IC Markets vs Tickmill 2026

Our IC Markets vs Tickmill review found each forex broker has 60+ currency pairs (i.e. EUR/USA). IC Markets offers 230 CFDs, including stocks and crypto, while Tickmill only offers 13 CFDs but, like IC Markets, has indices, gold and silver and bonds. Find out which is best for you.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do Tickmill Vs IC Markets Compare?

Our comprehensive comparison covers the 10 most crucial trading factors. Here are five notable differences between IC Markets and Tickmill:

- IC Markets offers a broader range of trading instruments, including more cryptocurrencies.

- Tickmill’s customer support may be less responsive compared to IC Markets.

- IC Markets boasts lower spreads on major currency pairs than Tickmill.

- Tickmill offers a more straightforward account registration process for traders.

- IC Markets provides a dedicated Islamic account option catering to Sharia-compliant traders.

1. Lowest Spreads And Fees: IC Markets

For this broker review, we compared the average spreads on common forex pairs across a range of brokers. The spreads for the ECN-style accounts are shown in the table below. IC Markets offers an average spread of 0.02 pips on the commonly traded EUR/USD currency pair while 0.1 pips for Tickmill. Across the board, IC Markets have slightly more competitive average spreads than Tickmill.

| RAW Account | IC Markets Spreads | Tickmill Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.29 | .50 | 0.75 |

| EUR/USD | 0.02 | 0.1 | 0.22 |

| USD/JPY | 0.14 | 0.1 | 0.38 |

| GBP/USD | 0.23 | 0.3 | 0.53 |

| AUD/USD | 0.03 | 0.1 | 0.47 |

| USD/CAD | 0.25 | 0.2 | 0.56 |

| EUR/GBP | 0.27 | 0.4 | 0.55 |

| EUR/JPY | 0.3 | 0.5 | 0.80 |

| AUD/JPY | 0.5 | 0.9 | 0.96 |

| USD/SGD | 0.85 | 1.9 | 2.29 |

Our dedicated and highly skilled team has put in extensive effort and expertise to design the exclusive fee calculator that you see below:.

Both IC Markets and Tickmill can achieve spreads as low as 0.0 pips and pricing similar to ECN-style brokers because of the no dealing desk execution with multiple liquidity providers.

Commission-Free Spreads

The table below summarises the average spreads on standard pricing accounts from various brokers. Average spreads for IC Markets are around 1.0 pips, while Tickmill offers 1.6 pips.

Our Lowest Spreads and Fees Verdict

IC Markets is the lowest spread forex broker with an average of 0.10 pips on the most commonly traded currency pair (EUR/USD). IC Markets achieve this level of competitive pricing due to direct access to over 50 liquidity providers, no dealing desk execution, leading ECN technology, and high-volume trading. Although Tickmill also offers competitive spreads with some forex pairs, IC Markets outperforms Tickmill across the board of currency pairs.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform: IC Markets

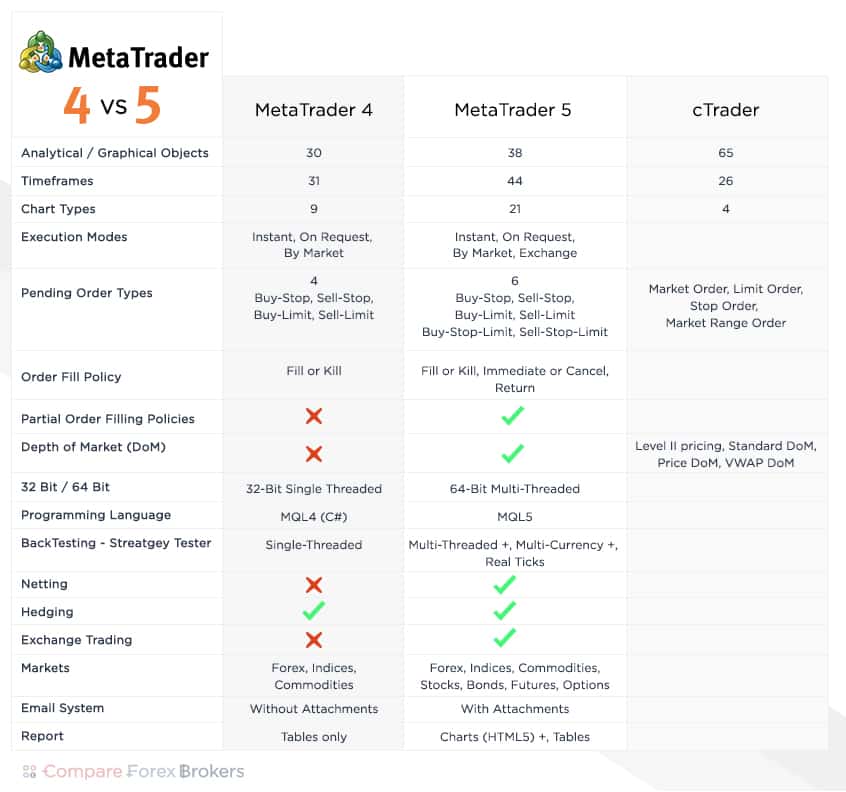

IC Markets allows you to trade on the MetaTrader 4, MetaTrader 5, and cTrader trading platforms. Tickmill only offers the MetaTrader 4 trading platform. All these trading platforms are available on desktop (PC or Mac) and mobile trading devices (iOS or Android). The trading apps come with a range of features for easy-to-use functionality.

| Trading Platform | IC Markets | Tickmill |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

MetaTrader 4

MetaTrader 4 is the first and most popular trading platform developed by MetaQuotes Software. MetaTrader 4 is ideal for traders of any level of experience, from beginner to intermediate to experienced scalping traders. Fit with a customisable interface and sophisticated order management functionality, MetaTrader 4 offers over 50 fundamental and technical indicators with fast order execution on a range of CFDs. This trading platform provides access to a range of Expert Advisors, allowing you to use algorithmic and automatic trading functionality.

- Fast execution of trades (reduced lag time and slippage)

- Expert Advisors and trading robots (EAs are programs that allow for automated monitoring and trading according to a set of chosen parameters)

- Autochartist compatibility (saving you on screen time by identifying and notifying you of chart patterns and key price levels)

- MyFxBook Copy Trading (providing tools to find and follow profitable traders on a social trading network)

The MetaTrader 4 trading platform remains the most popular trading platform because of the customisable charting, trading automation facilities, and easy-to-use interface. Both IC Markets and Tickmill provide the MetaTrader 4 trading platform.

MetaTrader WebTrader

MetaTrader WebTrader is an extension to the trading app that allows you to access and trade online directly through your modern web browser. WebTrader is equipped with the same functionality and features as the MetaTrader trading platform but requires no downloads or installations. WebTrader has enhanced security using trade history and encrypted data transmission.

MetaTrader 5

MetaTrader 5 is the new multi-asset platform from MetaQuotes Software. The MetaTrader 5 version comes with a built-in market for trading robots for algo trading and provides access to the MQL5 community. MetaTrader 5 maximises trade execution speeds using forex VPS. This upgraded trading platform is equipped with more indicators, timeframes, and order types, as well as enhanced charting features and backtesting for EAs than the previous MetaTrader 4. MetaTrader 5 also allows you to trade share CFDs along with forex currencies, commodities, and cryptocurrencies. Only IC Markets offers MetaTrader 5. Currently, you cannot access this trading platform with Tickmill.

cTrader

cTrader is a widely used trading platform and a close competitor to MetaTrader. With a personalised interface and charting options, cTrader is an easy-to-use trading platform. If you prefer to trade with cTrader, you can access algorithmic trading systems with the system liquidity pools, as well as back-testing facilities based on past market data. cTrader is a popular trading platform because of the enhanced modification options, advanced order placement features, and compatibility with desktop and mobile trading devices or apps. You can trade with cTrader through IC Markets but not with Tickmill.

IC Markets also offers a range of advanced tools that you can integrate with your chosen trading platform. These include:

- Alarm Manager, Correlation Matrix, Correlation Trader

- Trade Terminal, Market Manager, Sentiment Trader

- Session Map, Smart Lines

- Stealth Orders, Tick Chart Trader

Our Better Trading Platform Verdict

IC Markets is the clear winner over Tickmill due to the diversity of trading platforms available. Although Tickmill offers the most widely used trading platform MetaTrader 4, the broker does not offer MetaTrader 5 or cTrader as IC Markets does.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features: IC Markets

IC Markets Account Types

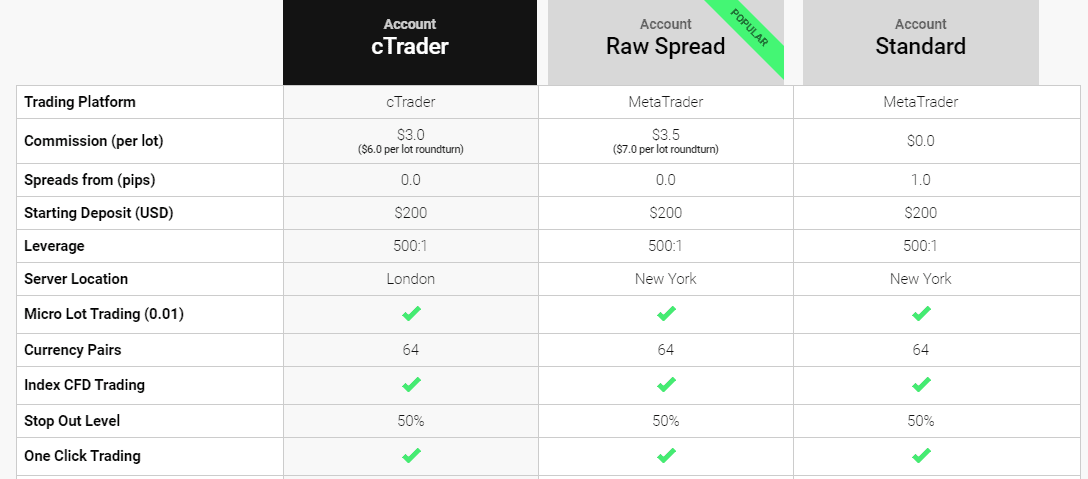

There are three main account types you can open with IC Markets, including the Standard Account, Raw Spread Account, and cTrader Raw Account.

Standard Account

The Standard Account from IC Markets is a commission-free account with a standard pricing model. This account type is ideal for beginner forex traders because trading costs are easier to calculate. You can trade with a Standard Account on the MetaTrader 4 and MetaTrader 5 trading platforms. This account has wider spreads than the Raw Spread Account, starting from 1.0 pips.

Raw Spread Account

The Raw Spread Account has IC Market’s lowest spreads starting from 0.0 pips on the EUR/USD currency pair, and commission fees of only $3.50 per lot. The Raw Spread Account is also available on the MetaTrader 4 trading platform and allows you to use the MQL4 programming language. The Raw Spread Account is the most popular choice from IC Markets because of the lower overall trading costs compared to the Standard Account.

cTrader Raw Account

The cTrader Raw Account is available on the cTrader trading platform using the C# programming language. With this account type, you can access low ECN broker spreads on a variety of forex pairs and trade with commission fees of only $3.00 per lot.

Tickmill Account Types

Three account types are available with Tickmill. These include the Pro Account, Classic Account, and VIP Account.

Pro Account

The Pro Account uses ECN-style pricing to offer retail trading spreads from 0.0 pips on the EUR/USD currency pair. Commission charges for the broker are only $2.00 per lot, making the Pro Account a popular choice among Tickmill clients.

Classic Account

The Tickmill Classic Account is the same as a standard account that many brokers offer. This account type is commission-free as costs are part of the spread, which starts from 1.6 pips. A standard or classic account is best suited for beginners with little experience in forex trading, as no commissions mean a simpler fee structure.

VIP Account

The VIP Account is available to traders with a trading account equity balance of $50,000 or greater. With this account type, you receive a discount on commissions with fees starting from $1.00.

Islamic Accounts

Both IC Markets and Tickmill offer the option to convert the standard or ECN account types into an Islamic Account for traders of the Muslim faith. The Islamic Account offers the same features, spreads and commission charges as the corresponding account types. However, there are no charges for swaps in compliance with Sharia law.

| IC Markets | Tickmill | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

The account types offered by both IC Markets and Tickmill will suit a range of traders with different levels of experience. Although the commission structure of Tickmill is appealing, the wider spreads make the overall trading cost relatively high. IC Markets has a more competitive pricing model with tighter spreads and low commission fees. With fast trade execution speed and low trading costs, the Raw Spread Account from IC Markets outperforms the other account types.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: IC Markets

When it comes to trading, the experience and ease of use are paramount. We’ve spent countless hours testing both IC Markets and Tickmill and here’s what we’ve found:

- IC Markets offers the best MT5 trading experience, making it a top choice for traders who prefer this platform.

- Tickmill, on the other hand, didn’t stand out in our tests for any specific trading platform.

- IC Markets also shines with its standard account, which we found to be one of the best in the industry.

- Execution speed is crucial, and while neither broker took the top spot in our tests, both offer reliable and fast trade executions.

Our Best Trading Experience and Ease Verdict

IC Markets edges out Tickmill in terms of overall trading experience and ease of use.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation: Tie

Stronger trust and regulation are essential for brokers, as they guarantee a secure and transparent trading environment.

IC Markets Trust Score

Tickmill Trust Score

Regulations

IC Markets has a licence with three main regulators.

- International Capital Markets Pty Ltd: Australian Securities and Investments Commission (ASIC) AFSL 335692

- IC Markets (EU) Ltd: Cyprus Securities and Exchange Commission (CySEC) Licence No. 362/18

- Raw Trading Ltd: Financial Services Authority of Seychelles (FSA) Licence No. SD018

With two Tier 1 and one Tier 2 regulation bodies, IC Markets is considered a safe and trustworthy forex broker.

Tickmill Global Regulation

Tickmill has a licence with five main regulators.

- Tickmill UK Ltd: Financial Conduct Authority (FCA) Licence No. 717270

- Tickmill Ltd: Financial Services Authority of Seychelles (FSA) Licence No. SD008

- Tickmill Europe Ltd: Cyprus Securities and Exchange Commission (CySEC) Licence No. 278/15

- Tickmill Asia Ltd: Financial Services Authority of Labuan (LFSA) Licence No. MB/18/0028

- Tickmill South Africa (Pty) Ltd: Financial Sector Conduct Authority (FSCA) Licence No. FSP 49464

Under extensive regulation, Tickmill is also considered a safe and reliable forex broker. Traders outside FCA, CySEC, LFSA, and FSCA will trade under FSA regulation, and as such, this should be taken into consideration as an offshore regulator. Furthermore, if you are trading from Australia or Dubai, Tickmill does not have ASIC or DFSA regulations.

| IC Markets | Tickmill | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | FSA-S (Seychelles) LFSA FSCA (South Africa) |

Reviews

As show below, IC Markets boasts an excellent rating of 4.8 out of 5 on Trustpilot, based on over 46,000 reviews. Tickmill holds a Trustpilot score of 4.0 out of 5, with around 1,000 reviews. IC Markets has a significantly higher rating and far more reviews, suggesting broader and more consistent customer satisfaction compared to Tickmill.

Our Stronger Trust and Regulation Verdict

The choice of broker will depend on the country you are trading from. Trading with an offshore regulator can sometimes impose challenges regarding communication, protection, or policy adherence. Although Tickmill has several more regulatory entities, IC Markets have higher tier regulation in more popular countries.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than Tickmill. On average, IC Markets sees around 246,000 branded searches each month, while Tickmill gets about 49,500 — that’s 79% fewer.

| Country | IC Markets | Tickmill |

|---|---|---|

| United Kingdom | 33,100 | 1,000 |

| South Africa | 9,900 | 3,600 |

| India | 8,100 | 2,900 |

| Vietnam | 8,100 | 1,900 |

| Thailand | 8,100 | 2,400 |

| Spain | 6,600 | 590 |

| United States | 6,600 | 1,600 |

| Australia | 6,600 | 210 |

| Germany | 5,400 | 880 |

| Pakistan | 5,400 | 590 |

| France | 4,400 | 320 |

| United Arab Emirates | 4,400 | 720 |

| Brazil | 4,400 | 3,600 |

| Morocco | 4,400 | 480 |

| Italy | 3,600 | 590 |

| Colombia | 3,600 | 1,600 |

| Malaysia | 3,600 | 4,400 |

| Singapore | 3,600 | 590 |

| Nigeria | 3,600 | 1,300 |

| Indonesia | 3,600 | 1,300 |

| Poland | 2,900 | 720 |

| Sri Lanka | 2,900 | 170 |

| Netherlands | 2,400 | 260 |

| Mexico | 2,400 | 590 |

| Philippines | 2,400 | 880 |

| Canada | 2,400 | 260 |

| Hong Kong | 2,400 | 320 |

| Algeria | 2,400 | 880 |

| Kenya | 2,400 | 140 |

| Saudi Arabia | 1,900 | 320 |

| Bangladesh | 1,900 | 880 |

| Switzerland | 1,600 | 140 |

| Peru | 1,600 | 720 |

| Egypt | 1,600 | 1,000 |

| Argentina | 1,300 | 1,600 |

| Sweden | 1,300 | 110 |

| Turkey | 1,300 | 1,600 |

| Japan | 1,300 | 260 |

| Taiwan | 1,000 | 210 |

| Portugal | 1,000 | 170 |

| Ecuador | 1,000 | 260 |

| Dominican Republic | 1,000 | 320 |

| Uzbekistan | 1,000 | 320 |

| Ireland | 880 | 40 |

| Cyprus | 880 | 480 |

| Ghana | 880 | 110 |

| Austria | 720 | 90 |

| Greece | 720 | 50 |

| Chile | 720 | 260 |

| Venezuela | 720 | 210 |

| Uganda | 720 | 260 |

| Ethiopia | 720 | 110 |

| Mongolia | 720 | 30 |

| Jordan | 590 | 140 |

| Mauritius | 480 | 10 |

| Costa Rica | 390 | 70 |

| Tanzania | 320 | 720 |

| Bolivia | 260 | 140 |

| Panama | 260 | 30 |

| Botswana | 260 | 140 |

| New Zealand | 210 | 70 |

| Cambodia | 170 | 50 |

33,100 1st | |

1,000 2nd | |

9,900 3rd | |

3,600 4th | |

6,600 5th | |

210 6th | |

4,400 7th | |

720 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 614,000 for Tickmill.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: IC Markets

Forex

The forex market is the world’s largest and most popular financial market because of the price action volatility and 24/5 availability for trading. As the most liquid market with over $5 trillion traded daily, the forex market allows you to simultaneously buy and sell currencies such as USD, EUR, GBP, CHF, JPY, and NZD for profit.

- IC Markets offers over 61 currency pairs

- Tickmill offers over 60 currency pairs

Indices

Indices allow you to trade a group of stocks as an amassed average. An index will track the average value of a group of stocks, allowing you to speculate on the changing average price across sectors, industries, or even countries. Similarly, trading oil can allow you to speculate on the average pricing of oil across several exchanges.

- IC Markets allows access to 26 of the largest global indices

- Tickmill allows access to 14 stock indices and variations of oil

Commodities

Commodities include agriculture, precious metals, and energy. These assets are often considered safe-haven assets, as they are relatively uniform across the globe during market volatility.

- IC Markets provides 19 mainstream commodities you can trade against the USD as both spot and futures CFDs

- Tickmill allows you to trade precious metals like gold and silver against the USD but does not offer soft commodities such as copper, palladium, and platinum

Stocks

Trading stocks is only available on the MetaTrader 5 trading platform, meaning you can only access stocks with IC Markets but not with Tickmill. Trading stocks as CFDs means you are not owning the underlying assets but merely speculating on the price movements.

- IC Markets has over 120 stocks to be traded as CFDs across the NYSE, NASDAQ, and ASX

- Tickmill does not allow stock trading

Bonds

Bonds are agreements for over-the-counter exchanges between borrowers and lenders. These bonds are futures (cash) contracts and have no central exchange.

- IC Markets offers 12 core bonds, including the UK, Japan, USA, and Europe

- Tickmill offers 4 main types of government bonds (otherwise known as treasury CFDs), all of which are German bonds

Cryptocurrencies

Cryptocurrencies are a form of digital currency that is becoming more popular as regularly traded financial assets. The cryptocurrency market is popular because of its high volatility nature of the market and large price movements. It is important to note that trading cryptocurrency CFDs is high risk; therefore, the allowable leverage is usually less than other financial products.

- IC Markets allows you to trade major cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple (because of the high risk of these assets, you can integrate social trading features such as ZuluTrade and MyFxBook to leverage off more experienced traders)

- Tickmill does not currently offer cryptocurrencies for trading as CFDs

Futures

Futures are contracts that allow you to speculate on the direction of financial assets, providing you with the opportunity to buy or sell at a predetermined price and time.

- IC Markets offers 4 global futures to trade, including the ICE Dollar Index and CBOE VIX Index

- Tickmill does not offer future CFDs

Our Top Product Range and CFD Markets Verdict

IC Markets offers a far greater variety of financial products to trade as CFDs than Tickmill. If you are only looking to trade the common forex pairs, either broker would suit you. However, diversification is an important factor to consider, and if you want to expand your investing scope with more complex instruments, IC Markets has a wider range of tradeable instruments than Tickmill.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources: IC Markets

Both brokers provide a range of useful tools and resources for clients, some of which are available to download, and others require account registration.

IC Markets features:

- Blogs for fundamental and technical analysis

- Trading Central and other 3rd party content providers

- Economic calendar and MyFxBook news headlines

- ZuluTrade social copy trading compatibility

- FX Blue LLP advanced trading tools

Tickmill features:

- eBooks with a range of trading topics

- Videos and video tutorials for trading, analysis, and strategies

- Webinars and seminars with forex experts

- Infographics to visualise trading data, charts, and statistics

Our Superior Educational Resources Verdict

There are more resources offered by IC Markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Superior Customer Service: IC Markets

IC Markets has a local support office based in Sydney, Australia. The customer service area can be contacted 24/5 and usually responds within 15 minutes. Complex issues may be resolved in a day through email, Skype, and phone. IC Markets also provides a live chat feature and a dedicated education centre for more information on general trading issues.

Tickmill has a head office in London, UK. The client support number is available Monday to Friday during the hours of 7:00 and 16:00 GMT. The response time is typically within 24 hours of the inquiry through the client support number or email. The broker also provides an inquiry submission section on the website and a live chat tool.

Our Superior Customer Service Verdict

IC Markets has more availability for contact than Tickmill, and given the nature of forex trading, communication with the broker is vital.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

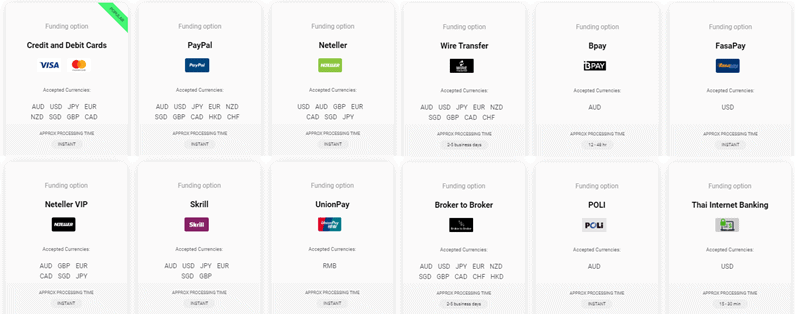

10. Better Funding Options: Tie

IC Markets Funding

IC Markets has a range of options for account deposits and withdrawals, including:

- Debit or credit card

- PayPal

- Neteller and Neteller VIP

- Wire Transfer

- Bpay

- FasaPay

- Skrill

- UnionPay

- Broker to Broker

- POLi

- Thai Internet Banking

- RapidPay

- Klarna

- Vietnamese Internet Banking

There are no deposit or withdrawal fees charged by IC Markets. Most transfer methods will complete transactions either instantly or within days. It is important to note that the withdrawal method must be the same as the deposit method.

Tickmill Funding

There are no costs associated with deposits or withdrawals with a Tickmill account because of the Zero Fees policy. If you use a wire transfer and deposit more than $5,000, Tickmill will refund any fees up to $100. The range of funding methods includes:

- Bank Transfer

- Visa and MasterCard

- Skrill

- Neteller

- DotPay

- PaySafeCard

- Sofort

- Rapid Transfer

- PayPal

Tickmill does not explicitly charge inactivity fees but reserves the right to charge such fees if the broker believes an account is not being actively used.

Our Better Funding Options Verdict

The funding method you choose will depend on what is available and what suits you best. IC Markets and Tickmill both offer a competitive range of options when looking to fund your trading account. By covering all the popular methods, either broker would be a suitable choice. It is slightly cheaper to start with a Tickmill account than it is for IC Markets. However, the difference is negligible, and IC Markets offers a far greater range of funding methods than Tickmill.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

11. Lower Minimum Deposit: IC Markets

The minimum deposit requirement for IC Markets is $0, and there is no minimum withdrawal amount.

For Tickmill, the minimum deposit requirement is $100, and a minimum of $25 is required for withdrawal from your account. To access the VIP Account with Tickmill, you need to have a minimum of $50,000 in your account to qualify.

Our Lower Minimum Deposit Verdict

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: Tickmill or IC Markets?

Based on the comprehensive analysis and comparison of the two brokers, IC Markets is the winner because it consistently outperforms Tickmill in several key areas, including trading platforms, account types, and overall trading experience. The table below summarises the key information leading to this verdict:

| Criteria | IC Markets | Tickmill |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platforms | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| CFD Product Range And Financial Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Better Customer Service | ✅ | ❌ |

| More Funding Options | ✅ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

IC Markets is the ideal choice for beginner traders due to its user-friendly platforms, comprehensive educational resources, and competitive pricing.

Best For Experienced Traders

For seasoned traders, IC Markets stands out with its advanced trading platforms, diverse product range, and superior trading conditions.

FAQs Comparing IC Markets Vs Tickmill

Does Tickmill or IC Markets Have Lower Costs?

IC Markets generally offers more competitive pricing than Tickmill. On average, IC Markets boasts tighter spreads, especially during peak trading hours. For instance, their EUR/USD spread can go as low as 0.1 pips. If you’re keen on exploring brokers with the lowest commissions, you might want to check out this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Tickmill and IC Markets offer robust MetaTrader 4 platforms, but IC Markets edges out slightly due to its enhanced execution speeds and customisable features. This platform is a favourite among traders globally, and if you’re interested in diving deeper, here’s a list of the best MT4 brokers available.

Which Broker Offers Social Trading?

When it comes to social or copy trading, IC Markets stands out. They provide traders with a platform that integrates seamlessly with various social trading tools. This feature allows even novice traders to mimic the strategies of seasoned professionals. For those keen on exploring more about social trading platforms, here’s a detailed review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Tickmill nor IC Markets offer spread betting services. Spread betting is a unique form of trading that’s especially popular in the UK. If you’re interested in brokers that do provide this service, you can explore the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian forex traders. Founded in Australia, IC Markets is ASIC-regulated, ensuring a high level of trust and security for traders. While Tickmill is a strong contender in the forex market, IC Markets’ deep roots in Australia and its commitment to local traders give it an edge. If you’re an Australian trader or someone interested in the Australian forex market, you might want to check out this list of Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe Tickmill offers a slightly better trading experience. While both brokers are FCA regulated, ensuring top-notch security for traders, Tickmill’s presence and tailored services for the UK market make it stand out. IC Markets, although a global powerhouse, is originally from Australia. UK traders looking for a comprehensive trading platform might find this list of the best Forex Brokers In UK quite useful.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What is the turnover of Tickmill?

Tickmill UK reported annual revenue of £6.18 million in 2022 which is a decline of 19.5 % from the £7.6 million in 2021.

Does Tickmill require KYC?

Yes they do.

Does IC Markets charge overnight fees?

Yes, IC Markets applies swaps when trading Forex, however you can apply for a swap-free account.