Best UK Spread Betting Brokers

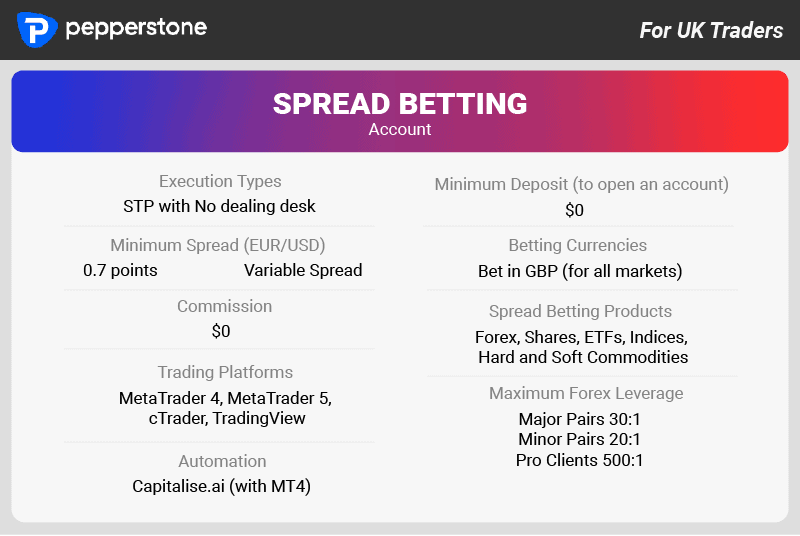

The best UK spread betting broker is Pepperstone based on their spreads, trading platform and customer service. This was based on our team opening Spread Betting accounts, testing spreads and fees and comparing factors such as trust and awards.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

Can I do spread betting if I am not in the UK?

The FCA is the only financial oversite that regulated spread betting. For this reason, spread betting is only generally available for traders with an FCA regulated entity

Can i spread bet if I am not in the UK?

If you mean financial spread betting? then no or not really. You can sports spread bet in some countries

Is spread betting the same as sports spread betting?

Yes – you can spread bet using financial instruments or with sports. They are much the same

Is spread betting the same as gambling?

Thats a tricky one to answer….It depends on your definition of gambling but in the UK you spread betting taxes are much the same as gambling and different from CFD trading or investing so you could argue it is.

Can you use leverage when spread betting?

Yes, you can. How much leverage you can use depends on the broker

Is spread betting better than CFD?

That depends on individual preference but spread betting has the benefit no capital gains taxes on your winning for retail traders.