Trade Nation Review of 2026

Trade Nation is, in my opinion, an exceptional broker that has rapidly risen, focusing on low costs and transparent pricing. As an active trader, I find their unique offering of guaranteed low, fixed spreads to be competitive, positioning the broker in a solid spot in 2026.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Trade Nation Summary

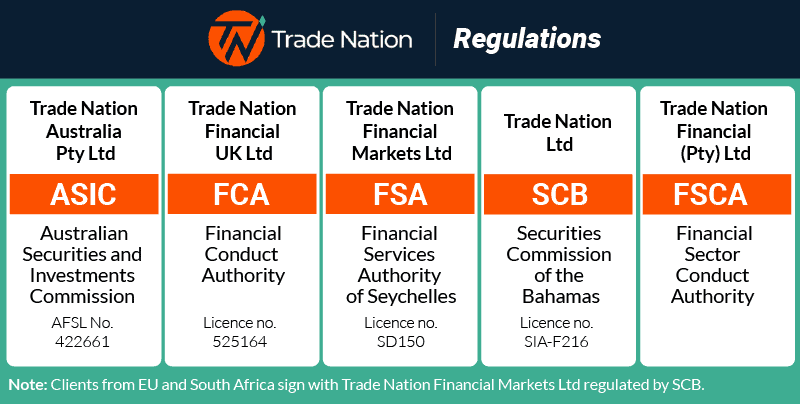

| 🗺️ Regulation | ASIC, FCA,FSCA, FSA, SCB |

| 📊 Trading Platforms | MT4, TN Trader, TradingView, TradeCopier |

| 💰 Minimum Deposit | $0 |

| 🎮 Demo Account | Yes |

| 🛍️ Instruments Offered | CFDs (Forex, Indices, Metals, Energies, Bonds, ETFs) |

| 💳 Funding Methods | Wire Transfer, Visa, Mastercard, Skrill, Neteller, AstroPay, GrabPay |

Why Choose Trade Nation

With an overall score of 79/100, I consider Trade Nation a well rounded broker overall. Features I appreciate are their commitment to fixed pricing, the excellent choice of trading platforms including TradingView and MT4, and their zero minimum deposit policy.

The broker’s core strength in my view, is their fixed spread structure. These predictable spreads is a huge benefit if you are a trader seeking to avoid unexpected spread widening or looking for scalp trade.

Despite these significant strengths, Trade Nation does have a few minor weaknesses. The total range of markets, whilst still exceeding 1,000 instruments, is not as extensive as other brokers. Furthermore, although their primary retail account offers highly competitive terms, traders utilising the Swap Free account must be mindful of the applicable administration charge.

Trade Nation Pros and Cons

- Low fixed spreads

- Top tier regulation

- Zero commissions

- Zero minimum deposit

- Modest Asset Range

- Swap Free Charges

- Not available to US traders

The overall rating is based on review by our experts

Trading Fees

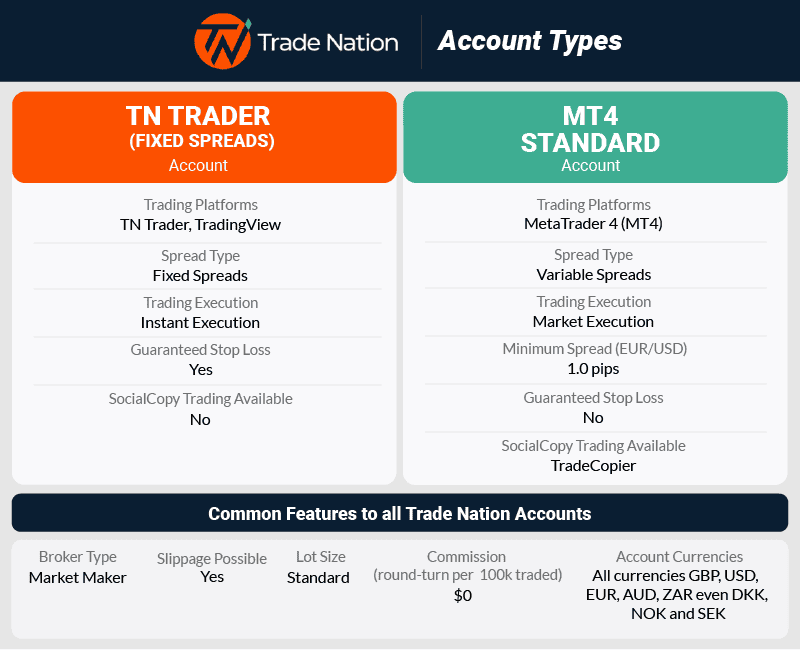

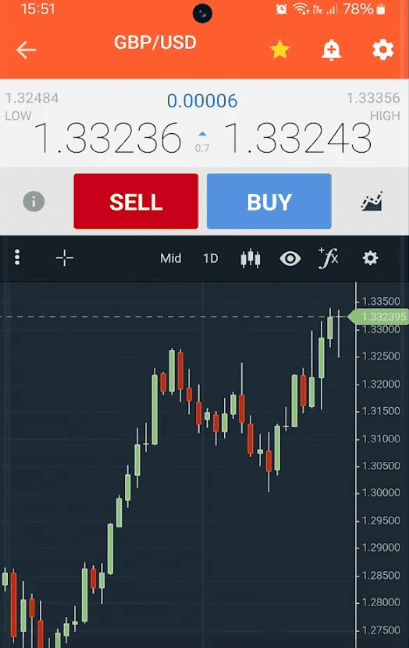

Your fees will vary depending on which platform you trade with. If you use TN Trader (or TradingView which runs off the same server at TN Trader) your spreads will be fixed. If you choose the MetaTrader 4 platform then your spreads will be variable.

For the lowest spreads, I recommend you choose the TN Trader platform as you will see below. Trade Nation does not have commission fees outside the spread.

Trade Nation generally offers a simplified account structure for you as a retail client:

- CFD and Spread Account (TN Trader, TradingView): This core retail offering features zero commission trading. It uses low, fixed spreads which start from 0.5 pips, The Spread account always uses your base currency for trades, the CFD account will depend on the currency pair you trade (not necessarily your base currency.

- Standard Account (MetaTrader 4): This platform has variable spreads which start from 1.1 pips.

- Islamic Account (Swap Free): This account removes overnight swap charges. It replaces them with a daily administration fee after a five day grace period.

- Professional Account: This is available to qualifying clients. It offers higher leverage and different execution terms.

Overall, I recommend the CFD and Spread Account (TN Trader, TradingView). It combines guaranteed fixed spreads with a zero commission structure.

Fixed Spread Account

Fixed Spread Account

Trade Nation’s unique proposition is their fixed spreads. They do not widen during high volatility or market announcements. In my experience, this provides unmatched cost certainty. On key Forex majors like the EUR/USD, the fixed spreads start from a very tight 0.6 pips.

As a long time trader, I place higher value on having fixed costs. With this account type your cost is fixed regardless of market volatility. This in term helps you to maintain accurate stop loss placement. It also prevents you from having unexpected slippage in short term scalping strategies.

Fixed spreads are available with the TN Trader Platform and TradingView platform.

You can choose between Spread or CFD TN Trader accounts. The spread account means your trades are always done using your base currency (typically USD, GBP, EUR or AUD). The CFD account means your trades will need to be converted from your base currency depending on the currency pair your trade.

The module below compares the spreads of Trade Nation vs other brokers with fixed spreads. Spreads start from 0.6 pips for EUR/USD, 0.7 for AUD/USD, 1.2 EUR/GBP which compares very favourably to other brokers with fixed spreads. You will also find they compare very well with brokers offering variable spreads for Standard accounts.

Fixed Spreads Comparison | |||||

|---|---|---|---|---|---|

| 0.50 | 0.40 | 0.50 | 0.70 | 0.80 |

| 0.90 | 1.10 | 1.50 | 1.80 | 1.50 |

| 0.70 | 1.20 | 1.50 | 1.80 | 1.30 |

| 1.20 | 1.50 | 1.30 | 2.00 | 1.70 |

| 1.50 | 1.80 | 2.00 | 2.00 | 2.00 |

| 3.00 | 3.00 | 3.00 | 3.00 | 3.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

I realise saying ‘spreads start from’ may seem strange when they are fixed but the thing to know is that they are fixed at different amounts depending on the time of the day.

| Forex Pair | Fixed Spread / Spread Times | Forex Pair | Fixed Spread / Spread Times |

|---|---|---|---|

| EUR/USD | 0.6 / 00:00 - 06:59 | EUR/GBP | 1.2 / 00:00 - 06:59 |

| 0.5 / 07:00 - 21:59 | 0.5 / 07:00 - 21:59 | ||

| 5 / 22:00 - 22:59 | 10 / 22:00 - 22:59 | ||

| 0.6 / 23:00 - 23:59 | 1.2 / 23:00 - 23:59 | ||

| AUD/USD | 0.7 / 00:00 - 06:59 | GBP/USD | 1.2 / 00:00 - 06:59 |

| 0.4 / 07:00 - 21:59 | 0.8 / 07:00 - 21:59 | ||

| 6 / 22:00 - 22:59 | 8 / 22:00 - 22:59 | ||

| 0.7 / 23:00 - 23:59 | 1.2 / 23:00 - 23:59 | ||

| USD/JPY | 0.7 / 00:00 - 06:59 | AUD/JPY | 1.4 / 00:00 - 06:59 |

| 0.6 / 07:00 - 21:59 | 1.0 / 07:00 - 21:59 | ||

| 6 / 22:00 - 22:59 | 11 / 22:00 - 22:59 | ||

| 0.7 / 23:00 - 23:59 | 1.4 / 23:00 - 23:59 |

Raw Account Commission Rate

Trade Nation does not offer a RAW account. Trade Nation operates on a strict zero commission basis.

Standard Account Fees

Trade Nation also has a spread-only account using variable spreads. This account is available with the MetaTrader 4 trading platform. Spreads with this account are higher than with the Fixed spread account, with the EUR/USD pair starting from 1.1pips.

While spreads are higher than the fixed account, they are generally competitive with similar accounts from other brokers. Since you are using MT4, you have the option of automating your trades which cannot be done with TN Trader.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 8.40 | 1.30 | 1.40 | 1.10 |

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.00 | 1.20 | 1.00 | 1.00 | 1.10 |

| 1.10 | 1.20 | 1.50 | 1.40 | 1.40 |

| 1.10 | 1.10 | 1.10 | 1.30 | 1.40 |

| 0.70 | 0.70 | 0.90 | 0.80 | 0.80 |

| 0.60 | 0.60 | 2.00 | 1.30 | 1.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Swap Free Account Fees

Trade Nation provides Sharia compliant accounts for traders. This is for those whose faith prohibits the receipt or payment of interest (swaps). A key benefit is the generous five day grace period.

No administration charge is applied to leveraged positions held overnight during this time. If a position is held beyond the fifth day, a daily administration charge applies. This charge continues until the trade is closed. This administration fee replaces the usual swap cost.

You must carefully calculate this administrative fee. It applies to positions intended to be held long term. It can accumulate significantly over weeks or months.

Other fees

A clear benefit for all traders is the broker’s policy of charging no monthly account fees and no inactivity fees. They also charge no deposit fees and no withdrawal fees.

My Verdict on TradeNation’s Trading Costs

I gave TradeNation a 8/10 for trading costs. Spreads are competitive but not the lowest in the industry. And you as a trader may find that some instruments have higher costs compared to top-tier brokers. While the fees are reasonable for most, if you are an active trader you might feel them more over time.

Trading Platforms

Trade Nation provides a decently versatile platform selection for you to pick from. They offer three primary platforms: their proprietary TN Trader and MetaTrader 4 (MT4). They also offer you to use TradingView as well which has fixed spreads like TN Trader.

My team and I at CompareForexBrokers created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

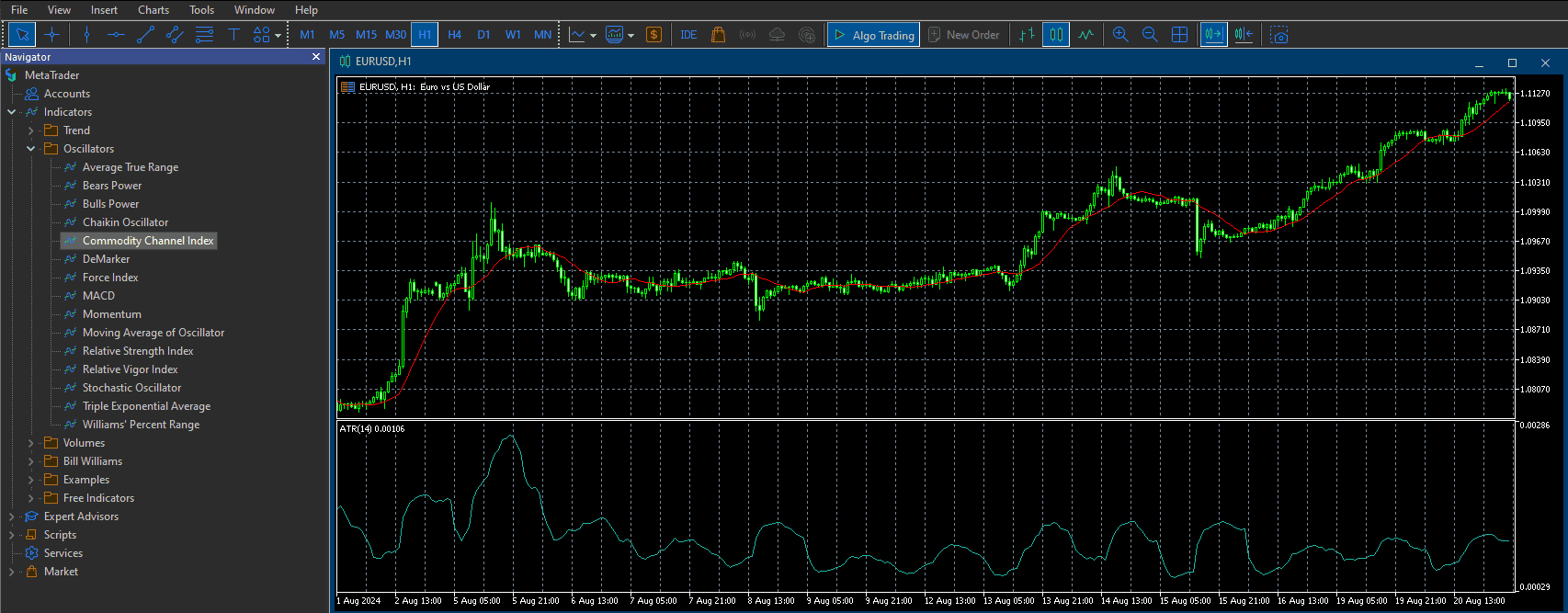

MetaTrader 4

I have used MT4 most of my trading career because it has a simple interface and a good balance of features. MT4 was one of the first mainstream platforms on the market. More retail traders use it than any other platform.

If you use this platform, just not that spreads will be variable.

Why I use MT4:

- Multiple order types include waiting status orders (buy stop, sell stop, etc.). You also get three order types for execution and one click trading.

- A large community means easily accessible resources. These include custom indicators, Expert Advisors (EAs), and support forums.

- Ability to create your own Expert Advisors using MQL4 to automate trading and implement custom indicators.

If flexibility in devices is important to you, I recommend MT4. You can run it on Android, iOS, and desktop (Windows and Mac). It also works via the MT4 WebTrader browser version.

That is a nice advantage for a busy trader as you can see and manage positions anywhere.

Trade Nation also offers their TradeCopier app exclusively for MT4 users. This allows you to mirror expert strategies in real time.

Why you might not use it:

Trade Nation’s MT4 implementation primarily focuses on a selection of forex and indices CFDs.

If you want the broker’s full depth of stock CFDs, access might be limited. The TN Trader platform or TradingView offers broader access.

TN Trader

TN Trader is Trade Nation’s bespoke platform. In my opinion, it is noted for its clean design. It features an intuitive interface and reliability. As a trader, I find this platform serviceable for fast, manual execution. It directly benefits from the low, fixed spread model.

Image courtesy of Trade Nation

Image courtesy of Trade Nation

Key features include free trading signals. You get a daily market news feed directly in the dashboard. It also features excellent optimisation for mobile use.

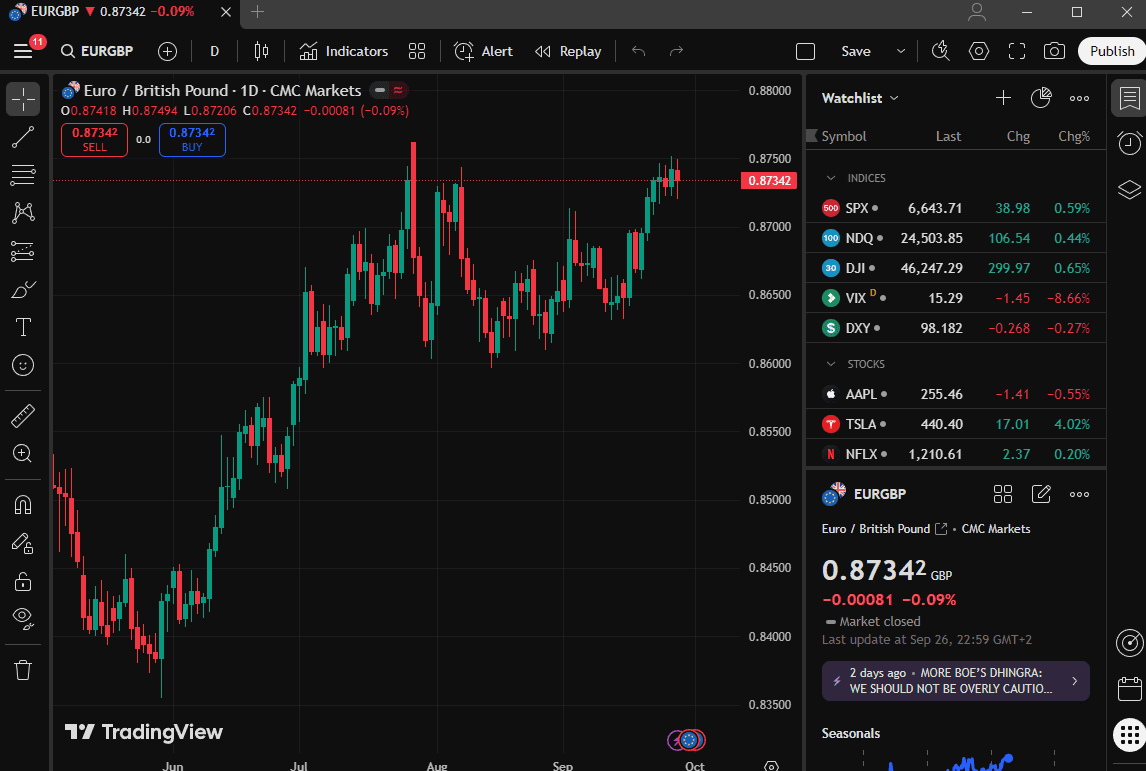

TradingView

TradingView is my most used app to monitor price action and my positions, as it has amazing charting capability. The addition of TradingView with Trade Nation is, in my opinion, a major asset for you as a trader.

Here is what I like about TradingView:

- This platform is globally recognised for its professional grade charting.

- It has a very large community, trusted by over 60 million traders worldwide.

- The platform offers 400 plus built in indicators and 110 plus drawing tools.

By connecting my Trade Nation account, I can execute trades directly from TradingView’s renowned “supercharts”.

This greatly surpasses MT4’s standard platform capabilities. With TradingView you can access so many indicators, scripts, and automation guides.

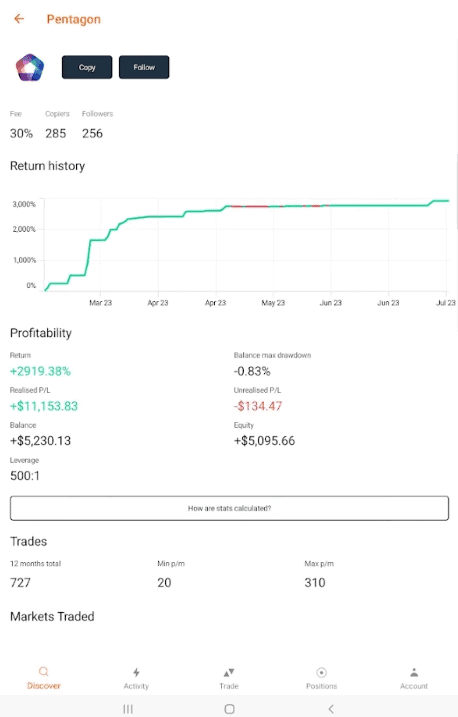

TradeCopier

With Trade Nation, you have the option to use TradeCopier to replicate the trades of signal providers. I liked using TradeCopier from Trade Nation, as it lets me automatically mirror or “copy” other traders in real time.

I can pick from different strategies, see all the stats, performance metrics, markets traded, and from that decide which traders I want to follow.

Image courtesy of Trade Nation

Then TradeCopier will replicate their trades on my account (proportionally) using parameters I choose, by equity, balance or lot size.

It’s also easy to set up: I just connect my MetaTrader 4 (MT4) account, pick traders I trust, and sit back while the system handles execution.

It also encourages me to diversify, copying several strategies with different risk profiles or market focuses. Moreover, there’s a community aspect: I can engage with other traders, learn from them, and adapt my own approach as I go.

My Verdict on Trade Nation’s Trading Platforms

I gave the category of trading platform a 8/10. The platforms offered cover essential tools and features, and you as a trader can rely on it for everyday trading. However, advanced traders might find the lack of cTrader or MT5 as a downside.

Is Trade Nation safe?

Trade Nation has built a strong reputation based on transparency and fairness. This legacy comes from its time as Core Spreads.

Regulation

With offices in The UK, Australia, Seychelles, South Africa and the Bahamas, its fair to say Trade Nation has a decent global presence. Trade Nation is regulated in Australia but ASIC and The UK by the FCA, Interestingly they are not regulated in the EU or UAE which are other populare markets, these clients will be directed to their subsidiaries in Syechelles or the Bahamas.

Reputation

Trade Nation launched back in 2014, so it is relatively established in the trading community. The broker’s safety profile is also substantially bolstered by its multi jurisdiction regulatory structure.

Trade Nation offers Negative Balance Protection (NBP). This fundamental safety mechanism ensures clients cannot lose more than deposited capital.

As far as I know, Trade Nation doesnt have any bad court cases against them which some other brokers have had.

The table below highlights Trade Nation’s regional search interest in 2025.

| Country | 2025 Monthly Searches |

|---|---|

| India | 2,900 |

| Germany | 2,900 |

| Colombia | 1,000 |

| Brazil | 590 |

| Argentina | 480 |

| Thailand | 320 |

| United States | 320 |

| Bangladesh | 320 |

| Poland | 260 |

| Peru | 260 |

| South Africa | 210 |

| Nigeria | 210 |

| Morocco | 210 |

| Pakistan | 170 |

| Hong Kong | 170 |

| Saudi Arabia | 170 |

| Malaysia | 140 |

| United Arab Emirates | 140 |

| Singapore | 140 |

| Uzbekistan | 140 |

| Jordan | 140 |

| Philippines | 110 |

| Ecuador | 90 |

| Canada | 90 |

| Greece | 90 |

| Algeria | 70 |

| Italy | 70 |

| Netherlands | 70 |

| Australia | 70 |

| Chile | 70 |

| Indonesia | 50 |

| Vietnam | 50 |

| Turkey | 50 |

| United Kingdom | 50 |

| Taiwan | 50 |

| Bolivia | 50 |

| Sweden | 50 |

| Botswana | 50 |

| Mongolia | 50 |

| Ghana | 40 |

| Uruguay | 40 |

| Cambodia | 40 |

| Costa Rica | 40 |

| Austria | 40 |

| Portugal | 30 |

| Mexico | 20 |

| Spain | 20 |

| Cyprus | 20 |

| Venezuela | 20 |

| Japan | 20 |

| Sri Lanka | 20 |

| Kenya | 20 |

| Switzerland | 20 |

| Ethiopia | 20 |

| Ireland | 20 |

| Egypt | 10 |

| Tanzania | 10 |

| France | 10 |

| Dominican Republic | 10 |

| Uganda | 10 |

| New Zealand | 10 |

| Panama | 10 |

| Mauritius | 10 |

2,900 1st | |

2,900 2nd | |

1,000 3rd | |

590 4th | |

480 5th | |

320 6th | |

320 7th | |

320 8th | |

260 9th | |

260 10th |

Reviews

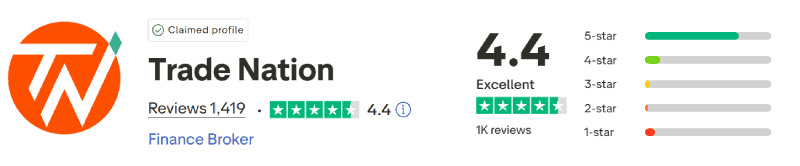

Trade Nation has an overall score of 4.4/5 from around 1350+ reviews on TrustPilot (as of me writing this review). This indicates a very strong public sentiment from traders. I saw that other users frequently praise the low fixed spread structure.

They also appreciate the platform’s clear and easy-to-use interface. Feedback suggests the spreads are quite competitive. However, the sentiment is not entirely outstanding.

My Verdict on Trade Nation’s Trust

For trust, Trade Nation gets a 8/10. The broker is regulated, which gives traders confidence, but it doesn’t yet have the long-standing reputation of some global names. You as a trader should still feel your funds are handled with care.

Deposit and Withdrawal

To start trading, a $0 minimum deposit is generally required. This applies to CFD and Spread Betting accounts. It covers card or digital wallet use.

If you wish to use Cryptocurrency for funding, a minimum deposit of $30 is required.

For their Shares CFD account, you only need enough funds. These funds must cover the margin requirements of your intended trade.

Trade Nation account base currencies

Trade Nation supports multiple deposit and account base currencies. This provides crucial flexibility for global traders.

Supported deposit currencies include USD, ZAR, and NOK. Depending on the regional entity, major international currencies such as GBP, EUR, and AUD are also generally available as account base currencies.

As discussed earlier, if you have a TN Trader account, you can choose between a spread account or CFD account. The spread account uses your base currency for trades, whilst the CFD account will vary by the forex pair.

My Verdict on Trade Nation’s Funding

I scored the category of funding options with 8/10. Deposits and withdrawals are straightforward, and you as a trader won’t run into unnecessary fees in most cases. Processing times are also fairly quick, which is always a plus.

Product Range

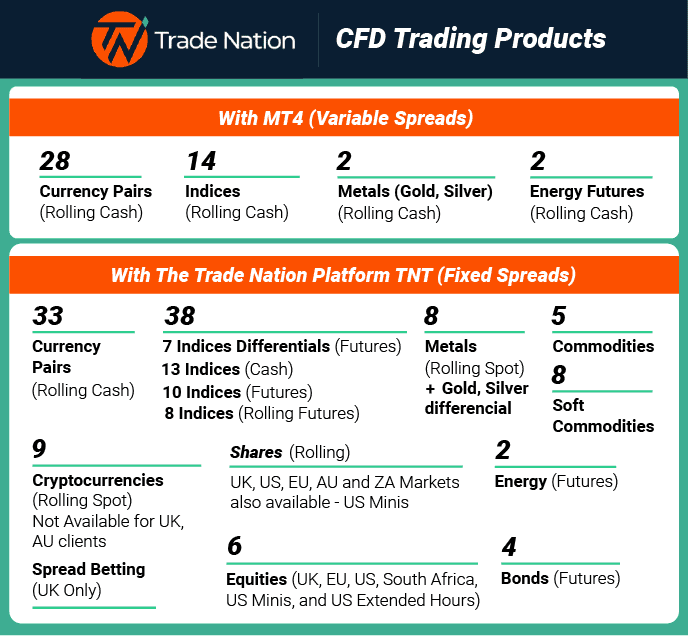

Trade Nation offers a diverse range of asset classes. Trading is primarily via CFDs and spread bets. Total tradeable symbols exceed 1,000 global markets. In my opinion, this targeted range is lackluster, but sufficient for traders who focus on liquid, mainstream markets.

The specific breakdown of their product range is as follows:

- Forex Pairs: 35 majors and minors.

- Indices: Over 40 global indices.

- Commodities: Extensive selection including Energy (Oil), Precious Metals (Gold, Silver), and Soft Commodities.

- Stocks/Shares: Diverse CFD selection from major global markets including the US, UK, Europe, and South Africa.

- Cryptocurrencies: CFD trading is available on major coins, including Bitcoin, Ethereum, Tether, Ripple, and Dogecoin.

My Verdict on Trade Nation Range of Markets

I rated this a 7/10. Trade Nation offers a decent variety of instruments, so you as a trader can access forex, indices, and commodities. However, the product list is not as broad as some brokers who also include more shares and crypto CFDs.

Customer Service

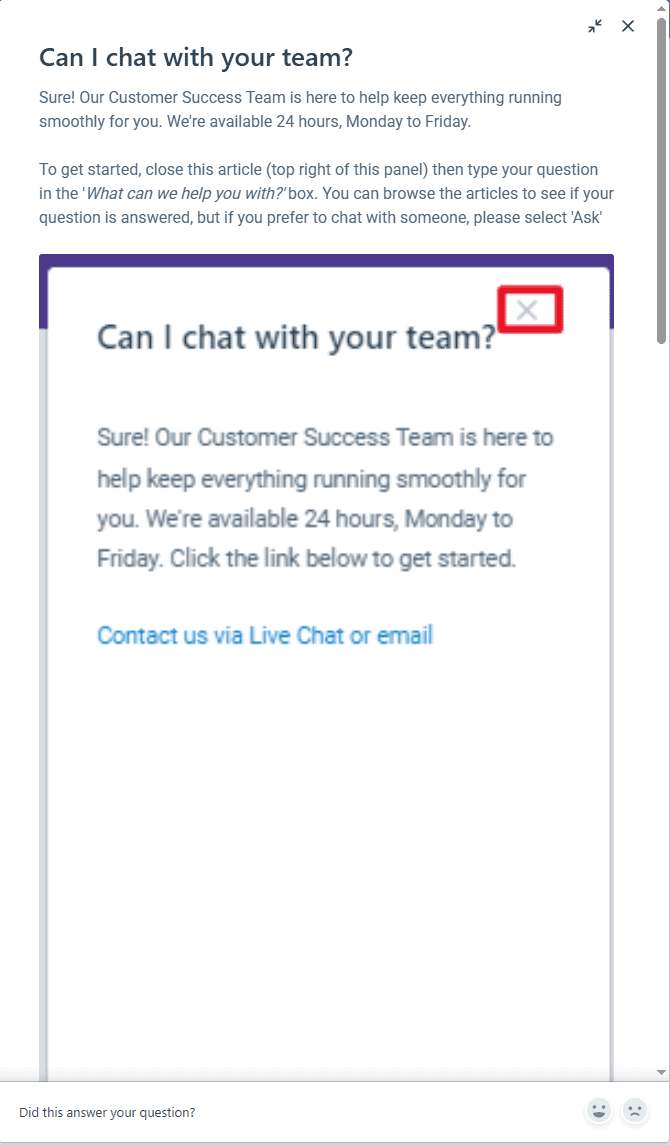

When I review this segment of a broker’s offering, I place a high emphasis on the user experience. With this, I have mixed experience with Trade Nation’s customer support. This team is available 24 hours a day, Monday to Friday. You can contact them via phone, email, and live chat.

The live chat initiation speed for me was generally excellent. This allows you to connect to an agent almost instantly. They have a couple of screenshots when you click the box “Can I chat with your team”. This is a bit of a letdown, as I’m used to having one button clicks to get me a live support agent.

When reaching out, I had a question about spreads and my agent “Sam” was quick to connect. However after a few exchanges, he let me know to wait for a white.

Eventually, the agent returned and apologised for the wait. They requested I switch the query to email and my ticket was soon after resolved.

My Verdict on TradeNations Customer Service

In my review, customer service scored 6/10. Response times are decent, and you as a trader can get help quickly through live chat or email. That said, the depth of support isn’t always as strong as with more established brokers.

Research & Education

I found that Trade Nation provides a substantial and comprehensive suite of educational materials. They aim at giving you tools, regardless of your experience level. This content is well organised into a KnowledgeBase, an eBook Hub, and expert led Webinars.

They also have analyses of major news events, fed meetings and major CFD price action.

These resources demonstrate a clear commitment to trader success. They move beyond foundational concepts into practical market application and strategic development.

The broker’s KnowledgeBase covers information more in the technical side. These include trading strategies, technical analysis, and fundamental market understanding. It provides detailed descriptions of various trading styles and proven trading patterns.

This serves as an excellent library for self paced learning. I found the resources particularly effective in explaining CFD trading to new traders. They also explain how their copy trading features work.

I liked that their expert led webinars provide higher level market insights and strategic guidance. Recent webinar topics cover complex but crucial areas. These include market psychology, focusing on risk and reward.

My Verdict on Trade Nation Education

Education resources earn a solid 8/10. As a trader, you will find some useful tutorials and guides, but the library isn’t very extensive. Serious traders may need to supplement with outside resources.

Final Verdict on Trade Nation

For traders who prioritise cost certainty and transparency, Trade Nation offers an outstanding value proposition. Their fixed spreads start from 0.6 pips on majors. These are incredibly competitive.

They eliminate the frustrating risk of spread widening. This is true even during major news events. They offer zero commissions on their primary account. They also have zero minimum deposits. Finally, zero withdrawal fees are charged. This confirms their status as a transparent, low cost broker. Strong Tier 1 regulation (FCA and ASIC) provides security. TradingView and MT4 ensure platform versatility.

Fixed spreads are a major strength. However, the price may not be the tightest spread available. This is often true during quiet, non volatile market hours. The total product range is over 1,000 instruments. For these reasons I give Trade Nation a solid overall score of 79 out of 100.

Frequently Asked Questions

How does the fixed spread model affect my trading strategy?

As a trader, the fixed spread model removes pricing uncertainty. Execution costs remain constant even during volatile events.

This is advantageous for high frequency traders or automated strategies. It ensures predictable cost management. It also allows for more reliable risk calculation.

What is the maximum leverage available for retail traders?

Trade Nation offers competitive retail leverage depending on the asset class and regulatory entity. For Forex major currency pairs, the maximum leverage available to retail clients is typically capped at up to 30:1.

For stock market indices and gold, this often drops to 20:1. Oil and other commodities usually sit at 10:1. Professional clients, subject to qualifying criteria, may have access to significantly higher leverage caps.

Can I automate my trading with Trade Nation?

Yes, you can absolutely automate your trading. Trade Nation offers the MetaTrader 4 (MT4) platform.

This fully supports Expert Advisors (EAs). EAs allow traders to implement sophisticated trading robots. Execution is handled automatically based on custom rules and indicators.

If you prefer advanced manual analysis, TradingView is available. This integration offers powerful scripting and alerting tools.

Alternatives to Trade Nation

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research