Tradersway vs IC Markets 2026

Choosing between Trader’s Way and IC Markets in 2026 comes down to what you value most as a trader. In this comparison guide, I’ll walk you through their differences so you can see which broker lines up with your trading goals.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

But first, here’s a quick overview of how the two brokers compare across the key areas :

- IC Markets has cheaper overall trading costs with lower spreads on both Raw and Standard accounts

- Trader’s Way has a lower minimum deposit requirement

- IC Markets offers a leverage of up to 1:500 while with Traders Way it’s up to 1:1000

- IC Markets is strongly regulated by ASIC & CySEC, and has a higher trust score

1. Lowest Spreads And Fees – IC Markets

I started by comparing Raw account spreads of both brokers which appear competitive. On major pairs like EUR/USD, USD/JPY, and GBP/USD, Tradersway’s spreads sit at a flat 0.5 pips, creeping up slightly on AUD/USD and USD/CAD.

IC Markets live up to its reputation for ultra-tight pricing. They offer near-zero spreads on majors like EUR/USD (0.02 pips), AUD/USD (0.03), and even the typically wider GBP/USD is 0.23 pips.

For scalpers, day traders, and algo traders who rely on tight spreads, IC Markets’ pricing gives more room to breathe, trade after trade.

RAW Account Spread | |||||

|---|---|---|---|---|---|

| 0.50 | 0.80 | 0.50 | 0.60 | 0.70 |

| 0.14 | 0.25 | 0.02 | 0.27 | 0.03 |

| 0.30 | 0.40 | 0.10 | 0.20 | 0.10 |

| 0.60 | 0.65 | 0.08 | 3.50 | 0.35 |

| 0.23 | 0.20 | 0.06 | 0.30 | 0.27 |

| 0.10 | 0.20 | 0.00 | 0.70 | 0.20 |

| 0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

| 0.30 | 0.20 | 0.10 | 0.30 | 0.20 |

| 0.40 | 1.40 | 0.10 | 0.50 | 0.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Raw accounts also mean you’re paying commission on top of the spread, so the real question is which broker is cheaper overall.

Tradersway charges a flat $3 per side in USD, while IC Markets is $3.50 per side for USD accounts. But when you factor in both spread and commission, IC Markets still comes out ahead on most pairs.

On EUR/USD, IC’s 0.02 pip spread plus $7 round-trip commission keeps costs to a bare minimum. Tradersway’s 0.5 pip spread plus $6 round-trip commission ends up higher overall, despite the lower commission rate.

This is the beauty of IC Markets’ raw pricing as that the tiny commission barely matters once you see how much you’re saving on spreads. For anyone trading actively, it works out cheaper in the long run.

| Broker | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Tradersway | 3 | N/A | N/A | N/A |

| IC Markets | 3.5 | 3.5 | 2.5 | 2.75 |

Standard Account

Standard accounts roll the commission into the spread, making them simpler to manage, especially for beginners. IC Markets still offers far sharper pricing than Tradersway on this account type.

Take EUR/USD, IC averages 0.82 pips, while Tradersway delivers 1.4 pips. The gap widens on pairs like AUD/USD (0.83 vs 2.5) and AUD/JPY (1.5 vs 4.9), where Tradersway’s costs are several times higher.

If you prefer the simplicity of an all-in spread without separate commissions, IC Markets still manages to keep costs low, which can make a meaningful difference over hundreds of trades.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall | |

|---|---|---|---|---|---|---|---|---|---|

| IC Markets | 0.82 | 0.94 | 1.03 | 0.83 | 1.05 | 1.27 | 1.3 | 1.5 | 1.09 |

| TradersWay | 1.4 | 1.6 | 2.1 | 2.5 | 2.6 | 2.5 | 2.6 | 4.9 | 2.53 |

Our Lowest Spreads and Fees Verdict

IC Markets easily beats Tradersway on both Raw and Standard account pricing, offering consistently tighter spreads and lower overall trading costs.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

MT4

Trader’s Way’s MetaTrader 4 offering is the classic “all-in-one” trading terminal, giving access to Forex, CFDs, and even Futures from one streamlined platform.

It’s fully equipped with 9 timeframes for detailed price analysis, over 50 built-in indicators and multiple customisable chart types. You can overlay analytical tools on the same chart, build combinations that suit your strategy, and save them as templates.

For those who rely on automated strategies or automation, the MQL4 programming language is fully integrated. That means if you’re comfortable coding, you can design your own Expert Advisors, custom indicators, or scripts to automate anything from risk management to trade execution.

IC Markets’ MT4, in comparison, is about as close as you can get to an institutional-grade trading environment in retail forex. It’s the same award-winning MT4 platform traders around the world know and love, but paired with raw pricing, lightning-fast execution, and zero restrictions on how you trade.

On top of that, you get 20 exclusive advanced trading tools e.g. the Alarm Manager for personalised alerts and the Correlation Matrix to monitor market relationships.

MT5

IC Markets is, in my view, the best MT5 broker on the market right now and that’s not a title I hand out lightly.

The platform’s extra timeframes, advanced charting, and improved order management make it far more versatile than MT4.

With spreads starting from 0.0 pips, you’re trading as close to institutional pricing as most retail traders will ever get. That’s thanks to IC’s raw pricing connectivity, pulling from up to 25 liquidity providers with no dealing desk, no requotes, and no hidden manipulation.

Execution is lightning fast, too, with servers housed in Equinix NY4 and directly cross-connected to liquidity providers for minimal latency. On top of that, MT5’s built-in Depth of Market lets you see the order book in real time, giving you a clear view of liquidity at every price level.

Trader’s Way’s MT5 offering has all the key features you’d expect from the platform. You get 21 timeframes, 80+ indicators, Market Depth, and built-in fundamentals like news feeds and an economic calendar. However, like MT4 it feels more like the default MetaTrader experience compared to IC Markets’ version.

cTrader

On cTrader, the two brokers deliver a strong ECN-style experience with raw spreads, Level II pricing, and no dealing desk interference.

IC Markets feels purpose-built for active, high-frequency styles with ultra-low latency, advanced order types for scalpers, and cTrader Automate for coding strategies in C#. Add features like detachable charts, Smart Stop Out protection, and one-click trading, and it’s clear IC has optimised cTrader for speed and control.

Trader’s Way uses the same cTrader engine, but leans harder into social and copy trading. With cTrader Copy, you can browse top-performing strategies, mirror them instantly, or even offer your own trades as a signal provider.

Additionally, the platform integrates with MetaQuotes Signals and FxStat, expanding the pool of strategies and providers well beyond what cTrader alone offers.

TradingView

If you prefer a visually driven trading experience, IC Markets’ TradingView integration delivers exactly that thanks to world-class charting features combined with direct trade execution.

You’ll have access to 15+ interactive chart types, 110+ drawing tools, and 400+ built-in indicators, plus thousands more from the platform’s vibrant global trading community. You can also run strategy tests, set 13 different alert types to stay on top of market moves, and filter opportunities with the Forex screener.

Trader’s Way doesn’t offer TradingView at all, so if that’s the trading platform you use regularly, the choice is already made.

| Trading Platform | Trader's Way | IC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

Our Better Trading Platform Verdict

IC Markets takes the win here with a broader platform lineup, deeper liquidity, and tighter integrations.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts and Features – IC Markets

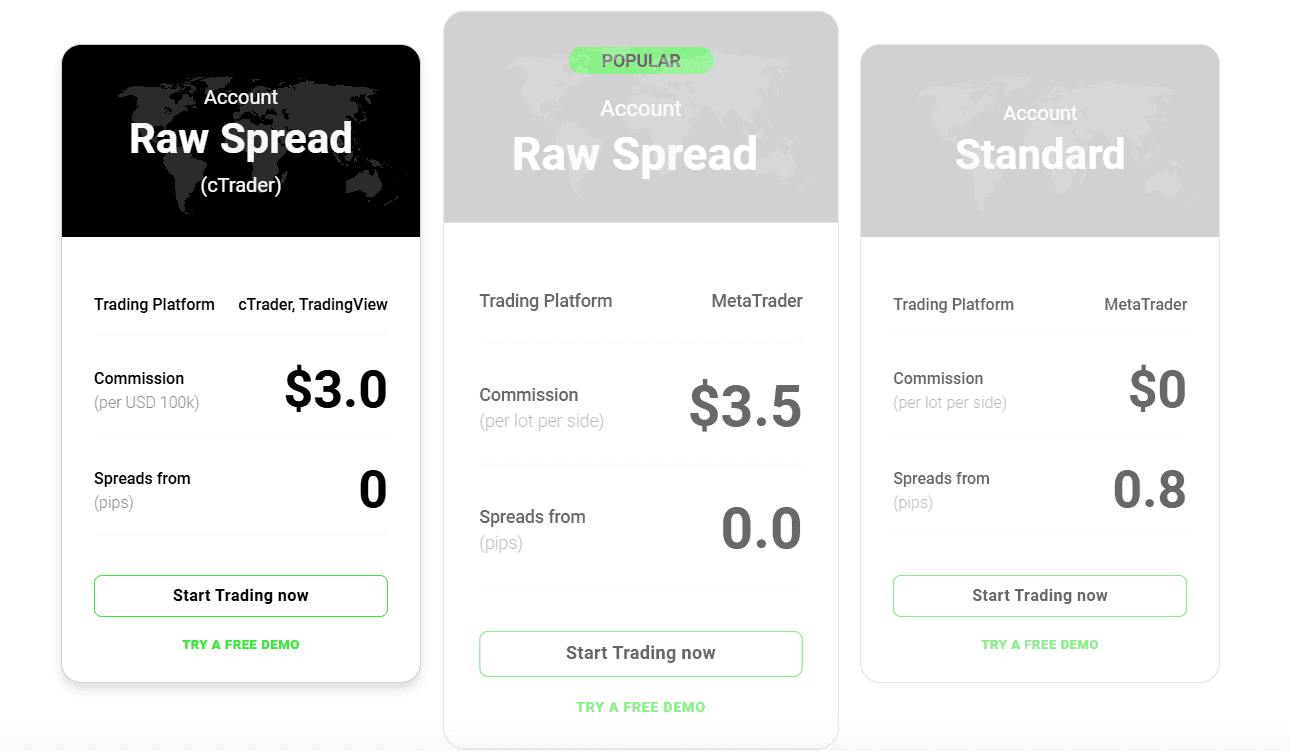

There are two Raw spread accounts and a Standard account on IC Markets.

The Standard account is spread-only, making it simple for beginners who don’t want to think about commission. It’s not the cheapest option if you’re trading actively, as we saw earlier on in the spreads comparison section.

The real value is in the Raw Spread accounts, which are divided into cTrader (with TradingView access) and MetaTrader. On MetaTrader, you’ll see spreads from 0.0 pips with a $3.50 commission per side (so $7 round trip).

On cTrader you get the same raw pricing directly from liquidity providers, but commissions are trimmed to just $3 per 100k traded. For scalpers, high-frequency traders, or anyone running EAs, that lower cost per lot makes a measurable difference over hundreds of trades.

It’s also worth noting that all three account types offer:

- Leverage up to 1:1000

- Micro lot trading from 0.01

- 50% stop‐out

- One‐click trading

- Islamic account availability

- No order‐distance restrictions and full strategy freedom

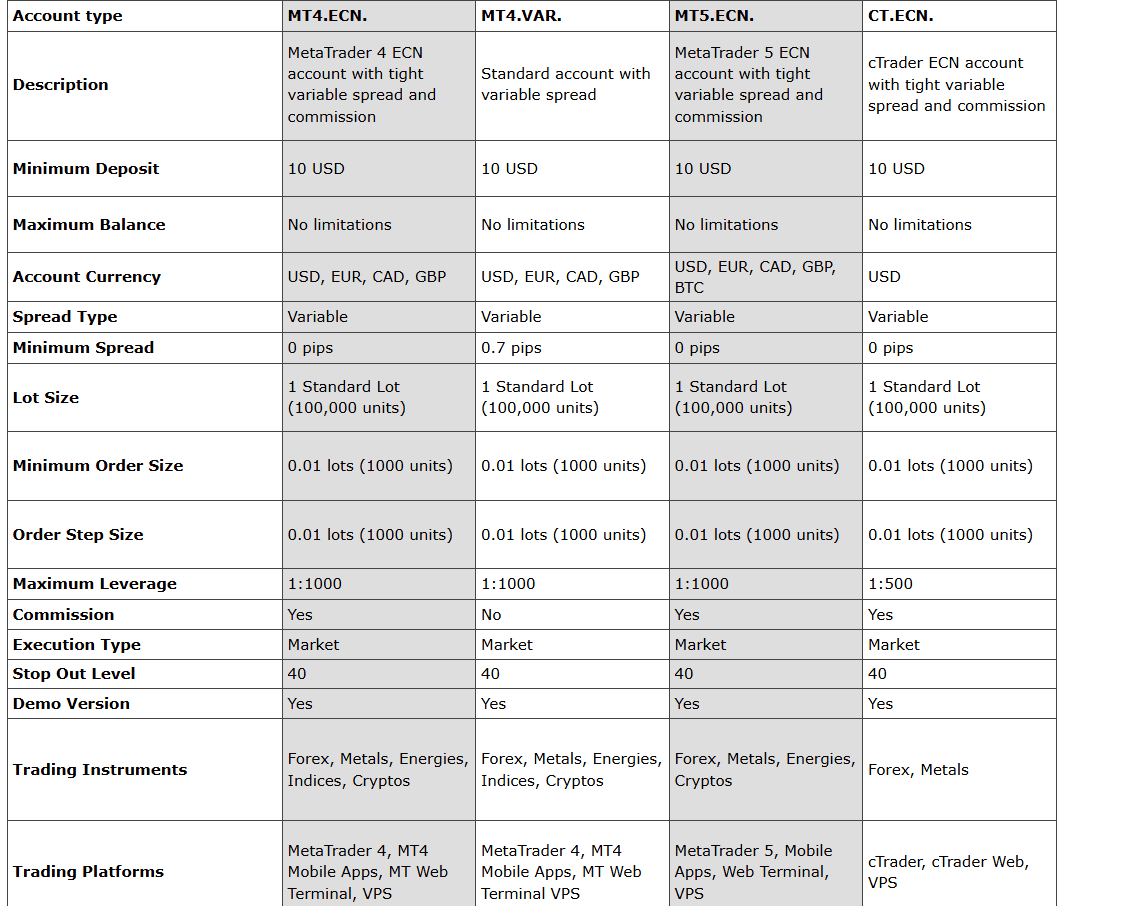

Trader’s Way

Trader’s Way provides four account types each built on a major trading platform. All accounts share some common ground with leverage up to 1:1000 (1:500 cTrader), micro lot trading from 0.01 and full market access. From there, the differences come down to pricing structure, platform choice, and product variety.

The MT4.ECN account gives you tight variable spreads from 0 pips with commission, running on MetaTrader 4 with full VPS support. It’s what I recommend if you want ECN execution in MT4.

The MT4.VAR account drops commissions entirely and starts spreads from 0.7 pips, making it more straightforward for cost management, while also offering swap-free availability.

The MT5.ECN account brings the same raw pricing model to MetaTrader 5 with spreads from 0.0 pips. You’ll find it ideal if you prefer commission-based trading on MT5’s advanced platform with upgraded analytics and order types. BTC is included as an account currency option giving crypto-focused traders extra flexibility alongside the usual fiat options.

Finally, the CT.ECN account delivers cTrader’s ECN environment with Level II pricing and sub-millisecond execution. Also starting from 0.0 pips with a separate commission, this account is my go-to for when I’m running strategies that demand speed and transparency.

| Trader's Way | IC Markets | |

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

While both brokers offer flexibility with multiple ECN and standard-style accounts, IC Markets stands out with deeper market access, stronger infrastructure, and superior execution conditions.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

Neither Trader’s Way nor IC Markets ranks among the absolute fastest brokers I’ve tested. However, IC still has a noticeable execution edge with 134ms for limit orders and 153ms for market orders compared to Trader’s Way’s 198ms and 214ms.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

| Trader's Way | 198ms | 29/36 | 214ms | 32/36 |

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

For me, where IC Markets really makes up ground is in the overall feel of its platforms. Whether I’m running MT4, MT5, cTrader, or even TradingView, the experience is consistently smooth, responsive, and perfectly synced across devices. This kind of polish helps offset any milliseconds lost on execution speed.

Our Best Trading Experience and Ease Verdict

IC Markets offers a way better trading experience thanks to its combination of slightly faster speeds, platform polish, and cross-device fluidity.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – IC Markets

When you trade with IC Markets, you’re under the watch of ASIC in Australia and CySEC in Cyprus, top regulators known for their strict standards. That means your funds are kept in segregated accounts, negative balance protection is in place, and the broker has to play by transparent, enforceable rules.

IC Markets Trust Score

Tradersway Trust Score

1. Regulations

On top of that, IC extends its global reach with additional registrations in Seychelles and the Bahamas. Those regulators aren’t as tough as ASIC or CySEC, but they add coverage in other regions and strengthen IC’s footprint.

Trader’s Way operates from Dominica with no recognised top-tier oversight. I mean there’s no ASIC, no FCA, no CySEC, none of the watchdogs that force brokers to safeguard client money or submit to independent audits.

While Trader’s Way has built a loyal following and earns decent reviews from its users, the lack of any formal regulation is a serious risk. If a dispute arises, you’re relying on the broker’s goodwill rather than a regulator’s enforcement.

2. Reputation

IC Markets gets searched on Google more than Trader’s Way. On average, IC Markets sees around 201,000 branded searches each month, while Trader’s Way gets about 4,400 — that’s 97% fewer.

| Country | Trader's Way | IC Markets |

|---|---|---|

| India | 170 | 33,100 |

| Argentina | 320 | 8,100 |

| Germany | 320 | 8,100 |

| Colombia | 1,300 | 6,600 |

| Turkey | 10 | 6,600 |

| Brazil | 390 | 6,600 |

| Philippines | 20 | 5,400 |

| Morocco | 10 | 5,400 |

| Thailand | 50 | 5,400 |

| United Arab Emirates | 20 | 5,400 |

| Pakistan | 20 | 5,400 |

| United States | 20 | 4,400 |

| Australia | 10 | 4,400 |

| Peru | 260 | 4,400 |

| Singapore | 90 | 4,400 |

| Bangladesh | 10 | 4,400 |

| Indonesia | 30 | 3,600 |

| Poland | 20 | 3,600 |

| Vietnam | 30 | 2,900 |

| Nigeria | 70 | 2,900 |

| Ethiopia | 10 | 2,900 |

| Saudi Arabia | 20 | 2,400 |

| Uzbekistan | 260 | 2,400 |

| Hong Kong | 40 | 2,400 |

| Taiwan | 10 | 2,400 |

| South Africa | 70 | 2,400 |

| Ecuador | 20 | 2,400 |

| United Kingdom | 10 | 2,400 |

| Malaysia | 30 | 1,900 |

| Uruguay | 30 | 1,900 |

| Switzerland | 10 | 1,900 |

| Jordan | 20 | 1,600 |

| Bolivia | 20 | 1,600 |

| Algeria | 20 | 1,600 |

| Italy | 10 | 1,600 |

| Mexico | 20 | 1,600 |

| Sweden | 10 | 1,600 |

| Spain | 10 | 1,300 |

| Netherlands | 20 | 1,300 |

| Ireland | 10 | 1,000 |

| Tanzania | 10 | 1,000 |

| Venezuela | 10 | 1,000 |

| Sri Lanka | 10 | 880 |

| Cyprus | 10 | 880 |

| Portugal | 20 | 880 |

| Canada | 10 | 880 |

| Botswana | 10 | 880 |

| Austria | 10 | 720 |

| Chile | 10 | 720 |

| Greece | 10 | 720 |

| New Zealand | 10 | 590 |

| France | 10 | 590 |

| Ghana | 10 | 590 |

| Kenya | 30 | 480 |

| Mauritius | 10 | 480 |

| Dominican Republic | 10 | 390 |

| Japan | 40 | 320 |

| Cambodia | 10 | 260 |

| Egypt | 10 | 260 |

| Uganda | 10 | 260 |

| Panama | 10 | 260 |

| Mongolia | 10 | 210 |

| Costa Rica | 10 | 170 |

8,100 1st | |

320 2nd | |

6,600 3rd | |

1,300 4th | |

5,400 5th | |

20 6th | |

4,400 7th | |

10 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with IC Markets receiving 2,290,000 visits vs. 20,456 for Trader’s Way.

3. Reviews

As shown below, Trader’s Way has a Trustpilot rating of 4.4 out of 5, based on around 60 reviews. IC Markets holds a much higher Trustpilot rating of 4.8 out of 5, with over 46,500 reviews. While Trader’s Way receives solid feedback for its trading features, its limited review volume and regulatory concerns make it less prominent. IC Markets, with its overwhelming number of positive reviews and strong reputation, is widely considered a more reliable and professional broker.

Our Stronger Trust and Regulation Verdict

IC Markets multi-regulatory framework and proven reputation put it far ahead of the unregulated Trader’s Way in overall trustworthiness.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Top Product Range And CFD Markets – IC Markets

Looking at the product range, I can say that Trader’s Way offers enough instruments to cover the basics. The range is relatively narrow, focusing on forex, a few indices, metals, energies, and some crypto pairs.

You’ll get 41 currency pairs, including the majors and a handful of exotics, plus seven index CFDs if you’re on MT4. Commodities are limited to just two metals and two energies and crypto traders get nine digital assets. Critically, there are no share CFDs, ETFs, bonds, or futures, which limits diversification.

In my opinion, this product lineup is enough to get by if you’re mainly a forex trader who dabbles in other CFD markets.

IC Markets, by contrast, feels like a true multi-asset broker. Alongside 61 forex pairs and 26 indices, it offers a fully fleshed-out commodities roster with multiple metals priced in various currencies, eight softs, and five energy products.

Crypto CFDs nearly triple those at Trader’s Way, and share traders can access over 2,100 global equities spanning the US, UK, Europe, and Asia-Pacific.

The range extends well into Futures, bonds, treasuries, and even investment products, which is why IC Markets is well regarded as a genuine multi-asset broker.

| CFDs | Trader's Way | IC Markets |

|---|---|---|

| Forex Pairs | 41 | 61 |

| Indices | 7 (MT4) | 23 Spot Indices 3 Index Futures |

| Commodities | 2 Metals 2 Energies | 4 Precious Metals (gold vs 6 flats) 3 Energies 3 Energy futures 14 Soft commodity futures |

| Cryptocurrencies | 9 | 18 |

| Share CFDs | No | 2100+ |

| ETFs | No | 3 NASDAQ 33 NYSE |

| Bonds | No | 12 |

| Futures | No | Yes |

| Treasuries | No | Yes |

| Investments | No | Yes |

Our Top Product Range and CFD Markets Verdict

IC Markets provides more products and CFD markets, allowing you to diversify your trading portfolio and capitalise on niche opportunities.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Superior Educational Resources – IC Markets

One thing I really like about IC Markets is that their education section doesn’t just throw random articles at you and call it a day. It’s actually well structured with categories for both beginners and traders with some trading experience to sharpen their skills.

I always point absolute beginners to the tutorial videos. They walk you through the basics including platform setup and trade execution in a way that makes it less intimidating to place that first live order.

You also have resources that keep you connected to what’s actually happening in the markets. The Web TV streams are part of my daily routine providing bite-sized analysis that helps you catch the big moves on time.

If you want something more interactive, the webinars are worth showing up for. Beyond just listening to market commentary, you can throw your own questions at professionals and get answers in real time.

I started listening to their new podcast recently, and I find it perfect for when I’m on the go and don’t have time to sit down in front of charts.

Trader’s Way offers a simpler learning package with a library of introductory guides, basic market explainers and walkthroughs on getting started. All these are helpful for newcomers finding their footing.

Beyond that, though, the material is squarely aimed at beginners. It covers spreads, margin, and the basics well enough, but once you’ve cleared that hurdle there isn’t much depth to keep you progressing.

Our Superior Educational Resources Verdict

IC Markets clearly outshines Trader’s Way in educational resources, offering a broader, more engaging mix of formats and content.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

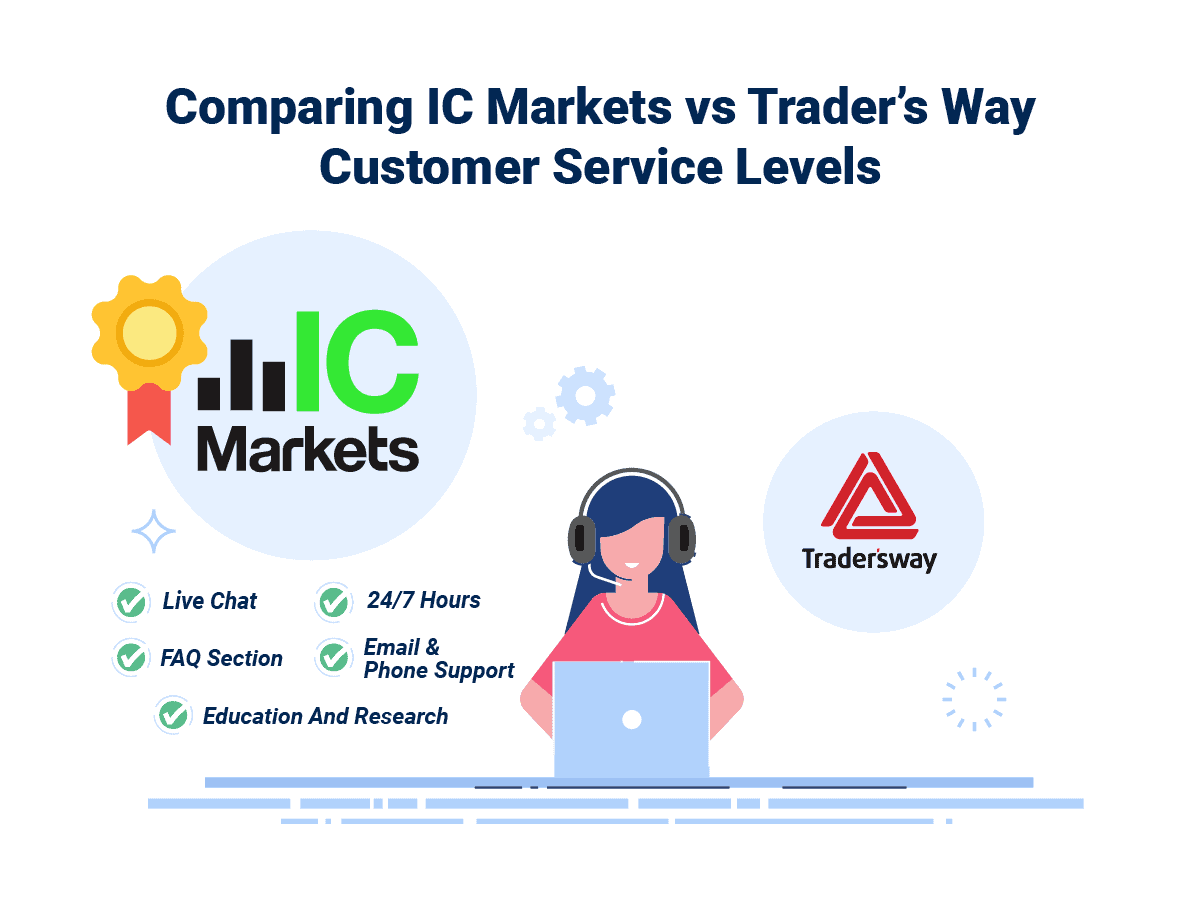

8. Superior Customer Service – IC Markets

When I compare Trader’s Way and IC Markets on customer support, the difference feels a bit like comparing a decent local café to a 24-hour, full-service restaurant chain. Both will get you fed, but one has more reach, consistency, and availability.

Take Trader’s Way, for instance, who’ve got the basics like live chat, email, and phone covered And support is multilingual, so you can get help in different languages, which I respect. But their coverage is 24/5 only. If you’ve ever been trading a Sunday night open, or caught in the middle of a Saturday funding delay, you know exactly why this matters.

I’ve had those moments where I needed an answer outside standard market hours, and with Trader’s Way, you’re waiting until Monday. That gap leaves you hanging.

Now compare that with IC Markets which offers similar support channels (live chat, phone, email, multilingual reps) but it’s 24/7. I’ve personally tested their live chat at some odd hours and someone was there within minutes.

That kind of constant availability is always reassuring as I know if an issue occurs I can get it resolved immediately.

| Feature | Trader's Way | IC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

IC Markets offers superior customer service with 24/7 availability, faster response times, and more consistent follow-ups.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Better Funding Options – Trader’s Way

Funding is where you really see the difference between a broker that’s global by design and one that’s still a bit niche.

With Trader’s Way, I’ll give them credit straight away with how they’re focused on crypto payment options. You can deposit and withdraw in Bitcoin, Ethereum, Litecoin, USDT, USDC, and more.

They also support e-wallets like Skrill and Neteller, plus some localized bank transfer methods in places like Malaysia, Vietnam, Nigeria, and India. I know a few traders who appreciate that flexibility, especially in regions where traditional card payments can be a hassle.

But step outside the crypto world, and you start to feel the limits. Trader’s Way doesn’t offer PayPal, no POLi or BPAY for Australians, no Klarna for Europeans, which IC does. In short, IC Markets runs what I’d call a truly global payment infrastructure.

| Funding Option | Trader's Way | IC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | No | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

IC Markets wins on the grounds of providing broader currency coverage, instant processing across most methods, and multiple high-trust global payment gateways.

10. Lower Minimum Deposit – Trader’s Way

I’ve always said minimum deposits tell you a lot about how a broker positions itself. With Trader’s Way, the bar to entry is almost nonexistent at just $10 to open an account. That’s pocket change, and it’s clear they’re aiming to make it as easy as possible for new traders to jump in.

Realistically though, I wouldn’t trade seriously with $10. Even their own recommended deposit is $100, which gives you at least a bit of room to size positions and manage margin. For me, that makes Trader’s Way appealing if you just want to test the waters with minimal risk or experiment with strategies on live markets without committing much capital.

IC Markets’ minimum and recommended deposit are both set at $200. This amount gives you enough margin flexibility to manage positions responsibly, especially if you’re trading with high leverage.

It’s not really designed for traders funding with pocket change,no offence, but for those who are ready to commit a bit more.

The pay off is that you’re getting access to raw spreads, ultra-fast execution, and platforms built to handle serious trading.

| Minimum Deposit | Recommended Deposit | |

| Trader's Way | $10 | $100 |

| IC Markets | $200 | $200 |

Our Lower Minimum Deposit Verdict

Trader’s Way makes it easier to get into forex trading with minimal upfront commitment.

Our Final Verdict On Which Broker Is The Best: IC Markets or Trader’s Way?

IC Markets dominates Trader’s Way in most categories, winning in nine out of ten, from spreads and fees to platforms, product range and regulation.

| Categories | Trader's Way | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | Yes | No |

Trader’s Way: Best For Beginner Traders

For beginners, I recommend Trader’s Way for its educational resources and ultra-low minimum deposit, making it easy to start trading without a big upfront commitment.

IC Markets: Best For Experienced Traders

For experienced traders, I recommend IC Markets for its razor-sharp pricing, advanced platform choices, and deep market access, ideal for high-volume and professional trading strategies.

FAQs Comparing Trader's Way Vs IC Markets

Does Trader's Way or IC Markets Have Lower Costs?

IC Markets typically offers lower overall trading costs. While Trader’s Way offers low raw account commissions on USD, IC makes up the difference with tighter spreads across both standard and raw accounts. On high-volume pairs like EUR/USD, IC’s spreads can drop as low as 0.1 pips. For a full breakdown of who’s offering the best rates, Check out this guide on the Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

If we’re talking strictly MetaTrader 4, IC Markets edges it out. Their MT4 isn’t just the plain version but you get 20+ extra trading tools, better order management add-ons, and access to deep liquidity that really shows when you’re scalping or running EAs. Basically, it feels more geared toward traders who want to push MT4 to its limits instead of just using the basic setup. For a closer look at the top MT4 setups in the market, check out this list of the best MT4 brokers.

What Broker is Superior For Australian Forex Traders?

If you’re trading from Australia, IC Markets is the clear pick. They’re ASIC-regulated, have deep local roots, and offer more firepower across platforms, tools, and liquidity. Add in their long-standing reputation and institutional-grade infrastructure and you’ve got a broker built for serious Aussie traders. Check out our Best Forex Brokers In Australia.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert