Axi vs CMC Markets: Which One is Best?

Our CMC Markets and Axi comparison examines trading costs, platforms, and regulations. Axi offers competitive spreads and MT4, while CMC Markets provides a broader range of instruments and advanced risk management tools. Based on our analysis, CMC Markets takes the lead in this reviesw

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 16:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most crucial trading factors to help you make an informed decision between AXI and CMC Markets.

- CMC Markets stands out with its Next-Gen platform and extensive product range.

- CMC Markets is a market maker, meaning they don’t charge commission fees but have slightly higher spreads.

- AXI offers tight spreads on MT4.

1. Lowest Spreads And Fees – Axi

Axi and CMC Markets cater to different trader needs with their unique offerings. Axi excels in cost-effectiveness, providing lower spreads (e.g., EUR/USD at 0.2 pips) and a commission-based ECN model. CMC markets, as a market maker, offers a broader range of instruments, including 338 currency pairs and 10,000+ share CFDs, but with slightly higher spreads (e.g., EUR/USD at 0.5 pips). Both waive minimum deposit requirements, ensuring accessibility. Axi’s focus on tight spreads appeals to cos-conscious traders, while CMC Markets’ extensive product range suits those seeking diverse trading opportunities.

Spreads

Axi leads with lower spreads across major pairs, such as EUR/USD at f0.2 pips, compared to CMC Markets’ 0.5 pips. This cost advantage benefits scalpers and high-frequency traders. CMC Markets, while offering slightly higher spreads, compensates with a vast selection of instruments, including 338 current pairs and 124 commodities. Both maintain competitive spreads, but Axi’s tighter pricing makes it a more cost-effective choice for traders prioritising low trading costs.

Commission Levels

CMC Markets charges lower commissions at $2.50 per side, compared to Axi’s $3.50. However, Axi’s ECN model ensures tighter spreads, balancing the higher commission costs. CMC Markets’ commission-free standard account simplifies cost structures for traders preferring straightforward pricing. Both cater to different preferences, with Axi appealing to traders seeking tight spreads and CMC markets offering cost predictability through lower commissions.

Standard Account Fees

Both brokers waive inactivity, deposit, and withdrawal fees, ensuring cost-efficient account management. Axi’s competitive spreads and ECN model enhance its appeal for active traders, while CMC Markets’ market maker model provides simplicity for beginners. Both prioritise affordability, but Axi’s focus on tight spreads and transparent pricing gives it an edge for traders seeking cost efficiency.

Axi shines with its lower spreads and ECN model, making it ideal for cost-conscious and active traders. CMC Markets impresses with its extensive product range and lower commissions, catering to traders seeking diverse opportunities. Both contribute significantly to the forex industry by addressing varied trader needs. However, Axi’s focus on cost-effectiveness and tight spreads positions it as the preferred choice for traders prioritising low trading costs. Both of these brokers demonstrate the importance of balancing cost and diversity in enhancing trading experiences.

| RAW Account | Axi Spreads | CMC Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.64 | 0.93 | 0.72 |

| EUR/USD | 0.2 | 0.5 | 0.28 |

| USD/JPY | 0.5 | 0.8 | 0.44 |

| GBP/USD | 0.5 | 0.9 | 0.54 |

| AUD/USD | 0.5 | 0.6 | 0.45 |

| USD/CAD | 0.5 | 1.3 | 0.61 |

| EUR/GBP | 0.5 | 0.7 | 0.55 |

| EUR/JPY | 0.6 | 1.2 | 0.74 |

| AUD/JPY | 0.7 | 1.2 | 0.93 |

| USD/SGD | 1.8 | 1.2 | 1.97 |

Depending on the currency you trade on, Axi or CMC Markets may have lower commissions. Refer to the table below:

| Commission Rate | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Axi | $3.50 | $3.50 | £2.25 | €3.25 |

| CMC Markets | $2.50 | $2.50 | £2.50 | €2.50 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

| Standard Account | Axi Spreads | CMC Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.31 | 1.53 | 1.6 |

| EUR/USD | 1.2 | 1.3 | 1.2 |

| USD/JPY | 1.3 | 1.3 | 1.4 |

| GBP/USD | 1.3 | 1.5 | 1.6 |

| AUD/USD | 1.3 | 1.5 | 1.5 |

| USD/CAD | 1.3 | 1.5 | 1.8 |

| EUR/GBP | 1.2 | 1.5 | 1.5 |

| EUR/JPY | 1.5 | 1.7 | 1.9 |

| AUD/JPY | 1.4 | 1.9 | 2.1 |

Standard Account Analysis Updated July 2025[1]July 2025 Publish And Tested Data

Our calculator helps you see how reduced spreads change trading costs. Choose your base currency, trade size, and the currency pair to find out.

Some things to note about CMC Markets:

- They only offer one trading account type (no pro account)

- There are no commission fees when trading

- Automated trading is available (with No Dealing Desk Brokers)

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.12 | 1.64 | 1.30 | 1.30 | 1.38 |

|

1.20 | 1.30 | 1.20 | 1.30 | 1.30 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Our Lowest Spreads and Fees Verdict

Geared with lower spreads and a cost-effective ECN model, Axi steals the crown in this segment, by reason of its lowest spreads and fees.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

2. Better Trading Platforms – CMC Markets

Axi and CMC Markets offer distinct trading platforms tailored to different trader needs. Axi focuses on MetaTrader 4, enhanced by its NexGen extension, providing advanced tools like sentiment indicators and trade journals. CMC Markets combines MetaTrader 4 with its proprietary Next Generation platform, offering features like pattern recognition scanners, mobile charting, and client sentiment tracking. Both support copy trading, ensuring accessibility for traders seeking strategy replication. Axi appeals to traders valuing simplicity and customisation, while CMC Markets caters to those seeking sophisticated tools and layouts. Together, they enhance trading experiences through unique platform offerings.

Metatrader

Both utilise MetaTrader 4, a reliable and widely-used platform. Axi enhances it with NexGen features like economic calendars and correlation traders, boosting functionality. CMC Markets integrates MetaTrader 4 alongside its proprietary Next Generation platform, offering flexibility but with restrictions on instrument access. Axi’s focus on customisation appeals to traders seeking tailored tools, while CMC Markets provides broader options for diverse trading strategies.

Advanced Platforms

CMC Markets excels with its Next Generation platform, offering advanced charting tools, pattern recognition scanners, and mobile accessibility. This platform caters to active traders with customisable layouts and real-time alerts. Axi relies on its NexGen extension for MetaTrader 4, delivering enhanced management tools and sentiment indicators. While CMC Markets provides a more sophisticated standalone platform, Axi’s extension ensures practical enhancements for MetaTrader users.

Copy Trading

Both of these brokers support copy trading, enabling traders to replicate strategies from successful investors. Axi integrates third-party services like Myfxbook AutoTrade, ensuring seamless strategy mirroring. CMC Markets leverages MetaTrader Signals, offering straightforward access to copy trading features. Axi’s broader integration appeals to traders seeking diverse options, while CMC Markets simplifies the process for beginners.

CMC Markets leads with its next-generation platform, offering advanced tools and layouts for active traders. Axi remains competitive with its NexGen extension, enhancing MetaTrader 4 for practical use. Both contribute significantly to the forex industry by addressing varied trader needs. CMC Markets excels in sophistication and flexibility, while Axi focuses on customisation and simplicity. Both elevated trading experiences, yet CMC Markets’ proprietary platform positions it ahead in this segment.

| Trading Platform | Axi | CMC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

CMC Markets’s next Generation platform, launched in 2013,offers advanced tools for active traders and now supports MetaTrader 4.

- 100% automated execution

- Competitive pricing

- Consistent performance

CMC Markets’ Next-Gen platform offers five customisable layouts, catering to both advanced and beginner traders’ needs.

- Powerful web and mobile platforms

Next Generation is available on iOS, Android, and web browsers for PC users.

Key features available include:

- Access charts on the go

- Live prices are updated every 5 seconds

- Access over 40 indicators

- Ability to set your trading positions within the charts

- Intelligent watchlists – create and store your watchlists

- Analysts’ insights – CMC Markets has its team providing market insights throughout the day

- Markets calendar – Powered by Reuters, keep up to date via push, email and SMS when important new events happen

- Client Sentiment tracking – See how other traders’ positions on the market

- Account deposits and withdrawals – organise your funding directly through the app

- Real-time alerts – receive a notification when you execute an order

CMC Markets offers some of the most sophisticated charting tools available. Key features include:

- Mobile charting – live streaming charts with access to 20 technical indicators and 10 drawing tools

- Pattern recognition scanner – data is automatically compiled and collated from over 120 instruments that could present trading opportunities.

CMC Markets MetaTrader 4

CMC Markets resisted MetaTrader 4 for a year, but now offers it to meet client demand and attract competitors’ users.

- You cannot use the same CMC Markets Account with CMC Markets Next Generation and MT4. You will need a separate account for each.

- Traders may not have access to the same range and breadth of instruments with MT4 as opposed to CMC Markets Next Generation trading platform.

- Add-on tools and extra features commonly available with other brokers may not be available with the CMC Markets MT4 platform.

Axi MetaTrader 4

Axi’s MetaTrader 4, launched in 2007, remains a top choice among brokers and traders for its reliability and features.

- Stability – the platform has gone through numerous upgrades since its formation in response to the client’s expectations and experiences, which has made it a very reliable and trustworthy platform to trade on.

- It is available through the web and via a strong set of mobile apps for iOS (Mac), Windows and Android. This makes it available to nearly all users and ideal for those relying heavily on mobile trading on the go.

- It is free of charge.

Key features of MetaTrader 4 include

- Expert advisors: This allows you to use algorithmic trading or automated trading

- Hedging and scalping

- Add-on trading tools such as Autochartist

- Social-copy trading with third-party account mirroring services such as Myfxbook AutoTrade

- Multiple market monitoring tools and chart windows can be customised

- MT4 Multi Account Manager (MAM) software

- Fundamental analysis tools with market news online

- Numerous order types, such as pending orders

- 1-Click trading – to enhance, simplify and speed up trading

- MT4 Forex VPS Hosting

- Enhanced connectivity to third-party extensions

- 128-bit secure encryption

- The desktop version is customisable, including different colours and sizes for background charts and fonts.

Axi’s ‘NexGen’

Axi enhances MT4 with a free extension, adding advanced tools, sentiment trading, and improved order management.

Advanced management tools include:

- ‘Trade Journal’ automatically records trade activity that one can use to improve future trading decisions.

- ‘Terminal Windows’ so you can manage alerts, functions and templates

- ‘Economic Calendars’ so you can plan your trading around major economic and market events.

- ‘Correlation Trader’ to help you find trading opportunities and manage your money

Sentiment trading tools include:

- ‘Sentiment Indicator’ so you can see what positions other traders are taking on the market

Enhanced ordering tools include:

- ‘Mini Manager’ to assist in dealing with complex ordering and fast trading

Our Better Trading Platform Verdict

Due to its Next Generation platform, which delivers superior tools and layouts, CMC Markets wins in this segment due to having a better trading platform.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

3. Superior Accounts And Features – Axi

Axi and CMC Markets showcase distinct strengths in account features. Axi stands out with its ECN model offering RAW accounts and direct liquidity access, providing lower spreads and cost-effectiveness. It also features SWAP-Free accounts catering to Islamic traders and supports automation via its MetaTrader 4 platform. CMC Markets, as a market maker, emphasises a broader range of currency pairs and integrated features, such as market data access. While Axi appeals to traders seeking transparent and cost-effective options, CMC Markets attracts users valuing extensive market offerings, demonstrating how each broker meets different trading needs with its unique features.

- Best MT4 Broker: AXI takes the lead with a feature-rich MetaTrader 4 platform.

- Best MT5 Broker: Neither AXI nor CMC Markets offer MetaTrader 5, making it a tie in this category.

- Best for Automation: AXI stands out for its MetaTrader 4 platform’s suitability for automated trading, including the use of Expert Advisors (EAs).

- Best ECN Account: AXI wins as an ECN broker, providing direct access to liquidity pools and lower spreads.

Axi excels with its RAW Accounts, offering direct access to liquidity pools that ensure tighter spreads, especially beneficial for active traders. Its SWAP-Free account ensures inclusivity for Islamic traders, while MetaTrader 4 automation tools enhance its appeal for algorithmic trading. CMC Markets caters to traders preferring simplicity through Standard Accounts and emphasises diverse market exposure with its extensive currency pairs and other features. While CMC Markets does not offer RAW or SWAP-Free Accounts, its broader range makes it appealing to those prioritising access to varied instruments. These brokers contribute uniquely to the forex industry by addressing contrasting trader preferences.

| Axi | CMC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | No |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | No |

Axi takes the lead with superior accounts focused on cost-effectiveness, automation, and inclusivity, making it ideal for both beginner and experienced traders. CMC Markets offers appealing features like broad market access and embedded tools, suitable for traders exploring a wide range of instruments. Both enhance the trading landscape, yet Axi’s ECN model, transparent pricing, and inclusion of SWAP-Free options make it a more versatile choice. CMC Markets complements this by offering extensive market diversity, ensuring both brokers serve a pivotal role in the industry. Ultimately, their unique focuses foster better opportunities for varied trader needs.

Our Superior Accounts and Features Verdict

Equipped with its superior ECN accounts, lower spreads, and inclusive features, AXI subtly overtakes in this segment thanks to its superior accounts and features.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – CMC Markets

Axi and CMC Markets offer standout features for enhancing trading ease and experience. Axi relies on the stability of MetaTrader 4, boosted by NexGen add-ons such as sentiment indicators and Mini Manager, enabling fast and complex ordering. CMC Markets’ proprietary Next Generation platform stands apart with five customisable layouts tailored to diverse trader preferences, plus real-time pricing updates every 5 seconds. While both provide competitive tools, Axi appeals to trades who value familiarity and reliability, whereas CMC Markets caters to users seeking flexibility and customisation through its robust proprietary offering.

- AXI’s MetaTrader 4 is stable and reliable, ideal for traders who prefer a well-known platform.

- CMC Markets’ Next Generation platform offers five different layouts to suit various trading styles.

- Live prices on CMC’s platform are updated every 5 seconds, keeping you in the loop.

- AXI’s MetaTrader 4 allows for complex ordering and fast trading through its ‘Mini Manager’.

MetaTrader

Axi’s MetaTrader 4 shines with robust add-ons like NexGen, offering features such as trade journals and sentiment indicators for personalised management. CMC Markets includes MetaTrader 4, meeting traders’ needs for reliability, but its platform integrates fewer advanced features compared to Axi’s enhanced MT4. The addition of NexGen pushes Axi’s MetaTrader capabilities ahead in delivering superior customisation and utility.

Advanced Platforms

CMC Markets’ Next Generation platform dominates in this category, providing intuitive customisation with multiple layouts for different trader needs. Active traders benefit from advanced tools like pattern recognition scanners and client sentiment tracking. Although Axi relies on its NexGen extension to bolster MetaTrader 4, the standalone sophistication of CMC Markets’ platform, paired with seamless mobile and web functionality, positions it as an industry leader.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Axi | 90ms | 8/36 | 164ms | 25/36 |

| CMC Markets | 138ms | 18/36 | 180ms | 26/36 |

CMC Markets excels in adaptability and trader-specific features, ensuring an intuitive trading experience through its Next Generation platform. Axi maintains its appeal for reliability and automation, boosted by NexGen’s practicality. Both contribute significantly to industry advancement by addressing distinct trader priorities-Axi through efficient add-ons and CMC Markets via advanced layouts and tools. Together, they highlight the importance of providing diverse options for varying trading styles, yet CMC Markets’ dynamic proprietary platform places it ahead in delivering exceptional ease and experience.

Our Best Trading Experience and Ease Verdict

Having Next Generation platform, offering superior customisation, and dynamic tools, CMC Markets rides high in this niche in light of their best trading experience and ease.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

5. Stronger Trust and Regulation – CMC Markets

CMC Markets and Axi present distinct regulatory strengths. CMC Markets boasts an impressive trust score of 91, coupled with Tier 1 regulations across multiple jurisdictions, including FCA (UK), ASIC (Australia), and MAS (Singapore). Axi’s trust score of 61 is backed by regulations like ASIC and FCA, but falls short in global breadth compared to CMC Markets. CMC Markets, established in 1989, benefits from a longer industry presence and wider market coverage, appealing to traders prioritising trust and legacy. Axi, while newer, focuses on consistent regional regulation but lacks the same global stature, positioning CMC as the leader in this segment.

Axi Trust Score

CMC Markets Trust Score

CMC Markets stands out with its robust regulatory framework, encompassing Tier 1 authorities like FaFin (Germany) and IIROC (Canada), alongside FCA and ASIC. Its credibility is further enhanced by serving over 1 million traders worldwide, showcasing strong market trust. Axi is regulated by Tier 1 bodies such as FCA and ASIC, alongside DFSA (Dubai), demonstrating reliability within specific regions. However, its smaller user base of 60,000 and fewer regulatory endorsements limit its perceived global reach. CMC Markets’ multi-tier regulation ensures broader confidence across key markets, making it the preferred choice for traders valuing widespread regulatory assurance and institutional trust.

Finally, we considered the regulation of both brokers. For Axi, they are regulated by:

- ASIC (Australia) – AFSL number 318232

- FCA (United Kingdom) – Reference Number 509746

- DFSA (UAE) – Reference Number F003742

It should be noted that Axi was shortlisted as one of the Best Forex Brokers in the UAE for 2025.

While for CMC Markets, they are regulated by:

- ASIC (Australia) – AFSL 238054

- FCA (United Kingdom) – Reference Number 173730

- BaFin (Germany) – Registration Number 154814

- MAS (Singapore) – Registration Number 200605050E

- IIROC (Canada)

- FMA (New Zealand) – Registration Number 1705324

It should be noted that CMC Markets was shortlisted on the Best Forex Brokers In Australia, Best Forex Brokers In UK list and Best Forex Brokers In NZ list.

| Axi | CMC Markets | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) ASIC (Australia) FMA (New Zealand) | FCA (UK) CIRO (Canada) ASIC (Australia) BaFin (Germany) MAS (Singapore) FMA (New Zealand) |

| Tier 2 Regulation | DFSA (Dubai) | DFSA (Dubai) |

| Tier 3 Regulation | SVGFSA |

CMC Markets dominates in trust and regulation through its extensive coverage and long-standing industry presence. Its diverse Tier 1 regulation portfolio ensures global credibility, appealing to traders seeking a secure trading environment. Axi holds its ground in regional reliability, offering trustworthy operations under Tier 1 regulators. Both contribute to strengthening regulatory standards in the forex market, yet CMC Markets’ broader scope, high trust score, and established legacy place it ahead. These brokers demonstrate the significance of robust regulation in building trader confidence, but CMC Markets remains the leading choice for those seeking unmatched security.

Our Stronger Trust and Regulation Verdict

With its higher trust score and extensive Tier 1 regulation, CMC Markets clearly takes the crown in this niche due to its stronger trust and regulation.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

6. Most Popular Broker – CMC Markets

CMC Markets gets searched on Google about twice as often as Axi. On average, CMC Markets sees around 90,500 branded searches each month, while Axi gets about 11,000 — that’s 87% fewer.

| Country | CMC Markets | Axi |

|---|---|---|

| Australia | 49,500 | 9,900 |

| United Kingdom | 9,900 | 27,100 |

| Canada | 4,400 | 18,100 |

| United States | 4,400 | 260 |

| Germany | 3,600 | 9,900 |

| Spain | 3,600 | 9,900 |

| Singapore | 2,400 | 5,400 |

| New Zealand | 1,900 | 1,900 |

| Poland | 1,600 | 6,600 |

| India | 1,300 | 210 |

| Italy | 880 | 8,100 |

| France | 720 | 14,800 |

| South Africa | 720 | 2,900 |

| Nigeria | 720 | 2,900 |

| Sweden | 590 | 5,400 |

| Malaysia | 480 | 5,400 |

| Indonesia | 480 | 190 |

| United Arab Emirates | 390 | 3,600 |

| Hong Kong | 390 | 2,900 |

| Austria | 390 | 1,300 |

| Ireland | 390 | 1,300 |

| Netherlands | 320 | 4,400 |

| Pakistan | 320 | 2,400 |

| Turkey | 260 | 9,900 |

| Philippines | 260 | 9,900 |

| Thailand | 210 | 4,400 |

| Vietnam | 210 | 3,600 |

| Switzerland | 210 | 2,400 |

| Japan | 210 | 449 |

| Kenya | 170 | 720 |

| Cyprus | 170 | 320 |

| Brazil | 140 | 9,900 |

| Taiwan | 140 | 6,600 |

| Portugal | 140 | 2,900 |

| Greece | 140 | 1,000 |

| Bangladesh | 110 | 1,600 |

| Morocco | 110 | 880 |

| Mexico | 90 | 9,900 |

| Egypt | 90 | 2,900 |

| Saudi Arabia | 90 | 2,400 |

| Algeria | 90 | 480 |

| Sri Lanka | 70 | 1,000 |

| Ghana | 70 | 720 |

| Argentina | 50 | 4,400 |

| Colombia | 50 | 3,600 |

| Cambodia | 50 | 480 |

| Panama | 50 | 260 |

| Uganda | 50 | 210 |

| Peru | 40 | 2,400 |

| Ethiopia | 40 | 720 |

| Chile | 30 | 2,900 |

| Venezuela | 30 | 720 |

| Costa Rica | 30 | 390 |

| Jordan | 30 | 390 |

| Tanzania | 30 | 260 |

| Botswana | 30 | 70 |

| Uzbekistan | 30 | 70 |

| Ecuador | 20 | 2,400 |

| Dominican Republic | 20 | 480 |

| Mauritius | 20 | 260 |

| Bolivia | 10 | 2,400 |

| Mongolia | 10 | 210 |

2024 Monthly Searches For Each Brand

CMC Markets - AU

CMC Markets - AU

|

49,500

1st

|

Axi - AU

Axi - AU

|

9,900

2nd

|

CMC Markets - UK

CMC Markets - UK

|

9,900

3rd

|

Axi - UK

Axi - UK

|

27,100

4th

|

CMC Markets - CA

CMC Markets - CA

|

4,400

5th

|

Axi - CA

Axi - CA

|

18,100

6th

|

CMC Markets - US

CMC Markets - US

|

4,400

7th

|

Axi - US

Axi - US

|

260

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with CMC Markets receiving 1,747,000 visits vs. 993,000 for Axi.

Our Most Popular Broker Verdict

CMC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – CMC Markets

CMC Markets and Axi cater to different trader needs with their CFD offerings. CMC Markets dominates with an extensive range of over 10,000 share CFDs, 338 forex pairs, and 124 commodities, alongside unique options like treasuries and ETFs. Axi, while more selective, focuses on cryptocurrencies with 37 options and offers 72 forex pairs and 19 commodities. CMC Markets appeals to traders seeking diverse instruments, while Axi targets those prioritising crypto and streamlined offerings. Both enhance trading opportunities, but CMC Markets’ vast product range positions it as the leader in this segment.

CMC Markets CFDs

CMC Markets offers the most extensive range of CFDs among all the online trading brokers we have reviewed. In addition to Forex, the following CFDs are available:

1. Indices

2. Hard and Soft Commodities

3. Shares

4. Treasuries

5. Cryptocurrencies

CMC Markets excels with its comprehensive CFD portfolio, including hard and soft commodities, treasuries, and ETFs, making it a one-stop shop for diverse trading needs. Its focus on shares and stockbroking investments further broadens its appeal to traders exploring equity markets. Axi, on the other hand, emphasises cryptocurrencies, offering a wider selection than CMC Markets, and maintains a streamlined range of forex pairs and commodities. While Axi’s focused approach benefits traders seeking simplicity, CMC Markets’ extensive offerings provide unmatched flexibility and opportunities for portfolio diversification. Both cater to varied trading strategies, enriching the forex industry.

| CFDs | Axi | CMC Markets |

|---|---|---|

| Forex Pairs | 72 | 338 |

| Indices | 17 Indices 14 Index Futures | 82 |

| Commodities | 3 Metals (5 Gold crosses) 2 Energies 3 Metals Futures 3 Energy Futures 3 Softs Futures | 124 |

| Cryptocurrencies | 37 | 19 |

| Shares CFDs | 50 | 10000+ |

| ETFs | No | 11265 |

| Bonds | No | 55 |

| Futures | No | Yes |

| Treasuries | No | 55 |

| Investment | No | Yes |

CMC Markets leads with its unparalleled product range, catering to traders seeking diversity and comprehensive market access. Its inclusion of treasuries, ETFs, and a vast array of shares sets it apart. Axi remains competitive with its focus on cryptocurrencies and essential forex and commodity offerings, appealing to traders valuing simplicity and nice markets. Both contribute significantly to the trading landscape, yet CMC Markets’ expansive portfolio and versatility make it the preferred choice for traders prioritising variety and depth. Their unique strengths highlight the importance of tailored offerings in meeting diverse trader needs.

Important Note: Both brokers are regulated by the Financial Conduct Authority in the United Kingdom. Due to recent changes in FCA regulation, CMC Markets and Axi’s UK subsidiaries are no longer able to offer retail traders cryptocurrency trading or products.

Our Top Product Range and CFD Markets Verdict

Loaded with an extensive CFD range and offering unmatched diversity and flexibility, CMC Markets easily takes the cake in this segment, owing to their top product range and CFD markets.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

8. Superior Educational Resources – CMC Markets

Axi and CMC Markets adopt distinct approaches to educational resources. Axi emphasises foundational learning with MetaTrader 4 tutorials and webinars tailored for beginners. Its expert analysis supports a deeper understanding of market trends. On the other hand, CMC Markets delivers advanced market insights powered by Reuters and complements this with a client sentiment tracking feature, offering real-time trading perspectives. Both provide accessible tools, yet CMC Markets stands out for its sophisticated, analytics-driven educational offerings, while Axi appeals more to novice traders building their knowledge base.

When it comes to educational resources, both brokers offer a variety of tools to help traders. AXI focuses on MetaTrader 4 tutorials and webinars, while CMC Markets provides in-depth market insights and analysis.

- AXI offers MetaTrader 4 tutorials for beginners.

- CMC Markets provides market insights throughout the day.

- AXI has a range of webinars covering various trading topics.

- CMC Markets offers a market calendar powered by Reuters.

- AXI provides expert analysis of market trends.

- CMC Markets has a client sentiment tracking feature.

Axi’s educational resources are centered on MetaTrader 4 tutorials, providing clear guidance for traders new to forex markets. With a variety of webinars covering essential trading topics, Axi ensures accessibility for beginners seeking structured learning. CMC Markets elevates trader education through in-depth market insights updated throughout the day and a client sentiment tracking feature, enabling traders to gauge market shifts effectively. Its market calendar, powered by Reuters, adds another dimension to planning and analysis. Both of these brokers enrich the forex trading ecosystem, yet CMC Markets’ emphasis on advanced tools caters better to experienced traders seeking actionable data.

CMC Markets leads this segment with its comprehensive educational tools designed for real-time market analysis and decision-making. Its client sentiment tracking and Reuters-powered insights position it as a broker catering to data-driven traders. Axi remains competitive by simplifying education for beginners, leveraging MetaTrader 4 tutorials and webinars to create accessible learning pathways. Both contribute significantly to enhancing forex trading skills, yet CMC Markets’ advanced and analytics-centric approach gives it an edge for traders striving for informed strategies. They both highlight the importance of tailored educational resources in fostering successful trading.

Our Superior Educational Resources Verdict

Equipped with advanced analytics and comprehensive insights, CMC Markets ranks highest in this category due to its superior educational resources.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

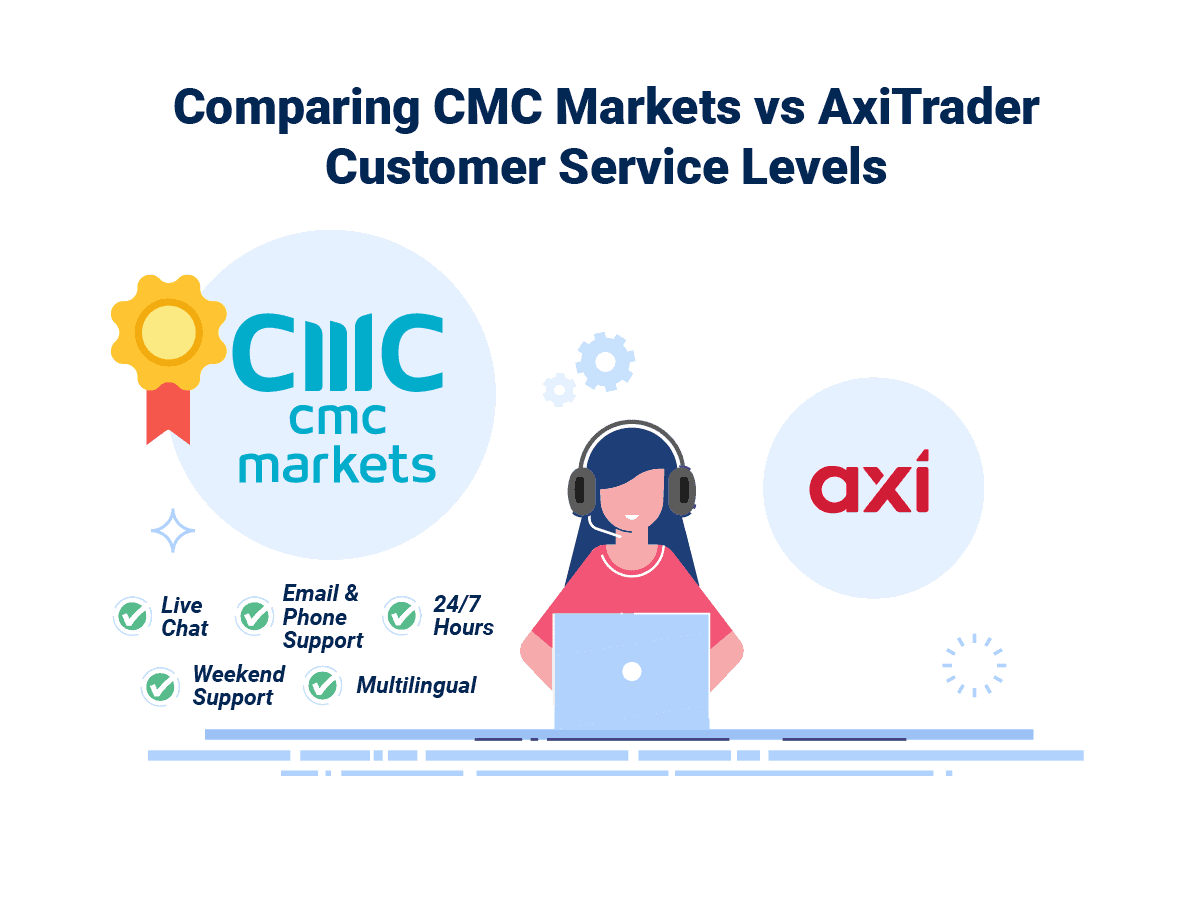

9. Superior Customer Service – CMC Markets

Axi and CMC Markets excel in customer service, offering live chat, email, and phone support paired with multilingual assistance. While Axi provides 24/5 service, CMC Markets extends this to 24/7 coverage, ensuring support even during weekends. Both prioritise user convenience, but CMC Markets’ round-the-clock service gives it an edge for global clients requiring continuous access to assistance. This distinction reflects their varying approaches, catering to different trader schedules and needs.

Axi ensures professional support through its 24/5 availability across all communication channels, delivering timely resolutions during active trading hours. Its multilingual team enhances accessibility for traders in diverse regions. CMC Markets goes further by providing 24/7 support, accommodating traders who operate outside regular business hours or during weekends. This added availability offers peace of mind to users seeking prompt solutions at any time. Both focus on maintaining high-quality customer experiences, yet CMC Markets’ continuous coverage makes it particularly appealing for global traders requiring seamless support, reinforcing its commitment to trader satisfaction.

- AXI offers 24/5 customer support via live chat, email, and phone.

- CMC Markets provides 24/7 customer support, including weekends.

| Feature | Axi | CMC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/5 |

| Multilingual Support | Yes | Yes |

CMC Markets emerges as the leader in customer service by combining accessibility and round-the-clock availability. Its proactive approach ensures traders can address concerns any time, enhancing overall convenience. Axi delivers dependable assistance during active hours, making it suitable for traders with predictable schedules. These brokers highlight the importance of responsive support in fostering trader confidence and successful trading environments. However, CMC Markets’ extended service hours and dedication to accessibility give it a clear advantage in this category, addressing evolving trader demands effectively.

Our Superior Customer Service Verdict

Powered by a 24/7 support, while delivering superior accessibility and convenience, CMC Markets reigns supreme in this segment due to its superior customer service.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

10. Better Funding Options – CMC Markets

Axi and CMC Markets provide reliable funding solutions but differ in their approaches. Axi supports traditional methods like credit cards, bank transfers, and e-wallets like Skrill and Neteller, along with cryptocurrency options. CMC Markets, meanwhile, caters to users with a slightly broader range, emphasising accessibility through options like POLi and bPay. Both accommodate diverse needs, ensuring secure and seamless fund management. However, CMC Markets’ inclusion of regional payment methods adds an extra layer of convenience, setting it apart for traders in areas where these options are commonly used.

Axi ensures simplicity by offering widespread methods like debit/credit cards, bank transfers, Skrill, and Neteller, appealing to traders who favour familiar financial tools. Additionally, Axi supports cryptocurrency transactions, making it attractive to tech-savvy traders seeking modern options. CMC Markets complements its standard methods with POLi and bPay, providing flexibility for regional traders in select markets. While both focus on secure transactions, CMC Markets’ diverse payment suite ensures greater inclusivity for traders needing alternative funding channels. This contrast in approach highlights their unique strengths, with Axi targeting streamlined transactions and CMC Markets appealing to traders valuing extended payment variety.

Axi and CMC Markets provide reliable funding solutions but differ in their approaches. Axi supports traditional

- AXI offers traditional funding options like bank transfers and credit cards.

- CMC Markets provides a broader range of funding options, including e-wallets like PayPal.

| Funding Option | Axi | CMC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | No |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

CMC Markets leads in better funding options due to its expanded suite of payment methods, ensuring inclusivity and flexibility for global traders. Axi excels in traditional funding options, supplemented by modern features like crypto support, offering reliability for users with straightforward needs. Both enhance the trading ecosystem by streamlining fund management, addressing the key priorities of convenience and security. Yet CMC Markets’ commitment to providing accessible alternatives, such as POLI and bPay, makes it the preferred choice for traders requiring localised payment options. Both showcase how tailored funding solutions can elevate the overall trading experience.

Our Better Funding Options Verdict

By having a broad range of payment methods, CMC Markets tops the charts owing to its better funding options.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Axi

Axi and CMC Markets impress with accessible deposit structures, offering no mandatory minimums to open accounts. Axi stands out with its zero minimum deposit policy, which welcomes traders of all levels, particularly those exploring forex with limited capital. CMC Markets, while also flexible, implements a recommended deposit of $100 based on account type, appealing to those seeking guided entry points. Both prioritise inclusivity, but Axi’s lower barrier to entry makes it ideal for beginners and those seeking cost-free onboarding.

Axi’s zero minimum deposit policy opens doors to traders seeking freedom and financial flexibility, fostering inclusivity across experience levels. This structure supports testing strategies without initial monetary pressure, making it a favourable choice for cautious traders. CMC Markets balances accessibility with professionalism, recommending a modest $100 entry level suited to structured trading. Both offer streamlined funding processes, ensuring smooth account setups without complexity. By addressing varied trader needs, Axi empowers exploration while CMC Markets sets standard guidelines for strategic onboarding, contributing significantly to the forex trading ecosystem.

- Axi does not require a minimum deposit, making it accessible to all traders.

- CMC Markets has a minimum deposit requirement based on the account type.

| Minimum Deposit | Recommended Deposit | |

| Axi | $0 | $200 |

| CMC Markets | $0 | $100 |

In terms of minimum deposit requirements, Axi takes the lead with its no-deposit policy, providing unmatched accessibility and freedom for traders testing the waters. CMC Markets remains competitive with its recommended deposit system, catering to those seeking organised trading paths. They both enhance the forex industry by prioritising inclusivity and flexibility. Axi’s dedication to cost-free account opening positions it as the preferred choice for novice traders and small-scale investors, while CMC Markets’ structured approach appeals to strategists seeking seamless account management. Their shared commitment to user-centric policies reflects the evolving demands of modern forex trading.

Our Lower Minimum Deposit Verdict

Loaded with a zero minimum deposit policy, Axi claims the crown in this category due to its lower minimum deposit.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

So, Is Axi vs CMC Markets The Best Broker?

CMC Markets wins for beginner traders with its superior educational resources, 24/7 customer service, and a structured deposit systmemn, catering to novices needing guidance and support. Axi, on the other hand, could focus on enhancing educational resources, expanding product offerings, or strengthening trust through broader regulatory coverage.

| Criteria | Axi | CMC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | Yes | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | Yes |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | Yes | No |

CMC Markets: Best For Beginner Traders

CMC Markets wins for beginner traders with its superior educational resources, 24/7 customer service, and a structured deposit system, catering to novices needing guidance and support.

CMC Markets: Best For Experienced Traders

CMC Markets also takes the lead for experienced traders due to its diverse product range, stronger trust and regulation, and lower spreads and fees, ensuring advanced tools and broader opportunities

FAQs Comparing Axi Vs CMC Markets

Does CMC Markets or Axi Have Lower Costs?

CMC Markets has lower costs when it comes to spreads and fees. They offer competitive spreads and a wide range of trading instruments. For more details, check out our lowest spread brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Axi is the superior choice for MetaTrader 4 users. They offer a stable and feature-rich MT4 platform. For more on this, visit our best MT4 brokers page.

Which Broker Offers Social Trading?

Neither Axi nor CMC Markets offer social or copy trading. However, there are other brokers that do. For more information, check out our best copy trading platforms.

Does Either Broker Offer Spread Betting?

CMC Markets offers spread betting, while Axi does not. For more on spread betting, you can visit our best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Axi is superior for Australian Forex traders. They are ASIC-regulated and founded in Australia. For more details, visit our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK Forex traders, I’d recommend CMC Markets. They are FCA-regulated and have a strong presence in the UK.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What is the minimum deposit required to open an account with AxiTrader?

Axi does not have a minimum deposit to open an account. You will need to have funds in your account to commence trading.

How long do CMC withdrawals take?

Depends on the withdrawals method but they can take up to two business days if being sent to an external bank account.