Admiral Markets vs IC Markets: Which One Is Best?

IC Markets and Admiral Markets are top forex brokers, offering strong platforms and features. IC Markets excels in RAW spreads and execution speed, while Admiral Markets provides superior risk management tools and diverse asset offerings. In this review, Admiral Market takes the lead.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors between Admiral Markets and IC Markets. Here are ten key differences:

- Admiral Markets offers less than 50 forex currency pairs.

- Admiral Markets requires a minimum deposit of USD 100.

- IC Markets has a minimum deposit requirement of USD 200.

1. Lowest Spread And Fees – IC Markets

IC Markets, known for tight spreads and fast execution, suits scalpers and high-frequency traders, while Admiral Markets stands out with diverse tools and resources for all experience levels. Both excel in offering competitive trading conditions and broad market access, attracting traders of all types. This analysis dives into their spreads, commissions, and fees, highlighting their unique strengths and benefits for traders aiming for success.

Spreads

For non-commission accounts, Admiral Markets has a slight edge in spreads. However, IC Markets dominates commission accounts with exceptional spreads, including a EUR/USD spread of 0.02 compared to Admiral Markets’ 0.51 (industry average: 0.28). Both offer a strong 0.03 AUD/USD spread (industry average: 0.45). Overall, IC Markets impresses with an average spread of 0.29, significantly outperforming Admiral Markets’ 0.86 and the 072 industry average, making it a standout choice for cost-conscious traders.

| RAW Account | Admiral Markets Spreads | IC Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.86 | 0.29 | 0.72 |

| EUR/USD | 0.51 | 0.02 | 0.28 |

| USD/JPY | 0.6 | 0.14 | 0.44 |

| GBP/USD | 0.4 | 0.23 | 0.54 |

| AUD/USD | 0.4 | 0.03 | 0.45 |

| USD/CAD | 1.4 | 0.25 | 0.61 |

| EUR/GBP | 0.6 | 0.27 | 0.55 |

| EUR/JPY | 0.85 | 0.3 | 0.74 |

| AUD/JPY | 1.3 | 0.5 | 0.93 |

| USD/SGD | 1.7 | 0.85 | 1.97 |

Commission Levels

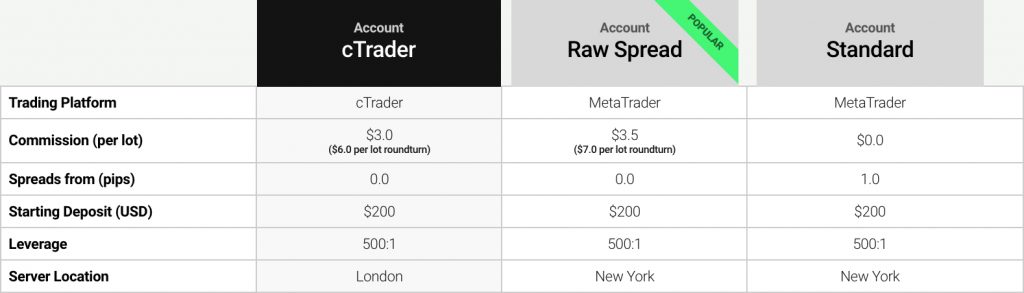

IC Markets imposes a commission fee of $3.50 per lot, in contrast to Admiral Markets, which charges $3.00 per lot. On the other hand, Admiral Markets stands out with a lower minimum deposit requirement of $100, compared to IC Markets’ $200. Additionally, both brokers provide SWAP-free accounts, making them ideal for traders adhering to Islamic finance principles.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Admiral Markets | $3.00 | $4.00 | £2.40 | €2.60 |

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

Standard Account Fees

IC Markets stands out with its attractive standard account fees, featuring a tight spread of 0.62 for EUR/USD and 0.77 for AUD/USD. In contrast, Admiral Markets presents higher spreads of 0.80 for EUR/USD and 1.00 for AUD/USD. These disparities underscore IC Markets’ advantage in offering reduced trading costs for standard account users.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

0.80 | 1.00 | 1.00 | 1.00 | 1.00 |

|

0.82 | 0.83 | 1.27 | 1.03 | 0.94 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Both IC Markets and Admiral Markets present distinct advantages. IC Markets is known for its low spreads and competitive commission rates, which can be suitable for high-frequency traders and scalpers. Conversely, Admiral Markets offers a comprehensive educational platform and a lower minimum deposit, which may be attractive to new traders and those with limited capital. The selection between these brokers ultimately hinges on the individual trader’s preferences and needs.

To remain informed about the latest trends and developments in forex trading for 2025, it is important to monitor market changes. The EUR/USD pair may experience bearish pressure, while the AUD/USD pair appears to be positioned for range-bound trading. Observing these trends can assist traders in making informed decisions in the evolving forex market.

Our Lowest Spreads and Fees Verdict

It is IC Markets that come out on top in this category in light of their lowest spread and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

IC Markets and Admiral Markets excel with robust platforms, offering advanced charting, real-time data, and fast execution. IC Markets, known for low spreads and speed, attract scalpers and high-frequency traders. Admiral Markets stands out with diverse tools and educational resources, catering to beginners and experienced traders. Both platforms enhance trading experiences with customisable interfaces, automation, and social trading features, ensuring informed and efficient decision-making for users across various trading styles.

| Trading Platform | Admiral Markets | IC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | Yes |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

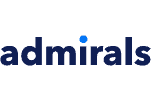

MetaTrader

IC Markets and Admiral Markets both excel in providing trading services on the MetaTrader 4 and 5 platforms. MetaTrader 4 (MT4) is celebrated as the premier forex trading platform worldwide, boasting a vast community and a robust marketplace. However, MT4 does not include some of the sophisticated features and products available in its successor, MetaTrader 5 (MT5). MT4 is particularly well-suited for traders who:

- Only wish to trade forex

- Have PCs with low memory capacity (MT4 is 32-bit, MT5 is 64-bit)

- Want access to one of the largest trading platform communities and marketplaces

- Prefer the MQL4 programming language

- Seek more flexibility with brokers, as more brokers offer MT4 than MT5

MT5, on the other hand, is equipped with additional features, including:

- More trading tools and features such as charts and backtesting

- Access to more CFDs, as MT5 is built for decentralized and centralized assets

- More processing power, resulting in faster speeds

- Continued development and support, as MT4 has ceased new development

Advanced Platforms

IC Markets features the cTrader platform, celebrated for its exceptional capabilities in forex trading, including advanced technical charting and rapid trade execution. cTrader offers:

- A customizable interface

- Direct access to liquidity pools designed for algorithmic trading

- Back-testing facilities on the platform

- 26-time frames, one-click trading, and market depth

- Compatibility on PC, Mac, iOS, and Android

Admiral Markets, however, does not offer cTrader but focuses on providing robust MetaTrader 4 and 5 platforms.

Copy Trading

Copy Trading

IC Markets provides a diverse range of social and copy trading platforms, many of which are compatible with MetaTrader. These options include:

MyFxBook AutoTrade

ZuluTrade

cTrader Copy

MT4 signals

MQL5 signals

Admiral Markets does not offer any social trading tools directly but may allow integration with third-party platforms via API.

Both IC Markets and Admiral Markets have distinct features. IC Markets provides a variety of trading platforms, including cTrader, and offers several social trading tools, which may appeal to traders interested in advanced trading options. Admiral Markets focuses on MetaTrader 4 and 5 and offers a strong educational platform, attracting those who prioritize these tools and resources. The decision between these brokers will depend on individual trading preferences and needs.

To remain informed about the latest forex trading trends and news in 2025, it is important to monitor market developments. The forex market is anticipated to undergo notable changes, influenced by technological advancements, geopolitical factors, and central bank policies. Awareness of these trends can assist traders in making informed choices in the evolving forex landscape.

Our Better Trading Platform Verdict

IC Markets come up trumps in this niche in light of their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – A Tie

IC Markets and Admiral Markets provide various account types to meet diverse needs, such as competitive spreads, low commissions, and advanced tools. They offer demo accounts, swap-free options, and access to multiple instruments, ensuring flexibility. Additionally, features like social trading and strong customer support enhance trader confidence and satisfaction, improving the trading experience.

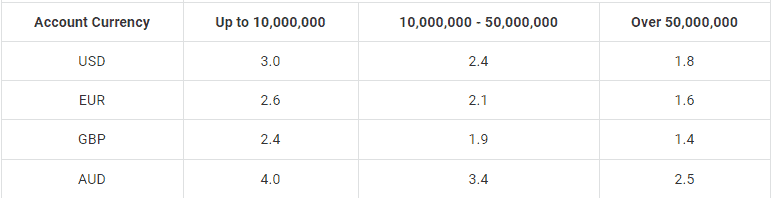

Admiral Markets Account

Admiral Markets provides two primary account types: Trade Account and Zero Account. The Trade Account facilitates trading without commission fees, while the Zero Account features tight spreads with straight-through processing (STP) trading execution. Additionally, an Islamic Account is available for traders following Islamic finance principles.

Trade Account

The Trade Account is a commission-free standard account that offers an attractive cost structure, especially for novice traders. It features an average minimum spread of 0.5 pips on all currency pairs available through Admiral Markets, although spreads may occasionally be higher. Additionally, there are two varieties of Zero accounts: Trade.MT4 and Trade.MT5. Opting for MT5 grants traders access to a wider array of trading instruments, enhancing their trading experience.

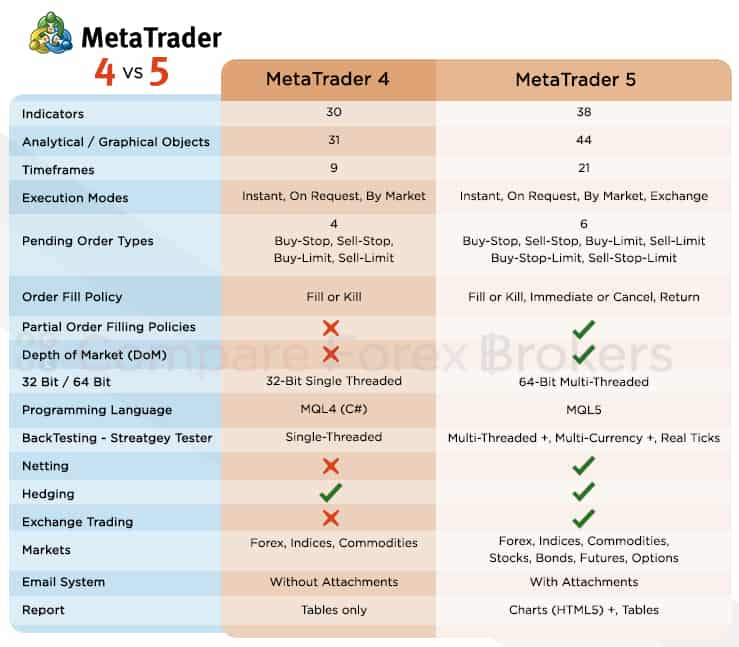

Zero Account

The Zero Account boasts a compelling commission structure with tiered pricing, allowing high-volume traders to benefit from reduced commission costs on each trade in the subsequent calendar month. Commission fees range from just $3.20 to $6.00 for a round-turn trade. Tailored for seasoned traders, this account features tighter spreads compared to the standard account. However, it’s worth noting that the selection of CFDs available is more limited than that offered by the Trade account.

IC Markets Account Types

IC Markets provides two key account options: the Standard Account and the Raw Spread Account (ECN Account). The Standard Account features no commission fees, though it comes with wider spreads. In contrast, the Raw Spread Account operates on an ECN pricing model, incorporating a minimal commission.

Standard Account

Standard Account

The Standard Account enables trading without commission fees; however, it features wider spreads, including a fixed 1.0 pip added to the spread for all currency pairs. This account can be accessed through the MetaTrader 4 and 5 trading platforms.

Raw Spread Account

The Raw Spread Account employs an ECN pricing model to offer the lowest spreads available at IC Markets. To ensure that spreads genuinely reflect market prices, IC Markets incorporates commission fees, preventing any widening of the spreads. The commission is set at $7.00 round-turn for each standard lot traded. This account is highly recommended for traders who prioritize optimal spreads.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Both provide standard and ECN-style account types, accommodating traders of varying experience levels. Admiral Markets is noted for its lower spreads in standard accounts, while IC Markets offers a wider selection of forex currency pairs and CFDs for ECN pricing. High-volume traders might find Admiral Markets’ lower commissions appealing.

Current forex trading trends suggest that the EUR/USD pair may experience bearish pressure, whereas the AUD/USD pair could be range-bound. The GBP/USD pair has been showing bullish momentum, influenced by expectations of possible interest rate cuts by the Federal Reserve. Staying informed about these trends may assist traders in making decisions in the forex market.

Our Superior Accounts and Features Verdict

It’s neck-to-neck for IC Markets and Admiral Market thanks to their superior accounts and features.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

IC Markets and Admiral Markets provide essential tools and support for a smooth trading experience. They offer advanced platforms, fast execution, competitive spreads, a user-friendly interface, and strong customer support. Educational resources also help traders enhance their strategies. Together, these features make trading efficient, enjoyable, and profitable.

Trading Experience and Ease

Admiral Markets and IC Markets each bring unique advantages to the trading experience. Our research reveals that both brokers are deeply committed to providing traders with a smooth and efficient trading journey.

IC Markets

IC Markets distinguishes itself with its MT5 platform, celebrated for its intuitive design and sophisticated trading functionalities. Additionally, it provides one of the finest standard accounts available in the industry, earning it a top spot among traders’ favourites.

Admiral Markets

Admiral Markets, in contrast, delivers a dynamic trading environment that caters to both novice and experienced traders alike. The broker’s dedication to ensuring a well-rounded trading experience is reflected in its diverse platform options and exceptional customer support.

Customer Support

Both brokers excel in providing responsive customer support, an essential element for a seamless trading experience. Whether you’re a beginner or a seasoned trader, having dependable assistance can greatly enhance your trading journey.

It’s crucial to acknowledge that the ideal trading experience is highly subjective and differs from one trader to another. What proves successful for one individual may not yield the same results for someone else. Ultimately, the key lies in discovering the perfect match for your unique trading style and requirements.

The EUR/USD pair is anticipated to experience bearish pressure, while the AUD/USD pair appears to be suitable for range-bound trading. The GBP/USD pair is currently displaying bullish momentum, influenced by expectations of possible interest rate cuts by the Federal Reserve. Monitoring these trends may assist traders in making informed decisions in the forex market.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Admiral Markets | 132ms | 15/36 | 182ms | 27/36 |

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

Our Best Trading Experience and Ease Verdict

Based on our team’s in-depth research, IC Markets ranks highest in this field of expertise due to their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Admiral Markets

A well-regulated broker, like IC Markets or Admiral Markets, provides a secure trading environment, offering traders peace of mind and preventing fraud. Strong regulation encourages active trading and attracts more clients. This review will compare IC Markets and Admiral Markets regarding trust, security, and regulatory compliance.

Admiral Markets Trust Score

IC Markets Trust Score

Admiral Markets has a higher trust score than IC Markets. However, as noted earlier, our evaluation of brokers includes more than just trust scores. We consider features, platforms, and the overall ease of use for traders.

Regulation Overview

Admiral Markets and IC Markets are regulated brokers, providing a secure trading environment for clients. Admiral Markets is regulated by three ‘tier 1’ regulators and one ‘tier 3’ regulator, while IC Markets is regulated by two ‘tier 1’ regulators and two ‘tier 3’ regulators.

