MultiBank Group Review Of 2026

MultiBank Group is regulated by 12+ different forex authorities – the most I’ve encountered. The broker offers three account types, including an ECN account with spreads from 0.0 pips and a $3.00 commission per lot. Trading platforms include MT4, MT5 and the MultiBank-Plus platform, which features integrated social and copy trading tools.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Multibank Group Summary

| 🗺️ Tier 1 Regulation | AU(ASIC), DE(BaFin), SG(MAS), CY(CySEC) |

| 🗺️Other Regulation | CIMA, FMA, VFSC, FSC-M, FSC-BVI, FSA-S, SCA-AE |

| 💱 Trading Fees | Pro, ECN, Standard |

| 📊 Trading Platform | MT4, MT5, Multibank-Plus |

| 💰 Minimum Deposit | $50 Standard, $1,000 Pro, $10,000 ECN |

| 💰 Funding Fee | $0 |

| 🛍️ CFDs Offered | Forex, Metals, Cryptocurrencies, Indices, Energies, Shares |

Why Choose MultiBank Group

MultiBank Group is a well regulated forex broker with licenses from over a dozen authorities worldwide, including ASIC (Australia), MAS (Singapore), and DFSA (UAE).

I found that the broker also has competitive trading conditions, including 0.0 pips (with ECN account), and commission rates of $3.00 round-turn. As a trader you also get access to MT4 and MT5 and the brokers proprietary MultiBank-Plus platform. The latter includes social and copy trading tools which I think is great if you are a beginner trader.

Some downsides are that to access the best trading conditions, you’ll need to deposit $10,000 to open an ECN account and $1,000 for a Pro account. This is fine as you will get any unused funds back but it is more than some other brokers. There’s also a $60 inactivity fee after 90 days and limited educational resources. While MultiBank isn’t licensed by the FCA (UK), it is regulated by several top-tier financial authorities across multiple regions.

MultiBankGroup Pros and Cons

- Regulated across five continents by 17+ authorities

- ECN accounts offering raw spreads from 0.0 pips

- High leverage options up to 500:1

- Over 20,000 tradable instruments

- Fee of $60/month, after 3 months of inactivity

- Minimum deposits for Pro ($1,000) and ECN ($10,000) accounts

- Services are limited for U.S. clients

The overall rating is based on review by our experts

Trading Fees

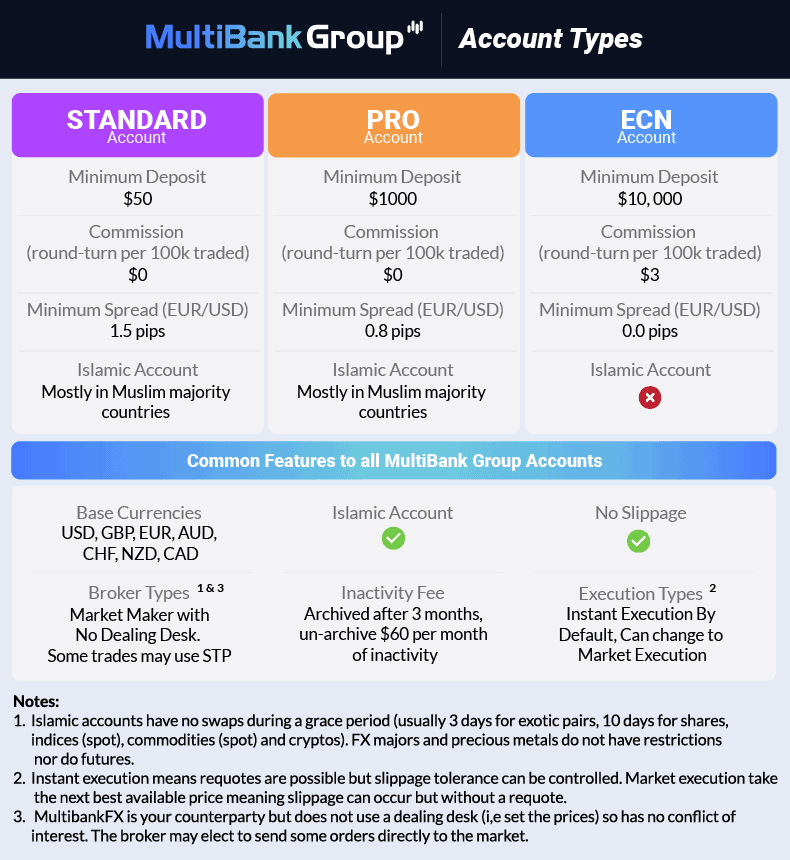

As a forex trader, trading fees are perhaps the most important metric when choosing a broker. MultiBank Group provides three core account types, each with distinct features and minimum deposit requirements.

These account types are:

- Standard – Spreads from 1.5 pips and no commission. Minimum deposit = $50.

- Pro – Spread from 0.8 and no commission. Minimum deposit = $1000

- ECN – Spreads from 0 pips with $3.00. Mininum deposit = $10,000

All these accounts use an ECN model, effectively connecting traders to a robust network of diverse liquidity providers. This gives MultiBank Group an advantage since it means they have “No-Dealing Desk (NDD)” execution.

In terms of transparency, I also appreciate that MultiBank Group discloses its liquidity providers publicly.

1. Raw Account Spreads

For seasoned professionals and high-volume traders, the ECN Account offers the most competitive conditions. To use the account, you will need to pay a higher minimum deposit of $10,000 but it provides raw spreads starting from 0.0 pips which are sourced using an Electronic Communication Network (ECN) model. Interestingly, this account has instant not market execution.

Spreads on major forex pairs start from 0.0 pips, allowing you to see the true market price before commissions are applied. For example, EUR/USD can trade at raw spreads as low as 0.0 pips, while other majors (e.g., GBP/USD, USD/JPY) often hover around 0.1 - 0.2 pips during peak liquidity.

This ECN account is ideal for scalpers and algorithmic traders who prioritise the tightest possible spreads. The increasingly competitive spreads and ECN access for Pro and ECN accounts appeal to more experienced and high-volume traders

2. Raw Account Commission Rate

As you already know, MultiBank’s ECN (Raw) account is commission‑based. It is charging a fixed USD 3.00 per standard lot (100,000 base currency) round-turn for forex trades. Yes, you read that right, just $1.50 to open and to close your trade. This is exceptionally competitive for the market.

| Broker | USD |

|---|---|

| Fusion Markets | $2.25 |

| CMC Markets | $2.50 |

| Go Markets | $2.50 |

| MultiBank Group | $3.00 |

| HF Markets | $3.00 |

| Tradersway | $3.00 |

| VT Markets | $3.00 |

| FIBO Group | $3.00 |

| FlowBank | $3.25 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| IC Markets | $3.50 |

3. Standard Account Fees

This account is particularly well-suited if you are new to trading as it requires a low minimum deposit of just $50. The account is commission-free or (more accurately) spread-only which means no commission costs outside the spread. You will find spreads start from 1.5 pips.

This accessibility makes it an excellent entry point into the forex market, appealing to individuals who are just beginning their trading journey.

4. Pro Account Fees

The Pro account at MultiBank Group requires you to deposit at least USD 1,000 and features average spreads from 0.8 pips. These spreads are on major forex pairs, translating to roughly USD 3.00 per standard lot round‑turn.

Unlike the ECN account, the Pro tier is commission‑free, making it well-suited if you are an intermediate trader who executes higher volumes but prefers predictable, all-in spreads.

Both the Standard and Pro accounts support MT4, MT5, and the proprietary MultiBank‑Plus platform.

5. Swap-Free Account Fees

MultiBank Group also offers an Islamic Account, also known as a ‘Swap-Free Account,’ for clients in specific eligible countries. These countries are those that largely follow Sharia rule or have Islam as their main religion. Examples include the UAE, Algeria, Bangladesh, Chad, Indonesia, Kazakhstan, Lebanon, Mali, and Oman.

Swap-free accounts waive all swap charges or credits on overnight positions, adhering to Islamic faith principles that don’t permit the use of riba. Accounts without swaps are available for Standard and Pro account types, but not for ECN accounts.

6. Other Fees

A notable charge is the $60 monthly maintenance fee applied to accounts that remain inactive for 90 days or more. Active traders will typically avoid this.

Swap rates, or rollover fees, are applied to leveraged positions held open overnight. These rates are based on interest rate differentials and prevailing market conditions.

My Verdict on Multibank Group Fees

MultiBank’s pricing is competitive at the top end but far from the cheapest for casual traders. The ECN account offers true raw spreads (0.0 pips), but requires a very high deposit and comes with ~$3/lot commissions.

The Standard account is easy to open ($50 min) and commission-free, but you pay wider spreads (e.g. ~1.5 pips on EUR/USD. In practice, these costs are reasonable but not industry-leading. I rate MultiBank’s fee structure 7.5/10: excellent for active ECN-style traders, but on the expensive side for beginners.

Trading Platforms

3 Trading platforms are available with Multibank Group. These are MetaTrader 4, MetaTrader 5 and MultiBank-Plus. You can also engage in social trading using EX Social trading.

My team at CompareForexBrokers created a trading platform selector so you can find out which trading software best matches your needs. I recommend you complete the short 5-step questionnaire to help you determine the most suitable forex platform to use.

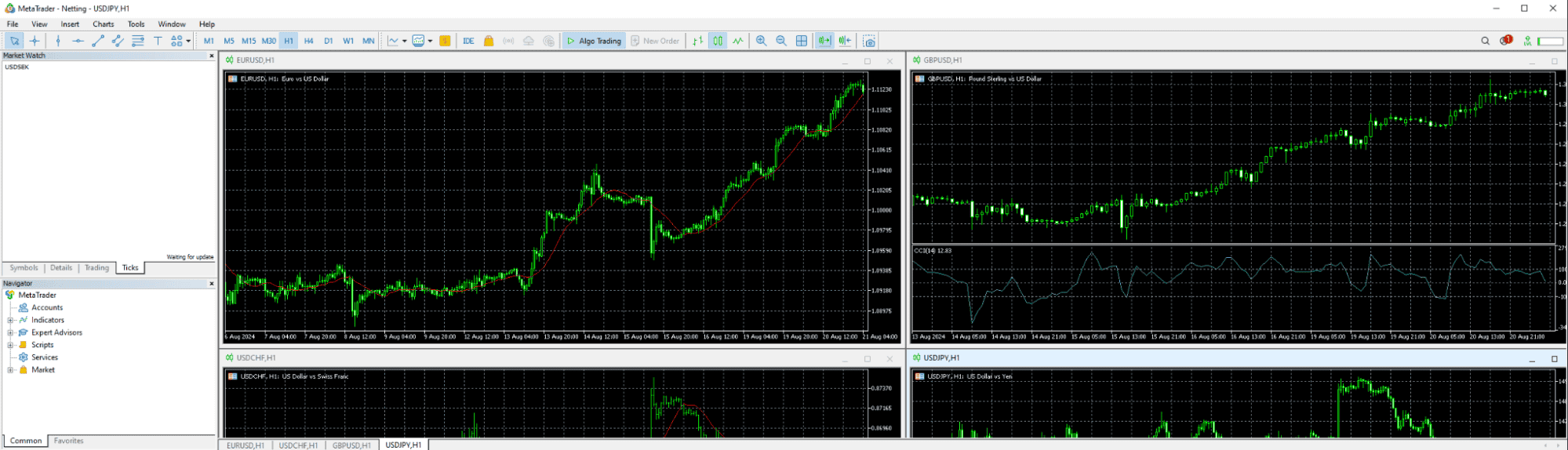

MetaTrader 4

Like many other professional traders, MT4 is my most-used trading platform overall. MT4, developed by MetaQuotes, is one of the most established platforms in retail trading, and there’s a reason it remains so popular today.

Why I use MT4:

- It has a huge global user base, meaning there’s a massive library of custom indicators, Expert Advisors (EAs), and community support.

- There’s solid charting functionality with 31 analytical objects, 30 built-in technical indicators, and 9 timeframes.

- You get 4 pending order types and 3 order execution modes, giving enough flexibility for most trading styles.

- I’ve been able to build and customise EAs with MQL4, and the marketplace is packed with ready-made bots and tools.

One of my favourite things: it works across all my devices like Windows, Mac, iOS, Android, and even in a browser with MT4 WebTrader.

Why you might skip MT4:

- MT4’s focus is mostly on forex and indices (if you want access to stock CFDs or broader assets, you’ll need a more modern platform).

- It’s starting to feel a bit dated when compared to MT5, especially when it comes to charting tools and order types.

- MetaQuotes has stopped updating or actively supporting MT4, so at some point, it may phase out in favour of MT5 entirely.

MetaTrader 5

In my experience, MetaTrader 5 (MT5) feels like a natural upgrade from MT4, especially once you get used to the interface. It offers more flexibility and power, from the number of charts and analytical tools to the wider range of tradable instruments and faster processing speeds.

One major difference I noticed is that MT4 was primarily built for decentralised markets like forex, while MT5 is a true multi-asset platform. With MultiBank Group, this means you can trade stock CFDs in addition to forex, since stocks are traded via centralised exchanges (something MT4 doesn’t support).

Some of the MT5 features I found particularly useful include:

- Advanced charting with 44 analytical objects, 38 built-in indicators, and 21 timeframes, ideal if you’re into scalping or technical analysis.

- Two additional pending order types: buy stop-limit and sell stop-limit, which add more control to your entries.

- Access to actual volume data (not just tick volume like on MT4), which gives better insight into market activity.

- A more flexible programming language (MQL5) that I found easier to work with compared to MQL4 when testing EAs or custom indicators.

Although MT5 looks somewhat similar to MT4 at first glance, it definitely took me a little while to adjust and make the most of its features. That said, if you’re an intermediate or advanced trader, I think it’s well worth the transition. It’s like a more modern and robust version of MT4, built for those who want more depth in their trading tools.

Overall, MT5 has become my go-to platform when I need more than what MT4 can offer.

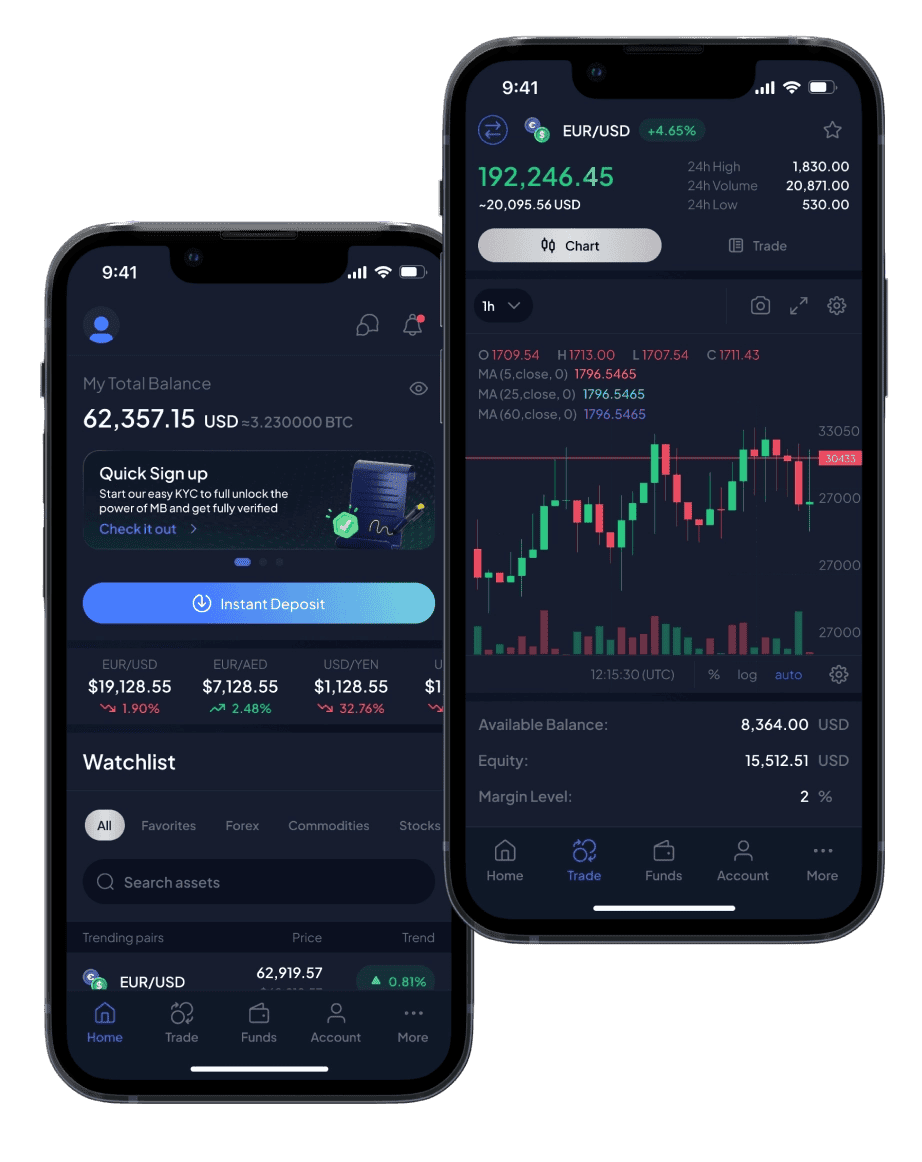

MultiBank-Plus Platform

In addition to the MetaTrader suite, MultiBank Group has developed its own proprietary platform. You can access the broker’s own trading platform via web and mobile (iOS/Android). It has a clean, modern look: charting is powered by TradingView, and it includes a customizable watchlist and market news panels.

At present, MultiBank-Plus is still being developed; it lacks some order types and advanced risk tools compared to MT4/5. Overall, it’s a nice “all-in-one” portal, but not yet as powerful as dedicated platforms.

Here is what I liked about their proprietary app:

- Social Trading: MultiBank provides copy-trading features through EX Social Trading. Clients can copy other traders through MultiBank’s own social platform (web-based) or via the MetaTrader Signals market.

- I found the mobile app most useful for tracking balances, funding, and performance without switching between portals.

I think that the biggest upside with their proprietary app, unlike MT4/5, MultiBank-Plus, combines trading and account tools in one place.

My Verdict on MultiBank Group Trading Platforms

Offering both MetaTrader 4 and 5 is a big plus (nearly all forex brokers support these, and MultiBank’s implementations include news and VPS support). The new MultiBank-Plus platform shows promise with a slick interface, but it still has room to grow.

In practice, I give MultiBank’s platforms a 8.0/10. Traders have flexibility (MT4/5 + web/mobile apps), but currently, the proprietary platform is not yet best-in-class.

Trading Experience & Execution Speed

As I already mentioned, the ECN model provides us as traders with direct access to over 20 interbank trading prices, ensuring complete market transparency.

The broker also offers Financial Information Exchange Application Programming Interface (FIX API) connectivity, which is particularly beneficial for high-frequency traders seeking enhanced accuracy and faster trading speeds.

Trust

The broker boasts an impressive global reach, serving over 2 million clients across more than 100 countries. Strict fund protection is also present with the broker, as they have features such as negative balance protection, segregated accounts and KYC protocols.

For clients of MEX Atlantic, MultiBank Group offers an additional layer of security through a $1 million excess loss insurance policy per account, underwritten by Lloyd’s of London.

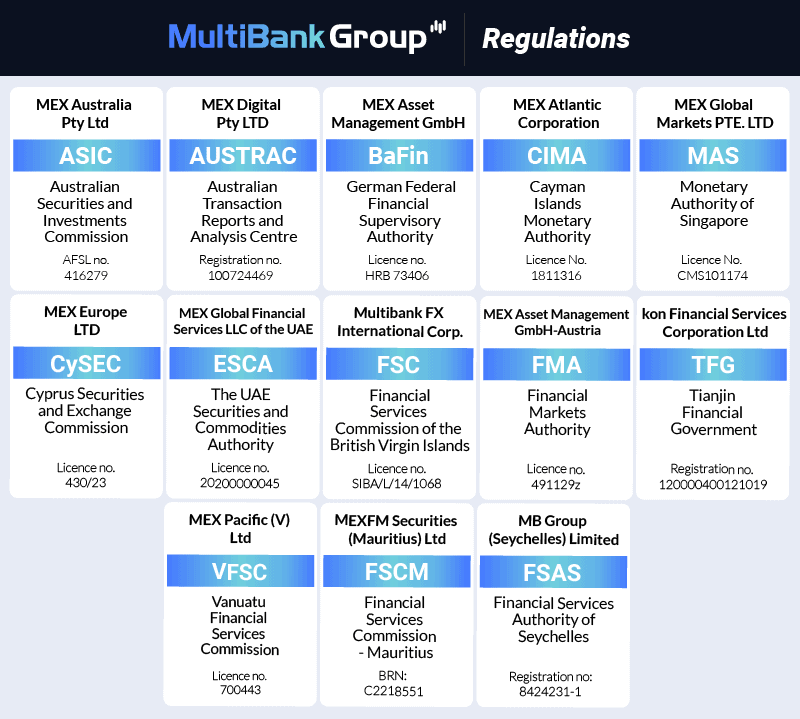

1. Regulation

MultiBank Group has a very impressive suite of regulators, whose sheer number is rare to see when reviewing competing brokers. This is always good to see, as it means that the broker had to go through multiple rigorous standards.

MultiBank Group explicitly lists ESCA (Emirates Securities and Commodities Authority) and VARA (Virtual Asset Regulatory Authority, Dubai) among its regulators.

Key Tier-1 regulators overseeing MultiBank Group entities include:

- ASIC (Australian Securities & Investments Commission)

- MAS (Monetary Authority of Singapore)

- CySEC (Cyprus Securities and Exchange Commission), providing regulation within the European Union via the MiFID passporting system

Other notable regulatory bodies mentioned include AUSTRAC, BAFIN, CIMA, FSC, FMA, TFG, VFSC, FSCM, FSAS, and FIU.

2. Reputation

MultiBank Group, a prominent name in the global financial derivatives industry, was initially established in California, USA, in 2005. Over nearly two decades, it has grown significantly, strategically relocating its headquarters to Dubai, UAE.

The table below highlights Multibank Group’s regional search interest in 2025.

| Country | 2025 Monthly Searches |

|---|---|

| United Arab Emirates | 1,300 |

| India | 720 |

| United States | 390 |

| Mexico | 390 |

| Spain | 320 |

| Canada | 260 |

| Australia | 260 |

| United Kingdom | 210 |

| Colombia | 210 |

| Brazil | 170 |

| Germany | 140 |

| Pakistan | 140 |

| Philippines | 110 |

| Italy | 90 |

| France | 90 |

| Indonesia | 90 |

| Bangladesh | 70 |

| Ecuador | 70 |

| Venezuela | 70 |

| Saudi Arabia | 70 |

| Hong Kong | 70 |

| Japan | 50 |

| Malaysia | 50 |

| Netherlands | 50 |

| Turkey | 50 |

| Portugal | 50 |

| Peru | 50 |

| Morocco | 50 |

| Singapore | 50 |

| Bolivia | 50 |

| Cyprus | 40 |

| Nigeria | 40 |

| South Africa | 40 |

| Thailand | 40 |

| Egypt | 40 |

| Cambodia | 40 |

| Panama | 40 |

| Poland | 30 |

| Switzerland | 30 |

| Uzbekistan | 30 |

| Vietnam | 30 |

| Chile | 30 |

| Greece | 30 |

| Taiwan | 30 |

| Jordan | 30 |

| Austria | 20 |

| Argentina | 20 |

| Sweden | 20 |

| Dominican Republic | 20 |

| Uruguay | 20 |

| Mongolia | 20 |

| Kenya | 10 |

| Algeria | 10 |

| Ireland | 10 |

| Botswana | 10 |

| Ghana | 10 |

| Costa Rica | 10 |

| Sri Lanka | 10 |

| Uganda | 10 |

| Ethiopia | 10 |

| Tanzania | 10 |

| New Zealand | 10 |

| Mauritius | 10 |

1,300 1st | |

720 2nd | |

390 3rd | |

390 4th | |

320 5th | |

260 6th | |

260 7th | |

210 8th | |

210 9th | |

170 10th |

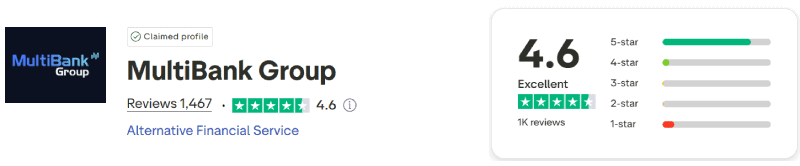

3. Reviews

MultiBank Group is generally well-received with its user base, and it boasts an impressive 4.6 out of 5 rating over 1,400 reviews. The overwhelming majority of these reviews are positive, with users mentioning the good customer support and easy withdrawal/ deposit.

The few negative reviews were mostly about financial holds or swap charges.

My Verdict on MultiBank Group Trustworthiness

MultiBank’s massive regulatory footprint and clean track record earn strong marks. I rate its trustworthiness at a near perfect 9.5/10. The brokers’ unblemished compliance and world-class licenses (ASIC, MAS, VARA, etc.) give me plenty of confidence. The only slight downside is the absence of an FCA/FCA-level license.

Deposit and Withdrawal

Funding options are another important part of the equation when evaluating a broker. MultiBank Group does well in this regard as they have a diverse range of methods available.

What is the Minimum Deposit at MultiBank Group?

The Standard account can be opened with only $50 (EUR/GBP/etc equivalent)

multibankfx.com. The Pro account requires $1,000, and the ECN account requires $10,000. As a retail trader, I find this to be great, but the pro account minimum deposit and ECN account are significantly higher than those of other competitors offering similar or better spreads.

Account Base Currencies

MultiBank Group supports a range of major currencies as account base currencies. These include USD, GBP, EUR, CHF, AUD, NZD, and CAD. Note that if you trade instruments in other currencies, standard conversion fees may apply.

Deposit Options And Fees

The broker explicitly states that it does not impose internal fees for deposits. Processing times vary: card and e-wallet deposits are typically instant to minutes, while bank transfers take 1–3 business days.

MultiBank Group offers several methods for depositing funds into a trading account:

- Instant Payments: Clients can deposit instantly using credit or debit cards. The broker also accepts a range of secure online payment channels, which may vary by country.

- Bank Transfer: This option covers a wide range of credit transfers, including cash payments and wire transfers to local banks.

- Crypto Payments: Instant crypto deposits are supported using BTC, USDT ERC20, or USDT TRC20 from a client’s wallet.

- SEPA: For clients within the Eurozone, SEPA transfers are available with a minimum amount of $250.

Withdrawal Options And Fees

Withdrawal options include wire transfer, credit/debit card, and e-wallets such as Neteller and Skrill, though availability may vary by country. You will be happy to learn that no internal withdrawal fees are charged by MultiBank Group. However, external charges from banks or payment providers may apply depending on the chosen method.

Ease of Opening an Account

Opening an account with MultiBank is largely online and user-friendly. You sign up on their website or MultiBank-Plus portal, fill in your personal details, and complete a quick KYC (upload ID and proof of address). The process takes minutes to submit; verification may take 1-2 business days. According to testers, the MultiBank client portal is clean and modern

My Verdict on Multibank Group Funding

MultiBank excels in funding flexibility. With a very low minimum deposit ($50) and over 20 payment options, almost anyone can fund their account easily. The lack of deposit/withdrawal fees from the broker is a plus. I rate funding at 8.0/10. The only minor downsides: regional clients may prefer local methods (which MultiBank does offer many of).

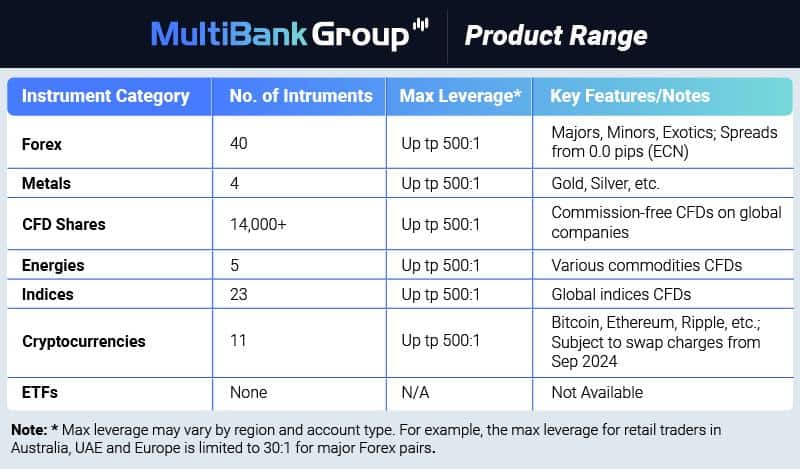

Product Range

MultiBank offers trading in forex and CFDs on many asset classes.

CFDs

MultiBank provides CFDs on over 1,000 shares (US and global companies), major indices (e.g. S&P 500, FTSE 100, DAX), commodities (like Gold, Oil), and most major forex pairs. You can also trade Bitcoin along with a few other cryptocurrencies like Ethereum and Ripple as CFDs. In total, the broker offers 20,000 instruments with roughly 1,042 symbols already being available by default on MT4/MT5.

FX Trading

55+ currency pairs are offered, including majors, minors and many exotics. The spreads you pay will be determined by the trading account you use for trading.

Indices

MultiBank Group offers 23 major global index CFDs across key regions including the U.S., Europe, and Asia. Notable examples include the S&P 500, Nasdaq 100, Dow Jones 30, FTSE 100, DAX 40, and Nikkei 225.

These index CFDs are competitively priced, with low trading commissions. For instance, trading the S&P 500 CFD typically incurs a cost of approximately $0.90 per contract, making it cost-effective for both day traders and longer-term investors.

Commodities

You can trade gold, silver and other metals, plus energies like oil, natural gas, and agricultural products. Gold/min spread is ~0.02 (at Standard)

Cryptocurrencies

Leading crypto assets (Bitcoin, Ethereum, etc.) are tradable as CFDs. Leverage is lower on crypto (e.g. 20:1 as is common), and spreads are wider (e.g. tens of USD on BTC).

ETFs

As of the writing of this review, MultiBank does not offer direct ETF trading. You cannot trade ETFs or bonds directly; only the underlying indices or stocks.

Share Trading

MultiBank Group allows you to trade fractional shares of U.S. and international companies through CFDs (Contracts for Difference). This lets you gain exposure to high-priced stocks — like Amazon or Tesla — without needing to purchase a full share.

Since all trades are CFD-based, you don’t own the underlying stock but instead speculate on its price movements. MultiBank does not offer traditional share dealing or direct stock ownership.

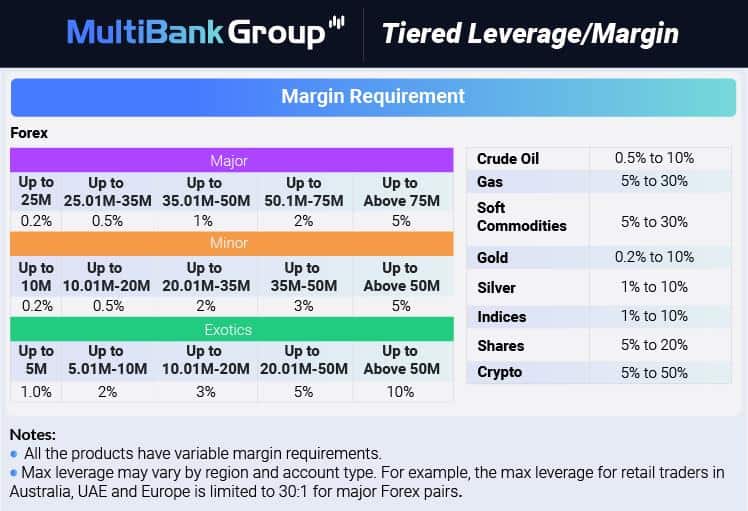

Leverage

MultiBank Group offers maximum leverage of up to 500:1 on forex pairs for Standard and Pro account holders. However, the actual leverage available to retail traders depends on local regulatory restrictions:

- Australia & Europe: Capped at 30:1 on major forex pairs, 20:1 on minors and non-major indices, in line with ASIC and ESMA rules.

- UAE (SCA-regulated): Typically allows leverage of up to 500:1 for major pairs

- Singapore: Retail leverage is restricted to 20:1 under MAS regulation.

- Unregulated or offshore jurisdictions: May access up to the full 500:1 leverage.

For CFD indices and commodities, leverage is generally up to 50:1, and for crypto CFDs, it’s capped at 20:1 — in line with common global regulatory standards.

MultiBank applies the same maximum leverage tiers across different account base currencies, though your actual leverage will depend on your location and client classification (retail vs professional).

My Verdict on MultiBank Group Trading Range

The breadth of markets is impressive – I give it 8.5/10. MultiBank covers all major asset classes: 50+ FX pairs, stock indices, commodities, metals, and crypto. The lack of ETF trading and direct stock ownership is a minor gap, but most traders can find alternatives via CFDs. The only drawback is that many of the thousands of listed instruments aren’t immediately visible in the platforms.

Customer Service

Customer support at MultiBank Group is available 24 hours a day, 7 days a week, ensuring that traders can receive assistance regardless of their geographical location or trading hours. The support team is multilingual, fluent in 22 languages.

As a trader, you can reach out via the following channels:

Customer support channels include:

- Live Chat

- Phone

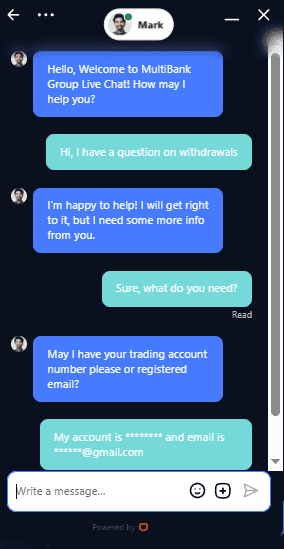

I had a question about setting up an Islamic account so I contacted support via live chat, and within 10 minutes, a friendly agent responded. Mark (the agent dealt with) promptly explained the documentation needed and even followed up by email to ensure my forms were submitted correctly. Within a few hours, my swap-free status was confirmed.

In addition, MultiBank provides a “Mission Centre” and an FAQ section on its site, though these resources are relatively basic.

My Verdict on Multibank Group Customer Service

MultiBank’s customer service earns a solid 8.5/10. The team is fast, professional and truly 24/7, which is above average in this industry.

The short story above illustrates a very positive interaction: they resolve issues (like account verification or special requests) quickly and follow up diligently. Overall, I found that their support is better than many small brokers.

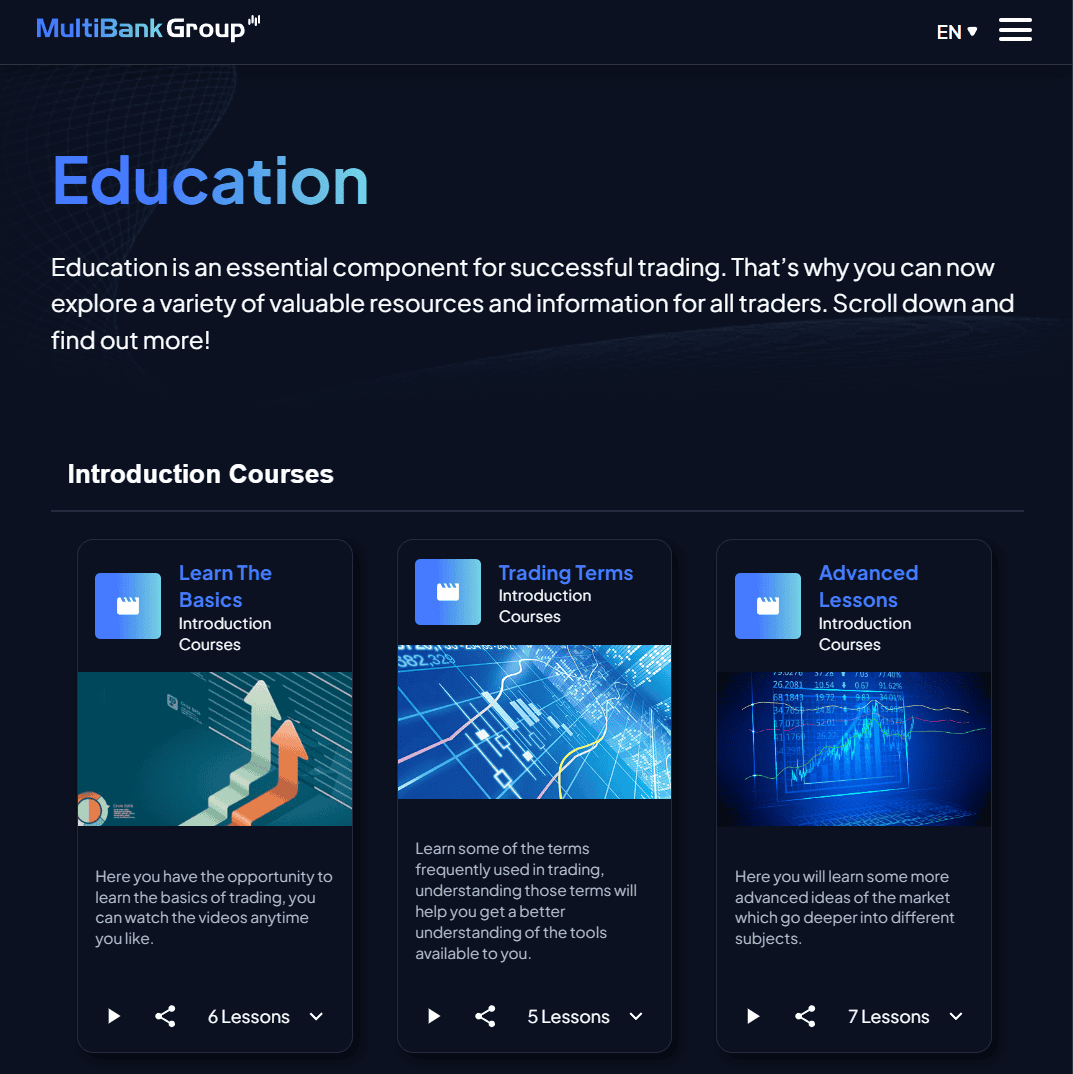

Research and Education

MultiBank’s educational offerings are fairly minimal. The broker provides some basic content: a handful of short “how-to” videos and e-book guides (via a portal powered by MTE Media).

These cover forex basics (pips, leverage, risk) and market overviews, but they are quite general and brief. There are no live webinars or in-house seminars, nor any regular market research reports.

The only market commentary available comes from the MT4 news feed or external sources. By contrast, top brokers often have extensive tutorial courses, webinars and daily analysis.

My Verdict on MultiBank Group Research and Education

I give MultiBank 7.0/10 in this category. They have the fundamentals in place (account guides, glossary, some videos), but nowhere near the depth of dedicated education portals.

Advanced traders like me won’t find much worthwhile research here. In my view, the broker’s focus is on execution and regulation rather than trader training.

FAQs

Is MultiBank Group regulated in the UAE?

Yes, MultiBank Group is regulated by the Securities and Commodities Authority (SCA) in the UAE under the name MEX Global Financial Services LLC. This provides added trust for traders based in the region.

Does MultiBank Group offer Islamic (swap-free) accounts in the UAE?

Yes, MultiBank Group offers swap-free Islamic accounts that are compliant with Shariah law. These accounts are available to UAE residents and can be requested during or after account registration.

Can I deposit and withdraw in AED?

While MultiBank primarily supports major currencies like USD and EUR, UAE traders can deposit in AED through local payment providers or bank transfers, with currency conversion handled automatically.

Final Verdict on MultiBank Group

MultiBank Group is a highly regulated, feature-rich broker that caters mainly to serious forex/CFD traders. It ticks many boxes: Tier-1 licenses (ASIC, MAS, etc.) and new UAE approvals, low-cost ECN execution (0.0 pip + $3/lot), and a vast product lineup (FX, stocks, indices, metals, crypto)

Its trading platforms are strong (MT4/5 plus a slick proprietary app), and its customer service is fast and 24/7. On the downside, MultiBank has slightly higher deposit requirements for its lowest spreads, and lacks regulation for UK-based traders.

Overall, I give MultiBank a very solid 81 out of 100 based on our evaluation criteria and testing. For advanced traders and those in regions served (especially the Middle East and Asia), it is an excellent choice. Beginners can use it too, but should be aware of the higher fees on standard accounts and the need to self-educate.

Alternatives to Multibank Group

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert