FxPro vs XM: Which One Is Best?

Our comprehensive comparison of FxPro vs XM dissects key areas like trading costs, Forex trading platforms, and regulations to help you choose the right Forex broker.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are some key differences between FxPro and XM:

- FxPro offers a wider range of trading platforms, including cTrader, while XM does not.

- XM provides guaranteed fills with no requotes, ensuring 99.35% of orders are executed in less than 1 second.

- FxPro offers some of the best fixed spreads available and discounts for VIP accounts.

- XM operates as a market maker, setting its own bid-ask prices, while FxPro uses Straight-Through-Processing (STP) with no dealing desk intervention.

- FxPro’s customer support is available in 27 different languages, offering quick and efficient responses.

1. FxPro: Lowest Spreads And Fees

Commission Fees

XM’s Micro, Standard and Ultra-Low trading accounts are all commission-free and may not suit scalpers, day traders and those using Expert Advisors requiring tighter ECN-style spreads with flat-rate commission fees. European/UK traders signed up to an XM Zero account pay a flat rate, a round-turn commission fee of $7 while accessing tighter spreads than XM’s commission-free accounts.

Zero Account With ECN-Style Spreads

XM’s ECN-like account provides customers access to institutional-grade pricing with minimum spreads of 0.0 pips. Although customers are offered much lower spreads than XM’s other account types, as mentioned above, market access is limited to forex and metals.

As shown below, XM offers tight average spreads as low as 0.10 pips for the EUR/USD currency pair. The EUR/GBP is the online brokers’ biggest strength, averaging 0.30 pips while top brokers such as Pepperstone offer 0.48 pips.

Commission Account Spreads | |||||

|---|---|---|---|---|---|

| 0.30 | 0.80 | 0.80 | 0.40 | 1.30 |

| 0.01 | 0.02 | 0.27 | 0.03 | 0.04 |

| 0.10 | 0.10 | 0.30 | 0.30 | 0.30 |

| 0.14 | 0.31 | 0.39 | 0.51 | 0.57 |

| 0.10 | 0.20 | 0.30 | 0.30 | 0.50 |

| 0.10 | 0.20 | 0.30 | 0.30 | 0.20 |

| 0.16 | 0.29 | 0.54 | 0.24 | 0.70 |

| 0.80 | 0.40 | 0.50 | 0.40 | 1.40 |

| 0.10 | 0.50 | 0.60 | 0.60 | 0.60 |

| 0.50 | 0.70 | 0.60 | 0.50 | 0.80 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

XM’s Commission-Free Spreads

Spreads offered by XM to Micro and Standard account holders (first row below) are the same and not particularly competitive when compared to other brokers. For instance, spreads for the EUR/JPY fx pair are 2.30 pips for Micro and Standard account holders and 1.70 pips for EUR/USD.

On the other hand, Ultra-Low traders outside of the EU can trade tighter commission-free spreads that are more in line with the industry standard (second row below). Customers can trade EUR/GBP and EUR/JPY at 1.20 pips with no commission fees, while brokers such as Forex.com offers 1.80-2.10 pips.

No Commission Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.40 | 2.00 | 2.30 | 2.30 |

| 0.90 | 1.30 | 1.40 | 1.40 | 1.80 |

| 0.70 | 2.20 | 1.10 | 1.60 | 1.60 |

| 1.13 | 1.01 | 1.71 | 2.27 | 1.98 |

| 1.10 | 1.10 | 1.60 | 2.00 | 1.90 |

| 1.20 | 1.30 | 1.30 | 1.50 | 2.00 |

| 1.00 | 1.00 | 1.27 | 1.30 | 1.20 |

| 0.94 | 1.48 | 1.45 | 3.24 | 2.03 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

XM’s Leverage

Leverage ratios with this broker follow the requirements of the appropriate regulator. If you are in Australia, Europe or the UK, then leverage is limited to 30:1 for major forex pairs and 20:1 for minor pairs. Traders outside these regions should be able to access leverage up to 888:1

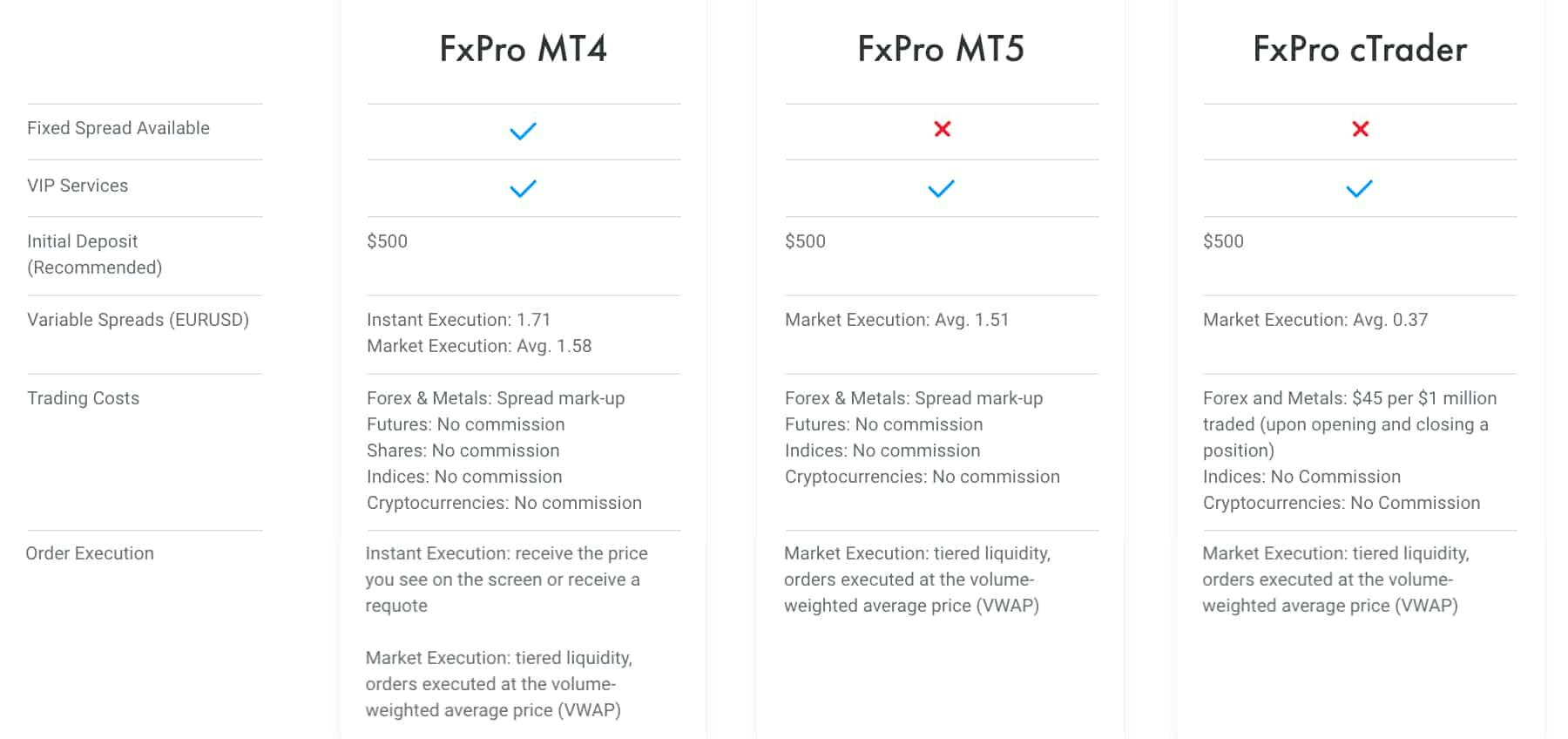

FxPro’s Variable Spreads

FxPro cTrader, MT4 and MT5 account types can trade floating spreads with either instant (MT4) or market (MT4, MT5 or cTrader) execution.

As shown below, FxPro and XM’s no commission spreads are not as competitive as brokers such as Forex.com or FXCM for the majority of currency pairs. Yet, FxPro may be ideal for those wanting to focus their trading strategies around the EUR/GBP, as the broker offers the lowest spreads when compared to the best brokers. While most online brokers commission-free spreads are over 2 pips for EUR/GBP, FxPro’s average spread is 1.74 pips.

No Commission Variable Spreads Comparison | |||||

|---|---|---|---|---|---|

| 1.52 | 2.08 | 1.46 | 2.15 | 1.76 |

| 1.40 | 2.50 | 2.50 | 2.60 | 2.60 |

| 1.20 | 1.30 | 1.20 | 1.20 | 4.00 |

| 1.20 | 1.30 | 1.30 | 1.50 | 2.00 |

| 0.70 | 0.80 | 1.30 | 2.40 | 1.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Fixed Spreads

Commission-free fixed spreads are available through a FxPro MT4 account type. As shown in the table below, FxPro is one of the best brokers for fixed spread pricing. Across EUR/USD, USD/JPY, AUD/USD, EUR/JPY and EUR/GBP currency pairs, the FxPro MT4 account gains access to the tightest fixed spreads ranging from 1.60 pips to 1.80 pips.

No Commission Fixed Spreads Comparison | |||||

|---|---|---|---|---|---|

| 1.94 | 2.36 | 2.11 | 2.24 | 2.05 |

| 0.50 | 0.40 | 0.50 | 0.70 | 0.80 |

| 0.70 | 1.20 | 1.50 | 1.80 | 1.30 |

| 1.50 | 1.80 | 2.00 | 2.00 | 2.00 |

| 3.00 | 3.00 | 3.00 | 3.00 | 3.00 |

| 1.20 | 1.50 | 1.30 | 2.00 | 1.70 |

| 1.80 | 2.00 | 1.80 | 2.50 | 3.00 |

| 2.00 | 3.00 | 2.00 | 3.00 | 3.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

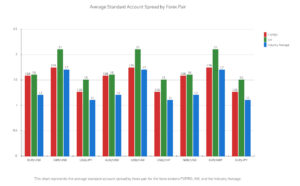

Standard Account Spreads

When it comes to standard account spreads, there’s a clear difference between FXPRO and XM. Based on the data we’ve gathered, FXPRO tends to have slightly lower spreads across most forex pairs. This means that, on average, you’re likely to get a better deal when trading with FXPRO.

| Standard Account | FxPro Spreads | XM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.69 | 2.11 | 1.7 |

| EUR/USD | 1.46 | 2 | 1.2 |

| USD/JPY | 1.59 | 2.5 | 1.5 |

| GBP/USD | 1.76 | 2.4 | 1.6 |

| AUD/USD | 2.06 | 2.4 | 1.6 |

| USD/CAD | 1.78 | 2.3 | 1.9 |

| EUR/GBP | 1.52 | 2.4 | 1.5 |

| EUR/JPY | 2.04 | 3.2 | 2.1 |

| AUD/JPY | 3.35 | 3 | 2.3 |

Standard Account Analysis Updated February 2026[1]February 2026 Published And Tested Data

However, it’s not just about the numbers. When choosing a forex broker, you also have to consider other factors like the trading environment, customer service, and trustworthiness. And while FXPRO might have the edge in terms of spreads, XM also has its strengths.

But how do these two brokers compare to the industry average? Well, it turns out that both FXPRO and XM have spreads that are fairly close to the industry average. This means that while there might be cheaper options out there, both FXPRO and XM offer competitive rates.

In my opinion, if you’re looking for the cheapest option, FXPRO might be the way to go. But remember, cost isn’t everything. Make sure to consider all factors before deciding on a forex broker.

Leverage With FxPro

The leverage available varies depending on the FxPro entity being used and its associated regulator. Traders in Europe will be restricted to 30:1 for major currency pairs and 20:1 for minor pairs. Those outside Europe will have a 500:1 leverage ratio.

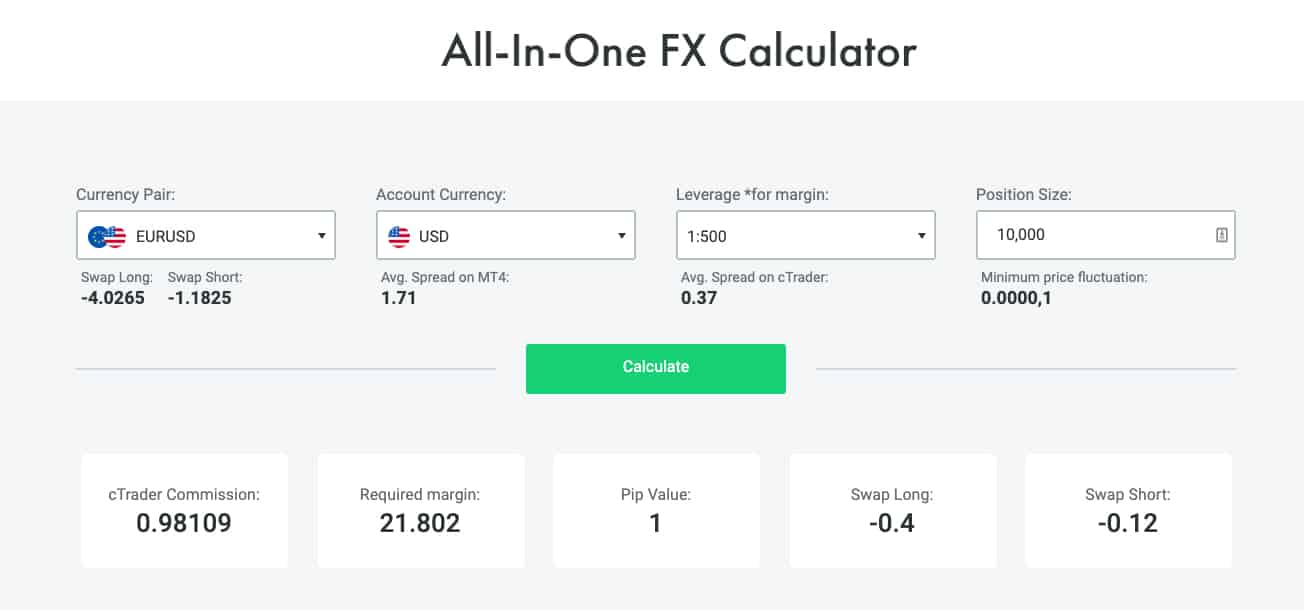

Commission Fees: FxPro

When trading forex with FxPro, commission fees and structure vary between trading accounts. FxPro MT4 and MT5 account holders pay no commission fees on top of the spread markup, while cTrader accounts pay $9 per $100,000 traded round turn. To assist FxPro cTrader account holders with commission cost calculations, a forex calculator can be found on the broker’s website.

Our Lowest Spreads and Fees Verdict

If you’re purely looking for the lowest spreads, FxPro seems to have a slight edge over XM for most of the mentioned forex pairs. However, when considering commission fees, XM’s Micro, Standard, and Ultra-Low accounts are commission-free, while FxPro’s cTrader accounts have a commission.

Remember, the best choice depends on individual trading needs and preferences.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

2. FxPro: Better Trading Platform

| Trading Platform | FxPro | XM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | No | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

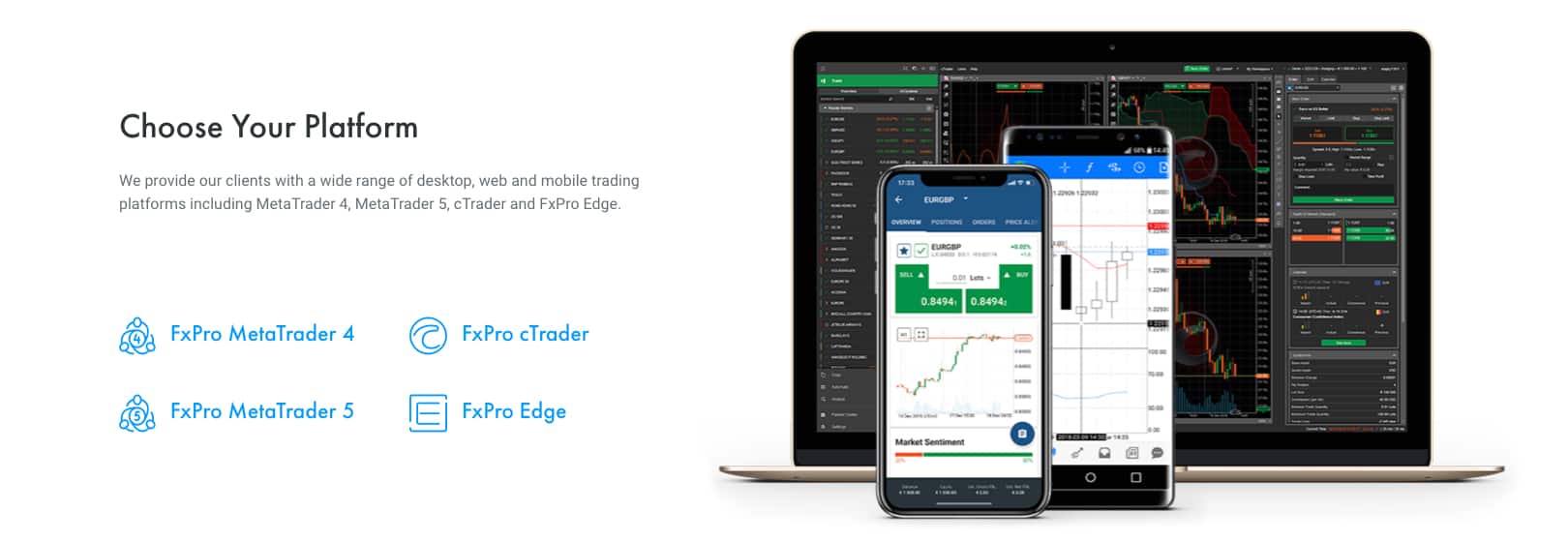

Both XM and FxPro provide access to MetaTrader 4 and MetaTrader 5 trading platforms, with FxPro also offering cTrader and FxPro Edge, a proprietary platform for spread betting (only available for UK traders).

XM CFD Product Range

XM customers can trade forex and CFDs on stocks, indices, commodities, precious metals and energies. All asset classes are available to trade via a Standard, Micro or Ultra-Low account type, while XM Zero customers are restricted to forex and precious metals. To trade share CFDs, XM customers must choose MetaTrader 5.

FxPro CFDs

Depending on the trading platform you choose, the following CFDs will be available to trade with FxPro:

- FxPro MT4: Forex, Indices, Metals, Energies, Futures and Shares

- FxPro MT5: Forex, Metals, Indices, Energies and Futures

- FxPro cTrader: Forex, Indices, Metals and Energies

MetaTrader 4 And MetaTrader 5

Offered by both XM and FxPro, MT4 and MT5 are two of the most popular trading platforms worldwide, largely due to their easy-to-use interface, advanced trading tools and Expert Advisors (trading robots). For those wanting to develop algorithmic trading strategies while accessing a huge forex community and marketplace, MT4 or MT5 are excellent options.

Each broker provides free access to advanced technical indicators and research tools. For instance:

- Expert Advisors (EAs) allow users to automate trading with the MQL4 (MT4) or MQL5 (MT5) programming language

- Finite technical indicators and EAs can be downloaded from the MetaTrader marketplace online

- Ultra-fast order execution ideal for scalping, day trading and Expert Advisor trading strategies

- Advanced technical analysis tools to help customers find trading opportunities and analyse financial markets

- Pending order types to manage the high risk of forex trading

- Tools to conduct fundamental analysis such as an economic calendar and real-time market news

- Copy and social trading via MT4 and MT5 Trading Signals

The main difference between the two trading platforms is that MT4 was designed for forex trading, while MT5 is a multiple-asset platform that permits share trading.

Additionally, MT5 offers improvements over MT4, such as more technical indicators, charts and timeframes, to allow for more sophisticated technical analysis. MT5 also saw improvements with backtesting. While MT4 allows for the single currency, single thread backtesting, multiple currencies can be backtested at a time when using MT5.

XM and FxPro both offer MT4 and MT5 as desktop trading platforms for Mac and Windows computers, as well as a webtrader platform and mobile trading apps.

cTrader

cTrader is a forex trading platform that offers an institutional-style trading environment with advanced technical analysis tools. As with MetaTrader platforms, complex algorithmic trading strategies can be developed and implemented on the cTrader platform. Trading robots (known as cBots) can be written using the C# programming language with backtesting available.

cTrader can be accessed via a desktop trading platform, webtrader platform, or trading apps for iOS and Android devices. FxPro customers wanting to use cTrader should note the trading platform is only compatible with Windows computers.

As with FxPro’s MT4 offering, share trading is not available on cTrader.

Our Better Trading Platform Verdict

For those wanting to access either broker’s full product range, MT5 is the best-suited trading platform. As well as Forex, CFD and Share trading, MT5 users gain access to an extensive range of trading tools and features. XM and FxPro customers can use the MT4 and MT5 platforms, which provide Expert Advisors, backtesting, and advanced technical analysis tools. Therefore, there is little that differentiates the two brokers. However, FxPro offers both MT4 and cTrader, providing more platform choices.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

3. FxPro: Superior Accounts And Features

Both online brokers offer multiple account types for customers to choose from with different spreads, commission fees, and trading platforms.

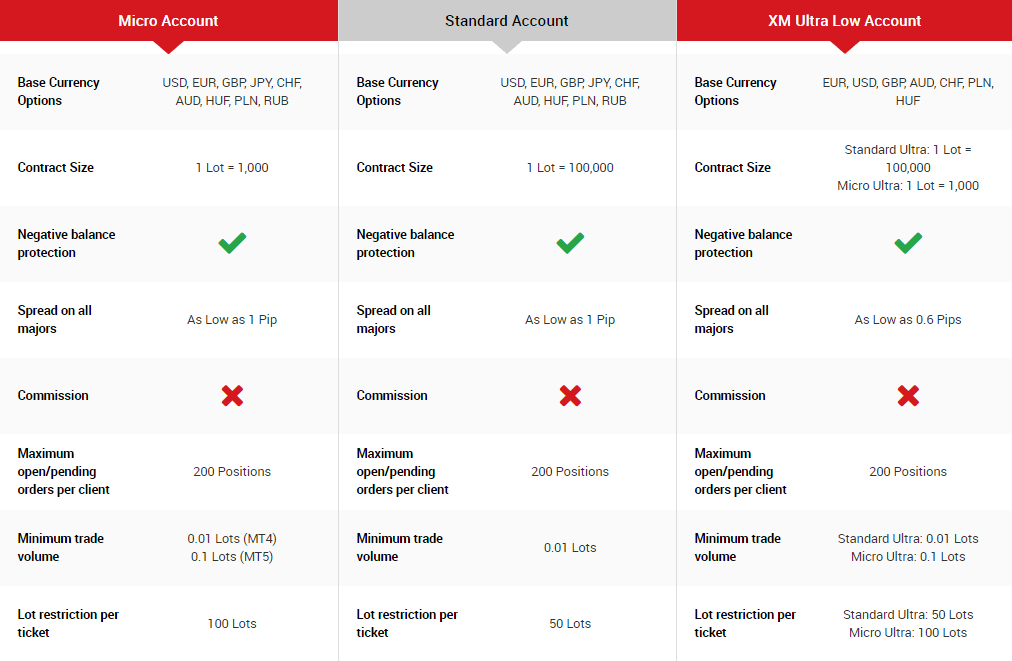

XM Account Types

When trading with XM, a Micro Account, Standard Account, Ultra-Low Account and Zero Account is available. XM traders can choose either MetaTrader 4 (MT4) or MetaTrader 5 (MT5) as their trading platform, regardless of the account type.

Common features between XM trading accounts include Negative Balance Protection and a maximum of 200 positions per client, with key differences being lot sizes, spreads and minimum deposits:

- Micro Account: No commission spreads as low as 1 pip, 1 lot = 1,000, minimum deposit $5.

- Standard Account: Commission free spreads from 1.0 pip, 1 lot = 100,000, minimum deposit $5

- Ultra-Low Account: No commission spreads as low as 0.6 pips, min $50 (not available to European clients).

- Standard Ultra: 1 lot = 100,000

- Micro Ultra: 1 lot = 1,000

- Zero Account: ECN-style account with spreads as low as 0 pips and $7 round-trip commission fees. Minimum deposit $100 (only available to European customers)

Micro accounts may be useful for those without a large enough account balance to trade larger lots, wanting more precision with position sizes or wanting to test strategies with low volumes instead of using a demo account.

While a higher minimum deposit is required for an XM Ultra-Low account, traders from certain countries such as South Africa and Australia can access tighter commission-free spreads than XM’s Micro or Standard account type.

If traders want to save on costs, then Ultra-Low will be the preferred option. Additionally, the Ultra-low account provides extra flexibility for trading size as it combines the trading lot size allowances of the Micro and Standard account with the Micro only allowing micro lot trading (1,000) and standard allowing standard lots (100,000).

FxPro Account Types

As a FxPro customer, you can sign up to the following account types:

- FxPro MT4 with instant execution and floating spreads

- FxPro MT4 with instant execution and fixed spreads

- FxPro MT4 with market execution and floating spreads

- FxPro MT5 with market execution and floating spreads

- FxPro cTrader with market execution and floating spreads

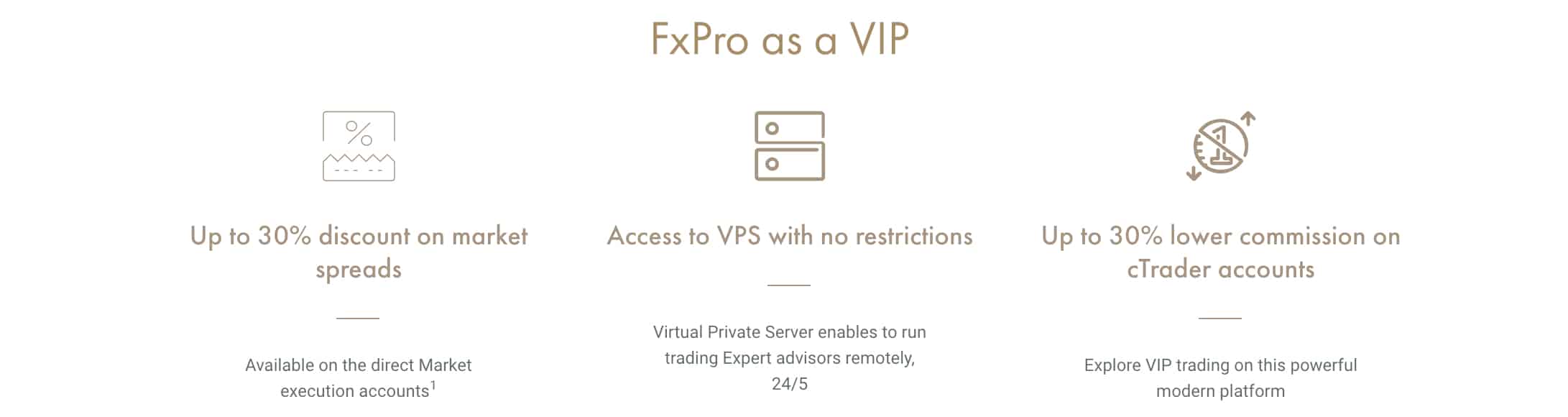

FxPro’s VIP Account

Designed for high-volume traders, FxPro offers a VIP Account type with premium benefits. As well as up to 30% discounts on spreads, traders gain access to VPS, while cTrader account holders also pay up to 30% less in commission fees. To qualify for a FxPro VIP account, a minimum deposit of $50,000 is required.

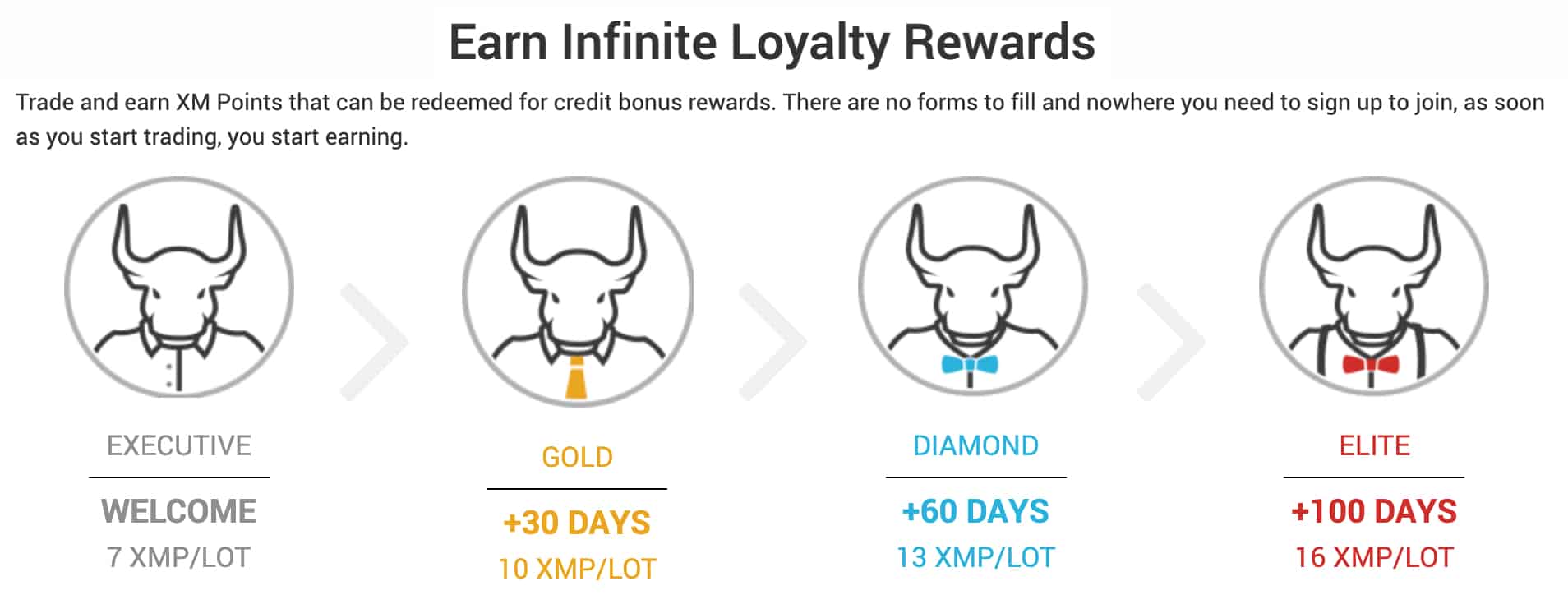

No premium account is offered by XM, although the broker does promote a loyalty program where XM points can be exchanged for credit bonus rewards.

Islamic Accounts

Islamic trading accounts are available with both XM and FxPro. Also known as swap-free accounts, Islamic account holders do not pay interest-based swap or overnight financing fees. Instead, a flat rate financing fee is applicable when positions are held open for a certain number of days. XM’s Islamic accounts are charged no additional commission fee on top of the spread, and unlike many competing brokers’ swap-free accounts, XM does not widen the spreads for Islamic account holders. FxPro, on the other hand, only offers Islamic accounts to existing customers and imposes administration fees.

To commence trading forex with an Islamic Account type, prospective customers can start the application process by contacting either broker’s customer support team.

Spread Betting – Which Brokers Has Better Spread Betting

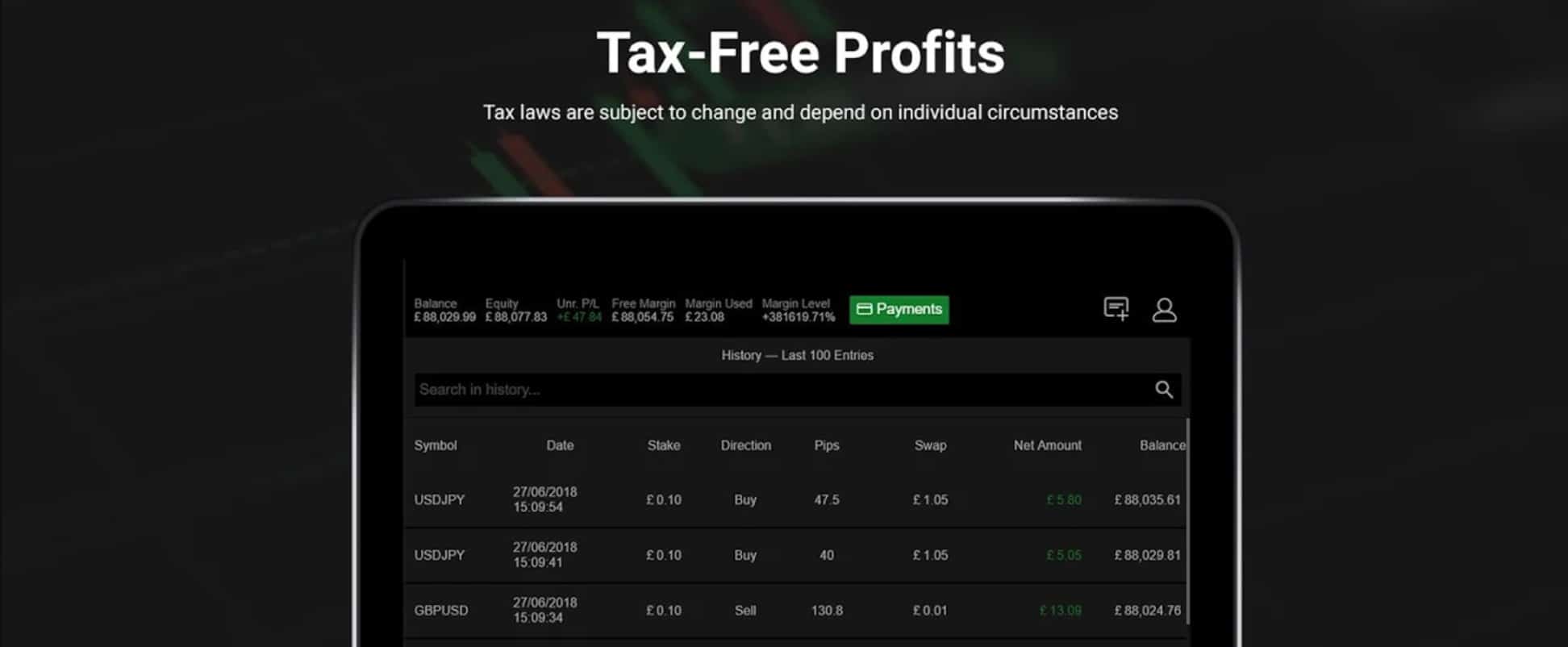

For UK traders, spread betting can be a tax-efficient trading strategy as, unlike CFD trading, spread betting profits are not subject to Capital Gains Tax (CGT). While XM does not offer spread betting services, FxPro is popular for this style of trading. To spread bet via FxPro, UK traders can use FxPro Edge, the broker’s proprietary spread betting platform.

FxPro Edge offers the following features and trading tools to help you develop spread betting trading strategies:

- A multi-asset trading platform with the ability to trade over 280 financial instruments from six different asset classes: Forex, Indices, Energies, Shares, Metals and Cryptocurrencies (Crypto not available to UK traders).

- Tax-free trading on tight spreads with fast execution

- Technical analysis tools to analyse markets and find trading opportunities: 53 technical indicators, 9 timeframes and 6 chart types

- Risk management tools including multiple order types

- Price alerts, watchlists and real-time news to keep track of financial markets

| FxPro | XM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | No | No |

| Spread Betting (UK) | Yes | No |

XM vs FxPro: Best Spread Betting Features

FxPro’s UK clients can enjoy great tax benefits when spread betting, as net profits are free from both capital gains tax and stamp duty. To execute spread betting strategies with the top broker, you can download their proprietary trading platform, FxPro Edge.

Our Superior Accounts and Features Verdict

As FxPro offers some of the best fixed spreads available as well as excellent discounts for VIP accounts, the broker offers better account type options than XM. Although XM’s Zero account type provides ECN-style spreads, Zero accounts are only available to a small selection of traders. On the other hand, FxPro offers a range of fixed or floating spreads as well as different types of execution to clients regardless of where they reside.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

4. Tie: Best Trading Experience And Ease

When it comes to trading experience and ease, both FxPro and XM have their strengths. We found that FxPro boasts a user-friendly interface and offers a range of trading platforms. On the other hand, XM is known for its educational resources and customer support, which can be crucial for both beginners and seasoned traders.

- FxPro offers a seamless trading experience with its intuitive interface.

- XM provides top-notch educational resources for traders.

- Both brokers have a strong reputation in the industry.

- Customer support is a highlight for XM, ensuring traders have the assistance they need.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| FxPro | 151ms | 23/36 | 138ms | 16/36 |

| XM | 148ms | 21/36 | 184ms | 28/36 |

Our Best Trading Experience and Ease Verdict

While both FxPro and XM offer a commendable trading experience, it’s a close call. If we had to pick, we’d lean slightly towards FxPro for its user-friendly interface, but XM’s educational resources and customer support are hard to beat.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

5. XM: Stronger Trust And Regulation

When it comes to trust and regulation, XM stands out with stronger scores across key areas, reflecting its broad regulatory coverage and positive trader feedback.

FxPro still holds respectable ratings, but its overall trust score comes in lower than XM, mainly due to differences in regulatory standing and market perception.

1. Regulations

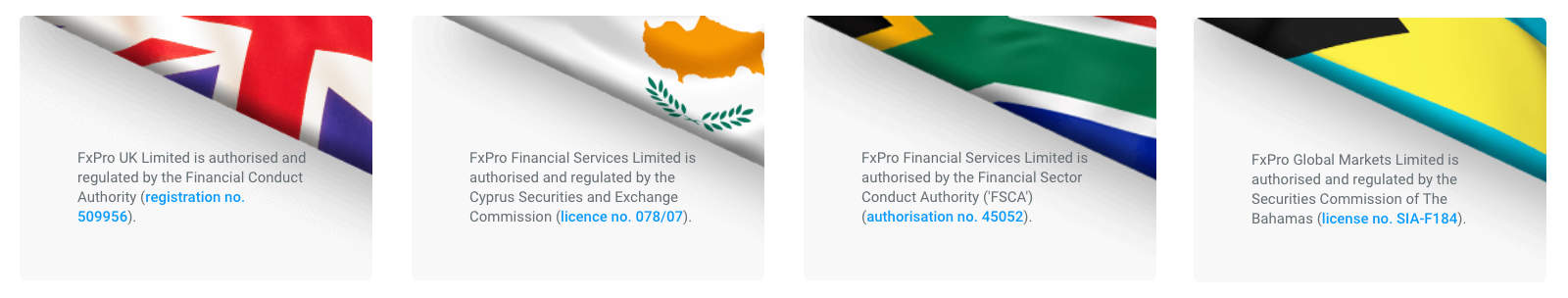

When trading CFDs, signing up with a regulated broker provides another level of protection for retail investor accounts. XM and FxPro are both overseen by top-tier financial authorities in multiple jurisdictions.

| FxPro | XM | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) FSC-M (Mauritius) FSCA (South Africa) | FSC-BZ |

FxPro is regulated by:

- The Cyprus Securities and Exchange Commission (CySEC)

- The Financial Sector Conduct Authority in South Africa (FSCA)

- The Financial Conduct Authority in the UK (FCA)

- The Securities Commission of the Bahamas (SCB)

- Financial Services Commission Mauritius (FSCM)

XM, on the other hand, is regulated by:

- The Australian Securities and Investments Commission (ASIC)

- The Dubai Financial Services Authority (DFSA)

- The Cyprus Securities and Exchange Commission (CySEC)

- The Financial Conduct Authority in the UK (FCA)

ASIC, CySEC, and the FCA are well-respected tier-1 financial authorities. Traders can be assured that client funds are held in segregated accounts, with customers of the CySEC and FCA broker subsidiaries receiving negative balance protection while close-out margins and leverage caps are enforced.

Additionally, CySEC and FCA-regulated brokers are required to display clear risk warnings to ensure customers are aware of the high risk that comes with trading CFDs and forex.

Australian traders should note that FxPro is not regulated by ASIC, and FxPro allows you to use the Securities Commission of the Bahamas (SCB), which is not a tier-1 regulator.

FxPro and XM’s Negative Balance Protection

In addition to top-tier financial regulation, FxPro and XM provide all trading accounts (regardless of location) with negative balance protection. Negative balance protection ensures customers cannot lose more than they have deposited into their trading account. If positions move in an unfavourable direction and account balances move into the negatives, the broker will close all a trader’s open positions, cover the losses and reset the customer’s balance to $0.

With negative balance protection, XM and FxPro clients are never at risk of becoming indebted to the broker.

2. Reputation

XM gets searched on Google more than FxPro. On average, XM sees around 823,000 branded searches each month, while FxPro gets about 74,000 — that’s 91% fewer.

| Country | FxPro | XM |

|---|---|---|

| Colombia | 6,600 | 74,000 |

| Jordan | 1,600 | 74,000 |

| Argentina | 2,400 | 60,500 |

| Turkey | 1,900 | 60,500 |

| Philippines | 3,600 | 33,100 |

| Germany | 8,100 | 27,100 |

| United States | 2,400 | 27,100 |

| Indonesia | 1,300 | 18,100 |

| Morocco | 4,400 | 18,100 |

| Australia | 480 | 18,100 |

| Bolivia | 1,000 | 18,100 |

| Malaysia | 1,300 | 14,800 |

| Peru | 880 | 14,800 |

| Vietnam | 880 | 14,800 |

| Thailand | 1,600 | 12,100 |

| Singapore | 1,300 | 12,100 |

| Saudi Arabia | 260 | 12,100 |

| Ireland | 480 | 12,100 |

| Algeria | 1,900 | 9,900 |

| India | 2,400 | 8,100 |

| Poland | 880 | 8,100 |

| United Arab Emirates | 880 | 6,600 |

| Uruguay | 170 | 6,600 |

| Italy | 170 | 6,600 |

| Cambodia | 170 | 6,600 |

| Uzbekistan | 480 | 5,400 |

| Nigeria | 2,400 | 5,400 |

| Switzerland | 210 | 5,400 |

| Mexico | 590 | 5,400 |

| Tanzania | 590 | 5,400 |

| Hong Kong | 590 | 4,400 |

| Bangladesh | 480 | 4,400 |

| Taiwan | 260 | 4,400 |

| South Africa | 1,300 | 4,400 |

| Brazil | 390 | 3,600 |

| Pakistan | 1,000 | 3,600 |

| Ethiopia | 70 | 3,600 |

| Ecuador | 480 | 3,600 |

| New Zealand | 210 | 3,600 |

| Sri Lanka | 480 | 2,900 |

| Cyprus | 260 | 2,900 |

| Austria | 480 | 2,900 |

| Spain | 1,600 | 2,400 |

| Venezuela | 170 | 2,400 |

| Sweden | 140 | 2,400 |

| Portugal | 1,300 | 2,400 |

| France | 90 | 2,400 |

| United Kingdom | 260 | 1,900 |

| Canada | 170 | 1,900 |

| Botswana | 390 | 1,900 |

| Ghana | 110 | 1,900 |

| Egypt | 170 | 1,600 |

| Costa Rica | 170 | 1,600 |

| Netherlands | 140 | 1,300 |

| Chile | 390 | 1,000 |

| Japan | 590 | 1,000 |

| Dominican Republic | 110 | 880 |

| Uganda | 110 | 720 |

| Kenya | 40 | 590 |

| Greece | 90 | 590 |

| Panama | 90 | 590 |

| Mongolia | 90 | 480 |

| Mauritius | 140 | 260 |

74,000 1st | |

6,600 2nd | |

60,500 3rd | |

1,900 4th | |

27,100 5th | |

2,400 6th | |

18,100 7th | |

480 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with XM receiving 8,619,000 visits vs. 584,533 for FxPro.

3. Reviews

As shown below, FxPro holds a Trustpilot rating of 4.3 out of 5, based on over 1,000 reviews. XM has a slightly lower rating of 3.6 out of 5, from around 2,800 reviews. FxPro is generally viewed more favorably for its platform variety and reliability, while XM receives mixed feedback, with strengths in education but concerns over support and fund handling.

Our Stronger Trust and Regulation Verdict

Both XM and FxPro are overseen by well-respected, top-tier financial authorities; however, FxPro does not offer ASIC protection to its Australian clients and uses SCB regulation which is not a tier-1 regulator. As well as multiple regulators, both online brokers provide negative balance protection (NBP) to all traders, regardless of location or the subsidiary they are registered with. Customers of both brokers are protected via NBP, ensuring they cannot lose more funds than they have deposited.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

6. XM: Top Product Range And CFD Markets

In the competitive world of forex trading, the range of products and CFD markets a broker offers can be a game-changer. A diverse product range allows traders to diversify their portfolios and take advantage of various market conditions. Let’s compare the offerings of FxPro and XM:

| CFDs | FxPro | XM |

|---|---|---|

| Forex Pairs | 69 | 55 |

| Indices | 18 | 14 |

| Commodities | 8 Metals (3 x Gold) 3 Energies | 2 Metals 5 Energies 8 Softs |

| Cryptocurrencies | 28 | No |

| Shares CFDs | 2031 | 1261 |

| ETFs | 18 (11 futures) | No |

| Bonds | No | No |

| Futures | No | No |

| Treasuries | No | No |

| Investment | No | No |

Our Top Product Range and CFD Markets Verdict

While both FxPro and XM offer a comprehensive range of products and CFD markets, XM seems to have a slight edge in terms of the diversity of offerings. However, the choice between the two would also depend on individual trading preferences and strategies.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

7. XM: Superior Educational Resources

In the ever-evolving world of forex trading, continuous learning is paramount. Both FxPro and XM recognise the importance of equipping traders with the knowledge and tools they need to navigate the markets confidently. Here, we delve into the educational resources each broker offers, comparing their strengths and areas of focus.

FxPro:

- Offers a comprehensive educational section on their website.

- Provides webinars and seminars for traders of all levels.

- Features a rich library of video tutorials.

- Includes articles and insights from market experts.

- Offers a dedicated FAQ section addressing common trading queries.

- Provides a platform tutorial for beginners.

XM:

- Boasts an extensive educational portal for traders.

- Conducts regular webinars and workshops.

- Offers video tutorials covering various trading topics.

- Provides daily market analysis and insights.

- Features a detailed FAQ section for traders.

- Includes platform guides and how-to articles.

Our Superior Educational Resources Verdict

Based on our team’s testing, XM offers the best educational resources with a score of 8.5, closely followed by FxPro with a score of 8.2.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

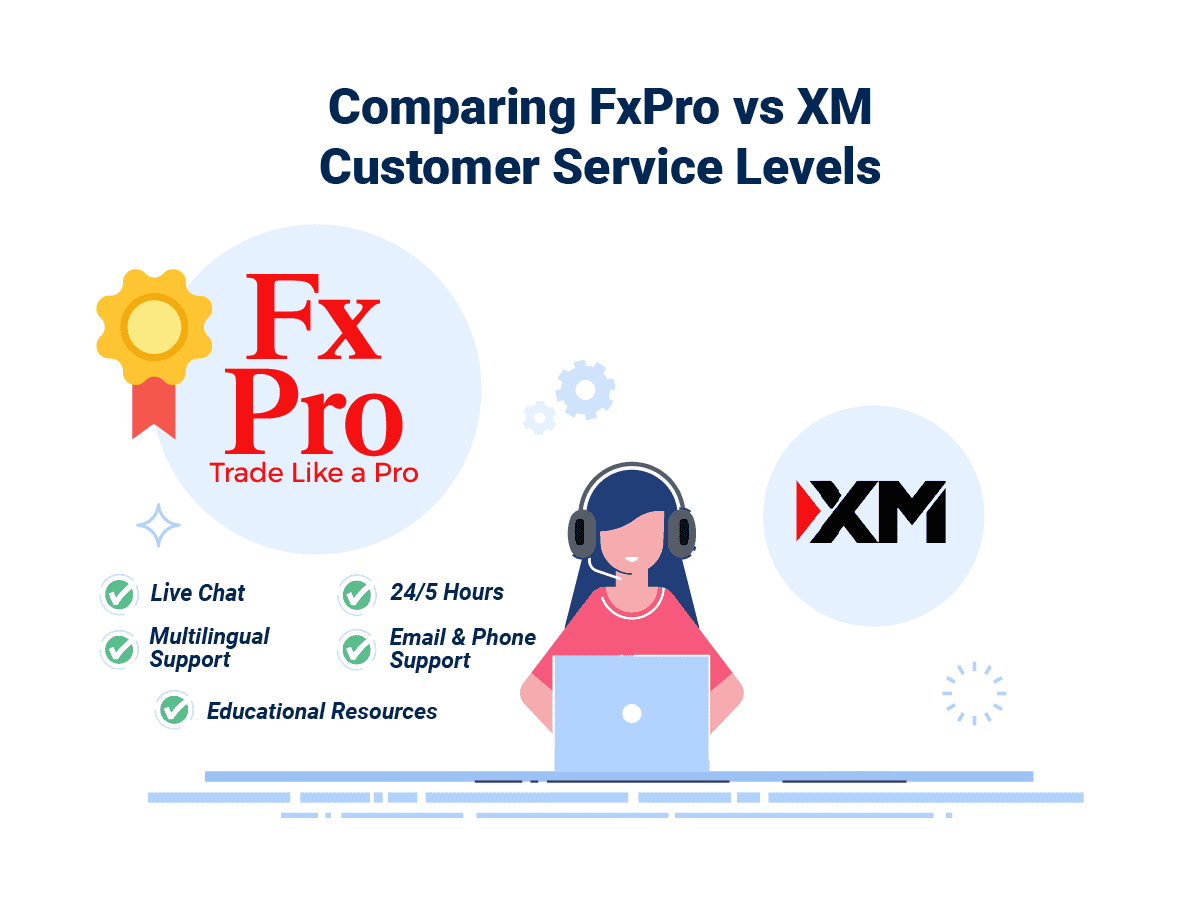

8. FxPro: Superior Customer Service

Customer Support: FxPro

Unlike XM, FxPro’s customer support is quick and efficient, with trained staff providing helpful information. The broker’s customer service team can be contacted through email, phone, fax or live chat, 24/5. Additionally, FxPro offers multilingual customer support that is available in 27 different languages.

| Feature | FxPro | XM |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Email, Messenger | |

| Phone Support | Yes | Yes |

| Support Hours | 9/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Customer Support: XM

To get in touch with XM, traders can contact the broker via live chat, email or phone. Customer support is only available 24 hours a day, 5 days a week (Monday-Friday). While XM’s customer service is sufficient, at times, answers are vague and not always relevant.

Education: FxPro

FxPro and XM both offer educational resources that cover various trading topics.

FxPro provides a wide range of materials aimed at beginners, with videos and articles that explain the basics of trading, fundamental analysis, technical analysis and the psychology of forex trading. Educational resources that are designed for experienced traders are limited and restricted to fundamental analysis.

Education: XM

XM’s educational resources cover beginner to advanced topics, with trading platform tutorials, videos and webinars available. As well as articles and videos, both online brokers offer demo accounts on their entire trading platform offering, allowing both beginner and experienced traders to practise and optimise trading strategies.

Our Superior Customer Service Verdict

With excellent educational resources and multilingual customer support, FxPro offers the best customer support. FxPro provides materials that cater to all levels of trading experience while providing quick customer service, while XM is known for slow and inefficient responses when traders are seeking help.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

9. XM: Better Funding Options

When opening a trading account with XM, a $5 minimum deposit is required for Micro and Standard accounts, with Ultra-Low accounts requiring an initial deposit of $50. FxPro requires a significantly higher minimum deposit for all account types, with traders required to deposit at least $500 to start trading forex and CFDs.

XM offers a range of payment methods with no deposit or withdrawal fees. As well as bank transfers and Visa, Mastercard and UnionPay credit cards, XM customers can manage their trading account balances using e-wallet services such as Skrill, Neteller and Moneybookers.

Like XM, FxPro provides multiple payment methods. Depending on the FxPro subsidiary you are trading with (the UK, Europe or Bahamas), the following funding methods are available with no deposit and withdrawal fees:

- Bank transfer

- Broker to broker

- Credit card (Visa, Mastercard and UnionPay)

- PayPal

- Skrill

- Neteller

- FxPro Wallet

| Funding Option | FxPro | XM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | No | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

As XM requires a smaller minimum deposit and charges no deposit and withdrawal fees, they offer the best funding methods when compared to FxPro. To start trading with XM, as little as $5 is needed to open an account.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

10. XM: Lower Minimum Deposit

XM has a lower minimum deposit requirement of $5 vs $100 from FxPro. The broker XM has made it incredibly accessible for traders of all levels by offering a very low minimum deposit amount.

| Minimum Deposit | Recommended Deposit | |

| FxPro | $100 | $1,000 |

| XM | $5 | $5 |

Our Lower Minimum Deposit Verdict

XM provides three different account types: Standard, Micro, and XM Ultra Low. For all these accounts, the minimum deposit is set at $5. This low barrier to entry allows traders to test the waters without a significant financial investment.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

So Is XM or FxPro The Best Broker?

FxPro is the winner because of its comprehensive offerings, low spreads, and superior customer service. The table below summarises the key information leading to this verdict:

| Criteria | FxPro | XM |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | Yes |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | Yes | No |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | No | Yes |

FxPro: Best For Beginner Traders

FxPro is the ideal choice for beginner traders due to its user-friendly platform and extensive educational resources.

XM: Best For Experienced Traders

For seasoned traders, XM offers advanced tools and features that cater to their sophisticated trading needs.

FAQs Comparing FxPro Vs XM

Does XM or FxPro Have Lower Costs?

XM generally offers more competitive costs. They have been recognised for their low spreads and commissions, making trading more affordable for their clients. On average, the spreads are tighter compared to many other brokers in the industry. For more detailed insights on low commissions, you can refer to this guide on comprehensive list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both FxPro and XM offer MetaTrader 4, but XM tends to have a more streamlined experience on this platform. MT4 is widely recognised for its user-friendly interface and advanced charting tools. If you’re keen to explore more about the best brokers for MT4, check out this detailed review of top MT4 brokers.

Which Broker Offers Social Trading?

FxPro stands out when it comes to offering social trading features. Social trading allows traders to follow and replicate the strategies of professional traders, making it easier for beginners to navigate the forex market. For those interested in diving deeper into social trading platforms, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

FxPro offers spread betting for its traders. Spread betting is a popular form of trading in the UK, allowing traders to speculate on the price movement of financial instruments without owning the underlying asset. For those interested in exploring the best brokers for spread betting, especially on the MT4 platform, you can check out this comprehensive guide on the best MT4 spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, XM is the superior choice for Australian forex traders. They offer a robust trading platform, competitive spreads, and are ASIC regulated, ensuring a high standard of conduct. While FxPro is also a strong contender, XM has a more established presence in the Australian market. Furthermore, being ASIC regulated adds an extra layer of trust for Australian traders. If you’re keen to explore more about the best brokers in Australia, here’s a detailed review of the Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

From my perspective, FxPro stands out for UK forex traders. They are FCA regulated, which is a testament to their commitment to maintaining high standards of integrity and transparency in the UK market. While XM is also a reputable broker, FxPro’s deep roots in the UK and their regulatory compliance give them an edge. For those looking to delve deeper into the Best Forex Brokers In UK, here’s a comprehensive guide on the Forex Brokers In UK.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does XM accept PayPal?

Unfortunately, XM does not accept PayPal as of the moment.