.

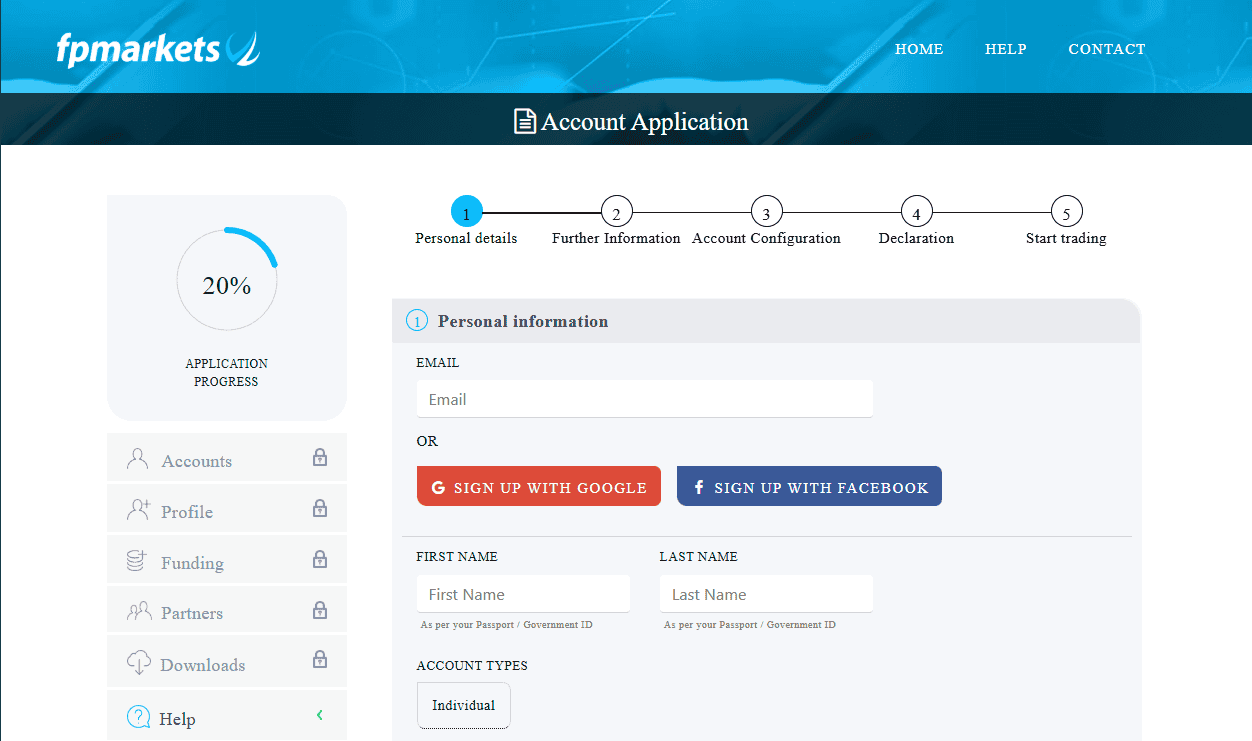

Ease To Open An Account

FP Markets account opening process is relatively easy and not time-consuming at all. I found it very user-friendly, and it took me about 15 minutes to submit all my necessary information for review.

You as an Australian trader also have the option to use Google or Facebook to sign in, which makes the process even faster.

The whole process was smooth, and my account was ready in no time. It included basic personal details, verification of the documents, and setup of the account-easy stuff, nothing too complex.

Just remember to select the correct account type during setup, such as Standard, Raw, Islamic, and Demo. Overall I think that FP Markets made the account opening was smooth and not a hassle.

My Verdict on FP Markets Funding

At 7.7, this rating captures the convenience of multiple deposit and withdrawal methods and a general lack of hidden fees making funding your account straightforward and efficient.

Product Range

FP Markets offers an extensive range of over 10,000 tradeable products across various asset classes including forex, cryptocurrencies, stocks, indices, ETFs, commodities, bonds, and metals.

| Asset Class | Number of Products |

|---|---|

| Total Products | 10,000+ |

| Forex Pairs | 70+ |

| Cryptos | 11 |

| Stocks | 10,000+ |

| Indices | 22 |

| ETFs | 45 |

| Commodities | 9 |

| Bonds | 2 |

| Metals | 9 |

CFDs

FP Markets product range overview for Australian traders:

- FX Trading: FP Markets forex product offerings are good, as there are 71 major, minor, and exotic pairs. Examples include but are not limited to the AUD, CAD, JPY, NZD, SGD, GBP, EUR, and more exotics like the Swedish Krona and Turkish Lira.

- Shares: The broker is very good in shares trading. It provides access to more than 10,000 stocks, including 814 as CFDs and almost 10,000 outright stocks via the IRESS platform, one of the widest ranges in the world.

- Indices: Traders have access to 15 global indices, including the NASDAQ 100, S&P 500, and EUREX.

- Commodities: FP Markets lists 13 commodities including 7 softs, 5 energies, and 9 metals (plus Gold and Silver fiat crosses).

- Cryptocurrencies: The broker offers trading in 12 cryptocurrencies, including major coins like Bitcoin, Ethereum, Ripple, Bitcoin Cash, and Litecoin.

- Bonds: The choice is limited, but FP Markets provides 2 bonds: the UK Long Gilt and the US 10-Year Treasury Note.

- ETFs: There are 46 ETFs available, which is a very unique opportunity for portfolio diversification with complex instruments replicating various asset classes.

Disclaimer: cryptocurrency CFD trading is not available to clients in the UK as the FCA banned the trading of this derivative.

Share Trading

FP Markets provides several options to trade on shares: one can perform a direct stock trading through IRESS(only in Australia) or share CFDs via MT4 or MT5.

MT5 supports 814 stocks on 9 global exchanges, while IRESS offers close to 10,000 outright stocks and a smattering of futures and ETFs. This clearly shows how far-reaching IRESS is, particularly with Australian and US markets.

Overall I think that FP Markets have an amazing product range for traders in Australia with over 10,000 different offerings, so I have to give them high ranks in this part.

Customer Service

Recently, I have had the chance to experience the customer support of FP Markets, and they seemed very serious about providing excellent support.

| FP Markets | Customer Service |

|---|---|

| Availability | 24/7 |

| Multilingual | ✅︎ |

| Live Chat | ✅︎ |

| Phone | ✅︎ |

| ✅︎ | |

| Social Media | ✅︎ |

FP Markets has around-the-clock customer support via various means: live chat, telephone, and e-mail. I could get in touch at any time of the day or night and got instant help.

My Verdict on FP Markets Range of Markets

I give it a 7.2 for offering access to over 10,000 instruments across asset types from forex and CFDs to shares, commodities, indices, crypto, ETFs, bonds and more though availability may shift based on where you are located.

Research and Education

I have used FP Markets not only to trade on a very reputable platform but also to learn and further my skills in trading. Furthermore, solid research and educational tools back it.

Research Tools: Keeping You Informed

A few research tools that may be available in FP Markets to aid traders in decision-making include the following.

- Daily Market Analysis provides updates on daily market conditions and offers insights into trends across Forex, indices, commodities, and cryptocurrencies.

- Economic Calendar lets you as an Australian trader tracks financial events and data releases, which can cause fluctuations in the volatility of markets.

- Trading Signals – these are helpful, especially for novice Australian traders and professional ones, too, because they provide suggestions based on the analysis of markets.

- Technical Analysis: The technical analysis feature allows traders to go deep into the movement of the markets with various charts and indicators.

The resources come mainly in English, but they are clear and accessible to traders who can understand the language. However, for those who are less comfortable with English, the gap can be bridged by using translation tools.

Educational Resources: Learn while You Trade

On the educational resources, FP Markets has provided a number of materials to direct traders at whatever point they may be in their trading:

- Webinars: Regular webinars by market experts on trading strategies, tips, and new market developments.

- Video Tutorials that I found have clear, step-by-step explanations of how to use the trading platform and understand the markets.

- Forex Education Articles includes a decently sized collection of articles ranging from the very basics of trading to advanced strategies.

While most of these learning tools are in English, FP Markets has done a great job in making them easy to use and interactive.

My Verdict on FP Markets Education

My score of 7.5 reflects solid educational offerings that help build your trading skills, but with more polish and depth available from the very top broker education programs.

Final Verdict on FP Markets

FP Markets has established itself as a leading broker with a full range of tradable financial instruments and a bouquet of services to meet the diverse expectations of traders in Australia.

Having access to over 10,000 financial instruments, including Forex, CFDs, commodities, and cryptocurrencies, expands a broad range of markets toward which Australian traders can diversify their portfolios. For these reasons I give the broker a combined score of 86 out of 100, which places it within my list of top 10 brokers.

Quick account opening and a strong education section, advanced trading tools are also strong reasons to try out FP Markets as an Australian trader. Meanwhile, the availability of platforms like MetaTrader 4, MetaTrader 5, cTrader also gave me a great experience in trading.

Disclaimer: Trading with financial instruments on a live account does have high risks involved, especially when you use the maximum leverage available to you.

FP Markets FAQs

Is FP Markets A Good Broker?

Yes, FP Markets is considered by many a good broker for both beginners and experienced traders. It offers a wide range of instruments, including Forex, CFDs, indices, commodities, and cryptocurrencies.

What Demo Account Does FP Markets Offer?

FP Markets provides traders with a free demo account, whereby one can try out a strategy without exposing any risk.

What Leverage Does FP Markets Offer?

FP Markets offers leverage of as high as 500:1*, depending on the asset class and your account type. For Forex traders, this allows significant flexibility in managing position sizes.

What is the Minimum Deposit at FP Markets?

The minimum deposit at FP Markets is as low as $100 for standard accounts. With such a low minimum deposit, it opens a wide avenue for traders of all ranks. Note the available account types might vary based on your exact region when opening the account.

About the Review

FP Markets has a number of entities that serve different markets – these include

1. First Prudential Markets Pty Ltd – Australia

2. FP Markets (Pty) Ltd South Africa

3. First Prudential Markets Limited – Seychelles

4. FP Markets LLC St. Vincent and the Grenadines

5. First Prudential Markets Ltd CySEC

Products may differ between these entities – while this review will have a bias to Australia, we have made notes of their offering in other regions where practical to do so.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to FP Markets Website

Visit Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

I’m in Spain, can i use a CySEC regulated broker here?

Yes you can. All regulators part of the European Union are part of the European Securities and Markets Authority (ESMA).

Regulators that are members of ESMA, are able to serve as the regulator to all other countries that are part of the European Union.

I’m outside Australia, can i use the IRESS trading platform?

FP Markets only offer IRESS for Australian clients. The main reason to use IRESS is to access FP Markets full range of stocks and to use DMA trading. If you are looking to trade stocks outside Australia with FP Markets then you are best to use the MT5 trading platform or consider TMGM who have IRESS outside Australia.

Hi David. I have opened an IRESS account while I was in Australia. Now that I am outside of Australia, just wondering if I can still trade using IRESS. If not, is it possible to use the platform through VPN? Thanks in advance!

Hi Clement, If you have an account with FP Markets Australia then I would expect you should be able to use the IRESS account. As I understand it, it’s only the FP Markets subsidiaries outside Australia that don’t offer IRESS, so in your case I don’t believe you should need to use the VPN.

In the Regulation section, you mention that customers of FP Markets outside Australia and Europe will have to join the subsidiary in St Vincent and the Grenadines instead, and that this will result in different liquidity access. Can you elaborate on this claim? Looking at FP Market’s FAQ pages for both international customers (non-regulated) and Australian customers (regulated under ASIC), they seem to suggest that he liquidity providers will be exactly the same. Perhaps this bit of the review needs to be updated? Would like to know more. Thank you, Mark

Hi Mark,

If you are in Australia you will need to join FP Markets Australian entity regulated by ASIC and in Europe you will need to join FP Markets Cyprus entity regulated by CySEC which is good fo countries in the European Economic Zone. I can see how what is written might be interpreted to mean FP Markets Grenada entity might be using a different source of liquidity to their other entities. I would suggest this is poorly phrased and have corrected it. Thank you for bringing this to our attention.

Thanks for the clarification David!

Hi can you permit me to tell my fellow traders how I recovered my money from a fake binary options broker?

No, our readers are not your fellow readers.