PU Prime Review of 2026

PU Prime has a strong regulatory framework and is best suited if you are a high-volume trader. You get access to highly competitive raw spread pricing with 4 account types to choose from. Trading with PU Prime can be done via MT4, MT5 platforms or via the PU Prime trading and copy trading apps.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

PU Prime Summary

| 🗺️ Tier 1 Regulation | ASIC (Australia) |

| 🗺️Other Regulation | FSCA, FSA-S, FSC-M |

| 💱 Trading Fees | Tight spreads + low commission for ECN |

| 📊 Platforms | MT4, MT5, PU Webtrader, PU CopyTrading |

| 💰 Minimum Deposit | $50 |

| 💰 Funding Fee | $0 |

| 🛍️ CFDs Offered | Forex, Indices, Commodities, Metals, Shares, ETFs, Bonds, Crypto |

Why Choose PU Prime

As a trader, my primary motivation for selecting a broker is often tied to execution quality and cost efficiency. PU Prime shines in this area, particularly with their Prime account offering, which delivers ultra-low, raw interbank spreads averaging 0.0 pips on the benchmark EUR/USD pair. This competitive pricing structure is great if you scalp trade and algorithmic traders will be happy to find broad support for copy and social trading.

Beyond pricing, PU Prime offers leverage up to 1:1000, 24/7 support, and access to MT4, MT5, and TradingView. It also provides its own suite of trading apps for standard, copy, and social trading. Lastly, the broker’s regulation in four regions further adds to its credibility.

PU Prime Pros And Cons

- Four strong regulators

- Competitive raw spreads

- Wide instrument range

- High ECN minimum

- Withdrawal concerns noted

- Limited exotic FX pairs

The overall rating is based on review by our experts

Trading Fees

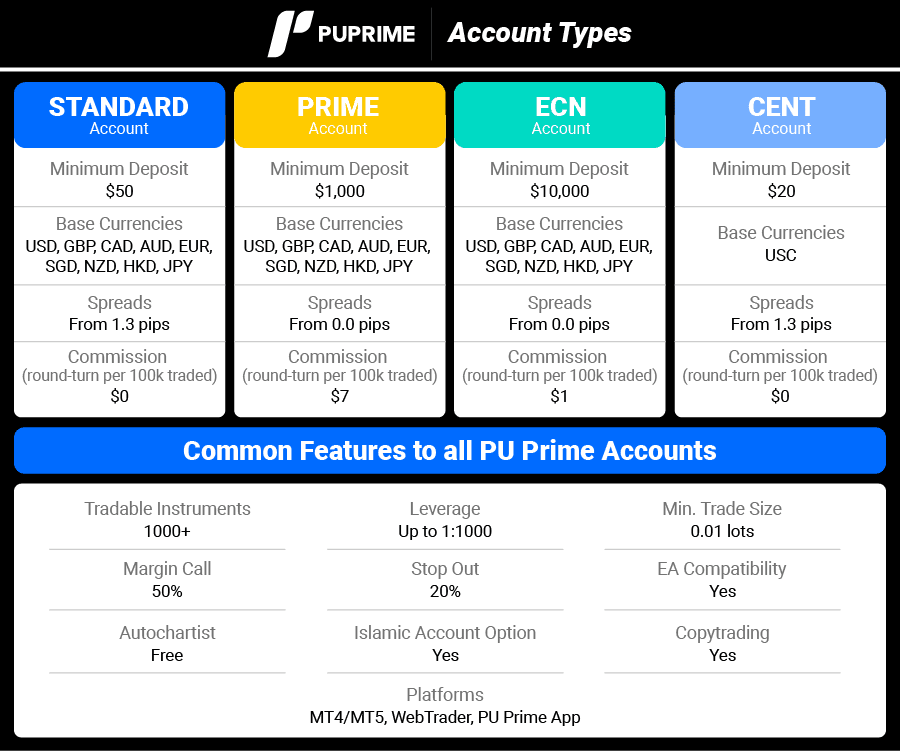

In my review and testing, I found that PU Prime employs a tiered fee structure based on the account type selected. There is a clear separation of commission-free models favoured by beginners traders. If you are a more advanced trader, I suggest you try the raw spread environments preferred by high volume traders.

Here is an overview of their account types, leverage, spreads and commission:

Raw Account Spreads (Prime Account)

PU Prime’s Prime Account is designed for performance and relies on raw pricing sourced directly from liquidity providers. In my experience, the average EUR/USD spread of 0.0 pips is genuinely impressive and aligns this broker with industry leading ECN providers.

This ultra-tight spread offering is crucial for high-frequency strategies and scalping, where minimising the entry and exit cost is the core factor determining success.

Although it comes with a steep $1000 minimum deposit, the Prime Account is entirely based commission rather than embedded costs 2within the spread.

Raw Account Commission Rate (Prime account)

PU Prime’s Prime Account charges a fixed commission of $7 per standard lot (round trip) — split as $3.50 to open and $3.50 to close each standard lot (100,000 units). Because spreads on major currency pairs often start from 0.0 pips, this commission can represent your entire trading cost.

This contrasts favourably with a Standard Account which has no separate commission, but spreads are wider (usually around 1.0–1.5 pips on major pairs). Wider because the broker’s fee is simply built into the spread.

If you are an occasional or low-volume trader, the Standard Account can seem more convenient or even slightly cheaper overall. This is not because its pricing is lower per trade, but because you’re trading less frequently making any extra costs you pay for the higher spread far less noticeable.

As an active or high-volume trader, the Prime Account is generally more cost-effective. Even after accounting for the $7 round-turn commission, the tighter 0.0–0.2 pip spreads typically result in a lower total cost per trade even with the additional commission cost . In volatile or high-frequency conditions, these small cost differences can translate into significant long-term savings.

RAW Account Spread | |||||

|---|---|---|---|---|---|

| 0.60 | n/a | 0.20 | n/a | 0.20 |

| 0.30 | 0.30 | 0.10 | 0.30 | 0.10 |

| 0.03 | 0.04 | 0.01 | 0.27 | 0.02 |

| 0.51 | 0.57 | 0.14 | 0.39 | 0.31 |

| 0.10 | 0.20 | 0.06 | 0.10 | 0.20 |

| 0.10 | 0.20 | 0.10 | 0.70 | 0.10 |

| 0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

| 0.30 | 0.20 | 0.10 | 0.30 | 0.20 |

| 0.40 | 1.40 | 0.80 | 0.50 | 0.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Raw Account Commission Rate (ECN Account)

Should you make a minimum deposit of $10,000, you will be able to use PU Prime’s ECN account. This account is the same as the Prime account meaning it has the same trading conditions like spreads but you only pay $1.oo commission each way per side. With a round-turn commission cost of $2.00 per lot, this account is excellent value and a better choice than the prime account if you have the funding.

Standard Account Fees

The Standard Account operates on a straightforward, commission-free model but has a wider spread compared to a RAW account. Spreads are wider to cover the broker’s fees but it does make calculating cost simpler as there are no commissions to account for. This simpler structure is why I think its a good starter account for new traders but eventually you will want to use a RAW account since these are usually cheaper.

The average EUR/USD spread for the Standard Account is 1.3 pips. While this is wider than the raw spread offered by the Prime account, it remains competitive for a commission-free offering in the current retail market.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.80 | 2.10 | 1.50 | 2.10 | 2.40 |

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.00 | 1.20 | 1.00 | 1.00 | 1.10 |

| 1.10 | 1.20 | 1.50 | 1.40 | 1.40 |

| 0.70 | 0.60 | 2.00 | 1.40 | 1.20 |

| 0.60 | 0.70 | 0.90 | 1.10 | 0.70 |

| 0.80 | 1.00 | 1.00 | 1.00 | 1.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Standard Account Fees (Cent Account)

PU Prime have a second spread-only account available which is the Cent Account. This account is the same as the Standard Account but you can only fund the account using US cents. As you are trading with cents, it means you are using micro-lots when you trade.To get started there is a minimum $50 deposit.

This account is a good choice for beginners as the smaller funds needed to meet margin requirements and trade reduces you risk. The cent a account is a good way to trade with real cash as opposed to a demo account.

Swap Free Account Fees

PU Prime demonstrates an inclusive approach by offering Islamic accounts, specifically the Islamic Prime and Islamic Prime Cent accounts. These accounts are designed to comply with Sharia law by providing a swap-free environment, ensuring that no overnight financing charges are applied or accrued, making them compliant for observant traders.

Although the available information doesn’t clarify whether alternative administrative fees apply after a holding period, it’s important to understand how swap-free trading works.

Brokers offering swap-free accounts usually include the cost of overnight interbank financing in slightly wider spreads.

Some may also charge a fixed administrative fee if positions are held for more than a few days.

This is an important detail for observant traders to check directly before opening long-term positions.

Other Fees

I am happy that PU Prime maintains a clear fee structure with minimal hidden charges. PU Prime confirms that it does not charge an inactivity fee for dormant accounts. However, if the account remains inactive for 90 days or more, it may be archived.

| Account Type | Minimum Deposit (USD Equivalent) | Average EUR/USD Spread | Commission (Round Turn) |

|---|---|---|---|

| Standard | Not explicitly stated (likely low/none) | 1.3 pips | Zero |

| Prime (Raw) | 1,000 account currency | 0.0 pips | $7.00 per standard lot |

| ECN | 10,000 account currency | 0.0 pips | Low commission (Implied) |

| Prime Cent | 1,000 (100,000 USC) | Similar to Standard | Zero (Implied) |

Trading Platforms

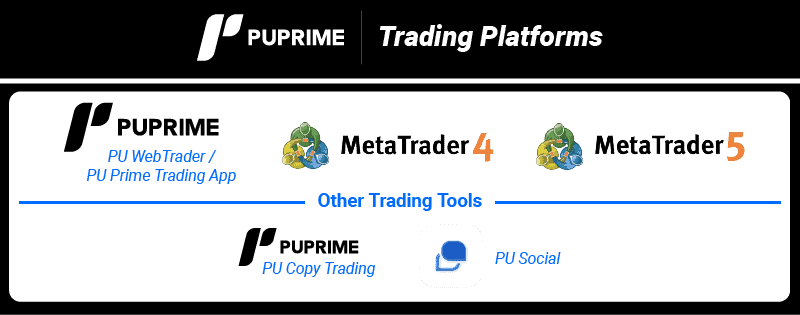

PU Prime supports the industry standard MetaTrader suite, offering MetaTrader 4 (MT4), MetaTrader 5 (MT5), and their proprietary PU WebTrader and App. The exception to this in Australia where only MT5 is available.

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

I have used MT4 most of my trading career because it has a simple interface and a good balance of features. MT4 is also one of the first mainstream platforms on the market, and is used by more retail traders than any other platform. PU Prime recognises the enduring popularity of this platform, offering it as a core trading solution.

Why I use MT4:

- MT4 has a very user friendly interface, simple to manage even for novice traders.

- A large community means easily accessible resources such as custom indicators, Expert Advisors (EAs) and support forums.

- A good selection of charting tools is provided, including 31 graphical objects and 30 free built in technical indicators.

- The platform allows for the ability to create your own Expert Advisors using MQL4 to automate trading strategies and implement custom indicators.

Also, if you consider flexibility in devices as important, I can highly recommend MT4 as you can run it on Android, iOS, desktop (both Windows and Mac), and browser (using PU WebTrader functionality). That is a nice advantage if you are a trader and am busy because you can see positions, and manage them anywhere.

Why you might not use it:

MT4 has a limited number of tradable symbols due to a hard limit of 1024 symbols, making it less ideal for brokers like PU Prime that offer hundreds of different assets.

Furthermore, the platform main emphasis is on forex, as it was specifically designed for decentralised trading. Stocks, bonds and exchange traded futures which run through a central exchange are not well served with MT4.

Note: MT4 is not available for Australia clients.

MetaTrader 5

Given MT5is the successor to MT4, it is no surprise that it is much the same in many ways, albeit with improved features. The user interface for example is visually much the same but you get more indicators and charts to choose from. While MT4 at this time is the more common and popular choice, MetaQuotes who develop both MT4 and MT5, are encouraging users to adopt MT5 as the platform of choice.

Why I use MT5:

MT5 provides access to a much wider range of financial instruments including stocks, options, futures, and bonds, which is crucial given PU Prime’s extensive asset offering.

The platform offers more advanced analytical capabilities, including 44 graphical objects and a wider selection of technical indicators than MT4, facilitating more in depth analysis.

A superior testing environment is available due to its multi threaded Strategy Tester, which allows for significantly more efficient and rapid back testing of complex Expert Advisors and multi currency strategies.

MT5 offers a greater number of timeframes (21 options) for in depth market analysis, which can be invaluable for sophisticated traders looking for finer granularity.

Why you might not use it:

- The MQL5 coding language used for automation is not backward compatible with the massive MQL4 library, meaning older, proprietary indicators or EAs written for MT4 cannot be used directly.

- While MT5 is gaining traction, the legacy community support and sheer volume of historical trading tools still lag behind the established MT4 ecosystem.

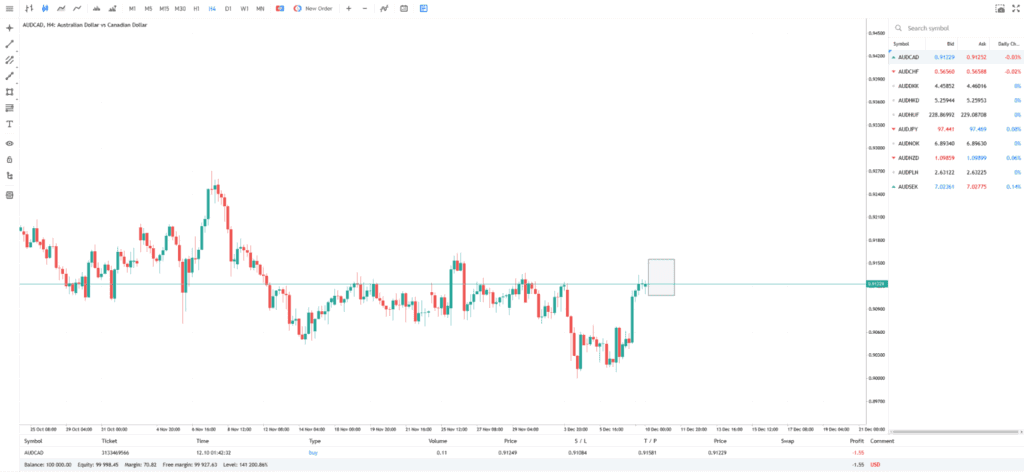

PU WebTrader

The PU WebTrader is the perfect companion platform for modern traders who prioritise convenience and mobility without sacrificing security or core trading functionality. It allows traders to maintain constant oversight of the markets regardless of their location.

PU Prime has integrated the Web Trader directly within the Client Portal, enabling fast login and instant access to the trading terminal with no secondary login required and no delays between decision and execution. Furthermore, the platform includes built-in advanced charting functionality, enabling access to dozens of technical indicators (MA, MACD, RSI) and professional drawing tools, with smooth zooming and panning performance.

Why I use PU WebTrader:

- It offers simple and easy entry, requiring no downloads or installations, allowing me to access my account from any modern web browser.

- The platform provides secure, encrypted connections (HTTPS) and supports two factor authentication, ensuring my login and account data are robustly protected.

- I can get instant access to global markets and use essential charting tools and risk management functions right from the browser interface.

- This platform is highly useful for monitoring existing positions, checking real time pricing, and executing quick trades when I am away from my main trading desktop.

Why you might not use it:

PU WebTrader typically offers a simpler feature set compared to the full downloadable desktop clients, particularly in relation to highly customized Expert Advisors or niche technical indicators that require the full MT4 or MT5 installation environment.

Other Trading Tools

PU Prime also offers 2 other apps, one for social trading and one for copy trading.

Trust

When assessing any broker, safety is paramount. I determine a broker’s safety profile based on its regulatory compliance framework, its policies on client fund handling, and its operational reputation as reported by the wider trading community.

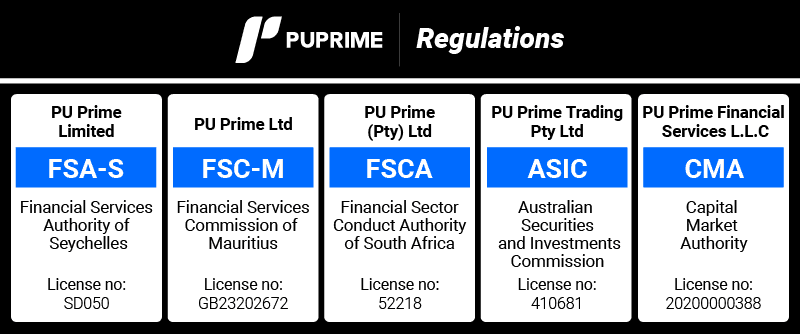

1. Regulation

PU Prime operates is regulated by five different regulatory bodies. These bodies are based in South Africa, Seychelles, Mauritius, Australia, and UAE.

Regardless which entity of PU Prime you trade with client funds are strictly segregated and stored with AA rated banks. This practice represents the gold standard in client asset protection, legally ensuring that the broker’s operational capital is kept entirely separate from your funds.

Australian traders will obviously be signed with their Australia arm which is regulated by ASIC and same for South African clients for their entity regulated by the FSCA. Clients from other countries, could be with their subsidiary based in Seychelles (regulated by FSA), Mauritius (regulated by FSC) or possibly PU Prime LLC, is registered with the Saint Vincent and the Grenadines FSA (SVGFSA). I’m not really sure which who gets signed with who for these regulators.

Should you sign with their Saint Vincent and the Grenadines based arm, that its worth noting the SVGFSA explicitly states that it does not regulate, monitor, supervise or license margin FX and contract for different issuers. This does not mean your fund are not sae since your funds are still segregated however its worth noting that a trader who signs up under the offshore SVG entity often receives higher leverage (up to 1:1000) but operates under substantially less consumer protection than those under the ASIC regulated subsidiary.

2. Reputation

The table below highlights PU Prime’s regional search interest in 2025.

| Country | 2025 Monthly Searches |

|---|---|

| United Kingdom | 2,400 |

| Canada | 2,400 |

| Italy | 1,900 |

| India | 1,300 |

| France | 1,000 |

| Egypt | 880 |

| Vietnam | 880 |

| Malaysia | 880 |

| Thailand | 720 |

| United Arab Emirates | 590 |

| United States | 480 |

| Netherlands | 480 |

| Nigeria | 320 |

| Japan | 320 |

| Australia | 260 |

| South Africa | 260 |

| Indonesia | 260 |

| Philippines | 260 |

| Spain | 210 |

| Pakistan | 210 |

| Algeria | 210 |

| Singapore | 170 |

| Sweden | 170 |

| Morocco | 170 |

| Turkey | 140 |

| Switzerland | 140 |

| Taiwan | 140 |

| Austria | 110 |

| Saudi Arabia | 110 |

| Mexico | 110 |

| Jordan | 110 |

| Germany | 90 |

| Ireland | 90 |

| Poland | 90 |

| Brazil | 90 |

| Portugal | 90 |

| Cyprus | 90 |

| Colombia | 90 |

| Kenya | 90 |

| Hong Kong | 70 |

| New Zealand | 70 |

| Bangladesh | 50 |

| Dominican Republic | 50 |

| Greece | 40 |

| Uganda | 40 |

| Sri Lanka | 40 |

| Argentina | 30 |

| Cambodia | 20 |

| Ghana | 20 |

| Ecuador | 20 |

| Uzbekistan | 20 |

| Chile | 20 |

| Mauritius | 20 |

| Panama | 20 |

| Tanzania | 20 |

| Peru | 10 |

| Uruguay | 10 |

| Venezuela | 10 |

| Botswana | 10 |

| Bolivia | 10 |

| Costa Rica | 10 |

| Mongolia | 10 |

| Ethiopia | 10 |

2,400 1st | |

2,400 2nd | |

1,900 3rd | |

1,300 4th | |

1,000 5th | |

880 6th | |

880 7th | |

880 8th | |

720 9th | |

590 10th |

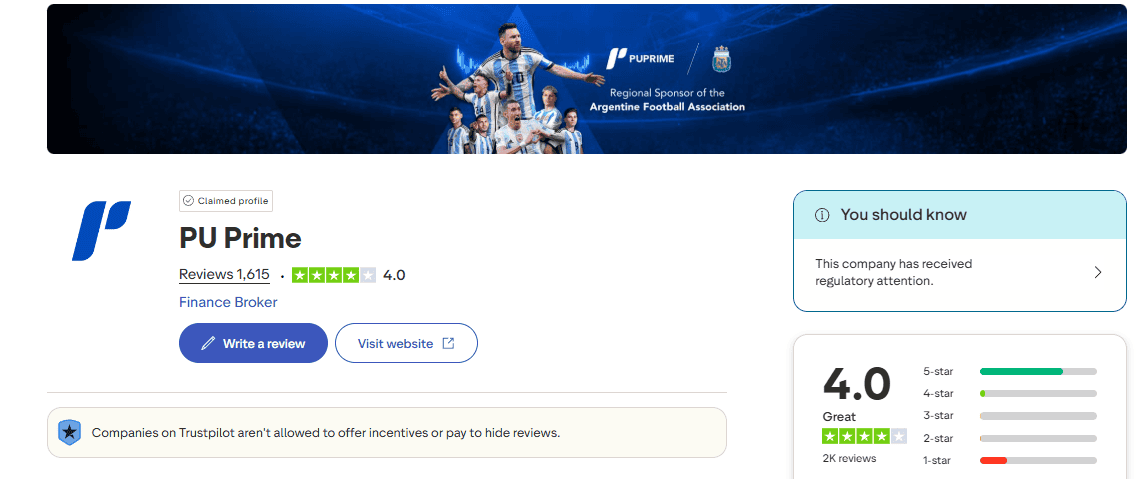

3. Reviews

I have analysed the general sentiment expressed by traders on review platforms, particularly focusing on TrustPilot, to gauge user sentiment. With a score of 4.0 out of 5 stars from over 1600 reviews, a large proportion of comments express high satisfaction.

Positive feedback frequently highlights excellent customer service and the perceived ease of starting their trading journey, sometimes mentioning highly effective account managers who provided helpful guidance.

Deposit and Withdrawal

Efficient capital management is fundamental to smooth trading operations. This area details the minimum requirements and transactional convenience offered by the broker.

To start trading with PU Prime as a trader, an initial minimum deposit of $1,000 is required for Prime and Islamic Prime accounts (or currency equivalent). The minimum requirement escalates significantly for the highly competitive ECN account, demanding a $10,000 minimum deposit (or equivalent).

If you wish to use their Prime Cent account, you are required to have a $1,000 minimum deposit, which is displayed internally as 100,000 USC. The specific minimum deposit for the Shares account is not explicitly stated as a separate tier, but would follow the requirements of the chosen core account (Standard, Prime, or ECN).

PU Prime Account Base Currencies

PU Prime supports a variety of account-based currencies, which is a convenience for international traders. Available major currencies include USD, EUR, CAD, GBP, AUD, and AED. Having multiple base currency options helps traders avoid unnecessary currency conversion fees when funding their accounts from foreign bank accounts.

Deposit Options and Fees

PU Prime offers a wide array of funding methods, catering to both traditional and digital payment preferences. Crucially, the broker charges 0% commission on all listed deposit methods, which is a significant saving for traders.

Methods include Local Bank Transfer, International Bank Transfer, Cryptocurrency, Credit Card, and e-wallet options. Most digital and local methods boast instant processing, allowing traders to capitalise on market movements without delay. International Bank Transfers naturally take longer, typically 2 to 5 working days.

The minimum deposit amount is generally $50 for most accounts, though the actual minimum to open a Prime or ECN account is much higher.

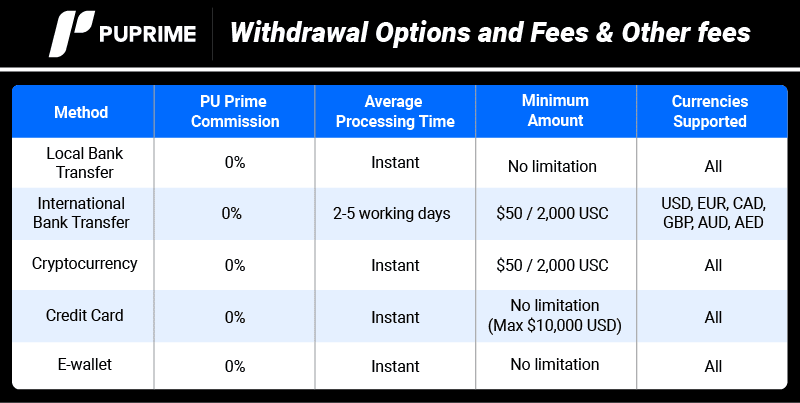

Withdrawal Options and Fees & Other Fees

PU Prime states explicitly that they do not charge any withdrawal fees. Withdrawals are processed through the Client Portal or Trading App, typically using the original payment method in accordance with global Anti-Money Laundering (AML) requirements.

Withdrawal requests are generally processed internally within 24 hours. However, depending on the method chosen, it can take between 1 to 7 business days for the funds to be received. Bank wires specifically require 3 to 5 business days to complete.

While PU Prime does not charge a fee, traders are responsible for covering any charges levied by the intermediary banks or financial institutions involved in the transfer process.

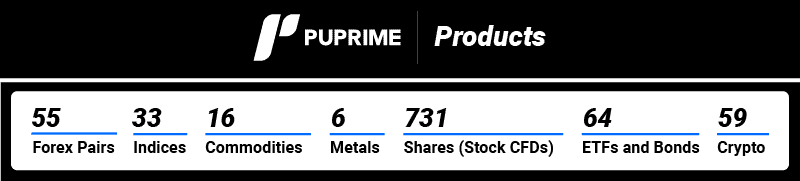

Product Range

A significant strength of PU Prime is its commitment to providing multi-asset trading opportunities, extending far beyond typical Forex offerings. This wide selection allows traders to implement sophisticated diversification strategies across multiple market types.

| Asset Class | Number of Instruments | |

|---|---|---|

| Forex Pairs | 55 | Strong focus on Majors/Minors; limited Exotics. |

| Shares (Stock CFDs) | Hundreds | Excellent depth for multi-asset diversification. |

| Indices CFDs | 33 | Core global indices provided, often with zero commission. |

| Precious Metals | 6 symbols listed | Includes Gold, Silver, Platinum, and Palladium. |

| Commodities | At least 8 distinct products | Covers both hard (Oil) and soft (Coffee, Sugar) markets. |

| ETFs and Bonds | Available | Provides low-cost exposure to diversified debt and equity. |

| Cryptocurrency | 59 | Offers more cryptocurrencies than many brokers |

Forex Pairs

PU Prime provides traders access to trade over 55 forex pairs. While this covers all majors and minors, and some common cross rates, this number is relatively low compared to specialist FX brokers and confirms the initial assessment that they offer a limited selection of exotic FX pairs. If you are a dedicated FX trader looking for highly niche pairs, you might need to look elsewhere.

Leverage outside Australia for major and minor pairs can be up to 1000:1 and up to 20:1 to 10: for exotics. In Australia major pairs can be 30:1 for major pairs and up to 20:1 for other pairs.

Shares (Stock CFDs)

You can find opportunities with leveraged trading in hundreds of different companies globally. This depth in single stock exposure is excellent for traders looking to capitalise on specific equity movements without holding the underlying asset.

Leverage for shares is 33:1 for NASDAQ and NYSE exchanges and 20:1 for other exchanges. or Australian clients leverage is 5:1.

Precious Metals

PU Prime explicitly lists at least six metal trading symbols. These include leveraged CFDs on major metals like Gold (XAUUSD, XAUEUR, XAUJPY), Silver (XAGUSD), Platinum (XPTUSD), and Palladium (XPDUSD).

Leverage for gold is 1000:1, silver is 100:1 and 20:1 for other metals. For Australian clients, leverage is 20:1 for gold and 10:1 for other metals.

Indices CFDs

You can diversify their exposure across global indices. At least six major indices are listed in the price tickers (including USDX, GER40, DJ30, HK50, NAS100, CHINA50). Trading indices through PU Prime often comes with the advantage of zero commission for both Standard and Prime accounts.

Leverage is generally 500:1 for major indices and 200:1 or 50:1 or other indices. For Australia clients, leverage is 20:1 for major indices and 10:1 for minor indices.

Commodities

PU Prime offers CFD trading in both hard and soft commodities. They provide access to at least 8 distinct products, including crude oil (CL OIL, USOUSD, UKOUSD, GASOIL), natural gas, sugar (SUGAR), coffee (COFFEE), cocoa, and silver.

Most energies have leverage of 500:1 but some may be 20:1. Soft commodities are 20:1. For Australian clients leverage can be up to 10:1.

ETFs and Bonds

Exchange Traded Funds (ETFs) and Bonds are also available for leveraged trading, providing further opportunities for portfolio diversification across global debt and equity baskets.

ETFs leverage can be either 50:1 or 1:1 while bonds are 100:1. For Australia clients leverage is limited to 5:1.

Cryptocurrencies

With 59 cryptocurrencies to choose from, Pu Prime’s range is relatively large. While not as extensive as Eightcap or eToro, it is far larger than other big name brokers like Pepperstone, IC Markets and IG Markets.

Leverage for cryptocurrencies is 100:1 for most pairs but some can be 5:1 or 1:1 even. If you are in Australia, leverage is a maximum 2:1.

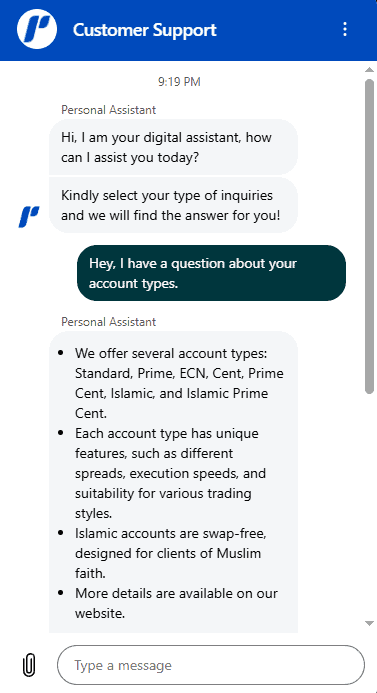

Customer Service

PU Prime promotes its customer service as a major advantage, making a significant commitment to its global clientele by offering dedicated support 24 hours a day, 7 days a week.

Support is accessible through multiple channels, providing redundancy for critical queries. These channels include responsive Live Chat, Email, and Phone support. The commitment to round the clock support in 18 languages is highly beneficial for the global trading community, ensuring that critical market events occurring outside typical business hours can still be addressed promptly.

As a trader, I rely on instant support, especially during volatile market hours. I recently tested their live chat function late on a Tuesday evening, seeking clarification on the exact overnight financing rate for an exotic currency pair I was considering.

The initial response was instantaneous, confirming the 24/7 availability. However, the agent, “Eliza,” immediately tried to direct me to the help centre documentation rather than provide the specific variable I requested. After explaining that I had already reviewed the general policy, Eliza took a few minutes to respond and resolve my issue.

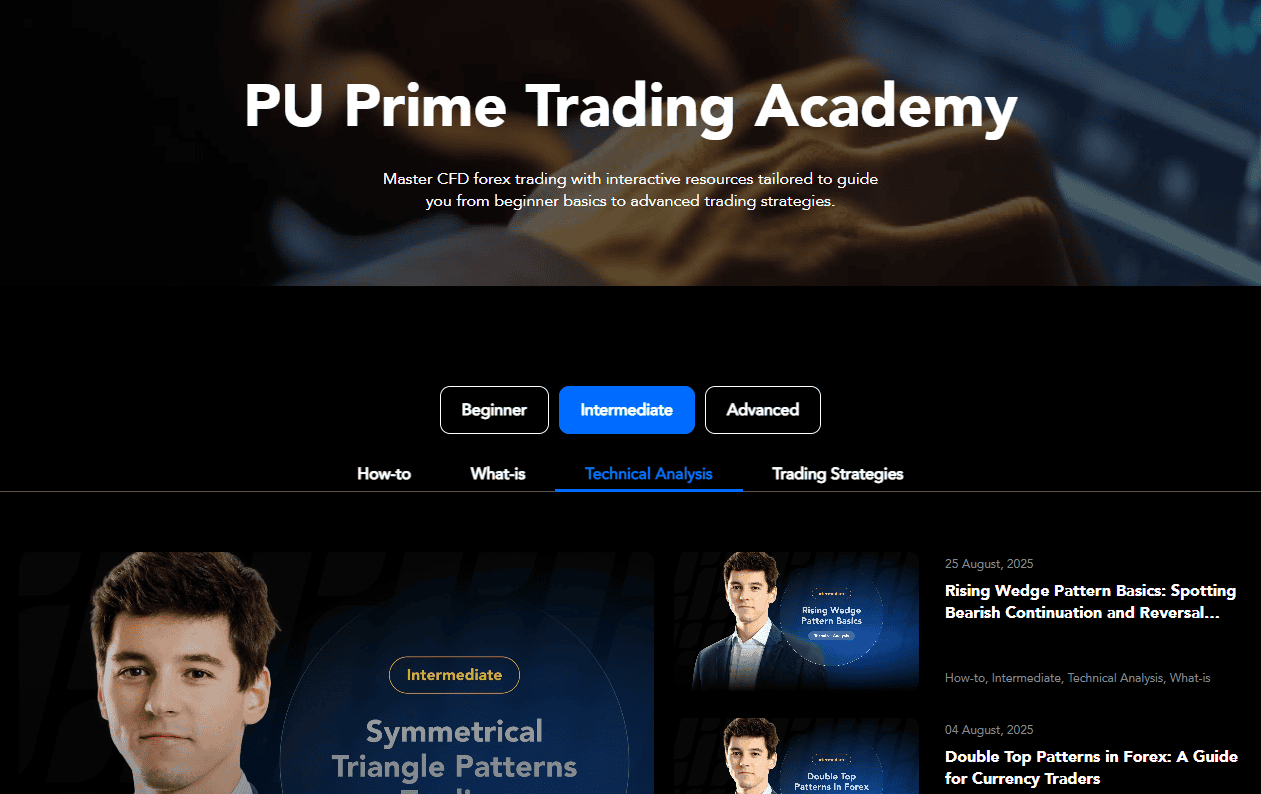

Research and Education

For traders committed to continual improvement, the quality of research and education is essential for developing robust strategies. PU Prime offers a structured and multifaceted educational suite known as the PU Prime Trading Academy.

The educational resources are strategically divided into competency levels, Beginner, Intermediate, and Advanced, ensuring relevant content for every stage of a trader’s journey. This Academy content spans various formats, including Video Tutorials led by experts, E books providing in depth market insights, and interactive Trading Quizzes to test and consolidate knowledge.

As a trader, I appreciate being able to follow a logical progression from foundational concepts to complex strategy implementation. The content is further categorized by type, covering How to guides, What is concepts, Technical Analysis, and specific Trading Strategies.

In addition to static content, PU Prime emphasizes real time learning through Webinars, which are available both live and on demand. These webinars address contemporary market topics, such as analysis of inflation data (PPI vs CPI) and advanced trading techniques like how bond markets signal shifts in equity markets.

Frequently Asked Questions

Which account type is most cost effective for high frequency traders or scalpers?

As a high frequency trader, I would suggest the Prime Account. Although it requires a minimum deposit of $1,000, it offers raw spreads averaging 0.0 pips on EUR/USD.

Does PU Prime offer sufficient regulatory protection, particularly regarding fund security?

PU Prime states they are regulated by four entities, including the reliable ASIC, and confirm client funds are held in segregated accounts with AA rated banks. In my opinion, this multi regulatory approach, combined with negative balance protection, provides a strong layer of security.

Should I choose MetaTrader 4 or MetaTrader 5 if I plan to trade stocks and indices as well as forex?

If your trading strategy involves diversifying into the hundreds of Stock CFDs offered by PU Prime, I strongly recommend using MetaTrader 5.

Final Verdict on PU Prime

PU Prime presents a formidable package anchored by extremely competitive pricing structures. The Prime Account’s 0.0 pip average spreads coupled with a transparent $7 round turn commission makes it a highly cost effective choice for high volume or aggressive traders.

The broker’s expansive product range, including hundreds of Stock CFDs, Metals, and Indices, ensures multi asset diversification is readily available, supported by the powerful MetaTrader 4 and 5 platform.

Despite the advantages, the high financial barrier to entry for the most competitive ECN account ($10,000 minimum deposit) is rather steep.

My final assessment is that while the trading conditions offered by PU Prime are premium, the broker is best suited if you are an experienced trader.

Alternatives to Capital.com

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert