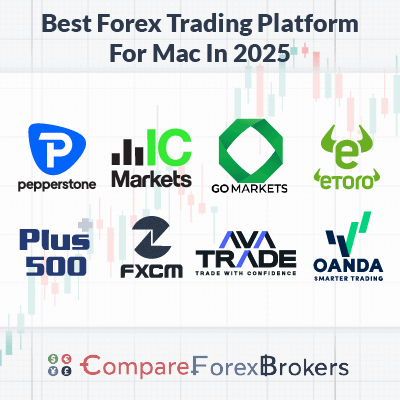

Best Forex Trading Platforms For Mac

Not every forex trading platform has compatible software for Macs. Together with the Compare Forex Brokers team, I’ve looked into the best forex brokers and platforms with trading solutions for Mac traders.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

For Mac users in the forex trading sector, selecting a platform that is compatible and optimised for this operating system is important, noting that not all platforms cater equally to Mac interfaces.

I’ve conducted a research and compiled a list of brokers that provide superior forex trading platforms tailored for Mac users.

These are the best trading platforms you can use on a Mac:

- Pepperstone - My Recommended MT4 Broker for Mac

- IC Markets - My Recommended MT5 Broker for Mac

- GO Markets - Top cTrader Broker for Mac Web Users

- eToro - The Best Social Trading Broker for Mac

- Plus500 - My Top Platform for Beginner Mac Users

- FXCM - My Recommended Ninja Trader Broker for Mac

- AvaTrade - My Pick for the Best iOS Mobile Experience

- OANDA - The Broker With Best Charting Platform for Mac

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

76 |

ASIC, CYSEC FSC, FSA, SCA |

0.2 | 0.5 | 0.2 | $2.50 | 1.0 | 1.3 | 1 |

|

|

|

144ms | $200 | 47 | 14 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

77 |

ASIC, FCA, CySEC CIRO, BaFin, FSCA |

0.30 | 0.90 | 0.40 | $4.00 | 1.3 | 1.8 | 0.7 |

|

|

|

150ms | $50 | 42 | 7 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.92 | 0.9 | 1.1 |

|

|

|

- | $0 | 68 | 4 |

|

What Are The Best Forex Trading Platforms For Mac?

When trading using a Mac, it’s important to pick a trading platform that is both compatible and customised for this operating system. Knowing that all trading platforms are created equal, I’ve created a list of brokers that offer the best forex trading platform for Mac users.

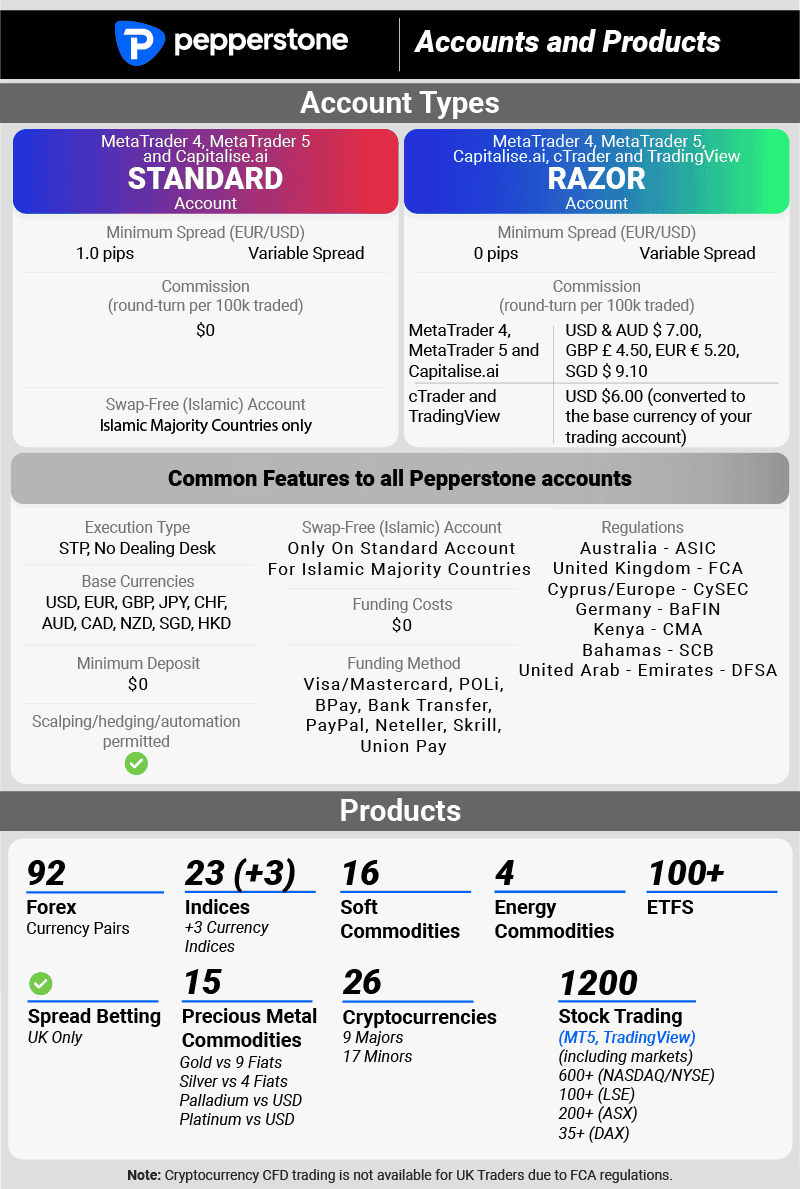

1. Pepperstone - My Recommended MT4 Broker for Mac

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.40

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

I really liked Pepperstone’s MT4 platform which comes with a comprehensive suite of 28 indicators and Expert Advisors. With such a strong offering, I see it as a powerhouse for technical analysis.

Specifically, the platform offers an array of charting tools, including 31 analytical objects, 30 technical indicators, and nine timeframes. This provides you with a holistic view of the market for better decision making.

Additionally, you can get more control over your trades with the broker’s four types of pending orders and three execution methods.

Pros & Cons

- Best MT4 for Mac users

- Tight ECN pricing model

- Over 92 currency pairs to trade

- Need MT5 to trade all products

- Demo account restricted to 30 days

- DMA access is limited to cTrader and MT5

Broker Details

MetaTrader 4, developed by MetaQuotes Software, is one of the most popular platforms in the financial markets. Virtually every forex broker offers MT4 as a standard desktop platform, and only recently has it become available on Mac.

Although this software isn’t natively available on the Mac, brokers use special tools that let you run the software without downloading a third-party tool. In the case of Pepperstone, I found that the broker packages their version of MT4 using Wine, a reliable emulator on the Mac, that lets the Windows-based software run natively on the operating system.

After installing the MT4 platform, I discovered that it offered 30+ indicators and analysis tools, three chart types, and nine timeframes. With the availability of my trusted indicators like Bollinger Bands and moving averages, I didn’t have any problem setting up my trading strategies on MT4 out of the box.

For professional traders who require uncommonly advanced indicators, you should note that MetaTrader 4 lets you develop custom indicators through its MQL4 platform, built into MT4 for Mac. As an alternative, I found that you can also use hundreds of thousands of indicators developed by MetaTrader 4’s large community online.

Another feature that surprised me is, even on Mac, MT4 has access to Expert Advisors — a big plus especially for automating trades. Like custom indicators, you can download them from the Internet or code an EA manually, and the MT4 platform will automate your trades.

Pepperstone backs up its MT4 offering with solid trading services, great range of financial instruments, low trading costs, and fast execution speeds. This is such an impressive combination, so I have the broker score 98/100 in my review.

While testing Pepperstone’s spreads, our analyst Ross Colins found that the broker’s Razor account offered spreads at 0.0 pips 100% of the time on major pairs. What this means is that, with zero-pip spreads, you’re effectively paying only the $3.50 per lot traded commission. This is a fixed cost, keeping your fees the same even during volatile trading periods.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

2. IC Markets - My Recommended MT5 Broker for Mac

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

I appreciated the versatility of IC Markets, particularly their MetaTrader 5 (MT5) platform, which I confidently recommend to Mac users. The MT5 platform stands out for its exceptional desktop and mobile trading app options, covering all bases from iPhones and iPads to Android devices. Even better, both demo and live accounts are readily accessible on these platforms.

Pros & Cons

- Low spreads on MT5

- No deposit or withdrawal fees

- Diverse range of trading products

- High minimum deposit

- Lacks market analysis resources

- Limited education resources

Broker Details

Australia-founded IC Markets offers MetaTrader 5, an upgrade to MT4 that comes with multiple new benefits. I appreciate that, for the most part, the developers kept the interface the same as MT4. It is simple and all the focus is placed on charting capabilities.

One key difference between the MetaTrader platforms is that MT5 is a true multi-asset platform allowing you to trade single stocks. It unlocked two new features that are related to stocks (but also helpful for other assets):

- the new Depth of Markets tool

- native economic calendar integration.

While trading with IC Markets, I came across the Depth of Market tool on MT5 which instantly became my favorite one to use. This lets you view the pending orders at specific price points in the liquidity provider’s order books.

Having access to this information has significantly helped in bettering the timing of my trades. For a bit more context, the Depth of Market tool allows you to see where most other traders place their orders, making it easier to see where the crowd’s attention goes and make decisions accordingly.

Meanwhile, I also found having an economic calendar built into the platform an excellent feature. You can customise the events you want to see, such as limiting it to high-impact events only. I like that the event labels are placed on the chart, too, so you can be alerted on upcoming news, which can help you time your trades.

In addition to these major new features, the platform increased the number of technical indicators available by default from 30 to 38. It added new indicators that can take advantage of the upgraded infrastructure, such as the adaptive moving average and the Chaikin oscillator.

With the introduction of MT5’s Depth of Markets tool that provides Leve 2 price data, I think the platform is a solid choice if you’re a scalper. For this reason, I named IC Markets as the best broker for MetaTrader 5 on Mac with their low spreads.

In my recent spreads tests on Raw accounts (tight spreads, commission-based), I found IC Markets to have some of the lowest EUR/USD spreads, averaging 0.19 pips.

