IC Markets Spreads And Fees Review

IC Markets offers a Raw Spread forex trading accounts with ECN pricing. 65 currency pairs are available with spreads starting from 0.0 pips for the EUR/USD fx pair. Trading platforms include MetaTrader 4, MT5 and cTrader and the choice of 232 trading instruments.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

IC Markets Fees Calculator

Our IC Markets calculator uses commissions that are pegged to the base currency a trader chooses and the average IC Markets spreads published by IC Markets and competitors each month. Calculating these two variables with live crosses (or the last cross at the close of business on Friday) allowed this calculation.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Summary Of IC Markets Spreads

Pepperstone has the lowest non-commission account. When we compared in July 2025 forex accounts that don’t charge commission our Lowest Spread Forex Brokers comparison found IC Markets was competitive but Pepperstone was consistently better. Pepperstone also has superior forex trading platforms, customer service and regulation. You can read more in our Pepperstone Review.

|

Broker Spread Comparison

|

|||||

|---|---|---|---|---|---|

|

0.94 | 1.05 | 0.82 | 1.27 | 0.83 |

|

0.30 | 0.40 | 0.10 | 0.30 | 0.30 |

|

0.20 | 0.40 | 0.10 | 0.20 | 0.10 |

|

0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

|

0.14 | 0.18 | 0.09 | 0.14 | 0.13 |

|

0.30 | 0.50 | 0.30 | 0.50 | 0.40 |

|

0.50 | 0.50 | 0.20 | 0.50 | 0.50 |

|

0.24 | 0.70 | 0.16 | 0.54 | 0.29 |

|

0.30 | 0.70 | 0.20 | 0.50 | 0.40 |

|

0.60 | 0.15 | 0.10 | 0.70 | 0.60 |

|

0.60 | 0.60 | 0.10 | 0.60 | 0.50 |

|

0.63 | 1.13 | 0.21 | 0.73 | 0.90 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

FP markets have the lowest raw trading account spreads. Our July 2025 Lowest Spread Forex Brokers comparison found the IC markets raw account had some competitive spreads only on some major pairings while FP was consistently better. FP Markets also has similar regulations to IC Markets and the same forex trading platforms. View our FP Markets Review to learn more.

|

ECN Broker Spreads

|

|||||

|---|---|---|---|---|---|

|

0.30 | 0.40 | 0.10 | 0.30 | 0.30 |

|

0.20 | 0.40 | 0.10 | 0.20 | 0.10 |

|

0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

|

0.14 | 0.18 | 0.09 | 0.14 | 0.13 |

|

0.30 | 0.50 | 0.30 | 0.50 | 0.40 |

|

0.50 | 0.50 | 0.20 | 0.50 | 0.50 |

|

0.24 | 0.70 | 0.16 | 0.54 | 0.29 |

|

0.30 | 0.70 | 0.20 | 0.50 | 0.40 |

|

0.60 | 0.15 | 0.10 | 0.70 | 0.60 |

|

0.60 | 0.60 | 0.10 | 0.60 | 0.50 |

|

0.63 | 1.13 | 0.21 | 0.73 | 0.90 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

We have broken up the other fees and transaction costs a trader is likely to encounter with IC Markets and explained what these fees entail.

| IC Markets Fee Type | Charge |

|---|---|

| Raw Spreads (Forex) - commission | USD$7 Round-turn commission per standard lot ($3.5 per side) |

| Standard Spreads (Forex) | 1.0 Pip |

| cTrader Raw Spreads (Forex) | USD$3.0 per USD100k |

| Rollover / Overnight Fees | Varies by currency pair |

| Withdrawal Fees | $0 |

| Deposit Fees | $0 |

| Inactivity Fees | $0 |

| MT4 Advanced Trading Tools | Free |

| MyFxBook AutoTrade (Social Trading) | 0.6 Pip + Standard Account Spread of 1 Pip |

| ZuluTrader | 1.5Pip + Standard Account Spread of 1 Pip |

| Virtual Private Server (VPS) | Sponsorship available |

| Demo Account | Free |

When you buy CFD forex, shares, bonds, indices and other CFD products, you will encounter 3 types of costs. These are

- Trading/brokerage fees – This is the fee the IC Markets charge you to execute your trade. With IC Markets this will usually be in the form of spreads or commission.

- Commission: This is a charge you will pay for each side of the lots you trade. Use of commission means spreads are narrower as the broker does not interfere with the spread

- Spreads – This is the difference between the ‘buy’ and ‘ask’ price of a currency pair. You express the spread as a pip (percentage in point) or a pipette which is 1/10 of a pip. Spreads are 1 pip wider for non-commission accounts.

- Non-trading costs – These are cost operational costs for having an account with the broker. Non-trading costs include funding fees and inactivity fees.

- Other / Ancillary costs – IC Markets allow you to use other optional tools to enhance your trading experience such as social trading tools (i.e. ZuluTrader or MyFxBook Automate). These will sometimes have a cost involved.

Given the fact that IC Markets is governed by strict regulatory authorities, clients are protected from spread manipulation and other abusive practices. IC Markets abides by the rules and standards imposed by the Australian Securities and Investments Commission (ASIC, Australia), Cyprus Securities and Exchange Commission (CySEC, Cyprus) and the Financial Services Authority (FSA) of Seychelles.

The overall rating is based on review by our experts

IC Market Forex Fees

You will find IC Markets charge lower fees than traditional brokers. IC Markets uses ECN (electronic communication) and STP (straight-through processing) style trading when trading forex. ‘ECN’ and/or ‘STP’ style trading saves you on costs as No Dealing Desk Brokers is involved in the trading process and prices are kept low by sourcing the best available prices from a pool of 25 liquidity providers.

The brokerage fees you pay will be determined by the type of IC Markets account you are using. The following live accounts are available:

- Standard account -This account offers similar spreads to the RAW account but adds 1 pip to the final spread however does not commission.

- RAW spreads account – This account uses ECN/STP style trading. Spreads are low because they are set by the liquidity providers. IC Markets do not interfere with the final spreads but instead, charge a commission. This commission is AUD$3.5 per standard lot (100,000 units) each way (i.e. AUD$7). To use this account you must be using the MetaTrader platform

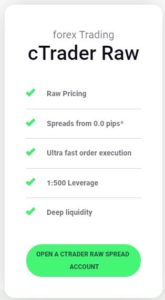

- Raw spread account (cTrader) – Like the RAW spreads account, this account uses ECN-STP style trading for spreads but is for traders using the cTrader platform. cTrader has more advanced charting functionality with CFD trading on the forex market compared to some other platforms. Commission, however, is different being USD$3 per USD$100,000 traded.

You can view our IC Markets Raw Spread vs Standard Accounts comparison to understand the differences between the two accounts.

Other expenses

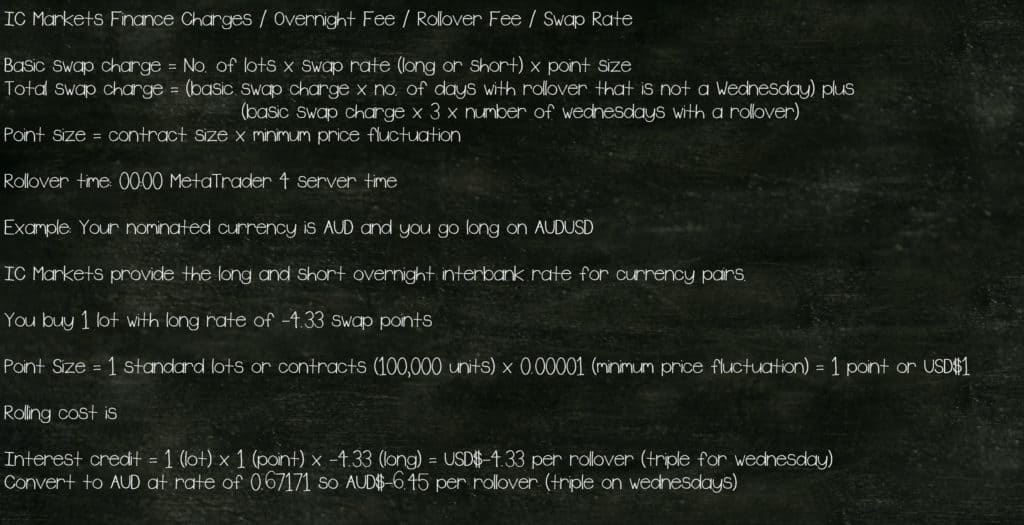

- Rollover Rate: Also known as overnight swap or finance fee, this is the interest charge for keeping your position open after closing. The rate is determined by the interest rate differential between the currency pair kept open. If you hold your position on a Wednesday night, the charge will be triple the usual rate. Swap rate calculation is Lots * swap points * point size

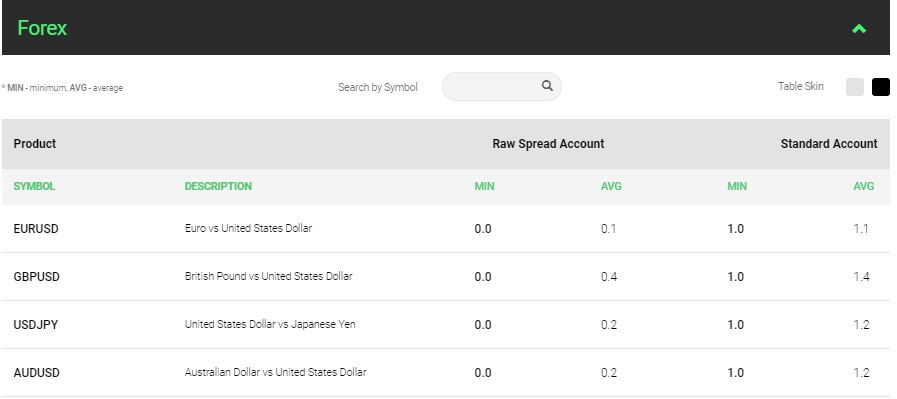

Typical IC Markets spreads for forex

Standard Account

The IC Markets standard account is a great account for beginner traders as there are no commissions. With the Standard account, you will get ECN style spreads (which IC Markets call RAW spreads) with a flat 1 pip added to the spread.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| IC Markets Average Spread | 0.82 | 0.94 | 1.03 | 0.83 | 1.05 | 1.27 | 1.3 | 1.5 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

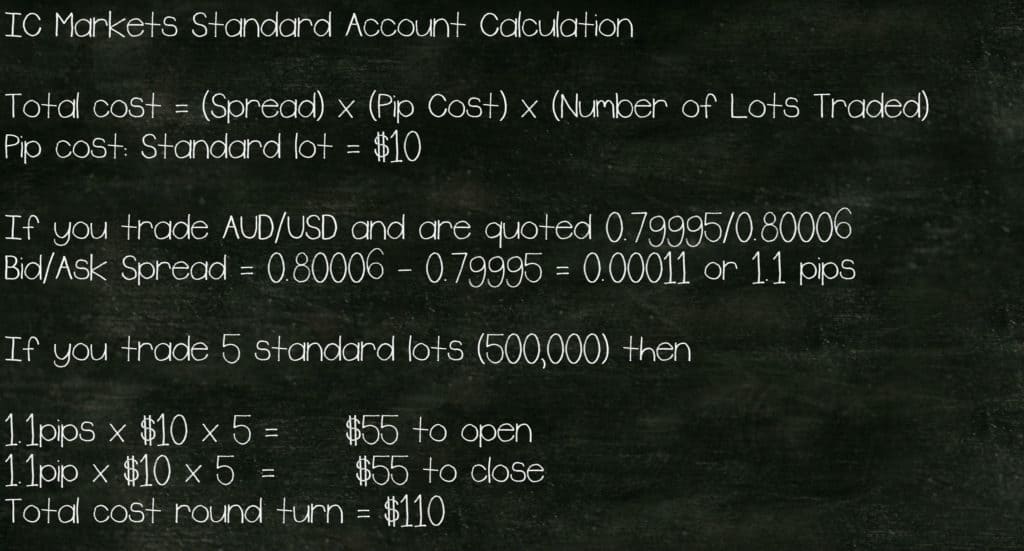

Trading cost for Standard Account

IC Market add 1 pip to the spread. They do this by subtracting -0.5 pips from the bid and adding 0.5 pips to the Ask price.

As an example, if the spread for an ECN style account is 0.80000/0.80001 then the spread will be revised to become 0.79995/0.80006. This gives a spread of 0.80006 – 0.79995 = 0.00011 pipettes or 1.1 pips.

To calculate your spread cost apply the following formula

Total cost = (Spread) x (Pip Cost) x (Number of Lots Traded)

To trade in your base currency then apply the following pip cost:

- Micro-lots (1000 lots base currency) then your pip cost will be $0.10c

- Mini-lots (10,000 lots base currency) then your pip cost will be $1

- Standard-lots (lots base currency) then your pip will be $10

Should your account not be the base currency then you will need to convert the currency, then the formula is

Pip value in quote currency (ask) = (1 pip/exchange rate) x lot size (the bid quote or base currency) or

Pip value per lot (1 pip) which is 0.0001 / exchange rare or current price of the pair x lot size (in base currency)

(not JPY is calculated differently)

IC Markets Standard account calculation example:

RAW Spreads Account

This account is likely to be for you if you want the lowest possible spreads. The Raw spread account is compatible with scalpers and day traders. By using Electronic Communication Networks style conditions for trading, spreads can be kept very narrow.

| Raw Account Spreads | IC Markets | Average Spread |

|---|---|---|

| Overall | 0.29 | 0.72 |

| EUR/USD | 0.02 | 0.28 |

| USD/JPY | 0.14 | 0.44 |

| GBP/USD | 0.23 | 0.54 |

| AUD/USD | 0.03 | 0.45 |

| USD/CAD | 0.25 | 0.61 |

| EUR/GBP | 0.27 | 0.55 |

| EUR/JPY | 0.3 | 0.74 |

| AUD/JPY | 0.5 | 0.93 |

| USD/SGD | 0.85 | 1.97 |

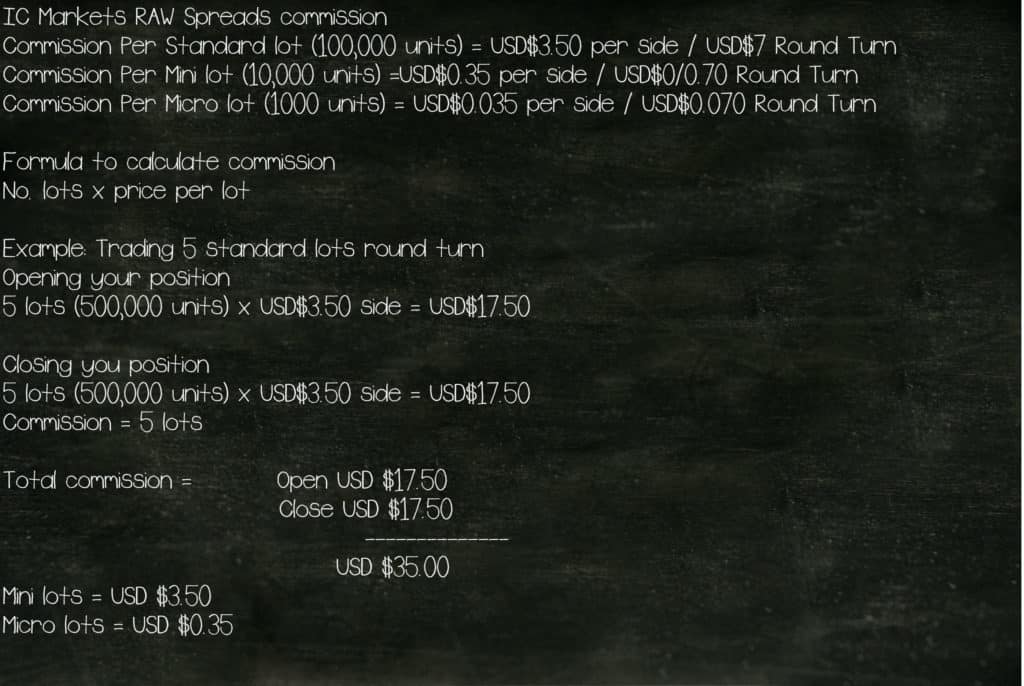

Trading cost for RAW spreads account:

The Raw spreads account charges a commission rather than a wider spread. Your commission cost for RAW spreads will be the following

- Standard lot (100,000 units) = USD$3.50/USD$7 round turn

- Mini-lot (10,000 units) = USD$0.35 / USD$0.70 round turn

- Micro-lot (1000 units) = USD$0.035 / USD$0.070 round turn

| Raw Trader Plus Rebates | Commission Rebate (per lot) | Trading Volume Requirement (closed lots) | Effective Commission For Raw Trader Plus Members |

|---|---|---|---|

| Tier 1 | $1.50 | 100 | $2 |

| Tier 2 | $2.25 | >1,000 | $1.75 |

| Tier3 | $2.50 | 2,000 | $1 |

Calculating the commission cost:

If you open (called go ‘long’) your 5 standard lots (i.e. 500,000 units) then the commission will be USD$17.50 (5 x USD$3.50) side trip.

When you close your position (go ‘short’) for the 5 standard lots your commission will also be USD$17.50.

This means your commission will total USD$35.

Trading costs with Raw Spreads account – cTrader account

cTrader Raw spreads account is the same as IC Markets Raw spreads account except you are using the cTrader platform rather than the MetaTrader platform. The commission is based on units sold rather than lots.

Comparing Spreads with other brokers

| IC Markets (RAW) | Pepperstone (Razor) | Plus500 | IG | |

|---|---|---|---|---|

| EUR/USD | 0.1 | 0.16 | 0.6 | 0.6 |

| AUD/USD | 0.2 | 0.27 | 0.6 | 0.6 |

| GBPUSD | 0.4 | 0.49 | 1.1 | 0.9 |

| USDJPY | 0.2 | 0.25 | 0.70 | 0.79 |

IC Markets fees for RAW Spread account which uses ECN Style trading compare much the same as Pepperstone. Both online forex brokers use similar trading policies which is why the average spreads are much the same. ECN Style spreads offer some of the lowest spreads on the market, which are good for scalping. This can be demonstrated by the fact IC Markets spreads are superior to Plus500 and PLUS500 spreads who are market makers and use a dealing desk with requotes.

While it is true IC Market RAW spreads have the cost of commission and IG Markets and Plus500 do not, the ECN style spreads or narrow spreads IC Markets offers mean lower cost.

Total cost = (Spread) x (Pip Cost) x (Number of Lots Traded).

IC Markets RAW spreads account cost = EUR/USD 0.1 (spread) x $10 x 1 lot = $1 + commission of $3.50 (Sideways) results in a cost of $4.

IG / Plus500 cost = EUR/USD 0.6 (spread) x $10 (pip cost) x 1 lot = $6

If your base currency is EUR then you will need to convert the pip cost to EUR.

cTrader Commission Rates

IC Markets cTrader commission = USD$3 per USD$100,000 bought and USD$3 per USD$100,000 sold.

To calculate the USD commission, you need to convert the base currency.

If you are trading with AUD/USD then the following calculation will apply:

Opening Price: AUD$100,000 x 1.300 = USD$100,000 x (3/100,000). This results in a commission of USD$3.90 for each lot.

Closing Price: $100,000 x 1.310 = USD$100,000 x (3/100,000) = This results in a commission of USD$3.93 for each lot

Total commission on trade = USD$3.90 + USD$3.83 = USD$7.83

If your base currency is AUD then you will need to convert this to AUD.

Calculating the finance charge/overnight holding fee

All brokers charge an overnight holding fee which IC Markets apply at 00:00 MetaTrader server time each night.

Calculating the finance charge/overnight holding fee for forex with IC Markets:

- Swap Charge = Number of Lots x Swap Rate (Long or Short) x Point Size x Number of Days (where the overnight charge for Wednesday is triple).

- Point size is contract size x minimum price fluctuation which is 0.00001.

IC Markets will provide the long and short swap points in their trading platforms for all the currency pairs they offer. Depending on the interest rates you will either incur a rolling fee or receive interest credit for the fee.

IC Markets Fees conclusion

The main takeaways for fees with IC Markets are the following:

- The standard account adds 1 pip to the spread. In our example, we traded 5 standard lots which have a round-turn cost of AUD$110

- RAW spreads account adds a commission fee of $AUD4.50 sideways / AUD$9 round turn for each standard lot you trade (100,000 units). The spread is not widened.

- cTrader charges a commission of USD$3 for each $100,000 traded. This makes it hard to compare with the MetaTrader platform which uses a fixed amount for each lot.

