AXI vs IG Group: Which One Is Best?

We compared Axi and IG Group on trading costs, platforms, and regulations. Axi offers lower spreads and MetaTrader 4, while IG Broup provides a wider range of markets and a powerful proprietary platform. After assessing all features, IG Group takes the lead in this review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Pro 2: 250:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors, helping you make an informed decision between Axi and IG Group.

- IG Group has been in the industry since 1974, offering a longer track record.

- IG Group has a broader product offering and a more comprehensive suite of trading tools.

- Axi offers lower spreads on average, making it a more cost-effective option for traders.

1. Lowest Spreads And Fees – IG Groups

Axi, an ECN broker, offers RAW spreads as low as 0.2 pips and a commission of $3.50 per side, making it cost-effective for high-frequency traders. IG Group, a market maker and DMA provider, has tighter RAW spreads at 0.16 pips but charges a higher commission of $6 per side. IG Groups provides access to over 17,000 markets, while Axi focuses on forex with 72 currency pairs. IG Groups supports proprietary and third-party platforms, while Axi specialises in MT4. This comparison examines spreads, commission structures, and fees to determine which broker provides the best balance of cost and market access.

Spreads

Axi offers competitive spreads, particularly through its RAW Account, which provides an average spread of f0.2 pips on EUR/USD. This makes it an attractive option for traders who prioritise low-cost trading. However, these spreads come with a commission fee per trade, which should be factored into overall trading costs. On the other hand, IG Group integrates its trading fees into the spread structure, eliminating additional commission charges. IG Markets’ spreads start from 0.6 pips on major forex pairs, making it a straightforward option for traders who prefer not to calculate extra costs. The choice between these two depends on individual trading preferences.

| RAW Account | Axi Spreads | IG Group Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.64 | 0.74 | 0.72 |

| EUR/USD | 0.2 | 0.16 | 0.28 |

| USD/JPY | 0.5 | 0.24 | 0.44 |

| GBP/USD | 0.5 | 0.59 | 0.54 |

| AUD/USD | 0.5 | 0.29 | 0.45 |

| USD/CAD | 0.5 | 0.7 | 0.61 |

| EUR/GBP | 0.5 | 0.54 | 0.55 |

| EUR/JPY | 0.6 | 0.68 | 0.74 |

| AUD/JPY | 0.7 | 1.5 | 0.93 |

| USD/SGD | 1.8 | 2 | 1.97 |

To make trading fees easier to understand, we created a calculator. Select your currency, trade size, and pair to get the fee.

Commission Levels

Axi applies a commission fee of $3.50 per lot per side when using its RAW Account, a pricing model that appeals to traders who seek lower spreads and are willing to pay a fixed fee per trade. This structure benefits high-volume traders who execute multiple transactions daily, as tighter spreads can lead to significant savings over time. In contrast, IG Group’s pricing model includes all costs within the spread, meaning traders do not incur separate commission fees. This model is particularly beneficial for beginners and casual traders who prefer a simplified cost structure without additional fees per trade.

| Commission Rate | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Axi | $3.50 | $3.50 | £2.25 | €3.25 |

| IG Group | $6 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Standard Account Fees

Axi’s Standard Account features wider spreads compared to its RAW Account but does not charge additional commission fees. This makes it a viable option for traders who prefer all-inclusive pricing without worrying about added transaction costs. IG Group, on the other hand, provides competitive spreads starting from 0.6 pips on major currency pairs, also without extra commission charges. This makes IG Groups’ standard account appealing for traders looking for low-cost forex trading without unexpected fees. While both offer commission-free standard accounts, IG Group’s tighter spreads may provide a slight cost advantage over Axi’s standard pricing.

| Standard Account | Axi Spreads | IG Group Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.31 | 1.62 | 1.6 |

| EUR/USD | 1.2 | 1.13 | 1.2 |

| USD/JPY | 1.3 | 1.12 | 1.4 |

| GBP/USD | 1.3 | 1.66 | 1.6 |

| AUD/USD | 1.3 | 1.01 | 1.5 |

| USD/CAD | 1.3 | 1.98 | 1.8 |

| EUR/GBP | 1.2 | 1.71 | 1.5 |

| EUR/JPY | 1.5 | 2.27 | 1.9 |

| AUD/JPY | 1.4 | 2.06 | 2.1 |

Standard Account Analysis Updated July 2025[1]July 2025 Published And Tested Data

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.20 | 1.30 | 1.20 | 1.30 | 1.30 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Axi is ideal for traders who prioritise tight spreads and are comfortable with per-trade commissions, making it a suitable choice for scalpers and high-frequency traders. The broker’s RAW Account structure allows for lower costs per trade, provided that the commission fees are accounted for. IG Group, however, is better suited for traders who prefer a simpler fee structure without additional commissions. By incorporating all trading costs into the spread, IG Markets offers a more transparent pricing model that benefits casual and beginner traders. Both brokers maintain regulatory oversight by ASIC, ensuring a safe and secure trading environment.

“Axi’s commitment to transparency and fairness has resulted in some of the most competitive spreads in the industry. This is a testament to their dedication to providing an optimal trading environment for their clients.”

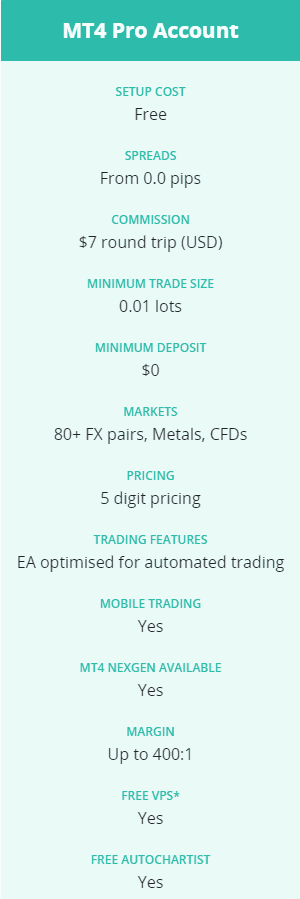

Axi Pro Account

The Axi Pro account has several key features to note:

The Axi Pro account has several key features to note:

- ECN Style Spreads

- Expert Advisers – Use of third-party tools for automatic trading

- Positive Price Improvement – if prices change during execution, Axi will give you a better price

- Low Swap Rates – Axi offers the lowest rates if you hold your position overnight in the industry

- Spreads as low as 0.0

- Roundtrip commission of USD$7

- No minimum deposits

- Fast execution speeds with low latency – Servers are near key exchanges in New York to maximise speed execution and reduce the risk of slippage during execution.

- Free VPS service – if you need to be online at all hours (such as if you use expert advisors), VPS is available and free of charge as long as you meet minimum trade volumes

- Authorised and Regulated by the Australian Securities and Investments Commission (ASIC) – Australian Financial Services Licence Number 318232

It is worth noting that Axi charges a commission in USD. Most other brokers charge in AUD. This extra expense can add up over time if you regularly trade.

Note: Axi offers two types of accounts. These accounts are MT4 Standard and MT4 Pro. MT4 Pro account spreads are narrower, and costs are cheaper than MT4 Standard accounts, even when one factors in the commission. It is for this reason that our review will focus only on MT4 Pro.

IG Group Plus/Trader Account (Standard Account)

Founded in 1974, IG is one of the oldest trading companies in the world. The forex broker offers two broad types of accounts. These are Retail and Professional. Our review is focused on the Retail account, given that you need at least $2.5 million in assets and to have been an active trader for the last 4 consecutive quarters to be eligible for a Professional Account.

If you are trading leveraged (CFD) instruments, IG has two types of trading accounts for retail traders. These setups:

- ‘Limited Risk’ account

- ‘Standard’ trading account

Both accounts are the same, but with the ‘Limited Risk” account, you must purchase a ‘Guaranteed Stop Order’ to take a position, and you cannot use other types of stops to manage your risk.

The IG accounts have several features worth noting.

Over The Counter Trading (OTC) / Sponsored Access Trading

- ‘Expert Advisors‘ (Automated Trading) available (not available on L2 Dealer)

- Wide Choice of Trading Platforms

- No Commission

- Hedging and Scalping

- Spreads from 0.6

- No minimum balance to open an account

- ASIC-Regulated and holder of Australian Financial Services Licence Number 220440.

Over-the-counter trading is when trading does not occur through a formal trading exchange market. Instead, traders buy and sell forex currency pairs through a network that connects banks, brokers and dealers.

DMA (Direct Forex) – Ideal For Advanced Traders

- Direct Market Access (DMA) trading

- AUD$1 per $100 million commission

- No minimum balance to open an account (but there are minimum margin requirements to open a position)

- Competitive minimum margins (IG use tiered margins, i.e. smaller trade sizes require smaller margin)

- Spreads from 0.1

- Must use L2 Dealer or IOS Phone/Android or IOS Tablet

- Faster Trade Execution

- Hedging and Scalping

Our Lowest Spreads and Fees Verdict

Offering a more cost-effective solution for traders considering the balance between spreads and commission structures, IG Group wins in this segment, thanks to their lowest spreads and fees.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

2. Better Trading Platforms – IG Group

Axi and IG group cater to different traders’ needs with their trading platforms. Axi specialises in MetaTrader 4 (MT), enhanced by its NexGen add-on, offering advanced tools like economic calendars and sentiment indicators. IG Group, on the other hand, provides a broader selection with six platforms, including MT4, TradingView, and its proprietary platform. IG Groups’ diverse options cater to traders seeking flexibility and advanced analytics, while Axi appeals to those valuing simplicity and customisation. Both enhance trading experiences, but IG Groups’ variety of platforms positions it as the leader in this segment.

Metatrader

Both of these brokers offer MetaTrader 4, a globally popular platform. Axi enhances MT4 with its NexGen add-on, providing features like trade journals and alerts, making it ideal for personalised trading. IG group also supports MT4 but lacks similar add-ons, focusing instead on its proprietary tools. Axi’s customisation appeals to traders seeking tailored solutions, while IG Group’s broader platform integration ensures flexibility for diverse trading strategies.

Advanced Platforms

IG Group excels with its proprietary platform and TradingView integration, offering advanced charting tools, real-time analytics, and customizable layouts. These features cater to active traders seeking sophisticated tools. Axi relies solely on its NexGen-enhanced MT4, which, while robust, lacks the standalone sophistication of IG Group’s proprietary offerings. IG Group’s platform diversity ensures adaptability for traders with varying needs, positioning it as a leader in advanced platforms.

Copy Trading

Both support copy trading, enabling traders to replicate strategies from successful investors. Axi integrates third-party services like Myfxbook AutoTrade, ensuring seamless strategy mirroring. IG Group leverages its proprietary tools and MT4 Signals for straightforward access to copy trading features. Axi’s broader integration appeals to traders seeking diverse options, while IG Groups simplifies the process for beginners.

| Trading Platform | Axi | IG Group |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

IG Group leads with its diverse platform offerings, including TradingView and a proprietary platform, catering to traders seeking advanced tools and flexibility. Axi remains competitive with its NexGen-enhanced MT4, providing practical solutions for personalised trading. Bot contribute significantly to the forex industry by addressing varied trader needs. IG Group excels in sophistication and adaptability, while Axi focuses on simplicity and customisation. Together, they elevate trading experiences, yet IG Group’s dynamic platform variety places it ahead in delivering exceptional trading environments.

Our Better Trading Platform Verdict

Geared with diverse platform offerings, IG Group ranks highest in this niche due to its better trading platform.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

3. Superior Accounts And Features – Axi

Axi and IG Group shine in their respective account features, catering to different trader needs. Axi excels with its MT4 Pro account, offering ECN-style spreads, low commissions, and fast execution, attracting traders seeking transparency and cost-efficiency. Additionally, Axi supports SWAP-Free accounts, ensuring inclusivity for Islamic traders. IG Group, on the other hand, specialises in automation and Direct Market Access (DMA), appealing to advanced traders with sophisticated strategies. Its standout feature is spread betting, exclusively available in the UK market. Both align their features with diverse priorities, making the choice between them reliant on individual preferences.

Axi’s MT4 pro account ensures competitive ECN spreads, complemented by a free VPS service for traders meeting m minimum trade volume. Its cost-effective approach suits traders aiming for efficient execution and minimal fees. IG Group focuses on automation with Direct Market Access and Expert Advisors, bolstering its appeal to strategy-driven traders. Its spread betting feature enhances market flexibility, exclusive to UK clients. Both of these brokers offer standard and RAW accounts, but Axi’s Swap-Free options provide an edge in inclusivity. Together, they contribute meaningfully to the forex industry by tailoring their offerings to specific user needs while upholding trader satisfaction.

Each broker has its own strengths, so your choice would depend on what specific features or trading conditions are most important to you.

- Best MT4 Broker: AXI excels with its MT4 Pro account, offering ECN-style spreads and fast execution speeds.

- Best MT5 Broker: IG Group stands out for its comprehensive MT5, including a wide range of instruments and advanced trading tools.

- Best for Automation: IG Group offers powerful automated trading features, including Expert Advisors and Direct Market Access (DMA) for more advanced strategies.

- Best ECN Account: AXI’s MT4 Pro account offers true ECN trading conditions, including low spreads and commissions, making it ideal for traders looking for a transparent trading environment.

Axi emerges as a reliable choice for traders prioritising cost-effective and transparent solutions through its MT4 Pro account and EXCN model. Its SWAP-Free feature enhances its accessibility for diverse trading demographics. IG Group impresses with its automation and advanced tools, catering to professionals seeking strategic precision. While IG Group leads in innovation through DMA and spread betting, Axi’s focus on inclusivity and affordability ensures its appeal for broad trader segments. Both play pivotal roles in advancing forex trading, yet the choice depends on individual priorities, whether simplicity and savings for automation or market flexibility.

| Axi | IG Group | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

Loaded with an MT4 Pro account and inclusive features, Axi steals the show in this portion due to its superior accounts and features.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

4. Best Trading Experience – IG Group

Axi and IG Group offer unique advantages in trading experience. Axi stands out with its fast execution speeds, low latency, and Positive Price Improvements, ensuring minimal slippage during trades. It’s a free VPS service for high-volume traders that further enhances execution efficiency. IG Group excels in platform variety, offering TradingView and a proprietary platform alongside MetaTrader 4, enabling flexibility for diverse trading styles. IG Group also provides Direct Market Access (DMA), a significant draw for advanced traders. Both prioritise a seamless experience, with Axi emphasising transparency and execution speed while IG Group highlights flexibility and advanced tools.

- Axi offers a free VPS service for traders who meet minimum trade volumes.

- IG Group provides a wide choice of trading platforms.

- Axi offers Positive Price Improvement, giving you a better price if prices change during execution.

- IG Group has no minimum balance to open an account, making it accessible for all traders.

Axi impresses with its strong focus on execution efficiency and trader convenience. By hosting servers near key exchanges, it ensures low latency and fast trade processing. The Positive Price Improvement feature offers traders better prices during volatile market conditions. IG Group diversifies trading tools with its proprietary platform and TradingView integration, catering to traders who require advanced charting analytics. The Direct Market Access (DMA) feature further elevates IG Group’s offerings, enabling professional traders to execute trades directly in the market. Together, they contribute significantly to enriching trading experiences, tailored to varying trader requirements and expertise levels.

Axi excels in reliability and fairness, offering a streamlined experience for traders prioritising speed and transparent execution. Its VPS service and Positive Price Improvement demonstrate a commitment to client-centric features. IG Group leads with its flexible platform choices and DMA capabilities, enhancing the overall trading experience for advanced users. Both succeed in addressing distinct trader needs, with Axi appealing to cost-conscious traders and IG Group drawing in professionals requiring sophisticated tools. These complementary strengths showcase how tailored services can boost trader satisfaction, ultimately highlighting the diverse opportunities in forex trading.

Our Best Trading Experience and Ease Verdict

By having broad platform options and Direct Market Access, IG Group takes the cake in this category owing to their best trading experience and ease.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

5. Stronger Trust and Regulation – IG Group

IG Group and Axi exhibit distinct strengths in trust and regulation, catering to diverse trader needs. IG Group outshines with a trust score of 97 and regulations from multiple Tier 1 authorities, including FCA (UK), ASIC (Australia), and BaFin (Germany). Its establishment in 1974 and wide global reach position it as a trusted industry leader. Axi, founded in 2007, offers reliability with ASIC regulation and an emphasis on transparency. While IG Group’s broader and long-standing regulatory framework sets the benchmark for global trust, Axi ensures dependable service for regional markets, appealing to traders seeking cost-effective and transparent solutions.

Axi Trust Score

IG Group Trust Score

IG Group boasts an exceptional track record, regulated by top authorities worldwide, from FCA and ASIC to MAS (Singapore) and NFA/CFTC (USA). Its longevity and reputation make it a preferred choice for traders prioritising credibility and global security. Axi, although comparatively younger, remains well-regulated, with ASIC and DFSA ensuring solid coverage. While Axi’s focus is narrower, its commitment to providing a fair trading environment with competitive spreads continues to grow its credibility. Both enhance the trading landscape by adhering to strict regulatory standards, yet IG Group’s comprehensive oversight and global recognition secure its leadership in this segment.

Regulation:

- IG Group:

FCA (UK), ASIC (Australia), and others - Axi:

ASIC (Australia)

IG Group’s extensive regulatory coverage and history firmly establish it as a trusted broker for global traders. Its involvement with multiple Tier 1 regulators and a strong industry reputation make it ideal for those prioritising trust and security. Axi excels in offering transparent and cost-effective solutions, catering to traders with regional needs. Both play vital roles in fostering trader confidence, but IG Group’s broader trust framework and long-standing expertise position it as the leader in regulation. Both showcase how trust and compliance form the backbone of a reliable forex trading experience.

| AXI | IG Group | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) ASIC (Australia) FMA (New Zealand) | ASIC (Australia) FCA (UK) BaFin (Germany) FINMA (Switzerland) NFA/CFTC (USA) CYSEC (Cyprus) MAS (Singapore) FMA (New Zealand) |

| Tier 2 Regulation | DFSA (Dubai) | JFSA (Japan) DFSA (Dubai) |

| Tier 3 Regulation | SVGFSA | BMA (Bermuda) FSCA (South Africa) |

Our Stronger Trust and Regulation Verdict

Having an unmatched regulatory coverage and a stellar trust score, IG Group rides high in this niche by reason of its stronger trust and regulation.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

6. Most Popular Broker – IG Group

IG Group gets searched on Google about twice as often as Axi. On average, IG Group sees around 97,080 branded searches each month, while Axi gets about 11,000 — that’s 88% fewer.

| Country | Axi | IG Group |

|---|---|---|

| United Kingdom | 27,100 | 2,900 |

| Canada | 18,100 | 320 |

| France | 14,800 | 14,800 |

| Australia | 9,900 | 6,600 |

| Germany | 9,900 | 5,400 |

| Turkey | 9,900 | 320 |

| Brazil | 9,900 | 170 |

| Spain | 9,900 | 110 |

| Mexico | 9,900 | 90 |

| Philippines | 9,900 | 90 |

| Italy | 8,100 | 8,100 |

| Taiwan | 6,600 | 480 |

| Poland | 6,600 | 90 |

| Sweden | 5,400 | 3,600 |

| Singapore | 5,400 | 1,000 |

| Malaysia | 5,400 | 480 |

| Netherlands | 4,400 | 480 |

| Thailand | 4,400 | 320 |

| Argentina | 4,400 | 50 |

| United Arab Emirates | 3,600 | 260 |

| Vietnam | 3,600 | 260 |

| Colombia | 3,600 | 70 |

| Hong Kong | 2,900 | 5,400 |

| South Africa | 2,900 | 2,400 |

| Portugal | 2,900 | 320 |

| Nigeria | 2,900 | 90 |

| Chile | 2,900 | 50 |

| Egypt | 2,900 | 50 |

| Pakistan | 2,400 | 1,000 |

| Saudi Arabia | 2,400 | 1,000 |

| Switzerland | 2,400 | 320 |

| Peru | 2,400 | 50 |

| Ecuador | 2,400 | 20 |

| Bolivia | 2,400 | 10 |

| New Zealand | 1,900 | 170 |

| Bangladesh | 1,600 | 50 |

| Austria | 1,300 | 480 |

| Ireland | 1,300 | 90 |

| Greece | 1,000 | 140 |

| Sri Lanka | 1,000 | 40 |

| Morocco | 880 | 260 |

| Kenya | 720 | 90 |

| Ghana | 720 | 20 |

| Ethiopia | 720 | 10 |

| Venezuela | 720 | 10 |

| Algeria | 480 | 90 |

| Dominican Republic | 480 | 30 |

| Cambodia | 480 | 30 |

| Japan | 449 | 140 |

| Jordan | 390 | 20 |

| Costa Rica | 390 | 10 |

| Cyprus | 320 | 70 |

| United States | 260 | 2,900 |

| Mauritius | 260 | 30 |

| Tanzania | 260 | 20 |

| Panama | 260 | 10 |

| India | 210 | 4,400 |

| Mongolia | 210 | 10 |

| Uganda | 210 | 10 |

| Indonesia | 190 | 110 |

| Botswana | 70 | 20 |

| Uzbekistan | 70 | 10 |

2024 Monthly Searches For Each Brand

Axi - UK

Axi - UK

|

27,100

1st

|

IG Group - UK

IG Group - UK

|

2,900

2nd

|

Axi - Australia

Axi - Australia

|

9,900

3rd

|

IG Group - Australia

IG Group - Australia

|

6,600

4th

|

Axi - Italy

Axi - Italy

|

8,100

5th

|

IG Group - Italy

IG Group - Italy

|

8,100

6th

|

Axi - France

Axi - France

|

14,800

7th

|

IG Group - France

IG Group - France

|

14,800

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IG Group receiving 9,438,000 visits vs. 993,000 for Axi.

Our Most Popular Broker Verdict

IG Group is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – IG Group

Axi and IG Group differ significantly in their approach to CFD product ranges and financial markets. Axi specialises in forex trading, offering 72 forex pairs and a streamlined selection of commodities and cryptocurrencies 937 crypto options). IG Group excels with an extensive portfolio spanning 150,000 markets, including 13,000+ shared, 2,000+ ETFs, and diversified indices, bonds, futures, and treasuries. IG Group focuses on diversity, caters to traders seeking broad market exposure, while Axi appeals to those preferring a focused forex and crypto approach. Both enhance the trading experience through their unique specialties.

| CFDs | Axi | IG Group |

|---|---|---|

| Forex Pairs | 72 | 110 |

| Indices | 17 Indices 14 Index Futures | 130 |

| Commodities | 3 Metals (5 Gold crosses) 2 Energies 3 Metals Futures 3 Energy Futures 3 Softs Futures | 11 Metals 7 Energies 23 Softs |

| Cryptocurrencies | 37 | 13 (+ Crypto 10 Index) |

| Shares CFDs | 50 | 13000+ |

| ETFs | No | 2000+ |

| Bonds | No | 14 |

| Futures | No | Yes |

| Treasuries | No | 14 |

| Investment | No | Yes |

IG Group offers an unmatched CFD range, providing options across shares, ETFs, commodities, and treasuries, enabling traders to diversify portfolios comprehensively. Its integration of innovative tools like the Crypto 10 Index adds value for niche market enthusiasts. Axi targets a borrower segment, concentrating on forex and tryptoo trading to ensure precision and simplicity for traders with specialised strategies. Although Axi does not over-share or invest, its commitment to forex-focused excellence makes it ideal for traders who prioritise streamlined options. Both contribute dynamically to the forex industry by addressing varied trading needs and preferences.

Important note: Both Axi and IG Group are regulated by the Financial Conduct Authority (FCA) in the United Kingdom. Due to recent changes to FCA forex and CFD trading rules, UK traders are no longer able to trade cryptos. UK brokers are not allowed to give retail traders access to cryptocurrency markets.

IG Group leads with its expansive product range, offering traders access to virtually all market classes from commodities to ETFs and indices. Its sheer diversity ensures adaptability for traders looking to navigate multiple opportunities. AXi excels as a specialised broker, focusing on forex and cryptocurrency markets for traders seeking simplicity and cost-effective solutions. While IG Group’s depth of offerings elevates its position as the preferred choice for comprehensive trading, Axi’s focused approach provides reliability and clarity. Together, they exemplify the versatility and precision traders need in today’s dynamic market.

Our Top Product Range and CFD Markets Verdict

With an unparalleled product range, IG Group reigns supreme in this segment owing to its top product range and CFD markets.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

8. Superior Educational Resources – IG Group

Axi and IG Group bring valuable features to forex traders with their diverse platforms and tools. Axi focuses on forex trading with MetaTrader 4 and its NewGen add-ons, offering features like economic calendars and sentiment indicators. IG Group outshines with a broader product portfolio, including CFDs, ETFs, and bonds, coupled with multiple platform options like TradingView and its proprietary tool. IG Group also stands out in advanced analytics and global markets, while Axi appeals with a simple yet effective setup ideal for forex-focused traders. Together, they share a versatile industry catering to both specific and broad trading needs

Axi targets forex and crypto traders with its streamlined CFD offerings and MetaTrader 4 platform enriched by NexGEn extensions. It focuses on low-latency execution, and Positive Price Improvement ensures reliability and efficiency. IG Group, with over 150,000 markets, provides comprehensive access to shares, indices, and commodities while integrating tools like TradingView for enhanced analysis. Its diverse educational resources and unique Crypto 10 Index add niche value for traders. By offering tailored platforms and features, Axi caters to cost-conscious traders, while IG Group provides experienced traders the opportunity to explore extensive market options.

- Axi offers webinars hosted by industry experts.

- IG Group provides in-depth courses and tutorials.

- Axi has a blog that covers market analysis.

- IG Group offers a demo account for practice.

- Axi provides eBooks for various trading strategies.

- IG Group has a community forum for trader discussions.

IG Group emerges as a leader with its expansive product range and sophisticated trading tools, ensuring market flexibility for traders seeking comprehensive solutions. Its strong regulatory framework reinforces global credibility. Axi maintains its position as a dependable choice for traders who value simplicity, transparency, and low-cost options. Both contribute uniquely to the forex landscape, meeting various trader requirements. While IG Group’s diversified offerings make it a top-tier choice for experienced traders, Axi’s specialisation provides significant appeal for those who focus on forex and cryptocurrency. Their combined strengths demonstrate the importance of adaptability in today’s dynamic trading world.

Our Superior Educational Resources Verdict

Geared with broad market access and cutting-edge tools, IG Group is having its moment in the spotlight due to superior educational resources.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

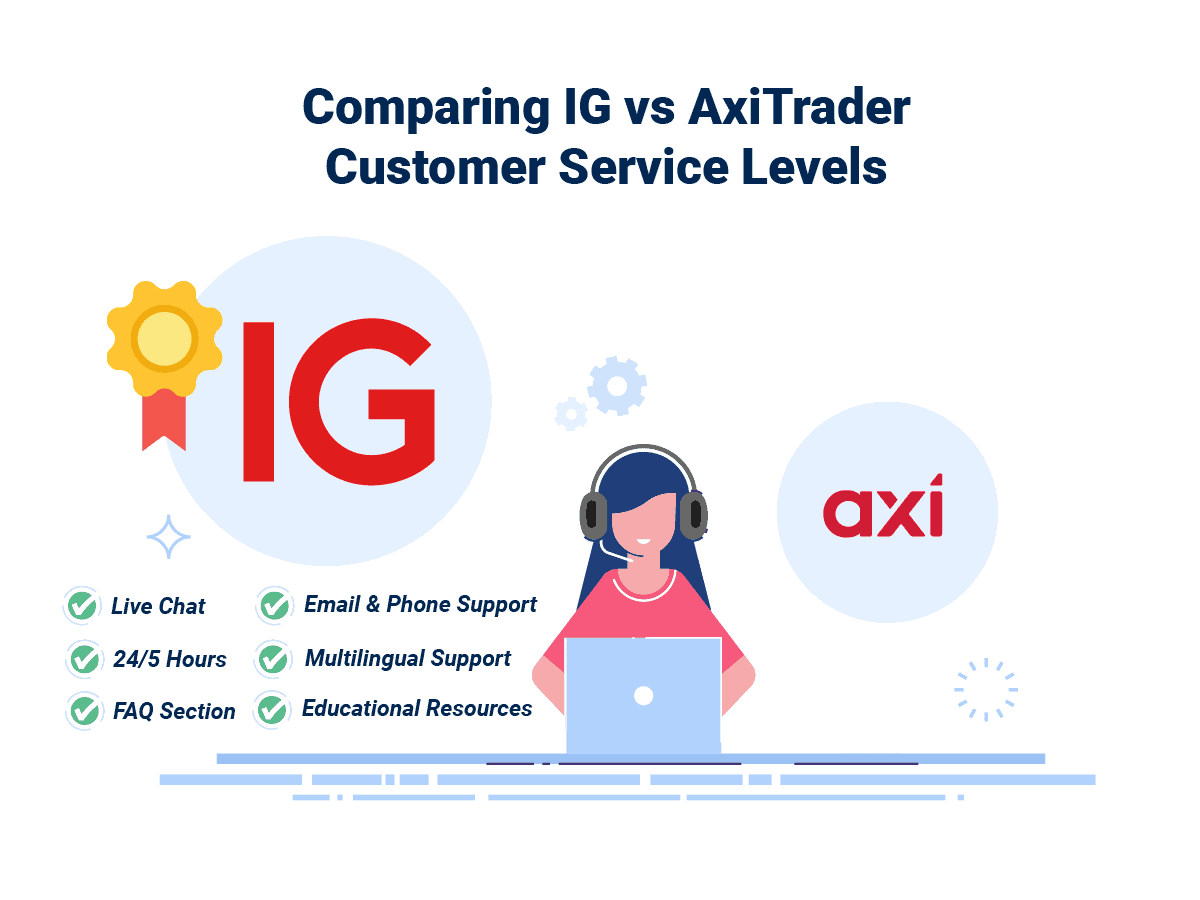

9. Better Customer Service – IG Group

Axi and IG Group demonstrate solid customer support systems that align with their commitment to assisting traders. Axi provides 24/5 live chat, email, and phone support, ensuring accessible solutions during trading hours. IG Group mirrors this offering but goes a step further with its 24/7 customer service and multilingual support, enhancing accessibility for global traders. While both prioritise efficient service, IG Group’s continuous availability ensures that users receive assistance anytime, making it especially appealing for traders operating in different time zones or requiring support during weekends.

Axi ensures straightforward and reliable customer support, catering to diverse regions with its multilingual offerings. Its 24/5 availability aligns with active trading hours, making it an efficient choice for traders who need prompt assistance. IG Group amplifies this service with round-the-clock availability, appealing to traders who operate across global markets. Moreover, IG Group’s dedication to providing multilingual support enhances its global reach and trader satisfaction. Both emphasise accessibility and professionalism in their support systems, yet IG Group’s extended hours and inclusivity set it apart in catering to the evolving demands of modern traders.

| Feature | Axi | IG Group |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | Yes |

IG Group takes the lead with its 24/7 customer support, ensuring unmatched accessibility for traders around the world. Axi, on the other hand, delivers dependable assistance within standard trading hours, making it a reliable option for those with predictable schedules. Together, they highlight the importance of seamless and responsive support in fostering trader trust and confidence. However, IG Group’s commitment to inclusivity and round-the-clock availability establishes it as the preferred choice for global traders seeking uninterrupted service and support across varying time zones.

Our Superior Customer Service Verdict

By delivering 24/7 customer service and multilingual support, IG Group outshines the contender due to their superior customer service.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

10. More Funding Options – IG Group

Axi and IG Group offer reliable funding solutions, but their approaches differ. Axi supports traditional methods like credit/debit cards, bank transfers, and e-wallets such as Skrill and Neteller. IG Group, while offering fewer e-wallet options, includes PayPal and regional methods like PLi and bPay, enhancing accessibility for specific markets. Both ensure secure and seamless transactions, but IG Group’s inclusion of localised payment methods provides added convenience for traders in select regions.

Axi’s funding options cater to traders seeking simplicity and reliability, with widespread methods like bank transfers, credit/debit cards, and e-wallets. Its inclusion of cryptocurrency transactions appeals to tech-savvy traders. IG Group complements its standard methods with PayPal and regional options like POLi and bPay, ensuring flexibility for traders in specific markets. While Axi focuses on streamlined and secure transactions, IG Group’s diverse payment suite ensures greater inclusivity for traders needing alternative funding channels. Together, they both address varied trader needs, enhancing the overall trading experience through tailored funding solutions.

| CFDs | Axi | IG Group |

|---|---|---|

| Forex Pairs | 72 | 110 |

| Indices | 17 Indices 14 Index Futures | 130 |

| Commodities | 3 Metals (5 Gold crosses) 2 Energies 3 Metals Futures 3 Energy Futures 3 Softs Futures | 11 Metals 7 Energies 23 Softs |

| Cryptocurrencies | 37 | 13 (+ Crypto 10 Index) |

| Shares CFDs | 50 | 13000+ |

| ETFs | No | 2000+ |

| Bonds | No | 14 |

| Futures | No | Yes |

| Treasuries | No | 14 |

| Investment | No | Yes |

IG Group leads in better funding options due to its expanded suite of payment methods, ensuring inclusivity and flexibility for global traders. Axi excels in traditional funding options, supplemented by modern features like crypto support, offering reliability for users with straightforward needs. Both enhance the trading ecosystem by streamlining fund management, addressing the key priorities of convenience and security. Yet IG Group’s commitment to providing accessible alternatives, such as PayPal and regional methods, makes it the preferred choice for traders requiring localised payment options.

Our Better Funding Options Verdict

Loaded with a broader range of payment methods, IG Group excels in this section owing to its better funding options.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Axi

Axi and IG Group offer no minimum deposit to open accounts, making both accessible for traders. Axi gains the edge with its zero minimum deposit policy, requiring no upfront financial commitment. IG Group, while also offering zero minimum balance, includes minimum margin requirements for opening positions, aligning with its professional approach. Both provide flexibility, but Asi’s no-deposit structure appeals more to beginners and cost-conscious traders. This accessibility demonstrates their commitment to inclusive trading opportunities.

| Minimum Deposit | Recommended Deposit | |

| Axi | $0 | $200 |

| IG Group | $0 | $100 |

Axi’s zero minimum deposit allows traders to explore the forex market without financial barriers, making it highly appealing for those starting or testing strategies. IG Group, while technically offering no deposit minimum, enforces margin requirements based on account activity, which can suit disciplined traders seeking a guided structure. Both focus on empowering traders with accessible funding models. Axi attracts individuals looking for cost-free flexibility, whereas IG Group’s approach supports structured market participation. These approaches reflect both brokers’ commitment to ensuring inclusivity while addressing varied trader needs, enhancing the forex trading industry effectively.

Axi excels in lowering financial barriers with its no-deposit policy, ensuring unmatched accessibility for beginners and small-scale traders. IG Group complements this by offering structured minimum margin requirements, appealing to professional traders focused on disciplined trading strategies. Both highlight the importance of inclusivity and financial flexibility in the forex industry. However, Axi’s focus on cost-free onboarding makes it a preferred choice for traders testing waters or with tighter budgets, while IG Group’s structured deposit aligns well with advanced trading needs. Together, they contribute meaningfully to enhancing trader participation across experience levels.

Our Lower Minimum Deposit Verdict

By having a zero minimum deposit, which offers greater accessibility and flexibility, Axi excels in this niche thanks to their lower minimum deposit.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

So, is AXI or IG Group The Best Broker?

IG Group wins in both segments, excelling with its extensive tools, resources, and tailored services for traders of all skill levels and aspirations. Axi could focus on improving educational resources, platform diversity, and expanding its product range to better compete in more categories.

| Criteria | Axi | IG Group |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | Yes | Yes |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | Yes | No |

IG Group: Best For Beginner Traders

IG Group emerges as the best broker for beginner traders due to its comprehensive educational resources, superior customer service, and well-rounded account offerings catering to entry-level needs.

IG Group: Best For Experienced Traders

IG Group also leads for experienced traders by offering advanced trading platforms, a road CFD product range, and features tailored for strategic, professional trading needs.

FAQs Comparing Axi Vs IG Group

Does IG Group or Axi Have Lower Costs?

Axi has lower costs when it comes to spreads. They offer spreads as low as 0.0 pips on their MT4 Pro account. However, IG Group offers a more diverse range of account types that might suit different trading styles. For more information on low spreads, you can visit our Lowest Commission Brokers page.

Which Broker Is Better For MetaTrader 4?

Axi is superior for MetaTrader 4 users, offering an MT4 Pro account with ECN-style spreads. IG Group also supports MT4 but doesn’t offer the same level of customisation. For more details, check out our best MT4 forex brokers in the UK.

Which Broker Offers Social Trading?

Neither Axi nor IG Group offer native social or copy trading features. However, both brokers allow for third-party integrations that can facilitate social trading. For more on this, visit our best copy trading platforms.

Does Either Broker Offer Spread Betting?

IG Group offers spread betting, which is tax-free in the UK. Axi does not offer this feature. For more on spread betting, you can visit our best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Axi is superior for Australian Forex traders. They are ASIC-regulated and founded in Australia, offering a sense of local trust. IG Group is also ASIC-regulated but is originally from the UK. For more, visit our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

From my perspective, IG Group is superior for UK Forex traders. They are FCA-regulated and have a long-standing reputation in the UK market. Axi is also FCA-regulated but is originally from Australia. For more details, check out our Best Forex Brokers In UK.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Which is better to copy trade on? Axi or on IG?

IG only has copy trading via MT4 and you are limited to Standard spread only. Axi might be a better choice, you can use MT4 Signals or Axi Copy Trading App which connects you to the MetaTrader Signals network and you can choose between a standard or a RAW spread account.

What is the highest leverage on IG market?

For retail traders it can be 1:30 in the UK, Australia, Europe, New Zealand and UAE. This is the maximum allowed by the regulator. For other regions and for professional traders it is 1:200.