Plus500 Fees

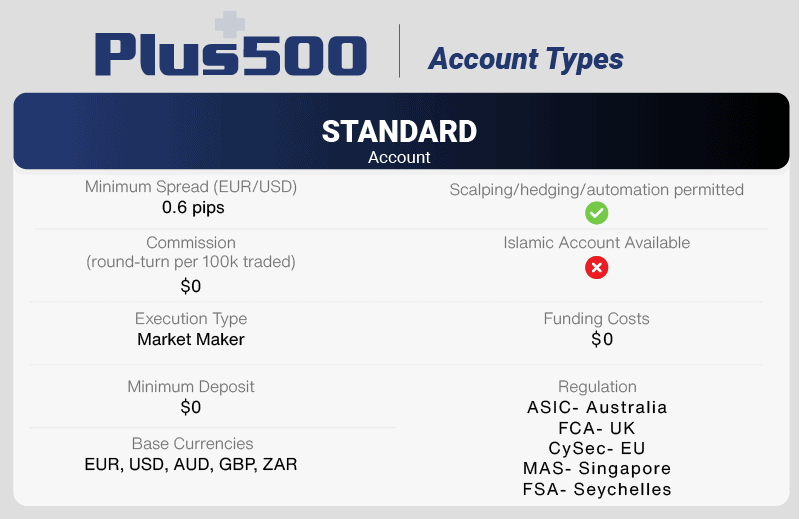

Plus500 is a CFD provider with commission-free spreads for forex CFDs. Discussed below are additional costs attached to guaranteed stop-loss orders, overnight funding, and inactivity fees are infrequent traders.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Key Elements Of Plus500 Fees

Plus500 fees like any CFD trading provider can be categorised into three areas:

Our Plus500 review of fees below examines the key strengths and weaknesses of forex trading with Plus500.

The overall rating is based on review by our experts

Plus500 Spreads

Spreads for Plus500 can be either fixed or dynamic. Variable or dynamic spreads means the difference between the buy and sell price of any currency pairing will vary through the trading day while fixed spreads mean your spread pip costs never change (except in exceptional circumstances).

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Plus500 Average Spread | 1.2 | 2 | 1.7 | 1.1 | 2 | 1.5 | 2.5 | 2 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

Plus500 offers all the majors such as EUR/USD, USD/JPY and AUD/USD, as well as many minor and exotic currency pairs. To provide an idea of spreads we have looked at the major pairings in July 2025 for a snapshot in time.

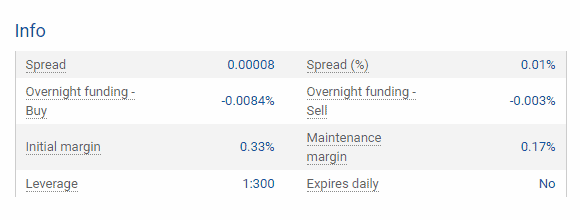

AUD/USD Spread

The spread for the Australian to American dollar currency pair is $0.0008 per unit, also known as 0.01%. At the time of this Plus500 fees analysis, the exact spread was 0.8pips. Leverage offered by Plus500 is 300:1.

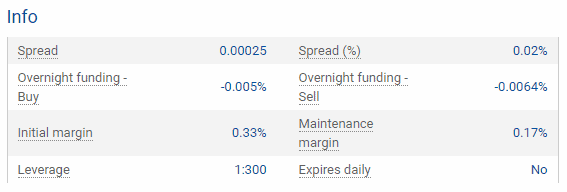

EUR/AUD

The Euro to Australian Dollar has a spread per unit of $0.00025. The spread in July 2025 was 2.5 pips or 0.02% expressed as a percentage. The leverage currently offered by Plus500 (depending on the jurisdiction) was 300:1.

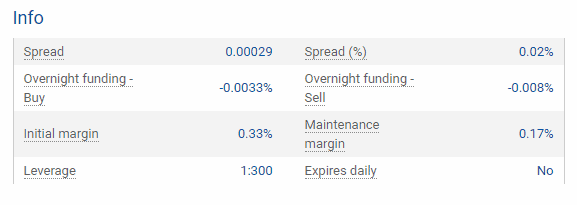

GBP/AUD

The British Pound to Australian dollar has the same percentage spread of 0.02% as the EUR/AUD currency pairing above. The spread per unit is $0.00029 at the time of this review, in July 2025.

| Plus500 | IG | Pepperstone | IC Markets | |

|---|---|---|---|---|

| EUR/USD | 0.6 | 0.6 | 1.16 | 1.1 |

| AUD/USD | 0.6 | 0.6 | 1.27 | 1.2 |

| GBPUSD | 1.1 | 0.9 | 1.49 | 1.2 |

| USDJPY | 0.70 | 0.79 | 1.25 | 1.2 |

Plus500 spreads remain stable across its user-friendly yet powerful WebTrader platform and on the mobile app (Android and Apple iOS).

View our Lowest Spread Forex Brokers page to compare spreads and other trading fees. It found that the overall lowest trading costs are with Fusion Markets as the forex calculator below highlights. To learn more about the broker, go to the Fusion Markets review.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Plus500 Commissions

Plus500 has no commissions on any of their trades. If you’re new to the concept of commissions, the below explains this concept in greater detail:

Why Do Some Forex Brokers and CFD Providers Charge Commissions?

The main way forex brokers and CFD providers make money is similar to a currency exchange business at an airport with a different rate charged to buy back the currency or sell the currency to an individual. The difference between these rates is known as the spread. The issue with spreads is that unless they are fixed (which easyForex Offers) they can widen and shorten every hour and day. This makes online trading costs inconsistent, which can be difficult for frequent traders working on systems.

To minimise spreads and make trading costs more consistent when forex trading, commissions were introduced. By having a set percentage fee based on volume; the spreads can be reduced and in some rare circumstances, spreads can be similar to ECN bid/ask spreads at 0.0 pips.

Open a demo accountVisit Plus500

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Plus500 Additional Fees

There are a handful of additional fees Plus500 charge when trading through CFDs.

1) Premium

When traders hold positions over an hour (which is indicated within the plus500 trading platform ‘instrument detail section’) a premium fee is applied. This covers the funding costs associated with the 300:1 leverage Plus 500 offers. The time of market close is also shown within the forex platform within the details page to provide greater transparency.

A premium is three times higher if held over the weekend. This means a position is opened on a Friday (or earlier) and not closed until the following Monday or later. It’s critical therefore to ensure when forex trading position is closed or the fees are known when choosing to hold a position.

2) Plus500 Inactivity Fee

A $10USD fee is charged to traders who don’t trade for a pre-defined period as stated on the Plus500 user agreement, typically three months. Such inactivity fees are common when currency trading due to the costs of the forex platform and other technologies used.

3) Plus500 Overnight Fee

Similar to the ‘Premium’ discussed above. Whenever client funds are left in an open position overnight, a fee or premium is added to or deducted from your Plus500 account. To better understand what the cut-off times are and how much of a premium Plus500 charge for their overnight fee, click on the ‘Details’ hyperlink next to the instrument name found on the main screen of your Plus500 platform.

4) Plus500 Deposit Fees

There are no deposit fees with Plus500. Client funds can be deposited via the following methods.

- Bank Transfer

- Debit Card

- Credit Cards (Visa, MasterCard)

- Electronic Wallets (PayPal, Skrill)

Disclaimer: Plus500 doesn’t charge depositing fees when you wire real money to your trading account.

5) Plus500 Withdrawal Fees

Plus500 does not charge customer withdrawal fees. However, if the funds you withdraw from your trading account are not in your local currency, you can expect to lose a bit on foreign exchange fees. If you’re withdrawing funds to PayPal, expect to receive slightly less as PayPal foreign exchange rates are slightly worse than if transferring to your bank account.

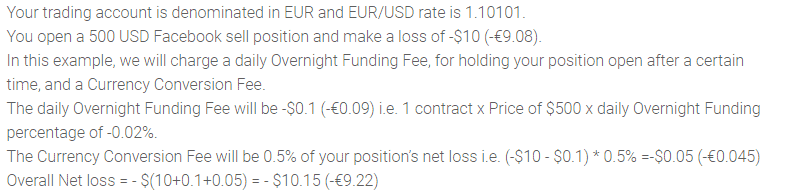

6) Plus500 Conversion Fee

Another additional trading fee charged by this CFD broker is the conversion fee. The currency conversion fee is only applied on CFD instruments that are priced in a different currency than the trading account base currency.

The example below will clarify how the currency conversion fee is calculated.

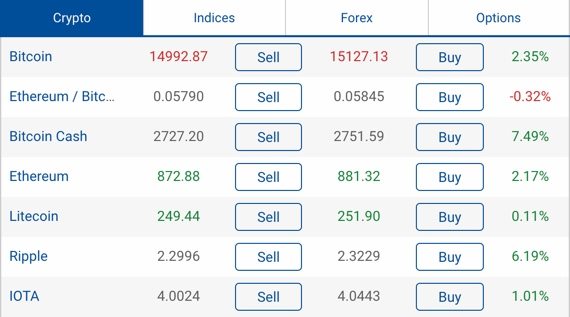

7) Plus500 Bitcoin Fees

Like with trading other financial instruments, Plus500 is largely compensated for its CFD platform services via the bid/ask spreads they offer. They don’t charge any special bitcoin or cryptocurrency fees. Some cryptocurrencies they offer for trading include Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple and IOTA.

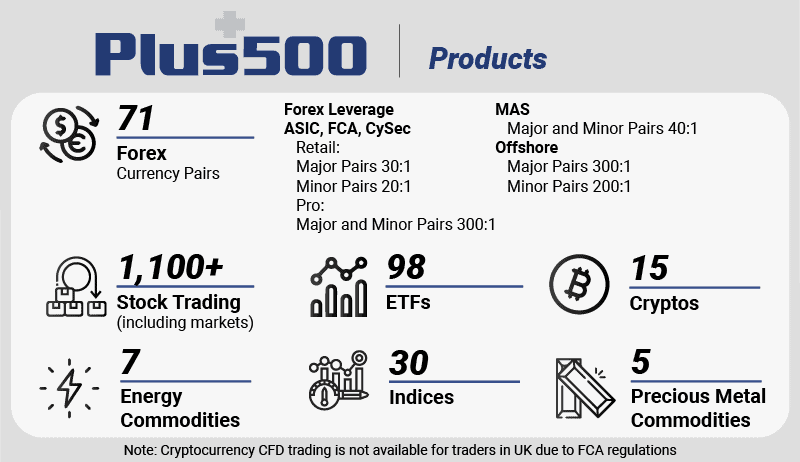

Other Plus500 Trading CFD Instruments

Plus500 Ltd is listed on the Main Market of the London Stock Exchange with a market cap of approx $750 million USD. While this Plus500 fee review focuses on forex trading, there are other options for trading CFDs, including the following asset classes:

1) Shares

20 different markets can be traded ranging from the UK, the USA to Germany. Traders can utilise leverage through Contracts For Difference (CFDs) with no commission charged on any trades. Australian shares can be traded to go short or go long. With leverage, small deposits can help achieve the impact or larger volumes amplifying gains or losses. For this reason, Plus500 allows share traders to pre-define profit/loss positions to close positions once reached.

2) Indices

Major indices such as the NASDAQ 100 FTSE 100, S&P 500 and DAX 30 can be traded. Leverage of up to 300:1 can be applied to these indices due to their historic low movement levels on a daily basis. Online trading with these indices can be done in real-time, and opening an account to start trading can be done in minutes.

3) Commodities

Gold, Silver and even oil can be traded for $100 AUD. Leverage on commodities is slightly lower than other markets at 300:1 (maximum).

4) ETFs

Exchange-traded funds with advantage trading tools market trading EFTs through contracts for difference a popular option. 1:100 leverage is made available, which means $200 can give you exposure of up to $20,000.

5) Options

Plus500 provides traders with the ability to call or put option CFDs on AEX 25, CAC 40 DAX 30, S&P500 or MIB 40. This provides the ability to hedge major indices and be impacted by rising, side-wards or falling markets. Advanced charting options help inform traders of trends and the latest movements within the market.

The Introduction Of Crypto Trading

Cryptocurrencies have taken the world by storm and in 2017 Plus500 started offering customers the ability to trade and speculate on the price fluctuations of the major cryptos including (but not limited to) Bitcoin, Litecoin and Ethereum. Given the volatility of crypto markets, Plus500 limit the leverage they offer to 20:1. This means that if you have a minimum deposit of $200, you could essentially commence trading with up to $4,000 capital. Bid/ask spreads are also relatively competitive when compared to other players.

Please take note that Plus500UK Ltd authorized and regulated by the FCA removed cryptocurrencies from their product list offerings, starting from 6 Jan 2022. UK traders can still bypass the FCA ban on crypto-assets by trading with another Plus500 subsidiary or by choosing an offshore forex broker. The main drawback of an offshore broker is that it doesn’t come with the same level of security and money protection as negative balance protection and other forex compensation schemes.

Please note, before you commence trading cryptos, make sure you fully understand the high risks associated with trading highly volatile, leveraged products. We recommend using risk management tools and trailing stops to help manage your risks.

Please note, before you commence trading cryptos, make sure you fully understand the high risks associated with trading highly volatile, leveraged products. We recommend using risk management tools and trailing stops to help manage your risks.

Open a demo accountVisit Plus500

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Plus500 Fees FAQ

What is the minimum deposit on plus500?

The minimum deposit at Plus500 is as little as $100. While for debit/credit cards and electronic wallet the minimum deposit requirement is $100, for bank transfers the minimum deposit is $500 or 500 units of the base currency. In your Plus500 secure client are, under the Funds Management tab, you can review the minimum and maximum limits per single transaction.

For a complete overview, see our full Plus500 Review and comparison.

Is plus500 commission free?

Pluss500 offers zero-commission trading, as it’s only compensated through the bid-ask spread. However, additional fees can be charged, such as the $10 inactivity fee, 0.5% currency conversion fee, overnight funding fee, and guaranteed stop order fee.

How long does a plus500 withdrawal take?

The withdrawal processing times vary based on the payment option used. Plus500 usually handles all withdrawal requests within 1-3 business days. Once the withdrawal request is internally approved by Plus500, the processing time for each payment method is as follows:

- Electronic wallets – within a few minutes with PayPal respectively 2-5 business days with Skrill

- Credit cards about 5-7 business days

- Bank transfer about 1-5 business days

Plus500 Fees Conclusion

Forex trading costs vary dramatically by the forex broker or CFD provider chosen. Plus500 fees stack up quite well and as explained earlier, their higher fees are offset by their ‘no commission policy’. There are other Plus500 fees such as holding positions and inactivity fees but these are aligned to industry standards. While fees are critical, it’s also important to make sure the leverage, forex platform and customer service suit your trading requirements. Plus500 customer support is accessible via live chat or email to assist traders with any queries. Read our full Plus500 Review for more details on these areas.

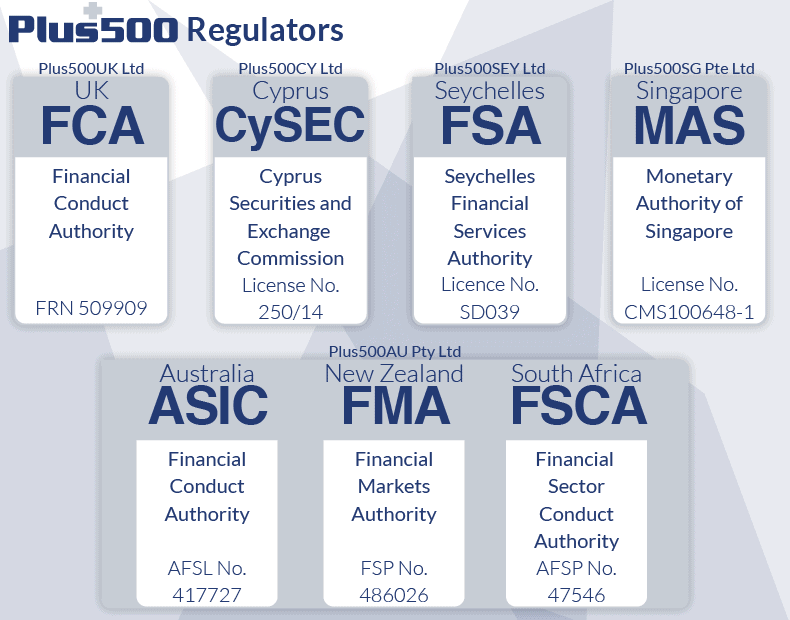

Plus500 is a global brokerage compliant with tier-one regulators in the following jurisdictions:

- Financial Conduct Authority (FCA) FRN 509909

- Plus500uk Ltd – UK

- Australian Securities and Investments Commission (ASIC) AFSL #417727

- Plus500AU Pty Ltd ACN 153 301 681 – Australia

- Seychelles Financial Services Authority (FSA) Licence No. SD039

- Monetary Authority of Singapore (MAS) – Singapore Licence No. CMS100648-1

- Cyprus Securities and Exchange Commission (CYSEC) Licence No. 250/14 Plus500cy Ltd – Cyprus (Europe)

- Financial Markets Authority (FMA) FSP No. 486026 – New Zealand

- Plus500 AU is authorised as Financial Services Provider (FSP) in South Africa #47546

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does Plu500 charge commission?

Plus500 does not charge a separate commission to the spread. Aside for swaps, your trading costs are included in the spread.

Is Plus500 good for day trading?

Yes, Plus500 is great for day trading, charging no commission on trades. The broker also offers a straightforward trading platform, diverse markets (shares, indices, commodities, ETFs, etc.), competitive spreads, and a user-friendly mobile app.