GO Markets vs IC Markets 2026

IC Markets and GO Markets are two heavyweight Australian brokers with global reach in the forex and CFD trading industry. But while they share the same regulatory backyard, the way they serve traders in 2026 is anything but identical.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

In this comparison guide, I’ll look at how they compare across key areas such as spreads, platforms, funding options and support.

Here’s a quick overview of their top features side-by-side:

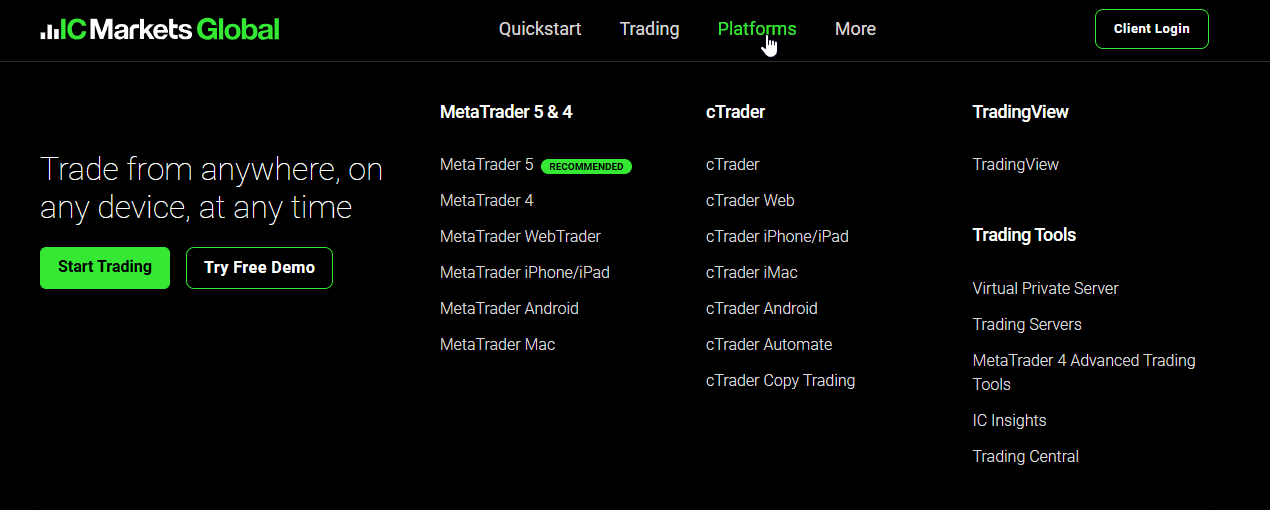

- IC Markets offers a wider range of trading platforms, including MT4, MT5, cTrader and TradingView

- IC Markets offers raw spreads from 0.0 pips and fast order execution

- In terms of trading experience, both GO and IC offer fast execution speeds and stable platforms

- IC Markets provides a wider range of CFDs, including ETFs and bonds.

- Looking at education, GO Markets delivers better-structured and more comprehensive learning materials.

- IC Markets leads on customer service, offering round-the-clock weekday support in multiple languages.

1. Lowest Spreads And Fees – IC Markets

I conducted tests using Standard account spreads data from my colleague, Ross Collins, and both brokers appear competitive from the get-go.

IC Markets is consistently tighter (not by a huge margin) but enough that it matters over time, especially if you’re trading frequently or high volume.

Take the EUR/USD pair, for example, where IC Markets spread is 0.82 pips while for GO Markets it’s 1 pip. If you’re trading a standard lot, IC Markets costs you about $8.20 per trade, while GO Markets runs you $10. This $1.80 difference over 50 trades means you’ll be paying $90 more in spread costs with GO Markets.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall | |

|---|---|---|---|---|---|---|---|---|---|

| IC Markets | 0.82 | 0.94 | 1.03 | 0.83 | 1.05 | 1.27 | 1.3 | 1.5 | 1.09 |

| Go Markets | 1 | 1 | 1.3 | 1 | 1.1 | 1.2 | 1.4 | 1.5 | 1.19 |

Raw Account

When I compared them on their Raw accounts, IC Markets still came out on top with lower overall trading costs (spread + commission).

I started with the big five majors since that’s where most traders spend their time and IC delivered razor-thin spreads across all five. On average, IC’s spread across those majors was just 0.13 pips while GO Markets averaged 0.28 pips.

RAW Account Spread | |||||

|---|---|---|---|---|---|

| 0.03 | 0.04 | 0.01 | 0.27 | 0.02 |

| 0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

| 0.30 | 0.30 | 0.10 | 0.30 | 0.10 |

| 0.51 | 0.57 | 0.14 | 0.39 | 0.31 |

| 0.10 | 0.20 | 0.06 | 0.10 | 0.20 |

| 0.10 | 0.20 | 0.10 | 0.70 | 0.10 |

| 1.00 | 1.50 | 1.00 | 1.50 | 1.00 |

| 0.30 | 0.20 | 0.10 | 0.30 | 0.20 |

| 0.40 | 1.40 | 0.80 | 0.50 | 0.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

And sure, GO Markets charges a slightly lower commission at $3 per side versus IC’s $3.50 but that’s not enough to close the gap. With IC’s spreads consistently coming in lower, the total cost per trade still leans in their favor.

| Broker | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| IC Markets | 3.5 | 3.5 | 2.5 | 2.75 |

| Go Markets | 2.5 | 3 | 2 | 2 |

Verdict

IC Markets offers the lowest overall spreads and fees across both the Standard and Raw account types.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

I’ve put IC Markets’ platform offering through its paces, and it’s one of the most complete I’ve seen. You’re covered with MT4, MT5, cTrader, and TradingView all in desktop, web, and mobile versions.

MT4 users get a full Advanced Trading Tools package, which includes mini terminals, trade management tools, sentiment indicators, correlation matrices, and more. With this toolkit in your arsenal you can sharpen your entries, manage risk dynamically, and scale positions with surgical precision.

And of course, both MT4 and MT5 support expert advisors (EAs) with backtesting, optimization, and VPS integration. IC’s servers being collocated with major VPS providers inside NY4 means your orders get filled with almost zero delay.

Algo traders are well looked after on cTrader, with cTrader Automate built right in, so you can code, test, and deploy cBots in C# without needing third-party tools.

But if I’m being real, MT 5 is where I tell everyone to start with IC Markets and where I’ve personally landed for most of my trading.

It’s modern, fast, and actually built for the kind of trading most of us are doing today. You’ve got more order types, built-in depth of market, better backtesting for EAs, depth-of-market visibility and no restrictions. So you can scalp, hedge freely, and place orders at any level without limits.

GO Markets

Go Markets’ platform lineup is similar to IC Markets’. GO was one of the first brokers to bring MT4 to Australia, and their experience with it shows. They’ve added tools like MT4 Genesis, giving traders better trade management, market sentiment indicators, and enhanced order functionality.

You can run EAs, automate strategies, and trade directly from mobile if you want. And yes, the Mac version works just as well as Windows.

MetaTrader 5, of course, brings more advanced tools at your disposal. If you’re looking to trade a mix of forex, shares, and commodities, its multi-asset support feature allows you to do so with ease.

Like IC’s MT5 version, you get full access to market depth, more order types, faster execution, trading signals, and automated trading with Expert Advisors.

TradingView is the newest addition to the mix, and I think you’ll find its powerful charting capabilities helpful for market analysis. There are over 400 technical indicators, 100+ drawing tools, real-time alerts, even Pine Script for coding custom strategies.

| Trading Platform | Go Markets | IC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Verdict

GO Markets lets you trade on just about any platform you want, but IC Markets is where those platforms actually perform at their best.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

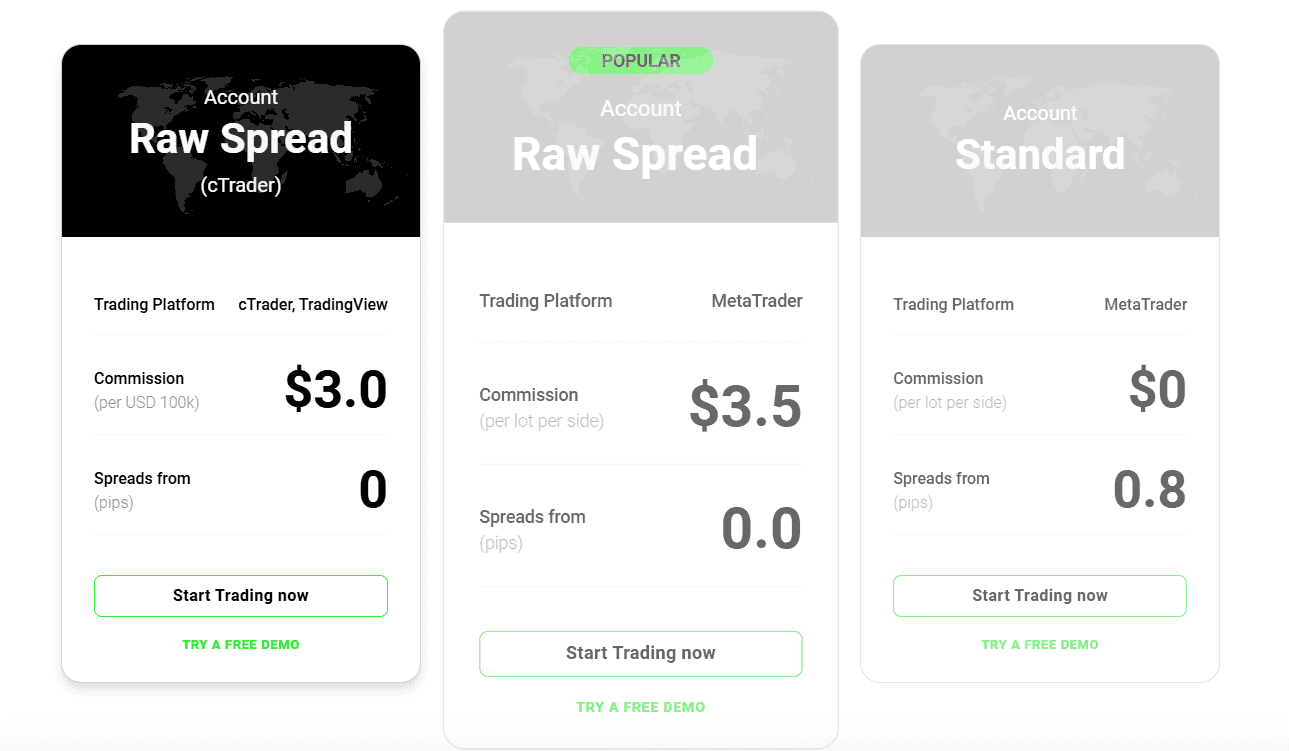

IC Markets gives you three core account types catering to just about every trading style.

If you’re a scalper or high-frequency trader, the Raw Spread account on MetaTrader is probably your go-to. You’re looking at spreads from 0.0 pips and $3.50 commission per side. There’s zero restriction on order distance, full EA support, and everything’s built around MQL4.

Then there’s cTrader and TradingView, running on their own Raw account. This one’s even tighter on commissions, charging $3 per side and you still get the same 0.0 pip spreads, micro lot access, and full freedom in trading style. If you’re into C# or prefer visual execution through TradingView, this account gives you both flexibility and speed.

For beginners and discretionary traders I recommend the Standard account. It’s commission-free with wider spreads averaging 0.8 pips. It supports multi-asset trading and gives you one-click trading, micro lots, and no minimum distance restrictions just like the other accounts.

All accounts support Islamic (swap-free) options, stop-out is 50% and you can access up to 1:1000 leverage.

On GO Markets you can open a Standard Account and the Plus+ Account. Both give you access to the same range of markets and start with a 0.01 lot minimum.

The Standard Account lives up to its name with no commission and spreads starting from 0.8 pips. You still get full access to all major platforms and leverage is up to 500:1. The Plus+ Account is GO Markets’ Raw version with spreads starting from 0.0 pips, and a commission of $2.50 per side per standard lot.

