ACY Securities Review of 2026

ACY Securities offers decent regulatory oversight and a wide range of CFDs. It supports MetaTrader 4, MetaTrader 5, and its proprietary web platform. Traders also gain access to advanced tools like Signal Start for copy trading and Capitalise.ai for strategy automation.

However, ACY’s relatively high trading costs make it less suitable for beginners who are more fee-sensitive.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

ACY Securities Summary

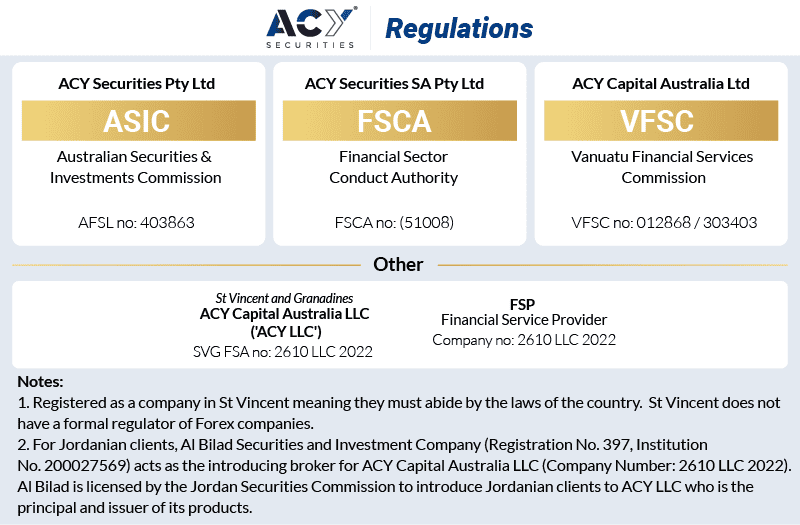

| 🗺️ Tier 1 Regulation | ASIC |

| 🗺️ Other Regulation | FSCA, VFSC |

| 💱 Trading Fees | Basic, Standard, ProZero |

| 📊 Trading Platforms | MT4, MT5 |

| 💰 Minimum Deposit | $50 to $200 |

| 💰 Funding Fee | $0 |

| 🛍️ CFDs Offered | Forex, Indices, Crypto, ETFs, Commodities, Stocks |

Why Choose ACY Securities

ACY Securities offers fast execution speeds, low-to-average spreads, and a strong range of trading tools. Over 2,200 instruments across forex, indices, shares, and commodities, giving you plenty of market opportunities with spreads starting from 1.0 pip. To trade these products, you can use the MetaTrader 4 and 5 platforms and integrate with Capitalise.ai for code-free automation.

Other benefits with ACY Securities include a low $50 minimum deposit and a variety of market analysis tools suited to both active and casual traders. Scalpers and day traders may also benefit from the broker’s execution infrastructure. ACY Securities was also named “Best Overall Broker” at the Fazzaco Expo Dubai in 2022.

That said, ACY is regulated by ASIC in Australia and the FSCA in South Africa. However, if you’re based outside these countries, your account will be held under their Saint Vincent and the Grenadines entity, which is not overseen by a formal forex regulator.

ACY Securities Pros and Cons

- Competitive Execution Speed

- Wide Range of Trading Instruments

- Research & Education Section

- High Overnight Fees

- No Stock/ Crypto Ownership

- Lack of UK/EU Regulation

The overall rating is based on review by our experts

Trading Fees

In my review and extensive testing, I found that ACY Securities has very high trading fees and spreads, as opposed to what’s advertised.

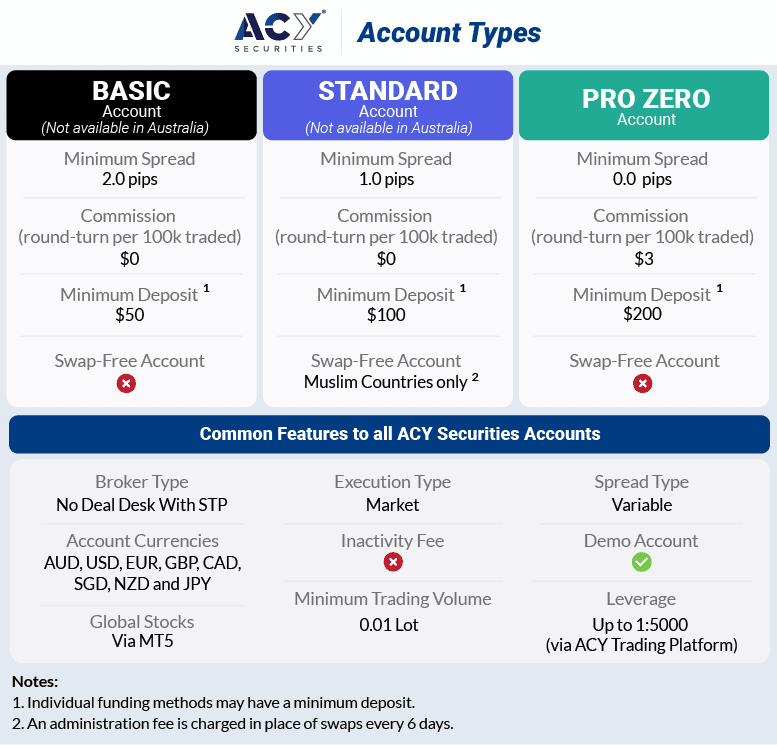

ACY Securities offers three different account types:

- Basic account: Commission-free but has the widest spreads (from 2.0 pips per lot). Minimum deposit of $50 and no Swap Free account.

- Standard account: Offers tighter spreads than the Basic account (from 1.0 pips). Minimum deposit of $100 and the option of a Swap Free account.

- ProZero account: Has the tightest spreads (from 0.0) and a $3 round-turn commission per lot. Minimum deposit is $200 and no Swap Free option.

Something to mention is that Australian traders can only use the Pro Zero account. I am not sure why that is. The Basic and Standard accounts are not available for Australian traders. So if you are in Australia and want spread-only trading, it is best to look at other ASIC-regulated brokers like Eightcap and IC Markets.

I have compiled a table below to provide a clear overview of their core trading costs:

Raw Account Spreads

The ProZero account is specifically tailored for active and high-volume traders, offering highly competitive raw spreads that start from 0.0 pips.

Looking at specific average spreads, I observe that major currency pairs generally exhibit excellent conditions.

For instance, EURUSD maintains “Good spreads” (1.1 to 2 points) across all major sessions (Asian, European, US), with “Excellent conditions” (0–1 points) possible during peak liquidity hours. AUDUSD reaches “Excellent spread levels” (0–2 points) during the US session, with “Good spreads” (2-3 points) in Asian and European sessions.

For commodities, Gold (XAUUSD) boasts “Excellent spreads” (0 to 10 points) during European and US sessions, becoming “most favourable outside Asian hours.”

Raw Account Commission Rate

For traders opting for the ProZero account, which provides access to raw spreads from 0.0 pips, the commission structure is straightforward: it starts from $3 per lot per side. This rate is average, compared to other brokers and is designed to appeal to active and high-volume traders who seek the tightest possible spreads.

For high-volume or professional traders considering the Bespoke account, the commissions are even more competitive, ranging as low as $2.50 per lot per side or $5 round-turn.

I think that their overall commissions are generally “below the industry average”, making their raw account offerings highly attractive for cost-conscious traders.

Basic/Standard Account Fees

ACY Securities offers two commission-free trading accounts – Basic and Standard. Both operate on a variable spread model there are some differences in terms of spreads, minimum deposit, and trading features.

The Basic account is designed for beginner traders or those seeking a low-cost entry point. It requires a minimum deposit of just $50, but it does not offer swap-free trading. Spreads on major currency pairs are wider compared to the Standard account. For example, the EUR/USD spread starts from 2.0 pips, AUD/USD from 2.20 pips, and USD/JPY from 2.30 pips.

In contrast, the Standard account requires a slightly higher minimum deposit of $100, but offers tighter spreads and includes swap-free (Islamic) trading. Spreads are more competitive, starting from 1.0 pips on EUR/USD, 1.30 pips on AUD/USD, and 1.20 pips on USD/JPY. These spreads make it a more attractive option for traders seeking lower trading costs and more flexible account conditions.

Both accounts are commission-free, with the trading cost embedded in the spread, simplifying fee calculations and making them suitable for traders who prefer transparent, all-inclusive pricing.

| FX Pair/Account Type | BASIC (minimum Spread) | BASIC (minimum Spread) | BASIC (minimum Spread) |

|---|---|---|---|

| AUD/USD | 2.20 (pips) | 1.30 (pips) | 0 (pips) |

| GBP/USD | 2.30 (pips) | 1.60 (pips) | 0 (pips) |

| EUR/USD | 2.00 (pips) | 1.0 (pips) | 0 (pips) |

| USD/JPY | 2.30 (pips) | 1.2 (pips) | 0 (pips) |

Swap Free Account Fees

If you are of Islamic faith and observe Sharia law, ACY Securities offers the option of a Swap-Free Islamic Account. This makes the broker suitable if you are based in the United Arab Emirates (UAE), Malaysia, and even parts of Thailand where Islamic finance principles might be followed.

The Swap Free account is based on the Standard account’s trading conditions and is available on both MT4 and MT5 platforms, providing access to over 2,200 trading instruments across FX, Indices, Commodities, and Cryptocurrencies.

Instead of traditional swaps, an administration fee is applied to positions held for longer than 4 days. The main thing to note is that positions held for less than 4 days have no administration fees charged.

The administration fees vary significantly by instrument type, which is an important detail for traders to consider:

- Forex Majors: $US12.5 per day per lot

- Forex Minors: $US15.5 per day per lot

- Commodities Majors: $US12.5 per day per lot

- Metals Majors: $US27.5 per day per lot

- Cryptocurrencies Exotics: $US45.5 per day per lot

Lastly, you should note that it is explicitly stated that “Shares” are not available with a Swap Free option.

Other Fees

As a trader, when considering the overall cost of trading with ACY Securities, it’s important to look beyond just spreads and commissions to other potential fees.

ACY Securities is rather transparent about their fee structure, and they claim no inactivity fee and deposit fees.

Beyond the dedicated Islamic account, ACY Securities’ general overnight fees are relatively high.

My Verdict on ACY Securities Spreads

In my testing, ACY Securities generally offers competitive trading costs, particularly through its ProZero account with raw spreads from 0.0 pips and competitive commissions.

The Standard account’s zero-commission structure also provides a clear advantage for many traders. However, the higher overnight fees and the varying administration fees for the Islamic account introduce additional considerations, for which I give them a score of 3 out of 10 for this category.

Trading Platforms

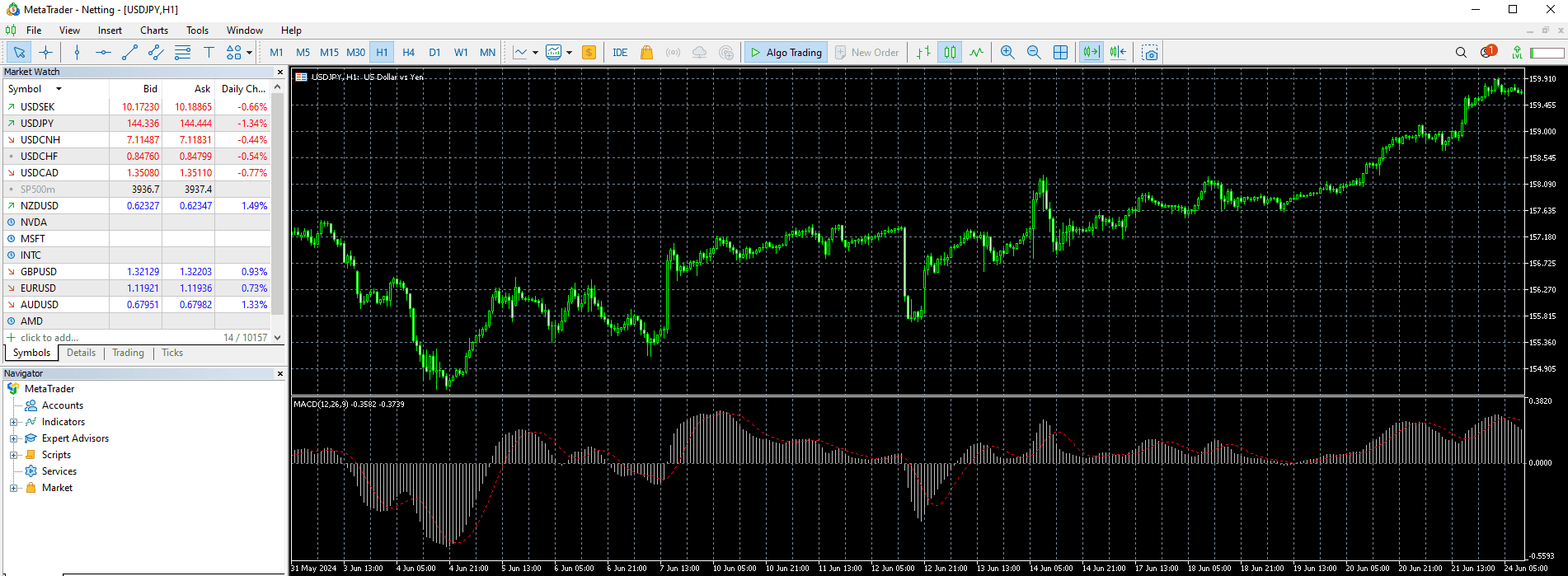

ACY Securities offers you three trading platforms, including MetaTrader 4, MetaTrader 5 and their proprietary ACY Trading Platform.

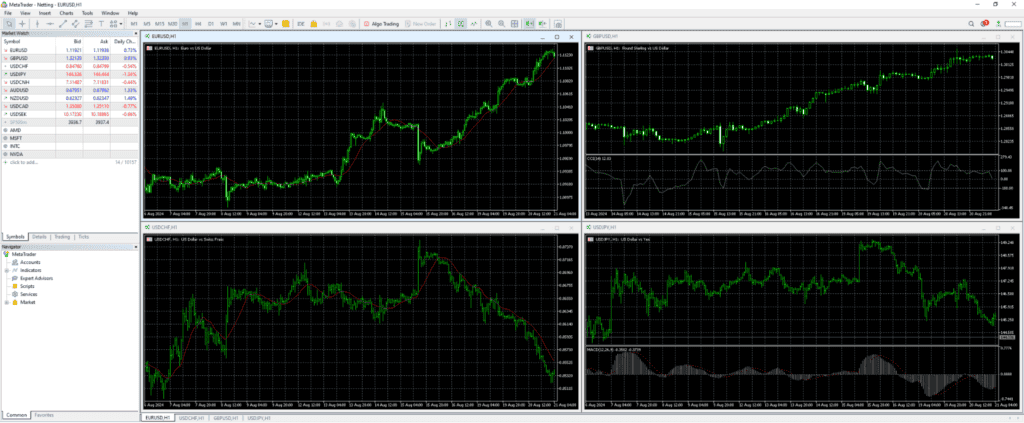

MetaTrader 4

From my experience trading forex, MT4 is an excellent platform for anyone looking for something simple and reliable. Its straightforward design enabled me to place trades quickly, even during very active market sessions.

The Expert Advisors (EAs) environment is unique. I developed strategies by coding in MQL4 with ease, and found thousands of free EAs in the MetaTrader Marketplace.

Key Differences vs. MT5:

- Asset Focus: MT4 contains forex and CFDs only, no equities trading.

- Technical Tools: 30 in-built indicators versus MT5’s 80+.

- Timeframes: MT5 has 21 timeframes, while MT4 has 9. MT4 is adequate for most scalpers and swing traders.

- No Economic Calendar: MT4 lacks embedded macroeconomic data compared to MT5.

Best For:

New Traders: Easy-to-use design reduces learning curves. Forex Scalpers: Extremely fast order execution (under 30ms). EA Developers: A huge collection of pre-written algorithms.

MetaTrader 5

MT5 is my personal favourite for traders expanding outside of forex. The multi-asset feature of the platform allows me to easily toggle between forex, shares, and commodities. The economic calendar and Depth of Market (DOM) feature embedded in it were a revelation in fundamental analysis.

One of the primary distinctions is that you like to trade on both decentralised and centralised exchanges, which isn’t possible on MT4, sadly.

Major Improvements over MT4:

- Asset Classes: Stocks, bonds, futures, and crypto CFDs.

- Technical Features: 80+ indicators, 21 timeframes, and advanced charting tools like Renko bars.

- MQL5 Language: Faster back-testing and more complex EAs.

Best For:

- Multi-Asset Traders: Suitable for diversifying forex, stocks, and commodities in a portfolio.

- Algorithmic Traders: More coding flexibility with MQL5. Data-Driven Traders: Integrated economic insight that reduces dependence on third-party tools.

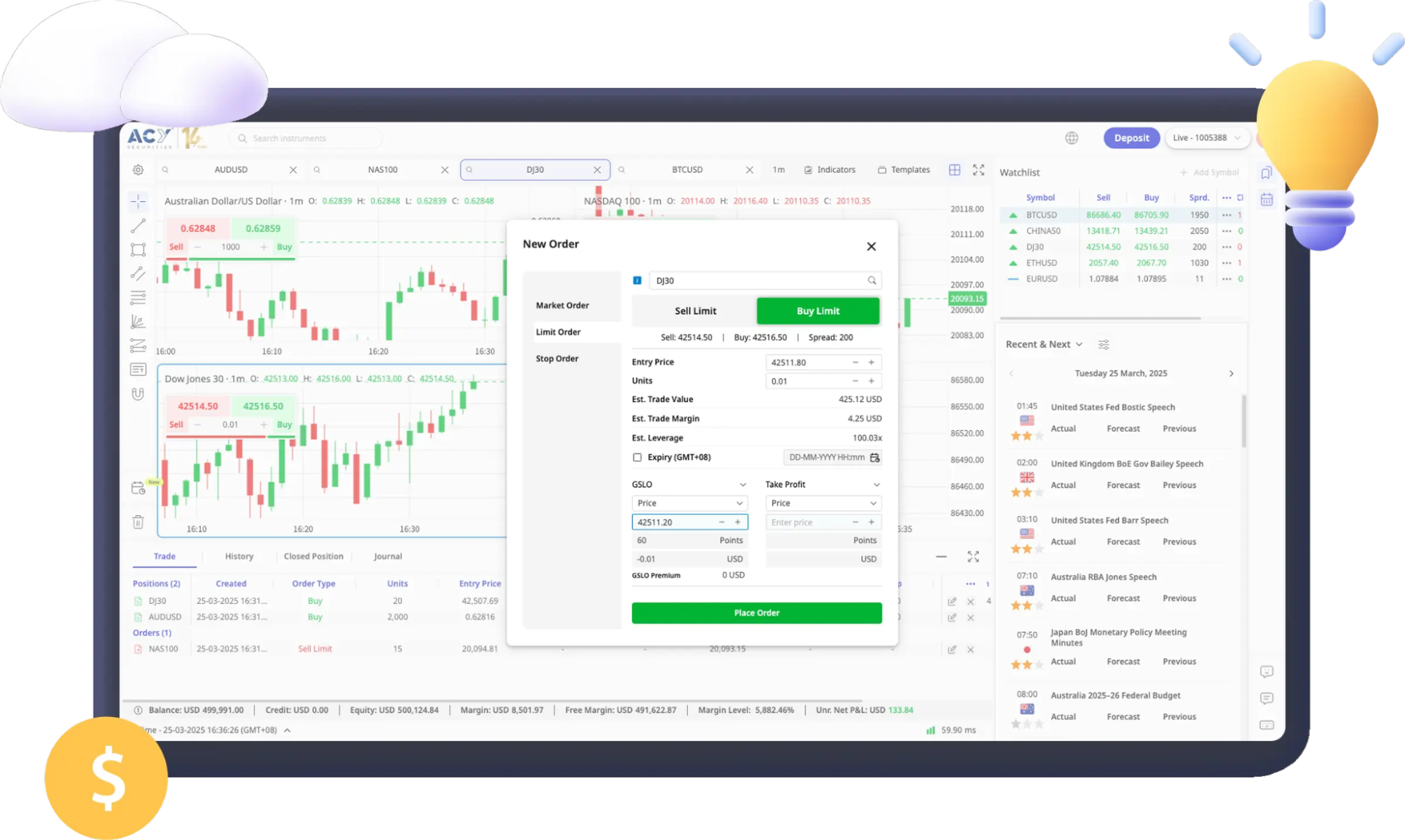

ACY Trading Platform

In addition to the MetaTrader suite, ACY Securities offers its proprietary ACY Trading Platform. This is a web-based platform built to give you, as a trader, the option to use it across all devices.

You can pick between the Standard and ProZero accounts, where you get very high leverage (up to 1:5000) and either variable or fixed spreads.

What I liked about their proprietary platform:

- It features a built-in economic calendar

- Multi-symbol charts (great for more advanced traders).

- Dynamic margin with guaranteed stop-loss orders.

- Works well on the browser (tested on Chrome and Firefox)

Overall, I was surprised by their proprietary app, as this is where many competitors don’t measure up.

My Verdict on ACY Securities Trading Platforms

ACY Securities provides a strong offering of trading platforms, giving traders access to the widely popular MetaTrader 4 and 5, alongside their own proprietary platform. The inclusion of EA-friendly features, free MetaTrader scripts, and VPS hosting.

However, the absence of other popular third-party platforms like cTrader or TradingView means they only get a score of 7/10 for this category.

Trust

Trust is a metric that I value highly when choosing a new forex broker. With this in mind, I assess ACY Securities’ trustworthiness based on its regulatory framework, reputation, and client reviews.

1. Regulation

ACY Securities operates under a multi-entity structure, but regulatory protection varies significantly by region:

- Australian clients are onboarded through ACY Securities Pty Ltd. It is regulated by the Australian Securities and Investments Commission (ASIC) – a Tier-1 regulator. This ensures strong investor protections, including negative balance protection.

- South African clients are onboarded under ACY Securities Ltd, which is licensed by the Financial Sector Conduct Authority (FSCA).

- All other international clients, including those in the Middle East and Asia, are onboarded through ACY Capital Australia LLC. This is an entity registered in St Vincent and the Grenadines (SVG).

This entity is not regulated by a recognised financial authority and only complies with local business laws, offering limited safeguards.

ACY has also been registered in Vanuatu (VFSC) since 2021, but I can’t see any indication that this entity is currently used for client onboarding. The company is also registered in Jordan as an Introducing Broker, primarily referring clients to its SVG entity.

2. Reputation

ACY Securities have received numerous accolades from the global Forex community, institutions, and media organisations.

Notable awards include “Best Overall Broker” at the Fazzaco Expo Dubai 2022, recognising their expansion in the Middle East, and “Best Transparent Trading Broker” at the Smart Vision Investment Expo Egypt 2022.

If you’re based in the UAE or other offshore jurisdictions, be aware that you’ll likely be trading under the SVG entity, which does not offer the same level of investor protections as ASIC or FSCA-regulated brokers.

With approximately 2,400 monthly Google searches, ACY Securities ranks as the 61st most popular forex broker among the 65 brokers we analyzed. Similarweb data from August 2025 shows the same positioning, with ACY Securities ranking as the 51st most visited broker with 124,847 global visits.

| Country | 2025 Monthly Searches |

|---|---|

| Australia | 590 |

| Jordan | 210 |

| United Kingdom | 140 |

| India | 90 |

| United States | 90 |

| South Africa | 90 |

| Philippines | 70 |

| Indonesia | 70 |

| Malaysia | 70 |

| Egypt | 70 |

| Germany | 50 |

| Pakistan | 50 |

| Kenya | 50 |

| Saudi Arabia | 40 |

| Nigeria | 40 |

| Vietnam | 40 |

| Taiwan | 40 |

| United Arab Emirates | 30 |

| Spain | 30 |

| Colombia | 30 |

| Italy | 30 |

| France | 30 |

| Japan | 30 |

| Turkey | 30 |

| Singapore | 30 |

| Algeria | 30 |

| Canada | 20 |

| Hong Kong | 20 |

| Netherlands | 20 |

| Morocco | 20 |

| Ghana | 20 |

| Mexico | 10 |

| Brazil | 10 |

| Bangladesh | 10 |

| Ecuador | 10 |

| Venezuela | 10 |

| Portugal | 10 |

| Peru | 10 |

| Bolivia | 10 |

| Cyprus | 10 |

| Thailand | 10 |

| Cambodia | 10 |

| Panama | 10 |

| Poland | 10 |

| Switzerland | 10 |

| Uzbekistan | 10 |

| Chile | 10 |

| Greece | 10 |

| Austria | 10 |

| Argentina | 10 |

| Sweden | 10 |

| Dominican Republic | 10 |

| Uruguay | 10 |

| Mongolia | 10 |

| Ireland | 10 |

| Botswana | 10 |

| Costa Rica | 10 |

| Sri Lanka | 10 |

| Uganda | 10 |

| Ethiopia | 10 |

| Tanzania | 10 |

| New Zealand | 10 |

| Mauritius | 10 |

590 1st | |

210 2nd | |

140 3rd | |

90 4th | |

90 5th | |

90 6th | |

70 7th | |

70 8th | |

70 9th | |

70 10th |

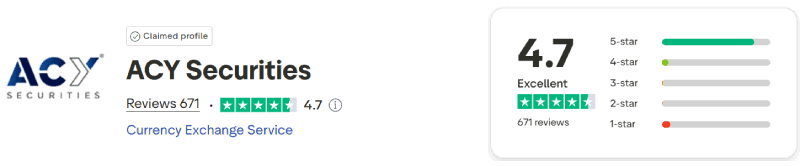

3. Reviews

ACY Securities has a rather good score of 4.7 on TrustPilot, which is always a green flag; however, they have only 671 reviews as of the writing of this review.

When I checked the feedback, it was mostly positive with praise for the platform’s user-friendliness, competitive spreads, and rich educational resources.

However, some reviews highlight significant concerns. There are reports of “cumbersome” and delayed withdrawal processes.

My Verdict on ACY Securities Trust

ACY Securities benefits from strong regulation by ASIC, which provides a high level of client fund segregation and professional indemnity insurance. However, they lack broader regulatory oversight, especially of tier 2 entities.

The presence of a less stringent VFSC license for some clients also means that the level of protection can vary. For these reasons, I give the broker a score of 6.0/10 for the category of trust.

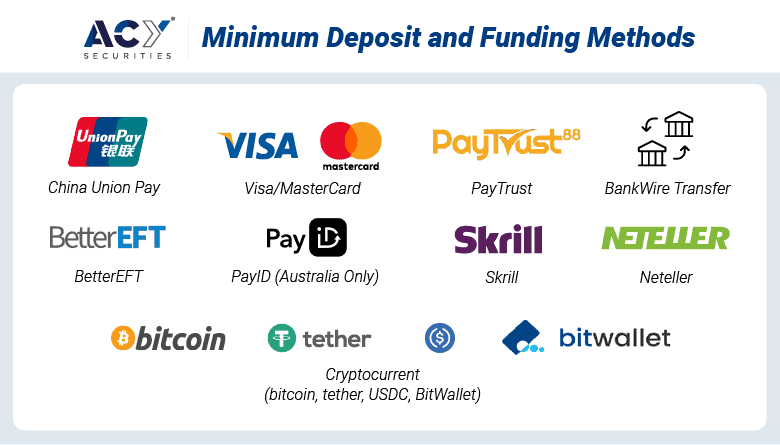

Deposit and Withdrawal

In my testing, I was extremely satisfied with ACY Securities’ funding options, emphasising their easy deposits and fast withdrawal processing speeds.

What is the Minimum Deposit at ACY Securities?

The minimum deposit at ACY Securities varies depending on the account type chosen. For the Basic account, the initial minimum deposit is $50. The Standard account requires an initial minimum deposit of $100.

For the ProZero account, the minimum initial deposit is $200, which is generally high, as many competing brokers have a zero or less than $20 minimum deposit..

Account Base Currencies

ACY Securities supports a wide array of account base currencies to cater to its global clientele. Traders can choose from major currencies including USD, AUD, EUR, GBP, NZD, CAD, and JPY.

Additionally, for region-specific payment methods, they support currencies like CNY, IDR, VND, MYR, PHP, ZAR, NGN, KES, and GHS.

Deposit Options and Fees

A significant advantage for traders is that ACY Securities explicitly states, “No deposit fees are charged by ACY Securities” across all listed methods. The broker also has an excellent range of deposit methods, ensuring convenience for traders globally.

These include traditional options like bank transfers (wire transfers) and credit/debit cards (Visa, Mastercard, UnionPay).

In addition, they support a variety of leading e-payment solutions such as PayID, Neteller, Skrill, Paytrust, Alipay, Bitcoin, Bitwallet, and DragonPay.

Cryptocurrency deposits are also supported in BTC, USDT (TRC-20 and ERC-20), and USDC.

Withdrawal Options and Fees

ACY Securities provides multiple withdrawal methods to ensure a smooth and timely process for traders. These options generally mirror the deposit methods, including bank transfers, credit/debit cards, and various e-wallets.

While many withdrawal methods are free, it is important to be aware that “some withdrawal methods incur a cost”. So if you are travelling to the UAE temporarily, international bank transfers are subject to a $25 USD charge.

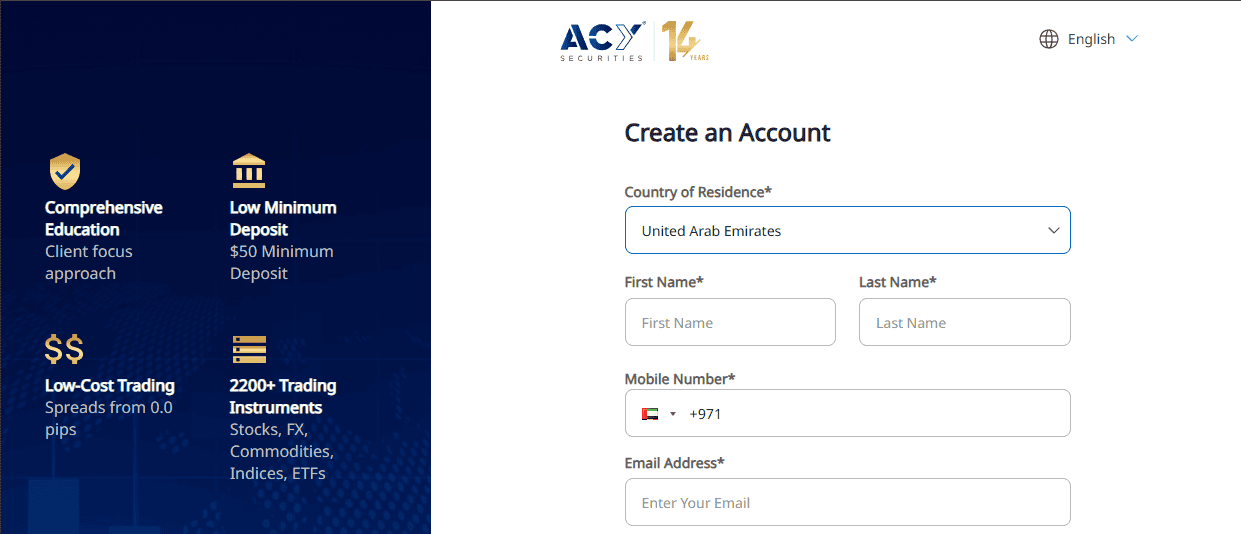

Ease of Opening an Account

Opening an account with ACY Securities was straightforward and fast, and all the needed steps were clearly explained.

The account opening journey involves the usual key steps as with any broker:

- Create & Verify:

- Upload Documents:

- Fund Account

During the setup, I also had to select my preferred platform (MT4 or MT5), base currency, account type, and desired leverage.

After funding, I could immediately begin trading across the available markets. Right away, ACY Securities also offered me a free demo account with $100,000 virtual funds.

My Verdict on ACY Securities Funding

I was thoroughly surprised by the diversity of funding options, speed and ease of opening an account. The great variety of base currencies is also a major bonus, as you will incur fewer fees in swapping if you deposit in your native currency. For these reasons, I give the broker a high score of 9/10 for the category of funding.

Product Range

ACY Securities offers an impressive and diverse product range, allowing you as a trader to explore over 2,200 global markets with ultra-low spreads starting from 0.0 pips. As I personally trade mostly forex, I was happy they also had a good selection of pairs.

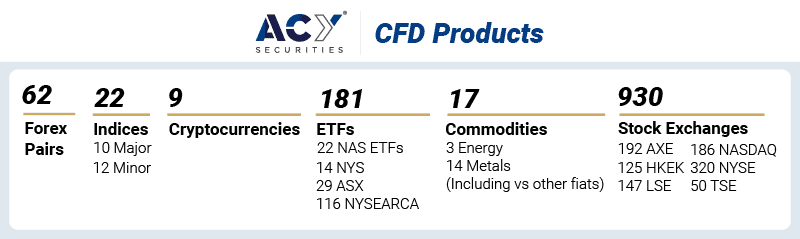

CFDs

The core of ACY Securities’ offering lies in Contracts for Difference (CFDs), which allow traders to speculate on price movements without owning the underlying asset. Their CFD offering is broader than many similar brokers.

FX Trading

ACY Securities provides access to a wide range of Forex CFDs, including 62 major, minor, and exotic currency pairs.

You can benefit from competitive spreads, with some major pairs like EUR/USD offering spreads from 0.0 pips on the ProZero account.

Indices

Traders can speculate on 22 global indices, including 10 major and 12 minor benchmarks. This includes favourites like the German 30 Index (GER30) and Dow Jones 30 Index (DJ30), offering exposure to entire stock markets via a single CFD.

Commodities

There are 17 commodity CFDs available with ACY Securities. These include CFDs on precious metals like Gold (XAUUSD) and Silver, as well as energies such as US Crude Oil (USWTI). During my research, I noted that gold was particularly popular with this broker, as they had very competitive spreads there.

Cryptocurrencies

ACY Securities supports 9 cryptocurrency CFDs, including Bitcoin (BTC), Chainlink (LINK), Stellar (XLM), EOS, and Polkadot (DOT). These are CFD products, meaning you don’t own any digital assets, as you just speculate on the price action.

ETFs

ACY offers 181 ETF CFDs, one of the most extensive ranges I’ve seen from a retail broker. These span across:

- 22 NAS ETFs

- 14 NYS

- 29 ASX

- 116 NYSEARCA

Share Trading

As a trader, you can access CFDs on shares from major global exchanges, including the NYSE, NASDAQ, and ASX. In total, you can trade 930 share CFDs from global exchanges, including:

- 192 AXE (Australia)

- 186 NASDAQ

- 320 NYSE

- 147 LSE

- 125 HKEK

- 50 TSE (Tokyo)

All share CFDs are available on MetaTrader 5, giving access to companies across North America, Europe, Asia, and Australia.

Leverage

For clients onboarded with the offshore entity, ACY Securities offers leverage of up to 1:5000, particularly via their proprietary ACY Trading Platform. Although I highly advise that you stay away from using 1:5000 leverage, it lets you deposit much smaller amounts to get the desired liquidity.

For retail clients under ASIC regulation (e.g., in Australia), leverage limits are typically much lower, up to 1:30 for currency pairs. Professional clients under ASIC may qualify for higher leverage, up to 1:500, subject to eligibility criteria.

For Futures CFDs, ACY Securities offers leverage of 10:1 on soft commodities like Cocoa, Sugar, and Orange Juice.

Customer Service

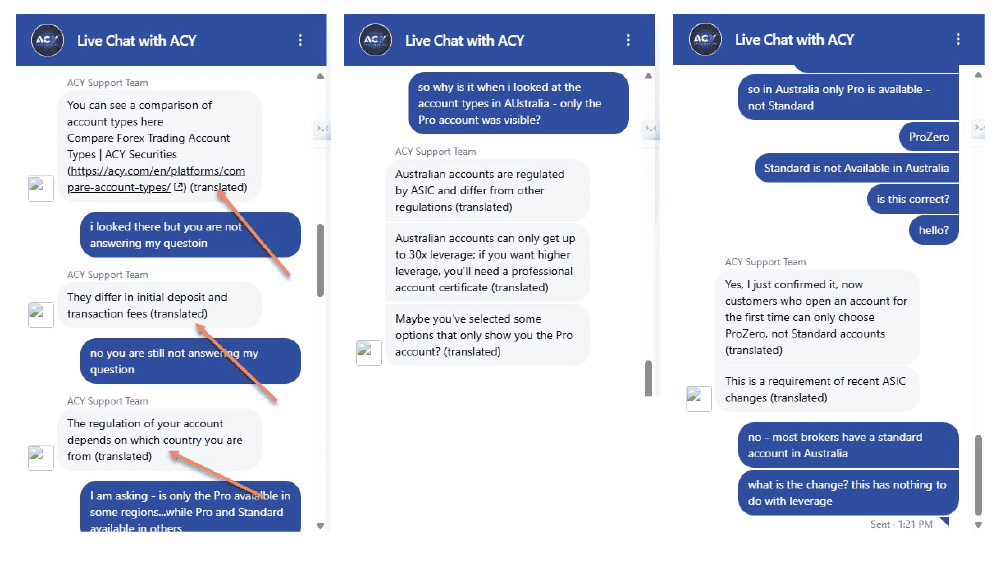

I found the customer service at ACY Securities to be fairly basic and, at times, frustrating.

On the positive side, the broker does offer 24/5 multilingual customer support through live chat, email, and phone, and supports over 10 languages, including English, Chinese, Vietnamese, Arabic, Thai, Japanese, Portuguese, and Malay.

However, during my own test of the live chat, the experience left much to be desired.

The first thing I noticed was that the support responses were marked as “(translated)”, suggesting the agent’s native language was not English. This made communication less natural and occasionally confusing. While I’m not sure where the support team is located, it was clear that English fluency was limited in my experience.

I specifically asked whether Australian traders only had access to the ProZero account. Initially, I was incorrectly told that all account types were available to all clients. It was only after some back-and-forth that the agent double-checked and confirmed that Australian clients are restricted to the ProZero account.

When I asked why the Standard and Basic accounts aren’t available to Australian traders, the explanation given was that leverage in Australia is capped at 30:1. This response was puzzling, considering nearly all ASIC-regulated brokers offer spread-only accounts for Australian clients. My experience suggests that the support team lacked adequate product knowledge.

My Verdict on ACY Securities Customer Service

The overall service is commendable for its accessibility and breadth, but there is room for improvement in ensuring consistent quality across all client interactions. For this category, I give the broker a score of 8.0 out of 10 for the speed and live support 24/5.

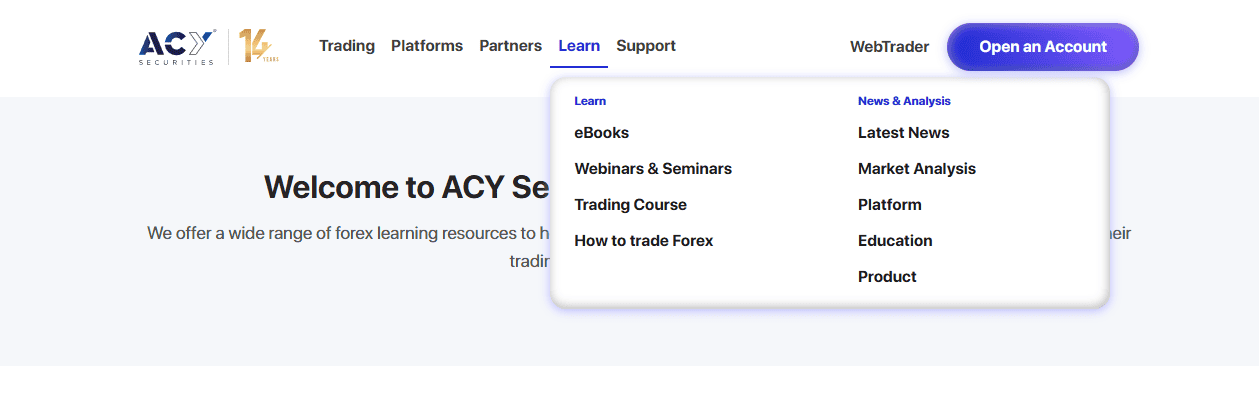

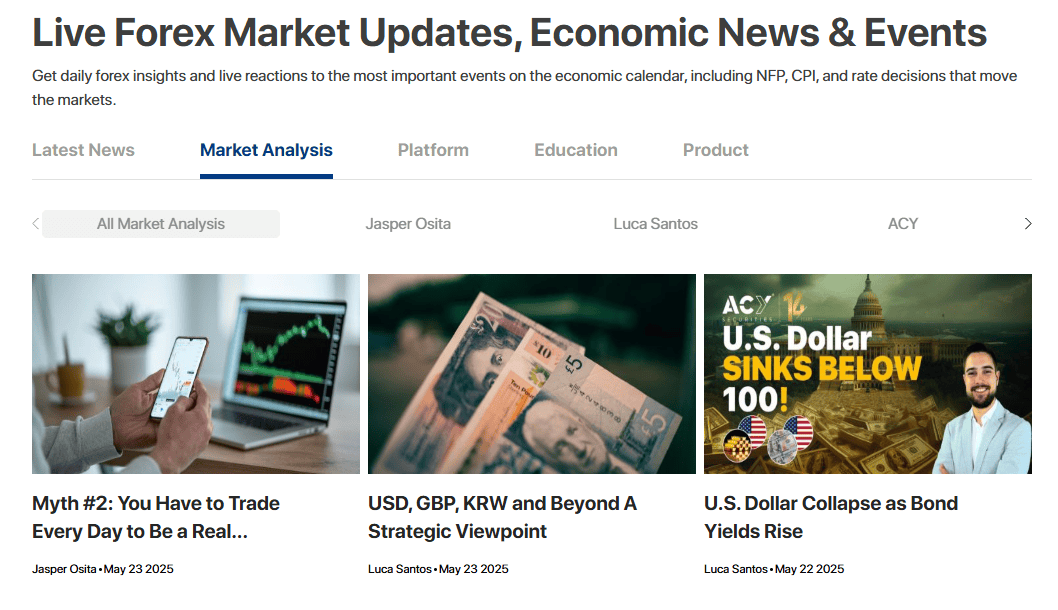

Research and Education

As a broker, ACY Securities places a strong emphasis on empowering you through comprehensive research and educational resources. Their research and education segment was one of the most impressive ones amongst the brokers I reviewed.

Their research tools include an intuitive economic calendar and a regularly updated news screener that utilises technical, fundamental, and economic analyses. They also provide market summaries, chart analysis, and live market summaries.

Here is what they had on offer:

- Webinars & Seminars: Regular online trading courses and market analysis webinars are conducted, providing live instruction and insights.

- E-books: A series of informative Forex trading e-books, such as ‘The Way of Forex,’ are produced by their team of traders and market experts, covering various aspects of successful trading.

- Trading Course & Tutorials: Access to over 60 Forex trading tutorials and videos that cover extensive and in-depth trading topics and views is available, particularly for live trading account holders.

- Market Analysis: ACY Securities provides robust market analysis, including daily market commentary, economic outlooks, and trade ideas from their experienced team of analysts.

- Trading Tools: Beyond educational content, they offer practical tools such as an economic calendar, trading widgets, MetaTrader scripts (12 free scripts for optimisation), and Forex VPS hosting for faster execution.

- Tradingcup Platform: The Tradingcup platform, originally a trading competition, has evolved to include live copy trading, allowing you to learn from and replicate the strategies of elite traders.

The broker also had a segment on how to use Capitalize.ai, which was good to see. Overall, it’s clear that they have a very professional and high-quality in-house research team. The articles and analyses I read were all top-notch, and not just posted content for the sake of getting exposure and backlinks.

My Verdict on ACY Securities Education

It’s no surprise that I give ACY Securities a score of 9/10 for education. This is because they offer an exceptionally strong suite of educational and research resources, making it a standout choice for traders of all levels. The combination of live webinars, extensive e-books, video tutorials, and daily market analysis provides a robust learning environment.

FAQs

What is the maximum leverage offered by ACY Securities?

The maximum leverage can go up to 1:5000 with their offshore entity. For retail clients under ASIC regulation, leverage is capped at 1:30. Professional clients can access up to 1:500 leverage.

What trading instruments can I trade with ACY Securities?

ACY Securities offers over 2,200 tradable instruments, including Forex CFDs, Index CFDs, Commodity CFDs, Share CFDs, ETF CFDs, and Cryptocurrency CFDs.

Does ACY Securities charge deposit or withdrawal fees?

No, ACY Securities does not charge any deposit or withdrawal fees from its end. However, third-party payment providers may apply their own charges.

Final Verdict on ACY Securities

My comprehensive review of ACY Securities reveals a broker with significant strengths, such as high leverage options, decent trading tools and useful funding options, education and support.

However, the broker falls short in one very crucial category – namely, trading costs. While ASIC regulation provides a strong foundation of trust and client fund segregation, the presence of a less stringent VFSC license for some clients introduces a disparity in investor protection.

The higher overnight fees and varying administration fees for the Islamic account for UAE-based traders also warrant careful consideration for certain trading styles. In these categories, I give ACY Securities a combined score of 47/100.

Alternatives to ACY Securities

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert