Best Australian Trading Platforms: Share, Forex, CFDs, Crypto

The most crucial step for Australian traders is selecting the appropriate trading software. We’ve matched each trading platform with the best broker suited for specific trading needs based on trading fees, service quality, speed, and features.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Australian traders should focus on choosing a broker regulated by ASIC with an AFSL license. We focused on ASIC-regulated brokers factoring in fees, trading software and customer support to identify the best providers for different needs.

Our recommended Australian trading platforms are:

- IG Trading - Best Share Trading Platform

- Pepperstone - Best Forex Broker Platform

- Eightcap - Best Crypto Trading Platform

- Interactive Brokers - One Broker

- IC Markets - Lowest Spread with MT5

- BlackBull Markets - Platform with the Highest Leverage

- eToro - Top Platform for Social Trading

- Plus500 - Best CFD Trading Platform for Beginners

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

98 | ASIC, FCA, DFSA | 0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

What Are The Best Trading Platforms For Australian Traders?

The best trading software depends on the type of trading from shares, CFDs, Forex to Crypto. We have matched the needs of different traders with the recommended software and broker to help make the right provider choice.

1. IG Trading - Best Share Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, IG Trading Platform,

L2 Dealer, ProRealTime, TradingView

Minimum Deposit

$250 - 450

Why We Recommend IG Trading

We’ve had a genuinely positive trading journey with IG Markets. Originating in 1974, IG has risen to be a global force in online brokering. Boasting a range that spans over 17,000 markets, IG Markets allows traders to have the flexibility of four distinct trading platforms, including proprietary and third-party options.

Pros & Cons

- Share trading available

- Fast execution speed

- Regulated by tier-one regulatory bodies

- High minimum deposit

- Customer service only 24/5

- Poor leverage levels

Broker Details

We’ve had a fruitful trading experience with IG, a prominent broker monitored by ASIC in Australia, along with five other crucial jurisdictions. The broker facilitates CFD trading over a broad spectrum of 13,000 instruments, while share trading remains a distinctive feature for Australian (and English) traders. As for the trading platforms, IG Markets brings forward impressive proprietary software complemented by the renowned trading platform MetaTrader 4.

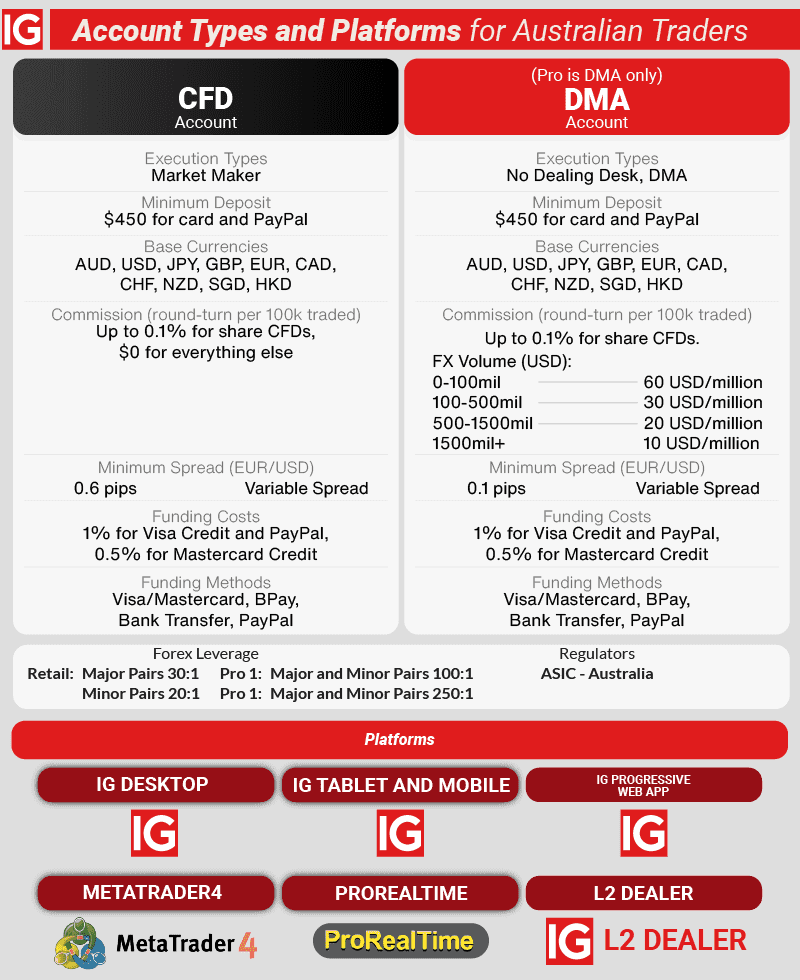

IG Trading Account

IG’s CFD Account is the broker’s main retail investor account. This account features market maker style execution, with spreads from 0.6 pips. You can opt for IG’s DMA account if you are a high-volume trader (or professional investor). Some reasons to explore IG’s accounts are:

- Require guaranteed stop-loss order (GSLO) on all trades (through a limited risk account)

- Stock trading (specific to Australian traders)

- Zero commission trading (other than share CFDs)

- High-volume FX discounts (only for DMA accounts)

Trading Platform Execution Speed

According to IG’s website, the broker states that 98.3% of market orders are processed within 0.014 seconds across every trading platform. Furthermore, IG states that 89% of its trades were executed at the intended exchange rate without slippage.

When testing for Execution Speeds ourselves, we found that while IG didn’t perform as well as others, the broker was still fast. Our chief of technology research, Ross Collins, tested the execution speed of 20 other top brokers using MetaTrader 4. He found that IG had an average execution speed of 0.174 seconds for limit orders and 0.141 seconds for market orders.

Shares CFD (all clients) and Share Trading (Australian traders)

IG distinguishes itself as one of the rare Australian brokers providing domestic and global shares available both as CFDs and the underlying assets themselves. Based on our review, the only other brokers that offer this combination are CMC Markets, Trading 212, ThinkMarkets and BlackBull Markets. IG’s share trading is unique because you can use the same platform to trade both currencies and stocks. Please be aware, though, that IG charges up to 0.1% commission fees for shares CFDs.

IG’s platforms are specialised for share trading

Part of IG’s appeal is the broker’s diverse platform range, with 4 excellent platforms, including the broker’s proprietary software and the popular MetaTrader 4.

We particularly like IG’s share trading platform, L2 Dealer, which won our DMA Forex Brokers for shares and CFDs. This is because the L2 Dealer platform is tailored for DMA trading with access to level 1 and level 2 data. Level 1 data means prices are sourced directly from the exchange while level 2 data enables you to engage directly with the exchange’s order book.

You can also trade shares on IG’s own, proprietary platform (including DMA trading) while currency trading is available on all of IG’s platforms.

Our Verdict on IG

Overall, we like IG for several reasons. The broker stands out for its share trading platform, L2 Trader, as well as its entire platform range. In addition, IG has an excellent range of 17,000 markets and a fast execution speed to trade these markets.

Broker Screenshots

2. Pepperstone - Best Forex Broker Platform

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader,

TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

In 2025, we named Pepperstone the Best Forex Brokers In Australia after opening several accounts and doing testing using trading robots. We observed that Pepperstone consistently boasts zero spreads and the quickest execution speeds among ASIC-regulated brokers. Furthermore, it’s noteworthy that Pepperstone secured the top spot in Investment Trends 2022 for trading experience and customer satisfaction.

Pros & Cons

- Fast MT4 execution speeds

- Enhanced MT4 trading tools

- Low MT4 brokerage fees

- Can’t trade physical shares

- No swap-free account in Aus

- 3rd party platforms only

Broker Details

Pepperstone has one of the fastest execution speeds on the most popular trading platform, MetaTrader 4 based on our testing. Combined with low trading costs, a good range of platform features and an easy account opening process, we rated Pepperstone 90/100 for the overall platform experience. Other notable Pepperstone features we found include:

- Low brokerage (spreads + commissions)

- Enhanced trading software features

- Top MT4 demo account

- Good range of currency pairs and CFDs

- Award-winning customer service

Pepperstone MT4 Execution Speeds

Our 2025 speed testing by our chief of technology research, Ross Collins, found that Pepperstone had the fastest MT4 execution speeds. Using Limit Orders, Ross tested the speed of 20 brokers and found that Pepperstone’s average speed was 77ms, the second fastest speed just behind BlackBull Markets. Pepperstone was third-fastest overall when combining limit and market orders. Ross’ tests were done using demo accounts of similar brokers offering a MetaTrader 4, no-dealing desk (NDD) setup. A faster execution speed reduces issues such as slippage, which can impact a trader’s returns.

Pepperstone has Easy Account Opening Process

To open a Pepperstone account, there are 4 main steps:

- Create Profile

- Personal Details

- Appropriateness Test

- Verification

Overall, we found Pepperstone’s account opening process quick and easy. You’ll be approved for an account once you create your profile, enter your personal information, and pass the appropriateness test composed of questions related to your trading experience. Pepperstone scored a maximum of 15 out of 15 in our account opening test.

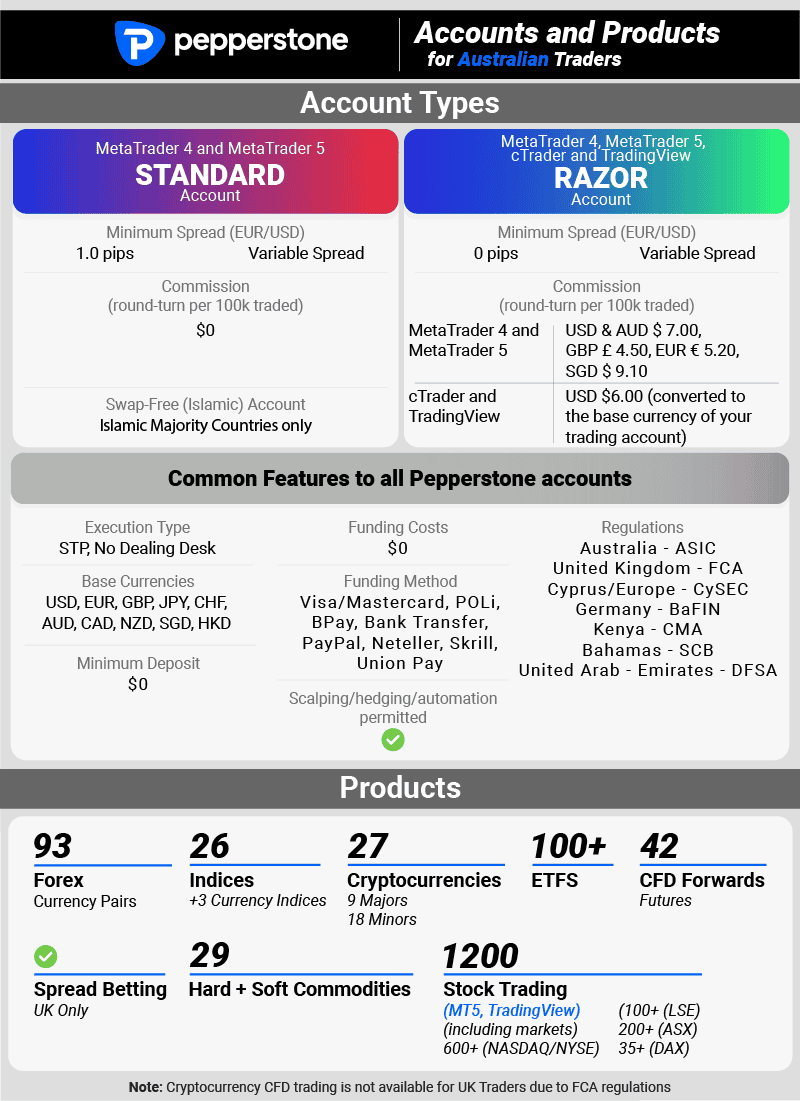

Pepperstone Account Types

Pepperstone offers two main account types: a standard account (spread only) and a Raw account (spread + commission).

The no-commission standard account has a published minimum spread of 1.0 pips, which is competitive for a spread-only account. As such, we recommend this account for beginners just starting out.

Meanwhile, Pepperstone’s Razor account charges AUD $7 round-turn commissions with tight spreads as low as 0 pips. With additional cost factors to consider, we think the Razor account is suited for more experienced traders. You can play around with our calculator below, which combines the spreads and commissions of Pepperstone to IG and Axi based on trade size.

Apart from spreads, the main difference between accounts is the additional platforms you can access with Razor. With Razor, you can use cTrader and TradingView, which also cheapens your commission costs if USD is your base currency.

Our table below highlights the major features of both Pepperstone’s Standard and Razor accounts and the products offered.

Pepperstone MT4 Platform Enhancements

Pepperstone stands out with its suite of MT4 platform enhancements. While most MT4 brokers offer Trading Signals, EAs (Expert Advisors), and a library of custom indicators, Pepperstone offers platforms you can integrate with MetaTrader 4. These tools include Myfxbook, and DupliTrade.

Myfxbook AutoTrade and DupliTrade

Myfxbook AutoTrade and DupliTrade are both account mirroring platforms that can integrate with your MT4 trading platform. Both these platforms allow you to copy the trades of the most successful traders in their network, thus sparing you to do your own research and manually execute trades yourself.

Our Verdict On Pepperstone

We selected Pepperstone as the best MT4 forex broker based on fast execution speeds, competitive spreads, and enhanced trading software features. Pepperstone is regulated by ASIC in Australia and was ranked our Best Forex Brokers In Australia. The Australian broker also won Investment Trends 2022 categories for customer satisfaction and trading experience for good measure.

Broker Screenshots

3. Eightcap - Best Crypto Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 1.0

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView,

Capitalise.ai

Minimum Deposit

$100

Why We Recommend Eightcap

We’ve been impressed with Eightcap, an Australian CFD broker established in 2009. The broker offers a notably extensive range of cryptocurrencies, complemented by a unique suite of trading platforms and tools. With its commitment to connecting traders directly to top-tier liquidity providers using STP execution and a no-dealing desk approach, Eightcap provides ECN-like pricing. As a result, Australian traders can enjoy spreads that rival some of the best online brokers out there.

Pros & Cons

- Wide range of trading tools

- Low spreads

- Live Chat fast response time

- Minimum deposit requirement

- Lack of interactive resources

- Need more markets and tools

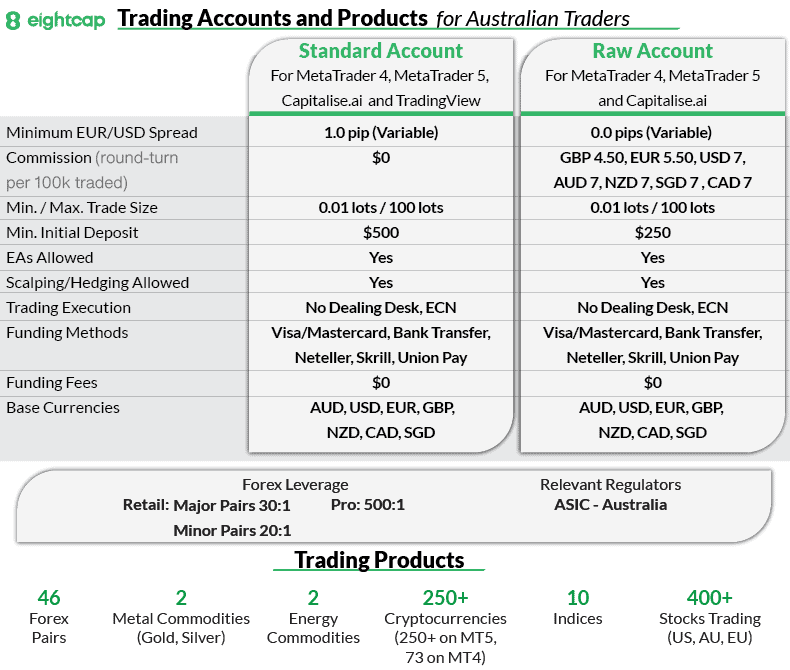

Broker Details

Like brokers with ECN-style pricing, Eightcap offers a Standard, no-commission account and a Raw, commission-based account. Compared to other brokers, Eightcap has slightly wider Standard account spreads, starting at 1 pip. The broker’s Raw account spreads, however, are relatively competitive across the board, with the industry standard $3.5 per side commission.

Raw Account Spreads

When testing the ECN/Raw Account spreads of six major USD currency pairs, we found Eightcap was very competitive against 20 top brokers, particularly for EUR and GBP. The broker had an average EUR/USD spread of 0.20 and average GBP/USD spread of 0.44. These spreads compared favourably to the average of 0.26 for EUR and 0.53 for GBP that we measured.

Trading Platforms

Eightcap has a diverse range of platforms, from both MetaTrader platforms to charting platform, TradingView and algorithmic platform, Capitalise.ai. Where the broker stands out, however, is in its crypto trading platform offering. Not only does Eightcap offer a great range of 86 cryptocurrencies, it also offers a unique platform, CryptoCrusher, to trade them with. We particularly like the CryptoCrusher dashboard, which allows you to scan the crypto markets quickly and easily, see market sentiment and obtain daily trade ideas. In fact, Eightcap won our overall Best Crypto CFD Brokers trading platform as well as best automated crypto trading platform with MT5.

Please note, the exact range of products will depend on what platform you opt for. MetaTrader 5 and TradingView offer Eightcap’s full product range, which includes over 400 shares CFDs.

Our Verdict On Eightcap

We chose Eightcap as our best crypto trading platform with a great range of crypto products as well as platforms to trade them with. Other factors that keep Eightcap high on our list include tight Raw account spreads and a wide range of trading tools.

Broker Screenshots

4. Interactive Brokers - All-In-One Broker

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

Trader Workstation

Minimum Deposit

$0

Why We Recommend Interactive Brokers

We liked how Interactive Brokers truly shine in CFD currency trading by providing direct market access and ensuring smooth transaction executions across various financial terrains. It’s also worth noting that Interactive Brokers boasts an extensive selection, with more than 6,100 CFD instruments on offer. For Australian traders searching for a comprehensive platform, this is certainly one to consider.

Pros & Cons

- Advanced trading platform

- $0 Minimum Deposit requirement

- Largest range of financial products

- Relatively low leverage

- MT4 not available

- Platforms not suited for beginners

Broker Details

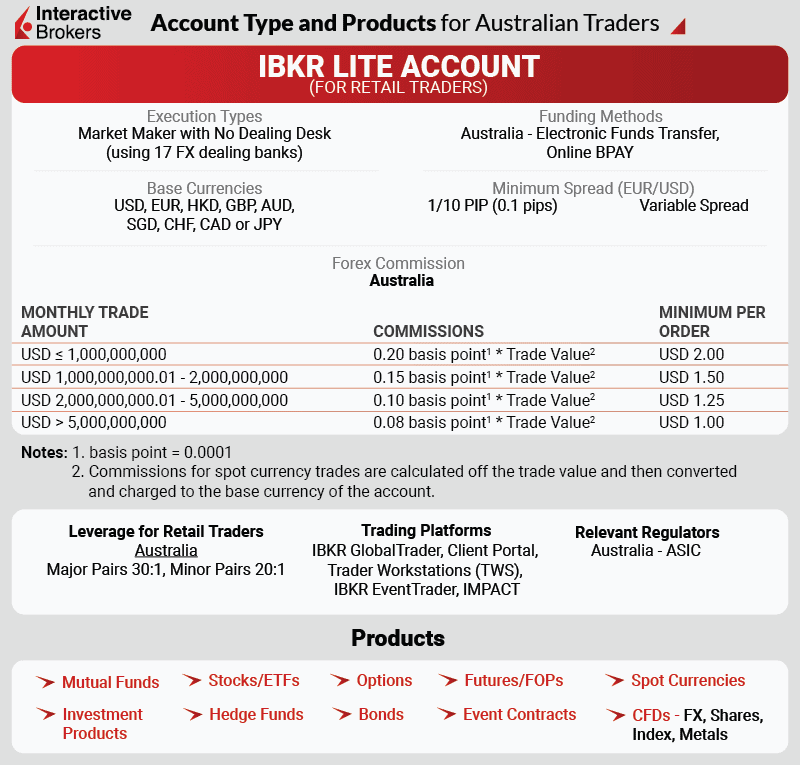

Interactive Brokers is a low-fee trading broker offering the advanced TWS trading platform, a range of CFDs from cryptocurrencies to ETFs backed by a score of 7.8/10 from 32 Interactive Brokers reviews.

ECN Broker Spreads

Interactive Brokers’ offering is the only true ECN broker with direct access to interbank quotes. This means:

- No markup

- No hidden price spreading

- Direct access to liquidity-providing banks or other IBKR clients

While the online broker doesn’t publish its average spreads, you can see real-time quotes on their website which are set by the market.

What Trader Is Suited For The Interactive Brokers Platform?

The IBKR platform (especially the TWS platform) is the best trading platform for traders looking for an all-in-one solution. If you want to trade shares, CFDs and foreign exchange without switching platforms while having powerful features, IBKR suits you. It’s worth noting that if you’re used to using the MetaTrader platforms (MT4 and MT5), Interactive Brokers doesn’t offer either, only proprietary software. The IBKR platforms are also quite complicated and may not be suited for beginner traders.

Range Of Markets From Shares, ETFs to CFDs

Interactive brokers are among the few online providers offering a full range of financial markets, from popular instruments such as shares, options and futures to complex derivatives such as Mutual Funds and Hedge funds. Having a plethora of options will particularly suit more experienced and professional traders.

Our Verdict on Interactive Brokers

Interactive Brokers suit traders looking for an ‘all-in-one’ broker offering, more than just trading but also stockbroking, mutual funds and even a hedge fund marketplace.

While you can learn about trading through Interactive Brokers Traders’ Academy, we recommend the broker for more experienced traders due to the complicated nature of the platforms and the potentially overwhelming product range.

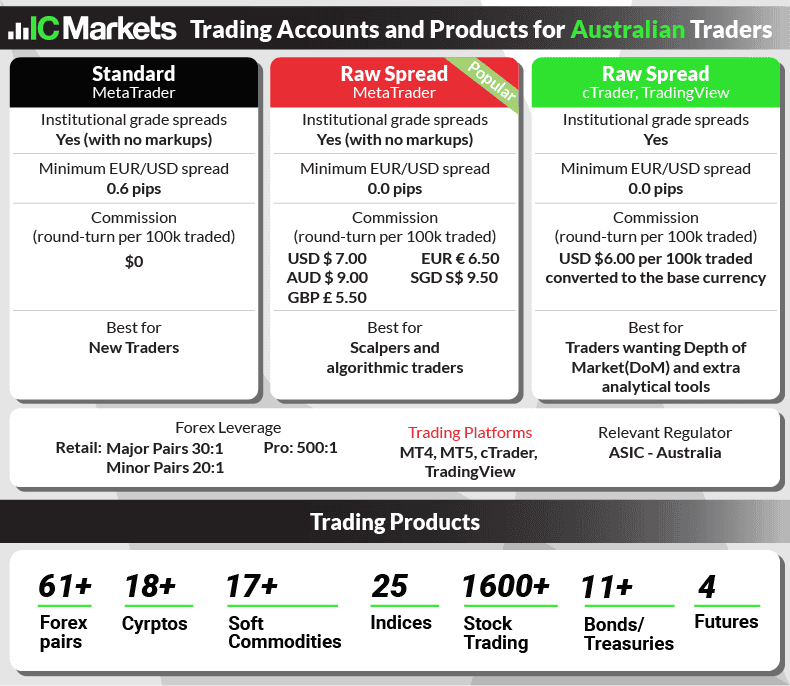

5. IC Markets - Lowest Spread with MT5

Forex Panel Score

Average Spread

EUR/USD = 0.82

GBP/USD = 1.03

AUD/USD = 0.83

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

Why We Recommend IC Markets

We discovered that IC Markets boasts the slimmest spreads with MT5 after tests highlighting its remarkably tight spreads across its Standard and RAW Trading accounts. We gave IC Markets an 84/100 overall, acknowledging the broker’s competitive trading fees, which mirror their advantageous spreads and competitive commission rates. The combination of IC Markets’ lean spreads, varied market choices, and swift trading atmosphere position them as the premier MetaTrader 5 CFD broker for Aussie traders.

Pros & Cons

- Low spreads

- Wide range of markets

- Fast trading environment

- High minimum deposit

- No proprietary app

- Lack of market research

Broker Details

Apart from having the lowest spreads on the MT5 trading platform, IC Markets offers cTrader and TradingView as an alternative platform, as well as a large range of CFDs, including 120 global shares.

IC Markets Has The Lowest MT5 Spreads

Comparing the top FX brokers’ average standard account spreads in 2025, our chief of technology research, Ross Collins, found IC Markets was the clear winner as shown below. Our test compared zero-commission accounts against a mixture of no-dealing desk and market maker brokers. IC Markets came out on top with a very competitive average spread of 1.03 pips and an average spread cost of USD $9.63.

| Broker | Average Spread | Average Spread Cost (USD) |

|---|---|---|

| IC Markets | 1.03 | $9.63 |

| CMC Markets | 1.11 | $10.10 |

| Fusion Markets | 1.19 | $11.07 |

| TMGM | 1.21 | $11.18 |

| Admiral Markets | 1.31 | $11.96 |

| FXCM | 1.47 | $13.49 |

| Pepperstone | 1.46 | $13.52 |

| FP Markets | 1.47 | $13.60 |

| Go Markets | 1.49 | $13.87 |

| EightCap | 1.51 | $13.97 |

| OANDA | 1.54 | $14.23 |

| Axi | 1.71 | $15.99 |

| City Index | 1.79 | $16.52 |

| Blackbull Markets | 1.82 | $16.95 |

| FXPro | 2.22 | $20.83 |

This table compares the published average spreads for Standard accounts to the industry average spreads.

| Forex Pair | IC Markets | Industry Average |

|---|---|---|

| EUR/USD | 0.82 | 1.24 |

| USD/JPY | 0.94 | 1.44 |

| GBP/USD | 1.03 | 1.57 |

| AUD/USD | 0.83 | 1.54 |

| USD/CAD | 1.05 | 1.82 |

| EUR/GBP | 1.27 | 1.66 |

| EUR/JPY | 1.3 | 1.95 |

| AUD/JPY | 1.5 | 2.21 |

The table below compares the published average spreads for RAW accounts to the industry average spreads. As you can see, IC Markets consistently has tighter spreads than the industry average, across all the major currency pairs.

| Forex Pair | IC Markets | Industry Average |

|---|---|---|

| EUR/USD | 0.02 | 0.22 |

| USD/JPY | 0.14 | 0.41 |

| GBP/USD | 0.23 | 0.52 |

| AUD/USD | 0.03 | 0.46 |

| USD/CAD | 0.25 | 0.66 |

| EUR/GBP | 0.27 | 0.57 |

| EUR/JPY | 0.3 | 0.74 |

| AUD/JPY | 0.5 | 0.87 |

You can open a Standard Account or a Raw Spread account with IC Markets, the main difference of which is trading platform and trading costs. For beginners, we recommend the Standard account (using MT4), for more experienced traders looking to capitalise on short-term market movements, Raw Spread with MT5 will suit you. For those looking for depth of market features, Raw Spread with cTrader is for you.

You will need AUD $200 to open a MetaTrader 5 Standard account. For Raw Spread, there is no minimum deposit.

IC Markets Trading Platforms

In addition to MT5, IC Markets also offers MT4, cTrader and TradingView as alternative standalone trading platforms. MT4, as mentioned above, is the most popular trading platform and cTrader has great charting, depth of market, and automated trading (via cAlgo) features.

IC Markets is one of few brokers to offer both MetaTrader platforms and cTrader, which gives it an edge, platform-wise.

In addition, you will be able to access MT4 advanced plugins such as MyFxBook, AutoChartist, and MetaTrader Signals.

Our Verdict On IC Markets

We rate IC Markets as the best MetaTrader 5 Australian broker based on the low spreads, range of markets, and fast trading environment offered.

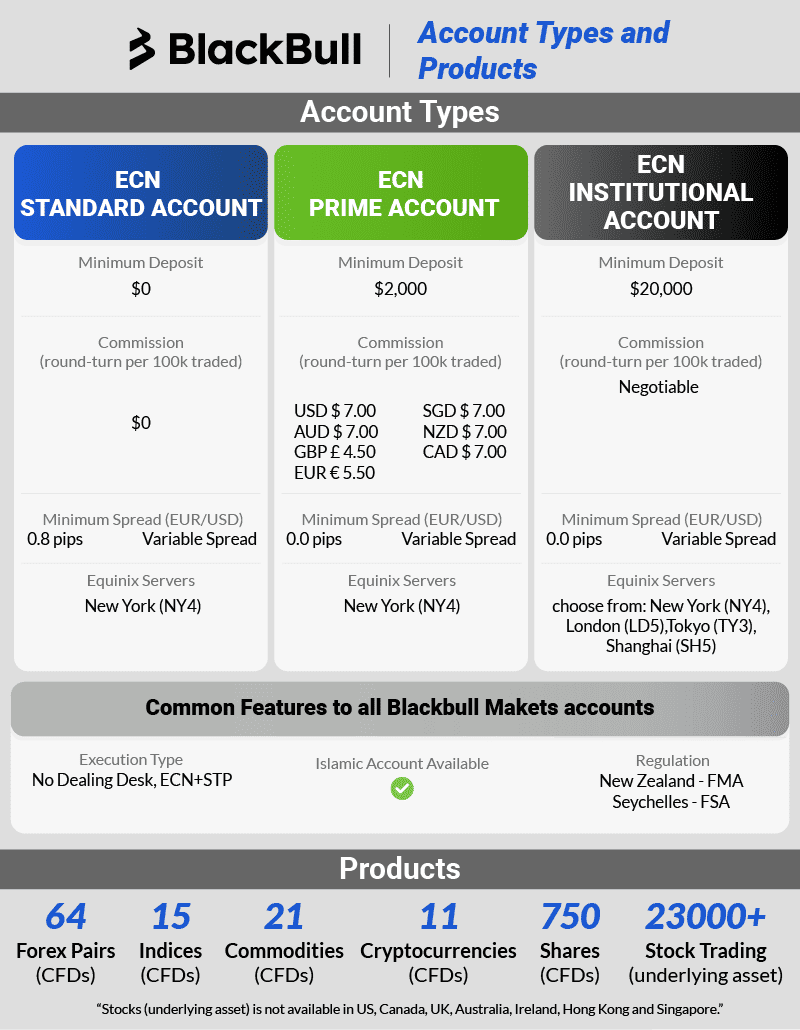

6. BlackBull Markets - Platform with the Highest Leverage

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView,

Blackbull Trade

Minimum Deposit

$0

Why We Recommend Blackbull Markets

We’ve had a solid experience trading with BlackBull Markets, particularly noting its standout leverage offering of 1:500, which tops other brokers we’ve evaluated. The broker’s unique trading conditions, especially for currency trades, stem from being overseen by New Zealand’s Financial Markets Authority (FMA) instead of Australia’s ASIC. With a vast market selection, rapid execution times, and tight spreads, BlackBull Markets truly impresses. However, a quick caution: we’d advise steering clear of such high leverage for those new to trading or with a low-risk appetite.

Pros & Cons

- Fast execution speeds

- 1:30 leverage for retail traders

- Top TradingView broker

- Has withdrawal fee

- Support is only 24/6

- Lacks in-house market analysis resources

Broker Details

Aside from offering the highest leverage of 1:500, New Zealand-based BlackBull Markets’ key strengths include having the fastest execution speeds, being a top TradingView broker and having the lowest spreads in NZ.

BlackBull Markets has the Fastest Execution Speeds

When we completed our 2025 speed testing courtesy of Compareforexbroker’s Ross Collins, BlackBull Markets had the fastest spreads overall when comparing both market and limit orders. BlackBull Markets had an average limit execution speed of 72 ms (1st ranked broker) and a market order execution speed of 90 ms (2nd highest broker).

| Broker | Overall Speed Ranking | Limit Order Rank | Limit Order Speed (ms) | Market Order Rank | Market Order Speed (ms) |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 1 | 72 | 5 | 90 |

| Fusion Markets | 2 | 3 | 79 | 1 | 77 |

| Pepperstone | 3 | 2 | 77 | 10 | 100 |

| OANDA | 4 | 5 | 86 | 2 | 84 |

| Octa | 5 | 4 | 81 | 6 | 91 |

| Exness | 6 | 10 | 92 | 3 | 88 |

| Blueberry Markets | 7 | 6 | 88 | 7 | 94 |

| FOREX.com | 8 | 13 | 98 | 4 | 88 |

| Global Prime | 9 | 7 | 88 | 9 | 98 |

| Tickmill | 10 | 9 | 91 | 11 | 112 |

| TMGM | 11 | 11 | 94 | 13 | 129 |

| City Index | 12 | 12 | 95 | 14 | 131 |

| Trading.com | 13 | 14 | 98 | 15 | 138 |

| FBS | 14 | 17 | 135 | 12 | 118 |

| Axi | 15 | 8 | 90 | 25 | 164 |

| Eightcap | 16 | 19 | 143 | 17 | 139 |

| IC Markets | 17 | 16 | 134 | 22 | 153 |

| FxPro | 18 | 23 | 151 | 16 | 138 |

| Go Markets | 19 | 20 | 144 | 20 | 145 |

| Markets.com | 20 | 22 | 150 | 18 | 141 |

| EasyMarkets | 21 | 24 | 155 | 24 | 155 |

| Admirals | 22 | 15 | 132 | 28 | 182 |

| IG | 23 | 26 | 174 | 19 | 141 |

| CMC Markets | 24 | 18 | 138 | 26 | 180 |

| FP Markets | 25 | 32 | 225 | 8 | 96 |

| VantageFX | 26 | 27 | 175 | 23 | 154 |

| XM | 27 | 21 | 148 | 29 | 184 |

| FXCM | 28 | 28 | 108 | 30 | 189 |

| Avatrade | 29 | 33 | 235 | 21 | 145 |

| ThinkMarkets | 30 | 25 | 161 | 36 | 248 |

| Tradersway | 31 | 29 | 198 | 33 | 214 |

| Swissquote | 32 | 37 | 258 | 31 | 198 |

| FXTM | 33 | 36 | 248 | 32 | 210 |

| Libertex | 34 | 31 | 215 | 35 | 244 |

| ATC Brokers | 35 | 34 | 238 | 34 | 241 |

| HYCM | 36 | 35 | 241 | 37 | 268 |

Besides fast execution speeds, you can trade an excellent range of markets from 64 forex pairs to 750 share CFDs with BlackBull Markets. These are listed below, along with the broker’s account details.

BlackBull Market’s Trading Platforms

BlackBull Markets offers three great trading platforms for Australian traders: MT4, MT5 and TradingView. While the NZ broker also offers an in-house app for share trading, this is not unavailable for Australian traders, unfortunately.

Our Verdict On BlackBull Markets

Overall, BlackBull Markets is our high-leverage winner, offering up to 1:500 leverage. We also like BlackBull Markets due to having the fastest execution speeds, low spreads, and a huge range of markets. If you are an inexperienced trader with a low-risk appetite, we strongly recommend not to trade with high leverage.

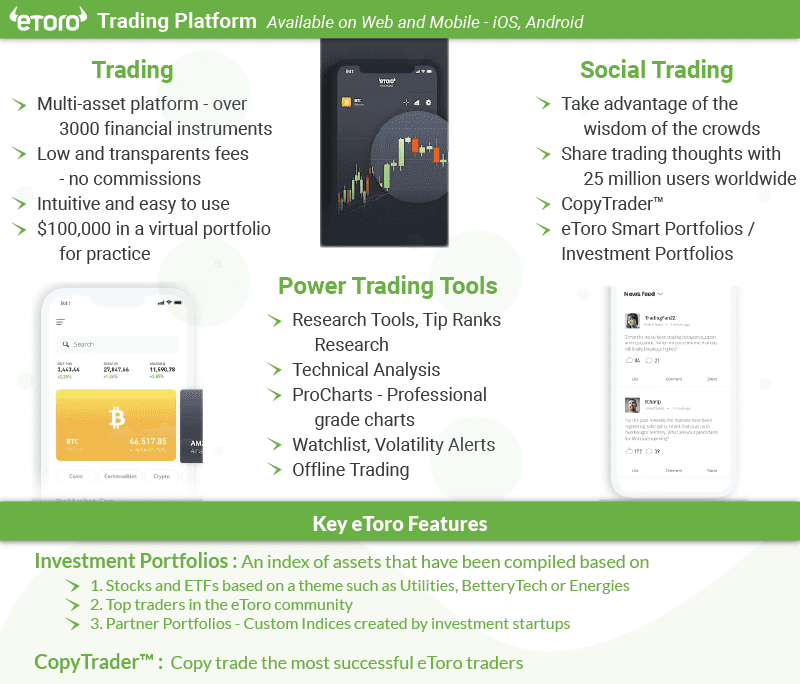

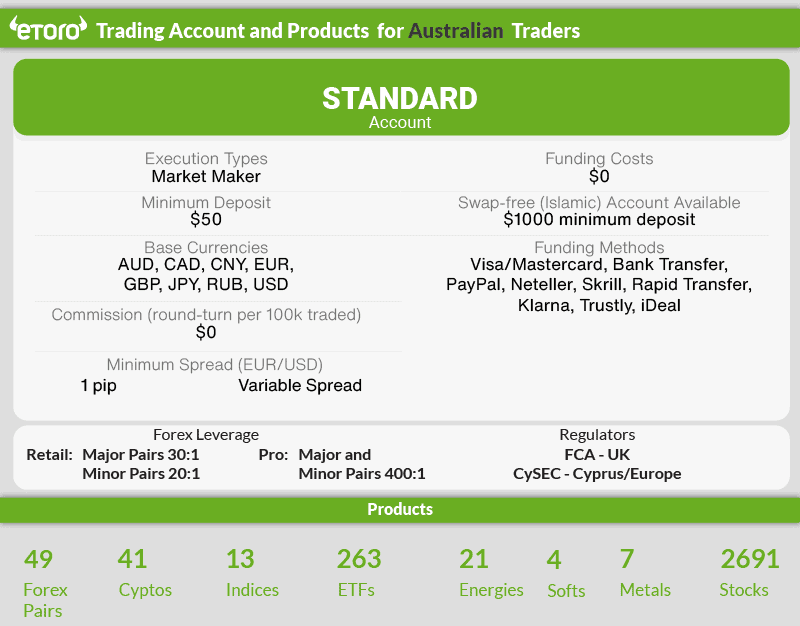

7. eToro - Top Platform for Social Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$200

Why We Recommend eToro

We highly recommend eToro particularly for those keen on social trading. With a global user base exceeding 25 million, they’ve carved a unique niche, centring their platform around the social trading experience. We particularly liked how effortlessly one can compare and choose traders to emulate, filtering by markets, regions, and recent returns. While they might have slightly steeper trading fees compared to brokers like Pepperstone or IC Markets, the intuitive proprietary interface of eToro makes it a top pick for copy traders in Australia.

Pros & Cons

- Huge social trading community

- Excellent proprietary platforms for copy trading

- Regular feeds to follow popular assets

- $50 minimum deposit

- $25 withdrawal fee

- Inactivity fee

Broker Details

Specialising in social trading, eToro is unique in its overall trading experience, which is why it is our top social trading broker. We also like eToro for its huge social trading community, excellent proprietary platforms for copy trading and regular feeds to follow popular assets.

eToro’s Excellent Social Trading Platforms

eToro only offers proprietary platforms, which are all listed below:

- eToro Trading Platform

- eToro Trading Mobile App

- CopyTrader

- Smart Portfolios

Based on our testing, we found eToro’s platforms were easy to use, with a good range of CFDs and a depth of copy traders online.

Given eToro’s focus on social trading, one slight downside of eToro’s platforms is the lack of charting tools such as technical indicators and graphical objects.

eToro Account Types

As a market maker, eToro only offers one commission-free Standard Account. Spreads are wider than a no-dealing desk broker, starting at 1 pip, which is on par with other market makers we’ve reviewed (but not competitive).

When opening an eToro trading account, a demo account is automatically created, which we particularly liked. This has $100,000 of virtual funds, which traders can experiment with and practise using the platform’s full functionality.

Our Verdict On eToro

With over 25 million users globally, eToro is easily our top pick for social trading. While the broker has higher trading costs than other brokers like Pepperstone or IC Markets, eToro’s proprietary platform is easy to use, making eToro the logical choice for copy traders.

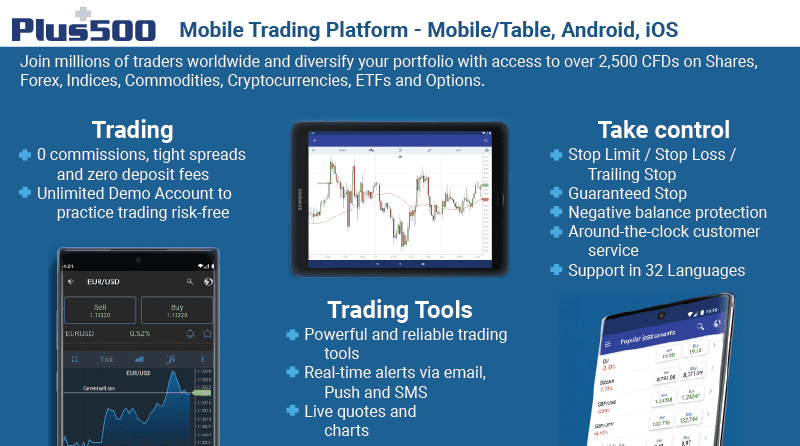

8. Plus500 - Best CFD Trading Platform for Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

MT4

Minimum Deposit

$100

Why We Recommend Plus500

We highly recommend Plus500 for beginners, as its platform is user-friendly and practically designed with essential risk management features, including a guaranteed stop-loss. While the closed environment does limit customisation options, such as specific technical indicators or third-party plug-ins, it ensures a streamlined and easy-to-navigate interface. Plus500 offers one of the most user-friendly trading programs available.

Pros & Cons

- User-friendly trading platform

- Strong regulatory oversight

- Diverse asset offerings

- Lack of comprehensive educational resources

- Inactivity and withdrawal fees

- No automated trading tools

Broker Details

Plus500’s in-house platform is user-friendly, with a simple but functional layout and great risk management tools, notably a guaranteed stop-loss. With a closed ecosystem, there is a lack of customisation through creating custom signals or adding 3rd party plug-ins to increase the number of technical indicators or graphical tools available. As such, we recommend the Plus500 trading platform for beginners without switching screens to implement strategies or perform orders.

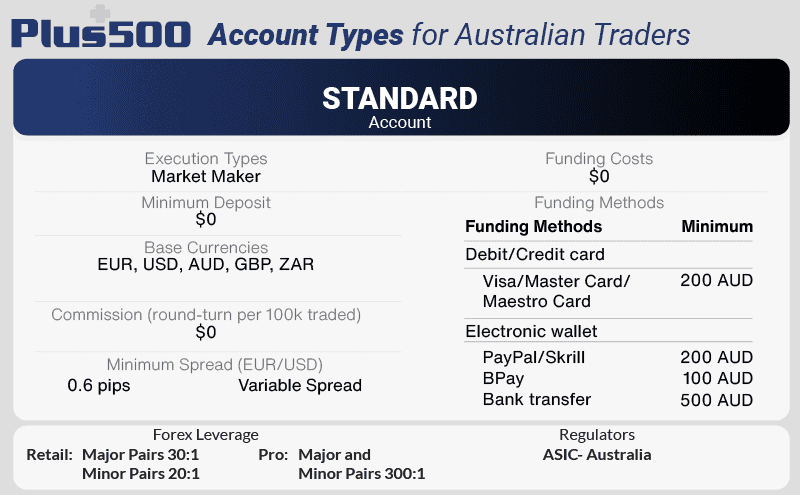

Account Types

Plus500 only offers a commission-free Standard Account with competitive minimum spreads of 0.6 pips, especially for a market maker. However, it’s important to note that ECN brokers will always offer lower spreads.

You must deposit a minimum of AUD $200 to open a new Plus500 account unless using BPAY or bank transfer.

Plus500 offers a decent range of tradeable products, particularly its 71 forex pairs and 1100 stocks. In addition to commodities, indices, and cryptocurrencies, Plus500 is also unique in offering ETFs and options as more complex instruments to trade, which only a few brokers offer.

Our Verdict On Plus500

Plus500 has the easiest-to-use forex trading software, with a functional interface and good risk management tools. We recommend Plus500 for beginner traders.

Great Trading Software With The Most Charting Tools

Great Trading Software With The Most Charting Tools Ideal Trading Platform For Day Traders And High-Volume Traders

Ideal Trading Platform For Day Traders And High-Volume Traders

Ask an Expert

I’m looking for a fixed spread trading platform. What do your recommend?

Most brokers offer variable spreads, so it is important to choose the right broker for fixed spreads. Brokers that offer Fixed spreads include AvaTrade, easyMarkets, FxPro and OctaFX. You can find out more about these brokers our best Fixed Spread Brokers page.

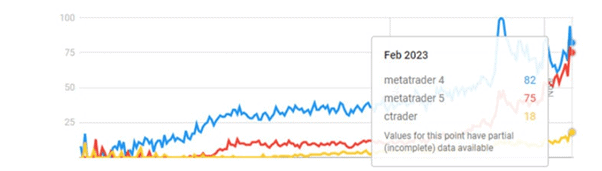

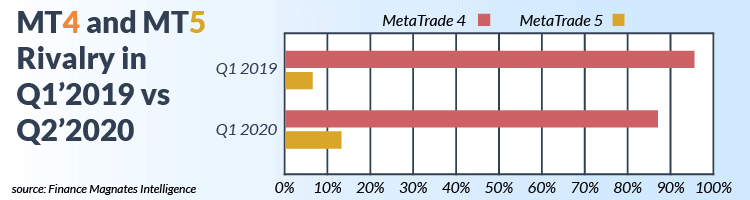

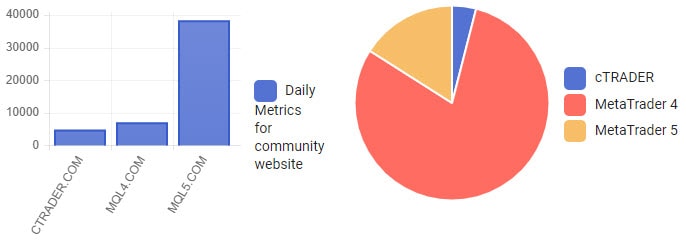

In Australia what is the most popular trading software used for forex?

MetaTrader 4 is the most popular software for currency trading but MetaTrader 5 is quickly gaining market share due to its additional CFD functionality. This makes it easier to trade gold, indices, shares and even crypto.

Are prop firms the same as a broker?

While both roles involve researching investments and trading securities, the nature of the work is different. Stockbrokers primarily serve as intermediaries, executing trades on behalf of retail clients, whereas traders also execute trades for institutional clients but also invest their firm’s capital.

Which country is Eightcap based in?

Hey Logan, Eightcap is based here in Australia.