Admiral Markets Regulation

Admiral Markets operates under the following regulatory bodies:

- Admiral Markets Pty Ltd: Regulated by the Australian Securities and Investments Commission (ASIC) for Australia (AFSL no. 41068).

- Admiral Markets Cyprus Ltd: Regulated by the Cyprus Securities and Exchange Commission (CySEC) for Cyprus (license no. 201/13).

- Admiral Markets UK Ltd: Regulated by the Financial Conduct Authority (FCA) for the United Kingdom (reg. number 595450).

- Admiral Markets AS: Regulated by the Estonian Financial Supervisory Authority (EFSA) for Estonia (license no. 4.1-1/46).

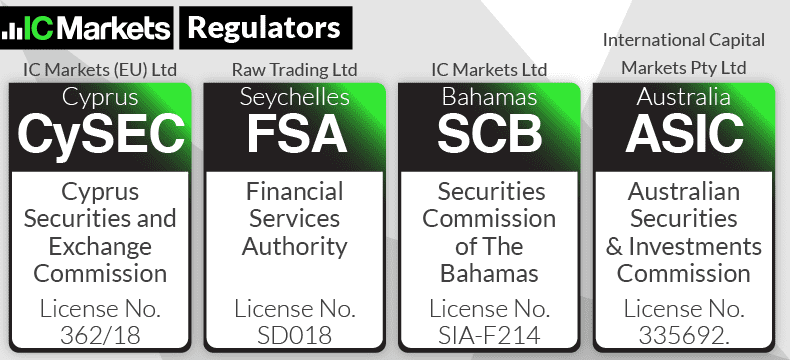

IC Markets Regulation

IC Markets is regulated by the following:

- International Capital Markets Pty Ltd: Regulated by the Australian Securities and Investments Commission (ASIC) for Australia (AFSL no. 335692).

- IC Markets EU Ltd: Regulated by the Cyprus Securities and Exchange Commission (CySEC) for mainland Europe (license no. 362/18).

- Raw Trading Ltd: Regulated by the Financial Services Authority of Seychelles (FSA) for Africa (license no. SD018).

- IC Markets Ltd: Regulated by the Securities Commission of The Bahamas (SCB) (license no. SIA-F214).

Admiral Markets IC Markets Tier 1 Regulation ASIC (Australia)

FCA (UK)

CYSEC (Cyprus)

CIRO (CANADA)ASIC (Australia)

CYSEC (Cyprus)Tier 2 Regulation ASIC (Australia)

FCA (UK)

CYSEC (Cyprus)

CIRO (CANADA)Tier 3 Regulation FSA-S (Seychelles)

CMA (Kenya)

JSC

FSCA (South Africa)FSA-S (Seychelles)

SCB (Bahamas)

Admiral Markets and IC Markets are highly regulated brokers, offering traders a secure environment. Admiral Markets is overseen by several top-tier regulatory authorities, establishing it as a trustworthy option. Similarly, IC Markets boasts a robust regulatory framework that guarantees a safe trading experience for its users.

The current forex trading trends indicate that the EUR/USD pair may experience bearish pressure, while the AUD/USD pair appears to be poised for range-bound trading. The GBP/USD pair has been showing bullish momentum, influenced by expectations of potential interest rate cuts by the Federal Reserve. Keeping abreast of these trends can assist traders in making informed decisions in the forex market.

Our Stronger Trust and Regulation Verdict

Without any doubt, Admiral Markets takes the crown in this category due to stronger trust and regulation.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than Admiral Markets. On average, IC Markets sees around 246,000 branded searches each month, while Admiral Markets gets about 220,000 — that’s 10% fewer.

| Country | Admiral Markets | IC Markets |

|---|---|---|

| United Kingdom | 450,000 | 33,100 |

| South Africa | 880 | 9,900 |

| India | 9,900 | 8,100 |

| Thailand | 1,000 | 8,100 |

| Vietnam | 720 | 8,100 |

| Spain | 6,600 | 6,600 |

| United States | 33,100 | 6,600 |

| Australia | 1,900 | 6,600 |

| Germany | 33,100 | 5,400 |

| Pakistan | 880 | 5,400 |

| France | 3,600 | 4,400 |

| United Arab Emirates | 1,000 | 4,400 |

| Brazil | 2,400 | 4,400 |

| Morocco | 480 | 4,400 |

| Italy | 60,500 | 3,600 |

| Colombia | 720 | 3,600 |

| Malaysia | 1,600 | 3,600 |

| Singapore | 720 | 3,600 |

| Indonesia | 2,400 | 3,600 |

| Nigeria | 1,000 | 3,600 |

| Poland | 2,900 | 2,900 |

| Sri Lanka | 140 | 2,900 |

| Netherlands | 1,900 | 2,400 |

| Mexico | 880 | 2,400 |

| Philippines | 5,400 | 2,400 |

| Canada | 3,600 | 2,400 |

| Hong Kong | 590 | 2,400 |

| Algeria | 320 | 2,400 |

| Kenya | 320 | 2,400 |

| Saudi Arabia | 880 | 1,900 |

| Bangladesh | 390 | 1,900 |

| Switzerland | 2,400 | 1,600 |

| Peru | 320 | 1,600 |

| Egypt | 1,000 | 1,600 |

| Argentina | 1,000 | 1,300 |

| Sweden | 1,300 | 1,300 |

| Turkey | 2,400 | 1,300 |

| Japan | 4,400 | 1,300 |

| Taiwan | 880 | 1,000 |

| Portugal | 590 | 1,000 |

| Ecuador | 170 | 1,000 |

| Dominican Republic | 140 | 1,000 |

| Uzbekistan | 390 | 1,000 |

| Ireland | 1,600 | 880 |

| Cyprus | 720 | 880 |

| Ghana | 210 | 880 |

| Austria | 550,000 | 720 |

| Greece | 60,500 | 720 |

| Chile | 880 | 720 |

| Venezuela | 170 | 720 |

| Uganda | 170 | 720 |

| Ethiopia | 70 | 720 |

| Mongolia | 70 | 720 |

| Jordan | 260 | 590 |

| Mauritius | 50 | 480 |

| Costa Rica | 90 | 390 |

| Tanzania | 70 | 320 |

| Bolivia | 170 | 260 |

| Panama | 90 | 260 |

| Botswana | 30 | 260 |

| New Zealand | 480 | 210 |

| Cambodia | 90 | 170 |

2024 Monthly Searches For Each Brand

IC Markets - UK

IC Markets - UK

|

33,100

1st

|

Admiral Markets - UK

Admiral Markets - UK

|

450,000

2nd

|

IC Markets - India

IC Markets - India

|

8,100

3rd

|

Admiral Markets - India

Admiral Markets - India

|

9,900

4th

|

IC Markets - Spain

IC Markets - Spain

|

6,600

5th

|

Admiral Markets - Spain

Admiral Markets - Spain

|

6,600

6th

|

IC Markets - Australia

IC Markets - Australia

|

6,600

7th

|

Admiral Markets - Australia

Admiral Markets - Australia

|

1,900

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 595,437 for Admiral Markets.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – A Tie

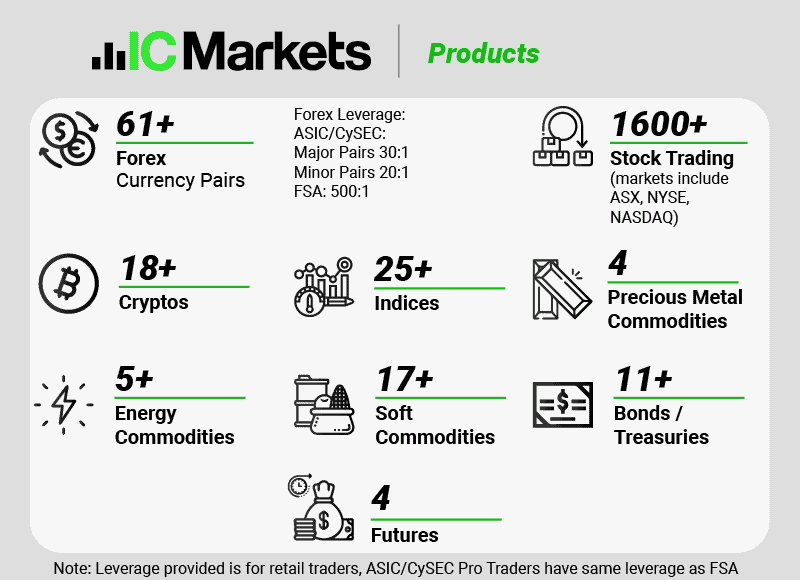

Access to diverse financial instruments in forex trading is crucial. IC Markets and Admiral Markets offer extensive CFDs, enabling traders to diversify and adapt strategies across forex pairs, commodities, indices, and cryptocurrencies. A broad product range enhances the trading experience and allows traders to confidently navigate the market and seize opportunities.

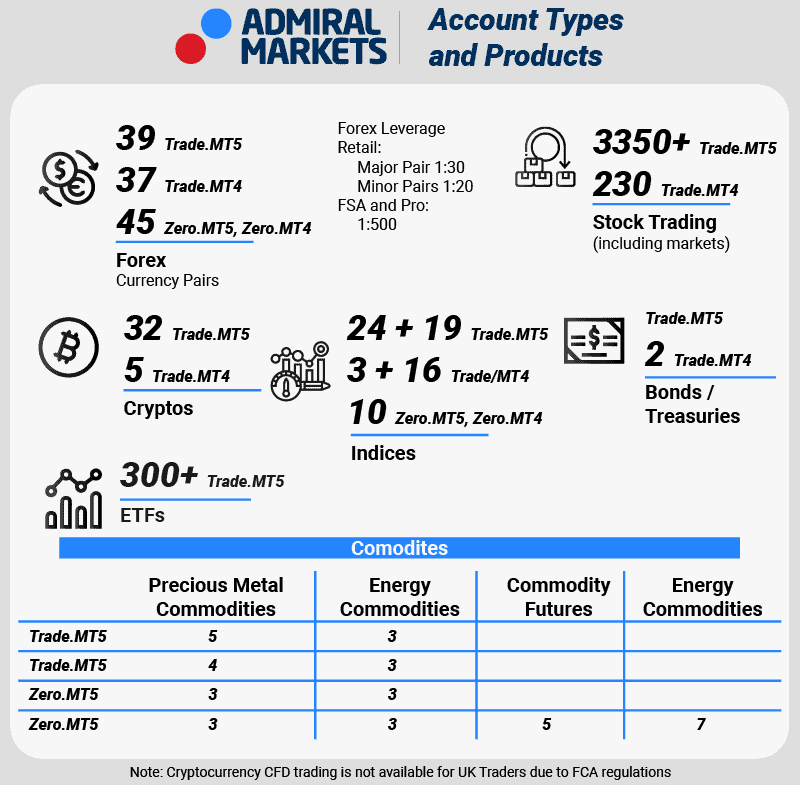

Financial Product Variety

When choosing a broker, a large variety of financial products is crucial for diversifying trading and investment exposure to global markets. Both Admiral Markets and IC Markets offer a good range of financial products.

Forex Currency Pairs

Admiral Markets offers fewer than 50 forex currency pairs, including major, minor, and exotic options like USD, EUR, AUD, CAD, GBP, CHF, JPY, and NZD. In contrast, IC Markets provides 64 forex currency pairs, which may appeal to traders looking for a broader selection.

| CFDs | Admiral Markets | IC Markets |

|---|---|---|

| Forex Pairs | 50 | 61 |

| Indices | 42 | 25 |

| Commodities | 29 Commodities 7 Metals (3 x Gold) 4 Energies 7 Softs (11 Futures) | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies |

| Cryptocurrencies | 37 | 23 |

| Share CFDs | 300 | 2100+ |

| ETFs | 362 | No |

| Bonds | 2 | 9 |

| Futures | No | Yes |

| Treasuries | 2 | 9 |

| Investments | No | Yes |

Admiral Markets CFD Range

Admiral Markets provides an extensive selection of CFDs and complex instruments available on both the Trade Account and Zero Account, encompassing:

- Commodities: 5 metals, 3 energies, 7 agricultures, 5 commodity futures

- Indices: 19 cash indices, 24 index futures

- Stocks: 3350 stocks, including 152 ASX, 273 LSE, 1358 NYSE, 869 NASDAQ, 18 AMEX, 111 EuropeNext

- ETFs: 300+ including 54 NASDAQ, 23 LSE, 16 Euronext

- Bonds: 2 bond futures, including 10-year German Bund and 10-year US Treasury Note

When selecting an account with Admiral Markets, reflect on whether you favour a standard or ECN-style trading experience, as the CFDs offered will vary between the account types.

IC Markets CFD Range

IC Markets allows all CFDs to be traded on both accounts and all trading platforms. Available CFDs include:

- Indices: 25+ indices worldwide

- Commodities: 26+ agricultures, metals, energies

- Stocks: 1600+ stocks across the NYSE, NASDAQ, ASX

- Bonds: 11+ core bonds for the UK, Japan, USA, Europe

- Cryptocurrency: Popular cryptocurrency CFDs, including Bitcoin, Ethereum, Litecoin, Ripple

- Futures: 4 global futures, including the ICE Dollar Index and CBOE VIX Index

Admiral Markets and IC Markets provide a variety of financial products, making them viable options for traders interested in diversification with a CFD broker. IC Markets has a wider selection of forex currency pairs and other CFDs, including cryptocurrencies, which may appeal to traders aiming to enhance their trading experience.

The EUR/USD pair may experience bearish pressure, while the AUD/USD pair could exhibit range-bound trading. The GBP/USD pair has been showing bullish momentum, likely influenced by expectations surrounding potential interest rate cuts by the Federal Reserve. Monitoring these trends can assist traders in making informed decisions in the forex market.

Our Top Product Range and CFD Markets Verdict

Again, it is a draw for both Admiral Markets and IC Markets thanks to their top product range and CFD markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources – Admiral Markets

Education transforms forex trading by enhancing skills and decision-making. IC Markets and Admiral Markets provide valuable resources like webinars, articles, and courses that help traders confidently navigate the market and refine strategies. Access to quality education is vital for success, making informed traders more effective. Brokers that prioritize education foster a successful trading community.

Educational Resources

Admiral Markets and IC Markets have made notable contributions to trader support by offering various tools and resources. Here is an overview of what each broker provides:

Admirals

- Webinars: Regularly scheduled webinars covering a range of trading topics.

- Articles: Comprehensive articles that delve deep into various trading strategies and market analysis.

- Tutorials: Step-by-step guides on how to use the trading platform and its features.

- E-books: Digital books that cover a wide range of trading topics.

- Seminars: In-person events where traders can learn from experts and network with other traders.

- Customer Support: A dedicated support team is available to answer any educational queries.

IC Markets

- Webinars: Frequent webinars that cover both basic and advanced trading topics.

- Articles: Detailed articles that provide insights into market trends and trading techniques.

- Tutorials: Video tutorials that guide traders on how to navigate the trading platform.

- E-books: A collection of e-books that cater to beginner and experienced traders.

- Workshops: Hands-on workshops where traders can get practical experience.

- Educational Portal: A dedicated section on the website filled with educational resources.

Both brokers provide educational resources that support traders with valuable information. Admiral Markets offers a variety of in-person and digital resources, whereas IC Markets features a comprehensive educational portal and practical workshops.

The latest forex trading trends indicate that the EUR/USD pair is poised to experience bearish pressure, while the AUD/USD pair is likely to engage in range-bound trading. The GBP/USD pair is exhibiting strong bullish momentum, fueled by expectations of potential interest rate cuts from the Federal Reserve. Keeping abreast of these trends will empower traders to make strategic decisions in the dynamic forex market.

Our Superior Educational Resources Verdict

Our team can surmise that Admiral Markets dominates this niche due to their superior educational resources.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

9. Superior Customer Service – IC Markets

IC Markets and Admiral Markets offer 24/7 live chat, phone, and email support in multiple languages. Their quick response times and knowledgeable teams enhance the trading experience, building trust and satisfaction among traders. Effective support is essential for resolving issues and maintaining trader engagement.

| Feature | Admiral Markets | IC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Customer Support

Admiral Markets provides valuable customer support features, including contact messaging, an FAQ section, and a glossary. However, their service is primarily focused on Europe, which may lead to delays in chat responses for clients outside the Eurozone. Additionally, support is only available 25 hours per week. As a global broker, Admiral Markets maintains accessibility through various platforms such as Twitter, Facebook, and Telegram in multiple languages, and clients can also submit inquiries via email and the website.

In contrast, IC Markets offers a more advanced 24/7 support system assistance based in Sydney, Australia. Clients can easily reach IC Markets’ customer support through email, Skype, or phone, while the live chat feature is exceptionally responsive. Their help centre addresses a comprehensive range of inquiries, ensuring clients receive timely and effective assistance.

Educational Resources and Analytics

Admiral Markets provides a variety of educational resources and analytical tools to help clients understand how CFDs work. These include:

- Online courses and lessons

- Webinars and instructional videos

- Articles and tutorials

- Live trading classes

- Economic calendar, blogs, and fundamental and technical analysis tools

- Market heat map and market sentiment data

IC Markets also offers a comprehensive selection of tools and resources:

- Economic calendar, blogs, and third-party content, including Trading Central

- Myfxbook news headlines

- ZuluTrade social trading feature

- FX Blue LLP advanced trading tools

Admiral Markets supports learning and training, while IC Markets is known for its customer service and support. The features, trading tools, social trading options, and analytical resources offered by IC Markets may appeal to those seeking an online broker.

The latest forex trading trends indicate that the EUR/USD pair may experience bearish pressure, while the AUD/USD pair appears to be poised for range-bound trading. The GBP/USD pair has been exhibiting bullish momentum, influenced by expectations of potential interest rate cuts by the Federal Reserve. Keeping abreast of these trends can assist traders in making informed decisions in the evolving forex market.

Educational Resources And Analytics

Admiral Markets offers an array of educational resources and analytical tools to help clients understand how CFDs work. These include:

- Online courses and lessons

- Webinars and instruction videos

- Articles and tutorials

- Live trading classes

- Economic calendar, blogs, and fundamental and technical analysis tools

- Market heat map and market sentiment data

IC Markets also offers a comprehensive selection of useful tools and resources:

- Economic calendar, blogs, and third-party content, including Trading Central

- Myfxbook news headlines

- ZuluTrade social trading feature

- FX Blue LLP advanced trading tools

Our Superior Customer Service Verdict

IC Markets, undeniably, steals the show in this field of expertise by the reason of its superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

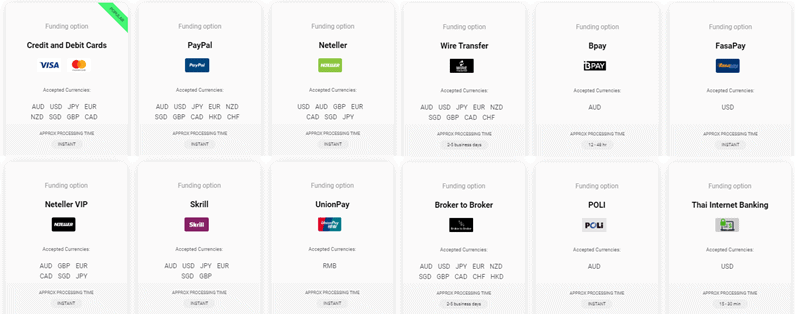

10. Better Funding Options – A Tie

IC Markets and Admiral Markets offer various deposit and withdrawal methods, including bank transfers, credit/debit cards, and digital wallets, sometimes even supporting cryptocurrency. Many options have low or no fees, facilitating easy account management. Quick transactions allow traders to focus on strategies, enhancing the overall trading experience.

Funding Methods

Admiral Markets and IC Markets provide various funding methods for traders. Admiral Markets offers free options such as bank transfer, Klarna, Visa, MasterCard, PayPal, Bitcoin, credit card, SafetyPay, Przelewy, iBank & BankLink, and iDEAL. For a small fee, funding is also possible through Skrill and Neteller. There are no additional fees for opening a trading account; however, Admiral Markets does impose an inactivity fee of 10 AUD/USD/EUR per month.

IC Markets provides a diverse array of funding options, including Skrill, PayPal, Neteller, Bpay (for AUD), UnionPay (for RMB), Rapidpay, and Klarna (for GBP). Notably, there are no withdrawal fees, and you won’t incur any inactivity charges.

| Funding Option | Admiral Markets | IC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | Yes | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

When selecting a funding method, it’s crucial to verify its availability in your country. Both brokers present an impressive selection of funding methods, featuring popular options like Visa, MasterCard, Skrill, PayPal, Neteller, credit cards, and POLi.

The EUR/USD pair may experience bearish pressure, while the AUD/USD pair appears suitable for range-bound trading. The GBP/USD pair has been exhibiting bullish momentum, influenced by expectations regarding potential interest rate changes by the Federal Reserve. Keeping track of these trends can assist traders in making informed decisions in the forex market.

Our Better Funding Options Verdict

It’s a stalemate for both IC Markets and Admiral Markets on account of their better funding options.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Admiral Markets

Brokers like IC Markets and Admiral Markets allow small starts, helping traders gain experience without high initial costs. This inclusivity fosters skill development and strategy refinement at a comfortable pace.

Minimum Deposit Comparison

Admiral Markets has a minimum deposit requirement of $100 or equivalent for major currencies, while IC Markets requires a minimum deposit of $200. This difference may provide an advantage for individuals who are new to trading.

Admiral Markets

Admiral Markets offers an excellent opportunity for beginner traders by setting a lower minimum deposit requirement. This feature allows newcomers to embark on their trading journey without the need for a hefty initial investment.

IC Markets

IC Markets stands out in various aspects. Although the minimum deposit may be higher, it provides a multitude of features and advantages designed specifically for seasoned traders.

Each broker possesses unique advantages. Admiral Markets stands out as an excellent option for beginners, thanks to its low minimum deposit requirement. On the other hand, IC Markets excels in various areas, positioning it as a superior choice for experienced traders.

The current forex trading landscape indicates that the EUR/USD pair is likely to endure bearish pressure, while the AUD/USD pair presents opportunities for range-bound trading. Meanwhile, the GBP/USD pair continues to exhibit bullish momentum, fueled by expectations of potential interest rate cuts from the Federal Reserve. By staying attuned to these market trends, traders can make well-informed decisions in the ever-evolving forex environment.

| Minimum Deposit | Recommended Deposit | |

| Admiral Markets | $100 | $100 |

| IC Markets | $200 | $200 |

Our Lower Minimum Deposit Verdict

Unquestionably, Admiral Markets is on top of the world right now as a consequence of their lower minimum deposit.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

So IC Markets or Admiral Markets The Best Broker?

IC Markets rides high in almost all categories this is because of its comprehensive educational resources, superior customer service, and competitive spreads and fees. The table below summarises the key information leading to this verdict:

| Categories | Admiral Markets | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | Yes | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | No | Yes |

| Better Funding Options | Yes | Yes |

| Lower Minimum Deposit | Yes | No |

Admiral Markets: Best For Beginner Traders

Admiral Markets is the ideal choice for beginner traders due to its extensive educational resources and user-friendly platform.

IC Markets: Best For Experienced Traders

IC Markets stands out for experienced traders because of its advanced trading tools and diverse product range.

FAQs Comparing Admiral Markets Vs IC Markets

Does IC Markets or Admiral Markets Have Lower Costs?

IC Markets generally offers lower costs compared to Admiral Markets. They are renowned for their competitive spreads, often starting from as low as 0.1 pips. For a detailed comparison of broker spreads, you can visit our Lowest Commission Brokers page. This data-driven approach provides a clearer picture of which broker offers the best value for traders.

Which Broker Is Better For MetaTrader 4?

Both IC Markets and Admiral Markets offer MetaTrader 4, but IC Markets is often preferred for its advanced tools and customisation options. Their MT4 platform is equipped with superior charting tools and a wider range of indicators. For traders specifically looking for the best MT4 experience, our comprehensive guide to the Best MT4 Brokers can be a valuable resource.

Which Broker Offers Social Trading?

IC Markets offers social trading features, allowing traders to copy strategies from experienced traders. Social trading has become a popular way for new traders to learn and for experienced traders to share their strategies. If you’re interested in exploring more about social trading platforms, check out our analysis of the best social trading platforms. It provides insights into the top platforms offering these features.

Does Either Broker Offer Spread Betting?

Admiral Markets offers spread betting, allowing UK traders to take advantage of tax benefits associated with this form of trading. Spread betting is a unique way to trade the financial markets without owning the underlying asset. For those interested in diving deeper into spread betting and finding the best brokers, our comprehensive spread betting guide is a great place to start.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian Forex traders. They are ASIC regulated, ensuring a high level of trust and security for traders. Founded in Australia, IC Markets understands the specific needs of Aussie traders. Their platform offers a wide range of assets and is known for its reliability. For a more detailed look at the best brokers in Australia, you can check out our Best Forex Brokers In Australia analysis.

What Broker is Superior For UK Forex Traders?

Personally, I believe Admiral Markets stands out for UK Forex traders. They are FCA regulated, which provides an added layer of security for traders in the UK. While they might not be founded in the UK, their strong regulatory framework and commitment to transparency make them a top choice. For those wanting to explore more about the Best Forex Brokers In UK, our UK trading platform guide offers valuable insights.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert