IC Markets vs OANDA: Which One Is Best?

OANDA and IC Markets are both esteemed players in the forex trading industry, each offering impressive features and platforms. However, one stands out above the rest. Curious to find out which one it is? Keep reading to discover more.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 33:1

Minor Pairs 33:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are nine noticeable differences between IC Markets and OANDA:

- OANDA is a market maker.

- OANDA only offers no commission forex trading.

- OANDA provides its proprietary platform and MT4.

- OANDA provides CFDs across 4 asset classes.

- IC Markets offers ECN forex spreads.

- IC Markets provides both commission-free and ECN accounts.

- IC Markets offers a choice of MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms.

- IC Markets offers a broader range of CFDs across 7 different asset classes.

- IC Markets offers 24/7 customer support, whereas OANDA’s customer support is available 24/5.

1. Lowest Spreads And Fees – IC Markets

In 2026, the forex market is driven by brokers with low spreads and fees, benefiting traders by lowering transaction costs, especially for high-frequency trading in pairs like EUR/USD and AUD/USD. This competitiveness attracts more traders, increases trading volumes, and boosts brokers’ revenue. Lower costs and greater efficiency enhance the trading experience, allowing traders to maximize profits in a seamless way.

IC Markets, established in 2007, and OANDA, founded in 1996, stand out as leading figures in the forex trading arena. Both brokers have earned a solid reputation for their transparency, competitive pricing, and outstanding customer support. In this review, we will analyze their spreads, commission structures, standard account fees, and draw conclusions based on the latest trends in forex trading for 2026.

Spreads

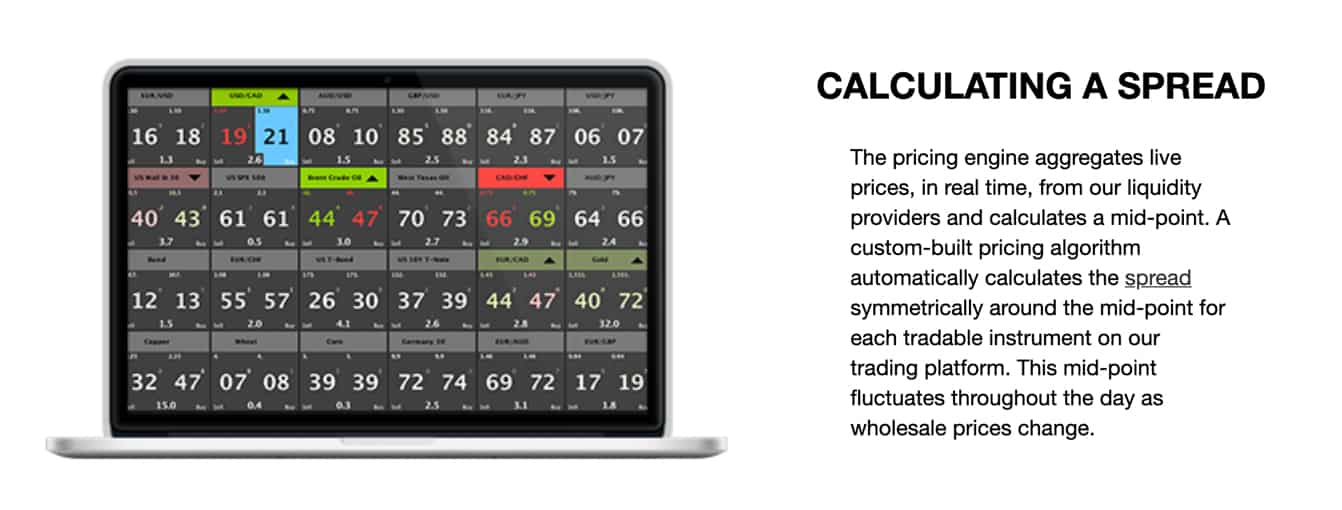

IC Markets stands out in the industry by offering exceptionally low spreads. For instance, the average spread for EUR/USD is just 0.82 pips with IC Markets, slightly lower than OANDA’s 0.9 pips. Similarly, for AUD/USD, IC Markets boasts a mere 0.83 pips, while OANDA’s spread is 1.54 pips. Overall, IC Markets maintains an average spread of 1.09 pips, in contrast to OANDA’s 2.02 pips. These highly competitive spreads position IC Markets as the go-to choice for traders seeking cost-effective trading options.

spreads.

| Standard Account | IC Markets Spreads | OANDA Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.09 | 2.02 | 1.7 |

| EUR/USD | 0.82 | 0.9 | 1.2 |

| USD/JPY | 0.94 | 1.9 | 1.5 |

| GBP/USD | 1.03 | 1.78 | 1.6 |

| AUD/USD | 0.83 | 1.54 | 1.6 |

| USD/CAD | 1.05 | 2.1 | 1.9 |

| EUR/GBP | 1.27 | 1.52 | 1.5 |

| EUR/JPY | 1.3 | 3.41 | 2.1 |

| AUD/JPY | 1.5 | 2.99 | 2.3 |

Commission Levels

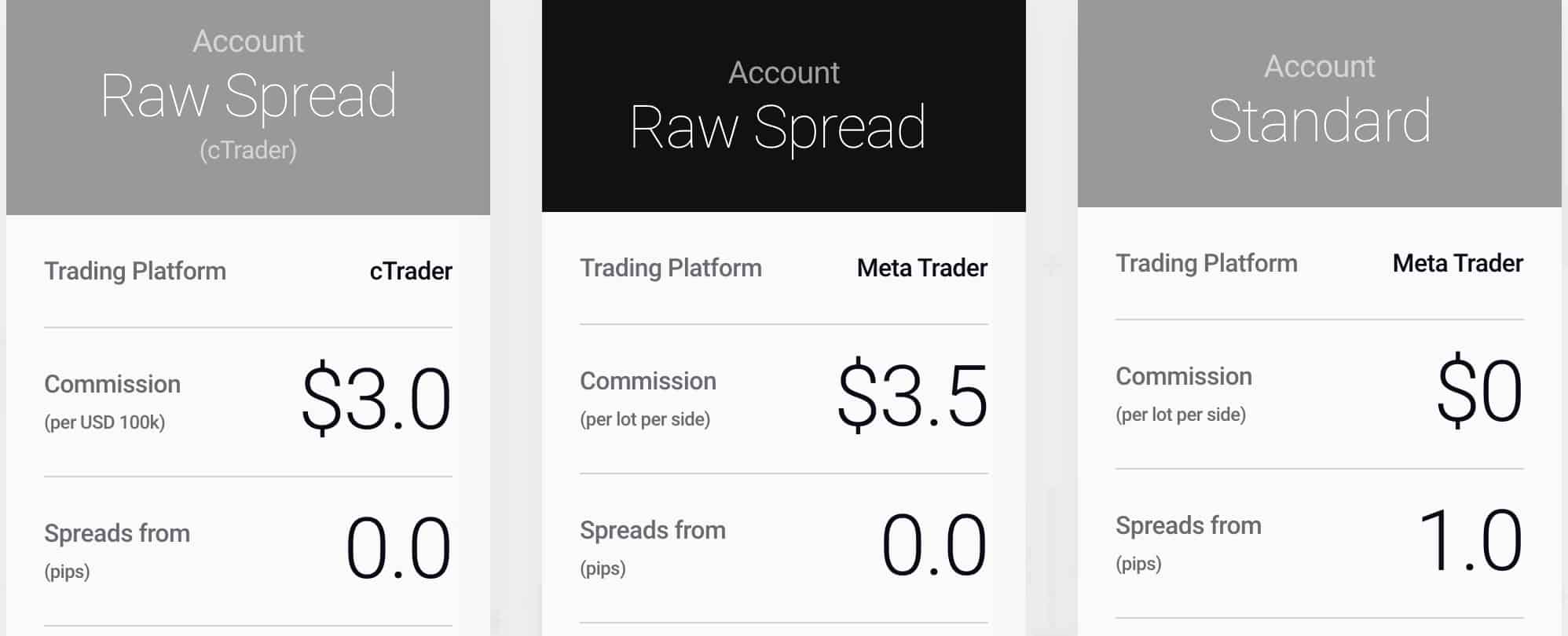

IC Markets levies a commission of $3.50 for each standard lot traded under its Raw Spread accounts, while OANDA imposes a fee of $5 for every $100,000 in currency traded within its core pricing accounts. Additionally, IC Markets mandates a minimum deposit of $200, contrasting with OANDA’s policy of no minimum deposit requirement. Both brokers provide the advantage of zero funding fees, ensuring accessibility for traders regardless of their capital size.

Standard Account Fees

IC Markets provides highly competitive standard account fees, featuring spreads of just 0.62 pips for EUR/USD and 0.77 pips for AUD/USD. In comparison, OANDA’s standard account spreads are marginally higher, at 0.60 pips for EUR/USD and 0.70 pips for AUD/USD. Both brokers present appealing options for traders seeking low-cost trading alternatives.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 0.94 | 1.48 | 1.45 | 1.68 | 1.90 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

IC Markets and OANDA each provide exceptional trading experiences, showcasing their distinct advantages. IC Markets shines with its lower spreads and competitive commission structures, positioning itself as a top option for traders focused on minimizing costs. On the other hand, OANDA attracts those who prioritize flexibility and security, thanks to its no minimum deposit requirement and strong regulatory oversight. Ultimately, the decision between these two brokers will hinge on each trader’s unique preferences and priorities

Our Lowest Spreads and Fees Verdict

Without any doubt, IC Markets ranks highest in this portion due to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

In 2026, top forex trading platforms provide advanced tools to enhance trading, featuring real-time data, speedy executions, and user-friendly interfaces. They support automated and social trading, offer diverse financial instruments, and ensure robust security. This blend of technology and flexibility fosters a seamless experience for both experienced and novice traders.

IC Markets and OANDA are pretty famous forex brokers, known for being transparent, having low costs, and good customer service. This review is gonna dive into how their MetaTrader setups stack up, what advanced platforms they offer, and their copy trading features. Plus, we’ll wrap it up with some forex trading trends to watch for in 2026.

| Trading Platform | IC Markets | OANDA |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

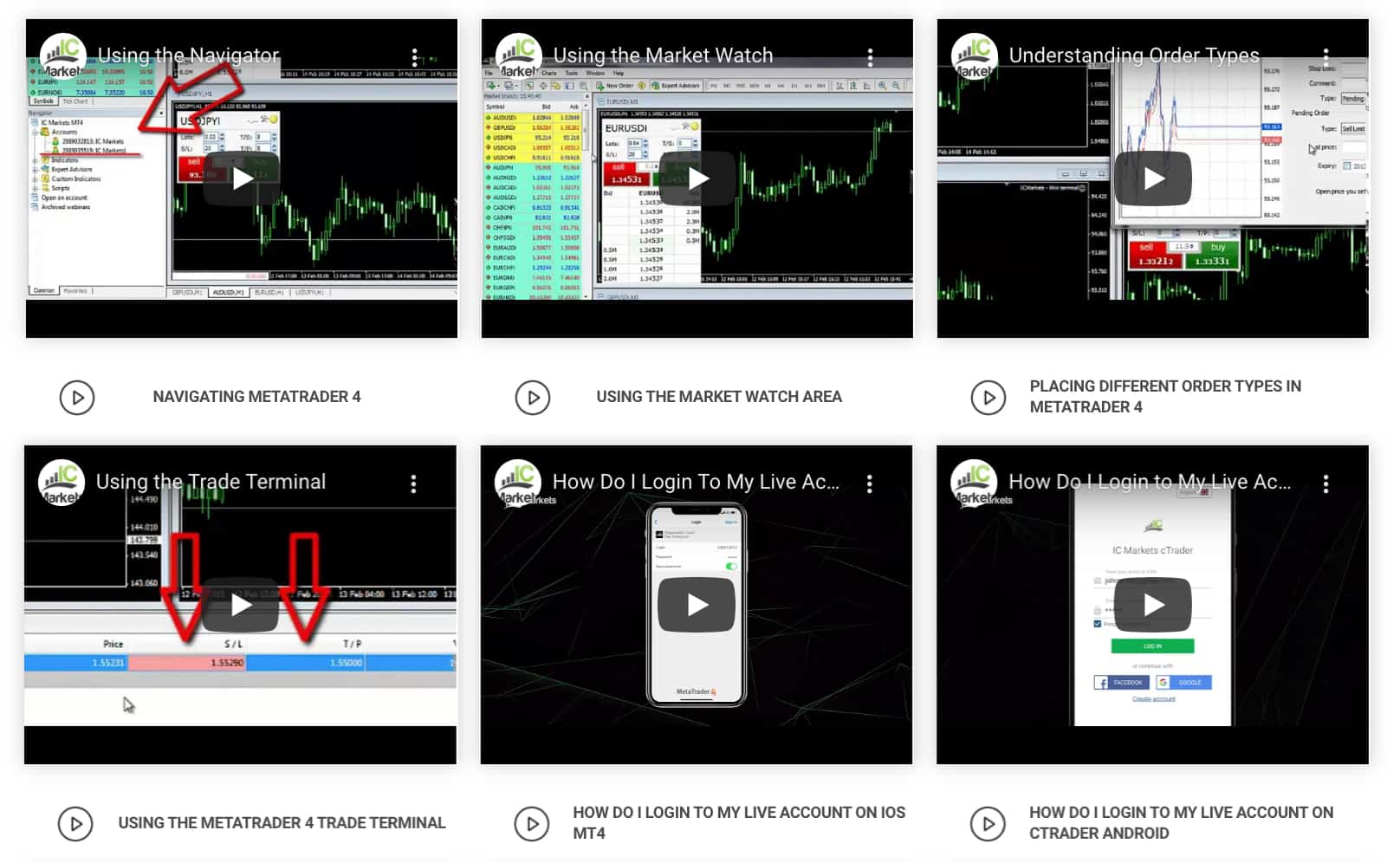

MetaTrader

IC Markets and OANDA both provide the highly sought-after MetaTrader 4 (MT4) platform, but IC Markets goes further by also offering MetaTrader 5 (MT5) and cTrader. This diversity empowers traders with a range of options to choose from. Both MT4 and MT5 are celebrated for their intuitive interfaces and sophisticated trading capabilities. IC Markets’ MT4 and MT5 platforms cater to both raw and standard accounts, granting access to forex pairs, indices, commodities, bonds, cryptocurrencies, and futures markets. On the other hand, OANDA’s MT4 platform excels for traders interested in developing algorithmic trading strategies, featuring tools like Expert Advisors and robust backtesting capabilities.

Advanced Platforms

IC Markets presents three robust trading platforms: MT4, MT5, and cTrader, each designed to cater to different trading preferences and needs. cTrader focuses primarily on forex trading, while MT4 also accommodates share trading. All three platforms excel in providing algorithmic trading capabilities, backtesting, advanced charting tools, hedging strategies, and flexible lot sizes. In contrast, OANDA features its proprietary platform, OANDA Trade, known for its user-friendly interface and valuable tools, including market sentiment data, real-time news updates, and comprehensive charting options. Additionally, OANDA enhances its offerings by supporting TradingView for advanced charting and analytics.

and MT4.

Copy Trading

When it comes to social trading tools, IC Markets’ MetaTrader 4 stands out as the premier option. It seamlessly integrates with third-party account mirroring services such as ZuluTrade and Myfxbook AutoTrade, while also supporting cTrader Copy for an enhanced copy trading experience. OANDA, on the other hand, offers a variety of copy trading solutions, including connections to ZuluTrade and other innovative platforms. Both brokers deliver comprehensive solutions for traders eager to follow and replicate successful trading strategies.

IC Markets and OANDA both have their perks when it comes to trading. IC Markets is pretty cool with its range of trading platforms and advanced tools, which is great if you’re into lots of options. On the other hand, OANDA’s platform is super user-friendly and has solid regulatory backing, so it’s a good pick if you want flexibility and security. At the end of the day, it really comes down to what you prefer as a trader.

Our Better Trading Platform Verdict

Our team surmises that IC Markets outperforms the other owing to their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

In 2026, forex accounts offer competitive spreads, low commissions, and advanced trading tools for all traders. Brokers provide demo accounts, swap-free options, and diverse assets. Features like social trading, AI automation, and algorithmic trading enhance strategy optimization. With 24/7 multilingual support, these offerings create a seamless and rewarding trading experience.

In 2026, IC Markets and OANDA continue to vie for dominance in the forex brokerage arena, each presenting unique pricing models tailored to various trading preferences. IC Markets operates as a no-dealing desk broker, offering both commission-free accounts and ECN-style options, while OANDA serves as a market maker, exclusively providing commission-free forex trading.

IC Markets presents two main account types: the Standard Account and the Raw Spread Account. The Standard Account is perfect for traders who prefer a transparent pricing structure, boasting commission-free forex trading with spreads starting at 1.0 pip. Conversely, the Raw Spread Account features institutional-grade spreads as low as 0.0 pips, accompanied by a commission per trade, appealing to scalpers and high-frequency traders focused on volatile pairs such as EUR/USD and AUD/USD, where every pip counts. With its deep liquidity and rapid execution speeds, IC Markets remains the go-to choice for those wanting to leverage tight spreads and low trading costs. On the other hand, OANDA’s simple fee structure is attractive to cost-conscious traders who prefer an all-in spread without any extra commissions, making it a compelling alternative.

By 2026, IC Markets remains unwavering in its dedication to offering traders competitive commission structures across all its platforms. For users of MetaTrader 4 and MetaTrader 5, the Raw Spread Account features an attractive commission of $3.50 per lot per side, amounting to a total of $7.00 for a round trip. This setup enables traders to access some of the tightest spreads in the market, with an average EUR/USD spread of just 0.1 pips. Operating on an ECN (Electronic Communication Network) pricing model, IC Markets ensures that all trades are directly routed to external liquidity providers. This strategy not only guarantees optimal execution speeds but also provides access to institutional-grade pricing, significantly enhancing the trading experience for both beginners and experienced traders alike.

In 2026, OANDA provides a simple trading experience with one account type and transparent pricing for forex and CFDs. Similar to IC Markets, OANDA offers commission-free trading with spreads from 1.0 pip. Operating as a market maker, OANDA’s dealing desk model creates stable pricing, though spreads may be wider than ECN brokers. Traders should weigh spread costs and execution speed, especially in volatile markets like EUR/USD and AUD/USD. OANDA is ideal for those favoring simplicity and fixed costs, particularly longer-term strategies over high-frequency trading.

Islamic Accounts in 2026: Swap-Free Forex Trading Options

Traders following Islamic finance need swap-free forex accounts. While OANDA lacks this option, IC Markets offers compliant Islamic accounts with no interest on overnight positions, adhering to Sharia law. Traders can select standard or raw spread pricing and use these accounts on platforms like MetaTrader 4, MetaTrader 5, and cTrader. Access to tight spreads and liquidity enables adherence to financial principles during market volatility.

| IC Markets | OANDA | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

IC Markets come up trumps in this arena this is due to their superior accounts and features.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – OANDA

A rewarding forex trading experience requires the right tools, speed, and support. Top brokers provide advanced platforms with fast execution, tight spreads on major pairs, and responsive customer service. User-friendly interfaces, educational resources, and effective trading tools cater to both beginners and experienced traders, enabling them to focus on informed decision-making and seizing market opportunities.

In assessing the overall trading experience, essential elements like platform performance, user-friendliness, and flexibility must be considered. Our recent analysis highlights the unique strengths of both IC Markets and OANDA. IC Markets excels with its state-of-the-art MetaTrader 5 (MT5) platform, which ensures seamless execution, deep liquidity, and comprehensive trading tools—perfect for experienced traders who demand precision. On the other hand, OANDA emerges as an excellent option for newcomers due to its intuitive interface and extensive educational resources, simplifying navigation through the forex market.

Furthermore, IC Markets’ standard account offers considerable flexibility with competitive spreads, appealing to cost-conscious traders. Both brokers also provide outstanding mobile trading solutions, enabling traders to manage their EUR/USD and AUD/USD positions anytime, anywhere. Whether you are a seasoned trader in search of advanced tools or a beginner seeking an effortless entry into forex, these brokers cater to a diverse range of needs in today’s dynamic market.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

| OANDA | 86ms | 5/36 | 84ms | 2/36 |

Our Best Trading Experience and Ease Verdict

Unmistakably, OANDA takes the cake in this niche due to their best trading experience.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – OANDA

Trust is crucial in forex trading. A well-regulated broker ensures transparency and security, allowing traders to focus on strategies without fear of scams. Strict regulatory oversight protects against fraud and fosters market participation. For major currency pairs like EUR/USD and AUD/USD, trading with regulated brokers provides reliable execution and fund protection, attracting serious investors seeking a safe platform for growth.

OANDA Trust Score

IC Markets Trust Score

By using this trust score calculator, we can see here that OANDA has a high score of 96 compared to IC Markets’ 80.

Regulations

IC Markets is governed by rigorous regulatory frameworks that guarantee a safe trading environment for its users. In Europe, the broker operates under the oversight of the Cyprus Securities and Exchange Commission (CySEC), ensuring adherence to EU financial regulations. In Australia, it is regulated by the Australian Securities and Investments Commission (ASIC), recognized for its strict compliance standards. Additionally, IC Markets is subjected to the Financial Services Authority of Seychelles (FSA) for its global operations, which enhances market accessibility. These diverse regulatory endorsements significantly bolster the broker’s credibility, instilling confidence in traders as they navigate major currency pairs such as EUR/USD and AUD/USD in today’s dynamic forex market.

IC Markets and OANDA both operate under rigorous regulatory supervision. OANDA is overseen by esteemed authorities such as ASIC (Australia), IIROC (Canada), NFA & CFTC (U.S.), FSA (Japan), and MAS (Singapore), ensuring adherence to high financial standards. The level of regulatory protections differs by region, with European and UK regulations providing advantages like negative balance protection and investor compensation schemes. Furthermore, both brokers prioritize the safety of client funds by segregating them, thereby protecting trader assets in the event of insolvency. To mitigate risk effectively, IC Markets and OANDA offer crucial order types, including limit, stop-loss, and trailing stop orders, which empower traders to successfully navigate the dynamic forex market, especially in major pairs like EUR/USD and AUD/USD.

IC Markets and OANDA both operate under rigorous regulatory scrutiny, providing a secure trading environment. However, OANDA distinguishes itself with a remarkable feature—Guaranteed Stop Loss Orders (GSLOs). Unlike regular stop-loss orders that may fail to execute during extreme market fluctuations or price gaps, GSLOs guarantee that your position will close at the predetermined price, safeguarding you from unforeseen losses. This enhanced protection is particularly beneficial for traders dealing with fast-moving pairs like EUR/USD and AUD/USD. While both brokers offer crucial risk management tools, OANDA’s GSLO option gives traders an added layer of confidence in unpredictable market conditions.

| IC Markets | OANDA | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | NFA/CFTC (USA) MAS (Singapore) CIRO (CANADA) FCA (UK) ASIC (Australia) |

| Tier 2 Regulation | JFSA (Japan) KNF (Poland) MFSA (Europe) | |

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | FSC-BVI |

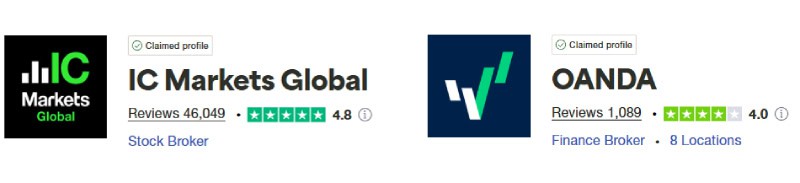

Reviews

IC Markets boasts an exceptional Trustpilot rating of 4.8 out of 5, based on over 46,000 reviews. OANDA, meanwhile, holds a respectable score of 4.0 out of 5 from around 1,100 reviews. IC Markets enjoys broader and more consistent acclaim, while OANDA maintains a solid reputation with fewer—but generally positive—reviews.

Our Stronger Trust and Regulation Verdict

Overall, OANDA outshines in this niche owing it to their stronger trust and regulation.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

6. Most Popular Broker – OANDA

OANDA gets searched on Google more than IC Markets. On average, OANDA sees around 550,000 branded searches each month, while IC Markets gets about 246,000 — that’s 55% fewer.

| Country | IC Markets | OANDA |

|---|---|---|

| United States | 6,600 | 49,500 |

| Germany | 5,400 | 40,500 |

| United Kingdom | 33,100 | 33,100 |

| India | 8,100 | 33,100 |

| Spain | 6,600 | 22,200 |

| France | 4,400 | 22,200 |

| Switzerland | 1,600 | 22,200 |

| Italy | 3,600 | 18,100 |

| Canada | 2,400 | 12,100 |

| South Africa | 9,900 | 12,100 |

| Japan | 1,300 | 12,100 |

| Portugal | 1,000 | 9,900 |

| Colombia | 3,600 | 9,900 |

| Philippines | 2,400 | 9,900 |

| Singapore | 3,600 | 9,900 |

| Brazil | 4,400 | 6,600 |

| United Arab Emirates | 4,400 | 6,600 |

| Mexico | 2,400 | 6,600 |

| Netherlands | 2,400 | 6,600 |

| Nigeria | 3,600 | 6,600 |

| Australia | 6,600 | 6,600 |

| Malaysia | 3,600 | 6,600 |

| Austria | 720 | 5,400 |

| Thailand | 8,100 | 4,400 |

| Argentina | 1,300 | 4,400 |

| Sweden | 1,300 | 4,400 |

| Turkey | 1,300 | 4,400 |

| Cyprus | 880 | 4,400 |

| Hong Kong | 2,400 | 4,400 |

| Kenya | 2,400 | 4,400 |

| Poland | 2,900 | 3,600 |

| Egypt | 1,600 | 2,900 |

| Ireland | 880 | 2,900 |

| Indonesia | 3,600 | 2,900 |

| Taiwan | 1,000 | 2,900 |

| Ghana | 880 | 2,900 |

| Vietnam | 8,100 | 2,400 |

| Peru | 1,600 | 2,400 |

| Saudi Arabia | 1,900 | 2,400 |

| Pakistan | 5,400 | 2,400 |

| Greece | 720 | 2,400 |

| Bangladesh | 1,900 | 2,400 |

| Mauritius | 480 | 2,400 |

| Morocco | 4,400 | 1,900 |

| Chile | 720 | 1,600 |

| Algeria | 2,400 | 1,600 |

| Jordan | 590 | 1,600 |

| Tanzania | 320 | 1,600 |

| New Zealand | 210 | 1,600 |

| Dominican Republic | 1,000 | 1,300 |

| Sri Lanka | 2,900 | 1,300 |

| Uganda | 720 | 1,300 |

| Ecuador | 1,000 | 1,000 |

| Costa Rica | 390 | 1,000 |

| Panama | 260 | 1,000 |

| Venezuela | 720 | 880 |

| Ethiopia | 720 | 880 |

| Bolivia | 260 | 720 |

| Cambodia | 170 | 590 |

| Botswana | 260 | 480 |

| Uzbekistan | 1,000 | 390 |

| Mongolia | 720 | 70 |

6,600 1st | |

49,500 2nd | |

5,400 3rd | |

40,500 4th | |

8,100 5th | |

33,100 6th | |

6,600 7th | |

22,200 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with OANDA receiving 4,647,000 visits vs. 2,425,000 for IC Markets.

Our Most Popular Broker Verdict

OANDA is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – IC Markets

A diverse product range is a transformative factor in forex trading. The greater the variety of financial instruments a broker provides, the more flexibility traders gain to respond to market fluctuations and refine their strategies. With options ranging from major forex pairs like EUR/USD and AUD/USD to commodities, indices, and even cryptocurrencies, a wide selection empowers traders to manage risks effectively and capitalize on emerging opportunities. A comprehensive market offering ensures that you’re not confined to a single asset class, enabling you to explore multiple avenues for profit and adeptly navigate changing trends. In the rapid-paced landscape of modern trading, diversity is not merely an advantage; it has become an essential requirement.

IC Markets and OANDA both operate under esteemed financial regulators, providing a safe trading environment for their users. In the realm of CFDs, IC Markets stands out with an extensive range of seven asset classes, compared to OANDA’s four. Traders at IC Markets can take advantage of over 61 forex pairs, 26 indices, 24 commodities, over 2100 stock CFDs, 12 bonds, 18 cryptocurrencies, and four futures contracts. Conversely, neither broker offers ETFs. With competitive spreads starting at just 0.0 pips and commission-free trading for indices and futures, IC Markets delivers a comprehensive CFD portfolio, making it an excellent choice for traders seeking varied market exposure.

OANDA CFDs

- Forex: 71 major and minor currency pairs.

- Commodities: Precious metals like Gold and Silver, oil and gas, plus soft commodities such as sugar and wheat.

- Bonds: 6 bonds including US T-Bills UK Gilts and Bunds.

- Indices: 16 different major global indices like the UK 100, Australia 200 and US 500.

| CFDs | IC Markets | OANDA |

|---|---|---|

| Forex Pairs | 61 | 68 |

| Indices | 23 Spot Indices 3 Index Futures | 15 |

| Commodities | 4 Precious Metals (gold vs 6 flats) 3 Energies 3 Energy futures 14 Soft commodity futures | 3 Metals (Gold x 10) (Silver x 10) 3 Energies 4 Softs |

| Cryptocurrencies | 18 | 4 |

| Share CFDs | 2100+ | No |

| ETFs | 3 NASDAQ 33 NYSE | No |

| Bonds | 12 | 5 |

| Futures | Yes | No |

| Treasuries | Yes | 5 |

| Investments | Yes | No |

Our Top Product Range and CFD Markets Verdict

Without a doubt, IC Markets excels in this field thanks to their top product range and CFD.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

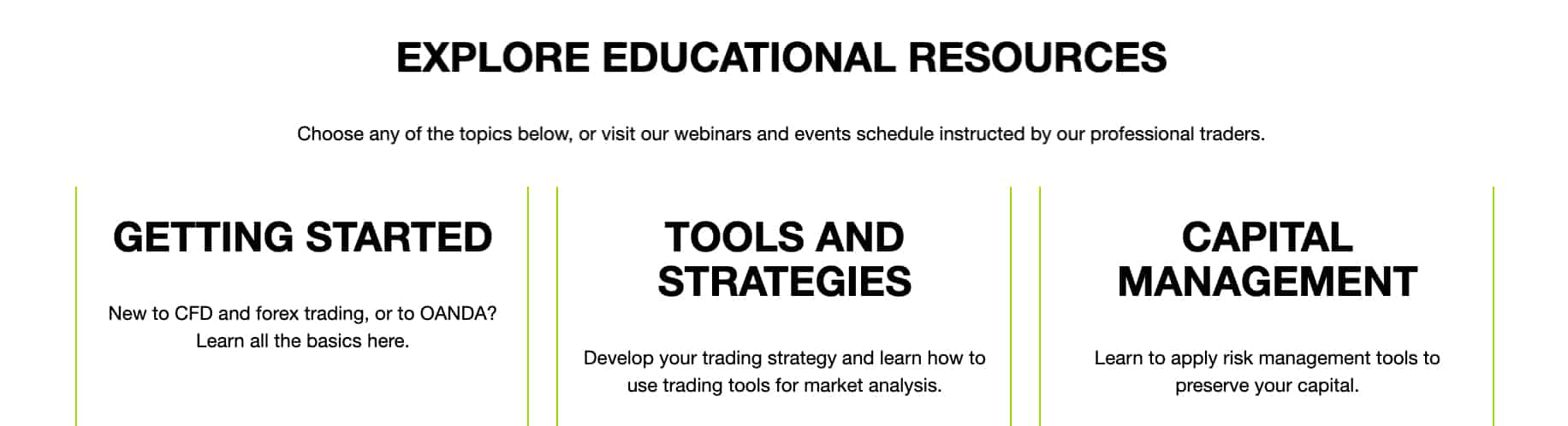

8. Superior Educational Resources – IC Markets

Navigating the forex market goes beyond executing trades; it involves making well-informed decisions. This is where exceptional educational resources become essential. The leading brokers provide a wealth of offerings, from engaging webinars and comprehensive articles to informative video tutorials and structured courses, all designed to enhance traders’ skills. Whether you’re a novice or honing advanced strategies, access to quality education is vital for sustained success. A broker that prioritizes effective learning materials does more than offer a trading platform; it empowers traders to operate smarter, adapt to market fluctuations, and maintain a competitive edge. Ultimately, knowledge is just as crucial as a solid trading strategy!

IC Markets and OANDA are regulated by leading financial authorities, providing a safe trading environment. For traders eager to expand their forex expertise, IC Markets offers an extensive collection of complimentary educational resources. These resources encompass live webinars, detailed tutorials, an economic calendar, and a market analysis blog brimming with up-to-date insights. Regardless of whether you are a novice or a seasoned trader, these tools are designed to sharpen your strategies and keep you abreast of market dynamics. Succeeding in forex trading requires more than just execution; it demands ongoing learning, and IC Markets equips you with the essential resources to foster that growth.

IC Markets and OANDA are both governed by stringent regulations from top-tier financial authorities, providing a secure environment for trading. OANDA particularly excels in education and research, offering an extensive array of learning resources such as video tutorials, webinars, and comprehensive platform guides. Traders gain access to real-time news feeds and thorough economic analyses, enabling them to stay ahead of market movements. These tools are invaluable for both novice and seasoned traders aiming to sharpen their strategies. A robust educational backbone not only enhances decision-making but also fosters confidence, positioning OANDA as an excellent option for traders who prioritize learning in their trading journey.

Our Superior Educational Resources Verdict

IC Markets, undeniably, ranks highest in this category thanks to their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Superior Customer Service – IC Markets

Exceptional customer service is crucial in the world of forex trading. Whether you face platform glitches or require prompt answers regarding your trades, responsive support can significantly enhance your trading experience. Leading brokers provide 24/7 assistance via live chat, phone, and email, often in various languages. Quick and dependable support not only helps traders address challenges effectively but also fosters trust and confidence in the broker. When brokers prioritize customer service, they cultivate a seamless trading environment that enables traders to concentrate on what truly counts—making informed decisions and seizing opportunities in the forex market.

IC Markets distinguishes itself through its outstanding customer support, providing 24/7 assistance via live chat, phone, and email. This constant availability guarantees that traders can receive help whenever necessary, whether they are facing technical difficulties, have account questions, or seek market insights. In the fast-paced world of forex trading, where swift decision-making is essential, reliable support becomes invaluable. IC Markets’ dedication to customer service significantly enhances the overall trading experience, instilling confidence and tranquility in traders. With a responsive team available at any hour, IC Markets creates a smooth and efficient trading environment for both novice and seasoned traders alike.

OANDA Customer Support

OANDA provides solid customer support, but its availability is limited to 24 hours a day, five days a week—unlike IC Markets, which offers 24/7 assistance. Traders can reach OANDA through live chat, email, phone, or an AI-powered chatbot for quick responses. While the service is reliable, the lack of weekend support may be a drawback for those trading in different time zones. In contrast, IC Markets’ round-the-clock availability ensures continuous support, making it a better option for traders who need assistance at any time, especially in the fast-moving forex market.

| Feature | IC Markets | OANDA |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Overall, IC Markets brings home the gold thanks to their superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

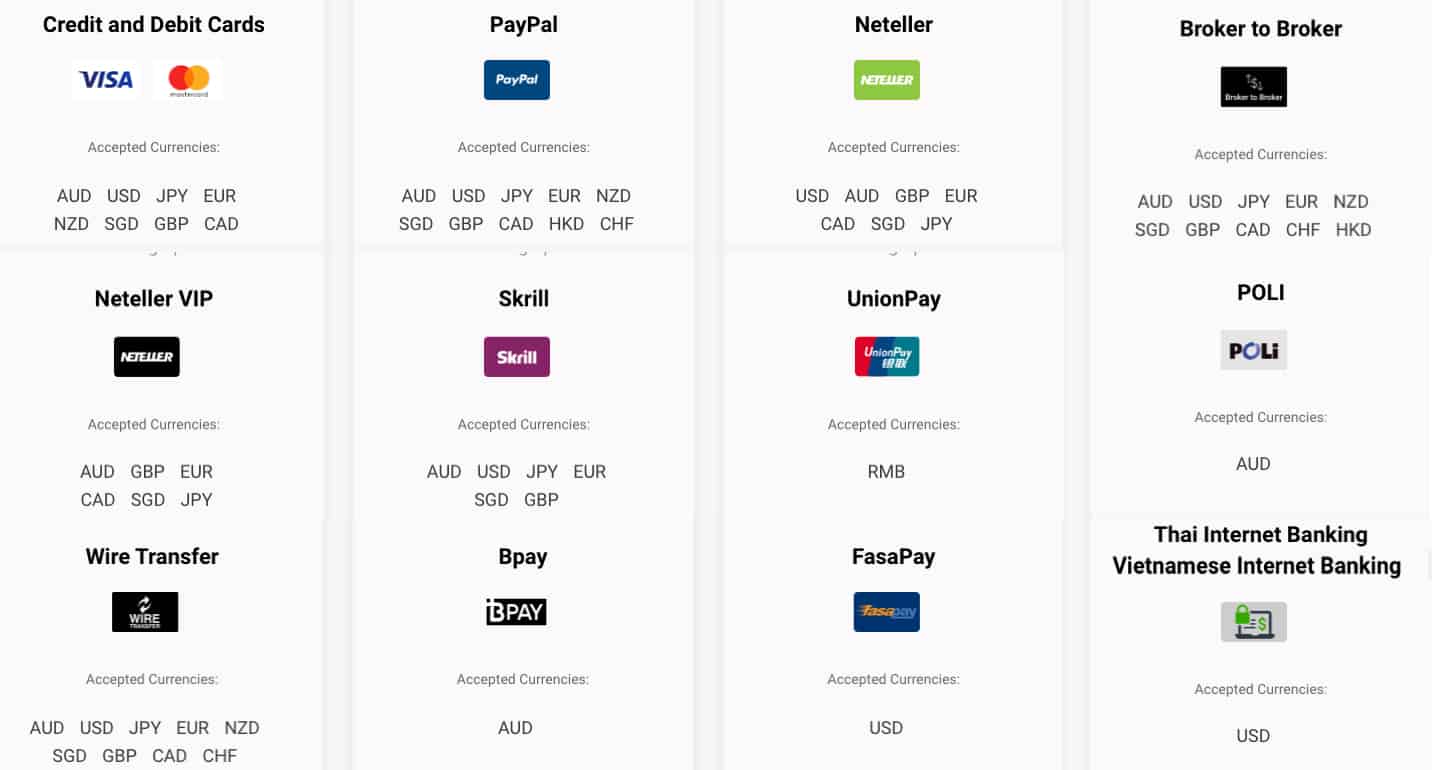

10. Better Funding Options – IC Markets

Smooth and flexible funding options can significantly enhance your forex trading experience. The top brokers provide a diverse range of deposit and withdrawal methods, including bank transfers, credit and debit cards, e-wallets like PayPal, Skrill, and Neteller, as well as cryptocurrencies. Access to multiple options with minimal or no fees empowers traders to manage their accounts with ease. Quick and seamless transactions enable traders to concentrate on market activities without the stress of payment delays. An efficient funding process not only enriches the trading experience but also ensures you can swiftly capitalize on opportunities in fast-paced markets such as EUR, USD, and AUD trading.

IC Markets offers an impressive array of 15 fee-free funding options, including debit/credit cards, PayPal, Skrill, and Neteller, ensuring seamless and cost-effective transactions. In contrast to many brokers that levy deposit or withdrawal fees, IC Markets allows traders to transfer funds without any additional costs. To embark on your trading journey, a minimum deposit of just $200 is required, with a choice of 11 account base currencies: AUD, NZD, USD, CAD, EUR, JPY, SGD, HKD, CHF, GBP, and RMB. This level of flexibility empowers traders to efficiently manage their accounts while reducing conversion costs, establishing IC Markets as a top choice for forex traders operating in EUR, USD, and AUD.

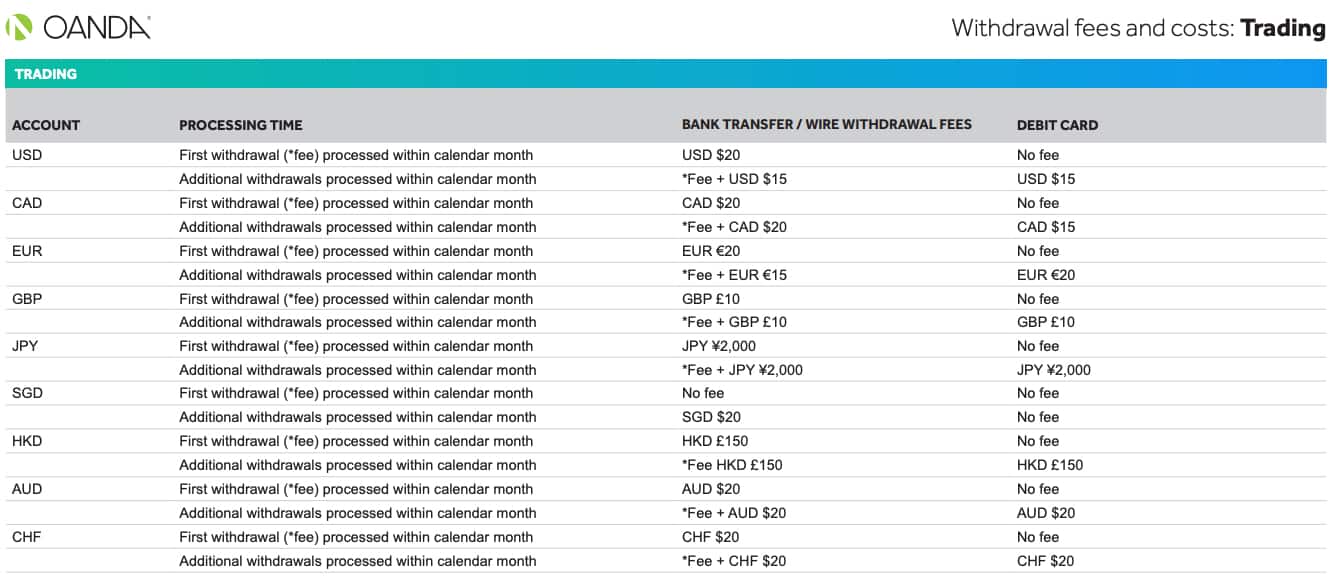

OANDA Funding

With OANDA, there is no minimum deposit requirement, making it an ideal choice for traders at any experience level. However, its funding options are comparatively less expansive than those offered by IC Markets. You can conveniently deposit and withdraw funds using credit/debit cards, PayPal, and bank transfers. Be aware that fees may vary depending on your account’s base currency, the funding method you choose, and the number of transactions made in a month. Traders have the flexibility to select from a range of account base currencies, including USD, CAD, GBP, EUR, JPY, SGD, HKD, AUD, and CHF. This versatility simplifies account management, although it’s essential for traders to check for any potential fees associated with their chosen transaction methods.

For OANDA accounts denominated in USD, the initial bank or wire transfer withdrawal each month incurs a fee of $20, whereas withdrawals via debit card are free of charge. Subsequent withdrawals within the same month are subject to fees—ranging from $15 or more for bank transfers and $15 for debit card transactions. These fees differ depending on your selected funding method and location, so it is essential for traders to consult OANDA’s latest fee schedule to effectively manage their transactions. By comprehending these charges, traders can optimize their withdrawal strategies, minimize unnecessary expenses, and ensure seamless access to their funds.

| Funding Option | IC Markets | OANDA |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

IC Markets, without a doubt, is riding high in this category due to their better funding options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – OANDA

A low minimum deposit in forex trading significantly expands access for a wider array of traders, particularly beginners or those with restricted capital. By lowering financial barriers, it enables newcomers to embark on their trading journey with minimal investment while acquiring valuable hands-on experience. This inclusivity not only stimulates greater participation but also promotes the development of trading skills without necessitating a substantial initial outlay. Brokers that offer flexible deposit options draw a diverse clientele, making the forex market more welcoming and versatile. Whether honing strategies or incrementally increasing their investments, lower deposit requirements serve as a practical gateway into the fast-paced world of forex trading.

OANDA provides an attractive advantage with a minimum deposit requirement starting at $0 for bank wire transfers, while IC Markets demands a $200 minimum deposit. For other funding options, such as credit/debit cards and Trustly, OANDA has set a minimum deposit of $25. This flexibility positions OANDA as a more accessible choice for beginners or traders eager to invest smaller amounts. On the other hand, IC Markets caters to those interested in a more comprehensive trading experience with its higher minimum deposit. Ultimately, the decision between the two brokers hinges on individual trading preferences and available capital, with OANDA appealing to thrifty traders and IC Markets delivering advanced features for more active investors.

The table below shows the different amounts for OANDA’s minimum deposit requirement.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £25 Minimum Deposit | $25 Minimum Deposit | €25 Minimum Deposit | $25 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Trustly | £25 Minimum Deposit | $25 Minimum Deposit | €25 Minimum Deposit | $25 |

| Paypal | N/A | N/A | N/A | N/A |

In contrast, IC Markets has their $200 requirement, whichever payment channel and base currency you use.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Paypal | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Bank Wire | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Skrill | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| OANDA | $0 | $25 |

Our Lower Minimum Deposit Verdict

Our dedicated team of experts surmises that OANDA outperforms the contender in this division due to their lower minimum deposit.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

So Is OANDA or IC Markets The Best Broker?

IC Markets is the winner because it dominates in most of the key areas that traders prioritise, such as spreads, fees, trading platforms, product range, educational resources, customer service, and funding options. The table below summarises the key information leading to this verdict:

| Categories | IC Markets | OANDA |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | Yes |

OANDA: Best For Beginner Traders

For those just starting out in the trading world, OANDA offers a more user-friendly experience, making it the better choice for beginner traders.

IC Markets: Best For Experienced Traders

For seasoned traders who prioritise advanced tools, tighter spreads, and a wider product range, IC Markets stands out as the superior option.

FAQs Comparing IC Markets Vs OANDA

Does OANDA or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to OANDA. They are renowned for their competitive spreads, especially on major currency pairs. For instance, traders can often find spreads as low as 0.1 pips on the EUR/USD pair. For a more detailed comparison on low commissions, you can check out this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both OANDA and IC Markets offer MetaTrader 4, but IC Markets is often preferred by traders for its enhanced MT4 features and tighter spreads. Their integration with the platform is seamless, providing traders with a range of advanced tools. If you’re keen on exploring more about the best MT4 brokers, this detailed review on the best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

IC Markets stands out when it comes to offering social trading features. They provide traders with the opportunity to engage in copy trading, allowing them to replicate the strategies of successful traders. This approach can be particularly beneficial for those new to the forex market. For a deeper dive into the world of social trading, here’s a comprehensive list of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither OANDA nor IC Markets offer spread betting as a primary feature. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of a financial market without owning the underlying asset. If you’re interested in brokers that specialise in spread betting, you might want to explore this list of the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian forex traders. They are ASIC regulated, ensuring a high level of trust and security for traders. Founded in Australia, IC Markets understands the unique needs of Aussie traders and offers features tailored to them. Their deep liquidity and tight spreads make them a favourite among many. If you’re looking for more information on the Forex Brokers In Australia, this comprehensive guide can be quite insightful.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally believe OANDA has a slight edge. They are FCA regulated, which provides an added layer of trust and security for UK-based traders. While IC Markets is also a strong contender in the UK market, OANDA’s deep roots and understanding of the UK trading environment give them an advantage. For those keen on exploring more about the best platforms for UK traders, here’s a detailed review on Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How long does IC Markets withdrawal take?

IC Markets will process your withdrawal within 24 hours however they can take 3-5 days in the case of credit and debit card withdrawals. eWallets such as PayPal, Neteller and Skrill are instant.

What is OANDA withdrawal speed?

OANDA takes 1-2 business days to withdrawal via bank transfer and up to 5 business days for overseas withdrawals.

Which broker is better in east African countries

I would say IC Markets but both are fine