OTC Forex Brokers (2024)

Over-the-counter (OTC) forex brokers connect you with a network of liquidity providers using ECN or STP that can lead to spreads as low as 0.0 pips. OTC Brokers also offer the benefit of 24-hour trading as hours.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

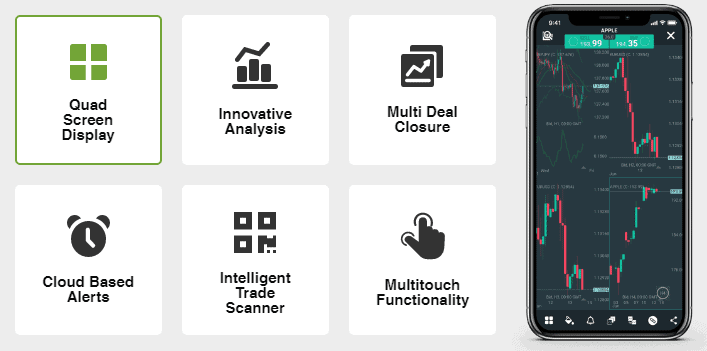

Cloud-Based Alerts and Triggers – clients can set up to 200 alerts and triggers, which will notify them of particular developments in the OTC market even when they are logged out of their trading account.

Cloud-Based Alerts and Triggers – clients can set up to 200 alerts and triggers, which will notify them of particular developments in the OTC market even when they are logged out of their trading account.

Ask an Expert

Is OTC trading the same as ECN trading?

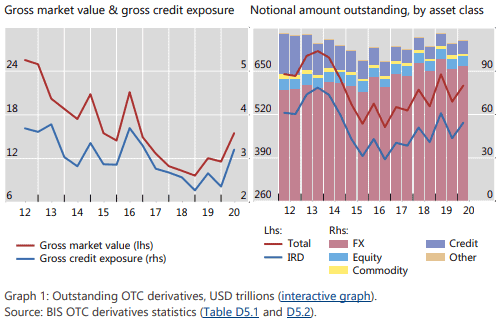

Over-the-counter trading (OTC) and Electronic Communication Networks trading are two different concepts. OTC trading means you are trading in decentralized markets, these markets have no central exchange or broker. Forex is a good example of a decentralised product since you are trading directly with the liquidity providers. Stocks by contrast will usually have a central exchange and use an auction market system.

ECN trading is the means that allows you to connect with liquidity providers so you can make the trade.