Axi Review Of 2025

Australian forex broker Axi offers ECN style tight spreads for its Pro Account. Through the MT4 platform, you can access 140+ currency pairs for forex trading, $0 minimum deposit, fast execution, and award-winning customer support.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Axi Summary

| 🗺️ Tier-1 Regulation | FCA, ASIC, FMA |

| 🗺️ Tier-2 Regulation | DFSA |

| 📊 Trading Platforms | MT4 Trading Platform |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | Forex, Indices, Metals, Energy, Crypto, Commodities |

| 💳 Credit Card Deposit | Yes |

Why Choose Axi

We found Axi has a good selection of Forex pairs for trading via MetaTrader 4 (MT4). Axi only offers MT4, but with scalping and automation permitted and special add-ons for the platform, the broker allows you to make of the trading platform. Other appealing features of Axi include its wide range of base currencies for your trading account and extensive education library.

While the brokers price and execution speed is good, it could be better and it would be nice to them have more trading platforms and software options and more CFD trading products.

Axi Pros and Cons

- No minimum deposit

- Strong regulatory oversight

- Free educational resources

- No MetaTrader 5

- Higher spreads on standard accounts

- Limited platform variety

Open a Demo accountOpen a Live Account

The overall rating is based on review by our experts

Fees

Our Axi review found that the company offers ECN broker spreads. This means that they don’t use a dealing desk but instead connect their clients with an ECN network so you can trade directly with global liquidity pools. These liquidity pools consist of 14 of the world’s leading banks.

Spreads

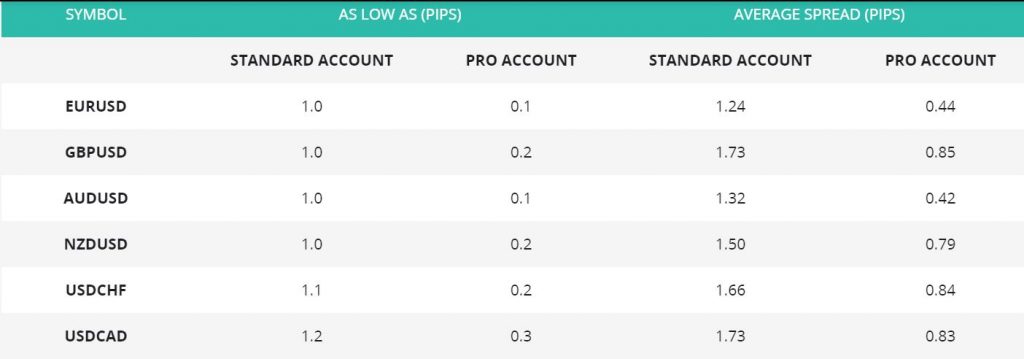

There are two Axi account types that impact the fx broker costs when trading with Axi.

Primary features of each account include:

- no minimum deposit

- scalping

- hedging

- MetaTrader 4 trading platform

- Minimum trade size of 0.01 per lot

- Quoting to 5th digit

- 30 days free demo platform

1) MT4 Standard Account

1) MT4 Standard Account

This trading account is designed for beginner forex traders as it’s not a market makers account. This forex trading account spreads are wider than their Pro account however the account has no commissions.

2) MT4 Pro Account

This account is designed for intermediate forex traders looking to minimise spreads when trading. To keep costs low, AxiTrader does not widen the spread but instead charges a commission of $7USD round trip for each standard lot.

Use the calculator below to compare Axi trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

You can view our guide to Axi Standard Vs Pro Accounts to help you determine which account is right for you. Below is a comparison of the average spreads for each trading account Axitrader offer:

When spreads and fees are compared to other Best Forex Brokers In Australia, the overall result was favourable. This included comparisons to popular currency brokers including Pepperstone and IC Markets. This is because their ‘No Dealing Desk Brokers‘ allows direct trading with liquidity pools, which also enhances execution speeds.

Trading Platforms

Axi focuses solely on the MetaTrader 4 forex trading platform. This forex platform is the most popular globally based on its functionality, ease-of-use and automated trading. Based on solely MT4 Compare Forex Brokers found Axi offered the best forex platform offering. It didn’t though receive maximum scores simply because competitors such as Pepperstone and IC Markets offer additional platforms.

| Trading Plaform | Available With Axi |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | No |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

The MT4 forex trading platform is ideal for forex traders of all levels. The forex trading platform is very clean, and all the charts and other trading tools are easy to find and use.

The site navigation is very nice and offers the best graphical user interface, which makes it ideal for all forex traders. Their trading platforms extend MAC and Windows PC and mobile trading tools like smartphone devices such as the iPhone and Android phones and iPad and Android. Traders can make use of the Autochartist and Myfxbook Autotrade, which is a social-based trade community. Registered traders can use Myfxbook to connect with their accounts and follow the trades of experienced forex traders.

Additional enhancements of MetaTrader 4 have been made through MT4 Next Generation, which is also offered by Eightcap. This gives traders extra features including:

- Sentiment Indicator – This tool helps traders view how other individuals are trading to understand live market insights and trends

- Forex news – An MT4 enhancement allowing individuals to follow other traders via social networks or import currency market news feeds

- Economic Calendar – Keep track of upcoming major market events such as rate and trade announcements, which impact forex markets

- Session Map – Like the calendar above, this global map helps keep track of when markets open and close impacting liquidity

- New terminal window – Get alerts, group functions templates and manage OCO to enhance forex trading on international markets

- Correlation trader – Reduce errors from money management and find new opportunities through spotting correlations on markets

- Alarm manager – Get alerts that allow you not to actively monitor the market avoiding lost opportunities

- Automated trade journal – Automate recording to improve the reporting and analysis of trading activity on fx markets

- Mini Manager – Speed up complex trades for traders who don’t focus solely on currency markets

Is Axi Safe?

Axi has a trust score of 61, from its regulation, reputation, and reviews.

Regulation

In terms of regulatory oversight, Axi’s online trading services comply with the financial rules imposed by 3 tier-one regulators, including:

- Australian Securities and Investments Commission (ASIC), AFSL number 318232.

- Financial Conduct Authority (FCA), Reference Number 509746.

- Dubai Financial Services Authority (DFSA), Reference Number: F003742

Overall, Axi fully complies with the regulatory standards imposed by some of the top financial regulators in the world. However, it’s worth mentioning that in Nov 2019, New Zealand’s financial regulator suspended AxiCorp licenses for not complying with the Financial Markets Conduct Act 2013. As a result, New Zealand retail traders can’t apply for an Axitrader account because Axi has stopped offering its services in this jurisdiction.

Our Compare Forex Brokers’ Axi review found that it has a US subsidiary called Axi USA. This is the avenue US-based traders need to choose to trade forex to meet American regulation. At present, the broker offers two different types of trade executions. These are the ECN instant trade order and Non-Dealing desk execution.

| Axi Safety | Regulator |

|---|---|

| Tier-1 | FCA ASIC FMA |

| Tier-2 | DFSA |

| Tier-3 | SVGFSA |

Reputation

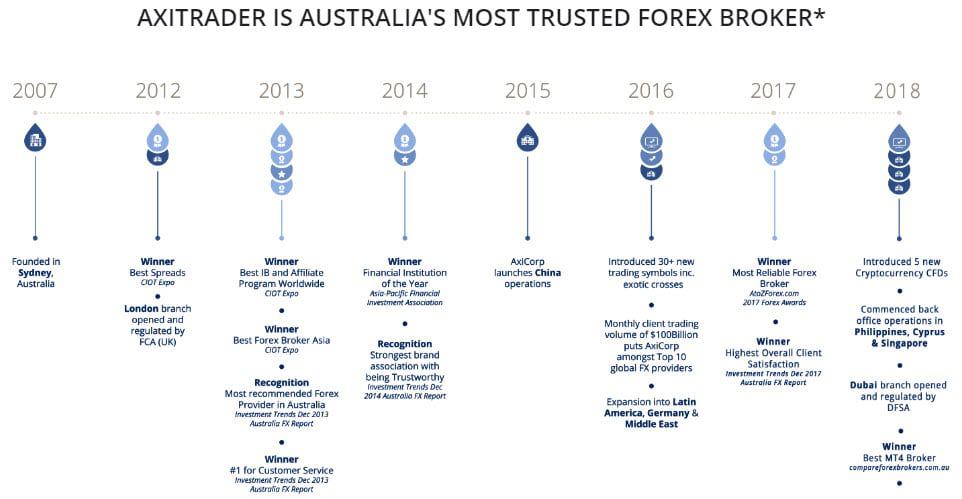

The broker is an Australian-based merchant that was founded in 2008 with its headquarters located in Sydney. They have around 40,500 Google hits monthly.

Reviews

Axi has a TrustPilot score of 3.8 out of 5 from 1,337 reviews.

How Popular Is Axi?

Axi (formerly AxiTrader) presents an interesting case with divergent popularity metrics. With approximately 11,000 monthly Google searches, it ranks as the 52nd most popular forex broker in terms of search volume. However, web traffic data tells a significantly different story, with Similarweb reporting 993,000 global visits in February 2024, placing Axi as the 22nd most visited broker—a substantial gap between search visibility and actual site traffic.

Founded in 2007 and based in Australia, Axi has built a global footprint across multiple regulatory jurisdictions. While the broker doesn’t publicly disclose exact client numbers, industry estimates suggest it serves tens of thousands of traders across more than 100 countries. Axi’s trading volume reportedly exceeds $12 billion monthly, indicating a substantial operational scale that aligns more closely with its web traffic metrics than its search volume positioning.

| Country | 2024 Monthly Searches |

|---|---|

| United Kingdom | 27,100 |

| Canada | 18,100 |

| France | 14,800 |

| Germany | 9,900 |

| Spain | 9,900 |

| Australia | 9,900 |

| Philippines | 9,900 |

| Turkey | 9,900 |

| Brazil | 9,900 |

| Mexico | 9,900 |

| Italy | 8,100 |

| Poland | 6,600 |

| Taiwan | 6,600 |

| Malaysia | 5,400 |

| Singapore | 5,400 |

| Sweden | 5,400 |

| Netherlands | 4,400 |

| Thailand | 4,400 |

| Argentina | 4,400 |

| United Arab Emirates | 3,600 |

| Vietnam | 3,600 |

| Colombia | 3,600 |

| Hong Kong | 2,900 |

| Nigeria | 2,900 |

| South Africa | 2,900 |

| Chile | 2,900 |

| Egypt | 2,900 |

| Portugal | 2,900 |

| Pakistan | 2,400 |

| Switzerland | 2,400 |

| Saudi Arabia | 2,400 |

| Peru | 2,400 |

| Ecuador | 2,400 |

| Bolivia | 2,400 |

| New Zealand | 1,900 |

| Bangladesh | 1,600 |

| Austria | 1,300 |

| Ireland | 1,300 |

| Greece | 1,000 |

| Sri Lanka | 1,000 |

| Morocco | 880 |

| Kenya | 720 |

| Venezuela | 720 |

| Ghana | 720 |

| Ethiopia | 720 |

| Dominican Republic | 480 |

| Cambodia | 480 |

| Algeria | 480 |

| Japan | 449 |

| Jordan | 390 |

| Costa Rica | 390 |

| Cyprus | 320 |

| United States | 260 |

| Mauritius | 260 |

| Tanzania | 260 |

| Panama | 260 |

| India | 210 |

| Uganda | 210 |

| Mongolia | 210 |

| Indonesia | 190 |

| Uzbekistan | 70 |

| Botswana | 70 |

2024 Average Monthly Branded Searches By Country

United Kingdom

United Kingdom

|

27,100

1st

|

Canada

Canada

|

18,100

2nd

|

France

France

|

14,800

3rd

|

Germany

Germany

|

9,900

4th

|

Spain

Spain

|

9,900

5th

|

Australia

Australia

|

9,900

6th

|

Philippines

Philippines

|

9,900

7th

|

Turkey

Turkey

|

9,900

8th

|

Brazil

Brazil

|

9,900

9th

|

Mexico

Mexico

|

9,900

10th

|

Deposit and Withdrawal

What is the minimum deposit at Axi?

There is no minimum deposit required at Axi. However, their recommended deposit amount is $200.

Account Base Currencies

Traders can choose a major base currency for their account from the AUD, USD, JPY to Euro.

Deposit Options and Fees

Deposit options for client funds include bank transfer, credit card, MasterCard, Skrill, BPAY, China UnionPay, bank wire transfer, MoneyBookers to Neteller can be used. For people having AUS bank accounts, the withdrawals do not attract any type of commission. However, the broker can charge anywhere between 15 and 25 dollars for people having international bank accounts. All the deposits are processed instantly while the withdrawals can take up to 5 days to settle.

Withdrawal Options and Fees

Withdrawing funds from an Axi MT4 account is secure, fast, and the transaction fees are low to none. The withdrawals are processed from 9:00 am to 3:00 pm AEST on weekdays. After 3:00 pm they are processed the following business day. Ways to withdraw funds include a bank account, Neteller or Credit Card, with some anti-money laundering regulations involved. Some international transfers will result in charges. When choosing to make a credit card or debit card deposit, a withdrawal must be to the same card. This is assuming the withdrawal is made within 90 days.

Product Range

Axi offers a wide currency for trading forex. With over 80 currency pairings and 140+ cross pairs. This means that in addition to classic currency pairs such as AUD / USD, GBP / USD and EUR / USD, there are also minor and exotic pairings. Minor, exotic and cross pairs can have more movements due to thin liquidity which can present significant profit opportunities albeit with a more high risk.

Our Axi broker review noted that in addition to forex, they offer other instruments for trading CFDs. The Axi range of markets includes:

- Cryptocurrency trading – Bitcoin, Ethereum, Dash, Litecoin and Ripple trading where you can trade CFDs on the BTC/USD pair

- Hard Commodities including Gold, Silver with no brokerage fees

- Energies such as US crude oil and UK crude oil

- Soft Commodities such as Coffee, Cocoa, Soybeans

- Indices

Note: Cryptocurrency trading is not available for Axi clients with AxiCorp Limited, the Axi subsidiary of the UK. FCA compliance requirements do not allow forex brokers to offer crypto products for trade.

Axi does lack a few CFD trading services such as stockbroking and Shares CFD services. This means that you will need to find a share trader provider in addition to Axi as your CFDs provider. Those looking for an all-in-one trading experience may want to consider some of the larger brokers such as CMC or IG.

Customer Support

In 2014, an Investment Trends report found that Axi forex broker had the strongest brand association as being ‘trustworthy’. This was backed up in 2017 when the Investment Trends Australian forex broker report gave it the highest overall client satisfaction. This could be attributed to the CFD broker being Australian owned, with an Australian customer support team. This is based in Sydney meeting ASIC training requirements for staff.

The customer service of Axi Corp (Axi) has also won awards thanks to its 24-hour day customer centre. This is only closed on the weekend when currency markets are closed. They can be contacted via e-mail, phone or live chat. The company has clients in more than 150 countries and a Monday to Friday call centre. When the Sydney office isn’t open, there is support from London and Chisinau. All forex traders that open an account are provided with a dedicated account manager. Account managers assist with trades, forex training, and other market information. Below shows some of the key players at Axi who have one of the most experienced teams worldwide.

Research and Education

The educational centre offers chart tools that provide concise information on various commodities, equity indices and currency pairs. The FX charts offer in-depth information on various charts and provide a suitable interpretation of the various price fluctuations. It does this using oscillator and Fibonacci levels.

Axi also offers various online courses right from basic Forex introduction to in-depth market analysis. The broker offers several educational videos which the registered traders can watch free of charge and get enlightened. In addition to the above, the broker also posts daily market updates. This keeps traders award of developments in the Forex industry.

Final Verdict on Axi

Axi prides itself on 24-hour support, fast trade execution, tight spreads with minimum account slippage.

Axi prides itself on 24-hour support, fast trade execution, tight spreads with minimum account slippage.

The parent company AxiCorp Financial Services Pty Ltd changed its brand name Axitrader to become Axi at the end of 2020. In the same process, they also changed their existing website from axitrader.com to axi.com to match its efforts to revamp the AxiCorp brand.

Over 60,000 former Axitrader clients with live accounts from over 100 countries have continued to trust Axi with their online trading operations.

Our Axi review above explains the wide range of financial instruments for trade like oil, silver, gold, CFD, etc. Traders can choose from 50 different types of currency pairs like AUD/USD, JPY/EUR, EUR/USD, AUD/CAD, etc. The market is open 24-hours and one can trade at any point of time suited to their needs. It offers low-cost trading with best in class risk tolerance limits and different types of assets to choose from.

Axi is a favourite among Australian forex traders. They have a simple-to-use forex trading platform, tight spreads (low fees) and an excellent training program. The forex broker is certified in Australia, which is critical due to the safeguards in place to protect currency traders.

Axi FAQs

What is Axi's minimum deposit?

Axi requires a minimum deposit of $0 for standard accounts, making it accessible for beginners who want to start trading without committing large sums of money upfront. However, more advanced accounts might have different deposit requirements.

Does Axi offer a demo account?

Yes, Axi provides a free demo account, allowing traders to test strategies and familiarize themselves with the platform before committing real funds. This is ideal for beginners and those wanting to practice risk-free.

What trading platforms does Axi offer?

Axi supports MetaTrader 4 (MT4), one of the most popular trading platforms globally. The platform is known for its user-friendly interface, advanced charting tools, and automated trading capabilities, making it suitable for both beginners and experienced traders.

What types of accounts are available with Axi?

Axi offers two main account types: the Standard and Pro accounts. The Standard account has no commission fees but slightly wider spreads, while the Pro account charges a commission with lower spreads for professional traders.

Is Axi regulated?

Yes, Axi is regulated by multiple authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK. This ensures that Axi adheres to strict standards of client protection and transparency.

Forex Broker Comparison Background

Australian forex traders have different requirements from forex brokers ranging from leverage, fees to features. This Axi review was based on our trading platform comparison, focusing on broker features as a focal point. If you have a different priority, then visit our homepage and view our other forex broker comparison charts. Our most popular forex broker comparison tables are low fee, high leverage and bonus offers. All information comes from providers’ websites with each provider offering free demo accounts to trial their offering and trading currency.

Compare Axi Competitors

Compare Axi With Head-To-Head Comparison Tables Of The FX Brokers Below:

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

Is MT4 the only platform offered by Axi?

Yes however you can also use MyFxBook and ZuluTrade for copy or social trading

How much does axi broker charge?

Axi charges a commission of USD 7 per lot round-turn with their Pro accounts. You only pay the spread with the Standard account.