Where GO falls short, though, is in the Islamic account offering. Neither account supports swap-free trading, which puts them at a disadvantage for Muslim traders or anyone trying to avoid overnight charges.

| Go Markets | IC Markets | |

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | Yes | Yes |

Verdict

IC Markets is the winner with more account variety, deeper trading features, and better support for all styles.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

I had a great trading experience with both and found their execution speeds exceptionally fast. Limit orders went through faster on IC Markets, averaging 134 milliseconds compared to GO Markets’ 144ms.

The gap wasn’t huge, but IC’s limit orders triggered more decisively. The execution felt immediate, with less of that subtle delay I sometimes got on GO during busy periods.

And it’s the same with Market orders where IC Markets is faster and delivers more consistent fills.

But just to be clear, GO Markets was responsive, reliable and I experienced no slippage issues, no weird platform freezes. But it just felt more tuned for steady, lower-frequency trading.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

| Go Markets | 144ms | 20/36 | 145ms | 20/36 |

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

Verdict

IC Markets offers a smoother, more reliable trading experience with consistent execution, fewer platform restrictions, and better infrastructure around how orders are handled.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Trust And Regulation – IC Market

This multi-regulatory framework along with IC Markets’ longstanding reputation and positive user reviews has earned the broker a trust score of 80 out 100. As for GO Markets, I awarded it 61 out of 100 with especially high marks for their high reviews as well.

IC Markets Trust Score

GO Markets Trust Score

1. Regulations

The two brokers hold multiple licences from tier-1 and tier-3 regulators. They’re regulated by Australia’s ASIC and CYSEC in Europe, both of which are highly regarded for their strict enforcement standards, client fund protections, and capital requirements.

Beyond their tier-1 credentials, IC and GO Markets also operate offshore entities licensed by FSA in Seychelles, FSC (Mauritius), and SCB (Bahamas).

| Go Markets | IC Markets | |

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | FSA-S (Seychelles) FSC-M (Mauritius) | FSA-S (Seychelles) SCB (Bahamas) |

So basically before registering with any broker, check their licensing, the exact entity you’re opening with, and whether client funds sit in true segregated accounts.

You want clarity on negative balance protection, margin‑call and stop‑out logic, and the broker’s policy when slippage spikes. Read the order‑execution policy to see if they’re routing to multiple LPs, how they handle rejects, and whether there’s any last‑look.

2. Reputation

In this section I used Google branded search data to find out which broker is more popular between IC Markets and GO Markets. When many people are Googling your name month after month, it says your reputation is landing exactly where it should.

In major international markets, like the UK,Spain, Germany, France, Italy, Netherlands, Ireland IC Markets is the clear leader. They consistently pull far higher branded search traffic, meaning it’s a broker on top-of-minds of many traders globally.

| Country | GO Markets | IC Markets |

|---|---|---|

| India | 480 | 33,100 |

| Argentina | 880 | 8,100 |

| Germany | 110 | 8,100 |

| Colombia | 12,100 | 6,600 |

| Brazil | 2,400 | 6,600 |

| Turkey | 880 | 6,600 |

| United Arab Emirates | 210 | 5,400 |

| Thailand | 140 | 5,400 |

| Pakistan | 70 | 5,400 |

| Philippines | 2,400 | 5,400 |

| Morocco | 9,900 | 5,400 |

| Peru | 1,000 | 4,400 |

| Bangladesh | 170 | 4,400 |

| United States | 480 | 4,400 |

| Singapore | 210 | 4,400 |

| Australia | 20 | 4,400 |

| Poland | 260 | 3,600 |

| Indonesia | 140 | 3,600 |

| Vietnam | 27,100 | 2,900 |

| Nigeria | 90 | 2,900 |

| Ethiopia | 50 | 2,900 |

| Hong Kong | 70 | 2,400 |

| Ecuador | 480 | 2,400 |

| Uzbekistan | 1,000 | 2,400 |

| United Kingdom | 260 | 2,400 |

| Taiwan | 40 | 2,400 |

| Saudi Arabia | 390 | 2,400 |

| South Africa | 20 | 2,400 |

| Malaysia | 210 | 1,900 |

| Switzerland | 90 | 1,900 |

| Uruguay | 30 | 1,900 |

| Sweden | 20 | 1,600 |

| Mexico | 110 | 1,600 |

| Algeria | 390 | 1,600 |

| Jordan | 170 | 1,600 |

| Italy | 320 | 1,600 |

| Bolivia | 390 | 1,600 |

| Spain | 260 | 1,300 |

| Netherlands | 20 | 1,300 |

| Tanzania | 140 | 1,000 |

| Venezuela | 320 | 1,000 |

| Ireland | 140 | 1,000 |

| Canada | 30 | 880 |

| Cyprus | 210 | 880 |

| Sri Lanka | 30 | 880 |

| Portugal | 40 | 880 |

| Botswana | 10 | 880 |

| Austria | 90 | 720 |

| Greece | 50 | 720 |

| Chile | 10 | 720 |

| Ghana | 10 | 590 |

| New Zealand | 10 | 590 |

| France | 140 | 590 |

| Mauritius | 20 | 480 |

| Kenya | 10 | 480 |

| Dominican Republic | 210 | 390 |

| Japan | 10 | 320 |

| Egypt | 10 | 260 |

| Panama | 10 | 260 |

| Cambodia | 70 | 260 |

| Uganda | 30 | 260 |

| Mongolia | 50 | 210 |

| Costa Rica | 10 | 170 |

33,100 1st | |

480 2nd | |

8,100 3rd | |

110 4th | |

5,400 5th | |

140 6th | |

4,400 7th | |

480 8th |

3. Reviews

IC Markets possesses exceptional customer feedback on Trustpilot with a 4.8 rating from over 46,000 reviews. GO Markets, though slightly behind with a 4.6 rating from around 700 reviews, is praised for its intuitive design and demo account with their $50,000 virtual funds. Both brokers empower traders to navigate forex trends, from AI-driven strategies of growing cryptocurrency opportunities.

Verdict

IC Markets, evidently, reigns supreme in this niche by reason of their stronger trust and regulations.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Top Product Range And CFD Markets – IC Markets

IC Markets has a broader CFD product range than GO Markets, especially once you step outside the core forex pairs.

Speaking of forex pairs, IC Markets offers 61 including majors, minors and exotics while GO Markets offers 47 currency pairs.

Commodities are relatively even on the surface, but IC pulls ahead again with more indices and a wider range of metals including gold and silver pairs quoted against multiple currencies.

In cryptocurrency CFDs, IC offers 23 digital assets while GO Markets lists 14. For share CFDs, IC again leads with over 2,100 symbols.

On top of that, you also get access to futures and investment-related CFDs, while GO doesn’t list these at all.

| CFDs | Go Markets | IC Markets |

|---|---|---|

| Forex Pairs | 47 | 61 |

| Indices | 16 | 23 Spot Indices 3 Index Futures |

| Commodities | 3 Metals 5 Energies 2 Softs | 4 Precious Metals (gold vs 6 flats) 3 Energies 3 Energy futures 14 Soft commodity futures |

| Cryptocurrencies | 14 | 18 |

| Share CFDs | 1190+ | 2100+ |

| ETFs | No | 3 NASDAQ 33 NYSE |

| Bonds | 5 | 12 |

| Futures | No | Yes |

| Treasuries | 5 | Yes |

| Investments | No | Yes |

Verdict

IC Markets gives traders broader market access, more trading opportunities, and stronger support for multi-asset strategies.

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

7. Superior Educational Resources – GO Markets

GO Markets’ Education Hub is properly organised by experience level and each section drills into practical topics. You’re not just getting quick overviews on forex trading topics but detailed walkthroughs on risk management, technical vs. fundamental analysis, trading psychology, and strategy planning.

They also integrate education with live markets on their News & Analysis section that covers daily updates with actual trade ideas, chart breakdowns, and sentiment insights. Webinars and trading courses are available too, although those aren’t as front-and-centre as the written materials.

IC Markets does offer a broader content format range including video tutorials, a podcast, and even Web TV. It’s great for passive consumption, and beginners will get value from their Getting Started series.

But if I’m being honest, their educational materials feel more like marketing resources than trader education. There’s not a lot of structure, and once you’re past the basics, you’re left on your own.

Verdict

If you’re serious about developing as a trader, GO Markets gives you comprehensive and well-structured educational resources.

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

8. Superior Customer Service – A Tie

GO Markets offers 24/5 support through live chat, email, and phone. I’ve reached out during London and New York sessions, and response times have been quick. Their support team actually understands trading so you’re not getting scripted responses or being bounced between departments.

The added bonus is their multilingual support, which is useful if you’re trading from a non-English speaking region.

IC Markets goes one step further with 24/7 support, which can make a difference if you’re trading late Sunday or managing positions overnight. Like GO, they offer live chat, email, and phone support, and I’ve always found their responses to be timely and informed.

| Feature | Go Markets | IC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Verdict

IC Markets has longer coverage hours, but GO Markets matches them on quality and responsiveness, that’s why I’m calling this one a tie.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Better Funding Options – IC Markets

Funding your account should be simple, fast, and cost-efficient. More importantly, you should have a bunch of funding options so you’re not locked into one method or waiting days for transfers to clear.

IC Markets and GO Markets both understand that, covering the basics such as credit and debit card deposits, bank transfers, Skrill, and Neteller. These methods are fast and reliable, with e-wallets and cards clearing in under 24 hours and bank transfers usually processing within 2–5 business days.

Variety-wise IC beats GO with more options like PayPal, crypto deposits and local options like POLi and BPAY, which GO Markets doesn’t support.

Neither broker charges internal fees for deposits or withdrawals, which is exactly how it should be. That said, you may still run into intermediary fees or international bank charges, especially on wire transfers. You definitely need to keep this in mind regardless of which broker you choose.

| Funding Option | Go Markets | IC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | No | Yes |

| Rapid Pay | No | No |

| POLi / bPay | No | Yes |

| Klarna | No | No |

Verdict

IC Markets simply offers more ways to move your money in and out, with the same low-cost structure and fast processing times.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Lower Minimum Deposit – A Tie

Minimum deposit requirements might seem like a small detail, but they say a lot about how accessible a broker really is. This is particularly relatable for newer traders or anyone testing the waters with a new platform.

The barrier to entry with IC Markets and GO Markets is somewhat low with the minimum deposit set at $200. It’s low enough to get started without too much risk, but still high enough to open meaningful positions and manage trades with proper risk controls.

| Minimum Deposit | Recommended Deposit | |

| Go Markets | $200 | $200 |

| IC Markets | $200 | $200 |

Verdict

Both brokers keep it simple and accessible with a $200 minimum, so I have no choice but to declare this one a tie.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: IC Markets or GO Markets?

IC Markets comes out on top across every major category I’ve covered from pricing, platforms and regulation to support and product range. GO Markets is accessible, but when you put them side by side, IC is clearly the more complete, professional-grade broker.

| Categories | Go Markets | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | Yes | No |

Go Markets: Best For Beginner Traders

GO Markets is better suited for beginner traders due to its low minimum deposit, user-friendly platforms and educational materials.

IC Markets: Best For Experienced Traders

IC Markets is the go-to broker for experienced traders because it offers a broad product range, advanced trading platforms and ultra-tight spreads.

FAQs Comparing GO Markets Vs IC Markets

Does GO Markets or IC Markets Have Lower Costs?

IC Markets typically offers lower overall trading costs. While Go offers low raw account commissions on USD, IC makes up the difference with tighter spreads across both standard and raw accounts. On high-volume pairs like EUR/USD, IC’s spreads can drop as low as 0.1 pips. For a full breakdown of who’s offering the best rates, Check out this guide on our Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

IC Markets offers a more advanced MT4 experience. With its custom suite of 20+ trading tools, enhanced order management features, and deeper liquidity connections, IC’s MT4 setup is built for serious trading. If you’re relying on MT4 for scalping, EAs, or advanced charting, IC provides more power straight out of the box. For a closer look at the top MT4 setups in the market, check out this list of the best MT4 Brokers.

What Broker is Superior For Australian Forex Traders?

If you’re trading from Australia, IC Markets is the clear pick. They’re ASIC-regulated, have deep local roots, and offer more firepower across platforms, tools, and liquidity. Add in their long-standing reputation and institutional-grade infrastructure and you’ve got a broker built for serious Aussie traders. Check out our Forex Brokers In Australia page.

Related Forex Broker Comparison Tables

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert