High Leverage Forex Brokers

Forex traders need leverage to take advantage of the currency market which often moves a fraction of a percent. We have compared the highest leverage forex brokers based on spread, forex trading platforms and features.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Forex Broker regulated by ASIC has a leverage cap of 30:1 for retail traders. We compared the brokers offering this maximum leverage and included an NZ-based broker regulated by the FMA which has higher caps.

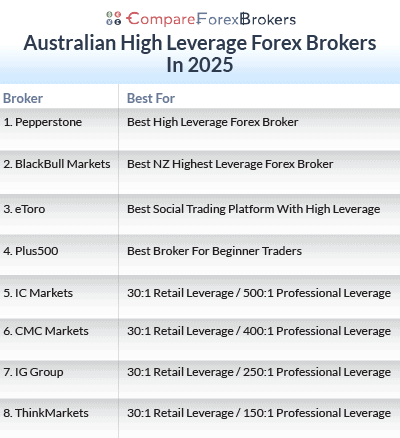

Our list of the top brokers are:

- Pepperstone - Best High Leverage Forex Broker

- BlackBull Markets - Best NZ Highest Leverage Forex Broker

- eToro - Best Social Trading Platform With High Leverage

- Plus500 - Best Broker For Beginner Traders

- IC Markets - 30:1 Retail Leverage / 500:1 Professional Leverage

- CMC Markets - 30:1 Retail Leverage / 400:1 Professional Leverage

- IG Group - 30:1 Retail Leverage / 250:1 Professional Leverage

- OANDA - 30:1 Retail Leverage / 150:1 Professional Leverage

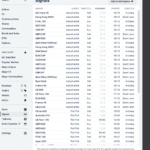

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 | ASIC, FCA, DFSA | 0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

91 | NFA/CFTC | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 68+ (Spot) | - | 50:1 | 100:1 |

|

What Forex Brokers Offer High Leverage?

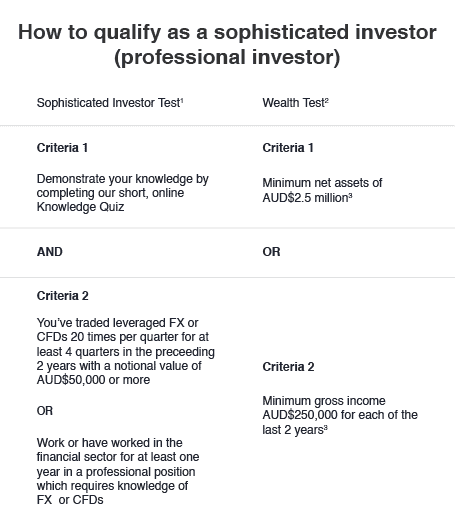

Retail traders are restricted by ASIC in the leverage locally regulated brokers can receive so either they can select a provider at offering the maximum level or choose an overseas broker. Below is a list of these two types of brokers each matching different trading styles and requirements.

1. Pepperstone - Best ASIC Regulated Forex Broker With High Leverage

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.69

AUD/USD = 1.22

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

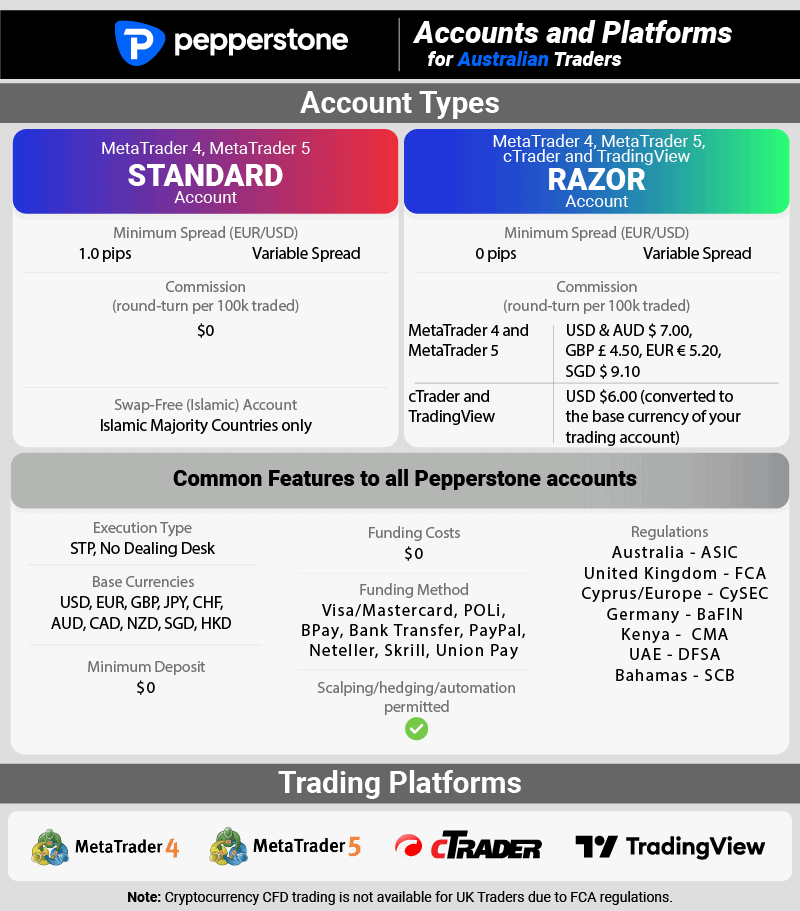

We recommend Pepperstone because they offer the maximum ASIC leverage for trading forex (30:1), while also offering raw spreads with no markups. The platform also has an average execution speed of 25 milliseconds.

Pros & Cons

- MetaTrader 4, MetaTrader 5, TradingView and cTrader

- Competitive spreads (EUR/USD spread of 1.12 pips)

- Average execution speeds of 77 milliseconds

- Only offers third-party platforms

- No trading on physical assets

- US clients not accepted

Broker Details

Best ASIC-Regulated Broker

We awarded Pepperstone the best overall broker in 2025 and for high leverage broker as the provider offers the maximum ASIC leverage level of 30:1 for retail traders and 500:1 for professional traders. Pepperstone stands out with its fast execution speeds, diverse selection of platforms and powerful range of trading tools.

Maximum Leverage Limits

Like all ASIC-regulated forex brokers, Pepperstone offers leverage of up to 30:1 for major currency pairs and 20:1 for minor pairs using retail investor accounts.

Maximum leverage for other products includes 20:1 for gold and major stock indices and 10:1 for silver and other commodities. The maximum leverage is 2:1 and 5:1 CFD shares if you wish to trade cryptocurrencies.

Given the high risk of trading with leverage, we recommend opening a demo account to practice with first, which is easy with Pepperstone. It took us less than 10 minutes to open an account and as a bonus, we didn’t need to make a deposit or even provide any funding account details like credit cards.

Fast Execution Speeds

From our testing, Pepperstone has some of the fastest execution speeds we’ve seen, which is important to reduce the high risk associated with leverage. This is because fast execution speeds can lower your slippage, thereby protecting you from undesirable losses.

To find out which brokers have the best execution speed, our CompareForexBrokers technology research analyst, Ross Collins, tested 20 brokers to find out which brokers were the fastest. In Ross’ tests, we found Pepperstone was one of the fastest ASIC-regulated Forex brokers, with an average execution speed of 77 ms and a market execution speed of 100 ms.

Only BlackBull Markets (NZ-regulated) and Fusion Markets (ASIC + others), could offer faster execution speeds.

Diverse Trading Platforms and Tools

To trade its high leverage, Pepperstone’s has one of the most diverse range of trading platforms that we’ve seen.

Not only does it offer MT4 and MT5, but Pepperstone also includes Smart Trader Tools to make your MetaTrader experience even better. Among the 28 apps included with Smart Trader tools, we like Smart Lines and Mini Terminal which help you manage your trading risks.

Then there is cTrader, which we see as a good alternative for traders wanting extra charting tools, depth of market visibility and the ability to control order fills. Like MetaTrader’s EAs (Expert Advisors), cTrader lets you automate your trading using cBots.

Lastly, TradingView is a specialised charting platform. In addition to a wealth of analysis tools and charts to help you identify trading opportunities, you can trade directly from the charts.

2. BlackBull - Highest Leverage NZ Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Blackbull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

We recommend BlackBull for traders in Zealand because they offer the maximum 1:500 leverage for trading forex and some of the lowest spreads on the market. BlackBull also offers the fastest execution speed on the market, as per our execution speed testing.

Pros & Cons

- Fastest execution speed in NZ

- ECN/NDD execution model that offers deep liquidity

- Institution-grade pricing for retail traders

- Limited deposit options

- Above-average commissions on forex pairs

- No cTrader and TradingView

Broker Details

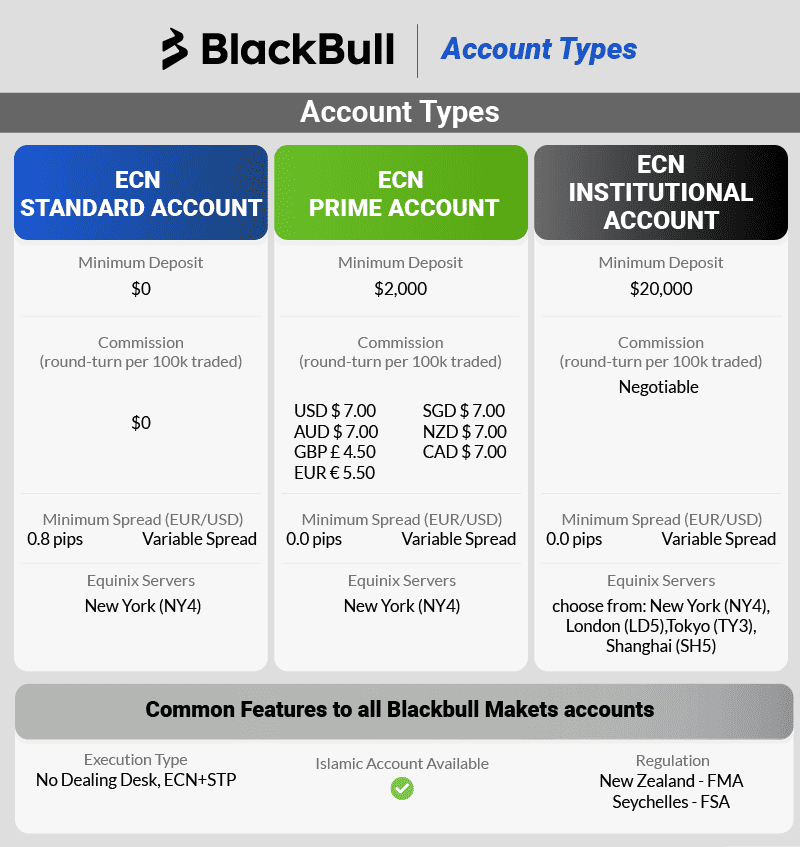

BlackBull Markets Offers 500:1 leverage

New Zealand broker, Blackbull Markets is regulated by the FMA (a ‘tier 1’ regulator), which allows significantly higher leverage than most brokers of up to 500:1. To trade this high leverage, we can recommend BlackBull Markets because of 3 reasons:

- The FASTEST EXECUTION SPEED of any forex broker

- Excellent selection of trading platforms

- Top range of algorithmic and copy trading tools

Fastest Execution Speeds

Based on our testing, BlackBull Markets is the fastest broker overall, with an execution speed of just 0.72 ms for limit orders.

BlackBull Markets also performed excellently in our test for market orders. When our own, Ross Collins, tested for market orders, he found that BlackBull Markets had a market order speed of 90 ms, second only to Fusion Markets with 77 ms.

When trading with leverage as high as 500:1 like BlackBull Markets’ offers, it’s important to use a broker with fast execution speeds, as this greatly reduces your risk of slippage (which can be very costly when markets move against your trading position quickly).

Diverse Account Types

Like the forex brokers we’ve reviewed, BlackBull Markets offers multiple account types to cater to all traders. Both beginners and experienced forex traders will benefit from ECN-style, STP execution with deep liquidity, while institutional investors can choose from among four different servers in major financial hubs.

While BlackBull Markets offers a diversity of account types, the broker’s spreads are slightly higher than the industry average from our analysis. For the popular EUR/USD pair, the broker averaged 1.2 pips for its Standard account and 0.23 pips for its Prime account.

Excellent Trading Platform Tools

True to its financial technology roots, BlackBull Markets doesn’t skimp when it comes to trading platforms. In addition to the standard versions of popular MetaTrader 4 and MetaTrader 5 trading platforms, BlackBull Markets also offers cTrader, TradingView and three diverse proprietary platforms.

While the third-party platforms offer the out-of-the-box trading experience from our testing, what elevates BlackBull Markets is its trading tool add-ons.

Social traders have access to a MyFxBook integration for MetaTrader 4, as well as ZuluTrade and Hokocloud. Virtual Private Servers (VPS) and API trading are also available.

3. Good Beginner Broker With High Leverage - Plus500

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

We chose Plus500 as the best high-leverage broker for Singapore traders since they offer the maximum 1:20 leverage for trading forex and also offer low spreads. As a market maker, Plus500 also issues no commissions to its traders.

Pros & Cons

- Well-regulated market maker

- Good variety of CFDs to trade

- Solid risk management tools

- Lack of trader education materials

- Does not have MetaTrader 5, TradingView and cTrader

- Does not have a commission-based RAW account

Broker Details

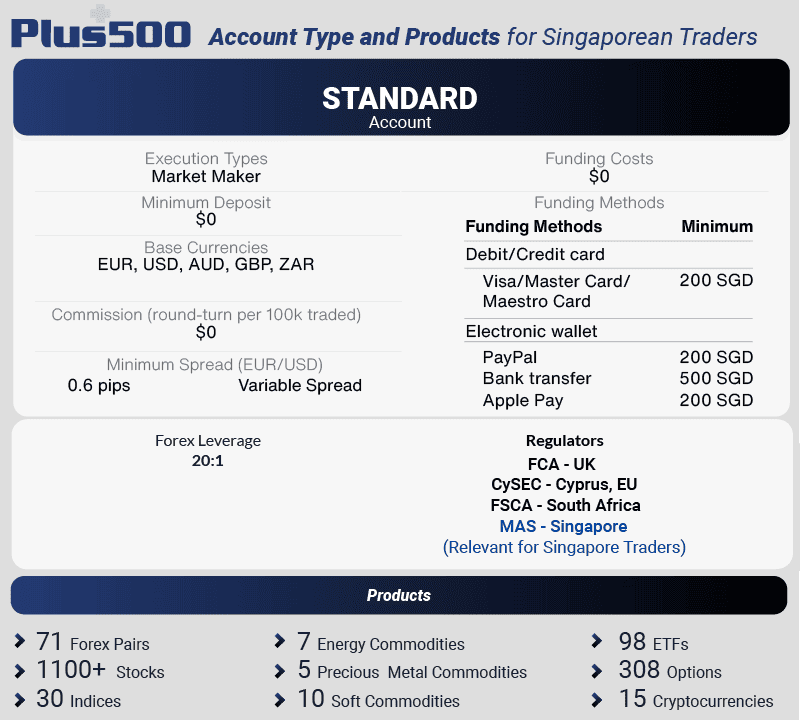

1:20 Leverage on Forex Pairs in Singapore

Offering the maximum leverage permitted by the MAS (1:20) in Singapore, we recommend Plus500 for beginners due to its commission-free spreads, risk management features and user-friendly platform.

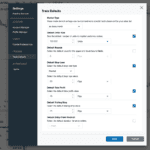

Top Risk Management Features

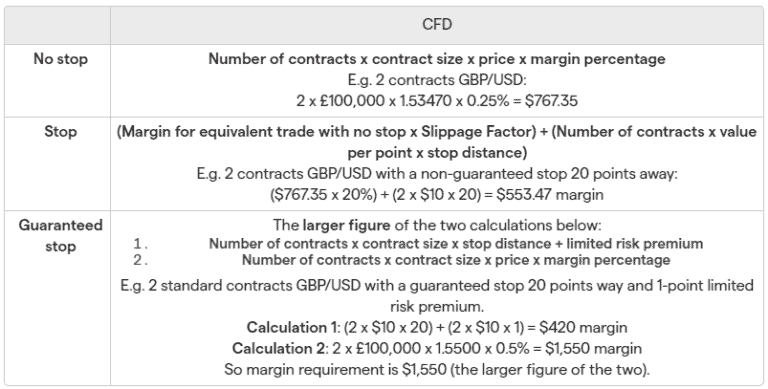

When trading with high leverage, it’s important to utilise risk management features to limit your potentially elevated losses. Luckily, Plus500 offers a range of risk management features ranging from guaranteed stop-loss orders (GSLOs) to negative balance protection.

Additionally, various trading tools are free to use, such as customisable alerts, market news, economic calendar, and educational resources online.

When we tested the broker’s platform, we liked the availability of GSLOs on every order ticket we opened. This encouraged us to place GSLOs for every trade to help protect against big losses due to high leverage.

Commission-free Spreads

As a market maker, Plus500 only offers a commission-free account with spreads from 1.7 pips for the EUR/USD pair from our analysis. While not having commissions will keep your costs down (essential for leverage trading), this is well above the industry average of 1.24 pips.

To trade its commission-free spreads and 1:20 leverage, we were impressed with the broker’s product range, which includes 71 forex pairs and over 1100 shares.

User-Friendly Platform

Plus500 only offers its own, proprietary platform, which is beginner-friendly from our testing, with a clean design and easy-to-access charting tools.

Despite lacking more advanced trading tools, we still found 100 technical indicators for charting and a ‘traders sentiment’ feature, displaying the ratio of buyers and sellers for a particular financial instrument, allowing us to utilise technical analysis and market research while trading high leverage.

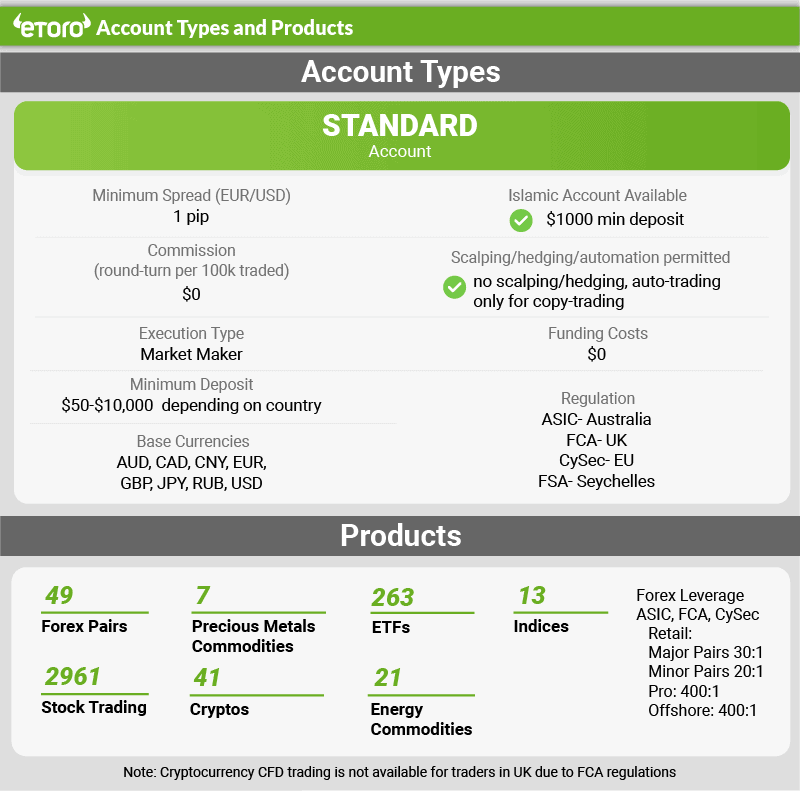

4. eToro - Best Copy Trading Broker With High Leverage

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro for the UAE because they are the best high-leverage forex broker that also offers access to social trading.

Pros & Cons

- 1:30 leverage on standard accounts & 1:400 on professional accounts

- Social/Copy trading

- Deposit requirement of only 200 AED

- Inactivity and withdrawal fees

- Too few technical analysis tools

- No MT4, MT5, cTrader or TradingView

Broker Details

Maximum Leverage of 1:30 in UAE

Alongside offering the maximum leverage for UAE retail traders of 1:30 under the Dubai Financial Services Authority (DFSA) legislation, eToro is also the social and copy trading king from our trading experience.

Top Social/Copy Trading Broker

While eToro combines manual and social trading, it is the broker’s social trading that stood out to us.

Two social trading aspects that we wanted to highlight include the search functions of the eToro platform and the CopyTrader feature.

Firstly, eToro allows you to search for a particularly instrument which brings up a market feed of traders discussing whether or not that instrument is over or undervalued. We found these insights were valuable when trading with leverage to help us determine which instruments would give us the highest chance of profit.

Secondly, we appreciated the inclusion of the CopyTrader feature, allowing us to pick traders to copy without risking too much of our leveraged trade. To streamline the process of who to copy, we could choose from the Editor’s Choice or Most Copied which displayed a range of performance statistics to best match our trading needs.

Competitive Commission-Free Spreads

Another market maker, eToro only offers a commission-free Standard account, with average spreads of 1 pip for the EUR/USD, which below the industry average of 1.24 pips.

Trading with competitive spreads and no commissions will lower your costs, important for leverage trading which increases the chance of profit but also your potential losses.

5. CMC Markets - Best Share And Forex Broker Provider

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We recommend CMC Markets for trading with leverage in the UK as the forex broker offers the maximum leverage of 1:30, as per FCA regulations.

Pros & Cons

- Most currency pairs in the UK

- Good spreads on the majors

- No minimum deposit requirement

- High stock CFD fees

- Only CFDs are available

- Trade speed is not fast

Broker Details

Retail Leverage of 1:30 in the UK

Regulated by the FCA in the UK, CMC Markets is our top pick for UK traders, offering up to 1:30 leverage on the major forex pairs as well as 1:500 for professional investors. You can also access low spreads, cheap commissions, a wide range of products and an excellent trading platform.

Low Commission-Free Spreads and Cheap Commissions

From our testing, CMC Markets offers the 2nd most competitive commission-free spreads of any broker we’ve traded with. For the 6 major currency pairs, CMC Markets averages 1.11 pips, with only IC Markets offering lower average spreads of 1.02 pips.

Should you choose the broker’s FX Active account, you can access commissions of USD $2.50 per side, one of the cheapest we’ve encountered. Only Fusion Markets at $2.25 per side offers cheaper commissions for an ECN account.

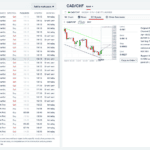

Excellent Trading Platform

While the broker offers the MT4 platform, CMC’s Next Generation platform is our pick with its fluid user experience, advanced tools and comprehensive selection of over 12,000 financial instruments.

What we particularly enjoyed about the Next Generation platform is the ability to add multiple fixed or variable layouts which you could customise.

This gave us flexibility when trading with leverage, as we could choose to have a multi-chart layout, a trade signals layout and a basic fixed layout to help monitor our positions and analyse the market simultaneously and with ease.

Lastly, we utilised CMC Markets guaranteed stop loss orders (GSLOs) to protect our trades from unnecessary losses from leverage during times of volatility.

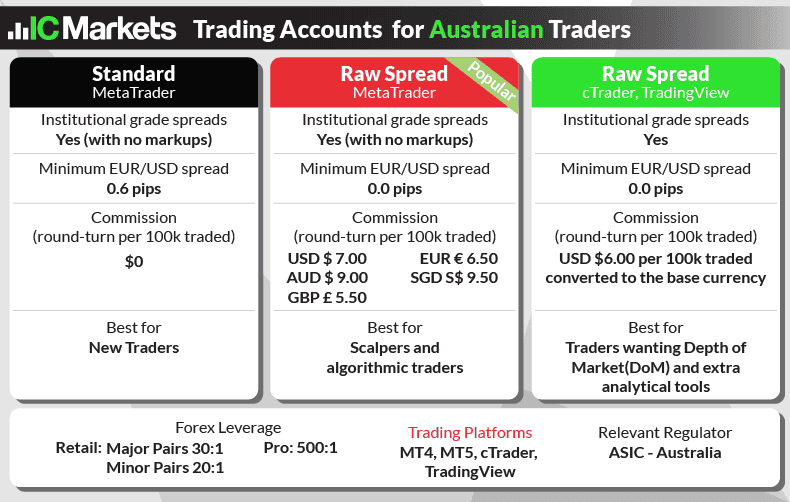

6. IC Markets - 30:1 Retail Leverage + 500:1 Professional Leverage

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

Why We Recommend IC Markets

We recommend IC Markets for leverage trading for European traders as the forex broker offers the maximum leverage of 1:30, as per CySEC regulations.

Pros & Cons

- Competitive raw spreads

- No deposit or withdrawal fees

- Minimum deposit requirement of $200

- Commissions are $2.50 USD per side

- No fixed spread account

Broker Details

Leverage of up to 1:30 in the EU

Offering up to 1:30 leverage in the EU due to its CySEC regulations in Cyprus, IC Markets also provides tight spreads, great platforms and high leverage, making it a good choice for beginners transitioning to more advanced trading strategies.

Tightest Commission-Free Spreads

When comparing commission-free accounts, our testing revealed that IC Markets had the lowest standard account spreads of 1.03 pips across the 6 major currency pairs. This put IC Markets on top of a list of 20 brokers, ahead of CMC Markets (1.11 pips) and Fusion Markets (1.19 pips).

Additionally, from our RAW/ECN trading account testing, IC Markets offered the 3rd tightest spreads of 0.32 pips for the 6 majors (behind Fusion Markets and City Index).

Trading with high leverage can greatly amplify your risk of losses, so trading with low spreads like IC Markets offers will help reduce your overall trading costs.

Good Trading Platforms

IC Markets offers a good range of platforms, including MT4, MT5, cTrader and TradingView.

From our testing, we highly recommend MT5 given the platform offers a comprehensive set of technical analysis tools, including over 38 indicators, more than 15 drawing tools, and three chart types.

A feature that stood out to us is the depth of market (DoM) tool, which allowed us to view the order books of liquidity providers and see where other traders were placing their orders. This feature intrigued us as it provided insight into the relative strength of both the buy and sell sides.

7. IG - 30:1 Retail Leverage + 250:1 Professional Leverage

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, IG Trading Platform, L2 Dealer, ProRealTime, TradingView

Minimum Deposit

$0

Why We Recommend IG Group

We chose IG for trading with leverage in the German market as the forex broker offers the maximum leverage of 1:30, as per BaFin regulations.

Pros & Cons

- A wide offering of trading products

- No minimum deposit requirement (Standard Account)

- Choice of 4 trading platforms

- Below-average execution speed

- Commissions of $3.50 per side

- DMA account is only for professional traders

Broker Details

Leverage of up to 1:30 in Germany

IG Group is a BaFin-regulated forex CFD broker in Germany and offers the maximum permitted leverage of 1:30 (1:200 for professional clients). In addition, we like IG Group for its huge range of products, range of platforms and is highly trusted.

Huge Range of Financial Products

You can trade a huge range of leveraged products offered by IG Group including, over 80 currency pairs (1:30 leverage), 12,000 share CFDs (1:5) and 100 indices (1:20). From our testing methodology, we rated IG Group a perfect 10/10 as having one of the biggest product ranges in the industry.

Great Selection of Trading Platforms

IG Group offers multiple trading platforms you can trade with its high leverage, including MT4 and IG Group’s proprietary platform.

Testing on its user-friendly proprietary platform gave us access to the broker’s full range of products in addition to impressive charting with over 28 indicators and trading signals from PIA First and AutoChartist.

Highly Trusted Broker

Lastly, we gave IG Group a 97/100 trust score given its highly regulated nature (8 tier-1 regulators) and longstanding reputation, which is a good reason to choose the broker when trading with something as risky as high leverage.

8. OANDA - 30:1 Retail Leverage + 100:1 Professional Leverage

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (fx Trade)

Minimum Deposit

$0

Why We Recommend OANDA

We recommend OANDA to traders in the USA as the forex broker offers the maximum leverage of 1:50, as per CFTC and NFA regulations, while providing over 65 currency pairs.

Pros & Cons

- 65+ currency pairs, including majors and minors

- Spread Only account offers 0.6 pips spread on EUR/USD

- STP-style trading with their Elite Trader Account

- No negative balance protection

- No guaranteed stop-loss order

- No swap-free account

Broker Details

1:50 Leverage in the USA

Operating in the USA as per NFA and CFTC regulations, OANDA offers maximum leverage of 1:50 on major currency pairs. We also like OANDA for its low commission-free spreads, user-friendly platform and risk management features.

Lowest Commission-Free Spreads

As a market maker, OANDA offers only 1 ‘Spread Only’ account type which offers the lowest spreads out of the other USA-regulated brokers that we reviewed.

Spreads matter in leveraged trading, and this is why OANDA has average spreads on the top 5 majors standing at 0.70 pips while the industry average is 1.52 pips from our analysis.

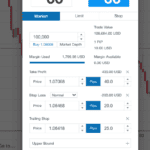

User-Friendly Platform

To trade its high leverage, you can choose either the OANDA Trade or MT4 platforms. From our testing of OANDA Trade, we liked the platform’s default trade ticket feature, which allowed us to pre-set trade size, stop loss, and take profit levels, a useful risk management feature when trading with leverage.

The fact that all future trade tickets automatically reflected our pre-set levels saved us time and allowed us to keep track of our leveraged positions.