Mitrade Review 2026

Mitrade operates as a commission-free broker with a proprietary platform. I signed up and tested their spreads, platform features, and trading conditions to see how their approach with 400+ instruments and spreads from 0.05 pips works for traders around the world.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Mitrade Summary

| 🗺️ Tier 1 Regulation | ASIC (Australia),CySEC(EU), CIMA, FSCA |

| 📊 Trading Platforms | MiTrade Trading Platform (TradingView-powered) |

| 💰 Minimum Deposit | AUD100, EUR50, USD20-50 |

| 💰 Deposit/Withrawal Fees | No fees from MiTrade (3rd-party fees may apply) |

| 🎮 Demo Account | Yes – $50,000 virtual funds, 90 days |

| 💰 Funding Methods | Visa,MC,Bank,Skrill,Neteller,QR,PayID,Apple/Google Pay |

| 🛍️ CFDs Offered | CFDs (Forex, Stocks, Indices, Commodities, Crypto, ETFs) |

Why Choose Mitrade

I’d recommend Mitrade because they provide commission-free forex trading with spreads from 0.05 pips on EUR/USD and access to 59 currency pairs. You get leverage up to 1:30 on forex for retail accounts (1:500 for Pro accounts in Australia) and a proprietary platform with 150+ indicators.

While Mitrade offers competitive pricing and regulation from tier-1 authorities, you need to understand the limitations. There’s no MT4, MT5 or tradingView platform support, no RAW accounts and withdrawal processing can take 2-3 business days depending on your method.

Mitrade Pros and Cons

Here are the Mitrade pros and cons to consider:

- Tier-1 regulation in key markets

- Commission-free trading structure

- MiTrade platform with 150+ indicators

- 4.7/5 Trustpilot rating

- No MT4, MT5 or tradingView platforms

- No Islamic swap-free accounts

- No ECN or Raw account option

- Inactivity fees apply

The overall rating is based on review by our experts

Account Types and Trading Fees

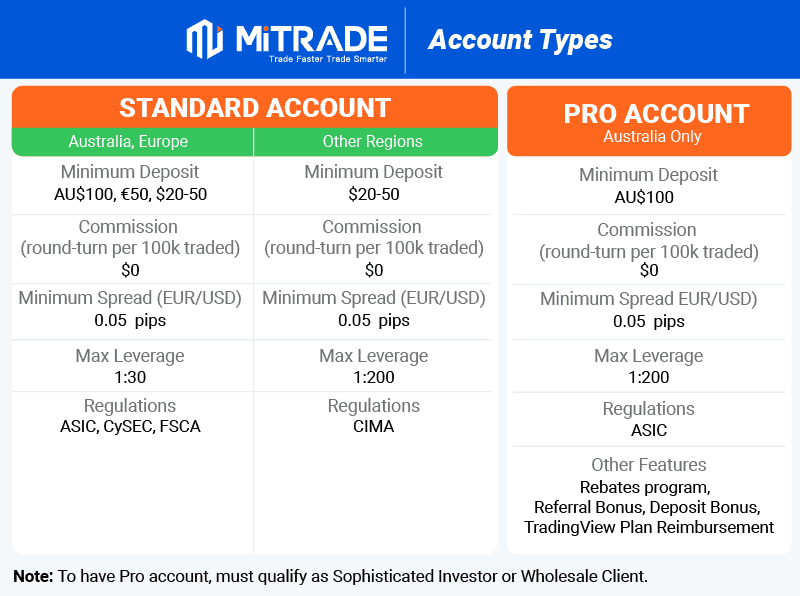

Mitrade offers two account types with varying features depending on your jurisdiction. Standard Account is available globally, while Pro Account is exclusive to select regions for qualified investors only.

Standard Account (Global)

Mitrade’s Standard account features variable spreads from 0.05 pips on EUR/USD (1.3 pips average) with zero commission on all CFDs. You get access to 400+ instruments across all markets.

The minimum deposit varies by your base currency. Australian traders need AUD 100, European traders need EUR 50, and traders in other countries face minimum deposits ranging from USD 20 to 100.

Leverage also varies by jurisdiction as Mitrade must comply with domestic regulations. Traders in Australia and the UK get 1:30 leverage on major forex pairs and 1:20 on minor and exotic pairs. If you are outside Australia or Eurrope, you can access leverage up to 1:200 on forex pairs.

Unlike many brokers, Mitrade does not offer an ECN or Raw spread account. This is because Mitrade operates using a market maker execution model rather than a no-dealing desk structure.

Accounts sitting dormant for 6 months with balances under $100 get charged $10 monthly inactivity fees.

Pro Account (Australia)

If you are based in Australia and you qualify as a sophisticated investor or wholesale client you can access Mitrade’s Pro Account. The main difference with this account is that you can trade with higher leverage, which is 1:200 for Forex pairs.

The Pro Account includes additional benefits: rebates program, referral bonuses, deposit bonuses, and TradingView Plan reimbursement. Spreads and commission structure remain identical to Standard at 0.05 pips minimum (1.3 pips average) with zero commission.

To qualify for a Pro Account, you must meet your local regulator’s definition of a sophisticated investor. In Australia, for example, this typically requires minimum net assets of AUD 2.5 million or annual income exceeding AUD 250,000 for the past two years, certified by a qualified accountant. Requirements vary by jurisdiction.

Trading Fees – Spreads

Mitrade provides commission-free forex trading, meaning all your trading costs are built into the spread rather than paying separate commissions. This simplified fee structure makes cost calculation straightforward – what you see in the spread is what you pay.

When I tested Mitrade’s commission-free account, I found the minimum spread around 0.05 pips for EUR/USD. However, industry testing shows the average spread sits closer to 1.3 pips during normal trading conditions, which is 18% wider than the industry average of 1.1 pips for commission-free accounts.

Compared to competitors, Mitrade’s 1.3 pip average on EUR/USD costs approximately $13 per standard lot. This sits above IC Markets’ ECN account at $8 total cost (spread + commission) but below some pure market-makers charging 1.5+ pips. If you’re a retail trader making occasional trades, the commission-free simplicity often outweighs the slightly wider spreads.

Standard Account Spreads Comparison | |||||

|---|---|---|---|---|---|

| 0.30 | 0.50 | 0.90 | 1.10 | 0.70 |

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.00 | 1.20 | 1.00 | 1.00 | 1.10 |

| 1.10 | 1.20 | 1.50 | 1.40 | 1.40 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 0.70 | 0.70 | 0.90 | 0.80 | 0.80 |

| 1.60 | 2.30 | 1.80 | 1.80 | 2.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Swap-Free Account

Unfortunately, Mitrade does not offer swap-free Islamic accounts. If you’re a Muslim trader who needs to comply with Sharia law, Mitrade is not suitable. You’ll need to look at brokers like IC Markets, Pepperstone, or Exness that provide swap-free options.

Trading Execution

Mitrade operates as a market maker broker, which means you trade directly with Mitrade rather than being connected to external liquidity providers through ECN execution. The broker provides decent execution with their proprietary platform, though spreads tend to be wider compared to ECN brokers offering Raw spread accounts.

This market maker model works if you’re a position trader or swing trader who holds positions longer. However, the wider spreads can make frequent trading or scalping more expensive compared to brokers offering ECN accounts with tighter spreads plus commission structures.

My Verdict On Mitrade Trading Fees

During my tests, I felt that Mitrade’s trading fees were adequate if you’re a casual trader making 5-10 trades monthly who values the simplicity of commission-free trading. The 0.05 pips minimum spreads during peak hours are genuinely competitive, but you need to understand these widen to 1.3 pips average throughout the trading day – typical for market maker execution.

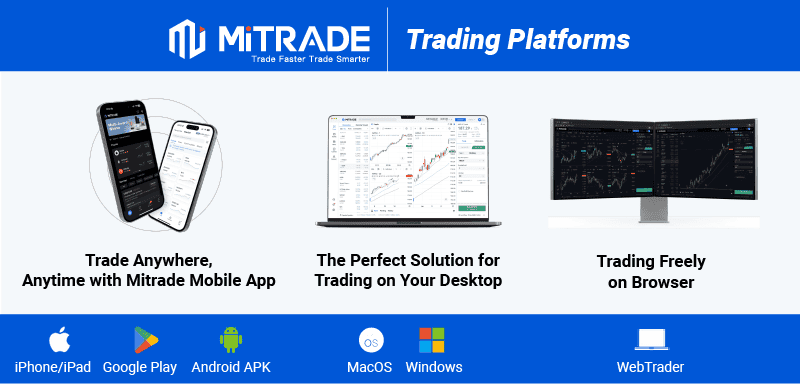

Trading Platforms

Mitrade provides you with their proprietary Mitrade trading platform. This platform is available for Windows and MacOS desktops, web browsers, along with Android and iOS mobile applications. Personally, I found the lack of MetaTrader options disappointing, especially if you need algorithmic trading capabilities.

You can open a demo account with $50,000 in virtual funds valid for 90 days, giving you three months to test the platform risk-free. The demo account provides real-time price feeds identical to a live account, allowing you to experience actual market conditions without financial risk.

Mitrade Proprietary Platform

Platform functionality is a key consideration as the tools you have on hand determine if you make or break the trade. Mitrade’s proprietary trading platform is powered by TradingView charting technology with many built-in trading tools and features available at your disposal, including:

Indicators: There are 150+ technical indicators including Moving Averages, Bollinger Bands, RSI, MACD, and Stochastic Oscillator to help you analyse price trends, identify potential entry and exit points, and assess market conditions.

Drawing tools: 74 drawing tools are available for technical analysis including trend lines, Fibonacci retracements, Elliott Wave patterns, and channels for identifying support and resistance levels and potential breakouts.

Different chart types: You can choose from 7 chart types including Candlestick, Hollow Candlestick, Heikin Ashi, Bar, Line, Area, and Baseline to analyse price action from different visual perspectives.

Timeframes: There are 10 timeframes ranging from 1 minute to 1 month which allow you to analyse price movements over varying periods suitable for scalping, day trading, swing trading, or position trading.

Integrated tools: The platform includes a real-time economic calendar, market news feed, and one-click trading functionality built directly into the interface so you can monitor events and execute trades without switching between multiple sources.

However, the platform lacks automated trading capabilities entirely. You cannot run Expert Advisors, trading bots, or algorithmic strategies. Additionally, there’s no copy trading, no social trading features, and no MetaTrader 4, MetaTrader 5, or cTrader support.

Also, the TradingView integration is limited to charting tools only – you cannot access TradingView’s social features, community scripts, or Pine Script custom indicators. The platform provides excellent charting but nothing beyond that.

Social Trading

Unfortunately, Mitrade doesn’t support social or copy trading features. The same applies for algorithmic trading tools. As such, Mitrade is very direct in its platform offering, focusing purely on its proprietary platform without additional social or automated trading functionality.

If you’re a beginner trader that wants to leverage the experience and success of expert traders via copy trading before you venture into proper trading, Mitrade is not for you. You’ll need to develop your own trading strategies or look at brokers like eToro or Pepperstone that offer copy trading.

Mobile Trading Apps

Mitrade provides mobile applications for both iOS and Android devices, which can be downloaded from app stores. Interestingly, you can also download the app as .apk file if you use Android. The mobile version maintains most of the desktop functionality with an interface optimised for smartphone screens.

Features on the app include:

- 11 timeframes

- Support for indicators like MACD, RSI, KDJ, TRIX, CCI, DMA

- Watchlist

- Price alerts

- Free Economica data (including some exclusive in-depth market analysis)

I found the mobile app responsive and well-designed, making it practical to monitor positions and execute trades on the go. The app includes real-time price quotes and TradingView charts, one-click trading capability, economic calendar, account management features, and news feed integration.

The mobile experience is solid for monitoring and quick trades, but complex analysis with multiple indicators is naturally better suited to the desktop version with larger screens and more workspace.

No MetaTrader 4, MT5 or Tradingview Platforms

Mitrade has never offered MetaTrader 4, MT5 and TradingView focusing exclusively on their proprietary platform. For me, this is a significant limitation if you’re an experienced trader accustomed to MT4 or MT5 functionality and ecosystem.

This lack of MetaTrader support is particularly disappointing if you’ve invested time developing strategies or custom indicators on these platforms. Moving to Mitrade would require abandoning algorithmic trading entirely and rebuilding your entire trading setup as manual-only.

In addition to MetaTrader, Mitrade does not offer cTrader or standalone TradingView platforms. The TradingView integration exists purely as charting technology within Mitrade’s proprietary interface, not as a standalone trading platform.

My Verdict On Mitrade’s Trading Platforms

I appreciate that Mitrade has integrated TradingView technology into their proprietary platform, providing excellent charting capabilities with 150+ indicators and 74 drawing tools. The platform is well-designed and suitable if you’re a beginner or intermediate trader who values simplicity and visual clarity.

However, the complete absence of MetaTrader platforms and algorithmic trading capabilities is a severe limitation for experienced traders. If you use Expert Advisors, trading bots, or have developed automated strategies, Mitrade is completely unsuitable for you. The inability to automate your trading removes a critical tool that many rely on.

Is Mitrade Safe?

Based on my research, I found Mitrade is safe from an operational and regulatory perspective. The broker has been operating for 14 years since 2011 and maintains regulatory oversight from multiple jurisdictions. Depending on your location, regulatory protection strength varies significantly.

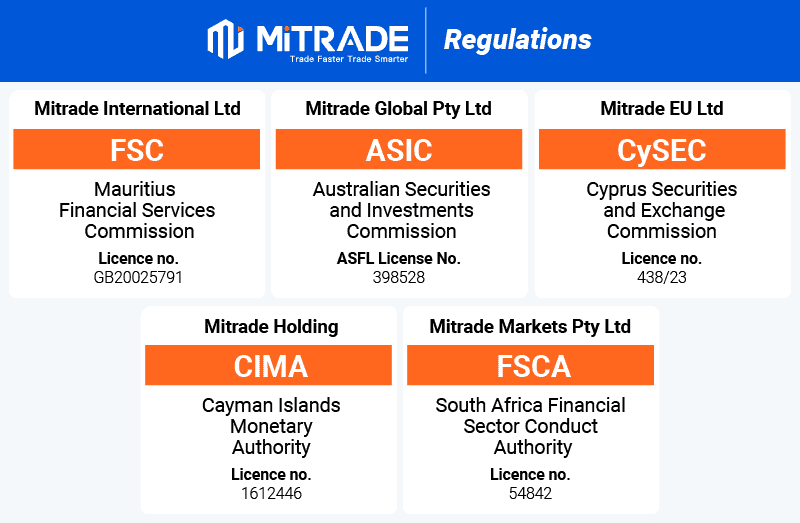

Regulation

Mitrade operates through multiple regulated entities worldwide, and which one regulates your account depends entirely on your location. Depending on where you live, you may fall under tier-1 regulation with strong consumer protection, or offshore regulation with minimal safeguards.

Mitrade’s regulatory licences include:

- Australian Financial Services Licence (AFSL) in Australia (licence 398528)

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus (licence 438/23)

- Financial Services Commission (FSC) in Mauritius (licence GB20025791)

- Cayman Islands Monetary Authority (CIMA) in the Cayman Islands (licence 1612446)

- Financial Sector Conduct Authority (FSCA) in South Africa (licence 54842)

You must understand which entity regulates your account before opening. Australian and European clients receive tier-1 regulatory protection with segregated funds, investor compensation schemes, and ombudsman access. Australian clients are regulated by ASIC, and clients in the EU by CySEC.

UK clients fall under CIMA offshore regulation, not FCA, which provides weaker protection but still something. Clients in other regions typically fall under FSC Mauritius or other offshore entities (including CIMA) with minimal consumer safeguards.

The regulatory entity assigned to your account determines your level of protection, compensation eligibility, and dispute resolution options. If regulatory security matters to you, verify which Mitrade entity you’ll be registered under based on your residence.

Reputation

Mitrade has been offering trading services since 2011, building substantial operational experience over 14 years. The broker was founded in Melbourne, Australia, and maintains a strong presence globally with over 3 million registered users according to their marketing materials.

The broker shows solid visibility in the online trading landscape. Mitrade has won several industry awards including “Forex Customer Satisfaction & Happiness Asia 2024” and “Best Forex Trading App Australia 2023”, demonstrating recognition within the industry.

I haven’t found significant regulatory fines or enforcement actions against Mitrade’s ASIC or CySEC regulated entities, which is a positive indicator of compliance with regulatory requirements. The broker’s 14-year operating history without major scandals or regulatory issues suggests stable operations and proper business conduct.

Broker Popularity

Vietnam emerges as Mitrade’s strongest market with 5,400 monthly searches, whilst Taiwan, Indonesia, Thailand, and Malaysia generate between 1,000-3,600 searches each. Australia, where Mitrade was founded, registers just 880 monthly searches – surprisingly low given the broker’s Melbourne origins.

This pattern shows Mitrade has built stronger brand recognition in newer Asian markets than in their home country. European markets show moderate search volumes, indicating Mitrade operates with established but not dominant brand recognition in these regions compared to their Asian strongholds.

| Country | 2025 Monthly Searches |

|---|---|

| Vietnam | 5,400 |

| Taiwan | 3,600 |

| Indonesia | 1,900 |

| Thailand | 1,600 |

| Malaysia | 1,000 |

| Australia | 880 |

| Philippines | 720 |

| Brazil | 590 |

| Hong Kong | 480 |

| India | 390 |

| Singapore | 390 |

| United States | 320 |

| Japan | 320 |

| Cambodia | 170 |

| Germany | 140 |

| Spain | 110 |

| United Kingdom | 110 |

| Mexico | 110 |

| Italy | 90 |

| Cyprus | 90 |

| Panama | 90 |

| Canada | 70 |

| Pakistan | 70 |

| Nigeria | 50 |

| United Arab Emirates | 40 |

| France | 30 |

| Netherlands | 30 |

| Saudi Arabia | 30 |

| Turkey | 30 |

| South Africa | 30 |

| Bangladesh | 30 |

| Poland | 20 |

| Portugal | 20 |

| Colombia | 20 |

| Argentina | 20 |

| Egypt | 20 |

| New Zealand | 20 |

| Chile | 10 |

| Peru | 10 |

| Ecuador | 10 |

| Austria | 10 |

| Switzerland | 10 |

| Morocco | 10 |

| Bolivia | 10 |

| Algeria | 10 |

| Dominican Republic | 10 |

| Venezuela | 10 |

| Ireland | 10 |

| Sweden | 10 |

| Costa Rica | 10 |

| Guatemala | 10 |

| Uruguay | 10 |

| Greece | 10 |

| Jordan | 10 |

| Honduras | 10 |

| Uzbekistan | 10 |

| Sri Lanka | 10 |

| Kenya | 10 |

| Ghana | 10 |

| Uganda | 10 |

| Tanzania | 10 |

| Mauritius | 10 |

| Ethiopia | 10 |

| Botswana | 10 |

| Mongolia | 10 |

5,400 1st | |

3,600 2nd | |

1,900 3rd | |

1,600 4th | |

1,000 5th | |

880 6th | |

720 7th | |

590 8th | |

480 9th | |

390 10th |

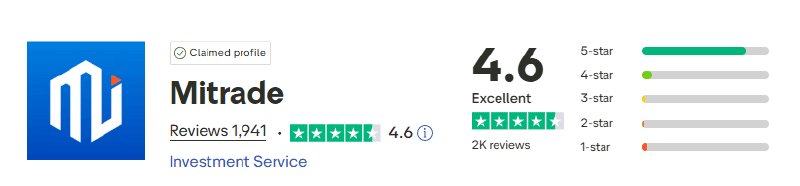

Reviews

Mitrade scores 4.7/5 on Trustpilot from over 1,800 user reviews. I observed most feedback praised the platform’s user-friendliness, quick trade execution, and responsive customer service. Users particularly appreciated how easy the platform is for beginners compared to complex MT4/MT5 interfaces.

The main complaints I encountered involved withdrawal processing times taking 3-5 business days, which some users found slower than competitors. A few users reported verification difficulties requiring multiple document submissions. However, these represent less than 5% of total reviews with 93% giving 4-5 star ratings.

My Verdict On Trust With Mitrade

Mitrade scored moderately in my trust assessment. The consistently positive user reviews and lack of significant regulatory issues are reassuring.

The broker appears to operate with reasonable integrity and processes withdrawals reliably. The tier-1 regulatory framework available in certain markets represents a significant advantage over pure offshore alternatives, though UK traders should note the absence of FCA regulation.

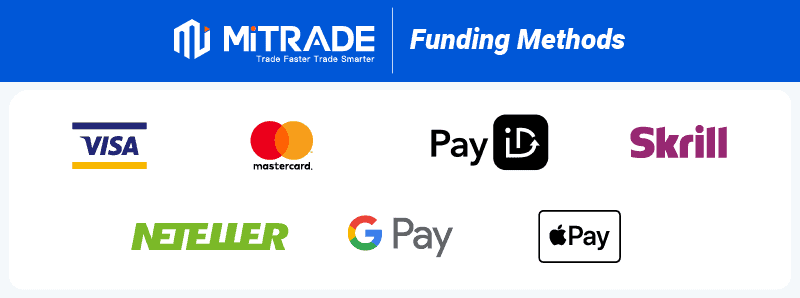

Deposit and Withdrawal

Mitrade offers decent funding options covering traditional payment methods and e-wallets. The broker charges no fees from their side for deposits or withdrawals, though third-party providers may charge their own fees.

What Is the Minimum Deposit At Mitrade?

The minimum deposit requirement varies by base currency: AUD100, EUR50, or USD20-50. This makes Mitrade reasonably accessible for retail traders, though the minimum is higher than some competitors offering $10-20 minimums.

Account Base Currencies

When opening my account, I was given the option of using USD, AUD, or EUR as the account base currency. Depending on your location and banking relationships, local currency options can eliminate currency conversion fees on deposits and withdrawals.

Traders with access to AUD or EUR base currencies benefit from avoiding the 1-3% conversion fees that would otherwise apply with USD-only accounts. This represents a significant cost advantage for those in regions where these currencies are offered.

Deposit Options and Fees

Mitrade accepts Visa/Mastercard, bank transfer, e-wallets (Skrill, Neteller), QR code payment, PayID (select regions), Apple Pay, and Google Pay. These options cover the most popular funding methods across different markets. The broker charges zero deposit fees but third-party banking fees may still apply.

Credit card deposits process instantly letting you start trading immediately. Bank transfers take 1-2 business days for funds to appear in your account. E-wallets like Skrill and Neteller process within 24 hours. Local payment methods like PayID (where available) process almost instantly. Choose your method based on how quickly you need funds available and what’s accessible in your region.

Regional payment method availability varies – some local options like PayID are only available in specific markets. SEPA transfers provide low-cost, efficient funding for European bank accounts where supported.

Withdrawal Options and Fees

Mitrade charges no withdrawal fees but processing takes up to 2 business days depending on your bank. I found this slower than some competitors offering same-day withdrawals. You must withdraw using the same method you deposited for anti-money laundering compliance.

Bank transfers can take 3-5 business days total including Mitrade’s processing time plus your bank’s clearing time. E-wallet withdrawals process faster, typically reaching your Skrill or Neteller account within 1-2 business days. Local payment methods (where available) generally process within 24 hours. Plan your withdrawals accordingly if you need funds quickly.

Ease To Open An Account

I found opening an account with Mitrade straightforward and quick. After clicking “Trade Now” at the top-right corner, I selected my country of residence, provided my email address, and requested a verification code to confirm.

Once I set my password, I completed my personal information including financial background and employment details. To verify my account, I uploaded my ID (passport or driver’s license) and proof of address (utility bill or bank statement). The verification process took approximately 24-48 hours.

All in all, a smooth account opening experience taking less than 10 minutes to complete the application. The verification wait time sits within industry norms. You can use the demo account immediately while waiting for verification to complete.

My Verdict On Deposit and Withdrawal With Mitrade

I was generally satisfied with Mitrade’s deposit and withdrawal structure, particularly the lack of fees from Mitrade’s side on both deposits and withdrawals. The minimum deposit (ranging from $20-100 depending on currency) is accessible for retail traders without being so low that it encourages undercapitalised trading.

The availability of local currency base accounts (where offered) eliminates the 2-4% conversion fees that would otherwise apply with USD-only accounts. This cost saving makes Mitrade more attractive than brokers forcing currency conversion on every transaction, though currency options vary by jurisdiction.

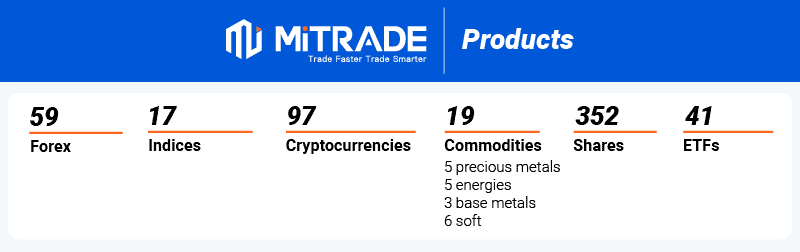

Product Range

Mitrade offers a range of 400+ instruments across different markets. However, most of the popular instruments are available:

- Forex: 59 currency pairs (majors, minors, exotics) with 1:200 leverage

- Shares: 352 stock CFDs with 1:10 leverage

- Indices: 17 global indices with 1:200 leverage

- Cryptocurrencies: Major crypto CFDs including Bitcoin, Ethereum with 1:10 leverage

- Commodities: 19 commodities including gold, silver, oil with 1:100 leverage

- ETFs: 41 Exchange Traded Funds with 1:10 leverage

The 59 forex pairs cover all majors (EUR/USD, GBP/USD, USD/JPY) and popular crosses but lack some exotic pairs available at larger brokers offering 80-100+ pairs. For most traders focusing on major and minor pairs, Mitrade’s forex selection proves adequate.

My Verdict On Mitrade’s Product Range

With 400+ instruments, I found Mitrade provides adequate coverage across traditional markets. The 59 forex pairs cover all major and most minor pairs you’d want to trade, though the wider spreads diminish the appeal for active forex traders compared to ECN alternatives.

Overall, the product range is comprehensive enough for most retail traders focused on traditional markets. The main limitation is the single account type (or two for Australian traders) with wider spreads – active traders would benefit more from brokers offering ECN accounts with tighter spreads across all these asset classes.

Leverage

Mitrade offers different leverage limits depending on your account type and location. Retail traders in tier-1 regulated markets face 1:30 maximum leverage on major forex pairs due to regulations like ASIC and ESMA requirements. Sophisticated investors with Pro Accounts in approved jurisdictions can access up to 1:200 leverage.

| Instrument | Retail Leverage (Standard) | Pro Leverage (Australia) and Offshore clients |

|---|---|---|

| Forex (major pairs) | 1:30 | 1:200 |

| Forex (minor pairs) | 1:30 | 1:200 |

| Gold | 1:30 | 1:200 |

| Other Commodities | 1:20 | 1:100 |

| Indices | 1:20 | 1:100 |

| Stocks | 1:5 | 1:10 |

| ETFs | 1:5 | 1:10 |

| Cryptocurrencies | 1:2 | 1:10 |

The 1:30 retail leverage restriction reflects ASIC and ESMA consumer protection regulations designed to limit excessive risk for retail traders. While some traders find this restrictive compared to offshore brokers offering higher leverage, the lower leverage actually protects you from catastrophic losses.

Mitrade provides negative balance protection ensuring you cannot lose more than your account balance even with leverage. This protects you from owing money to the broker if extreme volatility creates losses exceeding your deposits, which is particularly important for retail traders.

Customer Service

Mitrade offers 24/5 customer support coverage in multiple languages. You can reach support through live chat, email, and a ticket system. Australian traders can also use local phone support during business hours.

The broker lists specific phone numbers for different regions including Australia, making direct phone support accessible for local traders. European traders have dedicated email support and live chat options, though phone support may involve international calling costs.

When I tested Mitrade’s live chat, the customer service agent responded within 2-3 minutes and answered my queries about spreads and platform features knowledgeably. However, when I asked about average execution speeds and specific spread data, the agent provided general information rather than precise numbers.

The platform offers a comprehensive FAQ section and Help Centre covering common queries related to account setup, trading functionality, fees, and platform features. This self-service resource is well-organised with search functionality and helpful if you prefer finding answers independently rather than contacting support.

My Verdict On Mitrade’s Customer Service

My experience with Mitrade’s customer service was generally positive. The live chat availability is adequate for most trading needs, covering major market hours for European, American, and Asian sessions. When agents are available, the quality is decent with knowledgeable responses and reasonable wait times under 3 minutes.

Overall, customer service is adequate and meets basic expectations, though it’s not a particular strength of Mitrade’s offering. The support is functional and responsive enough for most trading needs without being exceptional.

Research and Education

Under Mitrade’s “Learn” section, the broker offers 4 categories: Basics, Education, Insights, and Academy. The Basics and Education sections provide light introductory trading information and FAQs. The substantial content lives in Insights and Academy.

Insights

The Insights section delivers daily market news, technical analysis articles, and in-house trading tools. I found the economic calendar useful for tracking high-impact events. The market analysis updates regularly with both fundamental news coverage and technical chart analysis.

The quality of the research content is decent though not exceptional. Mitrade could benefit from incorporating third-party content from providers like Trading Central or Autochartist for additional analysis perspectives. The current in-house content works for casual traders but lacks depth for serious market analysis compared to premium broker research offerings.

Education/Mitrade Academy

Mitrade’s YouTube channel hosts 30+ educational videos covering trading strategy development, risk management, and basic trading knowledge for beginners. I found the Mitrade Academy particularly valuable, offering free short courses on trading fundamentals and different asset types.

My main criticism is insufficient coverage of fundamental analysis and trading psychology. The educational content focuses heavily on technical analysis and platform features. Beginners would benefit from more comprehensive lessons on economic indicators, central bank policy, and managing emotions when trading.

My Verdict on Mitrade’s Research and Education

I thought Mitrade provides adequate educational content for beginners learning basic trading concepts, though it’s not particularly comprehensive or advanced. The Learning section covers essentials without overwhelming new traders, making it suitable if you’re starting your trading journey.

However, the research tools are basic and insufficient if you’re an experienced trader requiring detailed fundamental analysis, advanced screening capabilities, or proprietary market research. The gap between basic education and limited advanced research reflects Mitrade’s positioning as a retail-focused broker targeting newer to intermediate traders.

If you’re learning to trade, Mitrade’s educational resources are adequate to get started. If you’re experienced and need advanced research tools, comprehensive fundamental data, or proprietary analysis, you’ll find Mitrade’s offerings insufficient.

Final Verdict on Mitrade

Mitrade works well if you’re a casual trader making 5-10 trades monthly who values simplicity. The TradingView-powered platform delivers solid technical analysis with 150+ indicators, commission-free trading keeps costs predictable, and tier-1 regulation provides strong protection where available. The 4.7/5 Trustpilot rating backs up the positive user experience.

However, you’ll hit hard limits quickly. No MT4/MT5 means zero algorithmic trading capability, no Islamic accounts excludes Muslim traders, and the lack of ECN pricing means you pay wider spreads than active traders should accept. If you need automated strategies or tight institutional spreads, Mitrade simply can’t deliver.

I’d recommend Mitrade for casual traders who don’t need MetaTrader platforms and value straightforward execution. Avoid it if you’re an active trader, need algorithmic capabilities, or require Islamic swap-free accounts.

Mitrade FAQ's

Is Mitrade Good?

Mitrade is good for casual traders valuing platform simplicity and strong regulation. The broker offers commission-free trading with TradingView-powered charts under ASIC and CySEC oversight. However, 1:30 retail leverage, no MT4/MT5, and no ECN options limit broader appeal.

What Demo Account Does Mitrade Have?

Mitrade offers a demo account with $50,000 virtual funds valid for 90 days. You get access to all platform features, real-time market data, and 400+ instruments to practice strategies risk-free. The demo mirrors the live account environment exactly.

What is the Minimum Deposit at Mitrade?

The minimum deposit at Mitrade varies by base currency: AUD100, EUR50, or USD20-50. Available currency options depend on your regulatory jurisdiction, with local currency accounts eliminating 2-4% conversion fees on deposits and withdrawals where offered.

What Leverage Does Mitrade Offer?

Mitrade offers different leverage limits depending on your account type and location. Retail traders in tier-1 regulated markets (ASIC, ESMA jurisdictions) face 1:30 maximum leverage on forex pairs. Sophisticated investors and wholesale clients in select regions can access Pro Accounts with leverage up to 1:200 on forex. Always use stop losses and limit risk to 1-2% per trade.

Alternatives to Mitrade

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research