Best Forex Trading Apps In Australia

We opened ASIC-regulated forex trading accounts and tested the forex apps each broker offers on several Apple and Android devices. We listed our trading preferences based on our first-hand demo and live account testing.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our team believes that functionality is the key to a trading app. It needs to offer quick trade execution and a robust set of advanced features like analytics and charting. Equally important is the app’s ability to perform well even in Australia’s inconsistent reception, which constantly fluctuates between 4G and 5G, ensuring you’re always connected to the market.

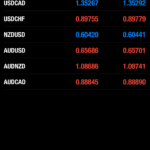

After functionality, ease of use of the app. This is crucial for traders of all levels, with an intuitive interface making a huge difference. The app should also provide real-time quotes for major currency pairs, as timely data is essential for effective trading decisions.

Our list of the best forex trading apps is:

- Eightcap - Best MetaTrader 5 Trading App

- Pepperstone - Best MetaTrader 4 Trading App

- eToro - Top Social Mobile Trading App

- OANDA - Best TradingView Broker

- AvaTrade - Best Trading Features With AvaOptions

- IG Trading - Best Range Of Markets

- CMC Markets - Best Trading App For Beginners

- SaxoBank - Good Mobile App Experience

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

98 | ASIC, FCA, DFSA | 0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

What Are The Top Forex Trading Apps?

We created a list of ASIC-regulated brokers and the trading apps they offer. We compared these forex apps based on weighted criteria from functionality and ease of use to execution speeds.

1. Eightcap - Best MetaTrader 5 Trading App

Forex Panel Score

Average Spread

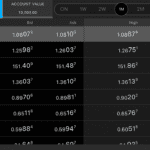

EUR/USD = 1.0

GBP/USD = 1.0

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

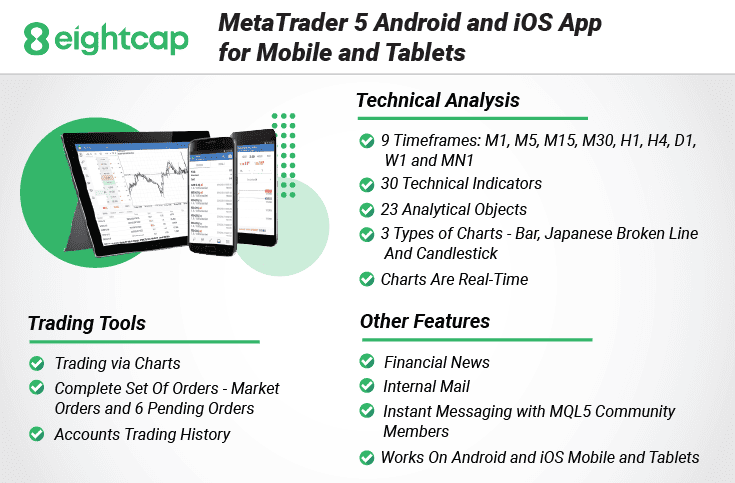

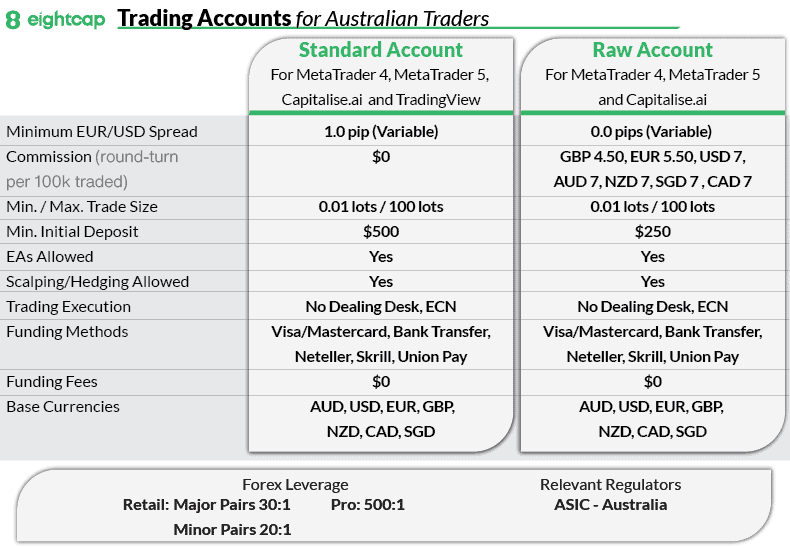

We liked how Eightcap pairs seamlessly with the MetaTrader 5 (MT5) app, a top choice globally for CFD trading. With Eightcap, traders can tap into an extensive range of CFDs, particularly in the Crypto domain, and benefit from some of the tightest spreads through their RAW account. These strengths make Eightcap and MT5 the go-to combo for Aussie CFD traders keen on mobile trading, whether on an Android or Apple device.

Pros & Cons

- Great range of trading apps

- Tight spreads from 0 pips

- Top cryptocurrency broker

- Small selection of tradeable markets

- Limited risk management tools

- Sparse educational resources

Broker Details

Eightcap is the best MT5 broker with superior trading execution with tight spreads

Out of all the brokers we’ve tested, Eightcap has the largest choice of crypto markets, which is ideal for traders looking to diversify their portfolios and capitalise on the growing cryptocurrency market. While testing the broker, we found that Eightcap’s selection of markets is varied, including 56 currency pairs, 586 shares, 16 indices, eight commodities, and 95 crypto markets.

| Broker | Crypto Markets |

|---|---|

| Eightcap | 95 |

| eToro | 41 |

| Pepperstone | 19 |

| AvaTrade | 16 |

| IG Trading | 15 |

| CMC Markets | 14 |

| OANDA | 4 |

| Saxo Bank | 0 |

When we opened our Eightcap RAW account, we got access to various platforms, including MetaTrader 4, MT5, and TradingView. We appreciate having multiple platform options, as it caters to traders with different preferences and trading styles.

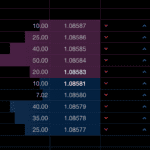

The MetaTrader 5 mobile app has a user-friendly interface and a comprehensive set of features similar to its desktop app. During our testing on the Android version, we were pleased to find 38 indicators and 20 drawing tools available, along with the ability to access the valuable Depth of Market tool directly on the app. We should mention that you cannot install or use Expert Advisors on the MT5 mobile trading app.

The Depth of Market (DOM) tool in MetaTrader 5 is a powerful feature for traders, offering real-time insights into the market’s liquidity and order book. By analysing DOM, you can leverage the raw pricing information of other traders to measure market sentiment and potential price movements, making it a top tool for scalpers.

As for Eightcap’s spreads, our analyst, Ross Collins, tested them with the RAW account and found they averaged 0.2 pips on EUR/USD, which is on par with some of the best in the industry.

| EUR/USD | Average Spread |

|---|---|

| TMGM | 0.15 |

| Tickmill | 0.15 |

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| City Index | 0.22 |

| ThinkMarkets | 0.22 |

| Blueberry Markets | 0.27 |

| Go Markets | 0.38 |

| Axi | 0.43 |

| CMC Markets | 0.44 |

| Blackbull Markets | 0.46 |

2. Pepperstone - Best MetaTrader 4 Trading App

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView,

Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

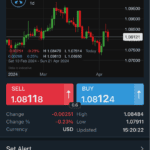

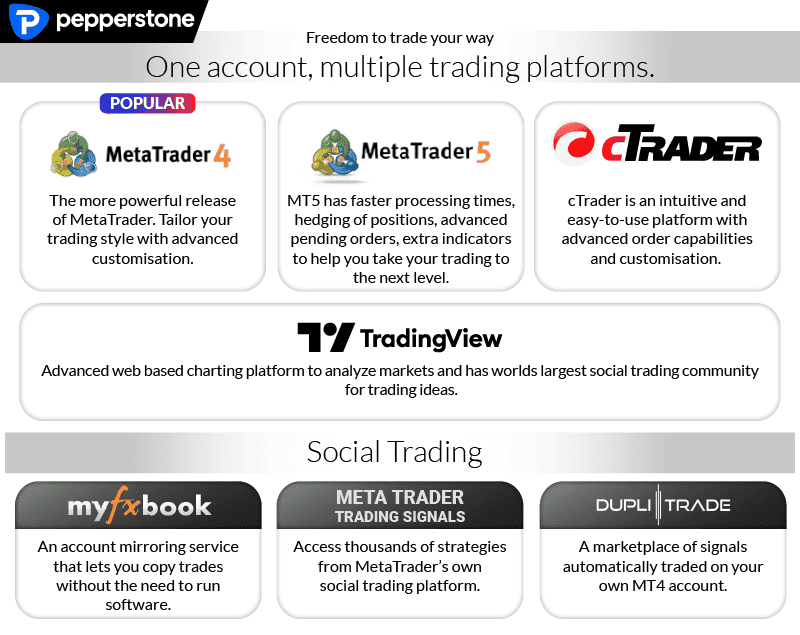

We’ve seen that Pepperstone truly shines when paired with the MetaTrader 4 (MT4) platform, the most downloaded forex app in Australia. Their swift execution speeds, competitive trading costs, and top-tier customer service set them apart in the forex trading landscape. The Pepperstone and MT4 combination stands out as the premier choice for Aussies dedicated to forex trading.

Pros & Cons

- Low spreads

- Enhanced MT4 trading tools

- Solid choice of markets

- Lacks guaranteed stop-loss orders

- Educational resources need updating

- Demo accounts expire after 30 days

Broker Details

Pepperstone offers MetaTrader 4, a popular choice for day traders, scalpers, and beginners. While testing the MetaTrader 4 app, we were pleased that it brings its simple user interface and quick execution tools to the mobile device. However, we felt it lacked most of its desktop features, like installing custom indicators, which is one of the reasons for MetaTrader 4’s popularity.

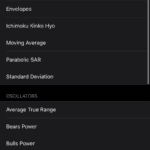

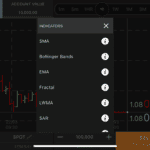

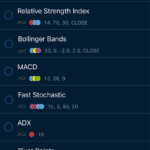

That said, we found the platform comes loaded with over 30 indicators, including popular ones like Ichimoku Kinko Hyo, MACD, and Bollinger Bands, available for free. So, we think it still packs a punch when analysing the markets on a mobile device.

During our tests, we found the Standard account’s spreads low, averaging 1.12 pips on EUR/USD, below the industry average of 1.24 pips. Tight spreads are crucial, as they directly impact your profitability and trading costs, especially if you trade frequently – the fees can add up quickly.

Pepperstone also advertises spreads from 0.0 pips on its RAW account, so our analyst Ross Collins tested the spreads to see how frequently the broker offers them this low. Surprisingly, his findings showed that they were offered 100% of the time on the major pairs.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

| GO Markets | 87.68% |

| Axi | 82.61% |

| CMC Markets | 81.88% |

This is an excellent offering, making the RAW account an attractive choice if you scalp the markets, minimising slippage while increasing your profit margins.

3. eToro - Top Social Mobile Trading App

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

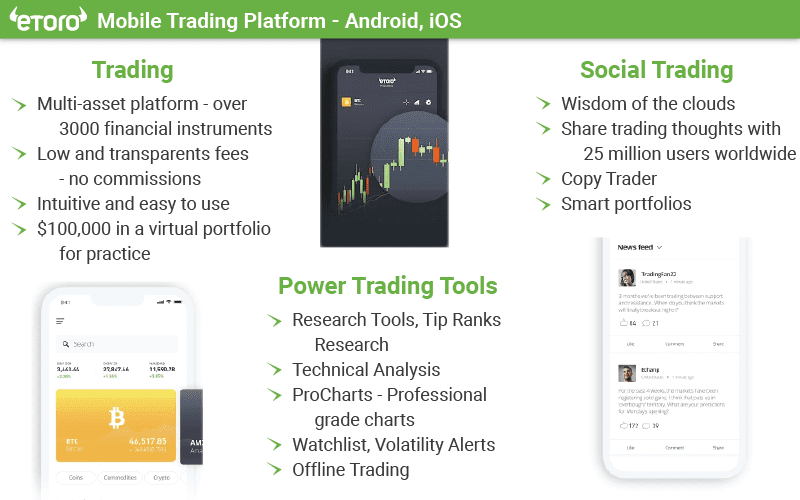

We favoured how eToro’s proprietary trading app stands out in copy trading. While the app boasts various features, the advanced social trading capability truly distinguishes it, allowing users to identify and follow traders based on specific criteria effortlessly. With advanced controls, traders can seamlessly replicate the strategies of their chosen professionals. The expansive copy trader community and an app environment tailored for Aussies solidify our appreciation for eToro.

Pros & Cons

- Excellent trading app for copy trading

- No commission trading

- Intuitive filters to find traders to copy

- Does not offer ECN/STP

- Limited to spread only fees

- Has withdrawal fees

Broker Details

eToro’s CopyTrader feature allows you to copy the trades of skilled traders, which can be useful if you are looking to diversify your portfolios without extensive market knowledge. By copy trading, you can leverage the experience of successful traders and follow their trades, meaning you’ll profit when they profit or lose when they lose.

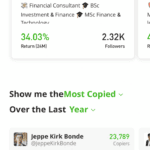

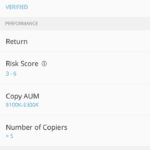

eToro’s CopyTrader platform is the easiest to use among the others we’ve tested. With features that simplify filtering its 30,000,000+ traders, we could optimise the criteria to find traders who match our requirements.

This user-friendly interface and vast trader pool make it an ideal choice for beginners seeking to learn from experienced professionals while gaining practical trading experience.

During our tests, we tried eToro’s filter tool by choosing the metrics we were interested in. It returned the top traders we could copy who matched our essential criteria. This helped us to find traders who met our minimum performance metrics, making it easier to find a suitable copy trader who matched our risk and trade frequency levels.

While copy trading, we were impressed with eToro’s fee structure. Typically, we’d expect the spreads to be wide or a service fee to use the copy trading tools. However, we found this not the case, with eToro offering spread-only, commission-free, Standard accounts that averaged one pip on EUR/USD.

4. OANDA - Best TradingView Broker

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

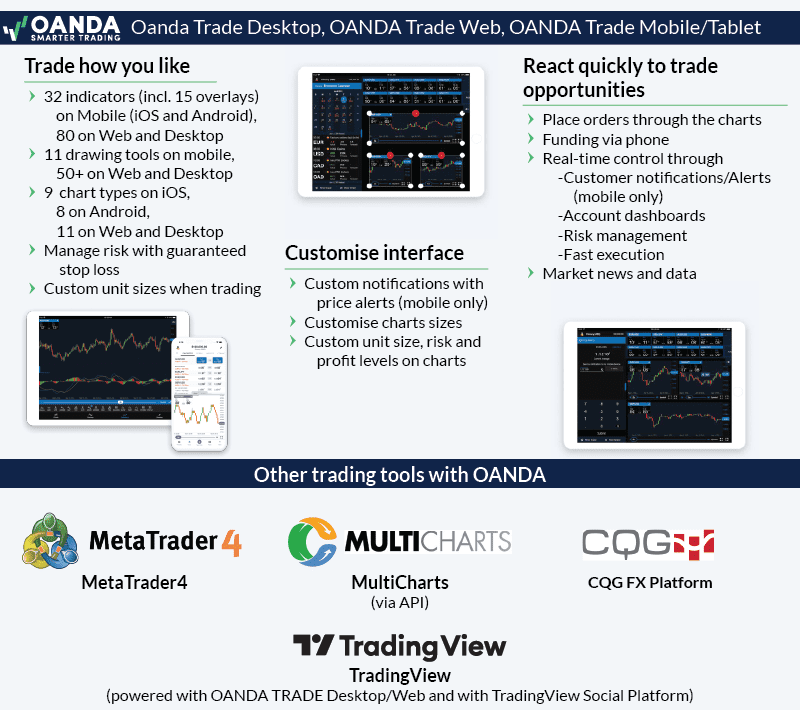

We’ve experienced OANDA’s platform suites firsthand and hold their in-house FxTrade trading platform in high regard. This platform uniquely allows traders to overlay different currency pairs on a single chart, making comparisons a breeze. Additionally, the seamless transition between the web-based and desktop versions of FxTrade speaks volumes about its user-centric design.

Pros & Cons

- Extensive range of technical indicators

- No minimum deposit

- TradingView is beginner-friendly

- Customer support is not 24/7

- OANDA tools unavailable on some platforms

- Lacks share CFDs

Broker Details

OANDA is a top broker in Australia, and it has a host of trading apps available, including MetaTrader 4, OANDA Trade, and TradingView.

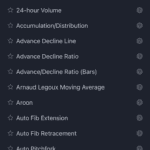

While testing OANDA, we used the TradingView mobile app, one of our favourite technical analysis platforms. We liked that most of TradingView’s desktop features were also available on the mobile version and that your analysis from the desktop was automatically synced to your mobile device. This feature is excellent as it means you don’t have to manually add or re-analyse your charts if you are on the go. The app syncs instantly, meaning you’ll always be ready to analyse a trade.

We were also pleased that the platform offered 110+ indicators on mobile devices, giving you the same charting experience on mobile as on desktop. However, some features are missing, such as the market screener, which isn’t a big miss if you work primarily from the desktop version.

When it came to executing trades, we opened an OANDA Standard account and found the spreads low, averaging just 0.7 pips on major pairs. These spreads are lower than the industry average, providing a cost-effective trading environment if you trade the major pairs.

| Broker | Major Pair Average Spread |

|---|---|

| OANDA | 0.70 |

| IC Markets | 0.76 |

| Fusion Markets | 0.99 |

| Admirals | 1.04 |

| Eightcap | 1.06 |

| Go Markets | 1.08 |

| OctaFX | 1.10 |

| TMGM | 1.16 |

| FIBO Group | 1.18 |

| Trading212 | 1.22 |

| ThinkMarkets | 1.22 |

| Axi | 1.24 |

| City Index | 1.24 |

| HYCM | 1.24 |

| eToro | 1.30 |

| FP Markets | 1.30 |

| Trading.com | 1.30 |

| CMC Markets | 1.35 |

| Exness | 1.36 |

| XTB | 1.36 |

| IG | 1.38 |

| Pepperstone | 1.40 |

| Blackbull Markets | 1.42 |

| HugosWay | 1.42 |

| Blueberry Markets | 1.46 |

| Saxo Markets | 1.48 |

| AccuIndex | 1.50 |

| MultiBank Group | 1.54 |

| Vantage FX | 1.54 |

| FXCM | 1.60 |

| Tickmill | 1.60 |

| FxPro | 1.62 |

| Axiory | 1.62 |

| Forex.com | 1.66 |

| Fair Markets | 1.70 |

| XM | 1.72 |

| HF Markets | 1.76 |

| Markets.com | 1.78 |

| Plus500 | 1.86 |

| Swissquote | 1.92 |

| Roboforex | 1.94 |

| TradersWay | 2.04 |

| FXTM | 2.12 |

| GCI Trading | 2.20 |

| IFC Markets | 2.20 |

| ADROFX | 2.32 |

| AMarkets | 2.52 |

| BlackWell Global | 2.52 |

| Industry Average | 1.52 |

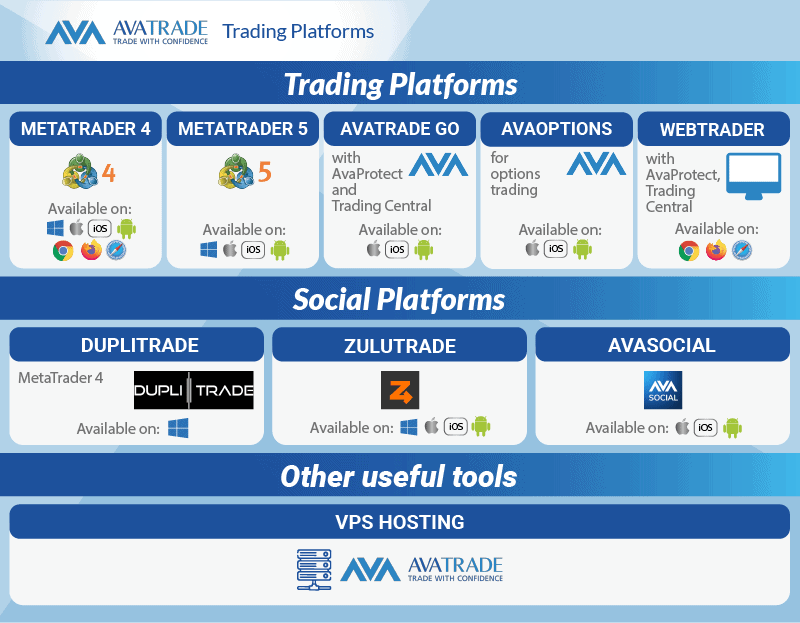

5. AvaTrade - Best Trading Features With AvaOptions

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We discovered that AvaTrade’s AvaOptions provides some of the best trading features. Trusting a platform is essential, and AvaTrade’s oversight by top-tier regulators in six countries certainly adds to that trust. With AvaOptions, we had access to more than 50 forex pairs, options for forex and bonds, and a rich assortment of cryptocurrencies, not to mention the ease of trading shares, indices, and ETFs.

Pros & Cons

- Intuitive platform for options trading

- top risk management tools with AvaProtect

- Offers fixed spreads

- No RAW spread pricing option

- Limited market research tools

- Spreads are above average

Broker Details

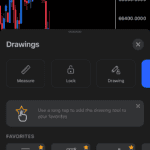

The platform that caught our attention was the AvaTrade Options app, which allows you to trade over 20 options across forex, gold, and indices markets. We believe options can be a decent alternative to CFDs, as they offer limited risk with unlimited profit potential while benefiting from market volatility, providing more ways to profit from price movements.

We had to go through the tutorial when we tried the AvaTrade Options platform, as the interface wasn’t user-friendly initially. We didn’t like that the app required the device to always be in landscape mode.

After the tutorial, we checked the charting and found that the app only had six indicators, far fewer than the AvaTradeGO platform. While executing options was straightforward, the app provided many technical details that an options trader would value but might appear confusing for beginners.

If you prefer trading CFDs directly, the AvaTradeGO app is our choice. It’s much more user-friendly than the AvaTrade Options app, with over 80 indicators. Additionally, it provides access to all of AvaTrade’s 2,400+ markets, offering a diverse range of trading opportunities.

Using AvaTrade’s Standard account, we tested their spreads and found they offered 0.9 pips on EUR/USD, which is surprisingly competitive compared with variable spreads.

| Broker | Avg. EUR/USD (Standard Account) | Fixed/Variable |

|---|---|---|

| OANDA | 0.60 | Variable |

| AvaTrade | 0.90 | Fixed |

| Eightcap | 1.00 | Variable |

| eToro | 1.00 | Variable |

| Pepperstone | 1.12 | Variable |

| CMC Markets | 1.12 | Variable |

| IG Trading | 1.13 | Variable |

| Saxo Markets | 1.20 | Variable |

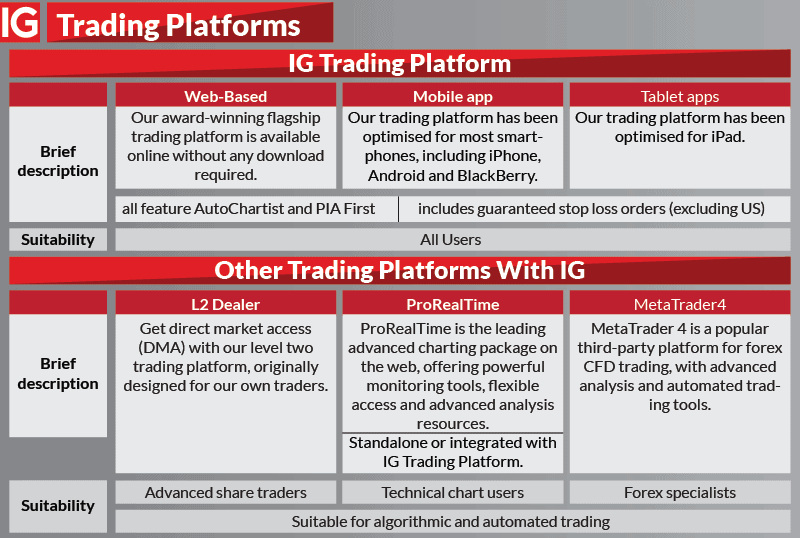

6. IG Markets - Best Range Of Markets

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Trading

We liked IG Trading’s commitment to providing diverse trading platforms, notably in forex and CFDs. Their core platform is browser-based, tailored for on-the-go FX traders, with no need for downloads. This seamlessly syncs with their mobile apps for iOS and Android. They’ve incorporated tools like setting limits, stops, and timely price alerts via email or SMS. Additionally, their research suite and interactive charts, brimming with technical indicators, set them apart for Aussie traders seeking extensive market options.

Pros & Cons

- Extensive range of markets

- IG Trading app is user-friendly

- Offers DMA access

- Limited client service over the weekend

- Lacks social trading tools

- High minimum deposit

Broker Details

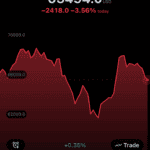

In our testing, we found IG Group to offer an impressive 17,000+ markets, which is the most we’ve seen from a CFD broker. These markets include 80+ currency pairs, 12,000+ shares, 130 indices, 41 commodities, and 6,000+ ETFs.

During our tests, we discovered that IG Group offered several trading platforms, including MetaTrader 4, IG Group Trading Platform, L2 Dealer, and ProRealTime. Because of its user-friendly interface and comprehensive features, we believe the IG Trading App is the top choice for beginner traders.

With over 40 indicators and full access to IG Group’s extensive market range (unlike MT4, ProRealTime, and L2 Dealer), the IG Trading App provides a trading experience tailored for novice traders. The IG Trading Platform also allows you to use guaranteed stop-loss orders, which can be helpful for beginners as it protects your losses from market slippage, which would cost you more money.

IG Group only provides a Standard account, a spread-only account with no commissions, as the cost is incorporated into the spread. We tested the Standard account to evaluate IG Group’s spreads across the forex markets and found them low compared to the industry average. The broker averaged 1.13 pips on EUR/USD, putting it in line with other low-spread brokers like Pepperstone

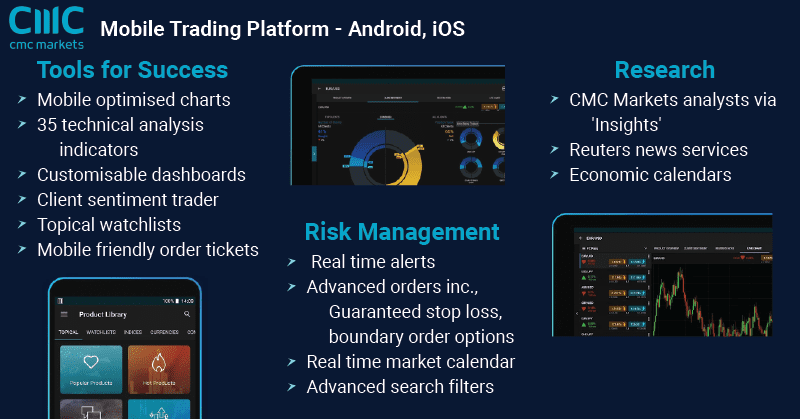

7. CMC Markets - Best Trading App For Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We found that CMC stands out as the best trading app for beginners, thanks to its extensive educational resources. From technical indicators to platform guides, they’ve got newbies covered. Their learning materials include easy-to-understand video tutorials, comprehensive online guides, and insightful webinars. For Aussie traders just starting out, CMC offers a solid foundation to kick off their trading journey.

Pros & Cons

- Offers guaranteed stop-loss orders

- Excellent choice of technical indicators

- Has low spreads

- Lacks social trading tools

- Customer support on the app is limited

- Unnecessary FX pair variations offered

Broker Details

If you specialise in forex trading, CMC Markets offers the largest selection of currency pairs we’ve tested, over 330+, covering a range of markets from EUR/USD to USD/THB. This gives you more market opportunities to diversify your strategies and capitalise on volatility from the more extreme exotic pairs that are unavailable with other brokers.

The NGEN platform by CMC Markets is an advanced trading app that provides excellent features from its Web Trader version, including advanced charting and pattern recognition tools with over 75 indicators and specialised pattern indicators.

Additionally, we found the broker had guaranteed stop-loss orders on the NGEN app, which can be particularly beneficial for beginners as it helps mitigate potential losses and promotes effective risk management.

We found that you can benefit from tight spreads if you choose to trade the major forex pairs with its FX Active account, offering the tightest spreads and cheap commissions for ten currency pairs (such as GBP/USD, AUD/USD, CAD/USD, EUR/USD, etc.).

In our testing, we found the spreads average 0.50 pips on EUR/USD while having the lowest commission of $2.50 per lot traded on its FX account. However, making it one of the lowest-cost trading accounts compared to the rest of the industry is hindered by these costs being limited to FX only.

| Broker | AUD |

|---|---|

| Fusion Markets | $2.25 |

| CMC Markets | $2.50 |

| Fair Markets | $2.50 |

| Go Markets | $3.00 |

| City Index (Web Trader) | $3.00 |

| VT Markets | $3.00 |

| FIBO Group | $3.00 |

| FlowBank | $3.25 |

| City Index (MT4) | $3.50 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| Axi | $3.50 |

| IC Markets | $3.50 |

| ThinkMarkets | $3.50 |

| Global Prime | $3.50 |

| TMGM | $3.50 |

| Blueberry Markets | $3.50 |

| Admirals | $4.00 |

| Blackbull Markets | $4.50 |

8. SaxoBank - Good Mobile App Experience

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.8

AUD/USD = 0.9

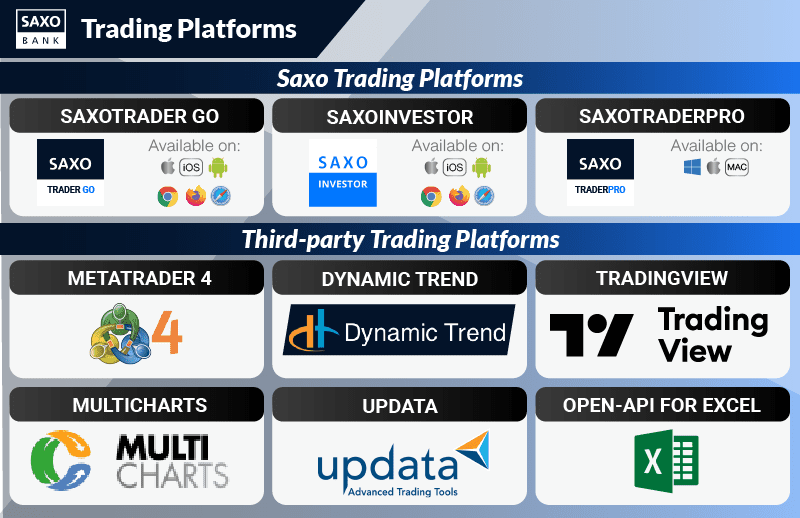

Trading Platforms

MT4, TradingView,

SaxoTraderGo, SaxoTrader Pro

Minimum Deposit

$0

Why We Recommend SaxoBank

We discovered that Saxo Capital Markets truly nails it when it comes to a seamless mobile app experience. Their SaxoTraderGo platform, celebrated for its reliability, execution speeds, and cross-device functionality, ensures traders can access markets on desktop, mobile, or tablet. On the other hand, their SaxoTraderPro is a dream for seasoned traders, tailored for those using multiple screens and compatible with both Mac and Windows. While its primary design excels on PCs, Saxo hasn’t overlooked tablet and mobile users, extending its expertise through dedicated apps.

Pros & Cons

- wide choice of financial markets

- Well regulated

- Top choice of trading tools

- High minimum deposit

- Trading platform has a learning curve

- Lacks live chat

Broker Details

After testing other proprietary trading apps, we think Saxo Markets has the best mobile app experience with its SaxoTraderGO platform. We tested the app on our phone and found it offered 40+ indicators, five chart types and 20+ timeframes, giving you a decent choice of setting up its charts the way you want.

We were impressed that the SaxoTraderGO app provided native trading signals from AutoChartist from within the platform. This is a bonus as most brokers force you to use the website to access the analysis from AutoChartist, which can take time and, therefore, miss a potential opportunity. We noticed you could use the same tools and features from the web platform, which is why we rated it highly for its mobile experience.

Saxo Markets is a multi-asset broker and offers a solid selection of CFD products with an impressive 185 forex pairs, 8,800+ stocks, 29 indices, and 20 commodities. Unlike other apps like MetaTrader 4, we found you have full access to each of these CFD markets with SaxoTraderGO in our tests.

Our live testing also found that Saxo Market’s spreads are competitive, averaging 1.20 pips on EUR/USD, which is lower than the industry average of 1.24 pips. We did find that the broker offered considerably wider spreads on other majors like USD/JPY and GBP/USD, both averaging 1.80 pips and wider than the industry average.