Capital.com Review of 2026

Capital.com stands out for its solid regulation, extensive range of markets (including 150+ pairs), CFD offerings and low trading costs. I also found they have great customer support, impressive education and offer MT4, MT5, TradingView trading platforms along with their own Capital.com Web/App platform which has a GSLO.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Capital.com Summary

| 🗺️ Tier 1 Reg. | Australia (ASIC), FCA (Australia), Cyprus (CySEC) |

| 🗺️Tier 2 Reg. | SCB (The Bahamas), SCA (UAE) |

| 💱 Trading Fees | $0 |

| 📊 Platforms | MT4, MT5, TradingView,Capital.com Web Trader and App |

| 💰 Minimum Deposit | $10-20 Bankcards, ApplePay, Others; $250 Wire Transfers |

| 💰 Funding Fee | $0 |

| 🛍️ CFDs Offered | Forex, Crypto, Indices, Commodities, Shares |

Why Choose Capital.com

Capital.com has established itself as a prominent global broker, attracting over 740,000 traders worldwide. As a trader, I’m drawn to their 0% commission model, which keeps trading costs low without sacrificing execution quality. These low costs cover over 4500 instruments including over 147 Forex pairs which start from 0.6 pips for EUR/USD.

I also found the broker has an impressive range of trading platform platforms to choose from. Their primary platform is Capital.com Web/App which comes with a guaranteed stop loss order (GSLO) but you can also choose from MT4, MT5 and TradingView.

Other points worth noting is the brokers extensive Forex education and their multi-regulator oversight, from the FCA, ASIC, CySEC, among others.

Capital.com Pros And Cons

- Competitive Spreads & 0% Commission

- Over 147 Forex Pairs

- Excellent Forex Education

- MT4/MT5 Trading Platforms

- GSLO with Capital.com platform

- Fast Execution Speed

- Inconsistent Fee Disclosures

- Reported Execution and Support Issues

- No Direct BaFin Regulation in Germany

The overall rating is based on review by our experts

Trading Fees

Capital.com operates primarily as a no-commission broker, which is a significant draw for many traders.

1. Standard Account Fees

For your standard trading account, Capital.com’s fee structure is straightforward: no commission on any of its financial markets. Your trading cost comes from the spread, which is the difference between the buy and sell price of an instrument.

I found that their average spread on the highly popular EUR/USD pair is 0.6 pips, which is considered very competitive and often better than the industry average of 1.0 pip. They also offer competitive spreads on other major pairs and instruments like the FTSE 100 and gold.

However, it’s worth noting that Capital.com’s official website documentation often states that typical or average spreads for major forex pairs are “unavailable”. As a scalper, I would have preferred a live price feed instead.

| Capital.com Average Spread | Average Industry Spread | |

|---|---|---|

| EUR/USD | 0.6 | 1 |

| AUD/USD | 0.6 0.3 (Australia) | 1.1 |

| EUR/GBP | 1.5 | 1.4 |

| GBP/USD | 1.3 | 1.3 |

| USD/JPY | 1.1 | 1.3 |

| AUD/JPY | 1.1 | 2.1 |

| EUR/JPY | 2.5 | 2.2 |

| USD/CAD | 2 | 1.9 |

| USD/SGD | 4 | 3.6 |

2. Raw Account Spreads

Capital.com does not offer a “Raw Account” or an ‘ECN’ style account. This means you won’t see a separate commission charge on your trades.

3. Raw Account Commission Rate

Since Capital.com does not offer a Raw Account, there is no specific “Raw Account Commission Rate.” They proudly state 0% commission on all trading positions. This simplifies the cost structure for you, as the primary trading cost is embedded within the spread.

4. Swap-Free Account Fees

If you are a trader that follows Sharia law, Capital.com offers a swap-free option. This means you get 0% overnight funding on unleveraged shares and cryptocurrency CFDs.

For leveraged positions, however, you will incur overnight funding charges, also known as swap rates or rolling fees.

This is an industry-standard daily fee for positions held open beyond a single trading day. Capital.com calculates this daily fee as 4% per year, which is then divided by either 360 or 365 days, depending on the currency of the underlying asset.

5. Other Fees

Beyond spreads and overnight funding, you should be aware of other potential non-trading fees:

- Inactivity Fee: The broker has a fee of 10 USD (or equivalent) if your account is inactive for six (6) months.

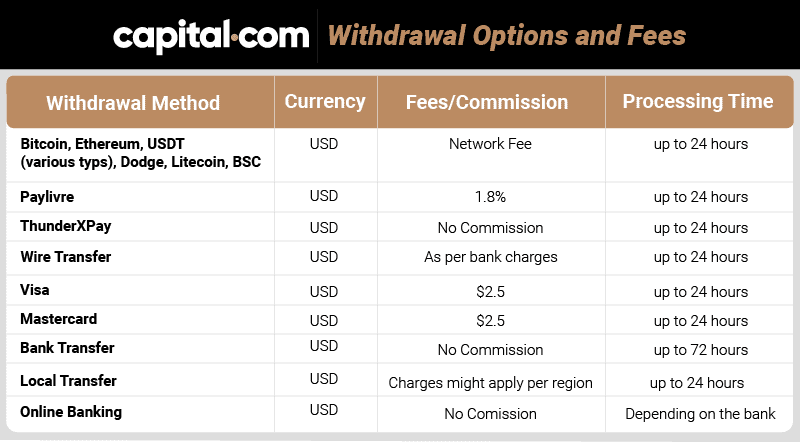

- There is a fee of $2.5 for Visa/Mastercard, 1.8% for Paylivre, a “Network Fee” for cryptocurrency withdrawals, and “As per bank charges” for Wire Transfers.

My Verdict on Capital.com Trading Costs

I give Capital.com a 7 out of 10 rating for the category of trading costs because their 0% commission model and tight spreads are competitive. However, the lack of fixed spread data and some variable withdrawal fees reduce transparency. As a trader, you should still find overall costs reasonable compared to industry standards.

Trading Platforms

Capital.com offers MetaTrader 4, MetaTrader 5 and TradingView for you to choose from, based on your trading style and needs.

My team at CompareForexBrokers created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

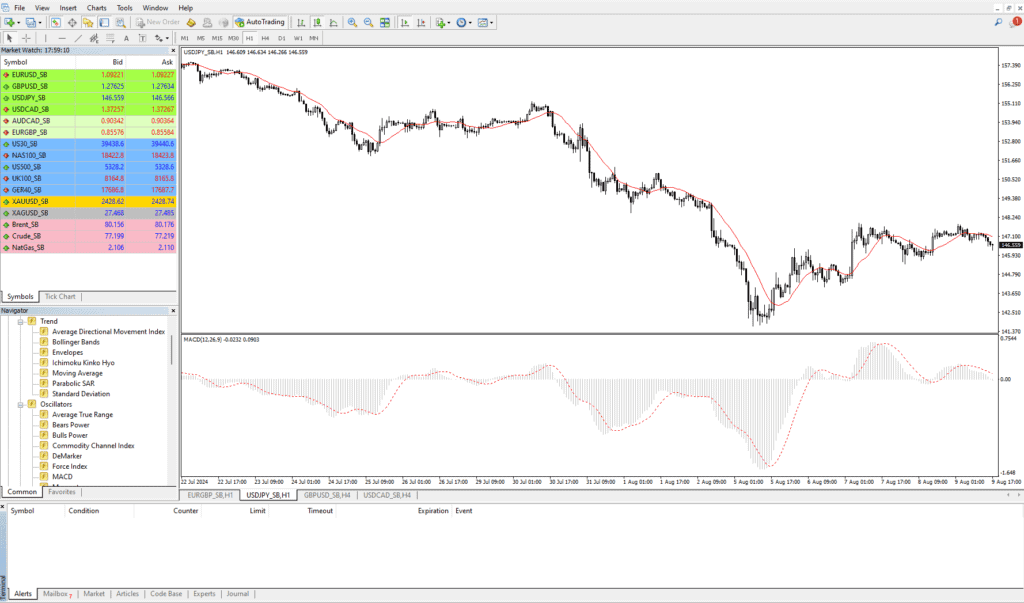

MetaTrader 4 (MT4)

I’ve used MT4 the most throughout my trading career because of its clean interface and good balance of features.

Developed by MetaQuotes, MT4 is one of the most established platforms in the market, and is used by more retail traders than any other platform.

Why I use MT4:

- MT4 has a relatively intuitive interface, making it easy to navigate even for beginners.

- A massive community means readily available resources like custom indicators and Expert Advisors (EAs).

- Great range of charting tools, including 30 technical indicators and 24 analytical objects.

- It supports 4 pending order types (buy-stop, buy-limit, sell-limit, sell-stop) and three order execution types.

- You have the ability to build your own Expert Advisors with MQL4 for automation and custom indicators.

- There’s a large EA marketplace to buy ready-made Expert Advisors.

Furthermore, if device flexibility is a priority for you, I can highly recommend MT4, as you can use it on Android, iOS, desktop (both Windows and Mac), and browser (via MT4 WebTrader).

Why you might not use it:

- Limited access to stock CFDs, focusing mainly on forex and indices.

- While still widely used, MT4 shows its age compared to newer platforms (like MT5) with more advanced features.

- MT4 is no longer being actively supported or developed by MetaQuotes, which is an indicator that MT5 might entirely supersede it in the future.

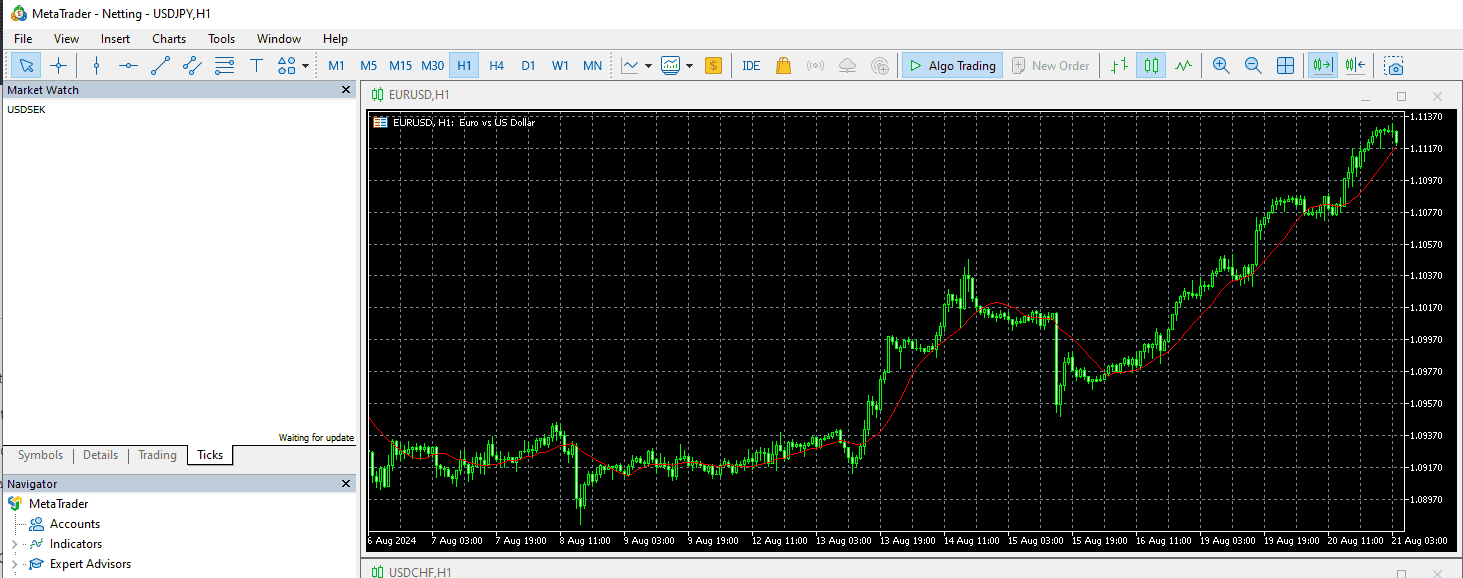

MetaTrader 5 (MT5)

Capital.com offers MetaTrader 5 (MT5), which is an upgrade on MT4, having far more capability in terms of the number of charts or analytical tools available, the range of products you can trade, and processing speeds.

Unlike MT4, which is designed for trading via decentralised exchanges (e.g., foreign exchange), MT5 is a multi-asset platform that offers more diverse market access.

In Capital.com’s case, this includes the addition of stock market CFDs, as these can be traded via a centralised exchange.

Additional features included with MT5 (in addition to those found on MT4):

- Advanced charting tools including 44 analytical objects, 38 technical indicators, and 21 timeframes (best for scalping).

- It has two extra pending order types not available with MT4, buy-stop-limit and sell-stop-limit.

- Access to real volume data unlike MT4 which limits tick volumes.

- Improved programming language with MQL5, which is said to be more manageable than MQL4 on MT4.

- Backtesting with 64-bit processing means MT5 has the power to transmit historical data related to a particular trading strategy, while MT4, which is 32-bit, can only backtest with a particular pair.

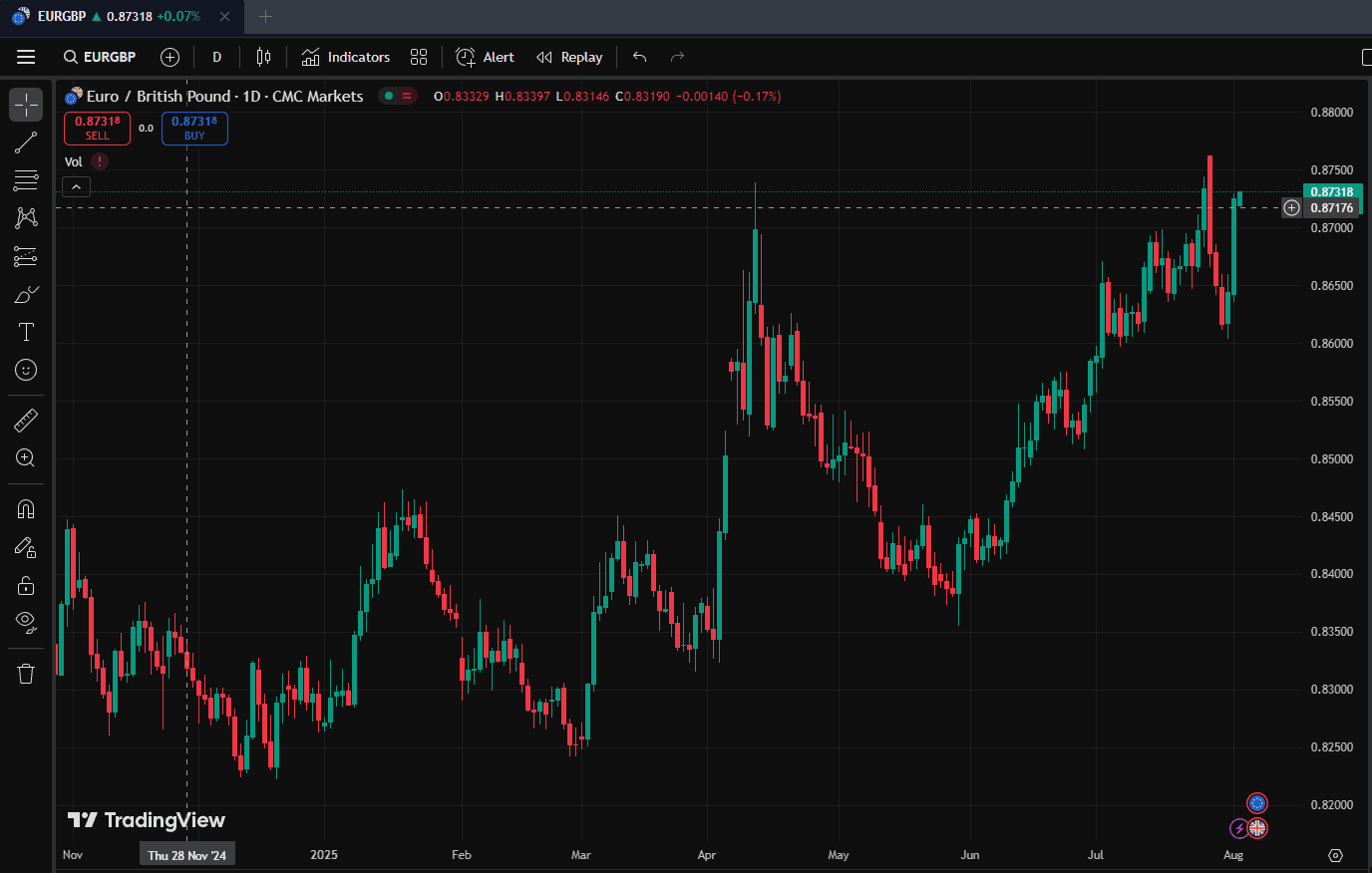

TradingView

I like using TradingView as it is a charting and TA powerhouse, where you can analyse and trade directly alongside a large variety of indicators. You can also test your strategies risk-free there with a Capital.com demo account.

Boasting over 30 million users worldwide, this is one of the most used solutions for technical analysis and market screening and is easy to learn.

Key Features of TradingView I liked:

- Access charts with advanced technical analysis tools.

- You can have up to 8 charts per screen with different symbols, indicators, and time frames, with variations depending on your plan.

- You can spread charts across as many as six monitors, with up to 8 charts per monitor.

- More than 90 drawing tools and hundreds of trading indicators for in-depth analysis.

- Extensive Chart intervals from seconds to years.

Capital.com Web Trading Platform

I particularly enjoyed Capital.com’s proprietary Web Trading Platform. Its key strengths are intuitive controls plus advanced functionality. It runs directly in your browser, meaning you don’t need to download or install additional software.

Unlike third-party platforms such as MT4 or MT5, it emphasizes ease of navigation and quick access to its internal trading tools.

The best feature for me was their Guaranteed Stop-Loss Order setting. It’s a special type of stop-loss order that guarantees your position will be closed at the exact price you set, regardless of market volatility, gaps, or slippage. While there is a small premium to activate the GSLO, you only pay this if you use the GSLO.

Features I liked with the Capital.com Web Trading Platform:

- Clean, customizable interface that let me adjust layouts, themes, and chart views.

- I could choose from 75+ technical indicators, drawing tools, and multiple timeframes.

- Risk management tools like negative balance protection, guaranteed stop-loss orders, and integrated margin alerts.

- Easy product access, supporting CFDs across forex, indices, commodities, shares, and crypto.

- AI-driven insights, showing me personalised suggestions and risk alerts based on my past trading behaviour.

On the Web Platform, you can add a GSLO directly when you open or edit a trade ticket. You’ll see the stop-loss settings, and if you toggle the guaranteed option, the platform will confirm the price level.

Capital.com Mobile Trading Apps

I’ve found Capital.com’s mobile app really handy when I’m away from my desk. It’s available on both iOS and Android, and the layout feels clean and straightforward. You don’t have to dig through menus to place a trade or check your watchlist.

What I like most is that it’s not just a stripped-down version of the web platform. The mobile app has most of the same features, and everything syncs automatically between devices.

Here’s what you can do on the app:

- Trade CFDs on over 3,000 markets, including forex, stocks, indices, crypto, and commodities.

- Get price alerts straight to your phone so you don’t miss key moves.

- Use over 100 technical indicators to analyse charts (surprisingly powerful for a mobile app).

- Manage your risk with stop-loss* and take-profit orders.

There’s also Investmate, Capital.com’s separate educational app. I tried it when I was starting out, and it’s a good way to pick up the basics.

Social Trading

While Capital.com doesn’t offer dedicated social trading platforms like some brokers (such as those with built-in copy trading networks like cTrader Copy or DupliTrade), their trading platforms allow you to have various forms of social interaction and automated trading.

You won’t find specific features like “Signal Start (Powered by Myfxbook)” or “Copy Trading by Capital.com” directly offered by the broker.

However, MT4 and MT5 have stand-alone Trading Signals service, which allows you to automatically copy orders made by other signal providers.

My Verdict on Capital.com Trading Platforms

Capital.com scores a 8.5 out of 10 due to the solid integration with MT4, MT5, and TradingView, which I find versatile and reliable. However, there’s no support for cTrader or proprietary platforms with built-in copy trading, which some competitors provide.

Execution Speed

In my testing, Capital.com had an impressive average transaction speed, with trades executed in just 0.025 seconds. As a trader that likes to scalp on the one and three minute charts, my orders get filled at or very close to your intended price, minimizing slippage.

Trust

You will be glad to know that Capital.com operates under the oversight of several prominent financial authorities globally.

1. Regulation

Capital.com is authorised and regulated by a great set of top financial bodies across various jurisdictions.

For traders in Germany, it’s important to clarify that Capital.com is not directly regulated by the Federal Financial Supervisory Authority (BaFin). Instead, Capital.com’s operations in Germany are facilitated through its CySEC-regulated entity via the EU’s MiFID passporting regime.

Capital.com also implements measures to safeguard your funds by using segregated bank accounts at regulated banks. This is ensuring your money is kept entirely separate from the company’s operational capital.

If you are a UK client, an additional layer of protection is provided by the Financial Services Compensation Scheme (FSCS), offering compensation up to £85,000 in case a regulated firm goes out of business.

Capital.com also offers Negative Balance Protection for retail CFD traders, ensuring your potential losses are limited to the funds in your trading account, preventing you from falling into debt to the broker.

2. Reputation

During my research I found no major incidents, fines or lawsuits against the company. Capital.com was founded in 2016 in Limassol, Cyprus so it is a relatively new broker in this space.

The broker has built a strong reputation within the industry, evidenced by numerous awards. They were recognized as the “Best Overall Trading Platform 2024” by the Online Money Awards and received multiple “Best In Class” distinctions as a TradingView Broker by the community.

Capital.com reaches over 740,000 traders globally with more than 100,000 active clients monthly. Their total trading volumes exceeded an impressive $1.7 trillion in 2024.

In Q2 2025 alone, client trading volumes reached $849.6 billion, a 29% increase from Q1, indicating strong and sustained client engagement.

| Country | 2024 Monthly Searches |

|---|---|

| Germany | 2,900 |

| United Kingdom | 1,900 |

| United States | 1,600 |

| Italy | 1,600 |

| United Arab Emirates | 1,600 |

| India | 1,300 |

| France | 1,300 |

| Switzerland | 1,300 |

| Poland | 1,000 |

| Greece | 1,000 |

| Mexico | 720 |

| Netherlands | 590 |

| Australia | 590 |

| Spain | 590 |

| Brazil | 320 |

| Morocco | 320 |

| Saudi Arabia | 320 |

| Austria | 320 |

| South Africa | 260 |

| Turkey | 260 |

| Colombia | 260 |

| Pakistan | 260 |

| Chile | 260 |

| Cyprus | 260 |

| Uzbekistan | 260 |

| Thailand | 210 |

| Portugal | 210 |

| Peru | 210 |

| Malaysia | 170 |

| Canada | 170 |

| Philippines | 170 |

| Hong Kong | 170 |

| Sweden | 170 |

| Nigeria | 170 |

| Ireland | 170 |

| Ecuador | 170 |

| Algeria | 170 |

| Jordan | 170 |

| Panama | 170 |

| Egypt | 140 |

| Kenya | 140 |

| Vietnam | 110 |

| Indonesia | 110 |

| Bangladesh | 110 |

| Dominican Republic | 110 |

| Bolivia | 110 |

| Japan | 90 |

| Singapore | 90 |

| Argentina | 90 |

| Taiwan | 70 |

| Costa Rica | 70 |

| Ghana | 50 |

| Mauritius | 50 |

| Sri Lanka | 30 |

| Uganda | 30 |

| Venezuela | 30 |

| Ethiopia | 30 |

| New Zealand | 20 |

| Tanzania | 20 |

| Botswana | 20 |

| Mongolia | 10 |

| Cambodia | 10 |

2,900 1st | |

1,900 2nd | |

1,600 3rd | |

1,600 4th | |

1,600 5th | |

1,300 6th | |

1,300 7th | |

1,300 8th | |

1,000 9th | |

1,000 10th |

3. Reviews

Capital.com has a very high average rating of 4.6 out of 5 stars from over 12,800 reviews. When going through the user feedback, I found that traders were happy with the deposit and withdrawal speeds and low spreads.

Some of the few complaints were related to withdrawal times, however the overall feedback was positive.

My Verdict on Capital.com Trust and Safety

I rated it 8.0 out of 10 because the broker is regulated by top-tier authorities like the FCA, ASIC, and CySEC, offering strong fund protections like segregated accounts and FSCS coverage. The only drawback is the lack of direct BaFin regulation for German traders.

Deposit and Withdrawal

Capital.com offers a variety of methods for deposits and withdrawals, though it’s important to pay attention to the fine print regarding your fees.

What is the minimum deposit at Capital.com?

The minimum deposit amount at Capital.com varies depending on the payment method you choose:

- For bank cards (Visa/MasterCard/Maestro) and Apple Pay, the minimum deposit is $10 USD/EUR/GBP (or currency equivalent).

- For most other payment methods, the minimum is $20 AUD/USD/EUR.

- For wire transfers, there is a higher minimum deposit of $250 USD (or currency equivalent).

Account Base Currencies

Capital.com currently offers you a choice of nine currencies when creating your account. These currencies are: EUR, GBP, PLN, USD, AED, CHF, HKD, MXN, and SGD.

Deposit Options And Fees

Capital.com does not charge you any fees to add or deposit funds to your account.

They offer a wide range of deposit methods to cater to traders globally:

- Bank Transfer

- Bank Cards (Visa / MasterCard / Maestro)

- Apple Pay

- Google Pay

- PayPal

- Neteller

- Skrill

- Przelewy (Poland)

- TrueLayer (UK)

- iDEAL (Netherlands)

- Trustly (various European countries)

- SPEI (Mexico)

- Lean (UAE)

- USDT (various countries)

- Volt (Austria, Estonia, Latvia, Lithuania)

Withdrawal Options And Fees

While Capital.com claims they offer free withdrawals, their detailed fee schedules reveal specific charges for certain payment methods.

Here are the withdrawal methods and their associated fees:

The minimum withdrawal amounts for you as a trader are typically $20 USD/GBP/EUR for bank cards, but may vary.

If your account balance is below the minimum, you will only be able to withdraw your full balance. I strongly advise you to check the specific fees for your chosen withdrawal method directly on Capital.com’s platform to avoid any surprises.

My Verdict on Capital.com Funding

Funding gets a score of 8.0 out of 10 because deposits are free, and the minimum starts at just $10 via cards, which is accessible for most traders. The deduction comes from small fees on some withdrawal methods and a lack of fee clarity in certain regions.

Ease To Open An Account

I found that Capital.com has put great effort into streamlining their user onboarding experience. To start the registration process, you need an email and password, with the option to use your Google or Apple instead.

Afterwards, you go through a variety of interactive questionnaires where you get to tick certain boxes during the sign up. The questions here are designed to suggest the best trading tools and account types that fit your trading style.

Lastly, you will need to provide the industry-standard documentations for verification before funding your account. This process took me about 8-9 minutes, and led to me getting verified quickly so I can fund my account.

Product Range

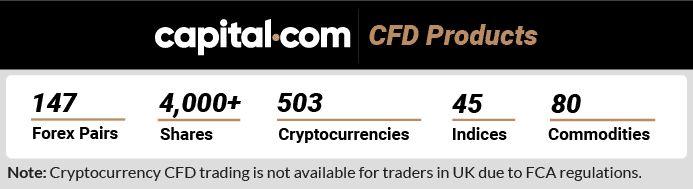

I found that Capital.com offers an extensive and diverse product range, primarily focusing on Contracts for Difference (CFDs). This means you have access to a wide range of global financial markets.

CFDs

Capital.com provides access to over 4,500 global markets through CFDs, which is a very high number compared to other competitors.

Here is a breakdown of the different CFDs they offer:

- Forex: You can access over 147 currency pairs, available for trading 24 hours a day, five days a week. This selection includes major, minor, and exotic currency pairs.

- Shares: Capital.com offers CFDs on more than 4,000 global stocks, encompassing major companies such as Tesla, Amazon, and Meta. This allows you to speculate on the price movements of individual equities.

- Indices: You can gain exposure to entire stock markets, including prominent indices like the US 500 and FTSE 100, through CFD trading.

- Commodities: The platform facilitates trading on various commodities, allowing you to go long or short on energies (like oil), precious metals (like gold), and agricultural products.

Gold Trading with Capital.com

One product I found especially useful on Capital.com is gold trading. You can trade gold CFDs just like you would forex or shares.

I’ve used it as a hedge when markets were volatile, and it felt snappy and responsive to trade on both the web platform and mobile app.

Here’s what stood out to me about trading gold on Capital.com:

- Tight spreads compared to many other brokers I’ve tried.

- 24/5 availability, so I could jump in and out of trades whenever I wanted during the week.

- Leverage flexibility, which lets me size positions to match my risk tolerance.

Cryptocurrencies

Capital.com is particularly strong in its cryptocurrency CFD offerings, providing access to over 500+ crypto CFDs.

This includes popular assets like Bitcoin, Ether, Cardano, and Dogecoin, making Capital.com one of the largest CFD crypto providers in the industry. I think this is a great asset class for brokers to be supporting, especially with the approval of many crypto ETFs worldwide.

However, please note that Crypto derivatives are generally not available to UK retail clients due to regulatory restrictions.

Share Trading

Capital.com offers CFDs on over 4,000 global shares. This means you can trade on the price movements of individual company stocks without the need to physically own the shares.

Leverage

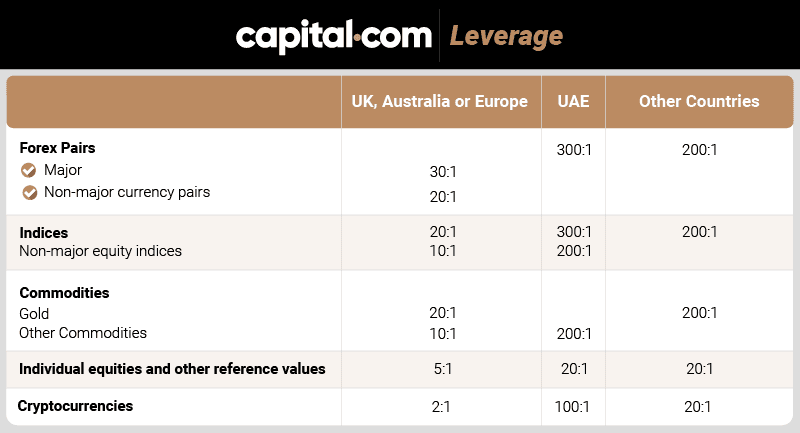

For retail clients, Capital.com adheres to regulatory standards, such as those set by ESMA and CySEC, which impose tiered leverage limits based on asset volatility.

Here is a quick breakdown of the leverage you can use as a UK, Australian or European trader:

- 30:1 for major currency pairs.

- 20:1 for non-major currency pairs, gold, and major indices.

- 10:1 for commodities (other than gold) and non-major equity indices.

- 5:1 for individual equities and other reference values.

- 2:1 for cryptocurrencies.

If you are a UAE trader, you are regulated by the SCA, which gives you the following leverage instead:

- 300:1 – currency pairs;

- 300:1 – indices;

- 200:1 – commodities;

- 100:1 – crypto;

- 20:1 – shares.

If you are with the Bahamas entity, the leverage is:

- 200:1 – currency pairs;

- 200:1 – indices;

- 200:1 – commodities;

- 20:1 – crypto;

- 20:1 – shares.

Spread Betting

If you are a UK-based trader, Capital.com offers you spread betting as an alternative to CFD trading.

Their spread betting offering provides access to a wide range of markets, including over 2,900 popular indices, commodities, shares, and forex pairs.

Similar to CFDs, spread betting allows you to speculate on rising or falling prices without owning the underlying asset.

My Verdict on Capital.com Range of Markets

Capital.com deserves a 9.0/ 10 rating for its tremendous product range, offering over 4,500 CFDs including forex, stocks, indices, commodities, and 285+ cryptocurrencies. This makes it one of the most diversified brokers I’ve reviewed.

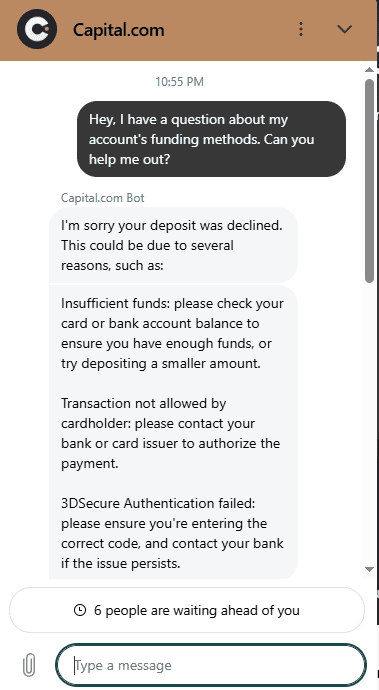

Customer Service

Capital.com states that it offers round-the-clock client support, available 24 hours a day, 7 days a week.

As a trader you have multiple channels to get in touch with Capital.com’s support:

- Phone

- Live Chat

In addition to English, you can also get help in German, Italian, and Spanish during standard office hours.

Shortly after I signed up with Capital.com, I had a very timely question about available financing options for my local currency. I decided to test out their support so I started a live chat around midnight one night, at 1 AM my time.

To my surprise, an agent responded within a minute (after I asked their AI bot to transfer me). I inquired whether I could transfer from a local bank or through an e-wallet. My assigned agent was quick to explain my options based on my location.

The interaction was smooth, professional, and, most importantly, speedy. Though I am used to waiting a bit or receiving ambiguous responses from brokers, this felt like quality 24/7 support in action.

My Verdict on Capital.com Customer Support

I gave customer service an 9 out of 10 because support is available 24/7 via chat, phone, and WhatsApp, with multilingual assistance during business hours. My colleagues also mentioned prompt replies and helpful agents, although occasional delays were noted.

Research and Education

Capital.com has a remarkably well made and thorough educational segment. You will find all types of research, market analysis, and educational resources on the “Learn” tab. Some of the more important topics such as “Risk Management” and “Market Analysis” were separated into their own sub-pages.

It is quite rare for me to see a broker go the extra mile on this type of content, as many tend to skimp and only post generic information.

What I also enjoyed is that they structured their educational materials based on experience, meaning beginner traders wouldn’t be overwhelmed.

The quality of their writing and guides was impressive, and I was pleasantly surprised by how neat and well organised the content was. However as an advanced trader I found their “Experienced traders” tab to be slightly lacking in depth.

My Verdict on Capital.com Education

I rate Capital.com’s education segment an 8 out of 10 as they provide strong beginner content, webinars, and the Investmate app for mobile learning. Still, advanced educational tools and structured learning paths could be more comprehensive.

Final Verdict On Capital.com

After a comprehensive review, I believe Capital.com offers a compelling and well-rounded experience for traders engaged in CFD and forex markets. My overall rating comes up to a high score of 82 out of 100.

The broker has a strong regulatory framework, overseen by multiple Tier 1 and Tier 2 authorities, including the FCA, ASIC, CySEC, SCB, and SCA.

Their extensive market range provides you access to over 4,500 global CFD instruments. Furthermore they offer you vast diversification across forex, indices, commodities, shares, and cryptocurrencies. The broker has a 0% commission model, with fees embedded in competitive spreads.

Another strong point is the inclusion of MT4, MT5, and TradingView and high-quality educational resources like the Investmate app. The only downsides I found are the high variance between spreads on certain currency pairs.

FAQs

Does Capital.com Offer Spread Betting?

Yes, Capital.com offers you spread betting, but only for UK-based clients.

What is the Minimum Deposit at Capital.com?

The minimum deposit at Capital.com varies by payment method. For bank cards and Apple Pay, it’s $10 USD/EUR/GBP. For most other payment methods, it’s $20 AUD/USD/EUR. If you’re using a wire transfer, the minimum deposit is $250 USD or equivalent.

What Demo Account Does Capital.com Offer?

Capital.com offers a free demo account that allows you to practice trading in a risk-free environment.

What Leverage Does Capital.com Offer?

If you are a retail clients, Capital.com offers tiered leverage limits in compliance with regulatory standards:

- 30:1 for major currency pairs.

- 20:1 for non-major currency pairs, gold, and major indices.

- 10:1 for commodities (other than gold) and non-major equity indices.

- 5:1 for individual equities and other reference values.

- 2:1 for cryptocurrencies.

These go up to 300:1 if you are a UAE-based client.

What Account Types Does Capital.com Offer?

Capital.com primarily offers a standard retail CFD account. For its UK clients, it also provides a dedicated spread betting account. It’s important to note that Capital.com does not offer you as a trader an ECN account.

Alternatives to Capital.com

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert