FP Markets vs eToro 2026

We compared the FP Markets who is more of a traditional forex broker to eToro which positions itself as a social or copy trading CFD broker to see how they stack up to each other. View our comparison table and writeup below.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors you need to know. Here are quick differences between FP Markets and eToro:

- FP Markets is best for CFD trading, while eToro focuses on social trading.

- eToro’s spreads are high, while FP Markets provides lower spreads.

- FP Markets offers an ECN account, eToro doesn’t.

1. Lowest Spreads And Fees – FP Markets

FP Markets offers both standard no commission spreads and competitive raw spreads with a commission, while eToro provides only standard spreads without commission fees.

Comparing the standard spreads of FP Markets and eToro, both brokers offer competitive no commission pricing. For EUR/USD, eToro’s spread is 1.0 pip, lower than the industry average of 1.2 pips.

| Standard Account | FP Markets Spreads | eToro Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.56 | 1.5 | 1.7 |

| EUR/USD | 1.18 | 1 | 1.2 |

| USD/JPY | 1.6 | 1 | 1.4 |

| GBP/USD | 1.49 | 2 | 1.5 |

| AUD/USD | 1.45 | 1 | 1.5 |

| USD/CAD | 1.75 | 1.5 | 1.9 |

| EUR/GBP | 1.4 | 1.5 | 1.5 |

| EUR/JPY | 1.8 | 2 | 1.9 |

| AUD/JPY | 1.8 | 2 | 2.2 |

Standard Account Analysis Updated February 2026[1]February 2026 Published And Tested Data

Looking at FP Markets, their spreads for EUR/GBP, EUR/JPY, and USD/CAD are some of the lowest commission-free spreads available.

- For the EUR/GBP, FP Markets offers a spread of 1.4 pips, below the industry average of 1.5 pips.

- For EUR/JPY, their spread is 1.8 pips, compared to the industry average of 1.9 pips.

FP Markets and eToro provide standard spreads that are competitive with the industry, with some currency pairs showing more favourable rates.

The calculator below is designed to compare the trading costs of the two forex brokers, highlighting the Raw Account from FP Markets as the most cost-effective choice.

Other Fees

eToro charges an inactivity fee of $10 per month after 12 months of no trading activity, while FP Markets do not charge inactivity fees.

Our Lowest Spreads and Fees Verdict

FP Markets offers both standard and highly competitive raw spreads, while eToro offers only standard spreads. When we compared trading costs, FP Markets was the broker with the overall lowest spreads.

FP Markets ReviewVisit FP Markets

2. Better Trading Platforms – FP Markets

While FP Markets offers essentially all the best trading platforms with MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, Iress, and Mottai available, eToro only offers their proprietary copy trading software.

| Trading Platform | FP Markets | eToro |

|---|---|---|

| MetaTrader 4 | Yes | No |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

FP Markets Offers MT4 and MT5

FP Markets offers comprehensive packages for MetaTrader 4 (MT4) and MetaTrader 5 (MT5) filled with add-ons, while eToro does not provide these platforms.

MT4 and MT5 Features:

- Advanced charting tools and automated trading capabilities with Expert Advisors (EAs).

- Customisable interface and alerts, with one-click trading.

- Compatible across Windows and Mac desktops, iOS and Android mobiles, as well as a WebTrader platform.

In addition to these features, FP Markets’ Traders Toolbox and Autochartist further enhance the trading experience. The Traders Toolbox offers a suite of 12 additional online tools including an economic calendar, news feeds, and various risk management applications like the Correlations Trader and Matrix, Alarm Manager, and Excel RTD.

Autochartist, integrated with both MT4 and MT5, provides powerful chart pattern recognition capabilities, simplifying trading and automating market analysis.

cTrader is Only Available with FP Markets

FP Markets offers cTrader, a platform renowned for its intuitive interface and advanced trading features.

It provides a range of timeframes and chart types, including Candlestick and Heikin, to suit various trading strategies. Key features include split-screen functionality for multi-chart analysis, ChartShots for easy social sharing, and the ability to save up to 50 chart templates, making it a versatile choice for forex traders.

Both Brokers Offer TradingView

Both FP Markets and eToro provide access to TradingView, a platform known for its advanced charting and analysis features. TradingView is recognized for its precise, feature-rich environment, ideal for demanding users. It offers real-time chart updates, intuitive visuals, and a range of customisation options.

eToro is the Social And Copy Trading Leader Globally

eToro’s business model and trading platform are fundamentally built around the concept of social and copy trading. In contrast, FP Markets offers copy trading services as an add-on to its MetaTrader platforms.

eToro’s proprietary trading platform focuses on copy trading, allowing users to easily follow and replicate the actions of experienced traders.

The two key eToro copy trading features are:

- CopyTrader: This tool allows for the automatic replication of trades from top-performing traders.

- CopyPortfolios: These are bundles of various assets, managed and regularly rebalanced by eToro’s experts.

FP Markets on the other hand offers copy trading through MetaTrader 4 and 5 thanks to the Myfxbook integration. This setup provides traders the advantage of copy and social trading while retaining the features of MT4 and MT5.

VPS

FP Markets offers VPS services for better execution speeds, while eToro does not.

Our Better Trading Platform Verdict

FP Markets wins in terms of platform diversity, offering MetaTrader 4, MetaTrader 5, and cTrader, among others. However, eToro’s unique copy trading features are unmatched in the industry.

3. Superior Accounts and Features – FP Markets

FP Markets presents two primary account options: a Standard account featuring no commission but wider spreads, and a Raw account which offers lower spreads plus a commission fee.

In contrast, eToro provides a single main account type that operates without commission but includes higher spreads.

Demo Accounts for Risk-Free Trading

Both brokers offer demo accounts for practicing trading and strategy testing. Each demo account is equipped with $100,000 in virtual funds. However, while eToro’s demo account has no time limit, FP Markets’ demo account is available for a duration of 30 days only.

Both Brokers Cater to Islamic Traders

Both eToro and FP Markets offer swap-free accounts that adhere to Sharia law. These accounts are swap-free, replacing interest charges on overnight positions with an administration fee. This arrangement is specifically designed for Muslim clients who aim to trade in accordance with Islamic principles. For FP Markets traders, Islamic accounts are exclusively available on its MT4 and MT5 platforms.

| FP Markets | eToro | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

FP Markets offers more flexibility with its two main account types, catering to different trading styles.

4. Best Trading Experience – FP Markets

FP Markets, with its Direct Market Access (DMA) brokerage model, excels in offering fast trade execution and transparent pricing, setting it apart from eToro’s market maker model. The DMA approach ensures real-time access to market prices and depth, allowing orders to be executed directly onto the underlying market. This contrasts with eToro, where as a market maker, it acts as the counterparty to trades, which can impact execution speeds and pricing transparency.

While eToro is renowned for its social and copy trading features, FP Markets focuses on providing traders with a transparent trading environment and rapid execution through its DMA and ECN pricing models. This commitment to speed and transparency, along with a broad range of tradable instruments and advanced trading platforms, makes FP Markets a preferred choice for traders who value quality execution and clear pricing.

Our Best Trading Experience and Ease Verdict

FP Markets delivers a more sophistciated trading experience with its DMA model, offering faster execution and more transparent pricing than eToro’s market maker approach.

5. Stronger Trust And Regulation – eToro

Both brokers are considered safe based on regulation, reputation and reviews, yet eToro’s trust score is higher at 80 vs 64 for FP Markets.

eToro Trust Score

FP Markets Trust Score

1. Regulation

FP Markets is regulated by two tier-1 regulators, the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

eToro on the other hand, is regulated by the Financial Conduct Authority (FCA) in the UK, CySEC in Europe, and the Australian Securities and Investments Commission (ASIC).

| FP Markets | eToro | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | MFSA (Europe) ADGM (UAE) GFSC (Gilbraltar) | |

| Tier 3 Regulation | FSA-S (Seychelles) FSC-M (Mauritius) FSCA (South Africa) | FSA-S (Seychelles) |

2. Reputation

eToro, established in 2007 in Tel Aviv, Israel, has a significant online presence with a monthly search volume of 1 million. FP Markets, started in 2010 in Sydney, is popular within Australia but has a lower global profile, reflected in its monthly search volume of 27,100.

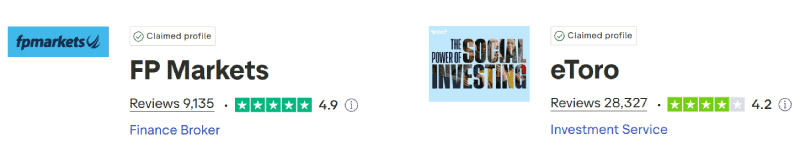

3. Reviews

As shown below, eToro has a rating of 4.2 out of 5 stars on TrustPilot from over 28,000 reviews, while FP Markets scores higher at 4.9 but from a smaller base of about 9,200 reviews.

Our Stronger Trust and Regulation Verdict

Both brokers are highly regulated and trustworthy, but eToro has a slight edge being regulated by the FCA in addition to CySEC and ASIC.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

6. Most Popular Broker – eToro

eToro gets searched on Google more than FP Markets. On average, eToro sees around 823,000 branded searches each month, while FP Markets gets about 49,500 — that’s 93% fewer.

| Country | FP Markets | eToro |

|---|---|---|

| United Kingdom | 2,400 | 135,000 |

| France | 880 | 110,000 |

| Italy | 12,100 | 110,000 |

| Germany | 1,300 | 74,000 |

| Spain | 1,600 | 60,500 |

| United States | 1,600 | 33,100 |

| Australia | 1,900 | 27,100 |

| Netherlands | 480 | 18,100 |

| Colombia | 260 | 14,800 |

| United Arab Emirates | 480 | 14,800 |

| Mexico | 170 | 12,100 |

| Switzerland | 480 | 12,100 |

| India | 2,900 | 9,900 |

| Malaysia | 720 | 9,900 |

| Peru | 70 | 9,900 |

| Poland | 720 | 9,900 |

| Philippines | 390 | 8,100 |

| Taiwan | 210 | 8,100 |

| Argentina | 140 | 8,100 |

| Portugal | 210 | 8,100 |

| Austria | 170 | 8,100 |

| Ireland | 90 | 8,100 |

| Greece | 1,900 | 6,600 |

| Brazil | 590 | 5,400 |

| Chile | 70 | 5,400 |

| Sweden | 210 | 4,400 |

| Morocco | 590 | 3,600 |

| Canada | 1,600 | 3,600 |

| Singapore | 590 | 3,600 |

| Thailand | 720 | 2,900 |

| South Africa | 2,400 | 2,900 |

| Indonesia | 590 | 2,900 |

| Vietnam | 320 | 2,900 |

| Pakistan | 1,300 | 2,900 |

| Nigeria | 590 | 2,900 |

| Ecuador | 70 | 2,900 |

| Turkey | 720 | 2,400 |

| Bolivia | 30 | 2,400 |

| Dominican Republic | 70 | 1,900 |

| Cyprus | 480 | 1,900 |

| Costa Rica | 20 | 1,900 |

| New Zealand | 40 | 1,900 |

| Japan | 140 | 1,600 |

| Egypt | 210 | 1,600 |

| Hong Kong | 170 | 1,600 |

| Algeria | 210 | 1,300 |

| Saudi Arabia | 210 | 1,300 |

| Venezuela | 110 | 1,300 |

| Bangladesh | 720 | 1,000 |

| Kenya | 590 | 1,000 |

| Jordan | 70 | 1,000 |

| Cambodia | 210 | 880 |

| Ghana | 70 | 480 |

| Sri Lanka | 140 | 390 |

| Panama | 20 | 390 |

| Uzbekistan | 70 | 260 |

| Ethiopia | 110 | 260 |

| Uganda | 70 | 260 |

| Mauritius | 20 | 260 |

| Tanzania | 110 | 210 |

| Botswana | 50 | 70 |

| Mongolia | 10 | 70 |

2,400 1st | |

135,000 2nd | |

880 3rd | |

110,000 4th | |

1,300 5th | |

74,000 6th | |

1,600 7th | |

33,100 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with eToro receiving 51,160,000 visits vs. 482,000 for FP Markets.

Our Most Popular Broker Verdict

eToro is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – FP Markets

FP Markets stands out with its extensive range of over 10,000 CFD products, significantly more than eToro’s 3,412, offering traders a broad spectrum of trading opportunities. With more than 70 forex pairs, FP Markets caters extensively to forex traders, while its selection of over 10,000 shares appeals to those looking to invest in global stock markets.

eToro, on the other hand, is renowned for its social trading platform and excels in the cryptocurrency market with 21 options, making it a preferred choice for crypto enthusiasts. It also offers a substantial range of over 300 ETFs, providing ample opportunities for diversified investments, a feature that FP Markets supports with 45 ETFs.

| CFD Products | FP Markets | eToro |

|---|---|---|

| Total Products | 10,000+ | 3412+ |

| Forex Pairs | 70+ | 40+ |

| Cryptos | 11 | 21 |

| Stocks | 10,000+ | 3,000+ |

| Indices | 22 | 21 |

| ETFs | 45 | 300+ |

| Commodities | 18 | 30+ |

| Bonds | 2 | ✖ |

Our Top Product Range and CFD Markets Verdict

While FP Markets provides access to traditional investment options like bonds, not available on eToro, it’s the sheer volume of shares and forex pairs that sets FP Markets apart. Conversely, eToro’s focus on social trading, cryptocurrencies, and ETFs positions it as a leader in these specific markets.

8. Top Educational Resources – Tie

FP Markets and eToro both provide extensive educational resources for traders of all levels.

FP Markets enriches its users with eBooks, video tutorials, and a trading glossary, ideal for self-study. eToro, meanwhile, offers live webinars and daily market analysis, focusing on interactive learning and up-to-date market insights.

Both platforms include demo accounts for practical trading experience, making them well-equipped to support traders in expanding their trading knowledge and skills.

Our Superior Educational Resources Verdict

It’s a tie in educational resources, as both FP Markets and eToro offer comprehensive learning tools tailored to enhance traders’ knowledge and forex trading skills effectively.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

9. Better Customer Service – FP Markets

FP Markets and eToro both offer 24/7 customer support in multiple languages via live chat and email, ensuring traders have access to assistance whenever needed.

FP Markets has an edge by also providing phone support, an option not offered by eToro, which may appeal to traders who prefer direct conversations for resolving their queries. This additional support channel enhances FP Markets’ customer service offering, making it more versatile and accessible.

| Feature | FP Markets | eToro |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | 24/7 | 24/5 |

| FAQ Section | Yes | Yes |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

With its broader range of contact methods including phone support, FP Markets offers a slightly more comprehensive customer service experience compared to eToro.

10. More Funding Options – FP Markets

FP Markets does not impose any fees for deposits and withdrawals, contrasting with eToro, which allows free deposits but applies a $5 fee to all withdrawals.

FP Markets supports a wide array of funding options including credit cards, Skrill, Neteller, and bank transfers, all without additional charges. eToro expands the choices with PayPal and cryptocurrency, yet the withdrawal fee is a consideration for traders.

| Funding Methods | FP Markets | eToro |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | Yes |

| POLi / bPay | Yes | Yes |

| Klarna | No | Yes |

Our Better Funding Options Verdict

FP Markets provides a more cost-effective funding and withdrawal experience with no fees, while eToro offers a wider range of payment methods at the cost of a withdrawal fee.

11. Lower Minimum Deposit – eToro

eToro requires a lower minimum deposit starting at USD 10 for US clients and USD 50 for most other key regions, whereas FP Markets sets a uniform minimum deposit of AUD 100 in Australia and 50 USD/EUR/GBP for Europe.

eToro’s minimum deposit varies greatly between jurisdictions, reflecting its tailored approach to meet diverse trader needs globally. In contrast, FP Markets maintains a consistent entry requirement, not accepting US clients but offering a straightforward minimum for others.

This difference highlights eToro’s flexibility in accommodating a wide range of traders, while FP Markets opts for simplicity and uniformity in its deposit requirements.

| Region | eToro Minimum Deposit | FP Markets Minimum Deposit |

|---|---|---|

| United States | USD 10 | Does not accept US clients |

| Australia | USD 50 | AUD 100 |

| Europe | See below | 50 USD/EUR/GBP |

| Austria, Cyprus, Denmark, Estonia, Finland, Greece, Guernsey, Hungary, Indonesia, Ireland, Latvia, Liechtenstein, Malaysia, Malta, Netherlands, Norway, Portugal, Singapore, Sweden, Switzerland, Taiwan, Thailand, Vatican City | USD 50 | - |

| Belgium, Czech Republic, France (and territories), Germany, Italy, Luxembourg, Monaco, Poland, Romania, Slovakia, Slovenia, Spain, United Kingdom | USD 100 | - |

| French Polynesia, Isle Of Man, Jersey Island, Kuwait, New Zealand, Reunion Island | USD 1,000 | AUD 100 |

| Bulgaria, Cayman Islands, Croatia, Gibraltar, the Philippines, South Africa, Vietnam | USD 2,000 | AUD 100 |

| Israel | USD 10,000 | AUD 100 |

| All other eligible regions | USD 200 | AUD 100 |

Our Lower Minimum Deposit Verdict

eToro offers a lower minimum deposit than FP Markets in the US and matches it in Europe.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

So is eToro or FP Markets the Best Broker?

FP Markets is the winner because it offers a more comprehensive package with lower spreads, more trading platform options, and wider market access. The table below summarises the key information leading to this verdict.

| Criteria | FP Markets | eToro |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ✅ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ❌ | ✅ |

Best For Beginner Traders

For beginner traders, FP Markets and eToro are both top brokers for with commission-free accounts and strong educational resources.

Best For Experienced Traders

For experienced traders, FP Markets is the go-to for its advanced trading platforms and lower spreads via its Raw Account.

FAQs Comparing FP Markets vs eToro

Does eToro or FP Markets Have Lower Costs?

FP Markets has lower costs. They offer tighter spreads, which can be as low as 0.0 pips. For more information on low-cost brokers, check out our Lowest Spread Forex Brokers in the UK.

Which Broker Is Better For MetaTrader 4?

FP Markets is the better choice for MetaTrader 4 users. They offer a seamless trading experience with advanced tools. For more details, visit our Best MT4 Brokers.

Which Broker Offers Social Trading?

eToro is the king of social trading. They offer a feature-rich social trading platform. Learn more about social trading platforms on our Best Copy Trading Platforms page.

Does Either Broker Offer Spread Betting?

Neither FP Markets nor eToro offer spread betting. If you’re interested in spread betting, you might want to check out our best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, FP Markets is superior for Australian Forex traders. They are ASIC regulated and founded in Australia. For more details, visit our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK traders, eToro is the better choice. They are FCA regulated and offer a wide range of trading options. Learn more about UK trading platforms on our Best Forex Brokers In UK page.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert