Plus500 Leverage

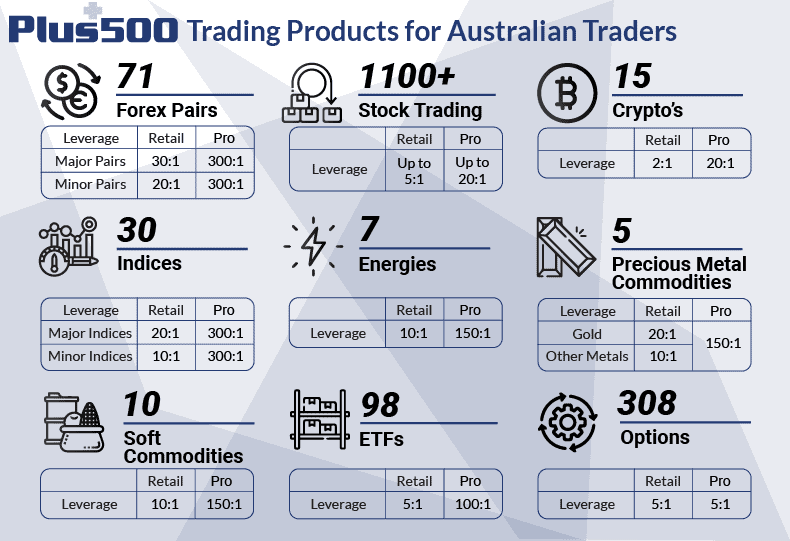

Plus500 account leverage ranges based on the instrument traded ranging from 2:1 leverage for crypto including bitcoin, 10:1 for commodities (20:1 for gold) to 30:1 for forex with each Plus500 instrument traded having specific leverage that cannot be changed.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Plus500 Leverage Levels

Leverage with Plus500 varies by the financial instrument traded as shown on the table below.

| Plus500 Instrument | Leverage |

|---|---|

| Crypto | 2:1 |

| Forex | 30:1 |

| Index CFDs | 20:1 |

| Share CFDs | 5:1 |

| Commodity CFDs | 10:1 |

| EFTs | 10:1 |

View the detailed instruments below offered by Plus500 and their corresponding leverage levels for 2025.

The overall rating is based on review by our experts

Plus500 Crypto Leverage

Plus500 offers cryptocurrency CFD trading. Maximum leverage for Crypto CFD trading is lower than other instruments due to the high risk and volatile nature of the financial instrument. Volatility can be double digits on some days, making leveraged positions leading to significant losses or gains. Plus500 offers the following cryptocurrency CFD trading:

Bitcoin

Bitcoin- Bitcoin Cash ABC

- NEO

- Ethereum

- Ripple XRP

- Litecoin

- IOTA

- Stellar

- EOS

- Cardano

- Tron

- Monero

On top of the 12 cryptocurrency instruments above, traders can also trade the crypto 10 index (the top 10 cryptocurrencies combined). The Ethereum / Bitcoin pairing can also be traded. For all 12 crypto CFDs and the two additional options, the leverage is 2:1. This means that the movements are amplified by a factor of 20 which is high compared to some mainstream forex and CFDs brokers shown below.

Plus500 Forex Leverage

Forex (currency trading) is the most popular instrument to be traded worldwide, and Plus500 is no exception. Over 70+ forex pairs can be traded with the main base currencies of the top pairing, including the:

Australian Dollar (AUD)

Australian Dollar (AUD)- British Pound (GBP)

- Euro (EUR)

- United States Dollar (USD)

- Japanese Yen (JPY)

- Swiss Franc (CHF)

- New Zealand Dollar (NZD)

- Canadian Dollar (CAD)

- South African Rand (ZAR)

- Singapore Dollar (SGD)

- Danish Krone (DKK)

- Czech Koruna (CZK)

With currency pairings movement on average single figures, it’s critical to have the leverage to make net profits substantial with successful trades. Most forex brokers offer their highest leverage levels to forex, and Plus500 is no exception with 30:1 leverage for currency.

It’s important to note that Plus500 does not allow leverage to be adjusted for financial instruments and trades, including currency pairs. This feature is offered by many other brokers and is a useful feature to lower one’s exposure when trading. This is discussed further at the bottom of this Plus500 leverage review.

Plus500 Index CFDs Leverage

Plus500 index CFDs offer both country indices and sector indices trading for retail traders. Example of country indices include the:

ASX 200

ASX 200- ES USA 500

- Nikkei Japan 225

- SPI200

- UK100

Sector indices include:

- BGCANG Cannabis Stock Index

- BUKHI50P UK Brexit High 50 Index

- BUBIOG US Biotech Giants Index

- FNG NYSE FANG+ Index

- BUSCYG Cybersecurity Giants Index

Index CFDs leverage is level with forex trading at 20:1 leverage. This is one of the highest of any Australian CFDs brokers which are shown below. As high leverage comes with a high risk that may lead to great gains or losses, it is important to understand the risks of CFD trading.

Share CFDs Plus500 Leverage

From the USA to Australia and the UK, Plus500 allows trading on the most popular shares offered by major exchanges. Markets where share CFDs are available include:

Australia

Australia- USA

- Hong Kong

- UK

- Germany

- France

- Italy

- Japan

- Singapore

- Holland

- Finland

- Belgium

- Ireland

Individual shares can have large movements during key economic and corporate events. These include annual reporting, company announcements, industry changes and changes to domestic economies. Due to these fluctuations, the leverage available across all Best Forex Brokers In Australia that offer share CFDs is 5:1 as shown below. Features such as guaranteed stop-loss trades should be considered when trading share CFDs to reduce the high risk and limit exposure to the market.

Commodity Plus500 Leverage

Plus500 allows commodity classes from Silver, Oil to Gold to be traded as contracts for difference (CFDs). With commodity CFDs, you do not own the commodity, rather you trade based on movements. The most popular commodities offered are:

- Gold

- Copper

- Oil

- Gasoline

- Platinum

- Palladium

- Wheat

- Heating Oil

- Soybeans

- Silver

- Natural Gas

- Cotton

- Coffee

- Cocoa

The leverage available for commodity CFDs trading is up to 10:1 with the exception of gold which is 20:1. This is consistent with other brokers including IC Markets and Pepperstone Leverage.

Plus500 ETFs Trading Leverage

The final asset class that offers leverage are Exchange-Traded Funds (ETFs). Plus500 offers over 90 ETFs to be traded as CFDs. The leverage available across these ETFs is 5:1.

The final asset class that offers leverage are Exchange-Traded Funds (ETFs). Plus500 offers over 90 ETFs to be traded as CFDs. The leverage available across these ETFs is 5:1.

ETFs are known to have large movements when market-sensitive information is released. Based on this, the negative balance guarantees CFDs brokers provide need to be understood. It means that a trader can’t have a balance that is less than their deposit. Even if this occurs due to slippage in times of extreme market volatility, the trader won’t be out-of-pocket. Rather, Plus500 will pay the difference. For this reason, a trader may consider keeping their balance on the lower-end and only having within the account any amount they are willing to lose.

Plus500 Leverage FAQs

Can you change leverage on Plus500?

No, every instrument has a specific leverage level that cannot be adjusted by a trader, unlike other forex brokers such as Pepperstone and IC Markets.

Can you trade Plus500 with no leverage?

Plus500 in Australia only offers CFD products. As such, leverage levels for different instruments are predetermined and cannot be removed with the CFD broker.

Plus500 Leverage Conclusion

The table below compares Plus500 to other Best Forex Brokers In Australia. It highlights that Plus500 offers some of the highest leverage levels on instruments from ETFs to cryptocurrencies. Other mainstream instruments such as forex and commodity leverage are more modest.

| Instrument Traded | Pepperstone Leverage | IC Markets Leverage | IG Markets Leverage | CMC Markets Leverage | EasyMarkets Leverage | Plus500 Leverage |

|---|---|---|---|---|---|---|

| Forex (Major/Minors) | 30:1/20:1 | 30:1/20:1 | 30:1/20:1 | 30:1/20:1 | 30:1/20:1 | 30:1/20:1 |

| Major Index CFDs/Minor Index CFDs | 20:1/10:1 | 20:1/10:1 | 20:1/10:1 | 20:1/10:1 | 20:1/10:1 | 20:1/10:1 |

| Share CFDs | 5:1 | 5:1 | 5:1 | 5:1 | ✘ | 5:1 |

| Commodities/Gold | 10:1/20:1 | 10:1/20:1 | 10:1/20:1 | 10:1/20:1 | 10:1/20:1 | 10:1/20:1 |

| Cyptocurrency | 2:1 | 2:1 | 2:1 | 2:1 | 2:1 | 2:1 |

| Bonds | ✘ | 5:1 | ✘ | ✘ | ✘ | ✘ |

| Futures | ✘ | 5:1 | ✘ | ✘ | ✘ | ✘ |

| ETF | ✘ | ✘ | 5:1 | ✘ | ✘ | 5:1 |

| Treasuries | ✘ | ✘ | ✘ | 5:1 | ✘ | ✘ |

Overall, the leverage levels offered by Plus500 should suit most traders. What may be the issue is that traders cannot change their leverage levels when using Plus500 as their CFD broker. This applies to all instruments and may rule out traders that require flexibility with regard to leverage. It may also make the broker not suitable for traders who are risk-averse. Yet this is a minority of traders, therefore the leverage offered by Plus500 should suit most individuals’ CFD trading needs.

Open a demo accountVisit Plus500

*Your capital is at risk ‘72% of retail CFD accounts lose money’

More About Leverage

Leverage allows traders to be more exposed to markets. This increases any profit or loss from movements which is critical for instruments like forex. This is because currency movements are normally single figure percentage movements. Without leverage, these movements would be so modest it would be hard to make meaningful gains/losses on most days.

Essentially, leverage is similar to a short-term loan. Leverage of 100:1 means that for every $1 traded that Plus500 will allow a trader to trade $100. So as an example, if a trader has a deposit of $1,000 and trades the full amount on forex which has 300:1, the total trade would be $300,000. A currency pair movement of just 0.2% would then leave to a profit or loss of $600. That is over half the initial deposit highlighting how leverage amplifies the risks of trading. Some locations such as UK limit leverage for Plus500 and Pepperstone in Europe. Read more about Pepperstone Leverage in Europe.

Risk Management Features By Plus500

With risk amplified by leverage and no ability to reduce it by Plus500, a trader should know the broker’s features. One such feature is the guaranteed stop order, which can only be placed on new orders. Once placed, a trader can choose the maximum amount they are willing to profit or lose on the trade. Even when conditions don’t allow the broker to exit at this rate, Plus500 will still honour the amount set. Losses on that trade will not exceed this amount. It should be noted the Plus500 guarantees stop losses have an additional fee attached to its usage.

The second risk management feature Plus500 offers is negative balance protection. This ensures a trader’s losses don’t exceed their deposit. It has been known in extreme market events of brokers’ losses far exceeding their deposit. Brokers have then chased up the funds they are owed. This will never be the case for Plus500 based on this Negative Balance Protection feature.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Ask an Expert