Purple Trading Review 2026

My Purple Trading review found this Forex Broker uses ECN, has multiple account types with discounts available and 3 types including MT4. See what I have to say about this CySEC Forex broker For the Europe Market.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Purple Trading Summary

| 🗺️ Tier 1 Regulation | Cyprus (CySEC) |

| 💱 Trading Fees | ECN Trading from 0.3 pips |

| 📊 Trading Platforms | cTrader, MT4, MT5 |

| 💰 Minimum Deposit | $ |

| 💰 Funding Fee | $ |

| 🛍️ CFDs Offered | Forex, Commodities, Shares, Indices, Futures |

Why Choose Purple Trading

I recommend Purple Trading for their transparent and trader-friendly experience with true STP/ECN trading—no dealing desk interference, no price requotes, and tight spreads starting from 0.3 pips. Their ultra-fast order execution ensures minimal latency, with over 80% of trades filled at zero or positive slippage.

Security is another big plus, with client funds held in segregated European bank accounts and protected under EU-wide regulation from CySEC. On top of that, they offer free card deposits and withdrawals.

However, there are a few drawbacks to consider before signing up with Purple Trading. Their product range is limited compared to some competitors like Pepperstone and IC Markets. Additionally, customer support is not available all day.

- ECN/STP trading environment

- No funding or account opening fees

- Good trading platforms and other useful tools

- No swap-free account

- No cryptocurrency trading

- Higher trading fees than most competitors

The overall rating is based on review by our experts

Trading Fees

There is no account opening fee on Purple Trading but you can expect deposit/withdrawal fees for wire transfers in some currencies as well as internal transfer fees. Transfer of funds between two accounts in the same currency is free but a maximum charge of 1% applies if the currencies are different.

Beyond these, there are additional trading account fees to consider.

1. Raw Account Fees and Spreads

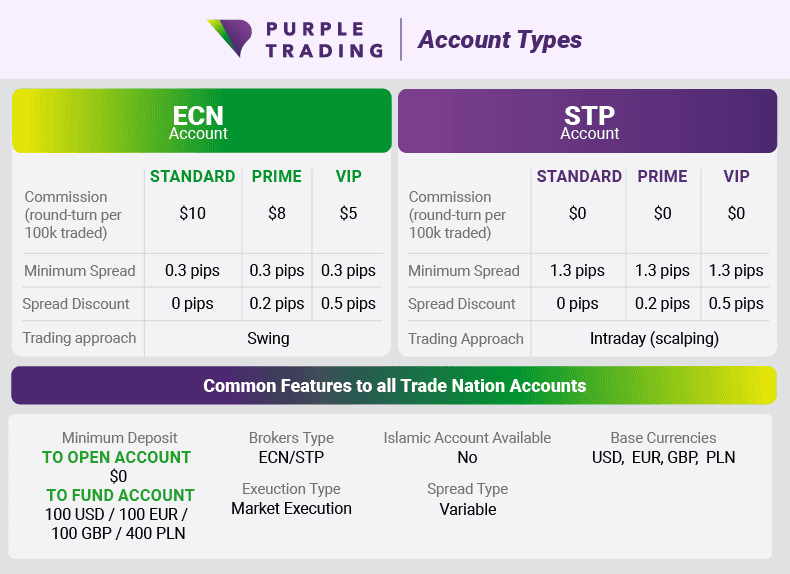

When you open an account on Purple Trading, you get their ECN account as the default account type. This account functions like what many brokers call a Raw account, meaning tight spreads sourced directly from liquidity providers, and commission-based pricing.

With spreads starting from 0.3 pips and a commission of $5–$10 per lot, I find this account type suitable for scalpers and intraday traders who prioritize cost efficiency. However, the commission structure and overall cost may not be the lowest cost option compared to other brokers.

For a frequently traded pair like EUR/USD, their 0.60 pip spread is higher than IC Markets’s 0.02 pips and Eightcap’s 0.06 pips. Similarly, their spread for cross-currency pairs exceeds what competitors offer.

RAW Account Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.70 | 0.50 | 0.90 | 0.70 | 0.90 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.01 | 0.02 | 0.50 | 0.27 | 0.30 |

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| n/a | n/a | 0.20 | 0.30 | 0.40 |

| 0.10 | 0.10 | 0.90 | 0.40 | 0.50 |

| 0.50 | 0.55 | 1.18 | 0.66 | 0.96 |

| 0.10 | 0.10 | 0.90 | 0.70 | 0.60 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

2. Standard Account Fees and Spreads

The STP account at Purple Trading is the Standard or commission-free account with costs incorporated into wider spreads starting from 1.3 pips. From my tests, spreads for this account type appear to be higher than most competitors. For example, their EUR/USD spread of 1.70 pips exceeds all listed competitors, with IC Markets offering the tightest spread at just 0.62 pips.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.80 | 1.50 | 1.50 | 1.80 | 1.70 |

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

3. Swap-Free Account and Fees

If your trading strategy involves holding positions overnight, keep in mind that Purple Trading applies swap fees, which vary by currency pair. These costs can impact long-term profitability, so it’s worth factoring them into your trade planning.

Other Fees

Purple Trading charges a quarterly dormant account fee of 15 USD (15 EUR, 15 GBP, 350

CZK). Dividend adjustments may also be applied to your trading account. This will be based on the size of the dividend, the size of your position, applicable taxes, and trade type (buy or sell) for the specific instrument.

My Verdict On IQ Option Spreads And Costs

Purple Trading’s ECN account offers spreads starting from 0.3 pips with a $10.00 commission per lot, resulting in a total cost of $13.00 per round lot. This spread is higher than the industry average, where total costs often range between $6.00-$7.00 per round lot.

Similarly, the STP account’s spread of 1.3 pips (equating to $13.00 per lot) is above the average spread of 1.1-1.2 pips for standard accounts. Therefore, in comparison to industry standards, Purple Trading’s trading fees seem to be on the higher side.

Trading Platforms

The trading platforms available on Purple Trading are cTrader, MT4 and MT5. They are all available for download on desktop, mobile, and tablet devices and are compatible with all major online browsers. Additionally, the broker offers other tools like Purple Indicators and Currency Indices to improve the trading experience.

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

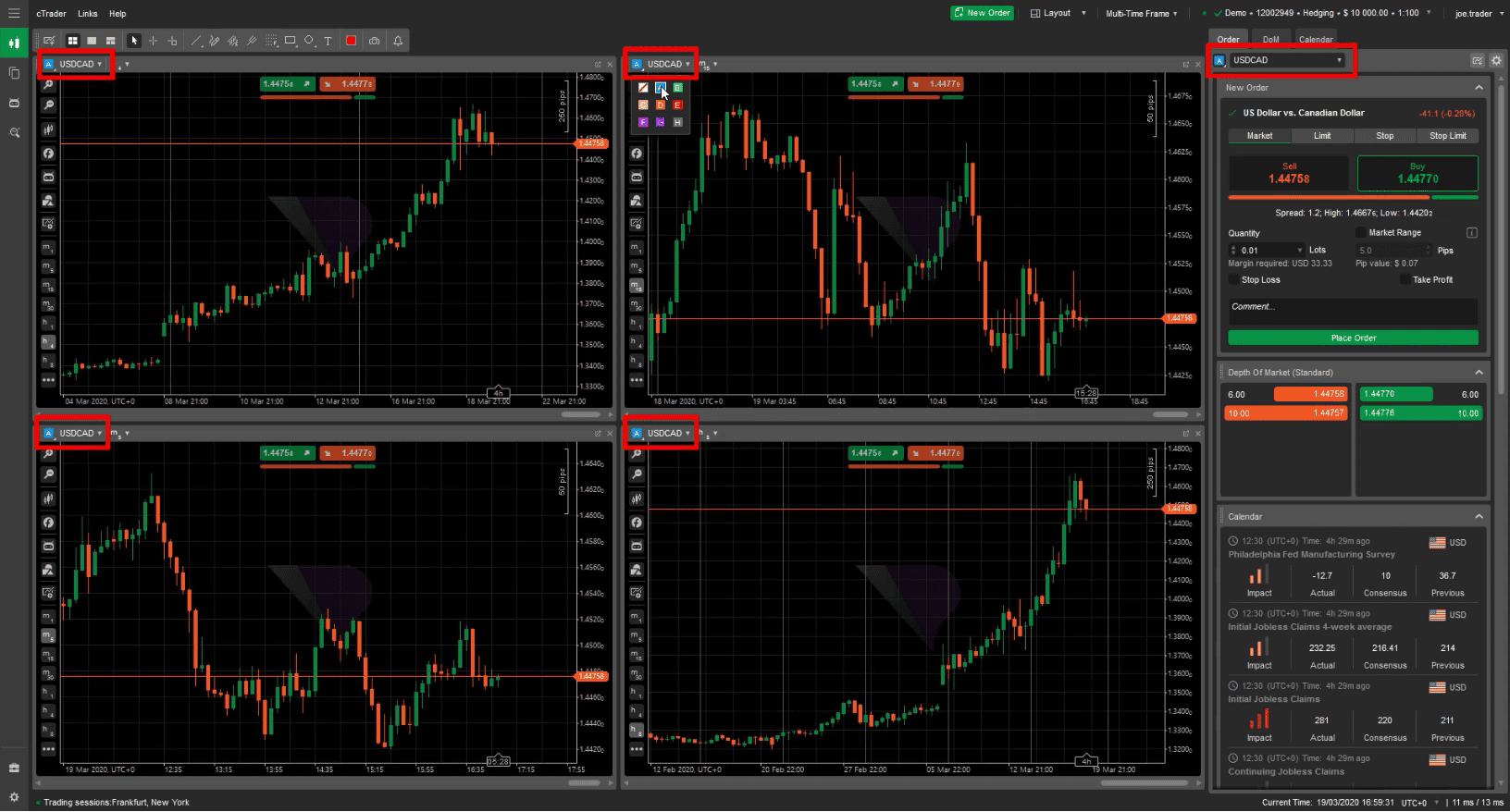

Among the platforms, cTrader is particularly appealing to me. It has a more modern interface and a full range of advanced features that cater to the needs of both novice and experienced traders, surpassing those offered by MT4. They include:

Advanced Charting & Technical Analysis

cTrader provides a variety of charting options to choose from including Bars, Candlesticks and Lines. You can access several technical analysis tools, including over 26 timeframes such as Ticks, Range, Standard, and Renko.

Thanks to its flexible chart layout options, you can choose between Single Chart Mode for viewing one chart at a time and Multi-Chart Mode for comparing multiple assets. There’s also the Free-Chart Mode for full customization of your workspace.

Furthermore, I appreciate the platform’s Smart-Size technology which automatically resizes charts whenever a window is adjusted. This technology ensures all charts remain visible and keeps your trading environment tidy without disrupting your analysis.

Depth of Market (DOM)

cTrader offers three options for assessing the depth of market – standard depth, price depth, and VWAP depth. These options provide a better view of market liquidity for different price levels and, thus aid in making more precise market entries. In comparison, MT 4 has only one market depth tool.

Algorithmic Trading with cTrader Automate

cTrader Automate allows you to develop trading robots and custom indicators to automate your trading strategies. You can use cTrader’s modern C# API to write code inside the integrated development environment as well as to backtest and deploy the robots and custom indicators.

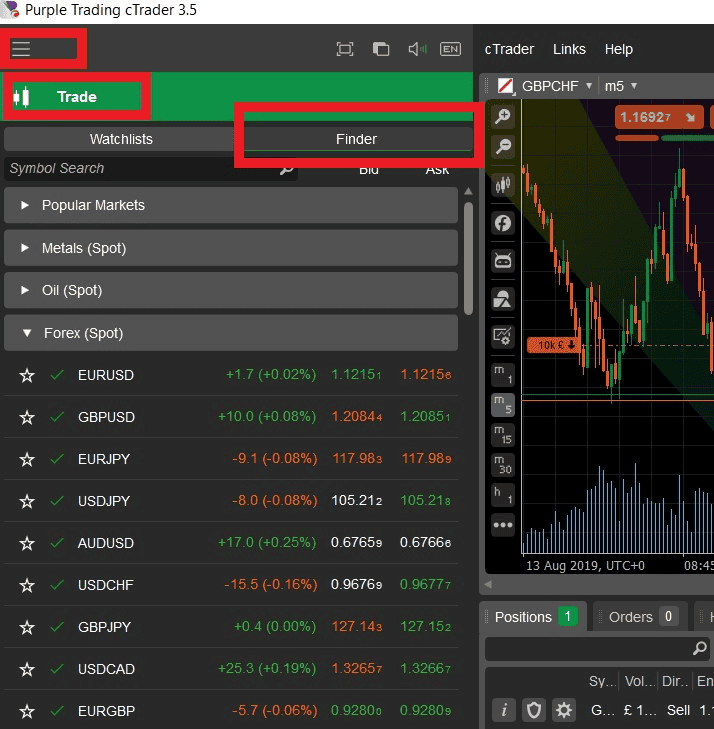

Watchlists

I found this feature particularly helpful, as it allowed me to see available instruments, currency pairs, metals, and CFDs. It also displays the real-time prices of these instruments and lets you open charts with one click. Finder enables you to locate any asset instantly with a simple search.

Advanced Order Types

cTrader supports various order types to suit different trading strategies. These include Market Orders for immediate execution, Limit Orders for precise entries, Stop Orders to capture price momentum and Trailing Stops to lock in profits automatically.

Price Alerts

cTrader offers a superior price alert system compared to MT4. This feature allows you to efficiently monitor specific price levels across various instruments for better decision-making. By setting custom alerts, you can receive notifications when an asset reaches your predetermined price.

Risk Management

To protect you from losses and risk, cTrader offers stop-loss orders to automatically close a position and limit losses if the price moves against you. You can also set trailing stop-loss orders and take-profit orders to lock in profits by closing the trade once the asset reaches a target price.

Trading Tools

In addition to the trading platforms above, the broker also provides some other useful trading tools, such as Purple Indicators and Currency Indices to assist in technical analysis.

Purple Indicators

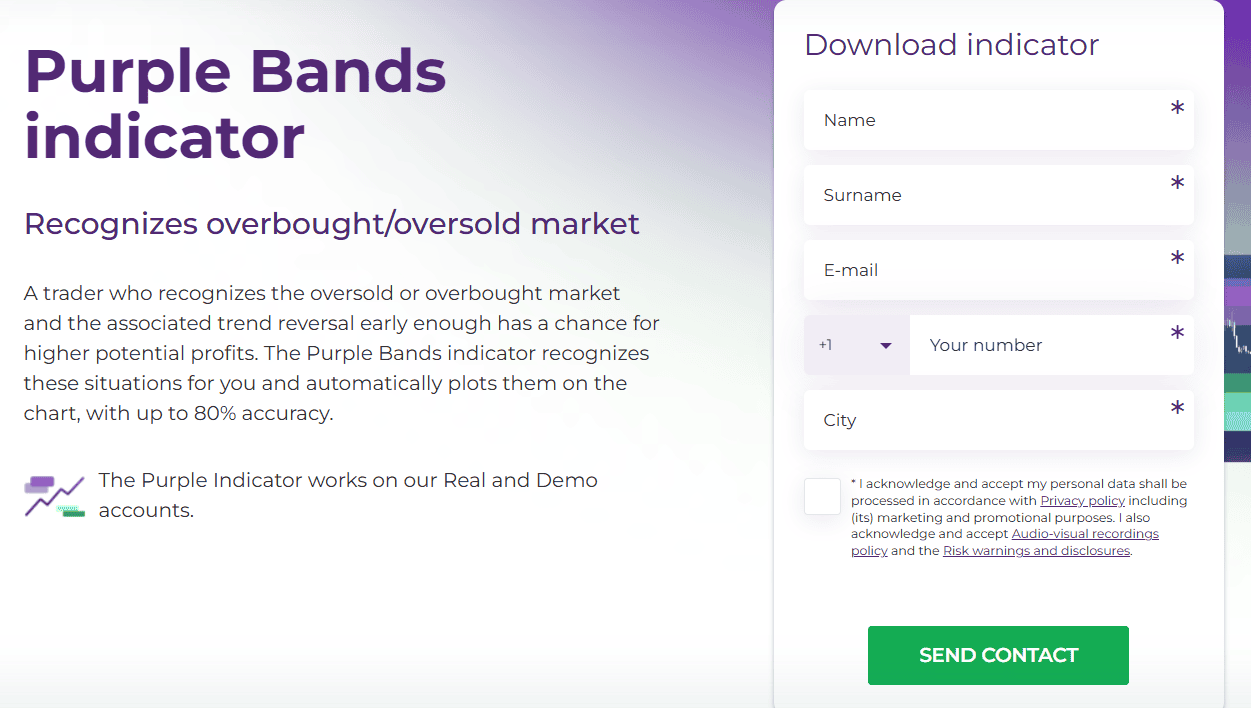

Compatible with the MetaTrader 4 and cTrader, these indicators help beginner and advanced traders spot and react to an emerging market trend as quickly as possible.

Among these, The Purple Bands indicator really stuck out for me because of its ability to detect overbought or oversold market conditions with up to 80% accuracy. This indicator provides valuable insights into potential trend reversals, allowing you to identify potentially profitable trading opportunities.

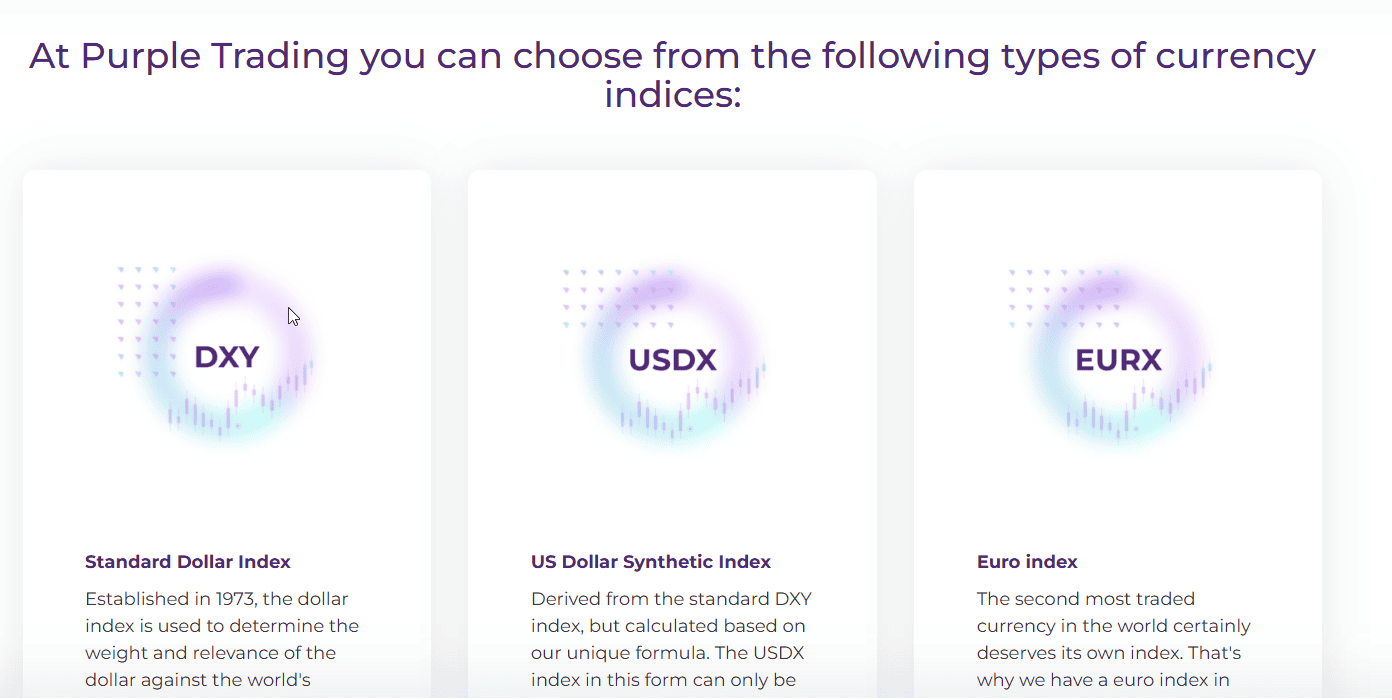

Currency Indices

These non-tradable indices serve as an indicator of the strength of a particular currency in the global market. With a currency index, you can get better insight into your price action analysis when trading Forex.

Mobile Trading App

The cTrader Purple Trading mobile app is a great option for on-the-go traders. Available for both Android and iOS devices, the app is certainly not just a stripped-down version of the standard desktop trading platform. It’s packed with a bunch of advanced features, the most noteworthy being:

Excellent Charting & Technical Analysis Tools

The app gives you access to various chart types, 26 timeframes, and 60+ technical indicators to conduct in-depth market analysis. I liked how the price chart is interactive, letting me zoom, rotate horizontally, and add indicators. Of course it’s a big leap from what the desktop version offers but I found the mobile experience smooth, and it was easy to analyse trends

Customisable Watchlists and Price Alerts

The Favorite Markets allow you to group and monitor your preferred trading instruments for quick access. By tapping on a symbol within your watchlist, you can check its overview, access a simplified price chart, and execute buy or sell orders with your chosen trading volume.

Moreover, you can set up price alerts for specific instruments to notify you when an asset reaches your predetermined price level so you never miss potential trading opportunities.

Order Placement and Risk Management

Placing buy or sell orders from your watchlist is easy with One-Click Trading. The app shows you important information about a trade before you confirm it, like the size of the position, the needed margin, and the possible loss. You can also set levels for stop-loss and take-profit, making risk management easy while on the go.

My Verdict On Trading Platforms

Purple Trading offers a solid range of platforms, providing the flexibility to choose the one that best suits your needs. Sadly, the mobile app feels lacking in terms of charting and response, especially when pitted against Plus500’s mobile app, which in my opinion, is the best in the market.

Is Purple Trading Safe?

I always prioritise safety and security when choosing a forex broker. In this case, Purple Trading is a moderate-risk broker based on its regulatory compliance, industry reputation, and customer reviews.

1. Regulation

Purple Trading is a regulated brokerage firm operating under the ownership of L.F. Investment Limited, a Cyprus Investment Firm. The company is authorised and overseen by the Cyprus Securities and Exchange Commission (CySEC), allowing them to offer their services across Europe.

This active mid-tier financial regulator enforces several key measures to protect investors. These include the segregation of client funds, participation in investor compensation schemes, and the implementation of strong risk management protocols.

2. Reputation

Purple Trading recorded 96.1K total visits and a positive growth trend of 14.66% increase in traffic in the last three months leading up to January 2025. However, compared to SimilarWeb data from February 2024, when the platform recorded 154,760 visits, the current figures indicate a decline over the past year.

In my opinion, this raises some questions about the broker’s long-term user retention and overall reputation.

The table below highlights Purple Trading’s regional search interest in 2025

| Country | 2025 Monthly Searches |

|---|---|

| Italy | 210 |

| Poland | 110 |

| Germany | 70 |

| India | 70 |

| United States | 70 |

| Cyprus | 70 |

| Japan | 70 |

| United Kingdom | 50 |

| France | 30 |

| Malaysia | 20 |

| Spain | 20 |

| Austria | 20 |

| Netherlands | 20 |

| Switzerland | 20 |

| Nigeria | 20 |

| Pakistan | 20 |

| Uzbekistan | 10 |

| Brazil | 10 |

| South Africa | 10 |

| Colombia | 10 |

| Thailand | 10 |

| Mexico | 10 |

| Indonesia | 10 |

| Argentina | 10 |

| Turkey | 10 |

| Vietnam | 10 |

| United Arab Emirates | 10 |

| Portugal | 10 |

| Kenya | 10 |

| Peru | 10 |

| Morocco | 10 |

| Bangladesh | 10 |

| Ecuador | 10 |

| Philippines | 10 |

| Venezuela | 10 |

| Canada | 10 |

| Sweden | 10 |

| Singapore | 10 |

| Saudi Arabia | 10 |

| Chile | 10 |

| Algeria | 10 |

| Egypt | 10 |

| Bolivia | 10 |

| Australia | 10 |

| Greece | 10 |

| Ireland | 10 |

| Dominican Republic | 10 |

| Botswana | 10 |

| Hong Kong | 10 |

| Taiwan | 10 |

| Uruguay | 10 |

| Ghana | 10 |

| Cambodia | 10 |

| Panama | 10 |

| Costa Rica | 10 |

| Sri Lanka | 10 |

| Uganda | 10 |

| Ethiopia | 10 |

| Jordan | 10 |

| Tanzania | 10 |

| Mongolia | 10 |

| New Zealand | 10 |

| Mauritius | 10 |

210 1st | |

110 2nd | |

70 3rd | |

70 4th | |

70 5th | |

70 6th | |

70 7th | |

50 8th | |

30 9th | |

20 10th |

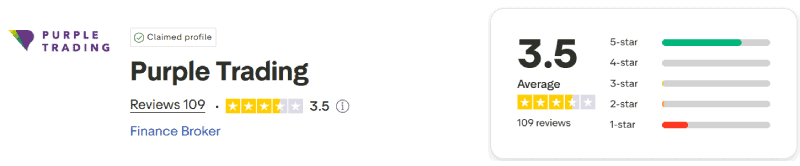

3. Reviews

On Trustpilot, the online forex broker has a rating of 3.5 stars. This suggests that they’re well-liked by their customers, who’ve posted several comments praising it for their competitive trading environment, responsive customer support and swift deposit/withdrawal methods.

However, I’ve also come across some negative reviews about withdrawal issues and other problems that I think the broker needs to address to achieve higher satisfaction levels.

My Verdict On Trust With Purple Trading

Purple Trading is a trustworthy broker that offers a regulated trading environment with a solid reputation and positive customer feedback. Nevertheless, I think its mid-tier regulatory status and mixed reviews indicate potential areas for concern. As always, do your due diligence and carefully assess the broker before signing up.

Deposit and Withdrawal

Deposits and withdrawals are quick, secure, and can be easily managed with just a few clicks in the PurpleZone client area. Here’s a closer look at the deposit/withdrawal options available and the potential fees you may be charged.

What Is the Minimum Deposit At Purple Trading?

The minimum deposit requirement is $100, €100, or £100, depending on your chosen account currency. This amount is the same for both Purple Trading’s ECN and STP account types.

Account Base Currencies

Purple Trading offers trading accounts with base currencies in EUR, USD, GBP, CZK, and PLN. This gives you the flexibility to choose an account currency that aligns with your local currency or preferred trading asset, thus reducing recurrent conversion fees.

Deposit Options and Fees

You can fund your account using your credit card (Visa, Mastercard) free of charge. Wire deposits are also accepted and cost nothing for EUR, CZK and PLN. Other currencies are charged a maximum of 0.5 % (min 5 EUR, max 100 EUR).

| Method | Fee | Processing Time | Average Bank/Provider Processing Time | Payment Method Limits | Requirements |

|---|---|---|---|---|---|

| Credit Card Deposits | Free | Instantly | Within a few minutes | Maximum limit of EUR 60,000 with all cards per client account per month. | Card scan on the first deposit with a new card (manual approval for the first deposit within one working day). |

| Domestic payment in CZK and PLN; SEPA payment in EUR | Free | 1 business day | 1-2 business days | - | - |

| International payment in other currencies | 0.5 % ((min. 5 EUR, max. 100 EUR) | 1 business day | 3-5 business days | - | - |

Withdrawal Options and Fees

Similarly, you can withdraw via wire transfer or by using the credit card used for deposit. Credit card withdrawals are free and wire withdrawals charge a maximum of 0.5 % (min 5 EUR, max 100 EUR) for all other currencies except EUR, CZK and PLN.

My Verdict On Funding With Purple Trading

Funding with Purple Trading is fast, straightforward and cost-free. While the available funding options cover standard needs, it’d be nice to see them add e-wallet services like Skrill or Neteller and online payment systems such as PayPal. By doing so, users will benefit from additional convenience and flexibility in payment options.

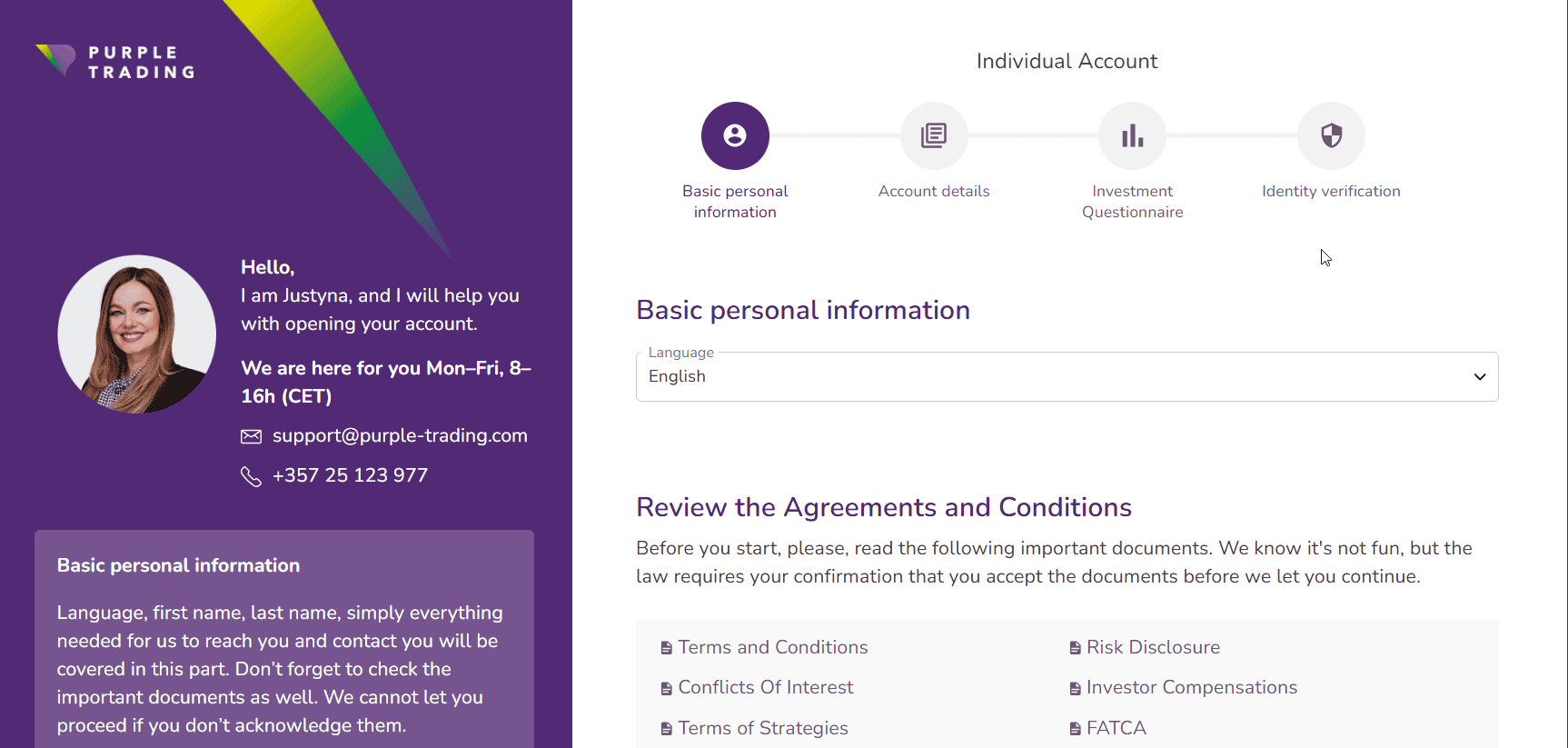

Ease To Open An Account

I had no problems opening a trading account, and the process was fairly straightforward. The first step is to fill in your basic personal information, such as name, country of residence, and phone number. The next step involves filling in your account details and picking your account base currency followed by an Investment Questionnaire.

Finally, you’ll be required to complete a Know Your Customer (KYC) verification process where you’ll need to provide your identification documents e.g. driver’s license, ID card, or passport. Standard account holders may not receive a personal account manager, but you’ll have access to customer support and the PurpleZone client area for account management.

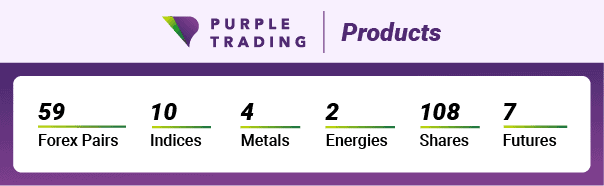

Product Range

Purple Trading offers more than 60 currency pairs including exotic currency pairs like GBP/ ZAR. You can also trade on 10 index CFDs and speculate on the development of stock indices of the biggest economies such as NASDAQ, DAX, and SP500.

If you’re a commodity trader you’ll enjoy trading on oil, gold, silver, and other precious metals with prices directly from the interbank market. Additionally, you can trade 100 stocks of the world’s most renowned companies and futures contracts of select agricultural commodities, government bonds and indices.\

What Leverage Does Purple Trading Offer?

The maximum leverage for retail traders is 1:30 while that for sophisticated or professional investors is 1:500. Major currency pairs like EUR/USD and GBP/USD have a 1:30 levera,ge and for the other pairs; it’s 1:20.

Besides Forex, Purple Trading offers financial leverage across the other asset classes, including up to 1:20 for indices, 1:20 for commodities like gold, 1:10 for silver, 1:5 for stocks, and 1:10 for futures.

My Verdict On Range Of Markets And Leverage

The broker offers a decent selection of trading instruments with competitive leverage options. I’d like to see them add more products like ETFs and bonds, which can attract a broader range of traders looking to diversify their investment portfolios.

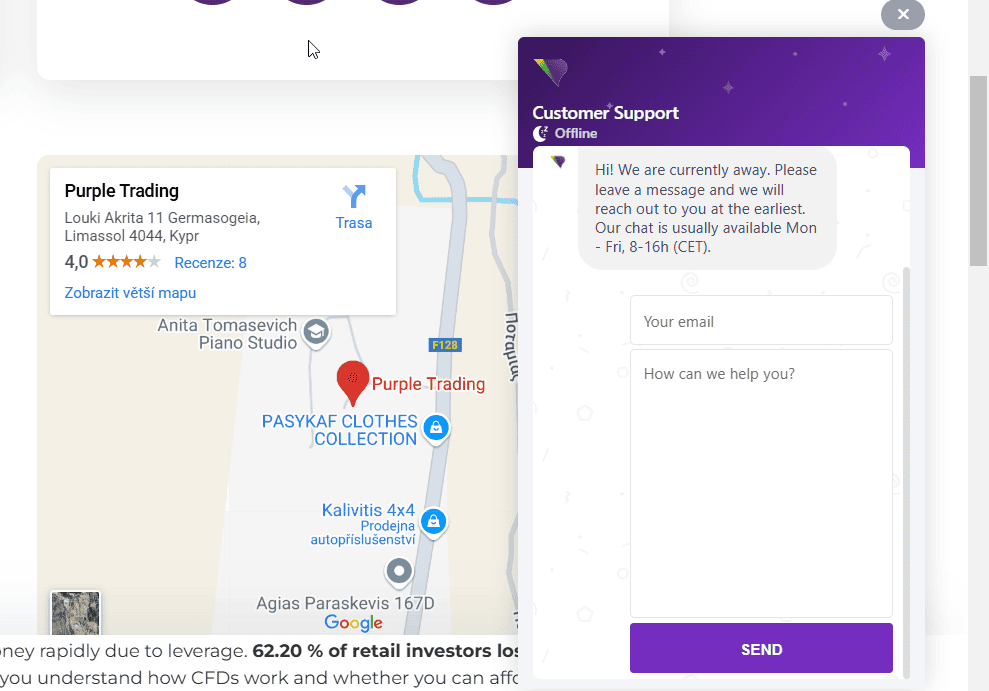

Customer Service

I found Purple Trading’s customer support responsive and professional for the most part, offering assistance through phone, email, and live chat. The live chat option is easily accessible by clicking the conversation logo at the bottom right.

However, their support is available only during regular office hours, Monday to Friday from 8:00 AM to 4:00 PM CET. These support hours may be inconvenient if you need assistance outside these times.

Research and Education

The Macroeconomic Calendar provided by the broker is a valuable research tool that offers real-time updates on significant economic events and data releases. It displays recent, expected, and current values for each event, enabling you to assess market impact effectively.

The Purple Academy handles everything related to education. It contains many articles and downloadable ebooks all completely free to access. They cover a wide range of topics from the absolute basics to specific trading strategies. The News keeps you updated on ongoing macroeconomic events and the behaviour of major players.

Final Verdict on Purple Trading

Purple Trading offers competitive trading conditions in a wide range of financial products on the popular cTrader, MT4 and MT5 terminals. Still, the broker’s high trading fees put it at a disadvantage for cost-conscious traders.

Additionally, the forex selection is decent but they still need to work on improving the broader asset offering. The same goes for their customer service and research and education section which only covers the basics while neglecting core topics like in-depth market analysis.

Overall, I found nothing strikingly wrong with the broker in my review, but it just lacks that extra spark that makes the top forex brokers stand out.

Purple Trading FAQ's

Is Purple Trading a Good Broker?

I think Purple Trading is a good broker for anyone looking to trade a generous range of markets with excellent trading conditions and in a regulated environment.

What Demo Account Does Purple Trading Have?

Purple Trading offers free demo accounts with no time limit on both MetaTrader 4 (MT4) and cTrader, allowing you to practice trading in a simulated market environment without financial risk.

Alternatives to Purple Trading

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert