Hankotrade Review Of 2026

Hankotrade offers MT4 and MT5 trading platforms, low commissions from $2.00 and a high leverage of 2000:1; however, they are not regulated by any financial regulator. Find out what we think of this Forex broker in our Hankotrade review.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Hankotrade Summary

| 🗺️ Country Regulation | Unregulated |

| 💱 Trading Fees | No Commission CFD trading, Shares |

| 📊 Trading Platforms | MT4, MT5 and Act Trader |

| 💰 Minimum Deposit | $10 |

| 💰 Funding Fees | $ |

| 🛍️ CFDs Offered | Forex, Commodities, Cryptocurrencies, Indices |

| 💳 Credit Card Deposit | No |

Why Choose Hankotrade

Hankotrade uses a no-dealing desk with an ECN execution model and trades with high leverage; however, they are not regulated by any financial regulator. While their currency markets are extensive, we think they are lacking in other asset classes, including CFD indices, commodities, energy, and shares.

We thought the spreads for their standard ECN account seemed a bit high, and their funding options are pretty limited as well, given you can only fund your account with cryptocurrency.

Hankotrade Pros and Cons

- Tight spreads

- Low commissions

- Extensive range of FX markets to trade

- Negative balance protection

- Virtual Private Server is offered and compatible with EA’s, hedging and scalping

- Unregulated

- No segregated client accounts

- No shares, and limited commodity, energy, and cryptocurrency markets

- No educational resources

- Limited information available on the website

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Fees

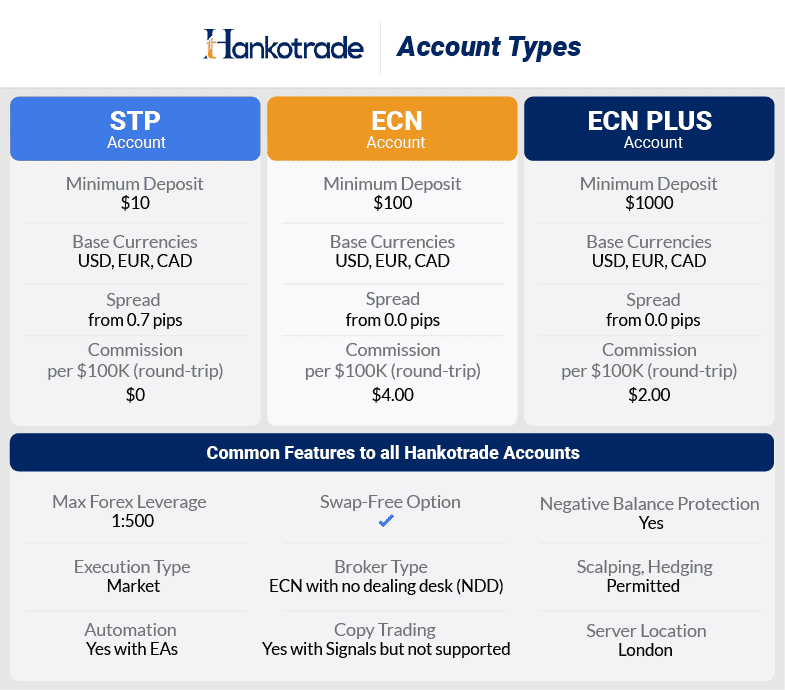

According to the Hankotrade website, spreads start from 0.7 pips on their STP accounts, which is relatively standard for brokers that offer competitive spreads of this type.

Spreads

For their Best ECN Forex Brokers account and ECN Plus Account, spreads start from as little as 0 pips, but they will charge a commission when you place a trade.

Being a pure Electronic Communication Network (ECN) broker, Hankotrade aggregates prices directly from third-party liquidity providers, including banks and other market participants. As such, the prices and spreads can vary according to market volatility.

We were curious whether Hankotrade really does offer spreads from 0.7 pips on their standard STP accounts. We spoke to them via their live chat, and while they couldn’t provide us with any numbers, they did confirm they offer raw spreads, which are variable and dependent on market liquidity.

We proceeded to analyse some of their spread metrics ourselves and found them to be significantly higher, but still quite competitive nonetheless.

STP Spreads

Our findings revealed that their spreads on EUR/USD and GBP/USD were 1.1 pips and 1.3 pips, respectively. While this doesn’t place Hankotrade at the top of the leaderboard, they aren’t bad numbers.

For comparison, IC Markets and Pepperstone, who are two of the leading brokers in the market, offer spreads on EUR/USD from 0.62 and 1.1 pips, respectively, while for GBP/USD, they offer 0.83 and 1.1 pips. These numbers, like with Hankotrade, are taken from the broker’s websites and updated each month.

| EUR/USD | GBP/USD | AUD/USD | |

|---|---|---|---|

| IC Markets | 1 | 1.2 | 1 |

| Pepperstone | 1.1 | 1.3 | 1.1 |

| IG | 1.13 | 1.66 | 1.01 |

| XTB | 0.9 | 1.4 | 1.3 |

| City Index | 0.80 | 1.80 | 0.90 |

| Saxo Markets | 1.1 | 1.8 | 1.1 |

| Hankotrade | 1.2 | 1.4 | 1.4 |

We also have done our own testing for the Standard Account Spreads. And, while we have not tested Hankotrade ourselves, we can say that overall, IC Markets and Fusion Markets have some of the most competitive spreads on the market, and these brokers are regulated.

ECN Spreads

Hankotrade were kind enough to provide us with their average spreads on the ECN account when we asked the customer support team via email. For EUR/USD, GBP/USD, and AUD/USD currency pairs they were 0.2, 0.4, and 0.6 respectively at the time of testing. Again, while this doesn’t put Hankotrade at the top of the leaderboard, they are competitive spreads. However, when you factor in the low commission costs, Hankotrader are very good.

| EUR/USD | GBP/USD | AUD/USD | |

|---|---|---|---|

| Pepperstone | 0.1 | 0.3 | 0.1 |

| IC Markets | 0.02 | 0.23 | 0.03 |

| Go Markets | 0.1 | 0.2 | 0.2 |

| FP Markets | 0.08 | 0.39 | 0.35 |

| IG | 0.16 | 0.59 | 0.29 |

| BlackBull Markets | 0.1 | 0.1 | 0.2 |

| Hankotrade | 0.20 | 0.40 | 0.60 |

Like with the Standard Account, we have done our own tests for commission or raw spread trading accounts. Fusion markets is an excellent choice along with City Index (in Australia) and IC Markets.

Swap-Free Account

Hankotrade offers an Swap Free Islamic Accounts which is ‘swap-free’ and ‘commission-free’ for Muslim traders, although you will be charged a fixed administration fee instead of the regular swap fees.

We should point out that fees are charged after two days of opening a position which is significantly less than some other brokers like Pepperstone which charges after 10 days.

Verdict on Hankotrade Spreads

When it comes to spreads, we think this is one particular area where Hankotrade really shines. While we wished they published spreads on their website for transparency, that’s the only criticism we have.

Trading Platforms

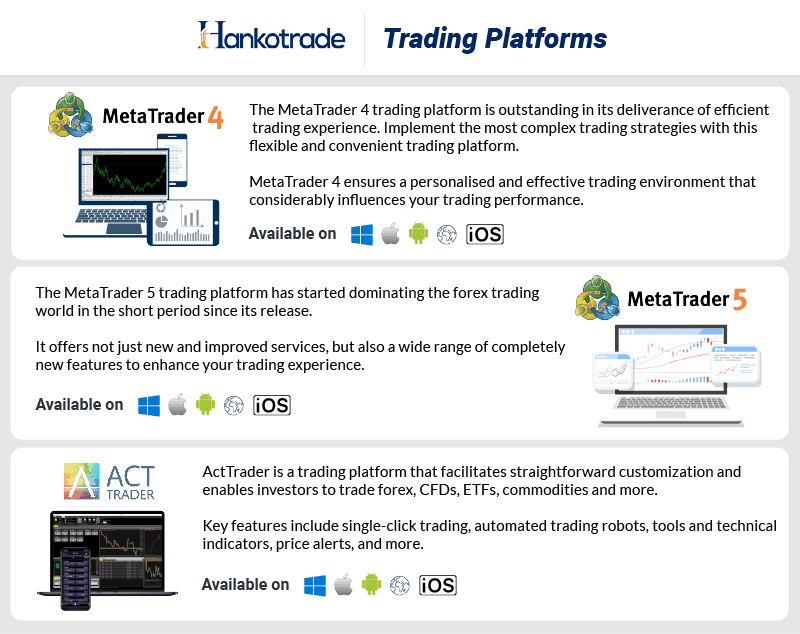

Hankotrade offers trading via MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms and ActTrader. We think it’s good that these platforms are integrated as they are very popular and boast large online communities with impressive functionality, including customised indicators for automated trading strategies.

| Trading Plaform | Available With Hankotrade |

|---|---|

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

The MT4 mobile app is useful when on the move and provides you with almost complete functionality, enabling you to access market data, monitor and place trades, and use EAs for automated trading strategies.

MetaTrader 5

Hankotrade also offers trading via MT5; however, in our view, one of the key selling points of using the platform is the ability to trade shares, but as we mentioned, Hankotrade doesn’t offer shares, which sort of defeats the purpose.

With that being said, MT5 still offers you enhanced functionality compared with MT4, which you can still apply to your forex trading.

There are more indicators (38 vs 30), analytical tools (44 to 33) and timeframes (21 to 9). The only thing that holds the platform back is that MT5 isn’t exactly compatible with MT4, and most traders are comfortable with MT4 and don’t wish to change what they are already familiar with.

For crypto lovers, another cool feature about MT5 is the ability to trade on a Bitcoin-denominated account. If you wish to know, see our deep dive for the differences between MetaTrader 4 vs MetaTrader 5 to help you decide.

ActTrader

Hankotrade is also available on ActTrader, which can be accessed on desktop, webtrader, iOS and Android. In terms of functionality, ActTrade offers many of the same features MT4 provides, including one-click trading, price alerts, customisable trading windows, and built-in indicators.

Verdict on Hankotrade Trading Platforms

In general, we think Hankotrade provides a decent offering given it is integrated with MT4, MT5 and ActTrader, although we would have liked to see it integrated with other platforms like cTrader and TradingView. Overall, we gave Hankotrade a moderate rating for trading platforms.

Is Hankotrade Safe?

We gave Hankotrade a trust score of 5/100 based on regulation, reputation, and reviews.

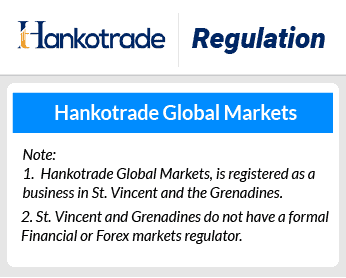

1. Regulation

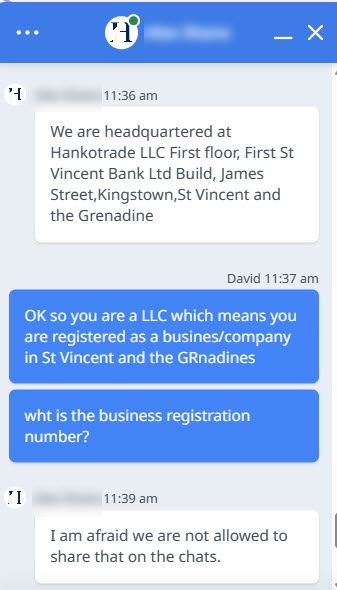

Hankotrade uses St Vincent and the Grenadines as its headquarters, where they are registered as a company; however, don’t interpret this as meaning the broker is regulated. St Vincent and the Grenadines does not have a regulator to oversee Forex brokers that are based in this country; being registered as a company simply means a firm has to comply with local laws and regulations.

| Hankotrade Safety | Regulator |

|---|---|

| Tier-1 | X |

| Tier-2 | X |

| Tier-3 | X |

While numerous resources on the internet suggest they are registered in Seychelles, we couldn’t verify this information, and oddly, the broker’s customer support team couldn’t confirm. The broker also states they have an office in Dubai, which implies they should be regulated by the DFSA, but we couldn’t find this either.

What we do know is that Hankotrade was founded in 2019 and is your typical no-frills No Dealing Desk (NDD) broker with ECN execution.

As we have mentioned, Hankotrade operates as an unregulated broker (sometimes called an offshore broker) and is headquartered in St. Vincent and the Grenadines.

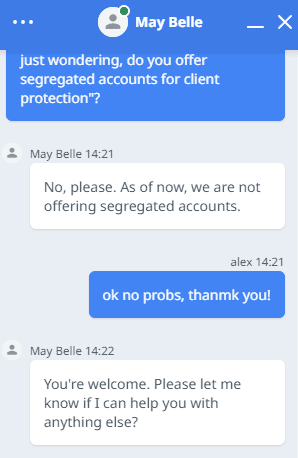

While being unregulated might be an instant turn-off for some, it doesn’t necessarily guarantee a broker is safe or not, and there are various other systems that can be put in place to protect client funds, such as segregated client accounts.

Unfortunately, we discovered Hankotrade doesn’t offer this, which means in the event of insolvency, retrieving funds could be extremely difficult as they are commingled with company assets.

2. Reputation

While numerous resources on the internet suggest that Hankotrade is registered in Seychelles, we couldn’t verify this information, nor could the broker’s customer service team.

Although, Hankotrade shows modest visibility in the online forex trading landscape. With approximately 14,800 monthly Google searches, it ranks as the 45th most popular forex broker among the 65 brokers analyzed. Web traffic data positions it slightly higher, with Similarweb reporting 187,425 global visits in August 2025, placing Hankotrade as the 46th most visited broker.

As a relatively recent entrant to the market, founded in 2019 and registered in St. Vincent and the Grenadines, Hankotrade doesn’t publicly disclose its client numbers or trading volumes. Its mid-to-lower-range positioning in both search and traffic metrics suggests a still-developing market presence rather than an established industry player. Hankotrade appears to focus primarily on emerging markets, particularly in Asia and parts of Africa, rather than pursuing a global leadership position.

| Country | 2025 Monthly Searches |

|---|---|

| United States | 9,900 |

| Canada | 480 |

| United Kingdom | 390 |

| South Africa | 210 |

| India | 210 |

| Germany | 210 |

| Australia | 170 |

| Nigeria | 110 |

| Vietnam | 110 |

| Netherlands | 110 |

| Philippines | 70 |

| France | 70 |

| Italy | 70 |

| Indonesia | 50 |

| Malaysia | 50 |

| Kenya | 50 |

| Singapore | 50 |

| Pakistan | 50 |

| Spain | 50 |

| Poland | 50 |

| Sweden | 50 |

| Turkey | 40 |

| Brazil | 40 |

| Mexico | 40 |

| United Arab Emirates | 40 |

| Austria | 40 |

| Ethiopia | 40 |

| Thailand | 30 |

| Japan | 30 |

| Egypt | 30 |

| Ghana | 30 |

| Greece | 30 |

| New Zealand | 30 |

| Morocco | 30 |

| Switzerland | 30 |

| Portugal | 30 |

| Uganda | 20 |

| Bangladesh | 20 |

| Saudi Arabia | 20 |

| Cyprus | 20 |

| Hong Kong | 20 |

| Algeria | 20 |

| Dominican Republic | 20 |

| Ireland | 20 |

| Tanzania | 10 |

| Colombia | 10 |

| Argentina | 10 |

| Cambodia | 10 |

| Taiwan | 10 |

| Venezuela | 10 |

| Peru | 10 |

| Botswana | 10 |

| Sri Lanka | 10 |

| Ecuador | 10 |

| Mauritius | 10 |

| Chile | 10 |

| Bolivia | 10 |

| Uzbekistan | 10 |

| Jordan | 10 |

| Uruguay | 10 |

| Costa Rica | 10 |

| Panama | 10 |

| Mongolia | 10 |

9,900 1st | |

480 2nd | |

390 3rd | |

210 4th | |

210 5th | |

210 6th | |

170 7th | |

110 8th | |

110 9th | |

110 10th |

3. Reviews

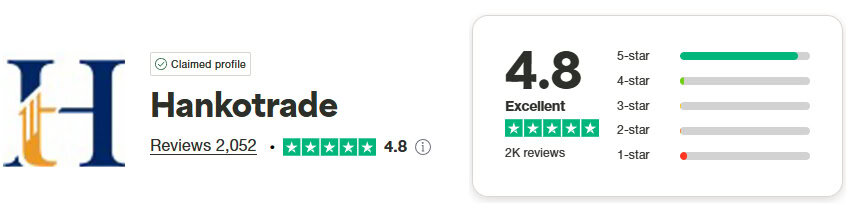

We checked Hankotrade out on Trustpilot, and they have an ‘excellent’ ranking of 4.8 and seem generally responsive to both positive and negative feedback by replying to messages posted on the forum. While most of the reviews do seem genuine, you can never be 100% sure. It should also be said that we noticed a recurring negative theme in relation to delayed fund withdrawals.

Verdict on Hankotrade’s Trustworthiness

Given that Hankotrade is unregulated and doesn’t provide segregated client accounts, we felt compelled to rank them poorly as this presents a significant risk should the broker become insolvent. While we stand by this ranking, we also want to note that it appears plenty of users and traders are happy with their offering, which is demonstrated by their ‘excellent’ Trustpilot ranking.

Deposit And Withdrawal

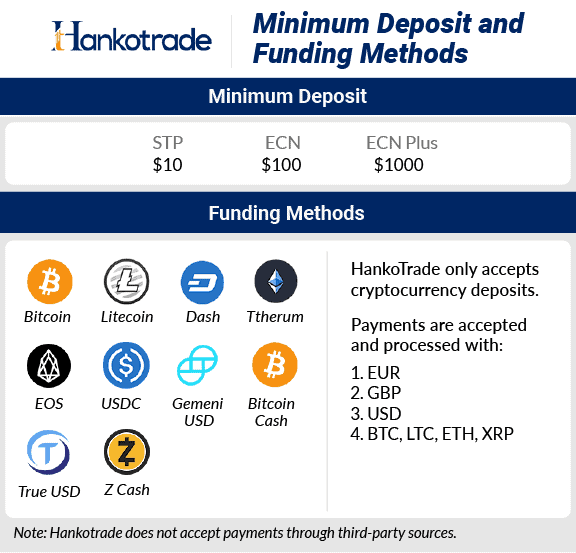

Hankotrade isn’t integrated with any third-party payment providers and only offers cryptocurrency deposits and withdrawals. They currently accept Bitcoin, Ethereum, Litecoin, Bitcoin Cash, USDC, USDT, and a few others.

What is the minimum deposit at Hankotrade?

Hankotrade has a minimum deposit of $10, but the broker recommends depositing at least $100. The minimum deposit amounts differ across all the accounts which Hankotrade offers.

The STP account has a $10 minimum, the ECN account has a $100 minimum, and the ECN Plus account has a $1,000 minimum.

Account Base Currencies

While crypto is used to fund the account, it is automatically converted when deposited into your base fiat currency, which can be either USD, EUR or CAD.

Deposit Options And Fees

Hankotrade only accepts cryptocurrency deposits with instant processing time and reimbursed fees.

| Payment Method | Processing Time | Fee |

|---|---|---|

| Bitcoin | Instant | Reimbursed |

| Litecoin | Instant | Reimbursed |

| Dash | Instant | Reimbursed |

| Ttherum | Instant | Reimbursed |

| True USD | Instant | Reimbursed |

| Gemeni USD | Instant | Reimbursed |

| USDC | Instant | Reimbursed |

| EOS | Instant | Reimbursed |

| Bitcoin cash | Instant | Reimbursed |

| Z cash | Instant | Reimbursed |

Withdrawal Options And Fees

The minimum withdrawal amount across all three account types (STP, ECN, and ECN Plus) is $50.

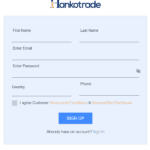

Ease To Open An Account

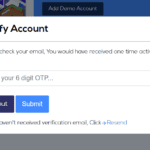

Being an unregulated broker, Hankotrade accepts clients from all over the world (with some exceptions like the UK and U.S.), and the account opening process is very quick. It took us about 1 minute to get set up with an account, which we thought was excellent.

Simply follow the below steps to get set up.

- Click register account in the top right-hand corner

- Fill out the basic information form and click sign up

- Verify your account with the link sent to your email

- Select the account you want to open

And that’s it! You should receive an email within seconds confirming your account, and then all you need to do is log in with the details provided. You can proceed to fund your account and download the platform of choice.

Verdict on Hankotrade Funding

Given Hankotrade only offers cryptocurrency funding methods, has no partnerships with third-party providers, and has minimum deposit and withdrawal restrictions, we scored the broker poorly overall.

Product Range

Hankotrade offers you a fairly standard range of forex pairs to trade, with 70 pairs in total, but unfortunately, commodities and indices are quite limited.

CFDs

For commodities and energy, only gold, silver, natural gas, and oil are available. Their CFD indices are equally limited, with just 6 markets to trade.

There are also no shares, bonds, options or ETFs, and while they do offer cryptocurrency markets, there are just three to choose from.

Verdict on Hankotrade Trading Products

We gave Hankotrade an average ranking in this category as apart from forex, the other asset class offerings are either very limited or non-existent.

Customer Service

Hankotrade’s customer support is very good and can be contacted via live chat, phone, Skype, email or web form. They are available 24/5, and every time we used their live chat feature, we were able to speak with a real person almost immediately.

The team seemed to know their stuff and had all the key information, which made the engagement smooth and useful, although we wouldn’t have needed to contact them so many times at all if they had just displayed the information on their website.

Verdict on Hankotrade Customer Support

We scored Hankotrade well for customer support given you get to speak to a real person almost immediately. Their team is helpful and happy to assist with any questions, although there were some knowledge gaps that we have outlined in this review.

Research and Education

There are no educational materials or market analysis at all on Hankotrade, which we thought was a bit of a disappointment. Additionally, their FAQs are very limited, and they don’t seem active on social media.

The one thing they do have is a forex calculator, which allows you to calculate your commissions, swap fees, pips, and margin, but this is nothing special as most forex brokers offer this at a bare minimum.

Verdict on Hankotrade Research and Education

Due to there being no educational resources of any sort on the website or on social media, we ranked Hankotrade poorly overall.

Final Verdict On Hankotrade

If you primarily trade forex and personal circumstances require use of an unregulated broker, then Hankotrade could be a good option if you’re looking for competitive spreads and high leverage. It’s also quick and easy to set up an account, and there are various account types to choose from.

We like this simplicity and flexibility, but as we have mentioned throughout the Hankotrade review, the fact they don’t have segregated client accounts is a major red flag for us. This puts retail investor accounts at significant risk in the event the forex broker becomes insolvent and therefore can’t be understated. This, combined with the lack of transparency and limited information on the website leads us to believe that the risks outweigh the benefits for Hankotrade clients.

In summary, we think Hankotrade offers competitive spreads, but we wish they were regulated and had some more client safety features in place.

While we are not in the practice of recommending unregulated brokers, we have reviewed other unregulated brokers in the past. For more information, you can read the KOT4X Review, Hugo’s Way Review, Exness Review and Trader’s Way Review.

Hankotrade FAQs

What is the minimum deposit at Hankotrade?

The minimum deposit amount starts from $10, and you can fund your account with cryptocurrency, which can be converted to either USD, EUR, or CAD as a base currency. You can denominate your account in the same three base currencies: USD, EUR, and CAD, but the minimum deposit is USD $100.

What Demo Account Does Hankotrade Offer?

Hankotrade’s demo account looks and feels just like a real account, and you can choose if you want a demo STP account, ECN, ECN Plus, or an Islamic account. Their demo accounts remain active indefinitely so long as you are using them; otherwise, they are automatically closed after 30 days if there’s no usage. You can also choose how much virtual currency you want to start with, which is a minor point, but it again speaks to the forex broker’s all-around flexibility and choice.

When setting it up, there’s no need to provide any financial details, and you can easily sign in with your Gmail account. It can also be easily converted to a live trading account.

Is Hankotrade a Safe Broker?

They have a high Trustpilot score, which may indicate that they are safe to trade with. While being unregulated might be an instant turn-off for some, it doesn’t necessarily guarantee a broker is safe or not, and there are various other systems that can be put in place to protect client funds.

What Leverage Does Hankotrade Offer?

Hankotrade offers 1:2000 maximum leverage across all accounts, which is pretty high. It should be said that using excessively high leverage is best reserved for experienced traders who understand and can afford to take the risk. Overall though, we like the flexibility and choice it provides, leaving it up to you as the trader to select whatever leverage suits your risk appetite.

How long does it take to withdraw money from Hankotrade?

Hankotrade processes withdrawals efficiently and safely. Withdrawals are typically processed within 24 business hours.

Alternatives to Hankotrade

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert