Best Automated Trading Software

Automated trading or algorithmic trading allows you to find more trading opportunities and execute them than is possible with manual trading. I looked at some of the best trading platforms to automate your trades.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

My June 2025 list of the best automated trading software is:

- MetaTrader 4 - Best Forex Algorithmic Platform

- MetaTrader 5 - Top Platform For CFD Share Trading

- cTrader - Great Robot Trading Software

- ProRealTime - Good Charting And Automation Platform

- eToro - Best Social And Copy Trading Platform

- Capitalise.ai - Best Software Automation With No Code

- TradingView - Best Charting And Indicators

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

76 |

ASIC, CYSEC FSC, FSA, SCA |

0.2 | 0.5 | 0.2 | $2.50 | 1.0 | 1.3 | 1 |

|

|

|

144ms | $200 | 47 | 14 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

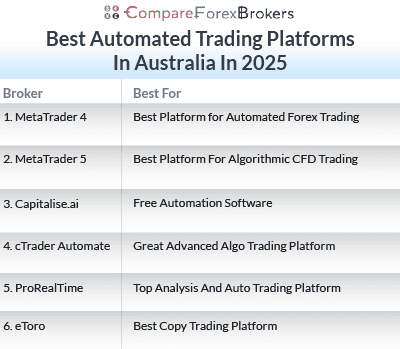

What Are The Best Automated Trading Platforms In Australia?

The following list reviews the best automated trading platforms in Australia and the brokers that offer them. Each platform has a unique advantage for algorithmic trading and each broker specialises in one trading platform that stands apart from the rest of the field. I have also factored in other trading considerations such as fees and product range.

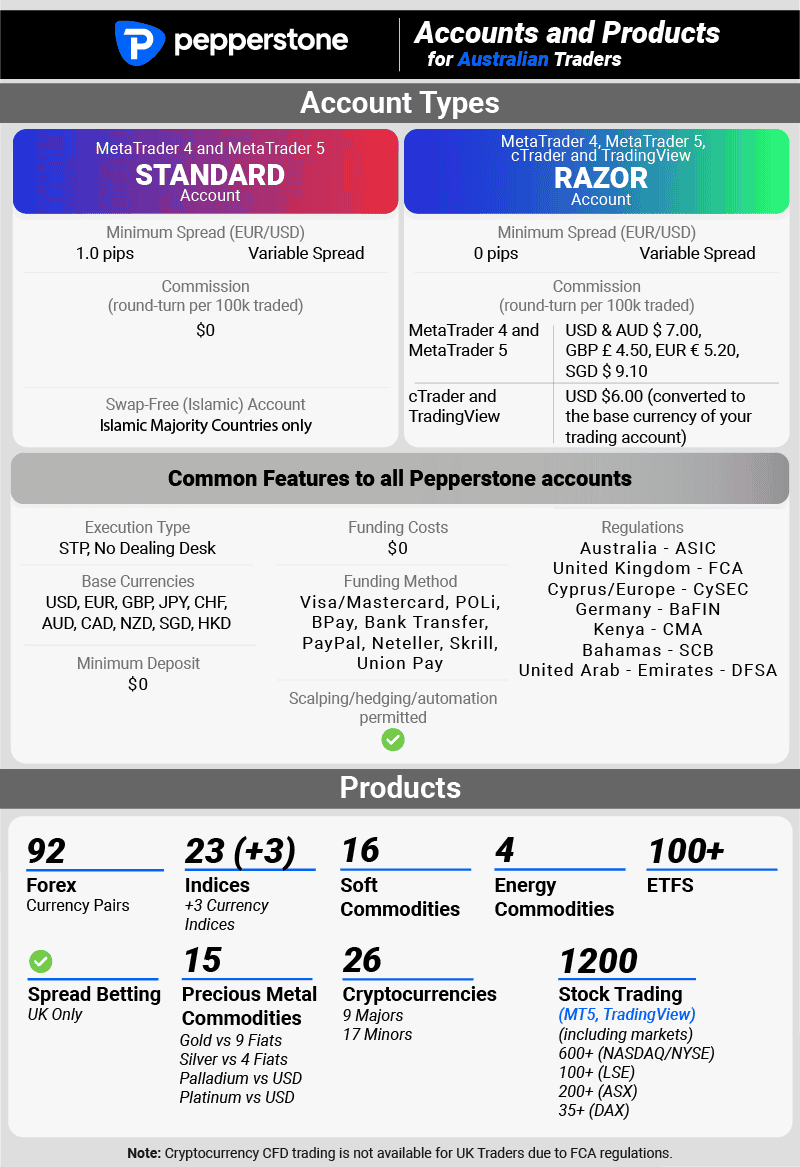

1. MetaTrader 4 with Pepperstone - Best Forex Algorithmic Platform

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend MetaTrader 4

I find MetaTrader 4 to be a solid choice for my algorithmic trading needs. The platform allows me to program my strategies using Expert Advisors that automatically follow my trading rules. I also appreciate that MT4 already have a huge community, and even if you’re relatively new to algo trading, it will be easy to find custom indicators and strategies from other traders. This wealth of shared knowledge has been invaluable in developing my automated trading approach.

Pepperstone is my top pick for forex algorithmic trading. I’m impressed by the broker’s excellent automated trading capabilities when using Expert Advisors, combined with tight RAW spreads. In my tests, I found the average spread for EUR/USD currency pairs to be just 0.1 pips on the RAW spread account.

This aligns well with the tests done by our analyst Ross Collins, who reported an average spread of 0.38 pips. Pepperstone also achieved 100% zero spreads outside rollover in tests also done by Ross Collins, making them an ideal choice for trading algorithms on MT4.

Lastly, the broker’s low trading fees, particularly zero deposit and withdrawal fee policy, with free VPS services on MT4 trading platform sealed the deal. This makes Pepperstone an ideal choice for active traders interested in capitalising on low-cost trading, and faster trade execution.

Broker Details

To test the MetaTrader 4 platform, I opened a Pepperstone account and downloaded the platform to my PC. I found that the MetaTrader 4 is a versatile trading platform offering a range of tools, including 30+ indicators, three chart types, nine timeframes, custom indicators, and automated trading bots.

What stood out for me was the ability to create your own Expert Advisors (EA) to automate your strategies. I tested MetaTrader 4’s algorithmic capabilities by downloading a free Expert Advisor from MetaQuotes and installing it on a demo account. This process was simple; you can do it all from within the MT4 platform.

I was impressed by how easy it was to get started with the EA. Once installed, you can simply drag and drop the EA onto the chart, and it will start to run based on the rules set.

I Recommend Pepperstone For MT4

In my opinion, Pepperstone pairs well with the MetaTrader 4 platform as the broker offers low spreads on both of their accounts, which is perfect for automated trading.

To understand the spreads better, I opened a Standard and a RAW spreads account. The Standard account is Pepperstone’s spread-only account with no commission, and the average spread for EUR/USD came at 1.12 pips. For active traders, the RAW account has tighter spreads, averaging 0.1 pips on EUR/USD, but charges a commission of $3.50 per lot.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

Another benefit of RAW spreads is that they can go as low as 0.0 pips, so I tested how frequently Pepperstone would offer the major pairs at zero pips. I was impressed to find that the broker has a 100% uptime of 0.0 pips on major pairs, outperforming all other brokers apart from City Index.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

Since spreads are this low on the RAW account, this makes Pepperstone a prime choice when automating your trades with MetaTrader 4. You’ll only pay the fixed commission of $3.50 for each trade and this will help keep your trading costs low and predictable.

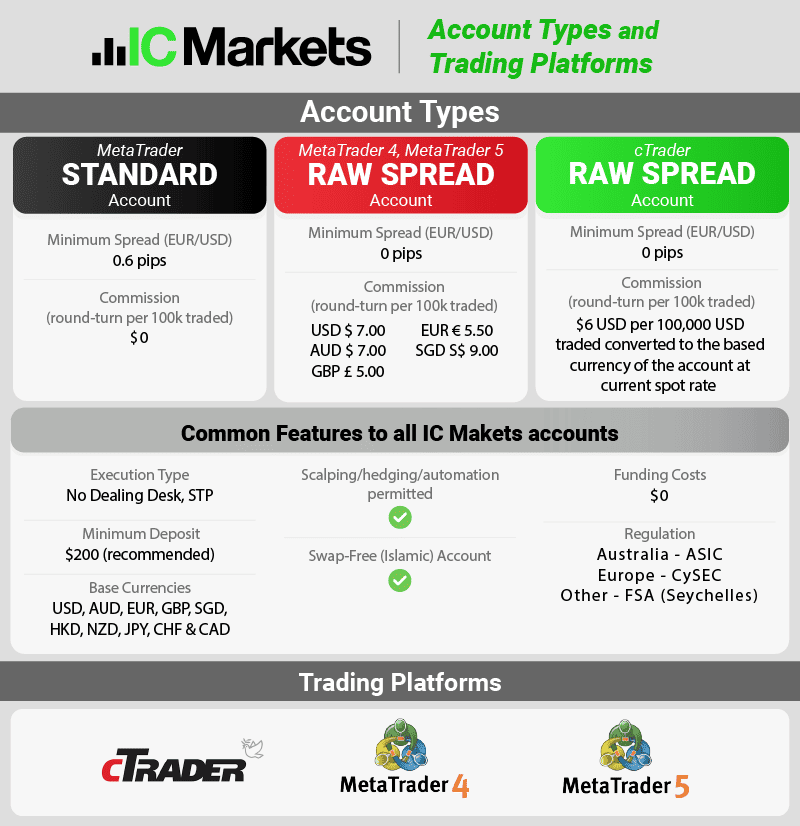

2. MetaTrader 5 with IC Markets - Top Platform For CFD Share Trading

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why I Recommend MetaTrader 5

I chose MetaTrader 5 as the best platform for CFD share trading as it offers access to global stock exchanges while maintaining the user-friendly interface of MetaTrader 4. What I like about MT5 is that it also offers novel features like the advanced Depth of Market tool and a native economic calendar. If you are a share trader, you’’ll get a combination of educational resources and deeper trading experience in one platform.

In my analysis of spreads, I ran a test and discovered that IC Markets offers impressively tight spreads. For EUR/USD currency pairs, I found that the broker offers 0.62 pips, and their major pair average spread is only 0.76 pips. This is significantly better than the industry average of 1.52 pips.

It is also worth mentioning that IC Markets has great VPS services powering MT4 and MT5 platforms while providing a proprietary platform.

Broker Details

MetaTrader 5 on IC Markets improves on MetaTrader 4, extending the range of indicators to 38, 21 chart timeframes, and has new tools like Depth of Market.

I’m impressed by the Depth of Markets feature, which has been made possible by recent infrastructure upgrades. These upgrades have opened a direct connection to the liquidity provider which allows users to view the open order book.

I tested this tool and liked that I was able to get valuable insight into all the open and pending orders for each price levels. This way, you’ll get a complete idea of the demand’s direction, allowing you can make or adjust your trading ideas to reflect this.

In my opinion, this Depth of Markets feature will be a helpful additional indicator to support your technical analysis across various market conditions. It provides raw price action data, meaning that it shows actual demand, making it a powerful intel for making unfiltered trading decisions.

I Recommend IC Markets With MT5

IC Markets is my top choice when it comes to trading with MetaTrader 5. The broker offers a wide-selection of asset classes and 1,600+ share CFDs across several major exchanges, including the FTSE, ASX, NYSE, and NASDAQ.

If you like to trade different financial instruments in multiple markets, the broker offers 61+ forex pairs, 25+ indices, 26+ commodities, and 18+ crypto markets. In all of these markets, you can take MetaTrader 5s features to your advantage.

Our analyst, Ross Collins, conducted an analysis of EUR/USD spreads across various market sessions to determine the average spread that IC Markets offers. His findings revealed that the broker provides an average spread of 0.32 pips on RAW Trading account, significantly lower than the industry average of 0.49 pips.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

As you can see, this placed the broker joint third, slightly behind City Index and Fusion Markets, which are well known for their low spreads.

3. cTrader with FxPro - Great Robot Trading Software

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.2

AUD/USD = 0.5

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why I Recommend cTrader

cTrader is my top choice for robot trading software. It has allowed me to develop my robots (cBots) with C#, a standard programming language that automates any strategy. I am also quite impressed to find that the platform has extensive backtesting and optimisation tools, helpful if you want to improve your cBots without risking your funds.

FxPro is my recommended option for retail investors seeking brokers with robot trading software via cTrader Automate. cTrader comes with advanced charting and technical analysis packages, allowing you to conduct in-depth market analysis.

Based on my test of the Standard account, the EUR/USD currency pair showed an average spread of 1.32 pips and a fixed spread of 1.96 pips. Additionally, if you are starting out, FXPro does not require a minimum deposit to open an account.

Broker Details

I like the cTrader platform and find it a cross between MetaTrader 5 and TradingView. It combines the automation features and depth of market tools of MetaTrader 5 with the excellent charting tools of TradingView.

After inspecting its nooks and cranny, I found that cTrader had 70+ technical indicators, 11 chart types, Depth of Market access, and tools that allow you to copy trade and automate your trades. Personally, I prefer having an extensive analysis tools, and this platform checked off many items on my list.

In testing the robot trading (cBot) feature, I downloaded a free cBot and installed it on the cTrader platform. Similar to installing new software, the cBot file handles everything and installs automatically. I found this to be easier than MetaTrader 4’s approach, and any other algorithmic trading platforms I tried in the past. Once installed, I simply clicked the blue play button, and it automatically opened a chart and started running. The process was quite straightforward.

Another point that stood out for me is connecting to the cTrader platform via a proxy. This means that trades are executed closer to the exchange, helping reduce the ping. This will be a significant advantage if you automate trades as it speeds up the platform’s execution.

FxPro Is A Good Choice For cTrader

From my testing, FxPro provided me with the best overall experience with cTrader. A key factor is that FxPro is an STP broker, allowing it to fully leverage the platform’s performance and tools, such as Depth of Market access.

I opened a FxPro cTrader account to test the spreads on the cTrader platform to see how affordable (or expensive) the rates are. To do this, I collected the average RAW spreads from the major pairs to generate an overall average, and this served as the yardstick on the cost of trading forex with the broker.

The spreads I gathered are:

| Pair | Avg. RAW Spread |

|---|---|

| EUR/USD | 0.32 |

| USD/JPY | 0.42 |

| GBP/USD | 0.37 |

| AUD/USD | 0.51 |

| USD/CAD | 0.74 |

| Overall Average | 0.47 |

I then compared this average with 40 brokers to see how they faired. Based on my findings, FxPro placed slightly above the industry average of 0.44 pips for the average spread on major pairs.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

When it comes to using trading robots, I think RAW accounts are best as they have tighter spreads and fixed commissions. Simply put, your trading costs will remain comparable even when the markets are more volatile around news announcements because you’ll be paying the same commission, no matter what.

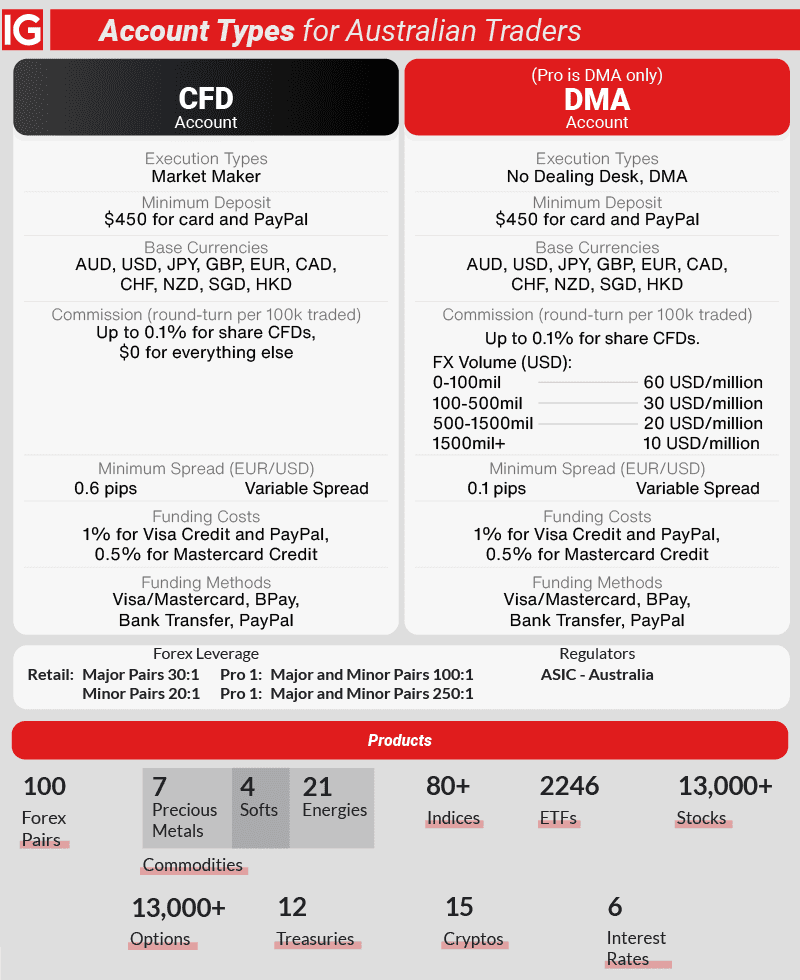

4. ProRealTime with IG Group - Good Charting And Automation Platform

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why I Recommend ProRealTime

ProRealTime provides a decent setup wizard that you can follow to automate your trading strategy (including risk management rules) without knowing how to code.

IG Group’s advanced charting, real-time analysis, and auto trading made possible with ProRealTime have positioned them as one of my top picks for auto trading. ProRealTime provides reliable market data and diversified analytic tools for improved trading efficiency.

With a tight RAW spread of 0.16 pops for the EUR/USD currency pair and a major pair average spread of 1.38 pips, IG Group allows you to maximise profits and minimise losses.

Broker Details

Clearly, ProRealTime isn’t as popular as MetaTrader 4 or TradingView, but in my experience, it packs a punch with features. While testing, I found that the platform comes with 53 technical indicators, 12 chart types including Heikin Ashi and Bar charts, and 20 timeframes ranging from tick charts to 1 year. Professional traders like myself will appreciate having such an extensive line-up.

Another standout feature is the range of automation tools available. While exploring the platform, I discovered the ProRealTime Trend tools, which automatically generate support and resistance levels based on major price points and update in real-time. This tool can also automatically generate trend lines, allowing you to easily identify short and long-term trades with the click of a button. I find this making so much sense in a fast-moving and trend-following market like cryptocurrency trading.

IG Group Offers ProRealTime For Automation

I am convinced that IG Group is a top choice for its extensive range of markets and low trading costs. While testing ProRealTime, I opened an account with the broker and explored the range of markets provided. It’s extensive, covering 100 forex pairs, 12,000+ shares, 130 indices, 41 commodities, 6,000+ ETFs, and 7,000+ options markets. I appreciate that you can access all CFD markets through ProRealTime, while other platforms IG Group offers, like MetaTrader 4, cannot access shares and most of the ETF markets.

However, one downside of ProRealTime is that you cannot access the options markets as it is only available on the IG Trading Platform.

I then opened a Standard account, since IG Group does not offer RAW spreads, which meant my account was commission-free. While trading, I recorded an average spread of 1.13 pips on EUR/USD, lower than the industry average of 1.24.

IG Group is one of the only brokers to provide the ProRealTime platform for free. If you do not want to sign up with them but want access to ProRealTime, it is still possible to subscribe to the platform directly for £24.00 per month.

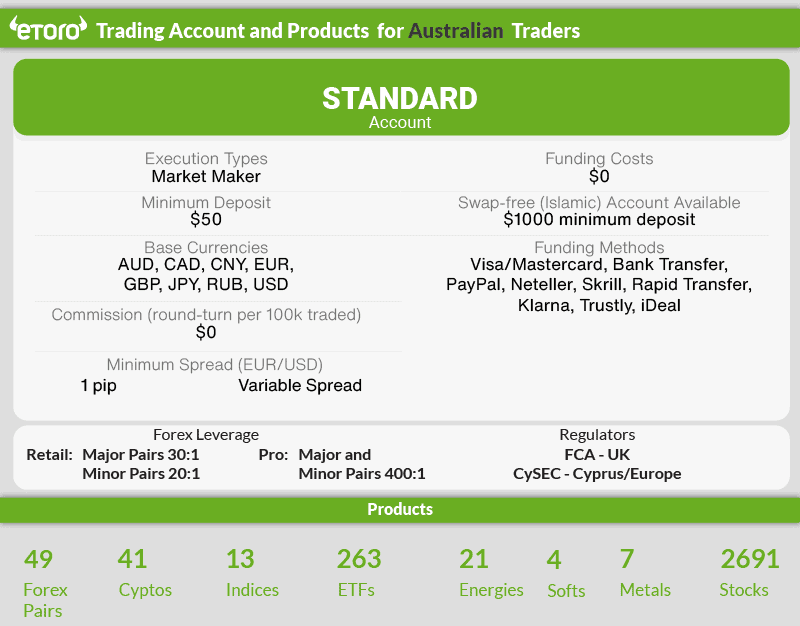

5. eToro - Best Social And Copy Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why I Recommend eToro

eToro is my foremost recommendation for experienced and beginner traders looking for brokers with great copy trading features. In my opinion, having a great copy trading tool provides an easy entry point for those new to trading while enabling experienced traders to gain new strategies. There is also an excellent opportunity to diversify portfolios by observing other traders.

Using eToro means you can trade with decent standard spreads, that average 1 pip for the EUR/USD currency pairs. My tests found that the broker achieved an average spread of 1.30 pips for major pairs which is superior to the overall industry average of 1.52 pips.

Broker Details

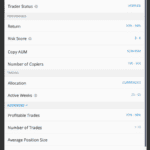

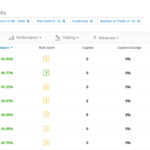

While exploring the CopyTrader platform, I found that it has a filter button that brings up a range of options to narrow down eToro’s 20,000,000 copy traders based on preferences.

Compared with other copy trading platforms like ZuluTrade, I like that eToro offers a more comprehensive filter for choosing traders. For example, you can choose traders based on:

- the markets they trade,

- how frequently they traded,

- what their success rate has been in the last 30 days,

- plus 11 other options

I selected my preferences based on my experience as a medium-to-high-risk investor seeking exposure in the forex markets. I traded ten times in the last month, which returned 1,121 potential traders. This allowed me to review each account before investing with a copy trader.

As part of my testing of the CopyTrader platform, I tested the spreads of eToro to see how expensive it is to copy trade. Like IG Group, eToro only offers spread accounts with no commission, so the spreads averaged one pip on EUR/USD in my experience, below the 1.24 industry average. I still find these spreads are competitive, considering eToro charges no commission.

Since the focus of using eToro is to copy trade, you may not have full control over what assets your copy trader chooses. So I thought it’s a positive thing that eToro didn’t charge commissions on assets like shares and ETFs, which other brokers like IC Markets charge. This helps keep trading costs simple and makes it easier to review your copy trader.

The broker has a solid selection of markets on its platform, offering 49 forex pairs, 2961 shares, 13 indices, 41 commodities, and 41 crypto markets. Personally, using eToro for stock trading is a smart choice, given the extensive choice of equities that can be traded with the broker.

6. Capitalise.ai with Eightcap - Best Software Automation With No Code

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why I Recommend Capitalise.ai

Capitalise.ai is my best choice for automating trading strategies. It simplifies the whole process by letting me type my own trading rules, and artificial intelligence will create the automated strategy instantly.

Eightcap offers an extensive range of tradeable cryptocurrency pairs with simplistic portfolio management and automated trading execution through Capitalise.ai. This is the basis upon which I recommend Eightcap as a good option for cryptocurrency CFD trading.

The broker also provides low-cost trading with a tight RAW spread of 0.06 pips on the EUR/USD currency pair and a tested RAW spread of 0.5 pips, according to my calculations.

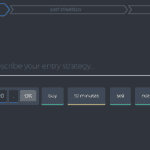

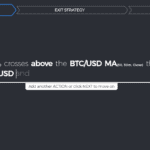

Broker Details

Capitalise.ai enables you to articulate your trading strategy to AI in plain English. This allows you to define entry and exit strategies according to your specifications. You can then seamlessly automate these strategies on your MT4 platform directly through Capitalise.ai.

To test the platform’s capabilities, I got free access via my Eightcap account. Since it was my first time using Capitalise.ai, I was provided with an interactive, step-by-step guide that made the learning process straightforward. I found the platform user-friendly; I just described my entry and exit points to set up my strategy, and the platform took care of the rest.

I noted another positive thing which is the ability to forward-test your strategy using the simulation feature. This allows running the strategy in real-time with live market data to evaluate its performance.

This will be particularly valuable if you are the type of trader who prefers seeing how a strategy operates in a live environment rather than relying on backtesting with historical data, which can sometimes be misleading. Moreover, this allows you to test new strategies without risking your funds.

Eightcap has Capitalise.ai for Forex and Crypto Trading

In my view, pairing Capitalise.ai with Eightcap is an excellent choice for crypto trading as the broker offers 95 crypto markets, including Bitcoin, XRP, Litecoin and Ethereum. This is the most cryptocurrencies available to trade from my tests and is over 4x higher than the average of 20 markets based on 30 other brokers.

In addition to crypto markets, the broker also offers 56 forex pairs, 586 stocks, 16 indices, and 8 commodities. It’s not the widest of choices, but Eightcap covers the popular exchanges available on Capitalise.ai.

While testing Eightcap, I found they have competitive spreads on their Standard and RAW trading accounts. The Standard account has spreads averaging one pip on EUR/USD, and the RAW account averaged 0.06 pips, both below the industry averages for their respective account types.

As RAW spreads vary greatly, I asked our analyst Ross Collins to test Eightcap’s spread on the majors to determine the average spreads over multiple market sessions. He found that Eightcap averaged 0.2 pips on EUR/USD, lower than the industry average of 0.25 pips.

7. TradingView with BlackBull Markets - Best Charting And Indicators

Forex Panel Score

Average Spread

EUR/USD = 0.23 GBP/USD = 0.72 AUD/USD = 0.65

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend TradingView

I highly rate TradingView for allowing users to develop an automated trading strategy which can run 24/7 without the computer turned on or any software running.

This is a game-changer compared to other platforms I’ve used, which typically require computers to be powered on to run automated strategies. I also find it convenient that my strategies sync across multiple devices, allowing me to monitor and adjust them from anywhere.

BlackBull Markets provides a solid foundation for automating your trades with TradingView, thanks to ranking number one in my execution speed tests, helping reduce slippage and improve trading costs.

The low trading costs are also echoed in RAW spreads, averaging just 0.23 pips on EUR/USD in my tests. Combining these low costs with fast execution speeds makes BlackBull an easy pick for automating trades with TradingView.

Broker Details

I highly rate TradingView for allowing users to develop an automated trading strategy which can run 24/7 without the computer turned on or any software running.

This is a game-changer compared to other platforms I’ve used, which typically require computers to be powered on to run automated strategies. I also find it convenient that my strategies sync across multiple devices, allowing me to monitor and adjust them from anywhere.

BlackBull Markets provides a solid foundation for automating your trades with TradingView, thanks to ranking number one in my execution speed tests, helping reduce slippage and improve trading costs.

The low trading costs are also echoed in RAW spreads, averaging just 0.23 pips on EUR/USD in my tests. Combining these low costs with fast execution speeds makes BlackBull an easy pick for automating trades with TradingView.

| Broker | Overall Speed Ranking | Limit Order Rank | Limit Order Speed (ms) | Market Order Rank | Market Order Speed (ms) |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 1 | 72 | 5 | 90 |

| Fusion Markets | 2 | 3 | 79 | 1 | 77 |

| Pepperstone | 3 | 2 | 77 | 10 | 100 |

| OANDA | 4 | 5 | 86 | 2 | 84 |

| Octa | 5 | 4 | 81 | 6 | 91 |

| Exness | 6 | 10 | 92 | 3 | 88 |

| Blueberry Markets | 7 | 6 | 88 | 7 | 94 |

| FOREX.com | 8 | 13 | 98 | 4 | 88 |

| Global Prime | 9 | 7 | 88 | 9 | 98 |

| Tickmill | 10 | 9 | 91 | 11 | 112 |

| TMGM | 11 | 11 | 94 | 13 | 129 |

| City Index | 12 | 12 | 95 | 14 | 131 |

| Trading.com | 13 | 14 | 98 | 15 | 138 |

| FBS | 14 | 17 | 135 | 12 | 118 |

| Axi | 15 | 8 | 90 | 25 | 164 |

| Eightcap | 16 | 19 | 143 | 17 | 139 |

| IC Markets | 17 | 16 | 134 | 22 | 153 |

On spreads, I found BlackBull Markets competitive, averaging 0.23 pips on the EUR/USD pair, closely matching the industry average of 0.22 pips. Admittedly, these spreads are not the tightest in the market, but I still find them reasonable, considering how fast you can execute your trades – a slight premium worth paying.

Additionally, I appreciate BlackBull Markets’ offer of free premium TradingView access for live account holders who place at least ten lot trades with them over a month. This is an excellent bonus, as it allows to increase the number of price alerts available so you can potentially capture more trading opportunities.

Ask an Expert

Is automated trading ultimately better than manual trading?

There is no simple answer to that, it depends on the quality of your algorithms but certainly automated trading does have the capability to monitoring more markets than possible manually and does remove emotions from trading.

How well does algorithmic trading usually work out?

This depends on a number of factors, your chose parameters for the algorithm you use and how the market is behaving. There is no simple answer to this as it varies from person to person and case by case basis.

Does TradingView allow automated trading?

While Pine script is available with TradingView and capable of being used for Automation, at the time you cannot directly automate your trading in TradingView. If you wish to automate your trading, you will need to use 3rd party tools and integrate them with TradingView via API.