FP Markets Review Of 2025

FP Markets has low spreads and is regulated with ASIC and the CySEC. We discovered that FP Markets offers excellent trading platforms, a wide range of CFD markets, and fast execution speeds.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

FP Markets Summary

| 🗺️ Country Regulation | Australia (ASIC), Europe (CySEC) |

| 💰 Trading Fees | Raw and Standard Spreads |

| 📊 Trading Platforms | MT4, MT5, cTrader, TradingView |

| 💰 Minimum Deposit | $100 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | Forex, Shares, Commodities, Indices, Crypto, ETFs, Bonds |

| 💳 Card Deposit | Credit Card, Debit Card |

Why Choose FP Markets

We awarded FP Markets an overall score of 81/100 based on consistency across every factor using our broker scoring methodology. In particular, the broker has fast execution speeds, a solid MetaTrader platform experience, and provides access to over 10,000 financial markets, which is why we rated FP Markets as the best CFD broker overall.

Areas we scored FP Markets the highest were excellent customer service (9/10), great educational resources (8/10) and a wide variety of funding methods (8/10). Beyond these factors, FP Markets offers very competitive spreads , particularly with its RAW account, its own intuitive FP Markets trading app, and the unique ability to trade spot shares (in certain regions) using the IRESS platform.

FP Markets Pros and Cons

- Fast execution speeds

- Excellent trading platforms

- Wide range of CFDs

- No proprietary platform

- Unregulated offshore entity

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

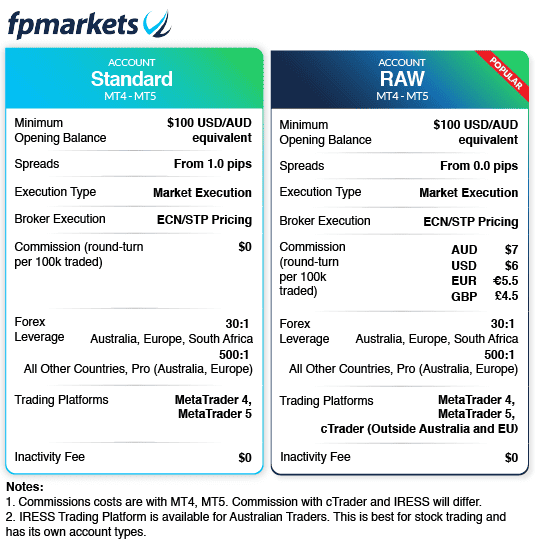

FP Markets offers two main forex account types and pricing structures:

- Standard Account: Commission-free spreads, ideal for beginner traders

- RAW Account: ECN pricing with low spreads, designed for active and experienced traders

1. RAW Account Spreads

FP Markets’ RAW account offers ultra competitive raw pricing, especially for AUD/USD and EUR/GBP, with spreads at 0.20 and 0.30 pips respectively.

|

ECN Forex Spread Comparison

|

|||||

|---|---|---|---|---|---|

|

0.10 | 0.30 | 0.50 | 0.30 | 0.60 |

|

0.06 | 0.23 | 0.49 | 0.30 | 0.59 |

|

0.10 | 0.10 | 0.90 | 0.20 | 1.10 |

|

0.20 | 0.20 | 0.50 | 0.40 | N/A |

|

0.09 | 0.13 | 1.70 | 0.14 | 1.40 |

|

0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

|

0.20 | 0.50 | 0.70 | 0.50 | 0.60 |

|

0.17 | 0.30 | N/A | 0.54 | 0.68 |

|

0.10 | 0.50 | 1.10 | 0.60 | 0.80 |

|

0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

|

0.44 | 1.23 | 1.17 | 1.13 | 1.23 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

While Eightcap offers a slightly lower spread for EUR/USD at 0.06 pips, FP Markets offers a spread of 0.10 pips, on par with leading competitors like Pepperstone and Admiral Markets, and lower than the industry average.

| Raw Account Spreads | FP Markets | Average Spread |

|---|---|---|

| Overall | 0.38 | 0.72 |

| EUR/USD | 0.10 | 0.28 |

| USD/JPY | 0.56 | 0.44 |

| GBP/USD | 0.29 | 0.54 |

| AUD/USD | 0.21 | 0.45 |

| USD/CAD | 0.16 | 0.61 |

| EUR/GBP | 0.43 | 0.55 |

| EUR/JPY | 0.3 | 0.74 |

| AUD/JPY | 0.5 | 0.93 |

| USD/SGD | 0.8 | 1.97 |

2. Raw Account Commission Rate

FP Markets commission fees are competitive compared to other online brokers with similar ECN Account types. As shown in the table below, RAW Account holders pay $3 per side, per 100k traded, while most brokers charge $3.50.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| FP Markets Commission Rate | $3.00 | N/A | £2.25 | €2.75 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

FP Markets offers competitive no commission spreads, as low as 1.2 pips for the frequently traded EUR/USD forex pair.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| FP Markets Average Spread | 1.2 | 1.5 | 1.4 | 1.3 | 1.4 | 1.2 | 1.4 | 1.6 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

Our methodology for determining spreads involves a comprehensive analysis of real-time forex spread data during peak trading hours, ensuring that the figures we present are both accurate and reflective of what traders can expect in live trading conditions.

This approach allows us to provide a transparent comparison of FP Markets against its peers, highlighting its strong position in the forex industry, especially for the EUR/USD pair.

When trading FP Markets commission-free spreads, MetaTrader 4 and MetaTrader 5 are available as trading platform options, and for those located outside Australia and the EU, cTrader is also an option.

4. Swap-Free Account Fees

FP Markets also offers an Islamic account, which doesn’t involve any swaps or interest on overnight positions to stay in line with Islamic principles. Rather, you’ll be charged a fee on positions, which is deducted from your account balance.

To be eligible for an Islamic Account, you need to sign up to a Standard or Raw Account with MT4 or MT5.

5. Other Fees

If you live in Australia, you also have the option of opening an IRESS trading account. While designed for stocks, other selected CFD products are also available on the platform. In most cases when using IRESS, you will pay a monthly fee of $55.

The equity CFD fees are as follows:

| Stock CFD Fees | Commission (per side) | Minimum Commission Fee |

|---|---|---|

| Australia | 0.1% | 0 AUD |

| Singapore | 0.15% | 25 SGD |

| Hong Kong | 0.3% | 10 HKD |

| London | 0.1% | 10 GBP |

| Frankfurt | 0.1% | 10 EUR |

| U.S. NYSE | 2 cents per share | 15 USD |

| U.S. NASDAQ | 2 cents per share | 15 USD |

These are lower than the equivalent charges on the MT4 and MT5 platforms.

Use the calculator below to compare FP Markets’ trading costs with competitors such as Pepperstone and Eightcap, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Verdict on FP Markets Fees

FP Markets caters to beginners with its standard spreads and no commission structure, and more experienced traders through ECN pricing with raw spreads, offering tailored solutions for every trading level .

Trading Platforms

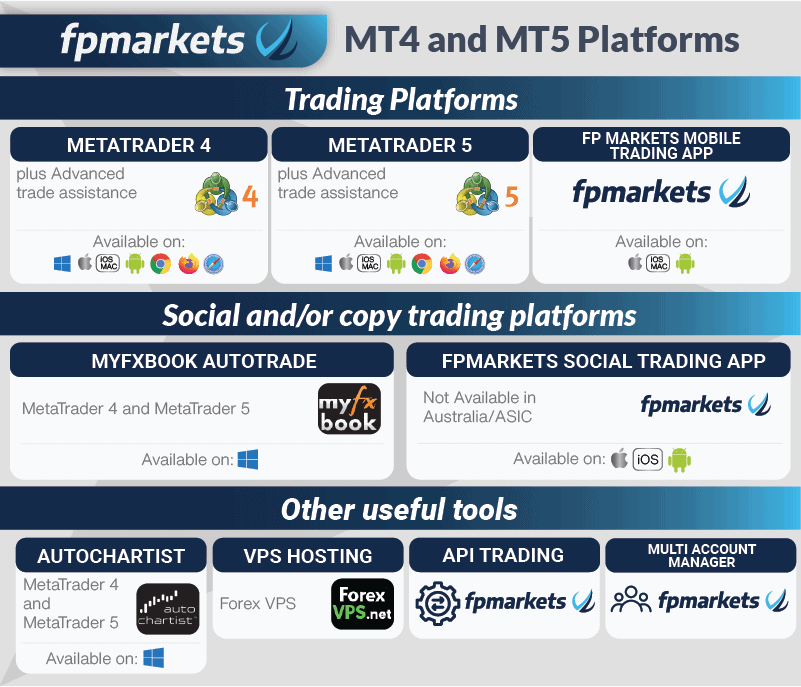

FP Markets provides traders with a wide selection of advanced trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, Mottai, Iress, TradingView, and the FP Markets trading app.

| Trading Plaform | Available With FP Markets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| TradingView | Yes |

| Proprietary Platform | No |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

As shown in the table below, the availability of these platforms varies depending on your location and the regulatory jurisdiction you fall under. Additionally, each platform is available on different devices, ranging from mobile apps, to webtrader options, and desktop trading platforms.

| Trading Platform | Australia (ASIC Regulation) | Europe (CySEC Regulation) | International (Offshore Regulation) | Devices Available |

|---|---|---|---|---|

| MetaTrader 4 (MT4) | ✅︎ | ✅︎ | ✅︎ | Mobile apps (Android and iOS), WebTrader, Windows PC, Mac PC |

| MetaTrader 5 (MT5) | ✅︎ | ✅︎ | ✅︎ | Mobile apps (Android and iOS), WebTrader, Windows PC, Mac PC |

| cTrader | ❌ | ❌ | ✅︎ | Mobile apps (Android and iOS), WebTrader, Windows PC |

| Mottai | ✅︎ | ❌ | ❌ | Mobile apps (Android and iOS), WebTrader, Windows PC |

| Iress | ✅︎ | ❌ | ❌ | Mobile apps (Android and iOS), WebTrader, Windows PC, Mac PC |

| TradingView | ✅︎ | ❌ | ✅︎ | Mobile apps (Android and iOS), WebTrader |

| FP Markets Trading App | ✅︎ | ✅︎ | ✅︎ | Mobile apps (Android and iOS) |

Note: MT4/MT5 is an option for Mac but you need to be using an earlier version than Mojave 10.14. A later version will require an Emulator or WINE.

MetaTrader 4 & 5

MetaTrader platforms are renowned for their reliability, comprehensive charting tools, and extensive support for automated trading. Both MT4 and MT5 offer features such as customisable charts across multiple time frames, a wide range of technical indicators, one-click trading, and support for trading robots (Expert Advisors). MT5 builds upon the offerings of MT4 with additional capabilities like centralised trading (except for spot shares), depth of market (DoM), enhanced charting tools, and an improved programming language for custom indicators and scripts.

Key Enhancements with MetaTrader:

- Autochartist: This powerful tool scans the markets in real-time, providing traders with insights and alerts on potential trading opportunities based on chart patterns and key price levels.

- Traders Toolbox: An exclusive collection of advanced tools including alarm managers, extra tick charts, and trade terminals, designed to enhance the MetaTrader trading experience.

You can check out our Pepperstone MT4 vs MT5 guide if you’re not sure which MetaTrader platform to choose.

Other Trading Platforms

Beyond the MetaTrader series, FP Markets offers a variety of other trading platforms, each with unique features to cater to different trading strategies and preferences:

- cTrader: Known for its intuitive interface and advanced order execution capabilities, cTrader is ideal for traders seeking detailed market analysis and precision in their trading operations.

- Mottai: A recent addition to FP Markets, Mottai offers a streamlined and efficient trading experience, designed with a focus on user-friendliness and high-tech trading solutions.

- TradingView: This platform is favoured by traders who need advanced charting tools and value the ability to connect with a global trading community, combining analytical tools with social networking features for strategy sharing.

- Iress: Tailored for comprehensive stock trading, Iress caters to a wide range of trading activities, from basic to advanced, and is equipped with various interfaces to suit different trader needs, providing access to extensive market data and trading tools.

Add-on Features and Trading Tools

FP Markets enhances its trading environment with a suite of features and add-ons designed to support and enhance the trading strategies of its clients.

From advanced tools that facilitate automated and social trading to services that ensure the stability and efficiency of trade execution, these additional offerings cater to the diverse needs of traders.

Here’s an overview of the key features and add-ons available at FP Markets:

- Copy Trading and Myfxbook: Myfxbook Autotrade extends automated trade copying services, enabling traders to mirror the strategies of seasoned traders directly within their MT4 platform. This integration not only provides access to a broad array of trading strategies but also delivers comprehensive performance statistics to inform trading decisions.

- Social Trading: The social trading platform at FP Markets encourages the exchange and replication of trading strategies among its community. This feature is particularly beneficial for traders looking to leverage the collective knowledge and experiences of a global trading network.

- VPS (Virtual Private Server): FP Markets offers a VPS service, ensuring that trading strategies are hosted on a secure, high-speed server. This service is crucial for traders using automated trading systems, as it guarantees that their strategies run uninterrupted, 24/7, without the need for a constant personal computer connection.

- Trading Central: As a leading provider of financial insights and analysis, Trading Central supports FP Markets traders by offering expert evaluations and recommendations. These insights are invaluable for making informed trading decisions based on technical analysis and market trends.

- Signal Start: This service allows traders to follow and copy the trades of successful traders, providing an opportunity to learn from experienced market participants. Signal Start is an excellent tool for traders looking to enhance their trading strategies and potentially increase their profitability.

Mobile Trading Apps

FP Markets caters to the modern trader’s need for mobility and flexibility by offering mobile trading options across its platform range. You can manage their accounts, monitor markets, and execute trades from anywhere, at any time. These apps are designed to provide a seamless trading experience on the go, featuring intuitive interfaces, full trading functionality, and access to real-time market data and analysis tools.

Whether using iOS or Android devices, FP Markets ensures that traders have the critical tools they need right at their fingertips, making mobile trading both efficient and accessible.

Trade Experience

FP Markets operates with a no dealing desk (NDD) model and works with various liquidity providers to offer competitive prices and deep liquidity across many instruments. This approach, along with direct market access (DMA) pricing, provides traders with tight spreads and quick execution times, leading to efficient and clear trading conditions.

In our Execution Speeds testing, FP Markets achieved market order speeds of 96ms, better than the industry’s 134ms average, although its limit order speed was slower at 225ms.

Still, FP Markets secured the 10th spot among 20 brokers, confirming it as a broker with effective execution speeds. Our ranking process includes detailed testing of execution speeds in different trading situations to guarantee the precision and dependability of our results.

| Overall Rank | Broker | Limit Order Speed (ms) | Market Order Speed (ms) | Execution Type |

|---|---|---|---|---|

| 1 | Blackbull Markets | 72 | 90 | ECN |

| 2 | Fusion Markets | 79 | 77 | ECN |

| 3 | Pepperstone | 77 | 100 | ECN |

| 4 | OANDA | 86 | 84 | Market Maker |

| 5 | Octa | 81 | 91 | ECN |

| 6 | Blueberry Markets | 88 | 94 | ECN |

| 7 | Global Prime | 88 | 98 | ECN |

| 8 | Axi | 90 | 164 | ECN |

| 9 | Tickmill | 91 | 112 | ECN |

| 10 | Exness | 92 | 88 | Market Maker |

| Industry Average | 127 | 134 |

Verdict

FP Markets delivers one of the most comprehensive selections of trading platforms and tools in the industry, ensuring traders have everything they need for successful trading.

Is FP Markets Safe?

FP Markets has an overall trust score of 60 based on regulation, reputation, and reviews.

Regulation

FP Markets is overseen by two top-tier financial authorities, being the Australian Securities and Investment Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC) in Europe.

Outside of Australia and Europe, the online broker is regulated offshore in South Africa (FSCA), Seychelles (FSA), and Mauritius (FSC).

| FP Markets Safety | Regulator |

|---|---|

| Tier-1 | ASIC CySEC |

| Tier-2 | X |

| Tier-3 | FSA-S FSC-M FSCA CMA |

Reputation

Established in 2005 in Sydney, Australia, FP Markets has a strong reputation in European and Australian markets despite a moderate monthly search volume of 27,100.

Reviews

The CFD broker boasts a TrustPilot score of 4.9 out of 5 from 5,478 reviews, indicating high levels of client satisfaction and trust in the broker’s services.

Verdict

Given its solid regulatory framework, established reputation, and exceptional client reviews, FP Markets is a reliable and trusted broker for forex and CFD trading.

How Popular Is FP Markets?

CMC Markets demonstrates solid visibility in the online trading space. With approximately 90,500 monthly Google searches, it ranks as the 22nd most popular forex broker among the 65 brokers analyzed. Web traffic data shows a somewhat stronger positioning, with Similarweb reporting 1,747,000 global visits in February 2024, placing CMC Markets as the 17th most visited broker.

Founded in 1989 and headquartered in London, CMC Markets is one of the industry’s longest-established online brokers. The company is publicly listed on the London Stock Exchange with a market capitalization of approximately £700 million as of 2024. CMC Markets reported serving 89,978 active clients as of its latest financial reporting, generating £290.5 million in net trading revenue for the 12 months ending March 31, 2024. The broker’s client assets reached £561.1 million, reflecting its established position particularly in the UK and European trading landscapes.

| Country | 2024 Monthly Searches |

|---|---|

| Italy | 12,100 |

| India | 2,900 |

| United Kingdom | 2,400 |

| South Africa | 2,400 |

| Australia | 1,900 |

| Greece | 1,900 |

| United States | 1,600 |

| Canada | 1,600 |

| Spain | 1,600 |

| Germany | 1,300 |

| Pakistan | 1,300 |

| France | 880 |

| Turkey | 720 |

| Bangladesh | 720 |

| Poland | 720 |

| Malaysia | 720 |

| Thailand | 720 |

| Indonesia | 590 |

| Brazil | 590 |

| Nigeria | 590 |

| Singapore | 590 |

| Kenya | 590 |

| Morocco | 590 |

| United Arab Emirates | 480 |

| Netherlands | 480 |

| Cyprus | 480 |

| Switzerland | 480 |

| Philippines | 390 |

| Vietnam | 320 |

| Colombia | 260 |

| Sweden | 210 |

| Egypt | 210 |

| Algeria | 210 |

| Saudi Arabia | 210 |

| Cambodia | 210 |

| Taiwan | 210 |

| Portugal | 210 |

| Mexico | 170 |

| Hong Kong | 170 |

| Austria | 170 |

| Sri Lanka | 140 |

| Japan | 140 |

| Argentina | 140 |

| Venezuela | 110 |

| Ethiopia | 110 |

| Tanzania | 110 |

| Ireland | 90 |

| Peru | 70 |

| Ecuador | 70 |

| Uzbekistan | 70 |

| Ghana | 70 |

| Uganda | 70 |

| Dominican Republic | 70 |

| Chile | 70 |

| Jordan | 70 |

| Botswana | 50 |

| New Zealand | 40 |

| Bolivia | 30 |

| Costa Rica | 20 |

| Mauritius | 20 |

| Panama | 20 |

| Mongolia | 10 |

2024 Average Monthly Branded Searches By Country

Italy

Italy

|

12,100

1st

|

India

India

|

2,900

2nd

|

United Kingdom

United Kingdom

|

2,400

3rd

|

South Africa

South Africa

|

2,400

4th

|

Australia

Australia

|

1,900

5th

|

Greece

Greece

|

1,900

6th

|

United States

United States

|

1,600

7th

|

Canada

Canada

|

1,600

8th

|

Spain

Spain

|

1,600

9th

|

Germany

Germany

|

1,300

10th

|

Deposit and Withdrawal

FP Markets has a low minimum deposit and offers a range of fee-free deposit and withdrawal methods.

What is the minimum deposit at FP Markets?

The minimum deposit requirement for both Standard and Raw accounts with FP Markets is 50 USD/EUR/GBP in Europe and 100 AUD or its equivalent for Australia and international clients.

For Iress accounts, a higher minimum deposit of 1000 AUD is required in Australia.

| Minimum Deposit Requirement | Australia (ASIC Regulation) | Europe (CySEC Regulation) | International (Offshore Regulation) |

|---|---|---|---|

| Standard Account | $100 AUD or equivalent | 50 USD/EUR/GBP | $100 AUD or equivalent |

| Raw Account | $100 AUD or equivalent | 50 USD/EUR/GBP | $100 AUD or equivalent |

| Iress Account | $1000 AUD | NA | NA |

Account Base Currencies

FP Markets provides the flexibility of choosing from seven base currencies for funding your account, including USD, AUD, NZD, CAD, GBP, EUR, and CHF. Upon registration, you have the option to select your preferred account base currency, which will be used for calculating commissions and managing your funds.

Deposit Options and Fees

FP Markets offers its clients the advantage of no deposit or withdrawal fees, coupled with a broad selection of payment methods including credit cards, debit cards, bank transfers, and e-wallets.

This policy ensures that traders can manage their funds efficiently without worrying about additional costs. For international deposits, FP Markets goes a step further by offering to cover internal bank fees. If a client submits a receipt showing an original deposit fee of no more than 50 USD, FP Markets will reimburse the international bank fees charged by the client’s bank for deposits over 10,000 USD.

Withdrawal Options and Fees

However, it’s important to remember that while FP Markets does not charge for withdrawals, clients may face fees from intermediary banks for international transactions.

| Payment Method | Australia (ASIC Regulation) | Accepted Currencies (Australia) | Deposit Fees (Australia) | Europe (CySEC Regulation) | Accepted Currencies (Europe) | Deposit Fees (Europe) | International (Offshore Regulation) | Accepted Currencies (Offshore) | Deposit Fees (Offshore) |

| Credit & Debit Card | ✅ | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, CZK, PLN, AED | No fees* | ✅ | EUR, USD, GBP | No fees | ✅ | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, CZK, PLN, AED | No fees* |

| Bank Transfer | ✅ | AUD, USD, EUR, GBP, SGD, CAD | No deposit fees; FP Markets covers international fees up to 50USD for deposits over 10,000 USD | ✅ | EUR, USD, GBP | No fees | ✅ | AUD, USD, EUR, GBP, SGD, CAD | No fees; FP Markets covers international fees up to 50USD for deposits over 10,000 USD |

| Neteller | ✅ | AUD, CAD, CHF, EUR, GBP, JPY, INR, BRL, SGD, USD | No fees | ✅ | EUR, USD, GBP | No fees | ✅ | Various | No fees |

| Skrill | ✅ | AUD, CAD, EUR, GBP, INR, USD, BRL | No fees | ✅ | EUR, USD, GBP | No fees | ✅ | Various | No fees |

| PayPal | ❌ | ✅ | EUR, USD, GBP | No fees | ❌ | ||||

| Safecharge | ❌ | ✅ | EUR, GBP | No fees | ❌ | ||||

| Local Bank Transfer | ✅ | MYR, IDR, VND | Covered by FP Markets | ❌ | ❌ | ||||

| SticPay | ✅ | JPY, EUR, GBP, USD, HKD, TWD, KRW, SGD | No Fees | ❌ | ✅ | JPY, EUR, GBP, USD, HKD, TWD, KRW, SGD | No fees | ||

| Fasapay | ✅ | USD, IDR | No fees | ❌ | ❌ | ||||

| Virtual Pay | ✅ | KES, UGX, TSH | No fees | ❌ | ✅ | KES, UGX, TSH | No fees | ||

| Rupee Payments | ✅ | INR | No fees | ❌ | ✅ | INR | No fees | ||

| Cryptocurrency (LetKnowPay) | ✅ | ADA, BCH, BTC, DASH, ETH, LTC, PAX, XRP, TUSD, USDC, USDT, ZEC | Blockchain fees applicable | ❌ | ✅ | ADA, BCH, BTC, DASH, ETH, LTC, PAX, XRP, TUSD, USDC, USDT, ZEC | Blockchain fees applicable | ||

| Rapid Transfer | ✅ | Various | No fees | ❌ | ✅ | EUR, DKK, SEK, HUF, GBP, PLN, NOK | No fees | ||

| Apple Pay/Google Pay | ✅ | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, CZK, PLN, AED | No fees* | ❌ | ✅ | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, CZK, PLN, AED | No fees* | ||

| PaymentRush | ✅ | INR | No fees | ❌ | ✅ | INR | No fees | ||

| B2Binpay | ✅ | Various cryptocurrencies | No fees | ❌ | ✅ | Various cryptocurrencies | No fees | ||

| Thuderxpay | ✅ | LAK | Covered by FP Markets | ❌ | ✅ | LAK | Covered by FP Markets | ||

| Plusdebit / Online Banking | ✅ | VND | Covered by FP Markets | ❌ | ✅ | VND | Covered by FP Markets | ||

| PaymentAsia | ✅ | IDR | Covered by FP Markets | ❌ | ✅ | IDR | Covered by FP Markets |

Verdict

FP Markets offers low minimum deposits and diverse, fee-free payment methods.

Product Range

FP Markets offers an extensive range of over 10,000 tradeable products across various asset classes including forex, cryptocurrencies, stocks, indices, ETFs, commodities, bonds, and metals.

| Asset Class | Number of Products |

|---|---|

| Total Products | 10,000+ |

| Forex Pairs | 70+ |

| Cryptos | 11 |

| Stocks | 10,000+ |

| Indices | 22 |

| ETFs | 45 |

| Commodities | 9 |

| Bonds | 2 |

| Metals | 9 |

CFDs

FP Markets Full Product Range:

- FX Trading: With 63 major, minor, and exotic pairs, FP Markets’ forex offerings are competitive, including currencies like AUD, CAD, JPY, NZD, SGD, GBP, EUR, and more exotic options such as the Swedish Krona and Turkish Lira.

- Shares: The broker excels in shares trading, providing access to more than 10,000 stocks, including 814 as CFDs and nearly 10,000 outright stocks through the IRESS platform, marking one of the broadest ranges available globally.

- Indices: Traders have access to 19 global indices, including the NASDAQ 100, S&P 500, and EUREX.

- Commodities: FP Markets lists 13 commodities, including softs, energies, and metals such as gold, oil, agricultural products, and silver.

- Cryptocurrencies: The broker supports trading in 11 cryptocurrencies, covering major coins like Bitcoin, Ethereum, Ripple, Bitcoin Cash, and Litecoin.

- Bonds: Although the selection is limited, FP Markets offers 2 bonds: the UK Long Gilt and the US 10-Year Treasury Note.

- ETFs: There are 46 ETFs available, providing a unique opportunity for portfolio diversification with complex instruments that replicate the performance of various asset classes.

Disclaimer: cryptocurrency CFD trading is not available to clients in the UK as the FCA banned the trading of this derivative.

Share Trading

FP Markets offers diverse stock trading options, including outright stock trading via the IRESS platform and share CFDs on MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

The MT4 platform has a limited selection of just four stocks, making MT5 or IRESS preferable if you are interested in share trading.

MT5 covers 814 stocks across 9 global exchanges, while IRESS provides nearly 10,000 outright stocks and a selection of futures and ETFs, highlighting its extensive coverage, especially for Australian and US markets

| IRESS vs MT5 shares with FP Markets | IRESS | MT5 |

|---|---|---|

| ASX (Australia) | 2829 | 105 |

| NSADAQ + NYSE (USA) | 1380 + 1524 | 168 + 287 |

| LSE (London) | 972 | 17 |

| HKE (Hong Kong) | 1418 | 105 |

| SGX (Singapore) | 438 | X |

| IDK (Indonesia) | 23 | X |

| Amsterdam | X | 26 |

| FrankFurt | X | 60 |

| Madrid | 32 | X |

| Paris | X | 13 |

Verdict

FP Markets offers a broad selection of over 10,000 products across multiple asset classes, making it a versatile choice for traders looking for extensive trading options.

Customer Service

FP Markets ensures round-the-clock support for its clients, offering customer service 24/7 through various methods including live chat, email, and social media platforms.

| FP Markets | Customer Service |

|---|---|

| Availability | 24/7 |

| Multilingual | ✅︎ |

| Live Chat | ✅︎ |

| Phone | ✅︎ |

| ✅︎ | |

| Social Media | ✅︎ |

To cater to its global clientele, FP Markets’ live chat service is multilingual and supports over 12 languages, effectively removing language barriers and enhancing the overall customer support experience.

Verdict

With its multilingual support team available 24/7, FP Markets underscores its dedication to providing exceptional customer service, ensuring a seamless and supportive trading environment for all its clients.

Research and Education

FP Markets provides research tools and educational resources to help traders make informed decisions and learn about trading. This includes market analysis, trading strategies, and educational materials available on their website.

Research Tools

FP Markets research tools are designed to provide traders with the insights and analysis necessary to make informed trading decision.

These include:

- Traders Hub: A comprehensive resource center where traders can access a wealth of information, including market analysis, trading strategies, and updates. The Traders Hub is regularly updated to keep traders informed about the latest market movements and opportunities.

- Trading Knowledge: FP Markets offers a section dedicated to enhancing traders’ understanding of the markets. This includes detailed articles and guides on various trading concepts and strategies, catering to both novice and experienced traders.

- Fundamental Analysis: For traders who base their decisions on economic indicators and news events, FP Markets offers fundamental analysis resources. This includes analysis of economic reports, interest rates, political events, and other factors that can influence market prices.

- Economic Calendar: An essential tool for all traders, the economic calendar lists upcoming economic events, announcements, and reports from around the world. It helps traders anticipate market movements and plan their trading strategies accordingly.

- Forex Calculator: FP Markets provides a forex calculator tool to help traders manage their risk and calculate potential profits or losses. This tool is invaluable for planning trades and managing capital efficiently.

Educational Resources

FP Markets stands out for its comprehensive suite of educational resources, designed to enhance the trading knowledge and skills of its clients.

The educational offerings at FP Markets include:

- Trading Courses: Structured lessons that cover various aspects of trading, from the basics to more advanced strategies, helping traders navigate the markets with confidence.

- Videos: A collection of instructional videos that provide visual and easy-to-understand explanations of trading concepts, platform functionalities, and market analysis techniques.

- Webinars: Live online sessions hosted by industry experts, offering insights into market trends, trading strategies, and the opportunity for participants to ask questions in real-time.

- Podcasts: Engaging audio content that explores trading stories, experiences, and advice from seasoned traders and financial analysts.

- Events: FP Markets occasionally hosts or participates in trading events and seminars, providing a platform for networking and learning from professionals in the field.

- eBooks: A range of downloadable guides that delve into various trading topics, from introductory material to complex trading systems and strategies.

- Platform Video Tutorials: Detailed tutorials on how to use FP Markets’ trading platforms effectively, including tips on making the most of the tools and features available.

- Trading Glossary: A comprehensive glossary of trading terms and definitions, serving as a quick reference guide for traders to familiarize themselves with common trading jargon.

- Newsletter Sign-Up: Traders can subscribe to FP Markets’ newsletter to receive regular updates, market analysis, and educational content directly to their inbox.

These educational resources are accessible through the FP Markets website.

Verdict

FP Markets equips traders with essential research tools and educational resources, ensuring a well-rounded trading education and informed decision-making through comprehensive market analysis and strategies.

Final Verdict on FP Markets

FP Markets sets itself apart in the competitive broker landscape with its ECN-style pricing and extensive asset offerings. It’s recognised for providing a variety of trading platforms, including MT4 and MT5, and for its swift execution speeds.

With a commitment to both novice and seasoned traders, FP Markets offers educational resources and customer service that enhance the trading experience.

Regulated by ASIC and CySEC, and offering international services under offshore regulation, it ensures a secure trading environment. However, traders outside Australia and Europe should be mindful of regulatory differences.

For those interested in low spreads, the RAW account is advantageous, though standard account users may find spreads slightly less competitive when compared to other top brokers.

Disclaimer: Trading with financial instruments on a live account does have high risks involved, especially when you use the maximum leverage available to you.

FP Markets FAQs

Is FP Markets a safe broker?

Yes, FP Markets is a safe forex broker by all industry standards. This brokerage trading firm is regulated in three tier-one jurisdictions (FCA, ASIC and CySEC) and your money is held in segregated accounts with leading banks (National Australia Bank or Commonwealth Bank of Australia).

At FP Markets clients can enjoy trading in over +10,000 CFD instruments spread across 5 asset classes, access a good range of trading platforms (MT4, MT5 and IRESS), spreads starting from 0.0 pips and ECN trading conditions.

What is the minimum deposit at FP Markets?

The minimum deposit requirement at FP Markets is 50 USD/EUR/GBP for Europe and 100 AUD (or its equivalent) for both Australia and international clients, with a higher minimum deposit of 1000 AUD for Iress accounts in Australia.

What demo account does FP Markets offer?

Yes, FP Markets provides a comprehensive demo account that allows traders to access $100,000 (USD) in virtual funds, offering a risk-free environment for experimentation and familiarisation with both the trading platform and the financial markets.

Demo accounts provide access to live market prices, enabling traders to gain real-time insights into market movements. Additionally, it offers the opportunity to experiment with automatic trading strategies using Expert Advisors, further enhancing the learning and testing experience.

The availability of trading platforms for demo accounts may vary depending on your location, but all users have access to demo versions of MetaTrader 4 and MetaTrader 5.

What leverage does FP Markets offer?

FP Markets offers leverage up to 30:1 for forex trading in Australia and Europe, and up to 500:1 for international clients and professional accounts.

This leverage allows traders to open larger positions than their initial deposits, potentially magnifying both profits and losses. The 30:1 limit aligns with the regulatory requirements established by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulations are designed to safeguard retail investors from the heightened risks associated with excessive leverage.

| Asset Class | Europe & Australia | International / Professional |

|---|---|---|

| Major Forex Pairs | 30:1 | 500:1 |

| Minor Forex Pairs | 20:1 | 500:1 |

| Major Indices | 20:1 | 200:1 |

| Gold | 20:1 | 500:1 |

| Other Commodities | 10:1 | 100:1 |

| Minor Indices | 10:1 | 200:1 |

| Shares | 5:1 | 20:1 |

| Cryptocurrencies | 2:1 | 5:1 |

For those located outside of Australia and Europe or those who qualify as professional clients, FP Markets presents the opportunity to access significantly higher leverage, reaching up to 500:1. However, it’s crucial to note that this level of leverage is substantial and should be approached with caution.

If you are situated in Australia or Europe and aspire to utilise higher leverage through the FP Markets Pro Account, this option is tailored for traders who meet specific criteria, demonstrating their experience and financial capability to manage the associated risks. To gain access, you will need to complete an application and meet the qualifying criteria.

Is FP Markets ECN?

Yes, FP Markets is an ECN broker in the sense they supply forex quotes from a wide network of liquidity providers including Goldman Sachs, JP Morgan, HSBC, Citibank, etc with no price intervention from the broker. FP Markets call this ECN Pricing

The benefits of trading with an ECN broker includes lower spreads, minimal slippage, lightning-fast order execution speed and deep liquidity. FX Markets clients can access the ECN pricing model through the RAW account with a minimum deposit of USD 100.

Does FP Markets accept Canadian clients?

Yes, FP Markets accepts retail forex traders from Canada, but do not accept clients from the United States (US).

However, FP Markets is not regulated in Canada with CIRO, the Canada Financial Markets Regulator.

Check out a full comparison of CIRO regulated brokers here: Best Forex Brokers In Canada.

About the Review

This review of FP Markets is grounded in CompareForexBrokers’ rigorous and transparent methodology, as detailed on Our Methodology page. We evaluated FP Markets across multiple critical performance metrics, including trading costs, platform usability, customer service, regulatory compliance, and the breadth of market offerings. Our assessment also considered unique features that set FP Markets apart from competitors. To learn more, you can read comparisons of FP Markets vs Plus500, FP Markes vs OANDA, FP Markets vs Admirals and FP Markets vs eToro. By comparing FP Markets against these industry benchmarks, we aim to provide traders with a comprehensive and unbiased view of where FP Markets stands in the competitive forex brokerage landscape.

Compare FP Markets Competitors

Versus, comparison pages of alternative online brokers to FP Markets are listed below.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to FP Markets Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

I’m in Spain, can i use a CySEC regulated broker here?

Yes you can. All regulators part of the European Union are part of the European Securities and Markets Authority (ESMA).

Regulators that are members of ESMA, are able to serve as the regulator to all other countries that are part of the European Union.

I’m outside Australia, can i use the IRESS trading platform?

FP Markets only offer IRESS for Australian clients. The main reason to use IRESS is to access FP Markets full range of stocks and to use DMA trading. If you are looking to trade stocks outside Australia with FP Markets then you are best to use the MT5 trading platform or consider TMGM who have IRESS outside Australia.

Hi David. I have opened an IRESS account while I was in Australia. Now that I am outside of Australia, just wondering if I can still trade using IRESS. If not, is it possible to use the platform through VPN? Thanks in advance!

Hi Clement, If you have an account with FP Markets Australia then I would expect you should be able to use the IRESS account. As I understand it, it’s only the FP Markets subsidiaries outside Australia that don’t offer IRESS, so in your case I don’t believe you should need to use the VPN.

In the Regulation section, you mention that customers of FP Markets outside Australia and Europe will have to join the subsidiary in St Vincent and the Grenadines instead, and that this will result in different liquidity access. Can you elaborate on this claim? Looking at FP Market’s FAQ pages for both international customers (non-regulated) and Australian customers (regulated under ASIC), they seem to suggest that he liquidity providers will be exactly the same. Perhaps this bit of the review needs to be updated? Would like to know more. Thank you, Mark

Hi Mark,

If you are in Australia you will need to join FP Markets Australian entity regulated by ASIC and in Europe you will need to join FP Markets Cyprus entity regulated by CySEC which is good fo countries in the European Economic Zone. I can see how what is written might be interpreted to mean FP Markets Grenada entity might be using a different source of liquidity to their other entities. I would suggest this is poorly phrased and have corrected it. Thank you for bringing this to our attention.

Thanks for the clarification David!

Hi can you permit me to tell my fellow traders how I recovered my money from a fake binary options broker?

No, our readers are not your fellow readers.