XTB Review Of 2026

XTB caters well to beginners and cryptocurrency enthusiasts, offering a simple trading environment with its single, no-commission account structure. With a broad selection of cryptocurrency CFDs, XTB is a strong choice for focusing on digital assets.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

XTB Summary

| 🗺️ Regulation Country | Cyprus, Poland, Spain, Belize, UK |

| 💰 Trading Fees | Standard Spreads |

| 📊 Trading Platforms | MT4 Trading Platform, xStation 5, Mobile Trading |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments | Forex, Commodities, Indices, ETFs, Share CFDs, Crypto |

| 💳 Credit Card Deposit | Yes |

Why Choose XTB

XTB is known for its competitive standard spreads, especially in the EUR/USD pair, and offers a wide range of over 1,500 instruments, including a diverse selection of cryptocurrency CFDs.

XTB has streamlined its account options, moving away from raw pricing and now offering a single, no-commission spread structure. This change, while simplifying the trading experience, may not be ideal for high-volume traders who previously benefited from the flexibility of raw spread accounts.

XTB Pros and Cons

- Free funding options

- Easy account opening

- Commission-free stocks

- High conversion fees

- Inactivity fee

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

In 2025, XTB streamlined its pricing options, now providing a singular, no-commission spread structure. Previously, they catered to diverse trading needs with a Pro Account featuring raw spreads. However, this option has been phased out, leading to a unified approach with the Standard Account.

In 2025, XTB streamlined its pricing options, now providing a singular, no-commission spread structure. Previously, they catered to diverse trading needs with a Pro Account featuring raw spreads. However, this option has been phased out, leading to a unified approach with the Standard Account.

While it might not be the ideal choice for traders dealing in high volumes, it’s perfectly tailored for beginners who prefer a straightforward, commission-free structure.

Standard Account Spreads

To determine XTB’s average spreads, we analysed the data of over 40 top brokers.

No Commission Spreads: Standard Accounts | |||||

|---|---|---|---|---|---|

| 0.90 | 1.30 | 1.40 | 1.40 | 1.80 |

| 0.83 | 0.83 | 1.02 | 1.37 | 0.92 |

| 1.00 | 1.20 | 1.00 | 1.20 | 1.00 |

| 1.00 | 1.00 | 1.20 | N/A | 1.10 |

| 1.20 | 1.90 | 1.90 | 2.30 | 2.10 |

| 1.20 | 1.40 | 1.40 | 2.00 | 1.50 |

| 1.00 | 1.11 | N/A | 1.30 | 1.28 |

| 1.10 | 1.10 | 1.10 | 1.20 | 1.20 |

| 0.60 | 0.70 | 0.90 | 1.00 | 0.80 |

| 1.20 | 1.30 | 1.20 | 1.20 | 4.00 |

| 1.20 | 1.41 | 1.47 | 1.85 | 1.67 |

| 1.10 | 1.10 | 1.30 | 2.30 | 1.40 |

| 1.00 | 1.00 | 1.50 | 2.00 | 1.50 |

| 0.80 | 0.90 | 1.20 | 1.80 | 1.80 |

| 0.50 | 0.60 | 0.70 | 1.20 | 1.30 |

| 0.80 | 0.90 | 1.40 | 2.40 | 1.50 |

| 1.13 | 1.01 | 1.71 | 2.27 | 1.98 |

| 0.90 | 1.30 | 3.60 | 3.00 | 1.70 |

| 1.00 | 1.20 | 1.60 | 2.10 | 1.80 |

| 1.50 | 2.00 | 2.60 | 3.00 | 2.50 |

| 1.10 | 1.20 | 1.50 | 1.70 | 1.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

To determine XTB’s average spreads, we meticulously analyzed data from over 40 top brokers. Our approach included gathering average monthly spreads published on their websites for standard accounts and employing MT4 indicator bots to test actual average spreads.

As shown in the table below, XTB offers a competitive average spread of 0.90 pips for the EUR/USD pair, one of the best in the market.

For other major pairs like EUR/GBP and AUD/USD, their spreads are not the lowest but remain reasonably competitive, and all are provided without additional commission fees.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| XTB Average Spread | 0.9 | 1.4 | 1.4 | 1.3 | 1.8 | 1.4 | 1.4 | 1.7 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

This comprehensive method ensures a reliable comparison of XTB’s spreads against the industry standards, providing a clear picture of their competitive positioning in the market.

Swap-Free Account Fees

XTB provides a Swap-Free account tailored for traders adhering to Islamic finance principles, which prohibit the payment or receipt of interest. This account replaces the usual swap fees with a fixed commission starting from $10 per lot.

It offers access to commodities, indices, ETFs, share CFDs, and forex markets. However, it excludes cryptocurrency trading and certain currency pairs like EUR/TRY and USD/ZAR.

Please note, the Swap-Free account option is available only through XTB International, not through XTB’s UK subsidiary.

Cashback Rewards And Bonuses

XTB offers cashback rewards for high-volume traders, but the availability and rules vary based on the trader’s location and the XTB subsidiary they are registered with. For non-UK/EU residents registered with XTB’s IFSC Belize regulated entity, cashbacks are part of a loyalty offer. Traders who exceed 15 contracts (lots) per month can contact their account manager to set up a personalised discount program.

However, for UK residents under FCA regulation and EU residents, cash-based incentives are not offered due to regulatory restrictions. Instead, XTB UK provides a discount program for high-volume traders.

Cashback bonuses are also not available for retail clients in the UAE due to local regulations.

Other Fees

While there is no withdrawal fee, note that there is a charge for deposits regarding:

- Outside EU

2% fee for Skrill and

1% fee for Neteller

There is also an inactivity fee of $10 after 12 months.

Verdict on XTB Spreads

In 2025, XTB consolidated its pricing structure by phasing out the Pro Account with raw spreads, focusing on a standard, no-commission spread model that offers competitive rates, such as 0.90 pips for EUR/USD, catering primarily to beginners and less to high-volume traders.

Trading Platforms

XTB offers customers two trading platforms, MetaTrader 4 (MT4) and xStation 5. Although both platforms make for an intuitive trading experience, there are key differences between the software in regards to product range, trading tools and risk management features.

| Trading Platform | Available With XTB |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

- MT4 may suit experienced traders or those wanting to develop sophisticated algorithmic trading strategies using Expert Advisors.

- xStation 5, the broker’s proprietary XTB trading platform, provides full market access to thousands of financial instruments with many useful tools for beginner traders.

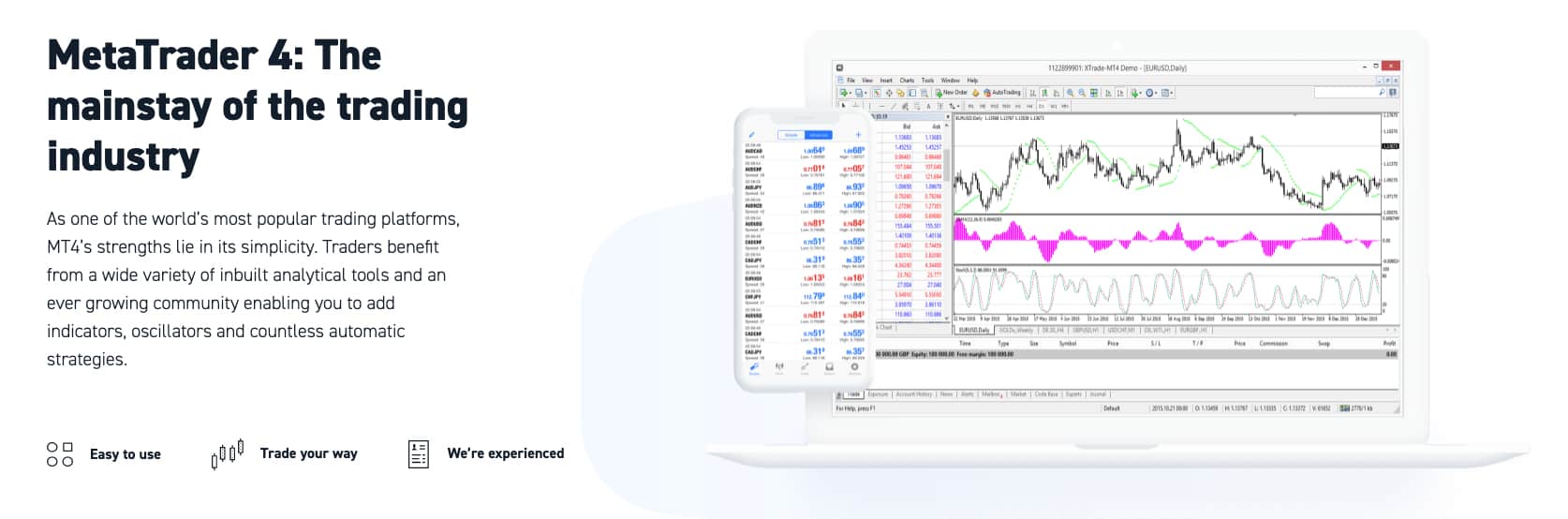

MetaTrader 4

MetaTrader 4 is the preferred trading platform for many retail investor accounts. XTB customers using MT4 can enjoy the following features:

- Technical analysis tools including 30 pre-installed indicators, 24 objects and 9 timeframes allowing traders to analyse financial markets and establish trading opportunities.

- Automated trading with EAs (algorithmic trading) and Trading Signals (social-copy trading).

- Write and develop algorithmic trading strategies using Expert Advisors (EAs) and the MQL4 programming language.

- Backtesting tools to test trading strategies and EAs.

- A large forex trading community plus an online marketplace to buy and download EAs and technical indicators.

- Pattern recognition scanners to automate financial market analysis.

- Tools to manage the high risk of trading with different pending order types available (stop loss and take profit orders).

A disadvantage to using MT4 is that you are unable to trade XTB’s full product range, as MT4 was primarily designed for forex trading.

[table “responsivescroll261” not found /]xStation 5

A major benefit to choosing xStation 5 over MT4 is the market access traders gain. While MT4 users cannot trade ETFs, shares or cryptocurrencies, those using xStation 5 can access XTB’s full product range with ETF, Share and Crypto trading permitted.

xStation 5 is well-suited to all levels of trading experience as the platform offers an easy-to-use design while providing unique technical analysis tools.

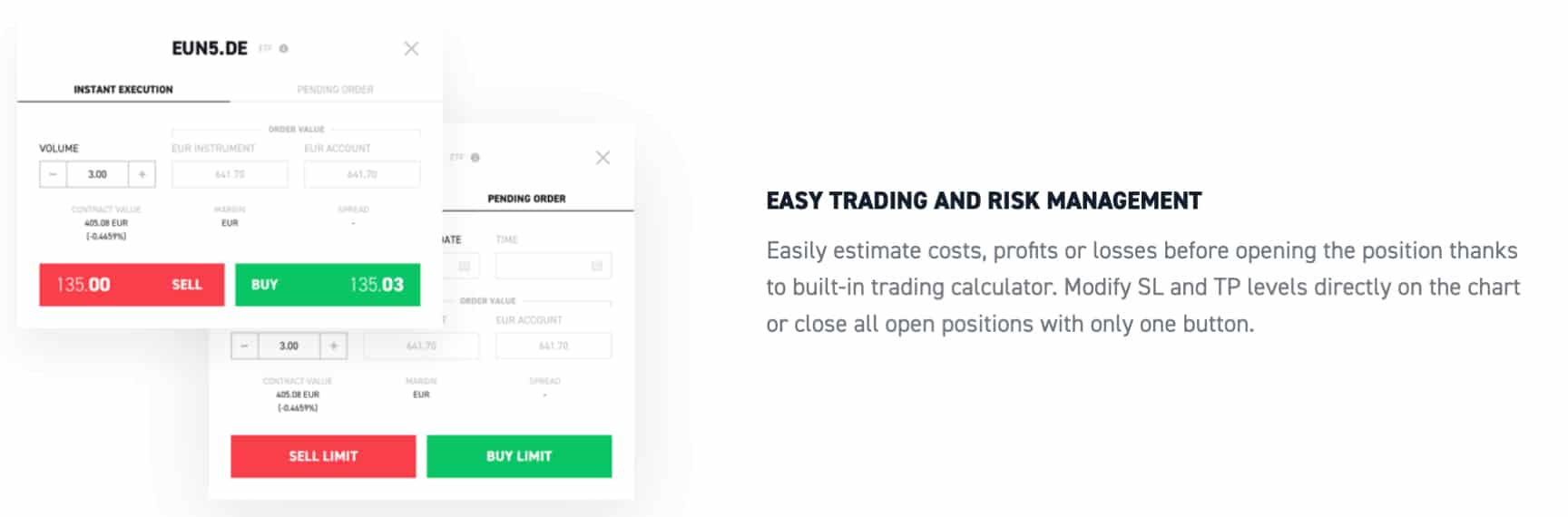

Examples of the trading tools and unique features the xStation 5 XTB platform offers include:

- A wide range of charting and analysis tools with over 34 built-in technical indicators

- Risk management tools: price alerts and multiple pending order types i.e. take profit, stop loss and trailing stop-loss orders

- Fundamental analysis tools such as an economic calendar and in-house market commentary from XTB’s leading analysts

- An in-built calculator to forecast costs and profits helps customers manage the high risk of trading

- The ability to close all open positions with one click

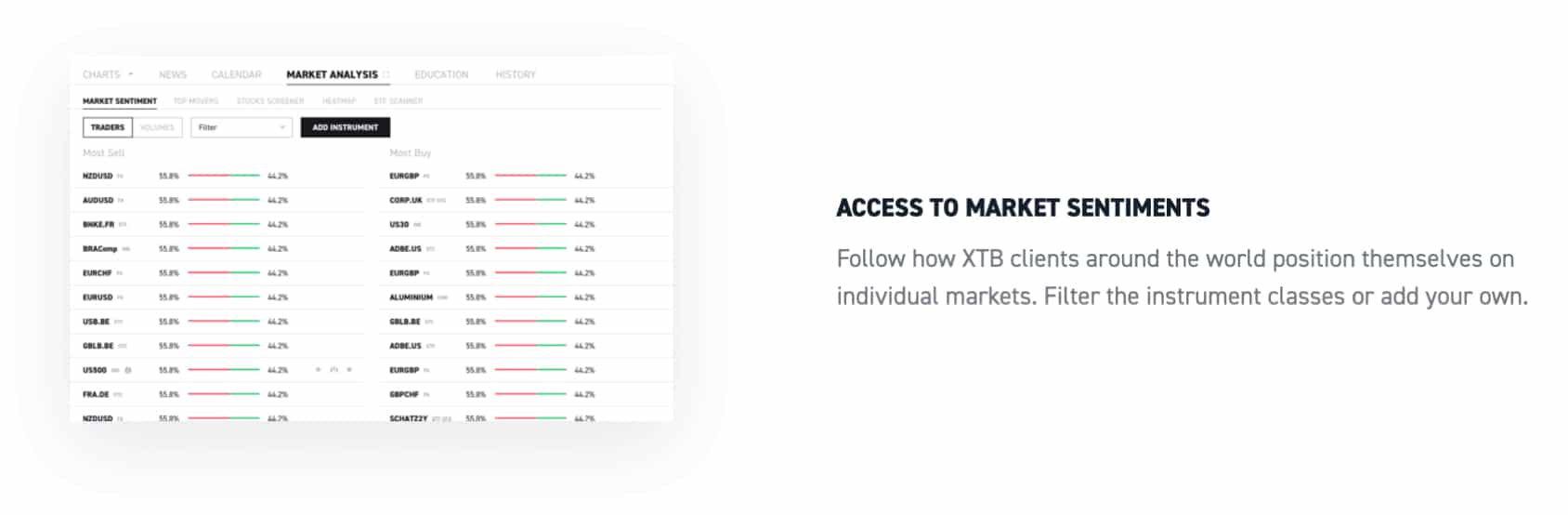

- Market Sentiment data displaying the percentage of XTB’s traders that are buying and selling different financial instruments

- Stock Screeners allows traders to search thousands of share markets to find CFDs with specific requirements, for example searching stocks based on their dividend yield, market capitalisation or beta

- Heatmaps are visual representations showing which markets are rising and falling, with the option to filer currency pairs, equities and time periods

Mobile Trading Apps

For those wanting to trade on the go, mobile trading apps are available for xStation and MetaTrader 4.

xStation Mobile App

The broker’s proprietary xStation mobile app offers similar features to the desktop trading platform, with multiple order types, real-time news and in-house analysis, market sentiments and a range of technical analysis tools.

The broker’s proprietary mobile app is customisable, with the option to change the display to dark mode to save battery and enhance mobile charting and analysis.

MT4 Mobile App

XTB customers will find an ease-of-use when trading on MT4 with the ability to easily switch between the desktop platform and mobile apps. Whether you want to trade via tablet or mobile device, the mobile apps well-designed layout makes it easy to analyse financial markets and place orders on the go.

Both xStation MetaTrader 4 mobile apps are compatible with Apple and Android devices.

Trade Experience

XTB achieves tight spreads and fast execution by sourcing its liquidity via X Open Hub. X Open Hub is a specialist in providing technology solutions that connect ECN and STP type brokers with the multi-asset liquidity pools consisting of banks and other top tier financial institutions. XTB’s arrangement with X Open Hub means XTB can offer ECN-style spreads on Forex, Shares, Crypto (not UK subsidiary), Commodities, Indices and ETFs so traders can take advantage of institutional-grade pricing.

Although spreads and fees vary between XTB’s 3 account types, benefits enjoyed by all XTB traders include:

- Low spreads

- No requotes

- Fast order execution

Verdict on XTB’s Trading Platforms

XTB offers two distinct trading platforms, MetaTrader 4 for experienced traders focused on algorithmic strategies and xStation 5, their proprietary platform, providing comprehensive market access and user-friendly tools suitable for traders at all levels.

Is XTB Safe?

XTB has an overall trust score of 53 based on regulation, reputation, and reviews.

1. Regulation

XTB is seen as a safe and trusted CFD broker as its overseen by top-tier financial authorities including:

- United Kingdom’s Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Polish Financial Supervision Authority (KNF)

- Spanish National Securities Market Commission (CNMV)

- International Financial Services Commission (IFSC)

| XTB Safety | Regulator |

|---|---|

| Tier-1 | FCA CySEC |

| Tier-2 | DFSA CMNV (Spain) KNF |

| Tier-3 | FSC-BZ |

2. Reputation

XTB was established in 2002, in London, UK and considered a reputable broker with 368,000 monthly Google searches, it ranks as the 7th most popular forex broker among the 65 brokers we have researched. This high visibility is matched by its web traffic, with Similarweb data from February 2024 positioning XTB as the 7th most visited broker globally, attracting 7,682,000 visits.

XTB is listed on the Warsaw Stock Exchange (Poland) and has a strong presence across Europe with offices in 13 different countries, including France, Germany, Italy, Turkey, and the Czech Republic.

The broker has seen one regulatory issue in 2018 where they received a significant fine for irregularities in the execution of client orders. Yet, they have not had any regulatory mishaps since.

XTB’s main market is Europe’s where XTB says they had 227,000 active clients in Q1 2024. In the same quarter, XTB’s trading volume reached PLN 1.67 trillion (approximately $392 billion) which underscoring the brokers substantial market presence. This broker is publicly listed on the Warsaw Stock Exchange with a market capitalization of approximately PLN 3.5 billion ($820 million) as of 2024.

| Country | 2025 Monthly Searches |

|---|---|

| Poland | 165,000 |

| Portugal | 40,500 |

| Spain | 27,100 |

| France | 22,200 |

| Germany | 18,100 |

| Brazil | 9,900 |

| Colombia | 8,100 |

| Chile | 8,100 |

| United Kingdom | 5,400 |

| Italy | 5,400 |

| Peru | 4,400 |

| United States | 3,600 |

| Vietnam | 3,600 |

| Argentina | 2,900 |

| India | 2,400 |

| Mexico | 2,400 |

| Netherlands | 2,400 |

| Thailand | 2,400 |

| Ecuador | 2,400 |

| United Arab Emirates | 1,900 |

| Austria | 1,900 |

| Switzerland | 1,600 |

| Morocco | 1,300 |

| Saudi Arabia | 1,000 |

| Bolivia | 880 |

| Canada | 720 |

| Algeria | 720 |

| Venezuela | 590 |

| Dominican Republic | 590 |

| Indonesia | 590 |

| Egypt | 590 |

| Ireland | 590 |

| Nigeria | 480 |

| Turkey | 480 |

| Sweden | 480 |

| Costa Rica | 480 |

| Pakistan | 390 |

| South Africa | 320 |

| Australia | 320 |

| Malaysia | 320 |

| Japan | 320 |

| Cyprus | 320 |

| Greece | 320 |

| Jordan | 320 |

| Uruguay | 320 |

| Philippines | 260 |

| Hong Kong | 210 |

| Cambodia | 210 |

| Singapore | 170 |

| Bangladesh | 140 |

| Taiwan | 110 |

| Uzbekistan | 110 |

| New Zealand | 110 |

| Panama | 110 |

| Kenya | 90 |

| Sri Lanka | 90 |

| Ghana | 70 |

| Tanzania | 40 |

| Uganda | 40 |

| Ethiopia | 30 |

| Botswana | 30 |

| Mauritius | 30 |

| Mongolia | 10 |

165,000 1st | |

40,500 2nd | |

27,100 3rd | |

22,200 4th | |

18,100 5th | |

9,900 6th | |

8,100 7th | |

8,100 8th | |

5,400 9th | |

5,400 10th |

3. Reviews

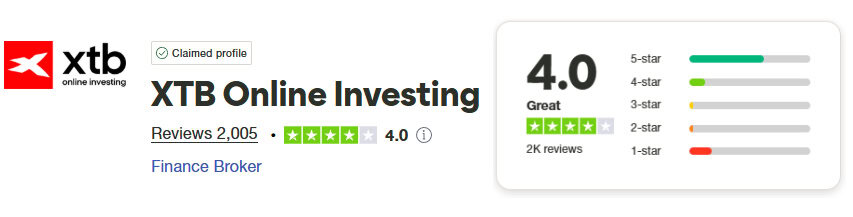

XTB has a TrustPilot score of 4 out of 5 from 2,005 reviews, indicating good client satisfaction.

Verdict on XTB Trustworthiness

XTB is recognised as a safe and trusted CFD broker with a trust score of 53, regulated by top-tier authorities, established with a strong European presence since 2002, and maintaining a good reputation with high client satisfaction despite a past regulatory issue.

Deposit and Withdrawal

XTB is an accessible broker with no minimum deposit and a range of fee-free funding methods.

What is the Minimum Deposit at XTB?

To start trading, no initial minimum deposit is required by XTB, although the broker recommends $250.

Account Base Currencies

When opening a trading account, you can select from four base currencies: the USD (United States Dollar), EUR (Euro), GBP (Great British Pound) and HUF (Hungarian Forint).

Deposit Options and Fees

XTB offers bank transfers, credit cards, debit cards, and e-wallets like Neteller and Skrill, although availability depends on the region you are trading in.

As you can see from the table below, most funding methods are fee-free.

| XTB Funding Methods | UK Residents | European Residents | MENA Residents | Non UK/EU Residents |

|---|---|---|---|---|

| Bank Transfer | No fee | No fee | No fee | No fee |

| Credit Card | No fee | No fee | ✖ | No fee |

| Debit Card | No fee | No fee | No fee | No fee |

| Skrill | 2% fee | No fee | ✖ | 2% fee |

| Neteller | ✖ | ✖ | ✖ | 1% fee |

| PayPal | ✖ | No fee | ✖ | ✖ |

Withdrawal Options and Fees

XTB charges no withdrawal fees as long as you are withdrawing at least €100 (Europe), $50 (International), or £60/€80/$100 (UK). Funds can only be withdrawn into your verified bank account.

| XTB Subsidiary | Minimum Withdrawal Amount | Withdrawal Processing Time |

|---|---|---|

| XTB Limited (UK) | £60, €80, or $100 | Same day if requested before 1pm (GMT); next working day if after 1pm |

| XTB Limited (CY) | €100 | No later than the next business day after receiving the request |

| XTB International Limited | $50 | Standard processing time is 1 business day |

Verdict on XTB’s Payment Methods

XTB offers accessible trading with no minimum deposit requirement, a variety of fee-free funding methods, and multiple base currency options, though withdrawal fees are waived only above certain minimum amounts.

Product Range

As an XTB customer, you can develop trading strategies using Contracts for Difference (CFDs) derived from 6 different asset classes.

- 57 major, minor, and exotic currency pairs with low spreads.

- 37 global indices including the US100, AUS200, EU50 and JAP225.

- 22 commodities including metals, soft commodities, oil, and gas.

- 1700+ stocks CFDs including some of the biggest companies worldwide like Apple and Facebook.

- 113 Exchange Traded Funds (ETFs).

- 14 cryptocurrencies.

Cryptocurrency Trading

When compared to top forex brokers, XTB offers one of the largest selections of cryptocurrency CFDs. While many brokers provide access to between 5-10 crypto CFDs, XTB offers 14.

A combination of popular and emerging crypto CFDs are available such as Bitcoin, Bitcoin Cash, Ethereum, EOS, Dash Litecoin, Ripple, , and Monero.

FCA Regulated Brokers are no longer able to offer cryptocurrencies to retail traders due to FCA regulations. If you want to trade cryptos, you will need to sign up for an XTB subsidiary outside of the UK.

There are some restrictions when it comes to XTB’s cryptocurrency range. Cryptocurrency CFD trading is not available to MT4 users or Islamic account holders.

To access XTB’s Cryptocurrency trading instruments, customers are required to use xStation 5 and a Standard Account.

Verdict on XTB’s CFD Range

XTB offers a diverse range of trading options with CFDs across six asset classes, including a wide variety of currency pairs, global indices, commodities, stocks, ETFs, and one of the largest selections of cryptocurrency CFDs among top forex brokers.

Customer Service

XTB offers customer support through email, phone, and live chat, complemented by face-to-face assistance in its offices across 12 countries. European clients have access to customer service 24/5, while traders outside the EU benefit from 24/7 support.

Verdict on XTB’s Customer Support

XTB provides comprehensive customer support options, including email, phone, live chat, and in-person assistance in 12 countries, offering 24/5 service for European clients and 24/7 support for traders outside the EU.

Research and Education

XTB offers a range of educational and research materials, though there is room for expansion in both depth and variety. Their current offerings include:

- Knowledge Base: This section, while informative, primarily covers fundamental topics in Forex, commodities, indices, stocks, and CFDs. It’s a useful starting point for new traders but may fall short for those seeking advanced insights.

- Platform Tutorials: Tutorials for xStation 5 and MetaTrader 4 are available, which are helpful for beginners. However, experienced traders might find these resources somewhat basic.

- Market Analysis: The market analysis section provides updates and insights into various markets. While this is beneficial for staying informed, the scope and depth of analysis might not satisfy traders looking for comprehensive research.

Verdict on XTB’s Research and Educational Materials

While XTB’s educational and research tools are helpful, especially for new traders, there’s potential for them to broaden their offerings to include more advanced topics and in-depth analyses.

Final Verdict on XTB

XTB has established itself as a reputable forex broker with a competitive range of over 1,500 instruments.

However, it’s important to note that XTB has transitioned to a single account type with a no-commission spread structure, which may not be ideal for all traders, particularly those who prefer the flexibility of raw spread accounts.

XTB’s trading platforms, MetaTrader 4 and xStation 5, cater to a wide range of trading needs, but the educational and research resources are more suited for beginners and might lack depth for advanced traders.

The broker’s overall trust score of 70, based on regulation, reputation, and client reviews, reflects its standing in the industry. While XTB offers low spreads, fast order execution, and no requotes, the limitations in account types and educational resources may be a consideration for some traders.

Overall, XTB is a solid choice for traders looking for a straightforward trading experience with competitive pricing, but those seeking more advanced features and resources might find it lacking in certain areas.

XTB FAQs

What Leverage Does XTB Offer?

XTB offers leverage ranging from a minimum of 2:1 to a maximum of 500:1, depending on the trader’s location and the specific entity they are registered with. For traders using XTB European entities, the maximum leverage is 1:30 for major currency pairs and 20:1 for minor currency pairs, while those registered with XTB’s offshore entity in Belize (IFSC) can access up to 500:1 leverage for forex pairs.

In the case of trading with XTB Limited UK, XTB Spain branch, or XTB Poland, the leverage is typically capped at 20:1. However, some instruments might require lower leverage. Outside Europe, traders can access leverage up to 200:1, except in gold trading, where it can be as high as 500:1.

For specific entities like XTB Limited UK, XTB Spain branch, or XTB Poland, leverage can be as restrictive as 5:1 or even 2:1, with certain instruments allowing a maximum of 1:1. For entities outside Europe, the leverage generally stands at 5:1.

What is the Minimum Deposit at XTB?

XTB does not require a minimum deposit to start trading, although they recommend a minimum of $250.

What Demo Account Does XTB Offer?

XTB offers free demo accounts for both MetaTrader 4 (MT4) and xStation trading platforms. Beginner traders will benefit from using demo accounts as it provides the opportunity to build confidence and learn the ins and outs of a trading platform prior to trading with real money.

Is XTB a Safe Broker?

Yes, XTB is considered a safe broker with an overall trust score of 70. It is regulated by top-tier financial authorities, including the United Kingdom’s Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Polish Financial Supervision Authority (KNF), Spanish National Securities Market Commission (CNMV), and the International Financial Services Commission (IFSC).

About the Review

CompareForexBrokers uses a detailed process to rank 40 brokers based on eight key categories (see Our Methodology). These categories include trading costs, trading experience, trust, trading platforms, customer service, range of markets, education, and funding methods.

This comprehensive approach helps traders find the best forex broker for their needs by considering factors like spreads, commissions, regulatory oversight, order speeds, available products, educational resources, and funding options. Justin Grossbard, the CEO and Co-Founder of CompareForexBrokers, leads this effort, leveraging his extensive experience in the field.

Compare XTB Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to XTB Website

Visit Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Do you have a subsidiary within IE I have signed up for xtb-global.com is this a subsidiary of the main platform XTB.com? I have signed up but is it a CON? Have I been De FRAUD’ED? Colin Jeffrey UK

Hi Colin, We have no idea if you have been scammed but we took a look at xtb-global.com and we did see a few red flags. We checked with both XTB and XTB-Global and despite XTB-Global having a very very similar logo, we can confirm neither company have anything to do with each other. Both brokers confirmed this. The other thing we noticed is the website states “regulated by the Australian Securities and Investments Commission” but we checked the ASIC website and could not find any sign they are regulated with ASIC. We could go on but you get the idea. It’s possible the broker is a legitimate (albeit seeming unregulated) broker so the takeaway is, one should always check the broker’s website for their regulation licence number.

What are the benefits of XTB?

Pro of trading with XTB include commission free trading, advanced trading tools available through their in-house developed trading platform xStation 5 such as risk management tools, technical indicators, and charting tools. The broker also has a good range of trading products.

What countries are banned from XTB?

The following countries are not accepted by XTB

India, Indonesia, Pakistan, Syria, Iraq, Iran, United States, Australia, Albania, Belize, Belgium, New Zealand, Japan, South Korea, Hong Kong, Mauritius, Israel, Turkey, Venezuela, Bosnia and Herzegovina, Ethiopia, Uganda, Cuba, Yemen, Afghanistan, Laos, North Korea, Guyana, Vanuatu, Mozambique, Republic of the Congo, Libya, Macao, Panama, Singapore, Bangladesh, Kenya, Palestine and the Republic of Zimbabwe

What documents are required for XTB?

You will need to upload government 1 authorised proof of identity documents with photo such as passport, drivers licence plus proof of address statement created in the last 3 months such as bank statement, utility bill, phone bill or tax statement. These document as required by the brokers regulators and for Know Your Customer (KYC) obligations.