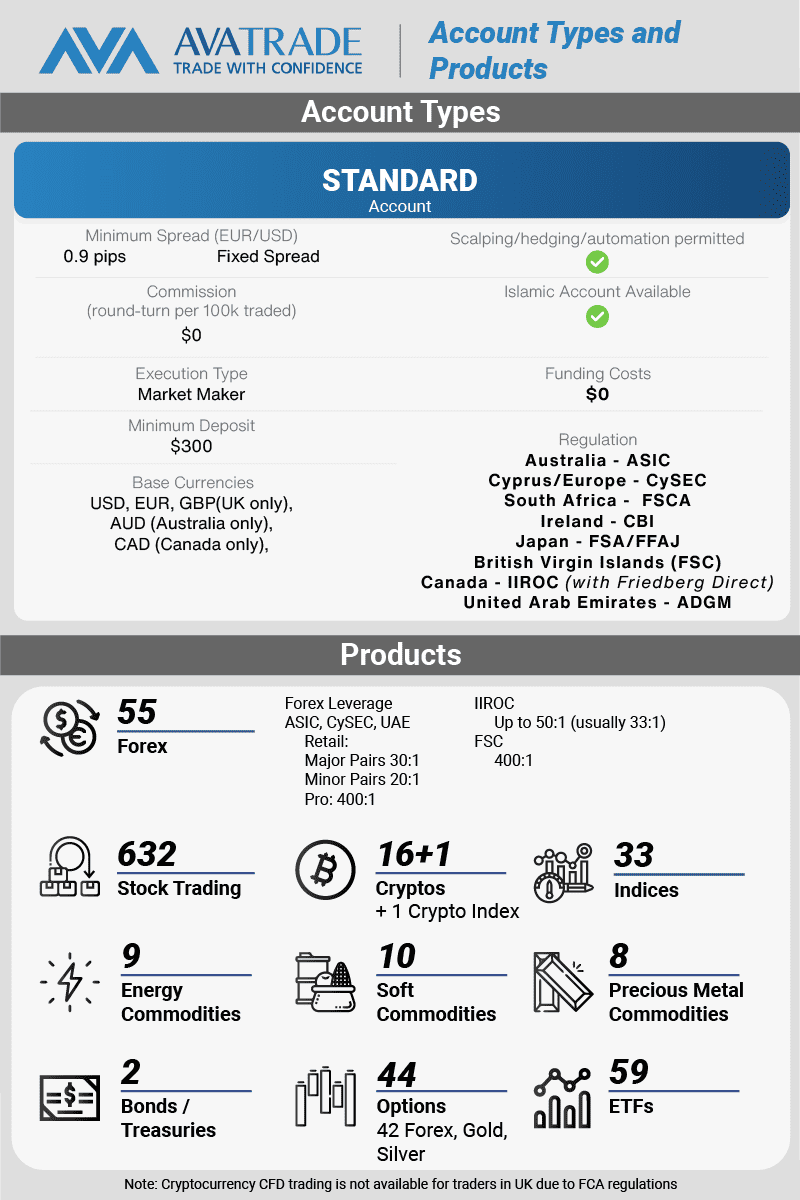

Forex Trading Software In 2024

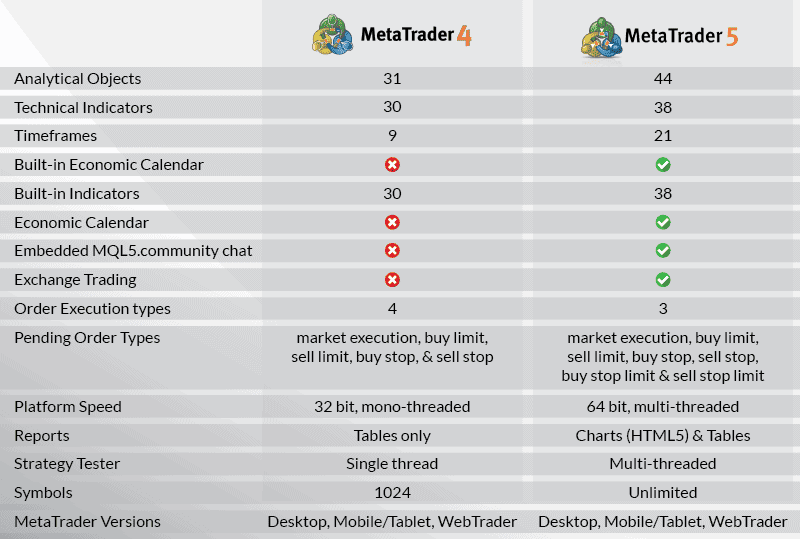

To get the best trading experience, having the right software for forex trading is critical. We compared the best forex trading platforms and the forex brokers offering the software based on features, 2024 brokerage and execution speeds.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site. For more information, visit our About Us page.

Ask an Expert

How much is your software?

Hi Jason

We don’t sell software ourself, we are a referral website. If you click on the link, you will be taken to the publishers website for you to buy directly through the publisher. Even though we do get a referral fee, you pay the same price as all clients of the publisher

As a beginner, is eToro the best choice?

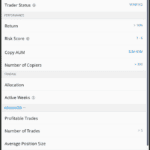

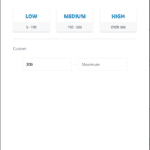

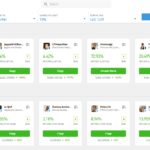

Depends on your point of view, some say copy trading is good for beginners since you can simply copy other trades. No need to learn to trade yourself but be careful as a traders past performance does not mean their future performance will be any good. On the other hand, if you want to learn to trade, eToro are not the best choice since their education and risk management tools are limited but they do have a good demo account.