IC Markets vs Eightcap: Which One Is Best?

In this review, we will lay out both IC Markets and Eightcap impressive trading platforms and features – IC Markets truly excels with their ultra-low spreads, while Eightcap stands out with their strong crypto CFD offerings. However, when it comes to their overall performance, IC Markets takes the win in this review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are six key differences between IC Markets and Eightcap:

- IC Markets offers lower standard account spreads starting from 0.6 pips, while Eightcap’s start from 1 pip.

- IC Markets is more popular and has a better Trustpilot score

- IC Markets is regulated in more regions, including ASIC, CySEC, and FSA.

- Eightcap is regulated by ASIC and SCB.

- Eightcap’s Raw Account provides superior spreads.

- Both brokers charge the same commission on MetaTrader 4 and 5, but their rates differ for other base currencies.

1. Lowest Spreads And Fees – IC Markets

Let us dig further into both IC Markets and Eightcap’s lowest spreads and fees. IC Markets and Eightcap are prominent forex brokers in the forex industry that provide traders with their competitive trading features and their user-friendly platforms. Both brokers are known for their tight spreads, low commissions, and most of all durable and reliable account options, these two cater to traders who are new and seasoned in the market, this supports a diverse strategies across all major currencies like AUD, GBP, EUR and USD.

Spreads

Spreads significantly affect trading costs, which makes them a critical factor in broker selection. For IC Markets, they offer RAW spreads which starts at 0.02 pips for EUR/USD and 0.03 pips for AUD/USD. Also, they come with average RAW spread of 0.29 pips across major pairs is among the industry’s lowest at the moment. Eightcap, on the other hand, their RAW spreads begin at 0.06 pips for EUR/USD and 0.27 pips for AUD/USD. However, they have slightly higher average RAW spread of 0.42 pips but still remain competitive.

| RAW Account | IC Markets Spreads | Eightcap Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.29 | 0.42 | 0.75 |

| EUR/USD | 0.02 | 0.06 | 0.22 |

| USD/JPY | 0.14 | 0.23 | 0.38 |

| GBP/USD | 0.23 | 0.23 | 0.53 |

| AUD/USD | 0.03 | 0.27 | 0.47 |

| USD/CAD | 0.25 | 0.2 | 0.56 |

| EUR/GBP | 0.27 | 0.3 | 0.55 |

| EUR/JPY | 0.3 | 0.59 | 0.80 |

| AUD/JPY | 0.5 | 0.49 | 0.96 |

| USD/SGD | 0.85 | 1.37 | 2.29 |

Commission Levels

Commission structure further impact overall trading expenses and accessibility for traders. In this case, IC Markets charges $3.50 per lot across all accounts with a $200 minimum deposit. In addition, their transparent structure ensures uniform rates across currencies like USD, GBP and EUR. For Eightcap, they charge $3.0 per lot but requires only a $100 minimum deposit. Their offers are slightly lower in commissions for GBP-based accounts, which appeals to selective traders.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

| Eightcap | $3.50 | $3.50 | £2.25 | €2.75 |

Our expert team created a fee calculator for transparent trading costs, allowing you to compare fees and make informed decisions for better trade value.

Standard Account Fees

Standard account fees are vital for cost-conscious traders evaluating long-term profitability. For IC Markets, they offer spreads of 0.62 pips for EUR/USD and 0.77 pips for AUD/USD. IC Markets also excel with cost-effective spreads for their frequent trading on major pairs. On the other hand, Eightcap offers spreads of 1.00 pips for EUR/USD and 1.20 pips for AUD/USD are somewhat higher. In addition, their lower deposit requirements balance the cost for new traders who are entering the forex market.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.00 | 1.20 | 1.00 | 1.00 | 1.10 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Our team’s analysis indicates that IC Markets and Eightcap offer unique benefits tailored to traders’ preferences. IC Markets excels in ultra-low spreads and transparent commissions, while Eightcap stands out with accessibility and cryptocurrency CFDs. To sum it all up, they provide traders the tools to thrive in the fast-paced forex industry.

Our Lowest Spreads and Fees Verdict

IC Markets ourperforms the contender in this portion thanks to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

Here is what we will be covering here in this review, both IC Markets and Eightcap’s best trading platform. Clearly, IC Markets and Eightcap are reputable forex brokers, they offer diverse trading platforms that cater to traders’ needs. Both brokers feature access to MetaTrader 4 and MetaTrader 5, but only IC Markets provide cTrader. this comparison highlights both their performance across MetaTrader capabilities, advanced platforms, and copy trading services, which focuses on all major currencies such as AUD, GBP, EUR, and USD.

| Trading Platform | IC Markets | Eightcap |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

Our expert team developed an interactive questionnaire with six key questions to help match you with the ideal trading platform tailored to your trading style.

MetaTrader

MetaTrader platforms are essential to traders in forex trading industry, they are known for their use-friendly interfaces and advanced analytical tools. Here’s how IC Markets and Eightcap integrate these platforms. For IC Markets, this broker provides MetaTrader 4 and MetaTrader 5, this ensures low latency with servers hosted in the Equinix NY4 data center. Their MT5 features RAW pricing, with deep liquidity, and Level II pricing for enhanced market depth.

Meanwhile, Eightcap offers MetaTrader 4 and MetaTrader 5, but emphasises customisability and extensive CFD cryptocurrency options. Their MT5 includes Depth of Market, unlimited charts, and advanced analytical tools, they’re all perfect for traders’ flexible strategies.

Advanced Platforms

Advanced trading platforms drive innovation, this offers traders enhanced funtionalities to maximise performance. For IC Markets, this broker features the exclusive cTrader platform for superior chart customisation and depth-of-market analytics. They also include in their platform TradingView integration for advanced charting and real-time insights. Meanwhile, Eightcap supports TradingView integration, this enables seamless charting and strategy development. They are also focused on a straight forward platform which offerings, this appeals to traders who are looking for simplicity without compromise.

Copy Trading

Copy trading platform empowers traders by allowing them to replicate successful strategies, fostering growth and learning. We see here that IC Markets partners with ZuluTrade, Myfxbook AutoTrade, and MQL5 for extensive copy trading options. This feature attracts traders who are keen on exploring markets, who are particular in the currencies of AUD, GBP, EUR, and USD. For Eightcap, they offer copy trading via platforms like Myfxbook AutoTrade, this ensures accessible and streamlined processes. This is designed for traders who are looking to integrate into the forex market with ease.

Ultimately, IC Markets and Eightcap excel in providing versatile tools and platforms. In this case, IC Markets shines with their advanced options like cTrader, while Eight stands out for accessibility and innovation in CFD cryptocurrency trading. We see here that both brokers truly enhance trader preferences for all traders in the market.

Our Better Trading Platform Verdict

IC Markets is in its golden age in this category due to their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – A Tie

This section will provide more insights and information on both brokers’ superior accounts and features. Evidently, IC Markets and Eightcap are recognised forex brokers in the industry for forex trading. They both offer comprehensive trading features which is designed too enhance the trading journey of each traders in the market. With their competitive spreads, l ow commissions and both of their user-centric platforms, these two brokers truly empower trader – both new and seasoned traders – to effectively navigate the dynamic forex markets.

Both IC Markets and Eightcap excel in delivering value through their superior accounts and features. We see here that IC Markets offers Islamic SWAP-free accounts for Sharia-compliant trading and ultra-tight spreads like 0.02 pips for EUR/USD. While Eightcap provides RAW spread accounts, which excels in GBP and EUR commission structures. Both brokers maintain competitive $7.00 round-turn commissions and support advanced trading on MetaTrader 4 and MetaTrader 5. IC Markets on the other hand, also highlights accessibility through SWAP-free options, while Eightccap appeals to traders with its compelling cryptocurrency CFDs. This evaluates spreads, costs, and tailored features, absolutely, is the key to choosing the most suitable broker.

| IC Markets | Eightcap | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

So for our team’s final analysis, both IC Markets and Eightcap provide for to a diverse trading preferences with competitive pricing and an advanced tool. Here, IC Markets stands out for their ultra-tight spreads and SWAP-free solutions, while Eightcap impresses with accessible accounts and cryptocurrency CFDs. To sum it all up, both brokers’ features and platforms enhance traders’ success in the business, which blends cost-efficiency and innovation in the forex markets.

Our Superior Accounts and Features Verdict

In this section, undoubtedbly, both IC Markets and Eightcap is riding high with their superior accounts and features.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

A rewarding forex trading experience requires balancing broker offerings with trader needs. Brokers should provide competitive spreads, low fees, advanced platforms, and excellent support. Traders need real-time data, fast execution, and effective tools. When aligned, these elements create an efficient and profitable trading environment.

When it comes to trading experiences and user-friendliness, both IC Markets and Eightcap excel in their unique strengths, catering to a diverse array of trader preferences. A careful analysis and hands-on testing reveal that IC Markets distinguishes itself with an outstanding MetaTrader 5 (MT5) platform. Its seamless execution and advanced features make it an ideal choice for those engaged in algorithmic trading. Meanwhile, Eightcap leads in TradingView integration, providing traders with an intuitive, data-rich charting environment.

- Best MT5 Experience: IC Markets stands out with its MetaTrader 5 offering, providing a seamless trading experience.

- Best TradingView Experience: EightCap takes the lead with its integration of TradingView, offering traders a comprehensive charting and analysis tool.

- Best ECN Account: Eightcap shines with its ECN account offering, ensuring traders get the best possible spreads.

- Best Standard Account: IC Markets offers a superior standard account, catering to a wide range of traders from beginners to professionals.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

| Eightcap | 143ms | 19/36 | 139ms | 17/36 |

For account types, Eightcap’s ECN account stands out for its ultra-tight spreads and direct market access, making it a top choice for scalpers and high-frequency traders. On the other hand, IC Markets’ Standard Account is an excellent option for traders seeking competitive spreads without commission fees. Both brokers have made remarkable strides in enhancing user experience, offering traders access to top-tier platforms, cutting-edge tools, and seamless execution to elevate their trading strategies.

Our Best Trading Experience and Ease Verdict

Unquestionably, IC Markets takes the lead in this niche as a consequence of their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

For brokers in the industry of forex trading, having a secure trading environment is crucial for successful forex brokerages, with strong regulation enhancing trader confidence. Regulated brokers protect clients from fraud and instability, fostering trust and encouraging market participation. Top-tier regulatory credentials help brokers attract clients and build credibility, allowing traders to focus on strategies without safety concerns. This review evaluates how IC Markets and Eightcap perform in trust and regulation, highlighting their compliance and reliability.

Eightcap Trust Score

IC Markets Trust Score

Regulations

Both IC Markets and Eightcap boast over a decade of experience in the forex industry, making them formidable contenders when it comes to reputation and regulatory authority. IC Markets, established in 2007, has grown into a globally recognized brand, boasting strong regulatory oversight in multiple regions. Eightcap, founded in 2009, has also built a solid presence, particularly in Australia. However, in terms of market recognition, IC Markets holds a distinct advantage, attracting significantly higher website traffic, with an average of 3.3 million visits per month compared to Eightcap’s 450,000. This significant visibility underscores IC Markets’ bolstered global presence and heightened brand recognition among traders.

| IC Markets | Eightcap | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | FCA (UK) CYSEC (Cyprus) ASIC (Australia) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | SCB (Bahamas) |

Trust and regulation are critical factors in choosing a forex broker. IC Markets is regulated by ASIC (Australia), CySEC (Europe), and FSA (Seychelles), offering traders greater coverage in key financial jurisdictions. Eightcap, on the other hand, is regulated by ASIC and SCB (Bahamas), meaning its regulatory framework is slightly more limited. Traders in Europe and the UK can significantly enhance their trading experience with IC Markets, thanks to its CySEC regulation, which provides an added layer of credibility and security. This makes IC Markets a standout choice in these regions. Additionally, the broker enjoys an outstanding Trustpilot rating of 4.9, derived from over 20,000 reviews, further solidifying its standing as a dependable trading partner. In comparison, Eightcap, while having a commendable rating of 4.4, has significantly fewer reviews, totaling under 500. While both brokers offer strong regulatory backing, IC Markets’ wider global reach and higher level of trust among traders give it a distinct edge.

Reviews

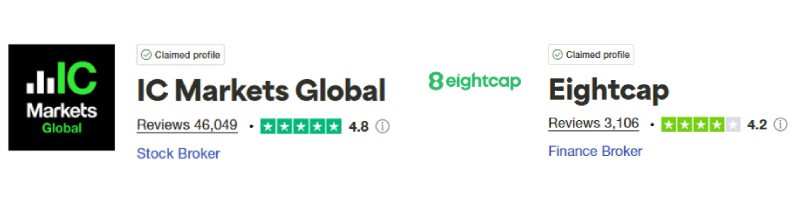

As show below, IC Markets holds an excellent rating of 4.8 out of 5, based on over 46,000 reviews. Eightcap, meanwhile, has a Trustpilot score of 4.2 out of 5, from around 3,100 reviews. IC Markets enjoys broader acclaim and a more consistent track record of customer satisfaction compared to Eightcap, according to Trustpilot reviews.

Our Stronger Trust and Regulation Verdict

We have a draw here in this category. Both IC Markets and Eightcap is in its golden age due to their stronger trust and regulation.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than Eightcap. On average, IC Markets sees around 246,000 branded searches each month, while Eightcap gets about 40,500 — that’s 83% fewer.

| Country | IC Markets | Eightcap |

|---|---|---|

| United Kingdom | 33,100 | 1,600 |

| South Africa | 9,900 | 480 |

| Thailand | 8,100 | 9,900 |

| India | 8,100 | 1,300 |

| Vietnam | 8,100 | 170 |

| Australia | 6,600 | 2,400 |

| United States | 6,600 | 1,900 |

| Spain | 6,600 | 720 |

| Germany | 5,400 | 1,000 |

| Pakistan | 5,400 | 320 |

| Brazil | 4,400 | 1,000 |

| France | 4,400 | 720 |

| United Arab Emirates | 4,400 | 210 |

| Morocco | 4,400 | 210 |

| Malaysia | 3,600 | 880 |

| Colombia | 3,600 | 720 |

| Italy | 3,600 | 590 |

| Indonesia | 3,600 | 590 |

| Singapore | 3,600 | 390 |

| Nigeria | 3,600 | 390 |

| Poland | 2,900 | 260 |

| Sri Lanka | 2,900 | 50 |

| Kenya | 2,400 | 170 |

| Mexico | 2,400 | 320 |

| Hong Kong | 2,400 | 170 |

| Netherlands | 2,400 | 480 |

| Philippines | 2,400 | 210 |

| Canada | 2,400 | 2,400 |

| Algeria | 2,400 | 110 |

| Bangladesh | 1,900 | 140 |

| Saudi Arabia | 1,900 | 70 |

| Peru | 1,600 | 140 |

| Egypt | 1,600 | 90 |

| Switzerland | 1,600 | 170 |

| Turkey | 1,300 | 110 |

| Argentina | 1,300 | 590 |

| Japan | 1,300 | 140 |

| Sweden | 1,300 | 320 |

| Ecuador | 1,000 | 110 |

| Taiwan | 1,000 | 140 |

| Dominican Republic | 1,000 | 320 |

| Portugal | 1,000 | 210 |

| Uzbekistan | 1,000 | 90 |

| Cyprus | 880 | 90 |

| Ghana | 880 | 70 |

| Ireland | 880 | 110 |

| Mongolia | 720 | 70 |

| Chile | 720 | 140 |

| Venezuela | 720 | 110 |

| Ethiopia | 720 | 30 |

| Uganda | 720 | 70 |

| Austria | 720 | 140 |

| Greece | 720 | 90 |

| Jordan | 590 | 30 |

| Mauritius | 480 | 20 |

| Costa Rica | 390 | 30 |

| Tanzania | 320 | 30 |

| Bolivia | 260 | 30 |

| Botswana | 260 | 30 |

| Panama | 260 | 20 |

| New Zealand | 210 | 210 |

| Cambodia | 170 | 90 |

33,100 1st | |

1,600 2nd | |

9,900 3rd | |

480 4th | |

8,100 5th | |

9,900 6th | |

6,600 7th | |

2,400 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 259,000 for Eightcap.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – IC Markets

A wide and various range of trading instruments is important for traders to maximize opportunities across market conditions. Brokers offering a wide selection of CFDs—such as forex, commodities, indices, and cryptocurrencies—allow for portfolio diversification and adaptability to economic trends. This access helps both short-term and long-term traders navigate market fluctuations, enhancing profit potential and accommodating different trading styles and risk appetites.

In the dynamic and ever busy industry of forex trading, having full access to a wide array of products and CFD markets is key to executing a diverse strategy and responding to dynamic market conditions. We can see that both IC Markets and Eightcap cater to this demand by offering a broad selection of financial instruments, empowering traders to tap into various asset classes. Whether looking to trade forex pairs, commodities, indices, or cryptocurrencies, traders have the flexibility to capitalize on multiple opportunities and manage their risk exposure effectively.

| CFDs | IC Markets | Eightcap |

|---|---|---|

| Forex Pairs | 61 | 55 |

| Indices | 23 Spot Indices 3 Index Futures | 30 |

| Commodities | 4 Precious Metals (gold vs 6 flats) 3 Energies 3 Energy futures 14 Soft commodity futures | 10 Commodities Softs and Metals |

| Cryptocurrencies | 18 | 33 Crypto 250 Crypto Derivatives |

| Share CFDs | 2100+ | 150 |

| ETFs | 3 NASDAQ 33 NYSE | No |

| Bonds | 12 | No |

| Futures | Yes | No |

| Treasuries | Yes | No |

| Investments | Yes | No |

For this topic, IC Markets, renowned for its extensive market coverage, provides an impressive range of CFDs, while Eightcap also offers competitive access to global markets. Both brokers ensure traders can explore different asset classes, whether through tight spreads on forex pairs or a range of CFDs on indices and commodities. This diverse offering enhances traders’ ability to optimize their portfolios and apply a variety of trading strategies to capitalize on the latest market trends.

Our Top Product Range and CFD Markets Verdict

IC Markets outshines the challenger in this niche due to their top product range and CFD markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

Access to quality educational resources is crucial in forex trading. Top brokers provide tools like webinars, articles, and courses to help traders improve skills and stay informed. These resources equip traders to make informed decisions and navigate the market effectively, promoting continuous growth and long-term success.

IC Markets Education Overview:

- Comprehensive Forex Education: IC Markets offers a robust educational section catering to both beginners and experienced traders.

- Webinars: IC Markets hosts regular webinars that cover topics ranging from basic trading strategies to advanced techniques, helping traders stay informed.

- Market Analysis: The broker provides insightful articles on market trends, offering traders valuable knowledge to make informed decisions.

- Trading Tools: The platform features a collection of essential trading tools, including calculators, indicators, and other resources to support traders’ strategies.

- Economic Calendar: Traders can easily access a detailed economic calendar, ensuring they stay updated on key financial events that may impact the market.

- Video Tutorials: IC Markets provides a comprehensive library of video tutorials covering various aspects of trading, offering visual and practical learning.

Eightcap Education Overview:

- Education Hub: Eightcap offers a well-rounded education hub with a variety of resources designed to support traders at all levels.

- Webinars: Their webinars aim to enhance traders’ knowledge, featuring content that caters to both beginners and seasoned traders.

- Market Insights: Eightcap regularly provides market insights, offering in-depth analysis of key movements and trends to aid traders in making informed decisions.

- Trading Guides: The broker also offers detailed trading guides, which cover different strategies, techniques, and how to apply them effectively.

- Economic Calendar: Eightcap features a user-friendly and detailed economic calendar that helps traders stay informed about upcoming market-moving events.

- Video Tutorials: Eightcap’s educational offerings also include video tutorials that cover a broad range of forex trading topics, providing traders with accessible and informative content.

In summary, both IC Markets and Eightcap offer extensive educational resources designed to equip traders with essential tools for success. From webinars to market insights and trading tools, each broker provides a range of materials that cater to different levels of traders. IC Markets shines with its comprehensive trading tools and detailed market analysis, while Eightcap stands out with its educational hub and in-depth trading guides. Both brokers prioritize education to ensure their clients are well-prepared for the dynamic forex market.

Our Superior Educational Resources Verdict

Based on our in-depth research, IC Markets come up trumps owing to their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Superior Customer Service – IC Markets

In forex trading, for traders having access to quality educational resources like webinars, articles, and courses is essential for success. These materials enhance trading strategies, support informed decisions, and foster continuous growth, helping traders build confidence and achieve long-term success.

Customer service plays a very important role in the trading experience, as traders often require assistance with technical challenges, account management, and market insights. Both IC Markets and Eightcap understand this significance and have invested heavily in delivering exceptional customer support.

From our testing, we’ve noted several key features that stand out in the customer service offerings of both brokers:

| Feature | IC Markets | Eightcap |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

IC Markets excels by providing round-the-clock live chat support, allowing traders from any time zone to receive assistance whenever they require it. They also offer email and phone support for more in-depth inquiries. On the other hand, while Eightcap does not provide 24/7 live chat, it guarantees a knowledgeable and responsive support team that is available during business hours to address queries promptly. Both brokers are dedicated to delivering exceptional customer service, significantly enhancing the overall trading experience.

Summary:

- IC Markets: 24/7 live chat, phone, and email support.

- Eightcap: Knowledgeable staff available during business hours, live chat not 24/7. Both brokers prioritize strong customer service, offering reliable support to meet traders’ needs.

Our Superior Customer Service Verdict

Based on our team’s scores and testing, IC Markets come out on top in this niche due to their superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – Eightcap

Funding options that are spotless enhance the forex trading experience, allowing efficient deposits and withdrawals. Leading brokers offer diverse methods like bank transfers, credit cards, e-wallets, and cryptocurrencies. A broker’s commitment to various, low-fee options promotes easy account management. Fast processing and secure channels improve trading, enabling traders to focus on strategy instead of financial logistics.

IC Markets and Eightcap offer traders a robust selection of secure and efficient funding options for managing deposits and withdrawals. IC Markets caters to Australian clients with widely recognized payment methods such as Visa, Mastercard, POLi, and BPAY. Additionally, they support various international options, including bank transfers, PayPal, Neteller, Skrill, UnionPay (for China), and FasaPay (for Indonesia). These options cater to traders worldwide, ensuring flexibility and ease of transactions.

| Funding Option | IC Markets | Eightcap |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Eightcap, on the other hand, expands its offering by integrating additional payment solutions such as cryptocurrency deposits, Worldpay, and PayRetailers, making it particularly attractive for traders in South America and those preferring digital assets. In the ever-evolving forex market, brokers that offer a wide range of low-cost and efficient funding methods are gaining prominence. This innovation provides traders with greater control over their capital, enabling them to seize market opportunities quickly and efficiently, without any unwarranted delays.

Our Better Funding Options Verdict

Undeniably, Eightcap takes home the crown in this category due to their better funding option.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Eightcap

Eightcap has a lower minimum deposit of $100 than IC Markets, which requires traders to fund their trading account with at least $200. While Eightcap is lower, you will likely still need to add extra funds to your account to meet margin requirements since CFDs are leveraged instruments.

The table below shows the most used payment channels along with their availability for some major currencies.

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | N/A | $100 | €100 | N/A |

| Neteller | N/A | $100 | €100 | N/A |

On the other hand, IC Markets provides more convenience with their minimum $200 or the equivalent of 200 in the following currencies:

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Paypal | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Bank Wire | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Skrill | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| Eightcap | $100 | $100 |

Our Lower Minimum Deposit Verdict

In this category, Eightcap triumphs over IC Markets with its lower minimum deposit prerequisite of $100 but both broker deposit requirements overall are very fair.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

So Is Eightcap or IC Markets The Best Broker?

IC Markets outshines the other in almost all features and platforms due to their great performance over Eightcap in several key areas, as evidenced by our detailed comparison. The table below summarises the key information leading to this verdict:

| Categories | IC Markets | Eightcap |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | Yes |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | No | Yes |

IC Markets: Best For Beginner Traders

For those just starting out in the trading world, IC Markets offers a more comprehensive educational platform, making it the better choice for beginner traders.

IC Markets: Best For Experienced Traders

For seasoned traders looking for advanced tools and a wide range of products, IC Markets remains the top choice due to its superior offerings in these areas.

FAQs Comparing IC Markets Vs Eightcap

Does Eightcap or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to Eightcap. They have been recognised for their competitive spreads, starting as low as 0.1 pips for major currency pairs. Traders can benefit from these low spreads, especially during high liquidity trading hours. For a more detailed comparison on broker commissions, you can check out this guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and IC Markets offer MetaTrader 4, but IC Markets is often preferred for its advanced integration and additional tools. Their MT4 platform is equipped with superior charting tools, expert advisors, and more. For traders specifically looking for the best MT4 experience, this comprehensive list of best MT4 brokers can provide further insights.

Which Broker Offers Social Trading?

Eightcap offers social trading features, allowing traders to copy strategies from experienced traders. This feature is especially beneficial for beginners who are still learning the ropes. IC Markets, on the other hand, focuses more on providing advanced tools and resources. If you’re keen on exploring more about social trading platforms, here’s a detailed guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Eightcap nor IC Markets offer spread betting. Spread betting is a unique form of trading popular in the UK and some other regions, allowing traders to bet on the direction of market movements without owning the underlying asset. If you’re interested in brokers that do offer this service, you can check out this guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian Forex traders. It’s an Australian-based broker, founded in Sydney in 2007, and is regulated by the Australian Securities and Investments Commission (ASIC). This gives traders a sense of trust and security. Additionally, their platform offers a wide range of tools and resources tailored for the Australian market. For a more comprehensive look at brokers in the region, here’s a list of Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe Eightcap holds a slight edge. While both brokers offer robust platforms, Eightcap’s offerings are more tailored to the UK market. However, it’s essential to note that neither broker was founded in the UK, but both are regulated by the Financial Conduct Authority (FCA), ensuring a high standard of conduct. If you’re keen on exploring more about the best platforms for UK traders, this guide on the Forex Brokers In UK can provide further insights.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert