IC Markets Raw Spread Vs Standard Accounts

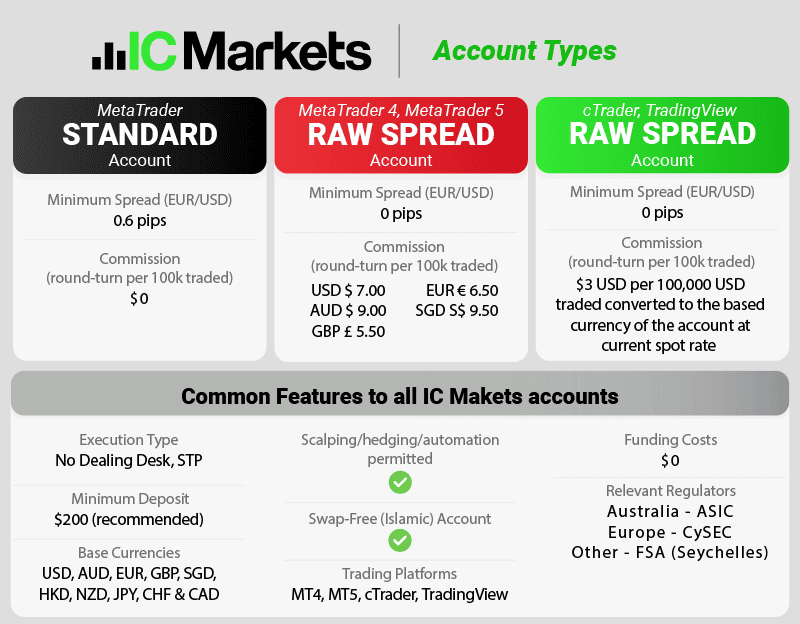

IC Markets is the lowest fee forex broker offering a Standard and Raw Spread account. The Standard account has higher spreads but no commissions, while the Raw Spread account has the tightest ECN spreads and a low commission of $3.50 per $100k traded.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

IC Markets Trading Accounts

IC Markets Standard Account

IC Markets MetaTrader 4/5 Raw Spread Account

IC Markets Raw Spread cTrader

MetaTrader 4

MetaTrader 5

TradingView

MetaTrader 4

MetaTrader 5

TradingView

cTrader

cTrader Copy )

MyFxbook Automate

MyFxbook AutoTrade (MT4 only)

ZuluTrade (MT4 Only)

MetaTrader Signals

MyFxbook AutoTrade (MT4 only)

ZuluTrade (MT4 Only)

MetaTrader Signals

Yes

Yes

Yes

$200

$200

$200

Beginner Traders

Discretionary Traders

Low Volume Traders

Day Traders

ECN Style Trading

Cost Saving

Scalpers

ECN Style Trading

cTrader Platform

How Does The Standard Vs Raw Spread Account Differ?

The fees are the only difference with the standard account having spreads marked up 0.6 pips compared to the raw account that has a commission added. We tested both IC Markets trading accounts and found the raw spread account has the lowest fees for CFD and forex traders.

Open Standard AccountRaw Spread Account

IC Markets offers three account types which are:

- The standard account has no commissions

- The cTrader account has low spreads and the lowest commissions

- The raw spread account has the lowest spreads but a modest commission

Beginner brokers often prefer the standard account based on fee simplicity while advanced traders should choose the raw spread account, which is the most popular account type. The table below compares these three IC Market accounts.

Similarities Between Accounts

The common features of both IC accounts are the:

- Minimum deposit requirement of $200 to start trading (view more on IC Markets minimum deposit)

- Leverage of up to 500:1 (ASIC) or 30:1 (CySEC) for retail traders

- Flexible lots – Micro Lots (0.01), Mini Lots (0.10) and standard lots (1)

- Choice of over 61 Currency Pairs

- The ability to activate Scalping, Hedging and utilise trading automation

- Social Trading tools like ZuluTrade, MyFxBook’s Autotrade

- Range of CFD leveraged products (cryptocurrencies, indices, shares CFD, commodities, precious metals)

All accounts offer 24/7 customer support with dedicated customer service teams in Sydney (Australia) and Limassol (Cyprus). You can contact IC Markets via live chat on their website, via phone or by email. The customer service and features above make IC Markets the best low-fee forex broker. To better clarify the exact differences between each forex platform and account (including the swap-free account for those of the Muslim faith) the following section will go into greater detail.

Open a demo accountVisit IC Markets

What Is The IC Markets Raw Spread Account?

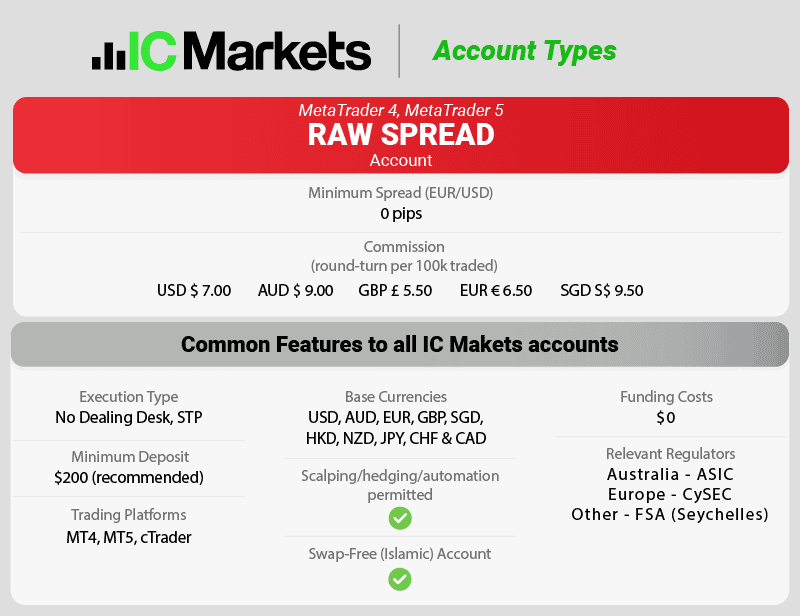

The IC Markets Raw spread account offers ECN pricing if you are using the MetaTrader Trader Platform. You find this account offers some of the tightest spreads in the online forex industry. This means savings when it comes to your costs. To keep tight spreads, IC Markets charges a commission of AUD $9.00 or USD $7.00 round turn.

IC Markets MetaTrader Raw Spread Accounts Distinguishing Features:

- Narrow spreads with ECN (RAW) pricing

- Spreads from 0.0 pips

- Commission of AUD / USD$3.5 side-way, AUD / USD$7.00 round-turn

- MetaTrader 4, MetaTrader 5, MetaTrader WebTrader (for browsers), MetaTrader Android, MetaTrader MAC trading platforms

- Perfect for scalpers

- Level II pricing – Market depth (with MT5 and cTrader)

- Fast trading execution

- MetaTrader 5 for Shares CFD trading

Best for: Traders who want low pricing and MetaTrader platforms.

Below compare the RAW spread account trading fees to other leading forex brokers who publish their average spreads and commissions. This also factors in live forex pair crosses through an API.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

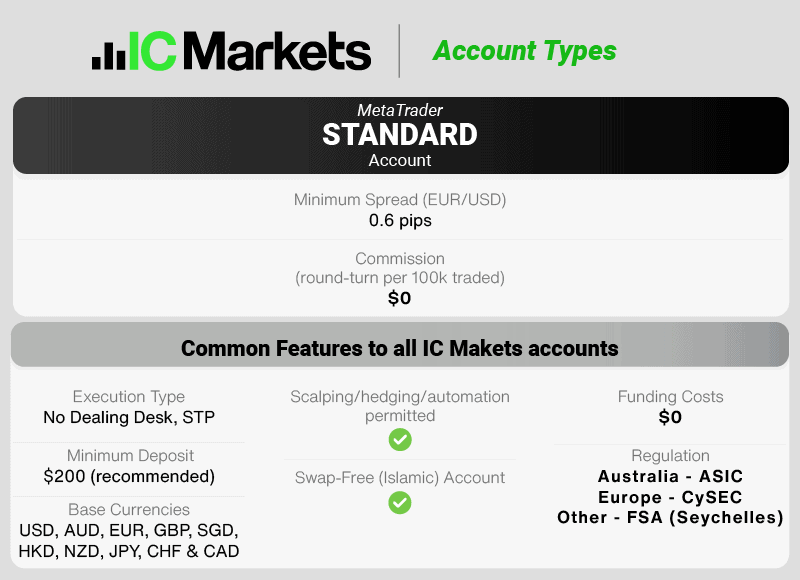

What Is A Standard Account?

Unlike Raw Spread accounts, the Standard account has no commissions. Instead, there is a markup of 0.6 pip. While this does mean your costs will be higher than the Raw spread account, no commission means the calculation of your costs is simpler, making it suitable for beginner forex traders.

IC Markets Standard Account Distinguishing Features:

- Spreads from 0.6 pips

- No commission

- MetaTrader 4, MetaTrader 5, MetaTrader WebTrader (for browsers), MetaTrader Android (for mobile trading), MetaTrader MAC trading platforms

- Level II pricing – Market depth

Best for: Traders with low trading experience

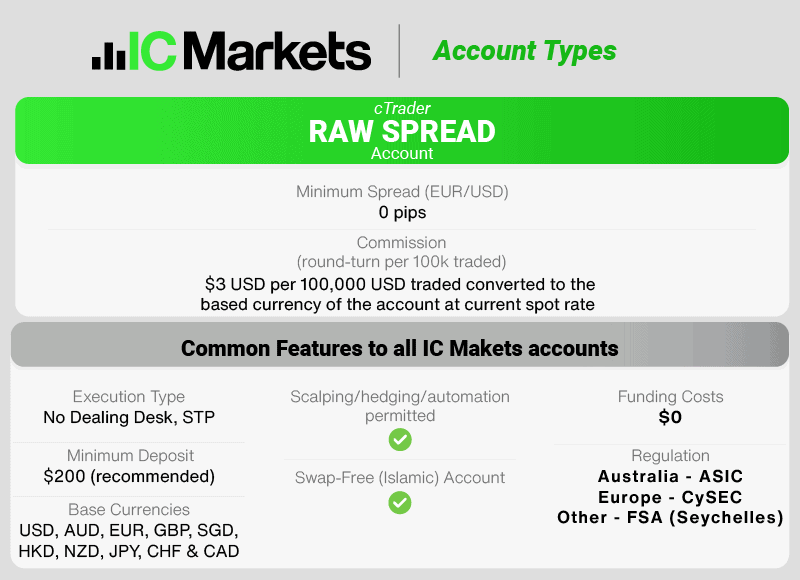

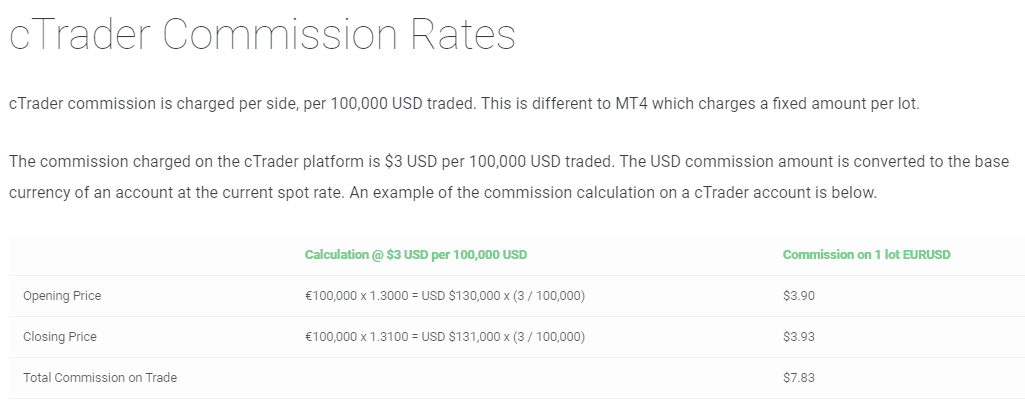

cTrader RAW Spread Trading Account

This type of trading account is similar to the MetaTrader Raw Spread account. The difference is that it is for traders using cTrader rather than the MetaTrader Trader Platform. If a trader chooses the cTrader trading platform, the commission structure is also different.

cTrader trading platform offers a different trading experience to MetaTrader so you would choose this platform if you prefer this platform over MetaTrader.

IC Markets cTrader Raw Spread Accounts Distinguishing Features:

- Narrow spreads with ECN (RAW) pricing

- Spreads from 0.0 pips

- Commission USD $3 per USD $100,000 traded

- cTrader

- Unrestricted scalping

- Level II pricing – Market depth

Best for: cTrader trading platform is for those who need superior charting options

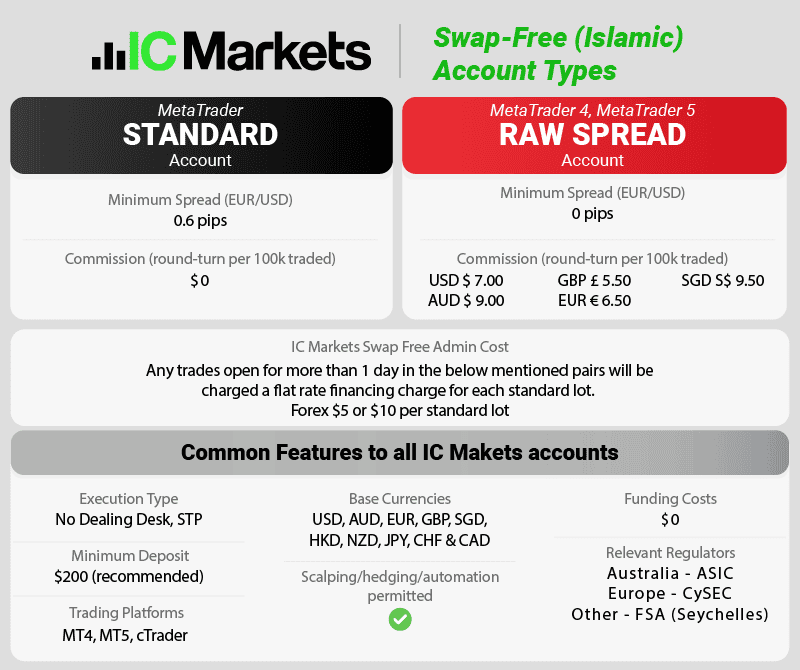

IC Markets Swap-Free Islamic Account

This account is designed for traders of the Islamic faith who must comply with sharia law. The account is similar to the MetaTrader Raw spread account. You will use the MetaTrader trading platform, have the same spreads for all currency pairs, and incur the same commissions. The main difference is there are no swap rates (also called overnight fees or rolling fees) and you will incur additional charges for trading minor currency pairs.

IC Markets Islamic Account Distinguishing Features:

To use this account you will need to provide evidence to IC Markets you are of the Muslim faith.

- Narrow spreads with ECN (RAW) pricing

- Zero spreads in some circumstances

- Commission of AUD / USD$3.5 side-way, AUD / USD$7.00 round-turn

- Swap-free account – no overnight financing charges or rolling fees

- In place of the swap fee, the following fees are applied

- Major currency pairs such as AUD/USD and EUR/USD are 100% commission based

- Minor forex pairs and exotics will incur charges ranging from $5 to $40 per lot

- MetaTrader or cTrader trading platforms

- Level II pricing – Market depth

Best for: Only for those of Muslim faith (proof will be required)

- In place of the swap fee, the following fees are applied

IC Markets ECN Pricing Technology

IC Markets are the issuer of the products they provide. This means they use an Electronic Communication Network pricing model (known as ECN for short) to access their deep pool of external liquidity providers when sourcing prices. IC Markets pass these prices to you without any requotes or dealing desk intervention.

To ensure you receive the best possible price, IC Markets do not hedge any positions with the liquidity providers. For this reason, while not completely a true ECN broker, IC Markets can offer what they call an ECN pricing model.

This kind of trading model is why IC Markets are known as an ‘A’ book broker. This is different from Market Maker Brokers which are ‘B’ book brokers. These types of OTC Forex Brokers will trade against you as they are your counterparty for each trade.

What It Means For Traders

As IC Markets is a No Dealing Desk Brokers, no requotes and do not hedge your position, the spreads passed onto you are ‘raw’. In other words, IC Markets are providing you with the very best spreads liquidity providers are willing to offer. This is critical for some trading styles as discussed on Quora.

IC Markets charge a commission for each trade you do rather widen the spread.

- Narrowest spreads

- No price manipulation

- Commission (in place of wider spreads)

IC Markets RAW ECN pricing account spreads compare extremely well when we compare spreads with other brokers using similar trading execution. The comparison below compares the spreads of different brokers using average spreads published.

IC Markets Raw Account Spreads | |||||

|---|---|---|---|---|---|

| 0.01 | 0.04 | 0.27 | 0.85 | 0.02 |

| 0.14 | 0.39 | 0.39 | 1.79 | 0.31 |

| 0.10 | 0.30 | 0.30 | 1.10 | 0.10 |

| 0.10 | 0.20 | 0.30 | 0.60 | 0.20 |

| 0.16 | 0.59 | 0.54 | 2.00 | 0.29 |

| 0.20 | 0.60 | 0.50 | 10.00 | 0.40 |

| 0.80 | 0.50 | 0.50 | 4.50 | 0.40 |

| 0.10 | 2.00 | 0.60 | 3.10 | 0.50 |

| 0.10 | 0.20 | 0.30 | 1.80 | 0.20 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Accounts That Use ECN Pricing

- IC Markets RAW spreads account

- IC Markets cTrader account

- IC Markets Islamic account

IC Markets standard account works a similar way to the ECN trading accounts however there is a requote. Prices will be the same as with ECN trading conditions but with 0.6 pip added to the spread. This one Pip is IC Markets charge for providing the service and is equal to USD$10 for each standard lot.

Spread Charges For IC Markets Accounts

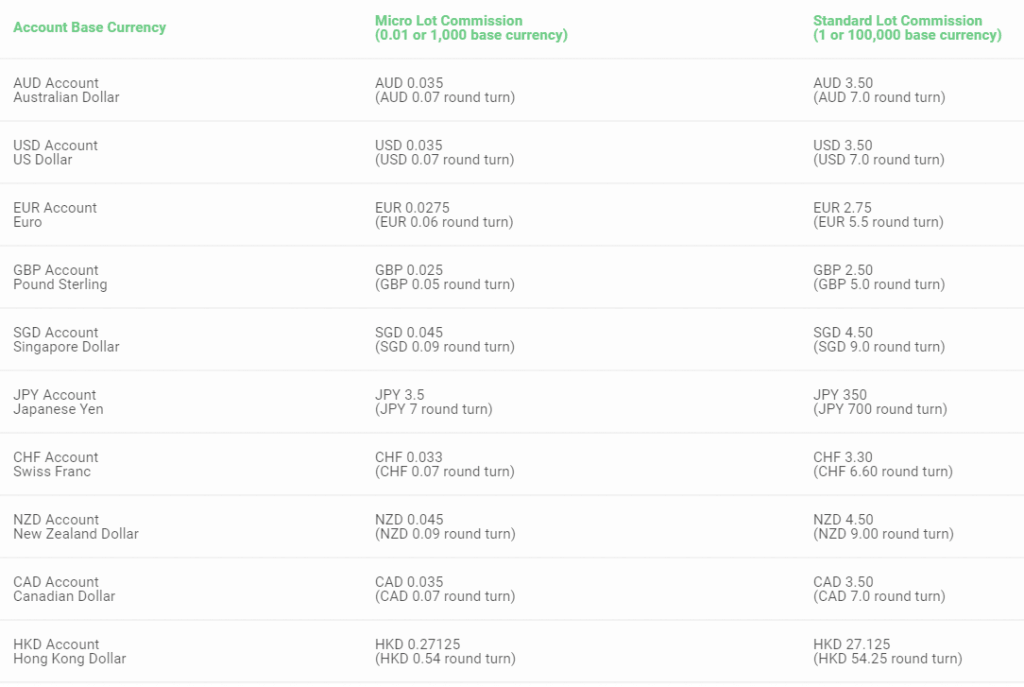

To keep spreads as low as possible, IC charges a commission for their IC Markets ECN pricing accounts. Commission for IC Markets RAW account with MetaTrader trading platform depends on the number of lots you trade, while the cTrader platform depends on the on-the-spot rate of the currency pairing when you go short or long.

1. MT4 Commission For RAW Accounts (MetaTrader)

IC Markets charge the following commission for RAW accounts for MetaTrader

- 0.01 micro-lots (1000 units) then you will be charged USD $0.035 one way and $0.07 round trip.

- 0.10 mini lots (10,000 units) then USD $0.35 one way and $0.70 round trip.

- 1 Standard lot (100,000 units) then USD $3.50 one way and $7 round trip.

The commission will vary depending on your account currency.

2. cTrader Commission For ECN Account

cTrader, unlike MT4, is based on a charge of USD $3 per USD$100,000 traded one way ($6 round trip) rather than lots. The commission needs to be converted to the base currency at the spot rate. For example:

- $100,000 x 1.4000 = USD $140,000 x (3 / 100,000) one way = $4.2

- $100,000 x 1.4100 (example spot rate) = USD $130,000 x (3 / 100,000) return = $4.23

3. Standard Account Charges

In place of commission, IC Markets widen their spreads with 1 additional pip. Pips costs are the following:

- 1 standard lot = US$10

- 1 mini lot = US$0.10

- 1 micro lot = US$0.01

Calculating The Costs For Each Account Type

In our example, we are using AUS USD where AUS is the quoted rate and USD is the base. IC Markets adds a flat 1.0 pip to the spreads on the Standard account (1.4 pips). RAW spreads account (MetaTrader, cTrader) does not have any pips added, so this example will use 0.4 pips.

MT4 Micro-Lots (1000 units) Standard vs RAW (AUS USD)

- Standard – ($0.10 per lot with a pip of 1.40)

$0.10 x $1.40 = $0.140 - RAW (MetaTrader) ($0.10 per lot with pip of 0.40)

$0.10 x 0.40 = $0.040 + $0.07 = $0.11

Thus, we can conclude you will save 0.03c with the RAW account when trading with micro-lots.

Mini Lots (10,000 units) Standard vs RAW (AUS USD)

- Standard ($1 per lot with a pip of 1.40)

$1 x 1.40 = $1.40 - RAW ($1 per lot with a pip of 0.40)

$1 x 1.40 = $0.40 + $0.70 = $1.10

Thus we can conclude you will save 0.30c with the RAW account when trading with mini lots.

Standard Lots (100,000 units) Standard vs RAW (AUS USD)

- Standard ($10 per lot with a pip of 1.40)

$10 x 1.40 = $14 - RAW (MetaTrader) ($10 per lot with pip of 0.40)

$10 x 0.40 = $4.0 + $7 = $11

Thus we can conclude you will save $3 with a RAW account when trading with standard lots.

IC Markets Trading Platforms

IC Markets offer you a choice of three platforms for trading. These are MetaTrader 4, MetaTrader 5 and cTrader.

1. MetaTrader 4 (MT4)

MT4 is a logical choice for traders as it’s the most popular trading software. Most brokers offer the platform as it offers a range of financial instruments and easy to use interface.

The core features of MT4 are:

- 3 execution modes – Instant execution, execution on request, execution by market

- 2 market orders

- 4 pending orders (buy limit, buy stop, sell limit, sell stop)

- 2 stop orders – (stop loss, take profit)

- Trailing stop

- One-click trading directly in charts

- Tick chart to define entry and exit points

- Low memory space

- Large support community

- Hedging and LIFO

- Expert advisors

2. MetaTrader 5 (MT5)

MT5 is an upgrade on MT4 however its adoption by brokers and traders has been slow. This is because MT5 when first released did not allow the ability to hedge as this is not permitted in US markets. This feature is now available meaning MT5 now offers everything MT4 offers and more.

- More CFDs (compared to MT4) with IC Markets means Shares CFD

- More chart time frames (including M1/M2, MI3, MI Ghost Protocol, MI: Rogue Nation

- 11 Minute Charts, 7 hourly charts, daily/weekly/yearly time frames

- Integrated economic calendar

- 22 Technical indicators

- 46 graphical objects

- Improved trading strategy tester for Expert Advisors.

- Depth of market

- Hedging and LIFO options (IC Markets don’t accept American clients)

- Expert Advisors

3. cTrader

This platform is a popular alternative to MetaTrader. Its strength is in its advanced charting tools. Compared to MetaTrader, cTrader has a cleaner and more user-friendly design which leads to better navigation while MetaTrader has a more professional look. cTrader tends to be more specialised in forex, so if you are looking to trade a variety of CFDs then MT5 could be your best option.

- 70 indicators for technical analysis

- Single-click trading with QuickTrade throughout the platform

- Advanced order types – Market/limit/stop/stop-limit orders, take profit, stop loss. Market orders have a market range feature to manage slippage

- 50 templates

- 3 chart modes – multi-chart, single-chart, free-chart) and 6 chart types

- 28 timeframes and 6 zoom levels

- Depth of market – (standard, price, VWAP)

- cAlgo

- Mirror trading with cMirror

Education And Research

One fo the best features IC Markets offers is a plethora of online educational tools. Across the forex and CFD ecosystem, the broker covers all the core educational areas including:

- Video Tutorials – here users will find a series of videos showing how to install and use MetaTrader 4

- Web TV – Recorded from the New York Stock Exchange by Trading Central, these are a series of short videos with ideas for trade and market commentary for Forex and CFDs

- Getting started – a series of 10 articles taking your forex 101. Everything you need to know to get started with Forex Trading.

IC Markets also have a section devoted to serious traders which cover the following:

- Fundamental Analysis – Daily report covering analysis of fundamental

- Technical Analysis – daily report covering technical analysis

- Trading Data – This covers dividends and earnings for different indices and stocks. It also covers swaps for MetaTrader and cTrader.

- Education – This covers topics such as:

- Risk Management 101

- Technical analysis 101

- Trading Psychology 101

- Trading planning 101

Regulation And Security Of Funds

IC Markets have the following entities and regulations:

- Australia: International Capital Markets Pty Ltd (ACN 123 289 109)

- Australian Securities and Investments Commission (ASIC) with AFSL 335 692

- Europe: IC MARKETS (EU) LTD

- Cyprus And Securities Exchange Commission (CySEC) (Registration No: 362049)

- Outside Australia and Europe: Raw Trading Ltd (Company number 8419879-2)

- Financial Services Authority of Seychelles [FSA] (Licence no: SD018)

Depending on where you sign up, you will join the most applicable entity for your region. This will impact leverage and fees and discussed on the MyFxBook IC Markets forum.

Using a regulated broker will mean your funds are secure and generally include the following benefits

- Funds are kept in a segregated Tier-1 bank account away from IC Market’s own funds

- Product Disclosure Statement (PDS) so you know the broker’s policies with their products

- Established complaints process

- Financial compliance to meet ASIC requirements, including minimum solvency

If you fall within CySEC regulation, then you will have guaranteed negative balance protection if you are a retail trader

Risk Warning: It is important for users to note that Trading Derivatives carry a high level of risk to your capital, and you should only trade with money you can afford to lose. As a result, it’s critical that potential account users fully understand the risks involved and seek independent advice if necessary.

Funding Methods

IC Markets offer one of the widest choices of funding methods of all forex brokers, and they do not charge any fees for deposits and withdrawals. This is often discussed on the Reddit forum.

With IC markets you can use the following methods to fund your accounts, and the transfer will almost always be instant.

- Debit cards / Credit cards

- Visa, MasterCard

- Currencies accepted: AUD, USD, JPY, EUR, NZD, SGD, GBP and even the Canadian CAD

- Electronic methods

- Bank Transfer

- Wire transfer

- Broker to Broker

- Digital Wallets / eWallet

- PayPal

- Neteller / VIP

- Skrill

- FasaPay (USD only)

- Region-specific

- Union Pay China (RMB only)

- Bpay and POLi Australia (AUD only)

- RapidPay

- Europe

- Klarna

- Cryptocurrency

- Bitcoin Wallet

- Bitcoin (BTC)

- Visa, MasterCard

IC Markets FAQ

Which IC Markets Account Is Best?

The Raw spread account is the best when it comes to fees and execution speeds. In fact, our ECN broker spread comparison found IC Markets to have the lowest spreads of any forex broker. The standard account is only recommended for beginner traders looking for the simplicity of having brokerage added within the spreads.

What Are The Typical Spreads For The RAW Spread Account?

The spreads for the IC Markets raw account are (in pips)

- EUR/USD – Minimum spread 0.0 Average spread 0.1

- AUD/USD – Minimum spread 0.0 Average spread 0.2

- USD/JPY – Minimum spread 0.0 Average spread 0.2

- USD/SGD – Minimum spread 0.0 Average spread 0.3

- GBP/USD – Minimum spread 0.0 Average spread 0.4

- USD/CHF – Minimum spread 0.0 Average spread 0.5

View our lowest spread forex brokers review to compare IC Markets to the leading ECN broker accounts.

Summary Of Which IC Markets Account Traders Should Choose

Our analysis shows ECN pricing leads to lower fees on the Raw Account overall in comparison to the Standard Account. Our calculations are as follows:

- Standard account 1 pip = $10 vs

- Commission = $7

Based on this, the ECN pricing is cheaper compared to the standard account leading the Raw Spread account to have lower brokerage. As a rule of thumb, the more you trade, the more your expenses will be, thus day traders and those using EAs (Expert Advisors) in particular will benefit from the Raw Spread account.

The only other reason one might prefer IC Markets Standard account is if you are a beginner forex trader and do not want the expense and hassle of having to calculate your commission fees or if IC Markets ever offer narrower spreads for the Standard Account. We recommend joining an IC Markets demo account and trading with micro lots until you are comfortable trading with fx.

Regardless of which type of forex trading account you select, it is important to remember that forex markets are very volatile, so you will want to ensure you fully understand the risks involved with forex trading and CFD trading. This also applies to any leveraged product due to leverage amplifying the risks of trading.

Open a demo accountVisit IC Markets

Article Sources

Testing and data comparing Raw Account Spreads

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Visit IC Markets

Visit

Ask an Expert

I’m looking to trade using automation (EA Robots). Is the Raw Spread or Standard account going to result in lower fees? What do most high volume traders choose?

Most high volume traders choose the RAW Spread account as it is better for scalping. This is because the RAW spread account has priority access to the order books which results in faster speeds that allow for less slippage.

I’m based in London and was wondering what account more UK traders choose?

We believe retail traders in the UK prefer the standard account. However, most experienced traders prefer Raw account for its lower spreads

What should be my intended purpose and nature of transaction as a beginner

Obviously you trade with the intention of making some profit, however it is important to appreciate that CFD are risky instruments and using leverage can amplify your losses. As a beginner trader you should practise by using a demo account and then when you are ready to use real money, trade in small amounts with low leverage and trade in micro or minimum lots. You should also make use of the risk management tools such as stop loss orders.

IC Markets provide a range of forex trading and education tools to help you with your trading journey.

Is Raw spread good for scalping?

Scalpers like raw spreads because the cost for each trade is lower, other scalper like fixed spreads because they want predictability when trading. It depends on your trading strategy.