Best DMA Brokers

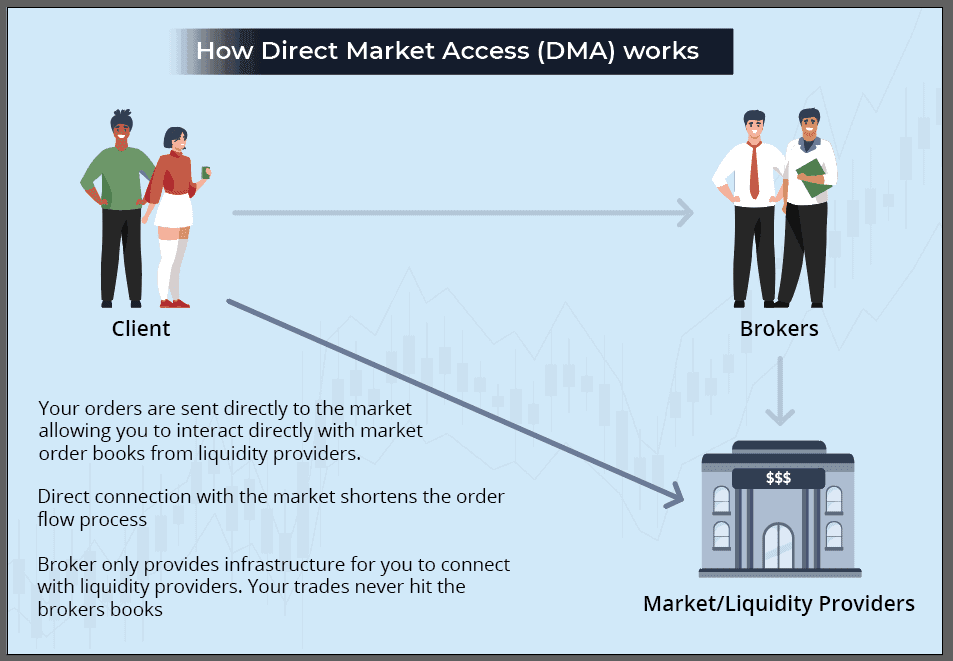

Direct Market Access Brokers (DMA) differ from types of brokerages like ECN and no dealing desk (NDD) as you can execute orders directly through electronic order books at the exchange. Below, we review the best DMA brokers for forex and shares.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

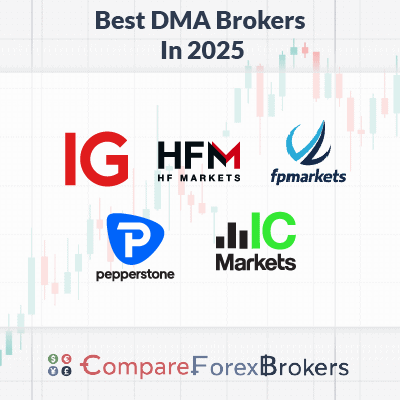

Our best DMA broker 2025 list is:

- IG Group - Top DMA Trading With Shares and Forex With L2 Dealer

- HFM - Good DMA Share Trading With MetaTrader 5

- FP Markets - Best ECN Pricing To Match DMA Options

- Pepperstone - Top Spreads With No Commissions

- IC Markets - Best Range Of Trading Platforms With ECN Pricing

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

46 |

FCA, FSCA, CYSEC DFSA, CMA, FSA-S |

- | - | - | $3.00 | 1.4 | 1.6 | 1.6 |

|

|

|

$0 | 38+ | 19+ |

|

What Are The Best Direct Access Market Brokers?

Direct Market Access (DMA) offers traders direct access to the order books of central market exchanges. Forex brokers with DMA have greater market depth (liquidity) and superior spreads, with the top brokers offering this feature listed below.

1. IG Group - A BROKER THAT HAS DMA FOR SHARES AND MAJOR FOREX PAIRS

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

We liked that IG Markets caters to the specific needs of its clients. While they predominantly use a Market Maker model, making most of their products spread-only, they also acknowledge the need for precise market price and liquidity assessment. This dual approach ensures that traders get the best of both worlds.

Pros & Cons

- A comprehensive selection of trading products

- Provides excellent market analysis with IGTV

- Has a good range of trading platforms

- Limited selection of trading products on MetaTrader

- DMA access is only available on L2 Dealer

- L2 Dealer is less user-friendly

Broker Details

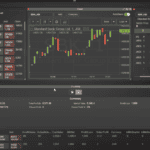

L2 Dealer stands out from the range of trading platforms on IG Group. It is specifically tailored for those who want true direct market access, something that isn’t fully implemented on other platforms like MT5.

Designed for spot currency and equity trading, while using the platform, we found that IG also allows you to trade forex and share CFDs, which is a bonus. Accessing CFDs allowed us to engage with the exchange’s order books using both leveraged and non-leveraged products, allowing us to increase our risk (and returns) through leverage.

Our first impression of the L2 Dealer platform is that it caters to the professional trading experience, focusing on the depth of market pricing and real-time newsfeeds from Reuters. If you like to read the order flow, we think the L2 Dealer is one of the better platforms.

The main benefit of direct market access is the ability to leverage the volume data available in books to predict order flow. We were impressed with the depth of markets offered, which showed the best bid and offer prices and further prices on either side of the order book.

You can customise the charts to match MetaTrader 5 and other advanced trading platforms, which offer similar technical indicators like moving averages and Bollinger Bands and chart types like bar and candlestick. We liked that we could narrow the chart’s timeframe to tick charts, which opens up DMA trading for scalpers on the L2 Platform.

While using L2 Dealer for shares and forex, we found you had to switch between the standard platform, which catered for stocks and share CFDs, and Forex Direct, which provided all of the forex DMA feeds and had a different interface. We think this feature lets you focus on one asset type, which is important to prevent mistakes or distractions from unnecessary charts or alerts.

The trading costs associated with Direct Market Access are traditionally lower due to the larger volumes or more frequent trades. We found that the spot forex spreads averaged 0.165 pips on EUR/USD, which is fairly low compared to other providers like FP Markets.

| Currency | DMA Avg. Spreads |

|---|---|

| EUR/USD | 0.165 |

| AUD/USD | 0.295 |

| USD/JPY | 0.242 |

| EUR/GBP | 0.54 |

| GBP/USD | 0.589 |

| USD/CHF | 0.399 |

(Source: https://www.ig.com/uk/trading-platforms/dma-trading)

In addition to low trading fees, we found IG Group had the largest choice of shares (over 12,000) and over 100 currency pairs with DMA access. This vast range of markets gives you plenty of options and liquidity to find opportunities in the markets daily, which is ideal for day trading.

2. HF Markets - Good DMA Share Trading With MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.9

AUD/USD = 1.8

Trading Platforms

MT4, MT5, HFM App

Minimum Deposit

$0

Why We Recommend HF Markets

We liked that HF Markets provides DMA pricing for equities from global exchanges. This is bolstered by their integration with the highly regarded MT 5 trading platform. In our experience, the combination ensures smooth and effective share trading. HF Markets is a clear front-runner for those seeking MetaTrader 5 for DMA share trading.

Pros & Cons

- Low trading commission on Zero account

- Trade over 3,000 markets

- Good range of free technical analysis tools

- Limited range of currency pairs compared to its competitors

- Slightly higher standard account spreads than the industry average

- Unimpressive customer support facilities

Broker Details

With HFM, we found the broker competed with IG Group in terms of the number of shares accessible with their DMA services. The broker offers 197 shares across eight exchanges, giving you access to the most popular markets while benefiting from the deep liquidity and better pricing DMA can provide.

We also appreciated the low share dealing costs with HFM, charging just 0.1% of the notional value for CFD trades. This commission is a typical cost when it comes to share dealing in Australia, so

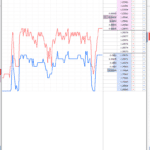

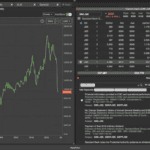

In terms of execution, we found that HFM used an STP and ECN model to execute your shares, giving you DMA access. Out of the available platforms, we found MetaTrader 5 to be the best for DMA access, thanks to its built-in Depth of Markets tool.

The DOM tool shows the different price levels beyond the current bid/offer price, allowing you to see which buy or sell side has more demand and giving you a decent insight into market bias.

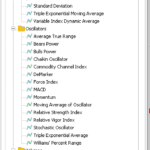

MetaTrader 5 platform also offers 21+ timeframes, including tick charts, which is excellent for scalpers. The platform also has over 37+ technical indicators, including popular tools like Ichimoku and Relative Strength Index, giving you a solid foundation for building your technical analysis strategies.

An improvement we liked about the MT5 platform is its inclusion of a native economic calendar, which ensures you are kept in the loop with real-time financial news and events that impact your trading decisions. The calendar adds labels to the charts to see when an upcoming event will be announced. Plus, it gives us the event details, which is helpful if you are about to place a trade so you can potentially avoid poor timing of your entry.

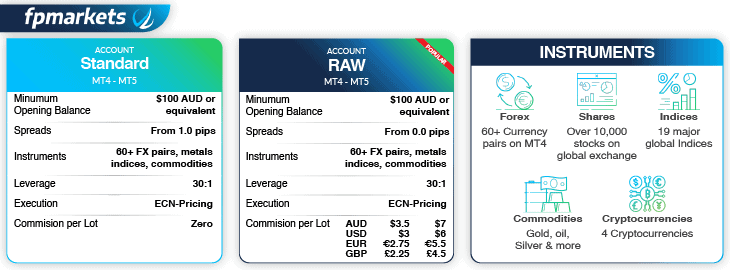

3. FP Markets - Best ECN Pricing To Match DMA Options

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We liked how FP Markets consistently delivers some of the best spreads we’ve seen, thanks to their STP trading. With their Raw account operating on a no-dealing desk model, they offer true ECN pricing. These spreads, provided directly by liquidity providers, are kept “raw”, ensuring that traders get the most competitive rates. We’ve noted spreads dipping to as low as 0.0 pips, especially for the EUR/USD pair.

Pros & Cons

- Spreads from 0.0 pips

- A wide range of trading products

- Three excellent trading platforms with DMA access

- Limited selection of forex pairs

- High minimum balance requirement for IRESS

- IRESS is only available in Australia

Broker Details

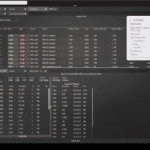

Out of the brokers we tested, FP Markets offered the best ECN pricing for share dealing and forex trading. The commissions charged on IRESS can vary between different markets (which is typical with share dealing services). We found the broker to charge 0.06% per side with a minimum of 6.00 AUD for Aus shares and 0.02 USD per share for NYSE/S&P500 shares with a minimum of $15 commission charged.

Based on our research, this appears to be the average share dealing costs with Australian-based brokers.

In our forex testing, we used the ECN-powered Raw account and found the spreads to average 0.1 pips on EUR/USD, 50% below the industry average. You do pay a commission of $3.00 per lot traded, which is lower than other ECN brokers, based on our tests, which averaged $3.48.

| Broker | EUR/USD |

|---|---|

| Tickmill | 0.1 |

| IC Markets | 0.02 |

| Fusion Markets | 0.13 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| FXTM | 0 |

| TMGM | 0.1 |

| HYCM | 0.1 |

| XM | 0.1 |

| GO Markets | 0.2 |

| Eightcap | 0.06 |

| Industry Average | 0.22 |

We found that you need a separate account to use the IRESS platform. This meant we needed two accounts to trade forex (plus other assets) and an IRESS account just for share dealing.

Although you can access a range of 600+ CFD markets, including forex, indices, and commodities, they are only available on the MT4/MT5 platforms, with a limited selection of stock CFDs. In contrast, the IRESS platform hosts 10,000 shares across nine major exchanges but doesn’t let you invest in the other markets mentioned. So, there is a decent range of markets to trade, but the fact you need two accounts can be slightly off-putting for some.

In our tests, we thought the IRESS platform was impressive. It offers plenty of technical indicators and drawing tools to make your analysis efficient.

Compared with MetaTrader 5 (FP Markets’ other DMA option), IRESS gives you a true DMA experience, offering a deeper and more transparent market depth than the MT5 tool (which is limited in comparison).

To access the IRESS platform, we were surprised to find it had a monthly subscription cost of 60 AUD. This fee is waived if you make 15 trades per month, which is easily achievable if you take trading seriously – which is likely why you are looking for DMA brokers.

An alternative would be the MetaTrader 5 platform; however, we found that it didn’t have the full portfolio of share markets available on the IRESS platform.

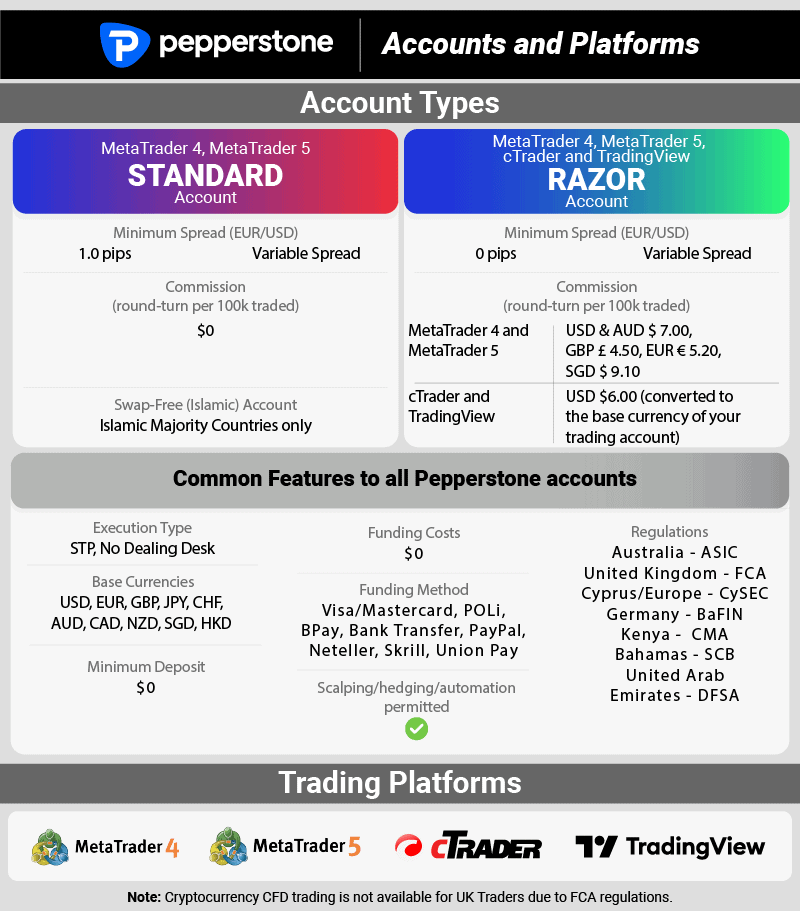

4. Pepperstone - Top Spreads With No Commissions

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.69

AUD/USD = 1.22

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone consistently delivers among the industry’s lowest spreads for their basic and razor account types, thanks to their advanced pricing improvement technologies. Knowing that multiple global regulatory bodies oversee this broker is also reassuring. In our experience, if you’re looking for a top-tier broker with no commissions, Pepperstone is the clear choice. We’ve tested it and can vouch for its credibility.

Pros & Cons

- Tight spreads with no commission

- DMA access through multiple platforms

- Has a wide range of markets to trade

- No guaranteed stop-loss orders

- DMA access is limited to cTrader and MT5

- Lacks up-to-date education resources

Broker Details

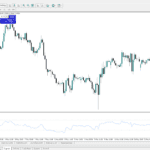

Pepperstone offers a commission-free standard account and uses an STP execution model, meaning your trades are executed with no dealing desk intervention. You should open this account if you want no-commission trading and use the MT4 or MT5 platform.

Pepperstone offers a commission-free standard account and uses an STP execution model, meaning your trades are executed with no dealing desk intervention. You should open this account if you want no-commission trading and use the MT4 or MT5 platform.

We asked our analyst to test the spreads for the standard account and found that the broker averaged 1.12 pips on EUR/USD, beating the 1.24 industry average. This spread makes Pepperstone one of the lowest-cost brokers, especially when you factor in that there are no commissions, keeping trading fees simple, which is ideal if you are a beginner.

Alternatively, if you wish to access Depth of Markets tools to read the market orders on the platform, you’ll need access to cTrader or MetaTrader 5. These tools are only available on the Razor account, which has tighter spreads and a low commission and uses an ECN execution model that instantly matches your trades with other traders.

The commission charged depends on which platform you are using. For MetaTrader 5 users, it is $3.50 per lot traded, and for cTrader platform users, it is $3.00. The low commission is one reason we think cTrader is appealing regarding DMA access platforms and their lower costs.

While exploring these platforms, we also tested the execution speeds on the MT4 platform to find out how fast Pepperstone can fill your trades and compared them with 19 other brokers.

Our testing found that the broker averaged 77ms on limit order speed, one of the lowest recorded. Having a fast limit order speed means your stop loss and take profit orders are less likely to suffer from negative slippage.

| Broker | Limit Order Rank | Limit Order Speed |

|---|---|---|

| Blackbull Markets | 1 | 72 |

| Fusion Markets | 3 | 79 |

| Pepperstone | 2 | 77 |

| Octa | 4 | 81 |

| OANDA | 5 | 86 |

| Blueberry Markets | 6 | 88 |

| Global Prime | 7 | 88 |

| Axi | 8 | 90 |

| Tickmill | 9 | 91 |

| Exness | 10 | 92 |

| TMGM | 11 | 94 |

Pepperstone offers a solid choice of platforms, such as cTrader and MetaTrader 5 for DMA access platforms, but also offers MT4 and TradingView as alternative options too.

We believe MT5 is becoming more popular for new (and experienced) traders. It expands on MT4’s features by improving its infrastructure to support trading stocks on the platform and including more technical indicators and chart types.

MetaTrader 5 and cTrader are set up to take advantage of direct market access with more advanced tools, such as the Depth of Markets tool, which is fine-tuned for DMA trading.

The broker does offer MetaTrader 4, but unlike cTrader and MT5, it doesn’t have Direct Market Access (DMA) unless you install third-party plugins or expert advisors—an unnecessary step considering you can rely on MetaTrader 5.

However, if you have MQL4-based technical indicators and expert advisors that haven’t been translated to MQL5 yet, this can still be an option for DMA-style access.

We also liked that Pepperstone provided a Smart Trader Tools tool that adds 20+ Expert Advisors and indicators to your MT4 and MT5 platforms. In our testing, we found this tool improves the trade management experience and enhances features missing from the platforms.

For example, EAs like Trade Manager, which lets you modify all of your stop-loss orders simultaneously, are useful if you have multiple open orders.

5. IC Markets - THE BEST RANGE OF PLATFORMS WITH ECN PRICING

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We liked that IC Markets offers traders the flexibility of trading platforms. Their commitment to low fees is evident, and it’s hard to overlook the exceptional spreads of their Raw account. In our experience, these factors set them apart as an outstanding broker choice. IC Markets is our top recommendation for those prioritising no commissions and competitive spreads.

Pros & Cons

- Competitive low spreads from 0.0 pips

- Good selection of platforms that offer DMA access

- Has Futures CFDs

- DMA access is not available on MT4

- Different commissions for MT4 and cTrader

- Minimum deposit is $200

Broker Details

IC Markets offers three trading platforms with DMA access: MT4, MT5, and cTrader. In our opinion, they all work and function similarly, so it all comes down to preference for how they look and ease of access.

IC Markets offers three trading platforms with DMA access: MT4, MT5, and cTrader. In our opinion, they all work and function similarly, so it all comes down to preference for how they look and ease of access.

For example, MT4 and MT5 platforms have the same interface and most of the same features. MT4 edges ahead if you want access to a larger community of developers for bespoke technical indicators and automated trading strategies, as you’ll find more su.

Otherwise, MT5 is superior with more native technical indicators (38+), a native economic calendar, and a depth of markets tool that receives Level 2 pricing from the Direct Market Service. In fact, when testing on MT4, we didn’t find any streaming of Level 2 pricing, so that you couldn’t monitor the trading volume on the platform as easily without the Depth of Markets tool.

cTrader is a combination of both platforms, offering all the same features you’d find with MT4 and MT5, but we think the interface is slightly better looking. You also get the depth of market tools on cTrader, real-time news feeds and native Trading Central/AutoChartist tools built into the charts, making it easier to use the analysis.

On another note, depending on your device, cTrader is the only platform that offers native software for each device. At the same time, MT4/MT5 uses a Wine emulator to run on Apple Mac computers, which doesn’t guarantee consistent performance and could impact the platform executing trades.

From our testing, we think IC Markets excels in providing an extensive range of platforms, including an impressive Raw spread account offering some of the lowest spreads tested.

The broker achieved an average of 0.19 pip spread on EUR/USD, the lowest tested on a Raw account, beating the industry average by 0.08 pips. You’ll find it hard to get lower spreads than this one, which also offers Direct Market Access.

| EUR/USD | Average Spread |

|---|---|

| TMGM | 0.15 |

| Tickmill | 0.15 |

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| CityIndex | 0.22 |

| ThinkMarkets | 0.22 |

| Tested Industry Average | 0.27 |

The commission charged for the Raw account is competitive, too. MetaTrader platforms charge $3.50 per lot traded and $3.00 on cTrader (similar to Peppertsone’s commissions), making IC Market a competitive broker for low trading fees.

IC Market’s low trading costs make it an excellent choice for day traders or scalpers who need tighter spreads to increase their profit margins.

Considering IC Markets is a low-cost broker, it certainly doesn’t limit its services or range of markets. It offers 1,700+ markets, including 61+ forex, 25+ indices, 26+ commodities, and 1,600+ share CFDs. If you like to day trade with this range of markets, we think you’ll be well equipped to find new trading opportunities daily.

Ask an Expert