IC Markets vs Blueberry Markets: Which One Is Best?

IC Markets and Blueberry Markets are two Aussie brokers with great reputations, razor-sharp pricing, and loyal trader followings. But which one really fits your trading style? If you’re deciding where to trade in 2026, this comparison guide will save you hours.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Here’s a quick overview of the noticeable differences between the two brokers:

- IC Markets has cheaper overall trading costs with lower spreads on both Raw and Standard accounts

- Both offer MT4, MT5, cTrader, and TradingView with full feature access

- Blueberry Markets offers personalised customer service with dedicated account managers.

- IC Markets has slightly slower execution speed, but smoother platform experience and interface

- IC Markets is strongly regulated by ASIC & CySEC, and has a higher trust score

1. Lowest Spreads And Fees – IC Markets

Standard Account

The first thing I compared with these two brokers is their Standard account spreads and right off the bat IC Markets had the upper hand.

IC Markets offers tighter pricing across every major currency pair. For instance, EUR/USD averages 0.82 pips with IC, while Blueberry averages 1.2 pips. Same with USD/JPY (0.94 for IC vs 1.5 for Blueberry) GBP/USD, AUD/USD, USD/CAD and even exotics. IC Markets is consistently lower by about 0.3 to 0.6 pips.

That might not seem like much on a single trade, but it adds up quickly, especially if you’re running a strategy with frequent entries or high volume. Over time, that spread difference can be the gap between a strategy that breaks even and one that’s actually profitable.

Blueberry’s pricing is competitive enough for casual traders, but the spreads are noticeably wider. If you’re after low costs on a Standard account, IC Markets provides better pricing efficiency without compromising on quality.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall | |

|---|---|---|---|---|---|---|---|---|---|

| IC Markets | 0.82 | 0.94 | 1.03 | 0.83 | 1.05 | 1.27 | 1.3 | 1.5 | 1.09 |

| Blueberry Markets | 1.2 | 1.5 | 1.4 | 1.5 | 1.5 | 1.3 | 2 | 1.8 | 1.53 |

Raw Account

On the Raw (commission) account, IC Markets still outperforms Blueberry with near-institutional pricing. EUR/USD at 0.02 pips is about as tight as you’ll get outside of a prop desk. I mean this is the kind of ultra-tight spreads that serious scalpers and high-frequency traders can truly work with.

RAW Account Spread | |||||

|---|---|---|---|---|---|

| 0.20 | 0.40 | 0.10 | 0.20 | 0.10 |

| 0.03 | 0.04 | 0.01 | 0.27 | 0.02 |

| 0.30 | 0.30 | 0.10 | 0.30 | 0.10 |

| 0.51 | 0.57 | 0.14 | 0.39 | 0.31 |

| 0.10 | 0.20 | 0.06 | 0.10 | 0.20 |

| 0.10 | 0.20 | 0.10 | 0.70 | 0.10 |

| 0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

| 0.30 | 0.20 | 0.10 | 0.30 | 0.20 |

| 0.40 | 1.40 | 0.80 | 0.50 | 0.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Blueberry Markets is still competitive, but the spreads are wider across the board. When you’re paying a commission on top of these numbers, that extra spread hurts more.

| Broker | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| IC Markets | 3.5 | 3.5 | 2.5 | 2.75 |

| Blueberry Markets | 3.5 | 3.5 | N/A | N/A |

Raw accounts are supposed to offer the tightest possible pricing, so even small differences can impact your trading edge.

Let’s calculate exactly what it costs to trade EUR/USD with each broker on their Raw accounts. Both IC Markets and Blueberry Markets charge $3.50 per side ($7 round turn) for USD and AUD accounts.

For a 1 standard lot trade (100,000 units) at Blueberry, each pip is worth $10. At IC Markets, the 0.02 pip spread works out to just $0.20 in spread cost. When the $7 commission is added, it brings the total trade cost to $7.20 for IC and $8.00 for Blueberry Markets.

Trading with IC Markets saves you $0.80 per lot on EUR/USD alone and much more on the other pairs.

Verdict

IC Markets wins on overall trading costs, in my view. It offers the lowest spreads across both Standard and Raw accounts, plus more competitive commission rates in GBP and EUR.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

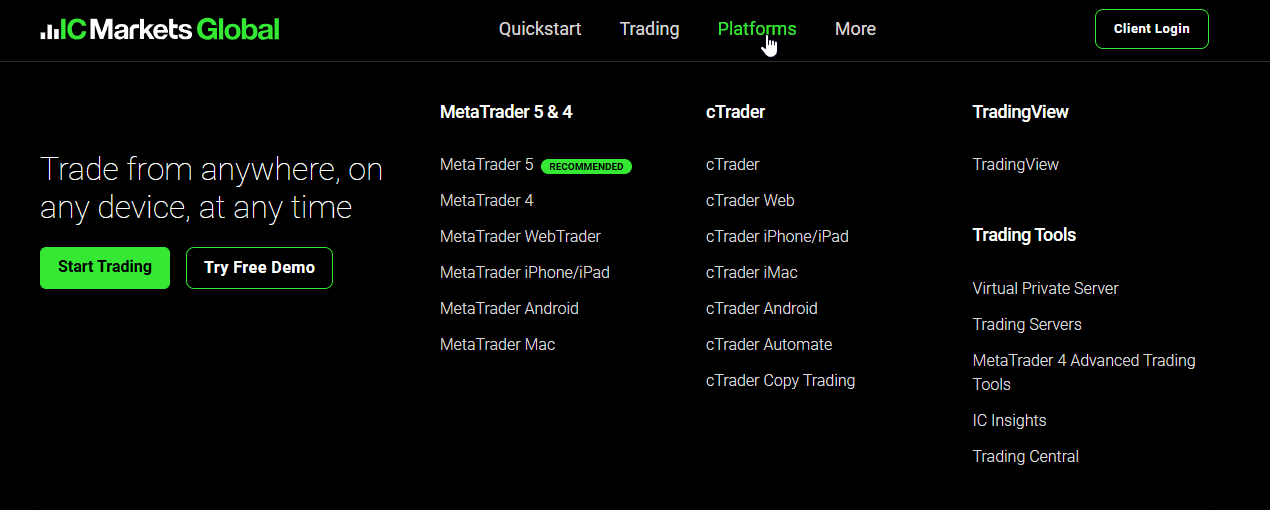

2. Better Trading Platform – IC Markets

IC Markets has one of the most flexible platform offerings I’ve seen from any broker. They give you access to MetaTrader 4, MetaTrader 5, cTrader, and TradingView. Most brokers will give you MT4 and MT5, maybe cTrader if you’re lucky, but IC is one of the few that integrates all four natively.

MT4 and MT5 remain the gold standard for most retail traders, but IC Markets sets itself apart as the best MT5 broker I’ve used.

The platform runs on IC’s Raw Pricing infrastructure, delivering institutional-grade liquidity and sub-200ms execution that actually makes high-frequency scalping and news trading practical.

You also get one-click trading, fully customisable charts, thousands of free and paid custom indicators, and Expert Advisors (EAs) for complete automation.

That said, MT4 is still a powerhouse, and IC Markets hasn’t left it behind. In fact, they’ve enhanced it with their Advanced Trading Tools that turn classic MT4 into a far more capable platform. This set of plugins add sentiment analysis, correlation tracking, mini terminals for precision trade sizing, alarm managers, and more.

Social and copy trading is one of IC Markets’ strong points. You can choose from Myfxbook AutoTrade, ZuluTrade, MetaTrader Signals, or cTrader Copy, each bringing something different to the table.

Myfxbook lets you mirror strategies from traders with verified track records, complete with stats you can dig into before committing. ZuluTrade has a massive global community, where you can rank and filter signal providers by risk, returns, and consistency.

MetaTrader Signals is built right into MT4/MT5, making it seamless if you already trade on those platforms. And for the cleanest integration, cTrader Copy delivers real-time transparency on provider performance, costs, and risk.

Blueberry Markets offers MT4, MT5, TradingView, and their proprietary Blueberry X terminal.

MT4 and MT5 come fully equipped for expert advisor automation, backtesting, and technical trading. You get all the core MetaTrader features with stable execution. Unlike IC Markets, though, there’s no suite of advanced MetaTrader add-ons.

TradingView is a recent addition to the lineup. Blueberry now lets you trade directly from the TradingView interface, giving you access to some of the best charting tools in the industry. You’ll appreciate this if you prefer to build strategies around multi-timeframe analysis or Pine scripting.

For social and copy trading, Blueberry supports MetaTrader Signals and DupliTrade.

DupliTrade offers access to a curated range of professional strategies you can follow automatically. I found it beginner-friendly, although not as broad or community-driven as IC Markets’ combination of Myfxbook, ZuluTrade, and cTrader Copy.

| Trading Platform | IC Markets | Blueberry Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Verdict

IC Markets provides more advanced, fully integrated trading platforms, complete with professional-grade tools, automation capabilities, and a wide range of copy trading options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

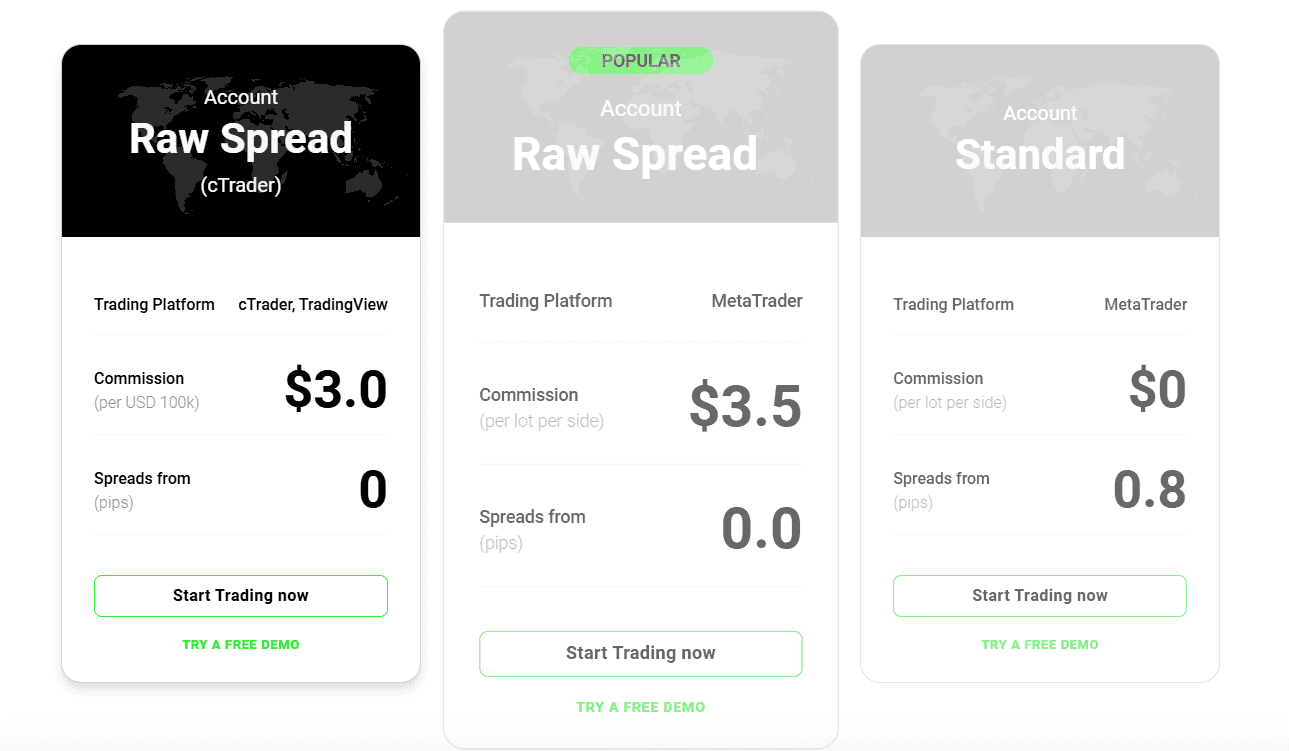

3. Superior Accounts And Features – IC Markets

The standout account at IC Markets is the Raw Spread on cTrader. It’s built for cost efficiency, with spreads starting from 0.0 pips and a commission of just $3 per 100k traded. It’s cheaper than most brokers I’ve come across and an obvious choice if you’re scalping or running high-frequency strategies.

cTrader’s execution engine is fast and gives you depth-of-market views that MT4 just doesn’t replicate. Pairing that with TradingView access gives you both charting precision and execution speed, which is rare to get in a single trading setup.

The Raw Spread account on MetaTrader charges slightly higher commission ($3.50 per side) but spreads are still ultra-tight. And for most retail traders, especially those who’ve been using MT4 for years, it feels familiar and easy to automate. I’ve used this account with multiple EAs, and IC’s infrastructure handles the load without freezing or rejecting orders.

And if you’re trading actively on a Raw Spread account, every trade you place earns you rebates on your commissions.

I tend to recommend the Standard account If you’re not trading with volume and just want a simpler pricing structure. It’s commission-free with wider spreads starting at around 0.8 pips.

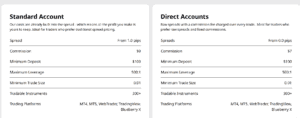

Blueberry Markets

Like IC, Blueberry Markets mainly offers the Standard (commission-free) account and the Direct account which is the equivalent of a Raw Spread account. Spreads on the Standard account start from 1.0 pips. On the Direct account it’s from 0.0 pips, with a $7 round-turn commission per lot and up to 500:1 leverage.

Both brokers reward active traders, but they go about it differently. Blueberry’s Premium and Premium+ accounts unlock tailored perks like exclusive rebates, dedicated support, customised spreads, and even a personal sales trader.

IC’s Raw Trader Plus program offers a fixed rebate system for high-volume clients, letting you calculate exactly what you’ll earn back on your trading activity.

| IC Markets | Go Markets | |

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Verdict

IC Markets provides greater account flexibility as well as tighter spreads, lower commissions, no trading restrictions, and a structured rewards program.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

Blueberry Markets impresses with execution speeds that rival the fastest in the industry. With 88ms for limit orders and 94ms for market orders, the broker earned a top-10 spot in my tests. That kind of responsiveness shows up in cleaner fills and less slippage, especially when markets get choppy.

IC Markets is a step behind on paper at 134ms and 153ms, but in practice, it’s still fast enough for most trading styles. When paired with cTrader or DMA access, it performs on par with some of the best ECNs available.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

| Blueberry Markets | 88ms | 6/36 | 94ms | 7/36 |

But trading isn’t just about looking at the milliseconds. Platform feel, chart responsiveness, and how seamlessly your tools fit together can matter just as much.

For me, this is where IC Markets actually outshines Blueberry as their platform suite is simply more advanced.

When I’m trading across multiple assets or running side-by-side systems on MT5 and TradingView, IC just gives me more control. The automation options are wider, the copy trading ecosystem is deeper, and the infrastructure feels professional-grade.

Verdict

IC Markets offers a more complete trading experience with fast and reliable execution, deeper platform functionality, advanced tools, and flexible automation.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – IC Markets

In forex trading, establishing a secure and transparent environment relies heavily on strong trust and regulation.

IC Markets Trust Score

Blueberry Markets Trust Score

Regulations

When assessing a broker’s trust and regulation, I look beyond the logo in the footer to the real safeguards behind their operation.

That means asking the important questions: Who regulates them? Where is my money held? How do they handle extreme volatility, slippage, or market shocks? Digging into these details is the only reliable way to judge a broker and far more telling than any Trustpilot rating.

IC Markets is well-regulated by ASIC in Australia, CySEC in Europe, plus offshore registrations in Seychelles and the Bahamas. Client funds are held in segregated accounts at NAB and Westpac, both big-name Aussie banks. And they use SSL encryption for payment security, something you’d think is standard in 2026, but not every broker offers that.

This earns them a modest trust score of 80 out of 100 in my books with especially high marks for their good reputation.

Blueberry Markets holds regulation from ASIC, giving them credibility in a market where trust can be hard to earn. However, ASIC is their only top-tier license, and there’s no additional oversight from other Tier-1 or Tier-2 bodies to add layers of protection. This is why they have a lower trust score of just 46 out of 100 in my broker review.

But credit where it’s due, their user reviews are excellent at 92, and in my own dealings with them, they’ve earned that score by being highly accessible and responsive. They’ve built a loyal following, particularly among newer traders who value personal service over.

| IC Markets | Blueberry Markets | |

| Regulation | 2 Tier-1 Licences (ASIC + CySEC) | 1 Tier-1 Licences (ASIC) Tier-3 SVG-FSA |

| Segregated Accounts | NAB & Westpac | NAB |

| Payment Security | Secure Socket Layer (SSL) | ✘ |

| Negative Balance Protection | ✘ | ✘ |

| Stop-out Level | 50% | ✘ |

Reviews

As shown below, IC Markets holds an exceptional Trustpilot rating of 4.8 out of 5, based on over 46,000 reviews. Blueberry Markets has a strong Trustpilot score of 4.7 out of 5, from around 2,900 reviews. Both brokers are highly rated, but IC Markets leads in review volume and consistency, suggesting broader trust and satisfaction across a larger user base. Blueberry Markets still shines with excellent service and trader-friendly conditions, making it a favorite among many retail traders.

Verdict

IC Markets operates with the kind of regulatory framework, security infrastructure, and user transparency that gives you confidence when real money is on the line.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

Google search volume is one of the best ways to measure broker popularity because it reflects genuine trader interest in real time. I prefer it over awards or review scores since it shows which names traders are actively seeking out when they’re ready to choose a broker and sign up.

Looking at the numbers, IC Markets isn’t just ahead, it’s everywhere. The Australian broker shows consistent demand across every major region I’d expect from a broker with global reach.

| Country | IC Markets | Blueberry Markets |

|---|---|---|

| United Kingdom | 33,100 | 1,900 |

| South Africa | 9,900 | 480 |

| Thailand | 8,100 | 110 |

| India | 8,100 | 880 |

| Vietnam | 8,100 | 260 |

| Australia | 6,600 | 1,000 |

| United States | 6,600 | 1,300 |

| Spain | 6,600 | 320 |

| Germany | 5,400 | 1,000 |

| Pakistan | 5,400 | 320 |

| Brazil | 4,400 | 210 |

| France | 4,400 | 1,600 |

| United Arab Emirates | 4,400 | 170 |

| Morocco | 4,400 | 210 |

| Malaysia | 3,600 | 480 |

| Colombia | 3,600 | 170 |

| Italy | 3,600 | 320 |

| Singapore | 3,600 | 480 |

| Indonesia | 3,600 | 320 |

| Nigeria | 3,600 | 480 |

| Poland | 2,900 | 110 |

| Sri Lanka | 2,900 | 50 |

| Kenya | 2,400 | 110 |

| Mexico | 2,400 | 90 |

| Hong Kong | 2,400 | 70 |

| Philippines | 2,400 | 590 |

| Netherlands | 2,400 | 320 |

| Canada | 2,400 | 1,900 |

| Algeria | 2,400 | 70 |

| Bangladesh | 1,900 | 170 |

| Saudi Arabia | 1,900 | 50 |

| Peru | 1,600 | 30 |

| Egypt | 1,600 | 70 |

| Switzerland | 1,600 | 170 |

| Turkey | 1,300 | 210 |

| Argentina | 1,300 | 50 |

| Japan | 1,300 | 70 |

| Sweden | 1,300 | 140 |

| Taiwan | 1,000 | 30 |

| Ecuador | 1,000 | 30 |

| Dominican Republic | 1,000 | 50 |

| Portugal | 1,000 | 110 |

| Uzbekistan | 1,000 | 70 |

| Cyprus | 880 | 50 |

| Ireland | 880 | 90 |

| Ghana | 880 | 70 |

| Mongolia | 720 | 10 |

| Chile | 720 | 20 |

| Uganda | 720 | 50 |

| Venezuela | 720 | 30 |

| Ethiopia | 720 | 30 |

| Austria | 720 | 170 |

| Greece | 720 | 50 |

| Jordan | 590 | 20 |

| Mauritius | 480 | 20 |

| Costa Rica | 390 | 10 |

| Tanzania | 320 | 40 |

| Bolivia | 260 | 10 |

| Botswana | 260 | 50 |

| Panama | 260 | 10 |

| New Zealand | 210 | 260 |

| Cambodia | 170 | 20 |

33,100 1st | |

1,900 2nd | |

9,900 3rd | |

480 4th | |

8,100 5th | |

110 6th | |

6,600 7th | |

1,000 8th |

It’s the kind of visibility you don’t buy with ads alone. It comes from scale, longevity, and word-of-mouth from real traders. People talk about IC Markets because they’ve used them, and more importantly, they’ve stuck with them.

Verdict

IC Markets has more reach, more recognition, and far more global momentum.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – IC Markets

IC Markets’ product range feels like walking into a supermarket that stocks everything on your list, plus a few extras you didn’t know you wanted.

The forex aisle alone is stacked with 61 pairs to Blueberry’s 38, meaning you can trade the usual majors and also niche crosses. Indices follow the same trend with IC offering 26, from the US30 and GER40 to more regional plays, compared to Blueberry’s 19.

In commodities, both brokers give you metals like gold and silver, while also adding soft commodities and five energies. Crypto traders are catered for as well with 18 digital assets at IC Markets versus just 10 at Blueberry.

The real knockout is in share CFDs where IC Markets offers over 2,100 global equities while Blueberry has around 300.

Additionally, IC offers bonds, treasuries, futures, and investment products, giving you room to pivot into macro trades. Blueberry’s unique card here is ETFs (140 of them), making it the better pick if you want to track entire sectors in one trade.

| CFDs | IC Markets | Blueberry Markets |

|---|---|---|

| Forex Pairs | 61 | 38 |

| Indices | 23 Spot Indices 3 Index Futures | 19 |

| Commodities | 4 Precious Metals (gold vs 6 flats) 3 Energies 3 Energy futures 14 Soft commodity futures | 9 Metals (Gold x 7 Currencies) (Silver x 6 Currencies) 3 Energies |

| Cryptocurrencies | 18 | 10 |

| Share CFDs | 2100+ | 300+ |

| ETFs | 3 NASDAQ 33 NYSE | 140 |

| Bonds | 12 | No |

| Futures | Yes | No |

| Treasuries | Yes | No |

| Investments | Yes | No |

Verdict

If you’re after product diversity, IC Markets offers market access few retail brokers can match, letting you pivot into different instruments without juggling multiple accounts.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

IC Markets provides the kind of in-depth educational resources I value. Their content is well-structured and goes way beyond just a few static articles.

When I first started testing their content, I used the beginner guides just to revisit fundamentals. There are tutorial videos for beginners with full walkthroughs for both MetaTrader and cTrader.

I also like the podcast series that’s ideal when you’re away from the desk but still want to absorb something practical.

Nowadays I gravitate more towards the live stuff or the platform-specific content when I’m building out strategies or testing on new platforms. For example, during heavy macro weeks, I rely on Web TV streams broadcasting daily from the New York Stock Exchange for quick, high-level market scans.

I’ve also joined their live webinars, and I’ll be honest, they’re more insightful than most broker-hosted events. The analysts don’t just rehash headlines, they break down strategies and walk through trades they’re watching.

Blueberry Markets’ Knowledge Hub feels designed with newer traders in mind, and that’s not a bad thing. The Academy is broken down into beginner, intermediate, and advanced levels, which I actually appreciated when I was mapping out a curriculum for beginners. Video tutorials are available too, explaining MetaTrader functions very clearly.

However, I did find myself wishing there were more advanced or live elements, like what IC offers with their webinars and podcast.

Verdict

If you’re serious about growing as a forex trader, IC Markets has the stronger, more dynamic education offering. But if you’re just getting started, Blueberry Markets is where I’d send you for their simplicity and clarity.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Superior Customer Service – Tie

I tested both IC Markets and Blueberry Markets customer service enough to say this one’s genuinely too close to call.

Support is available 24/7 across live chat, phone, and email, and in multiple languages with the two brokers. I’ve contacted them during off-peak hours and during market spikes, and in both cases, response times were fast.

Live chat usually connects within seconds, and when I tested their phone support, I was impressed by how little wait time there was.

They’ve also built out a detailed Help Centre, which is great when you just need a quick self-service answer about leverage changes, platform settings, or account types.

One detail I noticed and really liked with IC Markets is how they handle regional service. For example, Chinese clients can get localised support from 9am to 11pm Beijing time, with both email and live chat staffed during those hours.

| Feature | IC Markets | Blueberry Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Verdict

It’s a tie for me here because both brokers provide fast and responsive multilingual support with round-the-clock availability.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

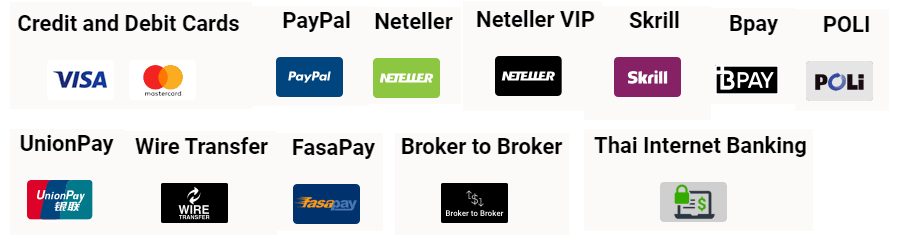

10. Better Funding Options – IC Markets

When funding your trading account or withdrawing profits, you want flexibility, speed, and minimal friction.

IC Markets support an impressively wide range of methods including credit/debit cards, Wire Transfers, PayPal, Skrill, Neteller, and UnionPay. They even offer more region-specific solutions like Thai and Vietnamese internet banking, Bpay, POLi, and Rapidpay.

Most of these are processed instantly, and the broker supports several base currencies so you don’t have to worry about recurring conversion fees. The base currencies include: AUD, USD, EUR, JPY, SGD, GBP, CAD, NZD, HKD, CHF, and RMB.

A feature I have to mention is the broker-to-broker transfer option. If you’re moving from another brokerage, IC can facilitate the transition without the usual red tape.

With Blueberry Markets you’ve got standard options like credit/debit cards, bank wire, Skrill, Neteller, and crypto (but only if you deposited via crypto). Crypto, Skrill and Neteller options are not available to European clients or those in unsupported countries.

The card funding process follows a FIFO refund policy, which is common, but it means withdrawals can get a bit messy if you’ve deposited across multiple cards or methods.

I’ve also noticed that the actual processing time can vary, especially with international wires, which can take 3 to 7 business days and come with a $25 fee imposed by banks.

Blueberry does offer some region-specific methods through their client portal, but it’s not always transparent until you log in, and the choices aren’t nearly as broad as IC’s.

| Funding Option | IC Markets | Blueberry Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Verdict

IC Markets gives you far more funding options, better currency coverage, and faster processing.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Blueberry Markets

Minimum deposit requirements is another important area to check when comparing brokers because it sets the tone for accessibility. If you’re testing a strategy, starting small, or just getting your feet wet, you don’t want to be forced to throw in more capital than you’re ready to risk.

In this case, Blueberry Markets clearly has the more accessible entry point, with a minimum deposit of $100. That’s also the recommended starting amount, and from experience, it’s enough to open an account and get a feel for the platform with minimal risk.

IC Markets has a $200 minimum deposit across all account types. It’s not unreasonable and actually well within industry norms. It gives you more room to manage trades with realistic stop-loss levels, especially when spreads are tight and leverage is high.

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| Blueberry Markets | $100 | $100 |

Verdict

Blueberry Markets’ lower minimum deposit makes it more flexible for entry-level traders, smaller accounts, and strategy sandboxing.

Is IC Markets or Blueberry Markets The Best Broker?

IC Markets dominates across nearly every major category we’ve looked at. You get consistently lower spreads, more trading platforms, a broader product range, and more.

| Categories | IC Markets | Blueberry Markets |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | Yes |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

IC Markets: Best For Beginner Traders:

While Blueberry might seem more beginner-friendly on the surface, IC Markets actually gives new traders more room to grow. You’ve got a full suite of educational resources and trading tools you won’t outgrow. The learning curve might be a touch steeper, but the ceiling is much higher.

IC Markets: Best For Experienced Traders:

IC Markets is built for pros, with raw pricing, ultra-low latency, full automation support, and enough instrument coverage to run multi-asset strategies without switching brokers.

FAQs Comparing IC Markets Vs Blueberry Markets

Does Blueberry Markets or IC Markets Have Lower Costs?

IC Markets typically offers lower overall trading costs. While Blueberry offers low raw account commissions on USD, IC makes up the difference with tighter spreads across both standard and raw accounts. On high-volume pairs like EUR/USD, IC’s spreads can drop as low as 0.1 pips. For a full breakdown of who’s offering the best rates, Check out this guide on the Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

If we’re talking strictly MetaTrader 4, IC Markets edges it out. Their MT4 isn’t just the plain version but you get 20+ extra trading tools, better order management add-ons, and access to deep liquidity that really shows when you’re scalping or running EAs. Basically, it feels more geared toward traders who want to push MT4 to its limits instead of just using the basic setup. For a closer look at the top MT4 setups in the market, check out this list of the best MT4 brokers.

What Broker is Superior For Australian Forex Traders?

If you’re trading from Australia, IC Markets is the clear pick. They’re ASIC-regulated, have deep local roots, and offer more firepower across platforms, tools, and liquidity. Add in their long-standing reputation and institutional-grade infrastructure and you’ve got a broker built for serious Aussie traders. Check out our best Forex Brokers In Australia.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

If I am in Australia, can I still register as an international trader to gain access to higher leverage with IC Markets?

ASIC regulation requires Australian traders to use an ASIC regulated broker. So legally speaking, you cannot register with an offshore broker.

Is IC Markets islamic?

No but they do offer a swap-free account for Islamic traders