Top 5 Forex Facts In Australia

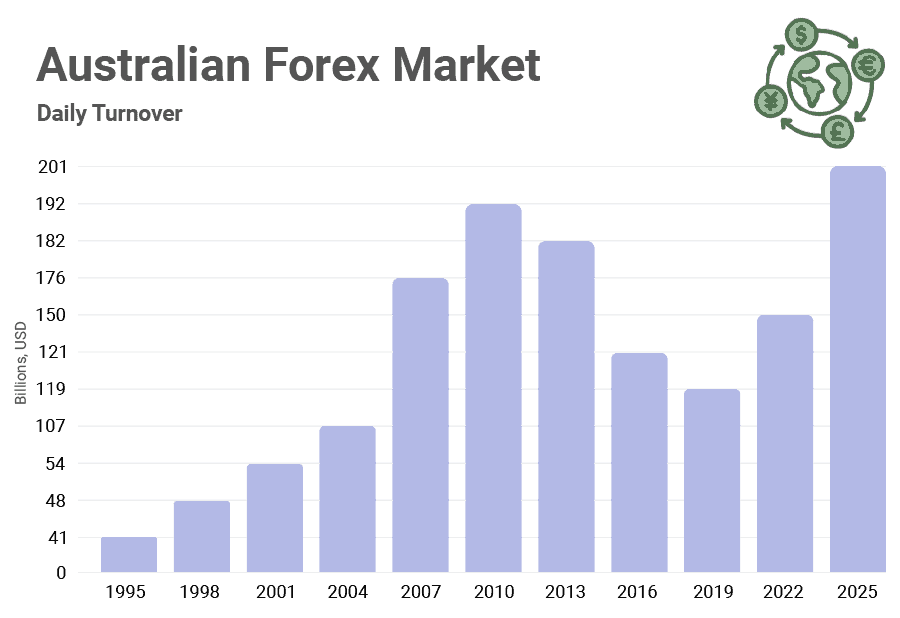

- The Australian forex market averaged USD $201 billion per day in April 2025, up from USD $150 billion in 2022 (a 34% increase)

- The Aussie dollar (AUD) dropped from the 6th most traded currency in the world to the 7th most traded currency. Overall the AUD made up 6% of the global forex turnover in 2025.

- 1.2% of turnover was by retail-driven Forex trading, totalling USD $2.5 billion per day. 75% of Forex turnover was between banks

- Over half of Australia’s forex trading was for short-term currency deals (USD $107b). Spot made up USD $51 billion, forwards $36 billion, options $6 billion.

- Australia is also a big hub for interest rate derivatives, with daily trading totalling USD $252b or 3% of global volume.

1. Australia’s Role in the Global Forex Market

In April 2025, Australia recorded USD $201 billion in average turnover (versus $150 billion in 2022). That’s a rise of 34% in 3 years, outpacing the global average of 28%.

Retail forex traders account for $2.5 billion of the overall turnover (1.2%). This is lower than the global average, which is 2.5%.

Justin Grossbard, Co-Founder of CompareForexBrokers, said, “In just 30 years, the forex market has increased 5-fold to USD $201 per day”.

Global Comparison

Globally, forex turnover reached USD $9.6 trillion per day. While the UK, USA, Singapore, and Hong Kong remain the largest hubs (combining for over 75% of global flows), the increase in Australian market turnover means Australia is catching up.

For more info on London being the largest trading hub worldwide, read our UK forex statistics.

| Rank | Market Hub | Daily Turnover (USD Billions) | Share Of Global |

|---|---|---|---|

| 1 | UK | $4,745.0 | 37.8% |

| 2 | USA | $2,334.7 | 18.6% |

| 3 | Singapore | $1,485.3 | 11.8% |

| 4 | Hong Kong | $883.1 | 7.0% |

| 5 | Japan | $440.2 | 3.5% |

| 6 | Germany | $386.1 | 3.1% |

| 7 | Switzerland | $370.5 | 2.9% |

| 8 | Canada | $242.6 | 1.9% |

| 9 | France | $242.2 | 1.9% |

| 10 | Australia | $200.9 | 1.6% |

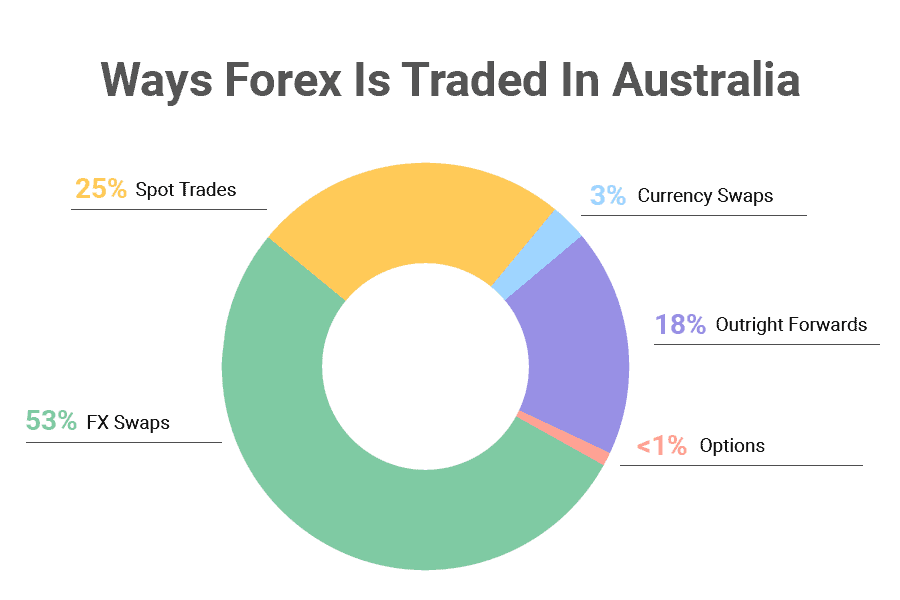

2. Instruments Traded In Australia

In Australia, Forex Swaps is the financial instrument of choice to trade Forex making up USD $107 billion or 53% of the market. This is higher than the 42% that make up Forex swaps globally. Spot trading with Forex by contrast only makes up USD $51 billion.

Future-dated deals (aka forwards) is responsible for USD $36 billion which essentially are agreements today for an exchange at a set date and rate in the future. Other instruments (currency swaps and options) account for the remaining turnover.

Who Trades Forex In Australia

- Reporting dealers (banks): USD 151 billion, 75%

- These are the large international and domestic banks that act as market makers. They are the core of interbank trading and provide most of the liquidity in the market.

- Other financial institutions: USD 40 billion (20%)

- This category includes non-reporting banks, institutional investors, hedge funds, proprietary trading firms, and retail-focused forex brokers.

- Non-financial customers: USD 10 billion (5 %)

- This covers corporates, exporters/importers, and government entities using FX to manage trade flows or reserves.

Local forex brokers (like Pepperstone) aggregate orders from retail and professional clients, then pass them through to the interbank market via reporting dealers. These only account for USD $2.5 billion per day or 1 percent of local forex trading (vs 2.5% globally) – Justin Grossbard

3. The Popularity Of The Aussie Dollar

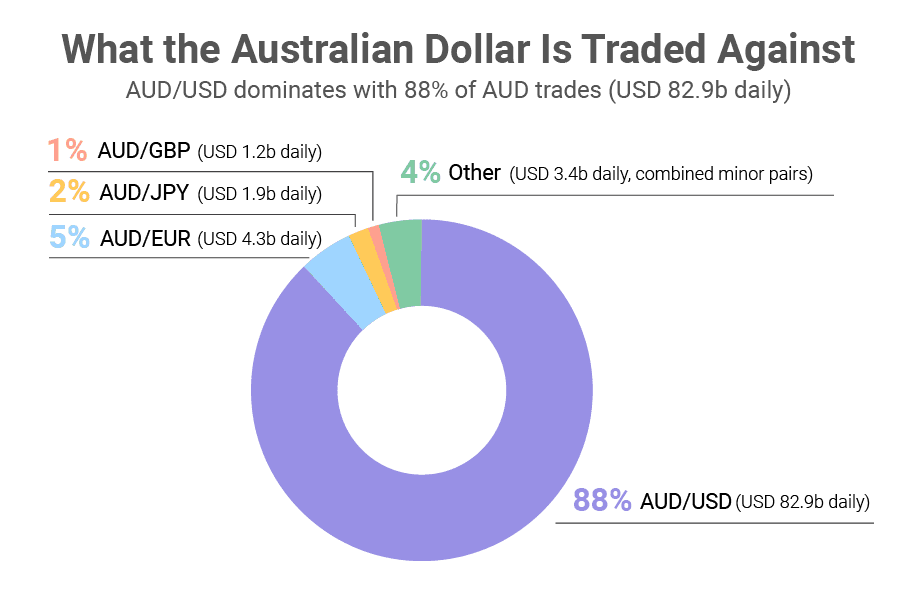

In April 2025, the Aussie dollar (AUD) was involved in 6% of global forex turnover (about USD $583 billion each day). This made the AUD the 7th most popular currency traded overall (dropping from 6th in 2022). This drop to 7th is due to the rise in the Swiss franc.

Unsurprisingly, the US dollar is the dominant currency worldwide with 89% of trades worldwide involving the USD. For more on this, read our USA forex statistics.

Most Popular Global Currency Pairs

From a global perspective, the most traded currencies traded against each other are the EURO and USD (EUR/USD) accounting for 22.7% of volume. This is followed by USD/JPY (13.5%) and then GBP/USD (9.5%).

| Rank | Currency Pair | Daily Turnover (USD billions) | Share of Global Turnover (%) |

|---|---|---|---|

| 1 | EUR/USD | 2,176 | 22.70% |

| 2 | USD/JPY | 1,293 | 13.50% |

| 3 | GBP/USD | 911 | 9.50% |

| 4 | USD/CNY | 774 | 8.10% |

| 5 | USD/CAD | 540 | 5.60% |

| 6 | AUD/USD | 476 | 5.00% |

| 7 | USD/CHF | 470 | 4.90% |

| 8 | USD/HKD | 344 | 3.60% |

In 2022, the AUD/USD was the 7th most traded currency pair globally and accounted for 4.4% of global daily turnover. While the AUS/USD rose slightly in overall share (about 5.0%) in 2025, it still only ranked 6th among traded pairs.

Over the past three years the biggest increase in volume has been for the Chinese Yuan. The USD/CNY rose from the 8th most traded to the 4th most traded. Meanwhile, the Swiss Frank dropped (USD/CHF) from 5th to 7th in popularity.

The yuan’s rise into the top four most popular Forex pairs to trade highlights China’s growing trade power, while the Swiss Franc’s drop shows reduced demand for safe-haven markets. – Justin Grossbard

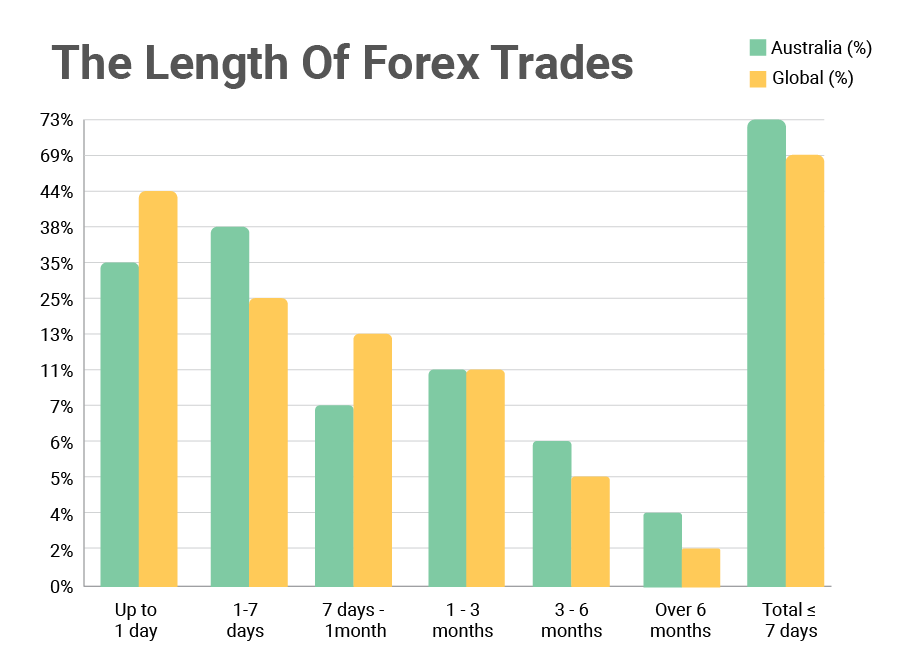

4. The Length Of Trades In Australia

In 2025 most forex trading in Australia involved short-term deals that are closed by taking the opposite side of the trade (i.e. offset) :

Time taken for trades to be closed:

- Up to 1 day: 35%

- 1 to 7 days: 38%

- 7 days to 1 month: 7%

- 1 to 3 months: 11%

- 3 to 6 months: 6%

- Over 6 months: 4%

Almost three-quarters (73%) of Forex swaps last less than a week showing how Australian traders are focused on short-term liquidity compared to long-term positions.

Globally, more forex trades finish on the same day, while in Australia more last between one and seven days. This means that big international hubs like London and New York rely more on very short overnight swaps to manage liquidity across time zones. This contrasts with Australian desks which tend to use weekly swaps instead of same-day trades, reflecting the smaller and more bank-focused nature of the local market.

73% of forex trades in Australia last less than a week which is shorter than the global average. – Justin Grossbard

Note: Forex currency pairs and forex are used interchangeably throughout this article.

Sources

Bank for International Settlements (BIS)

The majority of the forex trading statistics referenced in this article are sourced from the Bank of International Settlements (BIS) Triennial Central Bank Survey 2025. The survey conducted by BIS is the largest global analysis of financial markets, focusing on OTC derivatives and currency markets.