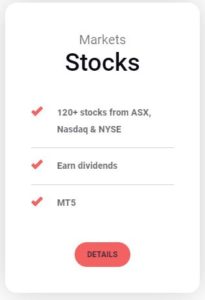

IC Market Shares CFD Fees

| Market | Commission | Size of 1 Lot | Min Volume | Max Volume | 1 Tick | Margin Requirement |

|---|---|---|---|---|---|---|

| NAS | $0.02 USD per side / lot | 1 Share | 10 | 10000 | 0.01 USD | 5% |

| NYSE | $0.02 USD per side/ lot | 1 Share | 10 | 10000 | 0.01 USD | 5% |

| ASZ | 0.10% per side / lot | 1 Share | 10 | 10000 | 0.01 AUD | 5% |

With IC Markets Shares CFD you can trade some of the largest and popular companies in the world through the Australian and New York stock exchanges. There are some 100+ stocks available across ASX, NASDAQ and NYSE. One of the key features with IC Markets is that you can earn dividends for the stock CFDs you own.

To trade shares CFD, you must be using the MetaTrader 5 platform.

Fees for Shares CFD

- Trading Fees:

- Brokerage Fees: This will vary by the market you trade with

- ASX: You will incur a charge of %0.10 for each share you trade.

- NASDAQ and NYSE: You will incur a charge of 0.02 USD for each share you trade.

- Finance Charge: To calculate the overnight fee the following formula will apply. (Number of shares) x (market closing price) x (interest rate) / 360. Fees are triple on Fridays.

- Brokerage Fees: This will vary by the market you trade with

- Non Trading Fees:

- Currency conversion: When you close your position with a currency that is not the base currency of your account there will be a cost to convert the currency to the base currency you use for your account which may differ from the spot rate.

- Stock borrow fee: IC Markets in some circumstances may pass on stock loan fees if IC Markets receive this charge from their hedge counterparty charges. IC Market will notify you of this fee if it occurs.

Calculating your Shares CFD fees to open and close on the ASX.

IF you want to buy 1000 ANZ Bank shares and are quoted AUD$28.50 / AUD$28.60 (Buy/Ask) on the exchange.

Cost to open your position = AUD$28.60 (1000 x 28.60 x 0.10%)

Later ANZ Bank prices rise to AUD$32.00 / AUD$32.10

Cost to close your position = AUD$32.00 (1000 x 32.00 x 0.10%)

Trading cost = AUD$28.60 + AUD$32.00 = AUD$60.60

Finance charges for Shares CFD with IC Markets

- Shares CFD: (Number of shares) x (market closing price) x (interest rate) / 360. Fees are triple on Fridays.

If the finance charge is 8% p.a. and the closing price of the ANZ share is AUD$29.00 making your shares valued at AUD$29,000.

Then the overnight interest you will pay is AUD$29,000 x 8%/360 which comes to $6.44.

Risk Warning: If you hold it for more than one day then you will need to recalculate the finance charge for each day. Finance charges for Fridays are triple.

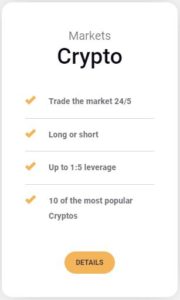

IC Market Cryptocurrency Fees

IC Market offers some ten different cryptos including Bitcoin, Ethereum, and Litecoin. You can go long or short without actually holding the Cryptocurrency which means you can get exposure without the security risks of storing the asset. You can trade with leverage of up to 1:5.

Trading Cryptocurrency has the following fees:

- Trading Fees: Bid/Ask Spread. Cryptocurrency is a spread-only product. You enter at the Ask price and exit at the Bid price.

- Spread = Ask – Bid

- Rolling / Overnight Fees: You will incur an overnight charge if you hold your position after trading hours has closed for the day. To calculate your finance charge apply the formula

- Finance Charge or Finance Credit = No of Lots x closing Market price x interest rate/360. Fees are triple on Fridays to cover the weekend period when trading is inactive.

| IC Markets Cryptocurrency vs USD CFD | Min Spread | AVG |

|---|---|---|

| Bitcoin | 5.0 | 10.0 |

| Bitcoin Cash | 5.0 | 6.0 |

| Ethereum | 4.0 | 4.5 |

| Lite Coin | 3.0 | 3.5 |

| Dash Coin | 4.0 | 5.0 |

| Ripple | 0.015 | 0.16 |

| EOS | 0.16 | 0.160 |

| Emercoin | 02.70 | 0.270 |

| NameCoin | 0.650 | 0.750 |

| PeerCoin | 0.350 | 0.55 |

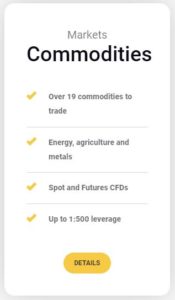

IC Markets Commodity Fees

There are 19 commodities available with IC Markets covering energies, precious metals and agriculture. Supply and demand can change dramatically giving you good opportunities for good returns.

When trading commodities, you can trade on both spot prices and futures with leverage of up to 1:500.

Fees with IC Markets

- Trading Feed: Your brokerage charge will usually be AUD$3.50 per standard lot which is calculated in the base currency of your account.

- Overnight charges:

- Spot prices: Finance Charge/Credit = No. Lots x swap points (long or short) x point size

- The overnight charge is triple on Wednesdays to cover the weekend when the market is closed.

- Futures: No finance or credit charge

- Spot prices: Finance Charge/Credit = No. Lots x swap points (long or short) x point size

| IC Markets | Minimum | Avg |

|---|---|---|

| Oils | ||

| Brent Crude Oil Futures | 0.030 | 0.050 |

| Brent Crude Oil Spot vs USD | 0.010 | 0.040 |

| Natural Gas Spot vs USD | 0.001 | 0.004 |

| Soft Commodities | ||

| Coffee | 0.300 | 0.900 |

| Corn | 0.600 | 1.250 |

| Soybean | 1.350 | 1.770 |

| Sugar | 0.040 | 0.060 |

| Wheat | 0.700 | 1.270 |

| Cocoa | 4.00 | 5.00 |

| IC Markets Metals | Raw Spreads Min | Raw Spread Avg | Standard Account Min | Standard Account Avg |

|---|---|---|---|---|

| Gold vs USD | 0.0 | 1.0 | 1.0 | 2.0 |

| Gold vs AUD | 0.0 | 4.5 | 1.0 | 5.5 |

| Silver vs USD | 0.0 | 0.2 | 1.0 | 1.2 |

| Palladium vs USD | 0.0 | 30.0 | 1.0 | 40.0 |

| Platinum vs USD | 0.0 | 9.0 | 1.0 | 10.0 |

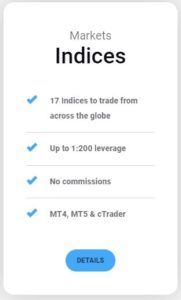

IC Markets Index Fees

IC Markets offer 16 indices that cover a wide range of large-cap blue-chip stocks and generally move in line with the market. With IC Markets you can use MetaTrader 4, 5 and cTrader platforms. A leverage of 1:200 is available.

Index CFD is a spread only product this means there is no commission charge.

IC Market Index Fees

- Trading Fees: Bid/Ask Spread is your brokerage charge. This is Spread = Ask-bid

- Rolling Fees: If you hold your position aftermarket closing hours you will incur the following overnight charge

- Finance Charge/Credit = Number of Lots x swap points (long or short).

- Swap points: Swap long/short = closing index price x interest rate/360

IC Markets Indices Min Avg AUS200 0.950 1.120 US30 2.300 2.500 US2000 (Small Cap) 0.300 0.300 UK100 1.000 1.000 DE30 (Germany) 0.950 1.000 ES35 (Spain) 4.200 4.400

- Finance Charge/Credit = Number of Lots x swap points (long or short).

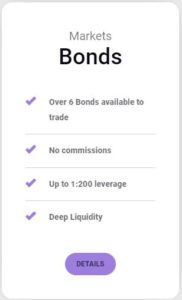

IC Markets Bonds Fees

IC Markets offer a selection of 6 highly-rated government issues debt securities from a range of governments around the world. Available on the MetaTrader 4 and 5 platforms (not cTrader) you can trade 24/5 and use a leverage of up to 1:200.

With IC Markets Bonds, you will incur the following costs:

- Trading Fees: Bonds are a spread only product. There is no commission.

| IC Markets Bonds | Min | Avg |

|---|---|---|

| Euro Bobl | 0.010 | 0.020 |

| Euro Bund | 0.010 | 0.020 |

| Euro Schatz | 0.010 | 0.020 |

| BTP Italian | 0.050 | 0.050 |

| Japanese 10 YR | 0.100 | 0.100 |

| UK Long Gilt | 0.020 | 0.030 |

| US 5 YR-T-Note | 0.014 | 0.015 |

| US 10 YR T-Note | 0.022 | 0.025 |

| US T-Bond (30 year) | 0.030 | 0.050 |

Non Trading Charges

IC Markets minimum deposit requirement is $200. In addition, they don’t have any funding or non-trading fees including:

One of the great features of trading with IC Markets is that they do not have non-trading fees.

- No deposit fees – there are no deposit fees when making bank transfers or debit cards or credit cards or using digital wallets like PayPal, BPAY, NETELLER, Skrill, UnionPay or POLi.

- No withdrawal fees (except for FasaPay withdrawals which may incur an extra fee)

- Zero account inactivity fees

- No fees for customer support, meaning you will always be able to get an answer to your query for free

According to general banking practices, all international bank wire transfers may incur intermediary bank fees. Clients should expect an AUD 20 processing fee for wire transfers, which IC Markets is kind enough to deduct from your withdrawal amount.

This means IC Markets compares well with other brokers as shown in the table below.

| Deposit Fees | Withdrawal Fees | Inactivity Fees | |

| IC Markets | ✘ | ✘ | ✘ |

| Pepperstone | ✘ | Bank Wire AUD$20 Minimum withdrawal $80 | ✘ |

| IG Markets | Credit Card (If AUD then Visa 1%, MasterCard 0.5%, Non AUD then 1.5% ) , PayPal 1%), Min AUD$450 deposit with Credit Card | ✘ | $50 per quarter if inactive for 3 months |

| Plus500 | ✘ | ✘ | USD$10 if not active for 3 months |

| Go Markets | ✘ | ✘ | ✘ |

| Think Market | ✘ (minimum deposit $0 for standard, $500 for go account) | ✘ | AUD$30 each month if inactive for 6 months of more |

| AxiTrader | ✘ | ✘ | ✘ |

| CMC Markets | Credit card payment will incur 1% fee or 0.6% for debit card | ✘ | AUD$12 per month if inactivty for 12 months |

When it comes to funding IC Markets offers a choice of 15 funding options with a choice of 10 different base currencies. Many of these options have instant deposits. Deposits are accepted in 10 different currencies including USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, CAD. While IC Markets has a global client base, residents from the United States, Canada, Israel, New Zealand, Japan and Islamic Iran can’t open a live trading account.

Note: while IC Markets do not charge fees for funding, some international banking merchants may charge fees from their end.

Other Fees

IC Markets have a range of features you may opt to take advantage of to enhance your trading experience.

Demo Account:

IC Markets demo account is free for all the IC Markets trading account types and both MetaTrader and cTrader platforms. There is no limit on the time you have access to the demo account. IC Markets’ demo account can also be accessed on your phone via mobile apps – Android and iOS compatible.

MT4 Advanced Trader Tools

IC Markets offer 20 additional trading tools that do not come with MetaTrader 4. The app offers institutional level trading features that help you make better trading decisions and superior execution and more advanced account management tools. IC Markets has a MetaTrader 4 server located in the Equinix data centre to ensure that there is no latency with any order execution no matter the trading conditions.

Mirror Trading /Copy Trading Tools

IC Markets have Myfxbook and ZuluTrade are social copying or mirroring tools that integrate with your trading platform. Social trading is great for traders that wish to learn trading strategies from experienced traders by seeing how they trade.

To use these trading tools you must be using IC Markets standard account.

With IC Markets social copy tools, you will incur the following costs:

- Myfxbook: 0.6pip (+ 1pip for standard account)

- ZuluTrade: 1.5 pips (+ 1pip for standard account)

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Can I deposit $100 on IC Markets?

Most likely yes.While IC Market advertises a minimum deposit of $200, this is not enforced.

If I deposit K100, how much profit will I make?