Fusion Markets vs City Index 2025

Our comprehensive comparison of Fusion Markets vs City Index dissects key areas like trading costs, Forex trading platforms, and regulations to help you choose the right Forex broker.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

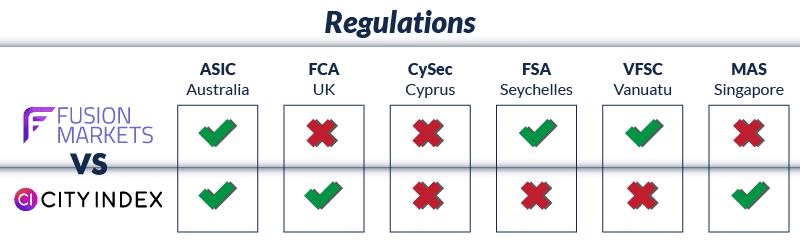

Regulations and Licenses

Brokerage

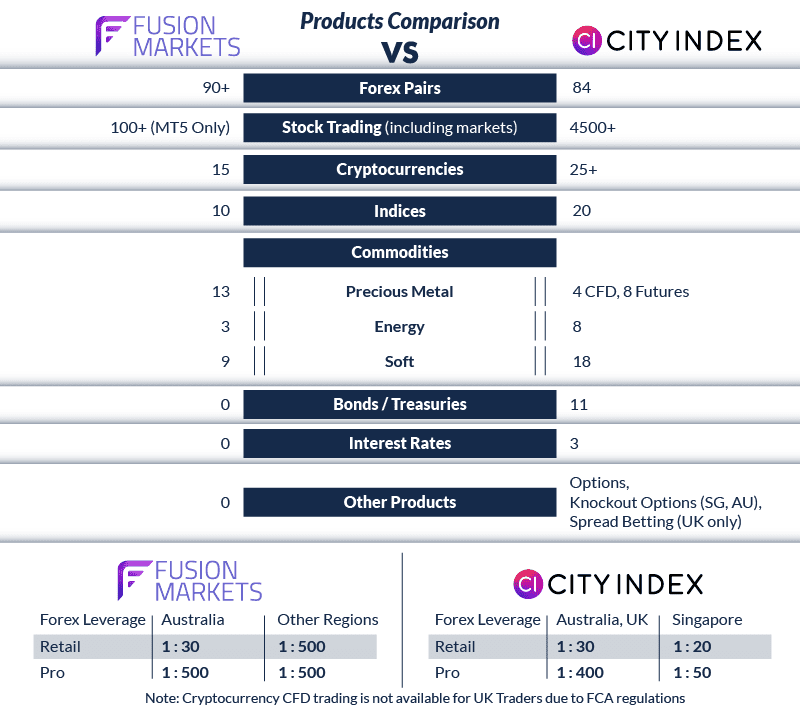

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do City Index Vs Fusion Markets Compare?

Our comprehensive comparison covers the 10 most important trading factors. Here are five noticeable differences between Fusion Markets and City Index:

- Fusion Markets offers an average raw spread of 0.13 for EUR/USD, while City Index offers 0.07.

- Fusion Markets provides 10+ cryptocurrency CFDs, whereas City Index offers 25+.

- Fusion Markets has a pro max leverage of 500:1 in Australia, compared to City Index’s 400:1.

- Fusion Markets doesn’t require a minimum deposit, while City Index requires $150 in Australia and Singapore and £100 in the UK.

- Fusion Markets is regulated by ASIC (Australia) and VFSA (Vanuatu), while City Index holds regulatory licenses with ASIC (Australia), FCA (UK), and MAS (Singapore).

1. Lowest Spreads And Fees: Fusion Markets

Fusion Markets is an Australian forex broker founded in 2017; it is known for its tight spreads with low commissions. City Index is one of the oldest forex brokers, having been founded in 1983, and they are a market maker that doesn’t charge commissions.

We compare Fusion vs City Index to help you choose between them and find your next broker.

Does Fusion Markets or City Index have lower trading fees?

Trading fees come in two types: commission fees and the spread cost. The costs that you will face depend on the trading account type you choose to use, so to compare brokerage fees, we analyse both the standard and ‘raw’ account types offered by Fusion Markets and City Index.

