IC Markets Minimum Deposit

IC Markets require a minimum deposit based on the case currency selected when opening an account. We detail each of the funding requirements for each currency base.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

What Is IC Markets Minimum Deposit

IC Markets minimum deposit is $200 in Australia and US while £200 in the UK and €200 in Europe.

When funding a Raw Spread (true ECN account) or Standard account, the funding requirement is set by the base currency. Below are details of the ‘top 5’ base currencies, traders choose when opening an account and their respective funding requirements.

IC Markets Minimum Deposit In Pounds

The minimum deposit in the UK at IC Markets is £200. When using the Standard or Raw Spread account with Pound sterling as the base currency, you can select a credit/debit card, NETELLER, Skrill, Klarna or a wire transfer to fund your account.

IC Markets Minimum Deposit In Euros

The minimum deposit for European traders with IC Markets is €200. Funding options for European traders are the same as in the UK as shown above.

IC Markets Minimum Deposit In Dollars

USD, AUD, and SGD base currency account with IC Markets minimum deposit requirement is $200. All three base currencies allow deposits with a credit card, debit card, PayPal, NETELLER, Skrill and wire transfer. If you are using AUD as the base currency you can also choose BPAY or POLi. USD traders have the option of FasaPay and Thai/Vietnamese Internet Banking.

IC Markets ReviewVisit IC Markets

The overall rating is based on review by our experts

IC Markets Minimum Deposit Comparison

Below compares the minimum deposit requirements of leading forex brokers based on the four major currency pairs.

| USD | AUD | EUR | GBP | |

|---|---|---|---|---|

| IC Markets | $200 | $200 | €200 | £200 |

| Pepperstone | $200 | $200 | €200 | £200 |

| AxiTrader | $0 | $0 | €0 | £0 |

| CMC Markets | $0 | $0 | €0 | £0 |

| IG Group | $300 | $450 | €250 | £250 |

| ThinkMarkets | $0 | $0 | $0 | $0 |

| FXCM | $50 | $50 | €50 | £50 |

| FXTM | $10 | N/A | €10 | £10 |

| Swissquote | $1,000 | N/A | €900 | £800 |

| Saxo Markets | $10,000 | $3,000 | N/A | £500 |

Saxo Markets has a higher deposit requirement to discourage small traders when comparing Saxo Markets vs IC Markets. And, when we look at IC Markets vs Axi, Axi requires no minimum deposit which reduces the barriers to signing up for accounts.

A $200 deposit is realistically the smallest amount required to trade currency markets. Trading with low deposits makes it difficult to earn enough profits to make the investment worthwhile, this is why most brokers will encourage higher minimum deposits.

IC Market’s minimum deposit requirement of $200 is around the ideal mark for decent trading.

IC Markets Deposit Methods And Fees

IC Markets have no payment fees however it is worth noting that international transactions can result in a $20 charge from the bank itself which is forwarded to the client. No deposit and withdrawal fee is a strong offering from IC Markets as some brokers such as eToro will charge you with funding your accounts. Read the IC Markets Review for more details about fees and funding.

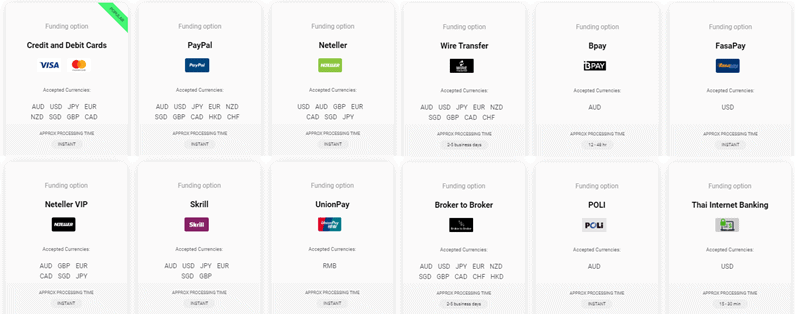

IC Markets offers traders a plethora of funding methods. The funding methods you can choose will depend on the base currency chosen and the region you are trading in. Instant funding options include debit/credit cards, PayPal, NETELLER, Skrill and UnionPay. Bitcoin and BPAY can take a few hours for funds to clear while Wire Transfers can take a few days.

Depositing via more traditional payment methods is also available. In this regard, IC Markets clients can conduct deposits via credit and debit cards and bank transfers. The basic bank wire transfers processing time can be up to two to five business days. For any technical questions regarding your deposit and withdrawals, feel free to contact IC Markets’ customer support service which is live 24/7.

Base Currencies Available

When a retail investor opens a live account with any broker, a base currency needs to be selected. This currency will normally be the trader’s native currency conversion fees when deposits arec made. Some brokers such as IC Markets and IG offers dual accounts so traders can nominate two different base currencies for use when appropriate. IC Markets offers 10 base currencies as shown below:

| Base Currencies Available | |

|---|---|

| IC Markets | 10 |

| Pepperstone | 10 |

| AxiTrader | 11 |

| CMC Markets | 10 |

| IG Group | 10 |

| ThinkMarkets | 5 |

| FXCM | 6 |

| FXTM | 4 |

| Swissquote | 9 |

| Saxo Markets | 5 |

IC Markets’ full list of supported currencies includes USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, CAD. IC Markets offers all the major currencies, along with a selection of minor ones however some currencies are not available such as the South Africa ZAR.

Traders who want to pick IC Markets in regions where the local base currency is not available will need to choose a major currency (such as the USD) and then transfer funds across which means traders will incur conversion charges. To minimise currency conversion fees, an intermediary service such as OFX or Transferwise is suggested. Using an intermediary service will result in significant savings compared to a wire transfer.

How To Open An IC Markets Account

There are three main steps to open an IC Markets account and then make a process.

1) Open The IC Markets Account

IC Markets offers a 100% online joining process which can be viewed here. This joining process involves providing your personal details, giving details about yourself and then configuring the trading account. The final stage of the joining process is the declaration confirming that all the information provided is accurate. This is an important requirement as IC Markets need to be sure the finances are not used for money laundering. The declaration will need to be verified with some sort of identification such as bank accounts, driver’s licence or passport details.

2) Make A Deposit

Once an account is opened traders will be directed to the IC Markets deposit section. A trader needs to select a deposit method that accepts the base currency selected. Factors a trader needs to consider when selecting a deposit method are:

- How long will it take for funds to be cleared using the payment method? (e.g. Credit Card is instant while wire transfer can take days)

- Are there any fees from this payment method? (IC Markets doesn’t charge deposit fees but institutions may have their own fees)

- Are you happy for the withdrawal to go back to this deposit method (IC Markets requires withdrawals to go back to the funding method)

3) Monitor The Deposit

While most deposit methods are instant, some other options such as direct transfer, Bitcoin Wallet and Bpay can take hours to days. It’s worth monitoring to ensure these funds clear (as issues can occur) and IC Markets will send a confirmation e-mail once the funds arrive.

Disclaimer: IC Markets welcome clients from all over the globe, however, due to governmental restrictions, residents of the United States, Canada, Israel, New Zealand, Japan and Islamic of Iran can’t open a live account.

Free Demo Account

A free practical way to discover IC Markets’ ECN trading conditions is to open a demo account. The demo account is free, but the only requirement is to complete an online registration form. The risk-free demo account allows prospective clients to explore the forex market and test all IC Markets’ features.

All account types, including the Islamic account, are supported for virtual testing. Additionally, the demo account can be tested on MetaTrader 4, MetaTrader 5 and cTrader platform, which are supported across multiple devices, including mobile apps (Android and iOS).

Traders can choose the High Leverage Forex Brokers with a range of instruments available, as well as Automated Trading Platforms for algorithmic trading. Besides forex, 6 different financial markets can be traded (indices, commodities, stocks, cryptocurrencies, futures and bonds).On the live account, clients will trade with raw pricing and an average EUR/USD spread of 0.1 pips. The spreads are low due to the IC Markets network of 25 liquidity providers and there are no restrictions on scalping or hedging.

Conclusion On IC Markets Deposit Requirements

IC Markets leads the way when it comes to the number of base currencies offered, the range of deposit funding methods and the fact that no additional fees are charged on deposits. While IC Market’s minimum deposit of $200 is not the lowest of forex brokers, it is not realistic to trade with a lower amount. Based on this IC Markets ticks all the boxes with it comes to the deposit and funding category.

Rest assured that IC Markets is compliant with all regulations that require them to segregate customer accounts. IC Markets complies with regulations from tier-one jurisdictions, namely Cyprus’s CySEC (for onboarding Europe and FCA Regulated Brokers) in UK, Forex Brokers In Australia ASIC (Australian Securities and Investments Commission) and the Financial Services Authority of Seychelles (FSA).

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Ask an Expert