Fusion Markets vs Admirals 2025

This Fusion Markets and Admirals forex broker review found both offer low commissions and tight spreads. Both have MetaTrader 4 trading platforms, with Fusion having 90 forex pairs and Admirals over 2000 stocks.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do Admirals Vs Fusion Markets Compare?

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Fusion Markets and Admirals:

- Fusion Markets was founded in 2017 in Australia, while Admirals (formerly Admiral Markets) was established in 2001 in Estonia.

- Fusion Markets is known for its low-cost brokerage, whereas Admirals is recognised for its high-frequency trading capabilities.

- Fusion Markets offers consistently lower spreads across all forex pairs compared to Admirals.

- Fusion Markets has no minimum deposit requirement and offers diverse funding methods, including cryptocurrencies, while Admirals has a minimum deposit of $100 and does not support crypto funding.

- On TrustPilot, Fusion Markets scores slightly higher with 4.7/5 stars, whereas Admirals has a rating of 4.6/5 stars.

1. Lowest Spreads And Fees: Fusion Markets

Fusion Markets was founded in 2017 in Australia, while Admirals (formally Admiral Markets) was founded in 2001 in Estonia. Fusion has a reputation as a low-cost broker, while Admirals’ reputation is based on high-frequency trading capabilities. We have evaluated the brokers in 2025 based on five criteria.

The primary way brokers charge traders for using their platform is through spreads followed by commissions.

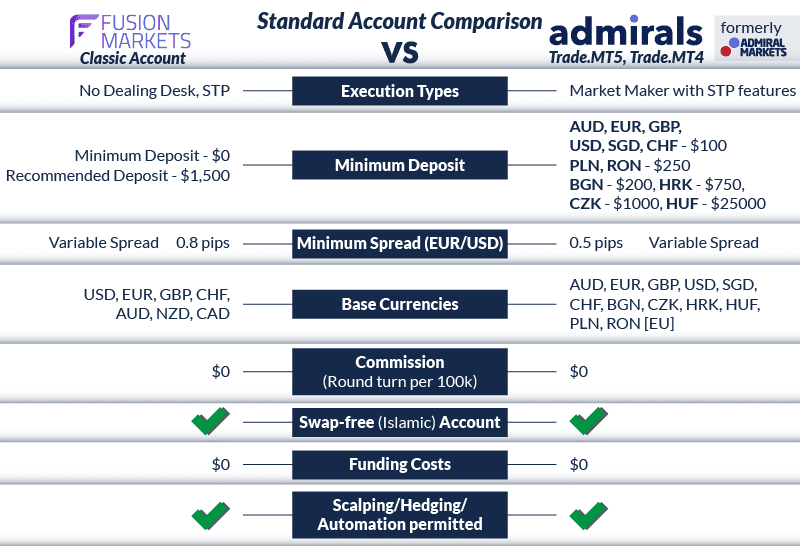

Standard Account Fee Comparison

Also known as a commission-free account, a standard account only charges brokerage through a spread. The spreads charged (the difference between the ask and sell price) are inflated above marketplaces, ensuring the broker makes money on trades. We’ve compiled the average spreads for different brokers’ standard accounts into the following table for you to compare. These spreads are taken from the broker’s websites and updated once a month.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 0.83 | 0.83 | 1.08 | 1.14 | 1.19 |

| 0.80 | 1.00 | 1.00 | 1.00 | 1.00 |

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 0.89 | 1.37 | 1.41 | 1.54 | 1.75 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 11/01/2025

Fusion Markets ReviewVisit Fusion Markets

Something you’ll notice when comparing Fusion’s average spreads with Admirals is that the broker with the consistently low standard account spreads is Fusion Markets.

Fusion Markets has a minimum of 0.8 pips on forex pairs, and their average spreads are extremely low to match that. You can get the EUR/USD for an average spread of 0.82 pips, and even other pairs like the AUD/USD are at an average of 0.85 pips wide.

While Admirals does have a minimum spread at 0.5 pips – lower than Fusion’s minimum, you can see that, on average, you won’t get spreads near that low. With Admirals, you can expect a 0.8 pip spread on the EUR/USD, for example, which is 0.3 pips above their minimum.

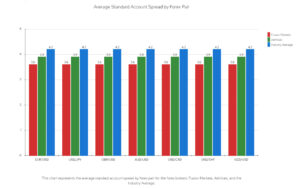

Here is the table of the average standard account spread by forex pair for the forex brokers Fusion Markets, Admirals, and the Industry Average:

| Standard Account | Fusion Markets Spreads | Admirals Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.32 | 1.26 | 1.7 |

| EUR/USD | 0.83 | 0.8 | 1.2 |

| USD/JPY | 1.41 | 1 | 1.5 |

| GBP/USD | 1.42 | 1 | 1.6 |

| AUD/USD | 1.12 | 1 | 1.6 |

| USD/CAD | 1.31 | 1.6 | 1.9 |

| EUR/GBP | 1.29 | 1 | 1.5 |

| EUR/JPY | 1.65 | 1.5 | 2.1 |

| AUD/JPY | 1.49 | 2.2 | 2.3 |

Standard Account Analysis Updated November 2025[1]November 2025 Published And Tested Data

When comparing the spreads of Fusion Markets and Admirals, it’s clear that Fusion Markets consistently offers lower spreads across all forex pairs. This suggests that Fusion Markets may be the more cost-effective choice for traders who prioritize low spreads.

However, it’s also important to consider the Industry Average. Both Fusion Markets and Admirals offer spreads that are below the industry average, indicating that they are competitive choices in the market.

In my opinion, while both brokers offer competitive spreads, Fusion Markets edges out Admirals due to its consistently lower spreads across all forex pairs. This could potentially lead to significant savings for active traders. However, it’s always important to consider other factors, such as trading environment, platform, and customer service, when choosing a broker.

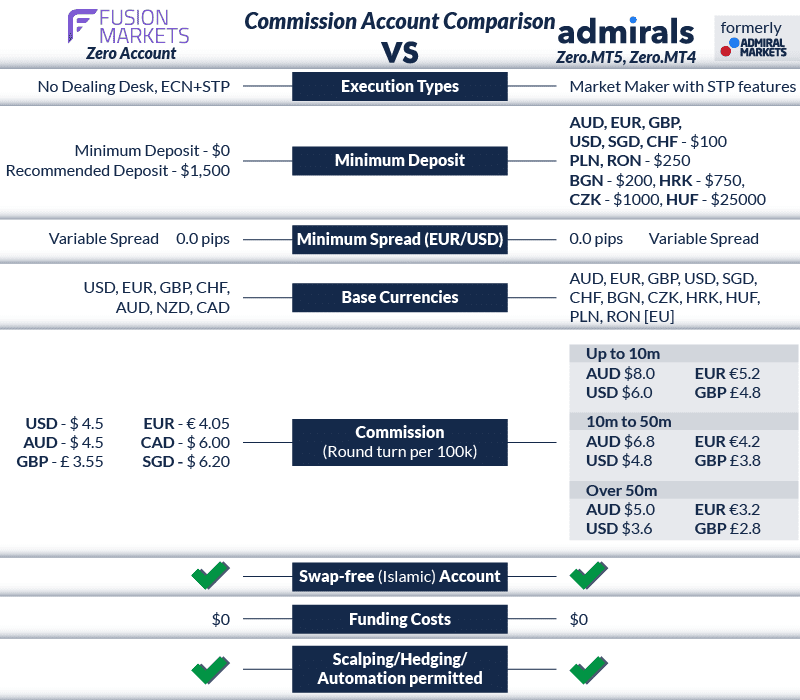

Raw Accounts Fee Comparison

Unlike Standard accounts, a ‘raw’ account type does have commission fees. In exchange, you get much lower spread costs, often as low as 0 pips.

ECN Broker Spreads | |||||

|---|---|---|---|---|---|

| 0.36 | 0.27 | 0.14 | 0.34 | 0.14 |

| 0.40 | 1.40 | 0.10 | 0.50 | 0.40 |

| 0.30 | 0.40 | 0.10 | 0.20 | 0.10 |

| 0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

| 0.30 | 0.50 | 0.30 | 0.50 | 0.40 |

| 0.24 | 0.70 | 0.16 | 0.54 | 0.29 |

| 0.30 | 0.70 | 0.20 | 0.50 | 0.40 |

| 0.40 | 1.21 | 0.38 | 0.70 | 0.92 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 11/01/2025

Much like with the standard account, you’ll notice from the spread module that you can expect much lower spreads with Fusion Markets as opposed to Admirals. You can expect to pay only 0.02 pips on Fusion’s ZERO account for the EUR/USD, next to nothing above their minimum of 0 pips.

As for commission fees, you will get extremely low fees on Fusion Markets compared to other top brokers. The commission is set at $4.50 AUD/USD round-turn per standard lot, and if you use a different base currency, you can still expect low commissions.

While Admirals also do have a minimum spread of 0 pips on their Trade.MT4 and Trade.MT5 accounts, the typical spread is often much higher than this. For example, you can expect a 0.1 pip spread on the EUR/USD.

Commissions on Admirals are volume-based, so the commission can be more or less than Fusion Markets depending on if how much you trade. Generally, unless you trade over 50 million, Fusion Markets have lower commission costs. Trades for 10 million to 50 million are $6.80 in AUD and $4.80 in USD, which is more than with Fusion Markets. However, if you trade above 50 million, then the commission is $5.00 AUD (which is more than with Fusion Markets) and $3.60 with USD, and this is where you can save.

As a result, it does appear that when it comes to commission costs, it will depend on the base currency adopted.

Our Lowest Spreads and Fees Verdict

Fusion Markets ReviewVisit Fusion Markets

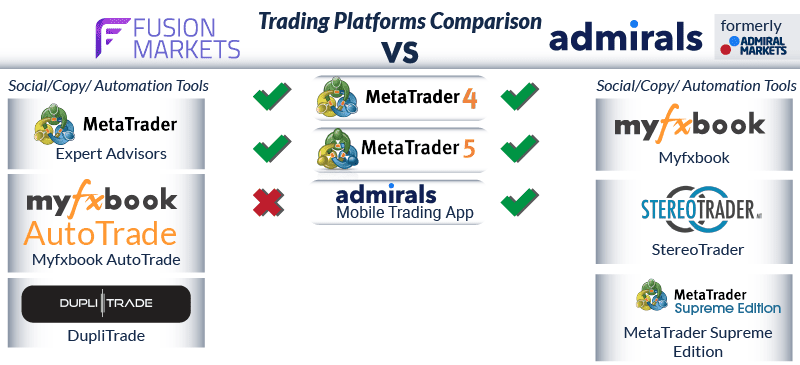

2. Better Trading Platform: Fusion Markets

| Trading Platform | Fusion Markets | Admirals |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Both Fusion Markets and Admirals offer three platforms.

Both MetaTrader 4 and MetaTrader 5 are available with the brokers. Recording over 75% of all forex trades in Q4 of 2021, both MetaTrader options are at the top of the line, and you can be sure to have a great trading experience when using them.

Fusion Markets and Admirals’ third platform is a mobile app. Fusion Markets’ mobile app is an extension of MetaTrader 4, with all the features of MT4 on your Android or iOS device. Admirals’ app is a proprietary one- the Admirals Mobile Trading App. You can access Admirals’ entire product range from this app to help you trade while away from your laptop or PC.

How many trading tools are offered by the two brokers?

Fusion Markets has two third-party tools, both aimed at providing access to social trading. Myfxbook and DupliTrade are two tools that give you access to the social-trading community. Through them, you can copy trades at the click of a button, making it easy for you to replicate portfolios of highly successful traders.

A weakness of Admirals is the lack of social trading tools. However, Admirals does provide you with StereoTrader and MetaTrader Supreme Edition. Both of these are add-ons to MetaTrader and are aimed at helping make you a better trader.

Our Better Trading Platform Verdict

Our winner for the combined category of platforms and trading tools is Fusion Markets. Although even on platforms, the copy trading options offered by Fusion Markets push them to a win over Admirals.

3. Superior Accounts And Features: Fusion Markets

When it comes to account types and features, both Fusion Markets and Admirals have their unique offerings. Fusion Markets stands out with its low spreads, especially in their standard account. Their average spreads are notably competitive, with the EUR/USD pair having an average spread of 0.82 pips.

Fusion Markets also offers a ‘raw’ account type where traders can benefit from even lower spread costs, often as low as 0 pips. Additionally, Fusion Markets has no minimum deposit requirement, making it accessible for traders of all levels. They also offer diverse funding methods, including the unique option of using cryptocurrencies.

On the other hand, Admirals, while having a minimum spread of 0.5 pips, tend to have higher average spreads. Their minimum deposit requirement is set at $100 for major currencies. Admirals do stand out with its regulatory oversight, being regulated by three top-tier and one second-tier regulators, offering traders an added layer of security.

| Fusion Markets | Admiral Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

Based on account features and offerings, Fusion Markets appears to have a slight edge due to its consistently lower spreads and more flexible deposit options.

4. Best Trading Experience And Ease: Fusion Markets

Having delved deep into both Fusion Markets and Admirals, I’ve found that each broker offers a unique trading experience. Fusion Markets, for instance, is renowned for its cTrader platform, as highlighted in our own testing. This platform is intuitive and offers a seamless trading experience, especially for those who prioritise a user-friendly interface. On the other hand, Admirals provides traders with both MetaTrader 4 and MetaTrader 5, which are top-tier platforms known for their robust features and reliability.

- Fusion Markets offers the cTrader platform, known for its user-friendly interface.

- Admirals provides both MetaTrader 4 and MetaTrader 5, ensuring a versatile trading experience.

- Our testing highlighted Fusion Markets as having one of the lowest commission structures.

- Admirals, while not topping our charts, still offer a competitive trading environment with a focus on high-frequency trading capabilities.

Our Best Trading Experience and Ease Verdict

Based on the overall trading experience and ease of use, Fusion Markets takes the lead, especially with its cTrader platform and low commission structure.

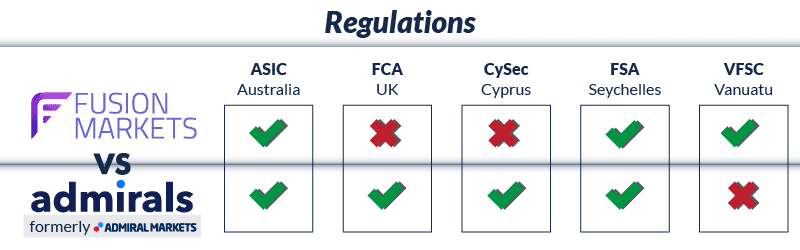

5. Stronger Trust And Regulation: Tie

Fusion Markets Trust Score

Admiral Markets Trust Score

To measure how well a broker is regulated, we take a look at the regions they are regulated within.

Fusion Markets are regulated by one top and one second-tier regulator. These two regulators and their respective environments are:

- Australian Securities and Investments Commission (ASIC), in Australia

- Vanuatu Financial Services Commission (VFSC), across the world

Admirals have more regulatory oversight, with three top and one second-tier regulators;

- ASIC, in Australia

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Cyprus Securities and Exchange Commission (CySEC) in the European Union

- The Financial Services Authority (FSA) in Seychelles

| Fusion Markets | Admirals | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) |

| Tier 2 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) | |

| Tier 3 Regulation | VFSC FSA-S (Seychelles) | FSA-S (Seychelles) CMA (Kenya) JSC FSCA (South Africa) |

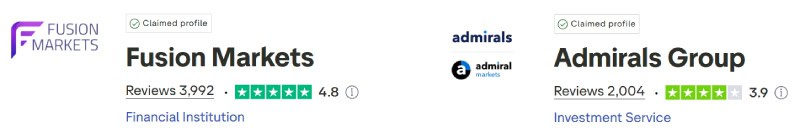

Reviews

Fusion Markets holds a high Trustpilot score of around 4.8 out of 5, based on around 4,000 reviews. Admirals, on the other hand, has a more moderate rating of approximately 3.9 out of 5. Fusion Markets is generally perceived as more user-friendly and cost-effective, while Admirals offers wider market access but receives more varied feedback.

Verdict

What truly matters most is that you trade with a broker regulated in the country you are trading from. While you will be fine most of the time with either, we recommend EU and UK traders use Admirals for bonus regulatory protection.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

6. Most Popular Broker – Admirals

Admirals gets searched on Google more than Pepperstone. On average, Admirals sees around 220,000 branded searches each month, while Pepperstone gets about 33,100 — that’s 84% fewer.

| Country | Fusion Markets | Admirals |

|---|---|---|

| Austria | 110 | 550,000 |

| United Kingdom | 1,900 | 450,000 |

| Italy | 1,000 | 60,500 |

| Greece | 110 | 60,500 |

| Germany | 880 | 33,100 |

| United States | 2,900 | 33,100 |

| India | 1,900 | 9,900 |

| Spain | 480 | 6,600 |

| Philippines | 1,000 | 5,400 |

| Japan | 170 | 4,400 |

| France | 1,300 | 3,600 |

| Canada | 1,900 | 3,600 |

| Poland | 480 | 2,900 |

| Switzerland | 140 | 2,400 |

| Brazil | 480 | 2,400 |

| Indonesia | 320 | 2,400 |

| Turkey | 390 | 2,400 |

| Australia | 1,900 | 1,900 |

| Netherlands | 590 | 1,900 |

| Malaysia | 590 | 1,600 |

| Ireland | 90 | 1,600 |

| Sweden | 140 | 1,300 |

| United Arab Emirates | 320 | 1,000 |

| Argentina | 90 | 1,000 |

| Thailand | 480 | 1,000 |

| Nigeria | 390 | 1,000 |

| Egypt | 170 | 1,000 |

| Mexico | 110 | 880 |

| Taiwan | 50 | 880 |

| Chile | 40 | 880 |

| South Africa | 720 | 880 |

| Pakistan | 480 | 880 |

| Saudi Arabia | 140 | 880 |

| Colombia | 110 | 720 |

| Singapore | 390 | 720 |

| Vietnam | 210 | 720 |

| Cyprus | 110 | 720 |

| Portugal | 170 | 590 |

| Hong Kong | 170 | 590 |

| Morocco | 260 | 480 |

| New Zealand | 50 | 480 |

| Bangladesh | 390 | 390 |

| Uzbekistan | 40 | 390 |

| Peru | 30 | 320 |

| Algeria | 170 | 320 |

| Kenya | 390 | 320 |

| Jordan | 50 | 260 |

| Ghana | 90 | 210 |

| Ecuador | 50 | 170 |

| Bolivia | 10 | 170 |

| Venezuela | 70 | 170 |

| Uganda | 90 | 170 |

| Dominican Republic | 140 | 140 |

| Sri Lanka | 880 | 140 |

| Costa Rica | 20 | 90 |

| Cambodia | 70 | 90 |

| Panama | 20 | 90 |

| Ethiopia | 90 | 70 |

| Tanzania | 90 | 70 |

| Mongolia | 10 | 70 |

| Mauritius | 40 | 50 |

| Botswana | 90 | 30 |

550,000 1st | |

110 2nd | |

450,000 3rd | |

1,900 4th | |

60,500 5th | |

1,000 6th | |

33,100 7th | |

880 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Admirals receiving 595,437 visits vs. 497,000 for Pepperstone.

Our Most Popular Broker Verdict

Admirals is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

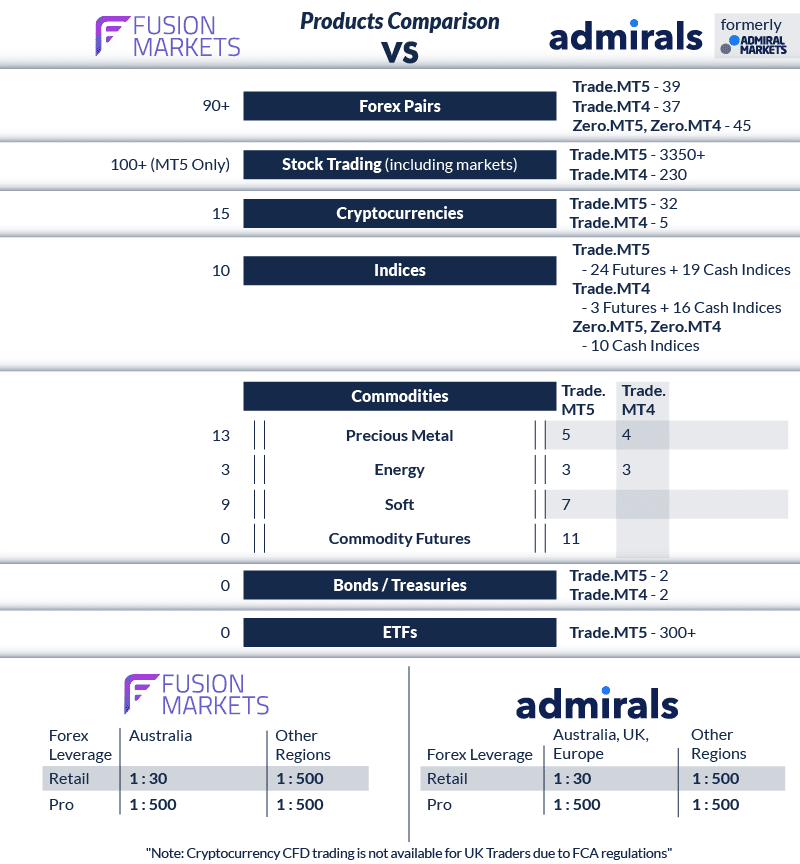

7. Top Product Range And CFD Markets: Admirals

Aside from forex pairs, other CFD products range from indices to cryptocurrencies and also include shares/ETFs. Both brokers offer you a strong range of different CFDs to choose from.

On Fusion Markets, you can trade over 90 different forex pairs. Leverage on these pairs goes up to 30:1. If you are classified as a retail trader in Australia and 500:1 elsewhere. Other products aren’t quite as impressive, although there is a strong range of different CFDs to choose from.

Admirals only have up to 45 different currency pairs, less than half of Fusion’s offerings. However, Admirals has more of every other type of CFD product. Leverage for Admirals is the same as Fusion- retail traders in Aus, the UK and the EU are capped at 30:1, while pro and international traders get up to 500:1 leverage.

Our Top Product Range and CFD Markets Verdict

While very close, we have to give this category to Admirals thanks to their wider CFD product range. However, our top forex CFD broker is still Fusion, with their impressive range of forex options more than sufficient if you are a forex trader.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

8. Superior Educational Resources: Admirals

Fusion Markets:

- Offers a comprehensive Forex 101 course for beginners.

- Provides webinars on various trading topics.

- Features video tutorials to help traders understand the platform.

- Has a dedicated blog with regular updates on market trends.

- Offers eBooks on advanced trading strategies.

- Provides daily market analysis to keep traders informed.

Admirals:

- Features an extensive Trading Knowledge portal.

- Provides webinars on a wide range of topics.

- Offers video tutorials on platform usage and trading strategies.

- Has a dedicated blog with insights from industry experts.

- Offers eBooks on various trading topics.

- Provides daily market updates to keep traders in the loop.

Our Superior Educational Resources Verdict

Based on our team’s testing, Admirals scores slightly higher in educational resources, making it the superior choice for traders looking to expand their knowledge.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

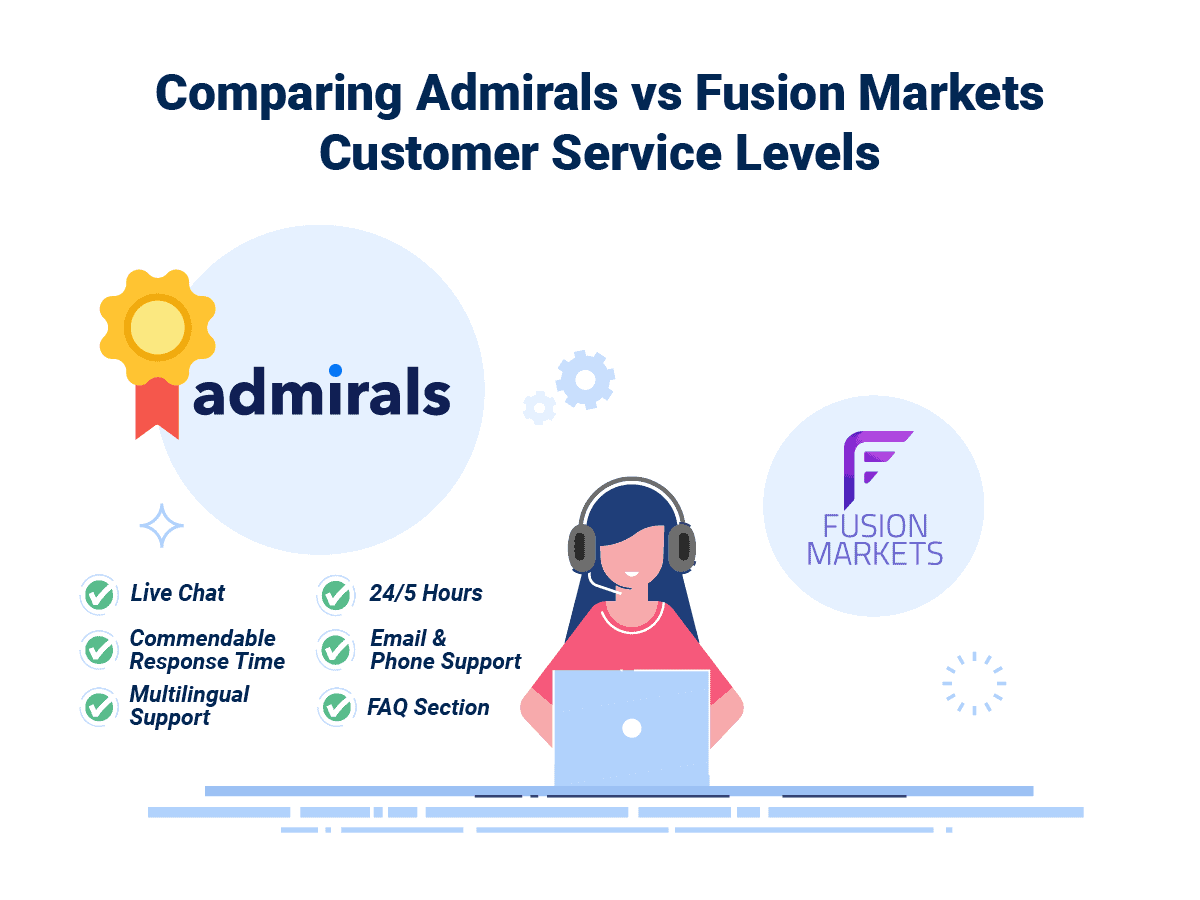

9. Superior Customer Service: Admirals

In the world of forex trading, customer service can make or break a trader’s experience. Both Fusion Markets and Admirals understand this and have invested heavily in ensuring their customers receive top-notch support.

From our own testing, we’ve found that Fusion Markets offers a responsive live chat feature, which is a boon for traders who need instant answers. They also provide email support and have a comprehensive FAQ section to address common queries.

Admirals, on the other hand, prides itself on its multi-lingual support team. They offer phone support, which is essential for traders who prefer a more personal touch. Their email response time is commendable, and they also have an extensive FAQ section.

| Feature | Fusion Markets | Admirals |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | No | Yes |

Our Superior Customer Service Verdict

While both brokers offer excellent customer service, based on our team’s scores, Admirals slightly edges out Fusion Markets due to its multi-lingual support and phone support availability.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

10. Better Funding Options: Admirals

In the ever-evolving world of forex trading, funding options play a pivotal role in ensuring seamless transactions for traders. Both Fusion Markets and Admirals have made significant strides in offering diverse funding methods to cater to the varied needs of their clientele. While Fusion Markets boasts a more streamlined approach, Admirals counters with a broader spectrum of choices.

The table below provides a comparative view of the funding options available with both brokers:

| Funding Option | Fusion Markets | Admirals |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | Yes |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

When it comes to the diversity of funding options, Admirals edges out Fusion Markets by offering a wider range of choices. However, traders should consider the convenience and fees associated with each method before making a decision.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

11. Lower Minimum Deposit: Fusion Markets

The two most commonly asked questions are how to fund a trading account and how much you need to fund.

You have no minimum deposit requirement on Fusion Markets. To make trading easy, you can deposit using all the main methods- ranging from bank transfers, credit cards or debit cards, or PayPal/Neteller/Skrill. Unlike most other brokers, you could even fund your trading account with cryptos ranging from Bitcoin to Ethereum to Tether.

Admirals do have a minimum deposit requirement. For all the major currencies like the USD, AUD, or CHF, it is set at $100. However, if you use another base currency, all deposit requirements are in our image below. All the payment methods on Fusion like bank transfers or Visa/Mastercard are also available with Admirals, with the exception of crypto funding. Australian traders with Admirals can also fund using POLi.

| Broker | Minimum Deposit | Recommended Deposit |

| Fusion Markets | $0 | $1,500 |

| Admirals | $100 | $100 |

Our Lower Minimum Deposit Verdict

Without question, our top low-cost broker is Fusion Markets. They have consistently lower spread and lower commission fees than Admirals.

Our Final Verdict On Which Broker Is The Best: Admirals or Fusion Markets?

Fusion Markets is the winner because it offers competitive spreads, an intuitive trading platform, and a lower minimum deposit, among other advantages. The table below summarises the key information leading to this verdict:

| Criteria | Fusion Markets | Admirals |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ❌ | ✅ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

Fusion Markets is the ideal choice for beginner traders due to its user-friendly platform and competitive spreads.

Best For Experienced Traders

Admirals stands out for experienced traders, offering a comprehensive product range and superior educational resources.

FAQs Comparing Fusion Markets Vs Admirals

Does Admirals or Fusion Markets Have Lower Costs?

Fusion Markets generally offers lower costs when compared to Admirals. They are known for their competitive spreads, especially on major currency pairs. For instance, the EUR/USD pair often has an average spread as low as 0.82 pips with Fusion Markets. Traders looking for cost-effective trading solutions often consider Fusion Markets as a top choice. For a deeper dive into brokers with the most competitive fees, explore the Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Fusion Markets and Admirals offer MetaTrader 4, but Fusion Markets stands out for its seamless integration and user-friendly features on the platform. Admirals, while offering MT4, is often recognised for its broader range of platforms. If you’re keen on finding the best brokers optimised for MT4, consider browsing through the best MT4 brokers.

Which Broker Offers Social Trading?

Admirals offers social trading features, allowing traders to follow and copy the trades of professionals. Fusion Markets, on the other hand, doesn’t have a prominent social trading platform. Social trading has become a popular trend, especially among new traders who wish to leverage the expertise of seasoned professionals. For a comprehensive overview of platforms offering this feature, check out the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Fusion Markets nor Admirals offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of market movements. For those interested in spread betting, it’s essential to choose brokers that specialise in this service. You can explore a list of the best spread betting brokers in the UK to find the right fit.

What Broker is Superior For Australian Forex Traders?

In my opinion, Fusion Markets stands out for Australian forex traders. Founded in Australia and regulated by ASIC, Fusion Markets offers a sense of familiarity and trust for local traders. While Admirals is also a reputable broker, it’s based overseas, which might not resonate as strongly with some Australian traders. If you’re an Aussie looking for more options, check out this comprehensive list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally lean towards Admirals. Being FCA regulated, Admirals offers a level of security and trustworthiness that UK traders often seek. Fusion Markets, while offering competitive services, is based overseas. UK traders have a unique set of needs, and it’s crucial to choose a broker that aligns with local regulations and market conditions. For a deeper dive into the best options for UK traders, consider browsing through the Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How much does Fusion Markets charge per transaction?

Commission is AUD and USD $2.25 per lot, in GBP it is £1.78 and in Eur it is €2.03