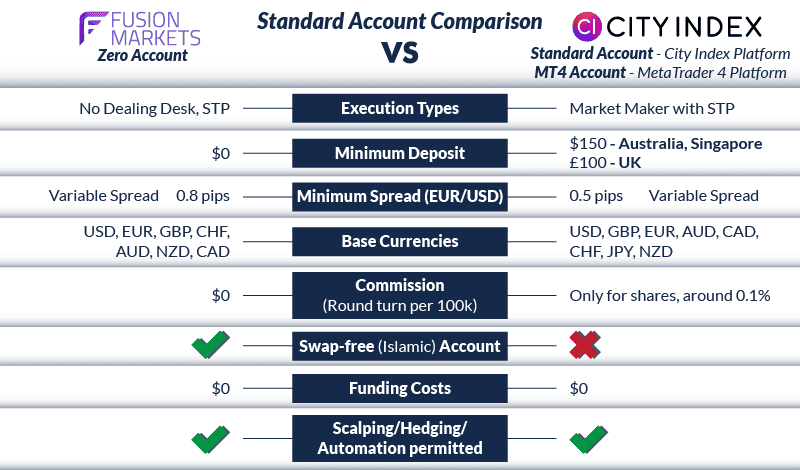

Standard Account Comparison

On a standard account, you have zero commission, but you have to pay an artificially increased spread cost. This represents the difference between the buy and sell price for what you are trading.

Fusion Markets only has one no commission account, the Classic Account. City Index, however, has two types of accounts with no commission. The Standard Account is for traders using one of the City Index Trading Platforms, and the MT4 account for traders using the MetaTrader 4 trading platform.

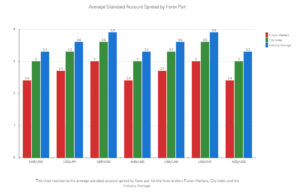

Below, you can see the average standard account spreads of different brokers.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

0.93 | 0.92 | 0.98 | 1.08 | 1.02 |

|

0.70 | 2.20 | 1.10 | 1.10 | 0.60 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.50 | 1.60 | 1.50 |

|

0.60 | 0.70 | 0.80 | 0.90 | 0.60 |

|

1.10 | 1.20 | 1.30 | 1.30 | 1.30 |

|

1.20 | 1.80 | 1.90 | 1.90 | 1.60 |

|

1.32 | 1.95 | 1.37 | 1.70 | 1.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

From the spread module, you will notice that while the two brokers have similar spreads for the EUR/USD and AUD/USD, Fusion Markets has much tighter spreads across the board.

The minimum spread you can get on Fusion Markets is 0.8 pips on the popular pairs, and from the module, you can see that the average spread for the EUR/USD is very low.

In comparison, City Index has slightly wider average spreads. Even though the minimum spread is advertised at 0.5 pips, you can expect spreads to be around the averages denoted in the table above.

As you can see, some of their spreads are fairly wide. For example, average spreads on the EUR/JPY are at 2.3 pips, more than double the average spread on Fusion Markets

Fusion Markets do not have a minimum deposit to open an account, City Index requires £100 for clients in the UK and $150 for clients in Australia and Singapore.

Looking at the average standard account spreads for Fusion Markets, City Index, and the industry average, we can see some interesting differences.

Fusion Markets consistently offers lower spreads across all forex pairs compared to City Index. For instance, the EUR/USD pair has a spread of 0.7 for Fusion Markets, while City Index has a spread of 0.9. This trend continues across all pairs, with Fusion Markets always having a lower spread.

| Forex Pair | Fusion Markets | City Index | Industry Average |

|---|---|---|---|

| EUR/USD | 0.7 | 0.9 | 1.0 |

| USD/JPY | 0.8 | 1.0 | 1.1 |

| GBP/USD | 0.9 | 1.1 | 1.2 |

| AUD/USD | 0.7 | 0.9 | 1.0 |

| USD/CAD | 0.8 | 1.0 | 1.1 |

| USD/CHF | 0.9 | 1.1 | 1.2 |

| NZD/USD | 0.7 | 0.9 | 1.0 |

Standard Account Analysis Updated June 2025[1]June 2025 Published And Tested Data

However, when we compare these two brokers to the industry average, we see that both are offering competitive rates. The industry average spread for EUR/USD is 1.0, which is higher than both Fusion Markets and City Index. This pattern is consistent across all forex pairs.

In conclusion, if we’re purely looking at the standard account spreads, Fusion Markets seems to be the cheaper option. However, it’s important to remember that spreads are just one aspect of the overall cost of trading. Other factors such as commission fees, account types, and trading environment should also be considered when choosing a forex broker.

Here’s the bar chart representing the average standard account spread by forex pair for the forex brokers Fusion Markets, City Index, and the Industry Average:

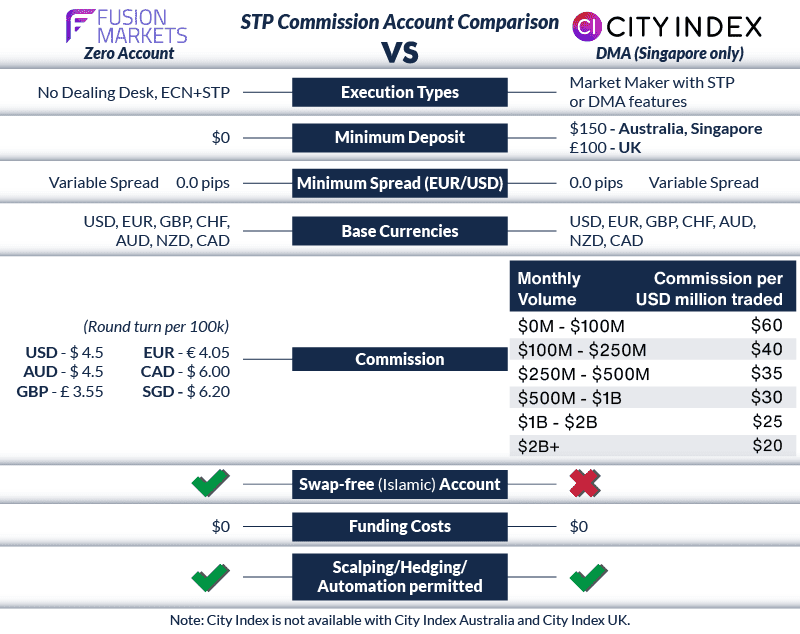

Raw Account Comparison

Meanwhile, STP-style or ‘Raw’ accounts have market-priced spreads, however, brokers will charge commission fees on trades as a brokerage fee.

Fusion Markets is an outstanding choice when it comes to an STP style no dealing desk trading account. Not only are the spreads very low with the Zero Account, the commission costs are also extremely low.

Commission fees on Fusion Markets are extremely low compared to other top brokers. You only need to pay $4.50 AUD or USD round-turn per standard lot, with the commission in other base currencies similarly low.

City Index does not offer a commission-style account in the UK and Australia; however, Singapore residents have the option of a DMA account. Commission with this account is tiered, meaning the more you trade, the less you will pay in commission costs. As a rule, Fusion Markets have fewer commission costs unless you are a professional trader who trades over 100 million a month.

|

ECN Broker Spreads

|

|||||

|---|---|---|---|---|---|

|

0.03 | 0.11 | 0.02 | 0.19 | 0.05 |

|

0.30 | 0.40 | 0.10 | 0.20 | 0.10 |

|

0.20 | 0.30 | 0.20 | 0.40 | 0.20 |

|

0.30 | 0.50 | 0.30 | 0.50 | 0.40 |

|

0.24 | N/A | 0.17 | 0.54 | 0.30 |

|

0.30 | 0.70 | 0.20 | 0.50 | 0.40 |

|

0.30 | 1.10 | 0.10 | 0.60 | 0.50 |

|

0.77 | 1.41 | 0.44 | 1.13 | 1.23 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

As you can see from the table above, Fusion has extremely low spreads on its ZERO account. With a minimum spread of 0 pips wide and the average spread on major pairs so tight, you can be sure you’re getting a great deal when trading with Fusion.

Our Lowest Spreads and Fees Verdict

Fusion Markets ReviewVisit Fusion Markets

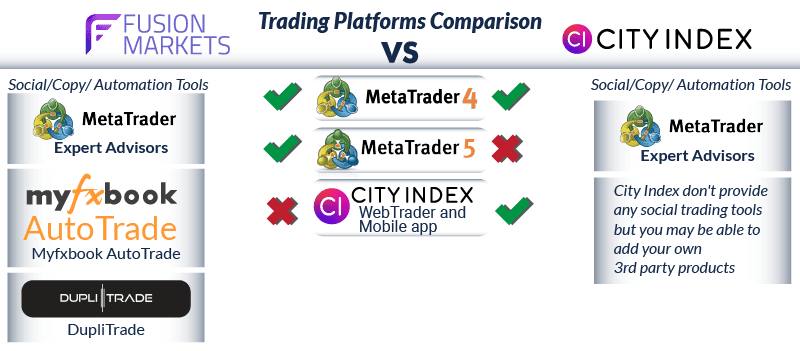

2. Better Trading Platform: City Index

| Trading Platform | Fusion Markets | City Index |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

Fusion Markets and City Index both have two platforms for you to trade with.

Both MetaTrader 4 and MetaTrader 5 are available with Fusion Markets. These are the two most popular forex trading platforms in the world, with over 75% of all forex traders in Q4 of 2021 being executed through either MT4 or MT5. The simple and consistent user experience when trading with the MetaTrader platforms has elevated it to the best in the world, and you will have no problems on either platform.

While City Index only offers MetaTrader 4, they also have their own proprietary platform, the City Index WebTrader and Mobile App (Android/iOS). Their proprietary platform makes it much more convenient for you to trade while on the go, as you can instantly execute trades on your phone at any time.

If you do use the City Index platform, you will be able to protect your trades with a guaranteed stop loss.

Our Better Trading Platform Verdict

View City Index ReviewVisit City Index

71% of retail investor accounts lose money when trading CFDs with this provider.

3. Superior Accounts And Features: Fusion Markets

Fusion Markets and City Index both present distinct account features tailored to different trading needs. Fusion Markets stands out with its Zero Account, boasting extremely low spreads and competitive commission costs. On the other hand, City Index offers a diverse range of accounts, including their proprietary platform, the City Index WebTrader and Mobile App, which provides traders with the convenience of executing trades on the go.

Additionally, City Index’s platform comes with a guaranteed stop loss, ensuring added protection for traders. Fusion Markets, while not offering as many platform varieties, compensates with its access to both MetaTrader 4 and MetaTrader 5, the world’s most popular forex trading platforms.

Furthermore, Fusion Markets provides traders with social trading tools like Myfxbook and DupliTrade, allowing them to tap into the strategies of professional traders. City Index complements its offering with tools such as Smart Signals, Trading Central features, TradingView charting, and custom alerts.

| Fusion Markets | City Index | |

|---|---|---|

| Standard Account | Yes | No |

| Raw Account | Yes | Yes |

| Swap Free Account | No | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

While both brokers offer commendable account features, Fusion Markets edges out with its combination of low-cost trading and access to popular trading platforms.

4. Best Trading Experience And Ease: Fusion Markets

Having dived deep into the trading platforms of both Fusion Markets and City Index, it’s evident that each broker brings its unique strengths to the table. Fusion Markets, for instance, is recognised for its exceptional cTrader platform, which offers a seamless and intuitive trading experience.

On the other hand, City Index, with its proprietary platform, the City Index WebTrader and Mobile App, ensures that traders have all the tools they need right at their fingertips.

- Fusion Markets offers the best cTrader experience, making it a top choice for those who prefer this platform.

- City Index’s WebTrader and Mobile App are user-friendly and packed with features.

- Our own testing revealed that Fusion Markets also stands out for its low commission structure.

- City Index, while not highlighted in our testing for a specific strength, consistently delivers a reliable and comprehensive trading environment.

Our Best Trading Experience and Ease Verdict

While both brokers offer a commendable trading experience, Fusion Markets takes the lead with its superior cTrader platform and competitive commission structure.

5. Stronger Trust And Regulation: Tie

Fusion Markets Trust Score

City Index Trust Score

Regulation helps make sure you will be as safe as possible when trading.

We found that Fusion Markets is regulated by one top-tier regulator and one second-tier regulator. These are:

- The Australian Securities and Investments Commission (ASIC), in Australia

- The Vanuatu Financial Services Commission (VFSC) gives protection to all countries outside Australia

City Index is slightly more regulated, holding four top-tier regulatory licences. The licences are with:

- ASIC, in Australia

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Monetary Authority of Singapore (MAS) in Singapore

It is interesting to note that, unlike Fusion Markets, which has an offshore regulator (VFSC) for clients outside Australia, City Index does not use any offshore regulators. So, if you are a resident outside Australia, the UK, or Singapore, you will sign with the City Index Singapore Subsidiary, and policies will be in line with those required by MAS.

| Fusion Markets | City Index | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) | ASIC (Australia) FCA (UK) MAS (Singapore) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | VFSC FSA-S (Seychelles) |

Our Stronger Trust and Regulation Verdict

While having many regulatory licences is great, what truly matters is that the broker is regulated in the country you are trading from. Therefore, we recommend that UK and Singaporean traders use City Index for maximum protection. Australian and global traders will be safely protected with both brokers.

View City Index ReviewVisit City Index

71% of retail investor accounts lose money when trading CFDs with this provider.

6. Most Popular Broker – Fusion Markets

Fusion Markets gets searched on Google more than City Index. On average, Fusion Markets sees around 33,100 branded searches each month, while City Index gets about 9,900 — that’s 70% fewer.

| Country | Fusion Markets | City Index |

|---|---|---|

| United States | 2,900 | 390 |

| United Kingdom | 1,900 | 4,400 |

| India | 1,900 | 590 |

| Canada | 1,900 | 50 |

| Australia | 1,900 | 1,000 |

| France | 1,300 | 70 |

| Italy | 1,000 | 50 |

| Philippines | 1,000 | 30 |

| Germany | 880 | 140 |

| Sri Lanka | 880 | 10 |

| South Africa | 720 | 90 |

| Netherlands | 590 | 40 |

| Malaysia | 590 | 110 |

| Spain | 480 | 50 |

| Poland | 480 | 90 |

| Brazil | 480 | 40 |

| Thailand | 480 | 40 |

| Pakistan | 480 | 40 |

| Turkey | 390 | 50 |

| Nigeria | 390 | 70 |

| Singapore | 390 | 720 |

| Bangladesh | 390 | 20 |

| Kenya | 390 | 30 |

| Indonesia | 320 | 90 |

| United Arab Emirates | 320 | 40 |

| Morocco | 260 | 20 |

| Vietnam | 210 | 40 |

| Japan | 170 | 90 |

| Egypt | 170 | 20 |

| Portugal | 170 | 30 |

| Hong Kong | 170 | 40 |

| Algeria | 170 | 10 |

| Switzerland | 140 | 30 |

| Sweden | 140 | 40 |

| Saudi Arabia | 140 | 20 |

| Dominican Republic | 140 | 10 |

| Austria | 110 | 10 |

| Greece | 110 | 20 |

| Mexico | 110 | 10 |

| Colombia | 110 | 20 |

| Cyprus | 110 | 20 |

| Ireland | 90 | 30 |

| Argentina | 90 | 10 |

| Ghana | 90 | 10 |

| Uganda | 90 | 10 |

| Ethiopia | 90 | 10 |

| Tanzania | 90 | 10 |

| Botswana | 90 | 10 |

| Venezuela | 70 | 10 |

| Cambodia | 70 | 10 |

| Taiwan | 50 | 50 |

| New Zealand | 50 | 10 |

| Jordan | 50 | 10 |

| Ecuador | 50 | 10 |

| Chile | 40 | 10 |

| Uzbekistan | 40 | 10 |

| Mauritius | 40 | 10 |

| Peru | 30 | 10 |

| Costa Rica | 20 | 10 |

| Panama | 20 | 10 |

| Bolivia | 10 | 10 |

| Mongolia | 10 | 10 |

2024 Monthly Searches For Each Brand

Fusion Markets - US

Fusion Markets - US

|

2,900

1st

|

City Index - US

City Index - US

|

390

2nd

|

Fusion Markets - India

Fusion Markets - India

|

1,900

3rd

|

City Index - India

City Index - India

|

590

4th

|

Fusion Markets - Australia

Fusion Markets - Australia

|

1,900

5th

|

City Index - Australia

City Index - Australia

|

1,000

6th

|

Fusion Markets - Philippines

Fusion Markets - Philippines

|

1,000

7th

|

City Index - Philippines

City Index - Philippines

|

30

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with Fusion Markets receiving 497,000 visits vs. 216,000 for City Index.

Our Most Popular Broker Verdict

Fusion Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

7. Top Product Range And CFD Markets: Fusion Markets

CFD products include forex/currency pairs, equity indices, cryptocurrencies, and even shares and ETFs. Fusion Markets and City Index each have a comprehensive range of trading products for you to choose from.

Fusion Markets offers over 90 different forex pairs for you to trade. If you are classified as a retail trader, you will be able to trade these pairs at 30:1 leverage in Australia and 500:1 if you are outside Australia or a professional trader. With so many pairs to choose from, you can be more than sure that the pairs you want to trade are available, whether that be a popular pair like the EUR/USD or GBP/USD to minor or exotic pairs like the CHF/JPY.

Meanwhile, City Index has 84 pairs for you to choose between. In Australia, the UK and the UAE, retail traders are capped at 30:1 leverage, and Singaporean traders at 20:1. Options trading is also available for over 40 markets, and if you are in Singapore or Australia, you can trade knockout options. Lastly, Spread betting is available for all products for UK traders.

Our Top Product Range and CFD Markets Verdict

Strictly speaking, as options are not a CFD product, our winner in this category is Fusion Markets, thanks to their extraordinarily wide range of forex pairs. However, if you are looking to trade options, City Index is a great option.

8. Superior Educational Resources: Fusion Markets

Fusion Markets:

- Webinars: Fusion Markets offers regular webinars to help traders understand the nuances of the market.

- Tutorials: Comprehensive tutorials are available for both beginners and advanced traders.

- E-books: A variety of e-books are provided to deepen the knowledge of traders.

- News and Analysis: Fusion Markets keeps its users updated with the latest market news and in-depth analysis.

- Customer Support: Their customer support is well-equipped to answer any educational queries.

- Score: Based on our testing, Fusion Markets scored 8.5 for their educational resources.

City Index:

- Webinars: City Index also conducts webinars, but they are less frequent compared to Fusion Markets.

- Tutorials: They offer a good range of tutorials, but they are more suited for intermediate traders.

- E-books: City Index has a limited collection of e-books which might not cater to all trading levels.

- News and Analysis: Their news and analysis section is robust and provides timely updates.

- Customer Support: City Index’s support team is knowledgeable but might take longer to respond to educational queries.

- Score: Based on our testing, City Index scored 7.8 for their educational resources.

Our Superior Educational Resources Verdict

Based on our team’s testing, Fusion Markets offers superior educational resources compared to City Index.

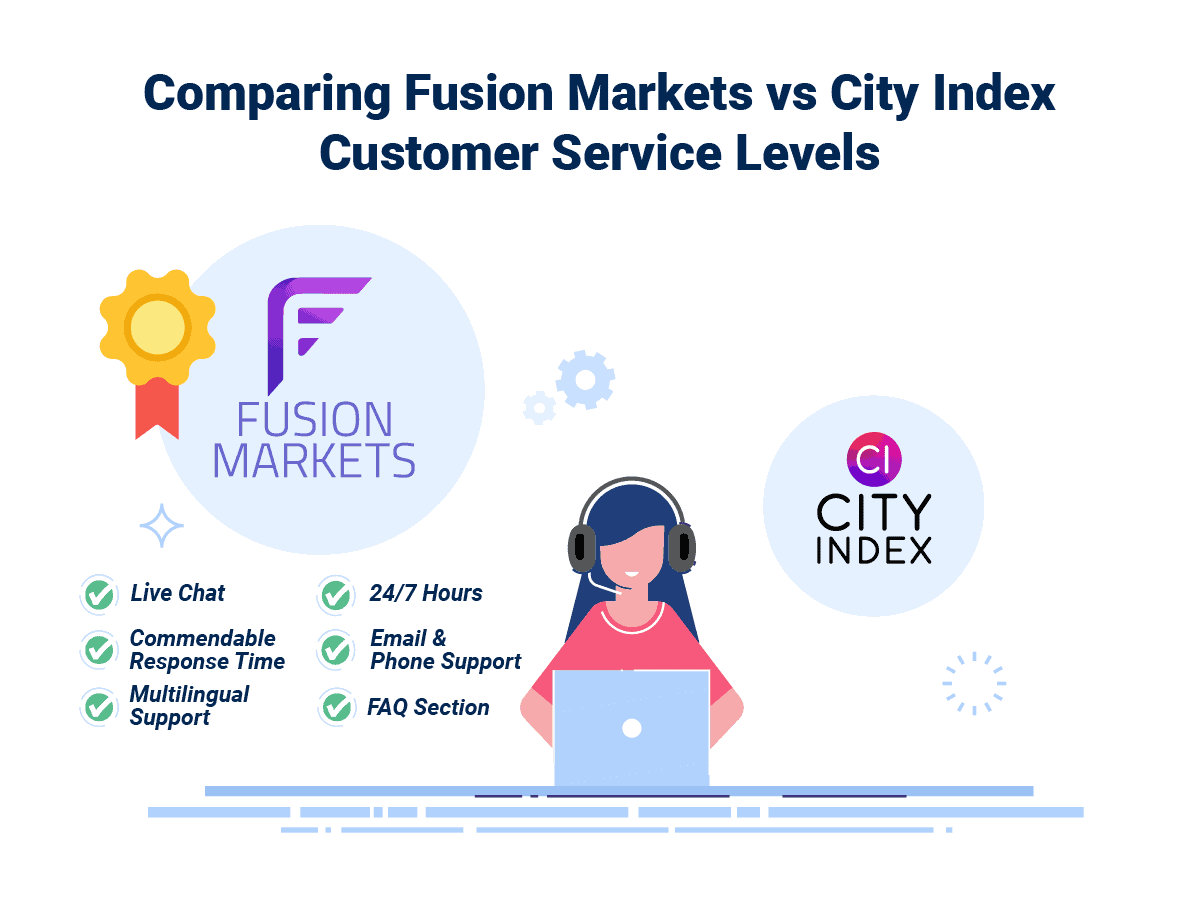

9. Superior Customer Service: Fusion Markets

In the world of forex trading, customer service can make or break a trader’s experience. Both Fusion Markets and City Index have made significant efforts to ensure their clients receive top-notch support.

Fusion Markets, for instance, prides itself on its responsive and knowledgeable support team, available through multiple channels. City Index, on the other hand, has a legacy of providing consistent and reliable customer service, ensuring that traders have a smooth trading journey.

Here’s a comparative table highlighting the key customer service features of each broker:

| Feature | Fusion Markets | City Index |

|---|---|---|

| Live Chat Availability | 24/5 | 24/5 |

| Phone Support | Available | Available |

| Email Response Time | Within 2 hours | Within 4 hours |

| Support Languages | Multiple | Multiple |

| Knowledge Base/FAQ | Comprehensive | Detailed |

| Customer Feedback | Generally Positive | Mostly Positive |

Our Superior Customer Service Verdict

While both brokers offer commendable customer service, Fusion Markets slightly edges out with its faster email response time and overall positive customer feedback.

10. Better Funding Options: Fusion Markets

At Fusion Markets, you have no minimum deposit requirement for both of their account types. You also won’t have to pay anything at all to deposit and withdraw funds. The broker, however, does recommend a minimum deposit of $1500 to cover your margin requirements when you open a trade.

To deposit funds, payment methods you can use range from bank transfers to Visa/Mastercard for both credit and debit cards, plus an extremely wide set of e-wallets like Paypal or Neteller. You can even fund your Fusion Markets CFD trading account with cryptos like Bitcoin or Ethereum.

City Index does have a minimum deposit, set at $150 in Australia and Singapore and £100 in the UK. However, they recommend that you deposit $2,000 for forex trading, $2,500 for stock trading, and $2,500 for other markets. As for funding methods, you can still pay with a bank transfer, Visa/Mastercard credit card and PayPal. Although you cannot deposit with other e-wallets or with crypto, you can fund your account with BPay or PayID in Australia.

Our Better Funding Options Verdict

While very close, we find that, on average, Fusion Markets will have lower trading fees. With consistently low spreads on both their accounts and very low commissions, on average, you can expect to pay less when trading with Fusion compared to City Index.

11. Lower Minimum Deposit: Fusion Markets

The initial deposit required by a broker can be a significant factor for many traders, especially those who are just starting out. A lower minimum deposit allows traders to test the waters without committing a large sum, providing flexibility and reducing the barrier to entry.

Fusion Markets, in this regard, has positioned itself as an accessible broker for traders of all levels by offering a $0 minimum deposit for both its Classic and Zero accounts. City Index, while renowned for its comprehensive trading environment, requires a higher initial deposit for its Standard and RAW FX accounts.

Here’s a comparative table highlighting the minimum deposit amounts of each broker:

| Account Type | Fusion Markets | City Index |

|---|---|---|

| Classic/Standard | $0 | $150 |

| Zero/RAW FX | $0 | $150 |

Our Lower Minimum Deposit Verdict

When it comes to the minimum deposit requirement, Fusion Markets clearly stands out by offering a $0 minimum deposit for its accounts, making it more accessible for traders.

Our Final Verdict On Which Broker Is The Best: City Index or Fusion Markets?

Fusion Markets is the winner because it outperforms City Index in most of the key areas that traders value the most, such as spreads, fees, account features, trading experience, educational resources, customer service, funding options, and minimum deposit requirements. The table below summarises the key information leading to this verdict:

| Criteria | Fusion Markets | City Index |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

Fusion Markets is the ideal choice for beginner traders due to its comprehensive educational resources and user-friendly platform.

Best For Experienced Traders

While both brokers cater well to experienced traders, Fusion Markets offers a slight edge with its advanced trading tools and competitive pricing.

FAQs Comparing Fusion Markets Vs City Index

Does City Index or Fusion Markets Have Lower Costs?

Fusion Markets generally offers lower costs compared to City Index. For instance, Fusion Markets boasts an average raw spread of 0.13 for EUR/USD, while City Index’s spread is slightly higher. This difference in spread can significantly impact a trader’s profitability over time. For a more detailed comparison on broker costs, you can check out our guide on the Lowest Spread Forex Brokers.

Which Broker Is Better For MetaTrader 4?

Both City Index and Fusion Markets offer MetaTrader 4, a popular trading platform among forex traders. However, Fusion Markets is often preferred for its seamless integration and additional features on MT4. If you’re keen on exploring more about this platform and the best brokers offering it, our comprehensive guide on the best MT4 brokers can be a valuable resource.

Which Broker Offers Social Trading?

Fusion Markets stands out when it comes to social trading, offering tools like Myfxbook and DupliTrade. These tools allow traders to tap into the strategies of professional traders and replicate their trades. Social or copy trading can be a game-changer, especially for those new to the forex market. For a deeper dive into the world of social trading, you might find our article on the best social trading platforms quite enlightening.

Does Either Broker Offer Spread Betting?

Yes, City Index offers spread betting to its clients. Spread betting is a popular financial derivative that allows traders to speculate on the price movements of various assets without owning the underlying asset. For those interested in diving deeper into spread betting and finding the best brokers offering this service, our comprehensive guide on the best spread betting brokers in the UK is a must-read.

What Broker is Superior For Australian Forex Traders?

In my opinion, Fusion Markets is the superior choice for Australian forex traders. Not only is Fusion Markets ASIC regulated, ensuring a high level of trust and security, but it’s also an Australian-founded broker. This local foundation means they have a deep understanding of the Australian market and its traders. City Index, while also ASIC regulated, is founded overseas. For a broader perspective on the best brokers in Australia, you can check out our detailed review of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK forex traders, I believe City Index holds the edge. City Index is FCA regulated, which provides a significant level of trust and security for UK traders. Additionally, being founded in the UK, City Index has a deep-rooted understanding of the local market and its nuances. Fusion Markets, while offering a competitive trading environment, is founded overseas. If you’re keen on exploring more about the best brokers in the UK, our comprehensive guide on the best forex brokers in UK can provide further insights.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does Fusion Markets support TradingView?

Yes, Fusion Markets offers TradingView