| EUR/USD | Average Spread |

|---|---|

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| CityIndex | 0.22 |

| ThinkMarkets | 0.22 |

| Blueberry Markets | 0.27 |

| Go Markets | 0.38 |

| Axi | 0.43 |

| Tested Industry Average | 0.27 |

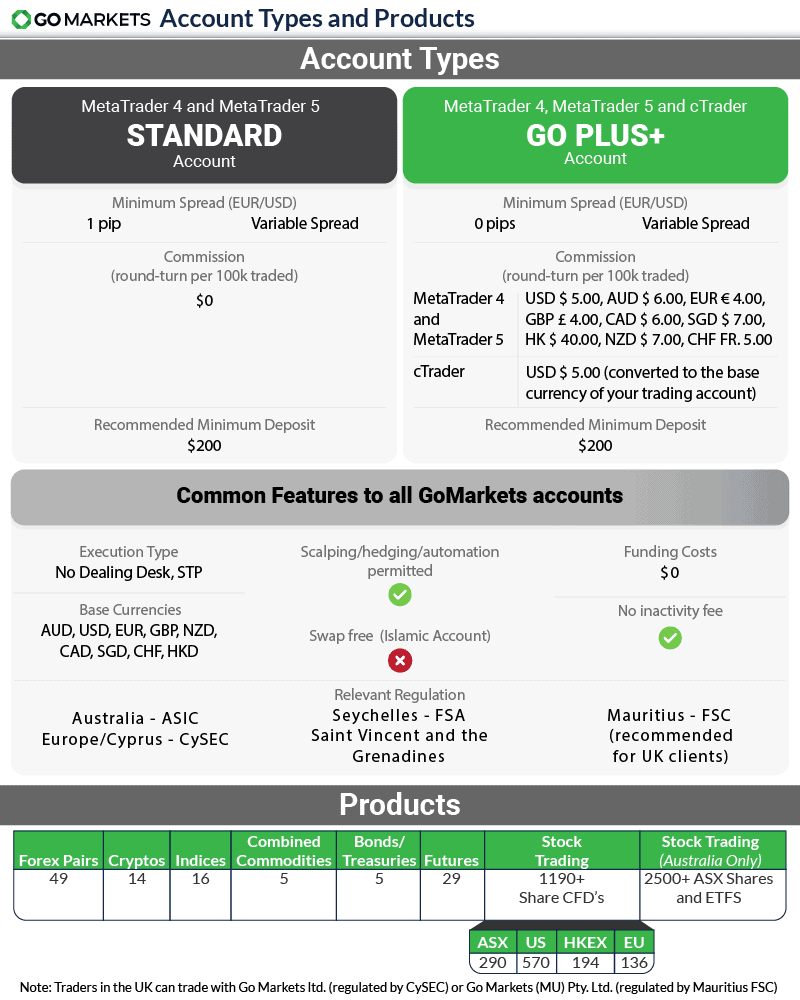

3. GO Markets - Top cTrader Broker for Mac Web Users

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 1.3

AUD/USD = 1.0

Trading Platforms

MT4, MT5, cTrader, TradingView, Go Markets Trading App

Minimum Deposit

$200

Why I Recommend GO Markets

I liked the addition of cTrader to GO Markets’ suite, as it stands out as a compelling third-party platform boasting advanced trading features, particularly in order management.

cTrader’s order entry and execution are swift and seamless, providing an edge against other web-based platforms, especially in fast-paced trading scenarios. I find their depth of market feature, which showcases the full spectrum of executable prices, as a valuable tool for informed trading.

Couple that with their leading risk management tools, and you’ve got a platform that truly caters to the needs of discerning traders.

Pros & Cons

- Low trading commissions on cTrader

- Top market analysis videos

- Copy trading on cTrader

- Lacks a diverse range of trading products

- 24/5 client support

- Has a high minimum deposit

Broker Details

Until recently, the only way you could trade cTrader was through its web platform on a Mac. Now, the developers of cTrader have released a native cTrader to Mac, and from my tests, it includes most of the Windows version, except key features like the Depth of Markets tool. So I highly recommend using the Web Platform if you want to use these features on online brokers like GO Markets.

cTrader, like MT4 and MT5, is focused on providing advanced charting with over 60+ indicators, such as Supertrend and RSI. Interestingly, I discovered that the platform also has 120+ timeframes, from time-based to price-based, such as renko bars, letting you choose how to trade the markets.

This range of timeframes allowed me to use the charts exactly how I wanted, and based on my experience, most platforms don’t allow clients to select how many pips per Renko bar are used.

Like MT5, cTrader has Depth of Markets tools, allowing you to take advantage of the broker’s direct market access and see the trading volume on the liquidity provider’s order books. I see these tools appealing best to scalpers and day traders looking for advanced market sentiment indicators.

GO Markets offered the lowest cTrader commissions. In my testing, an average broker charges $3.00 per lot traded on cTrader, while GO Markets charged only $2.50 per lot. This will be a large saving, particularly if you’re a high-volume trader.

| Broker | USD |

|---|---|

| Tickmill | $2.00 |

| FXTM | $2.00 |

| Fusion Markets | $2.25 |

| London Capital Group | $2.25 |

| CMC Markets | $2.50 |

| BD Swiss | $2.50 |

| AMarkets | $2.50 |

| Fair Markets | $2.50 |

| Go Markets | $2.50 |

| City Index | $2.50 |

| DNA Markets | $3.00 |

| Admirals | $3.00 |

| Blackbull Markets | $3.00 |

| FP Markets | $3.00 |

| HF Markets | $3.00 |

4. eToro - The Best Social Trading Broker for Mac

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why I Recommend eToro

I liked eToro’s standout social trading feature in trading CFDs. With access spanning over 140 countries and millions of users, the platform, with its capability to seek out and replicate trading, presents a wealth of options for social trading.

With eToro’s intuitive tool, you can easily identify top investors, narrowing down based on factors like location or risk score. For Mac users keen on social trading, eToro holds the mantle as the best broker in this space.

Pros & Cons

- No trading commissions

- Filter traders by performance to copy from

- Good choice of trading instruments

- Has withdrawal fees

- No RAW spread account

- Lacks educational resources

Broker Details

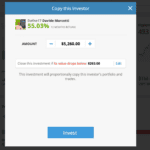

eToro is one of the largest social trading platforms in the industry, with over 30,000,000 users. This number of traders gives you plenty of traders to interact with or mirror trades through the broker’s CopyTrader platform.

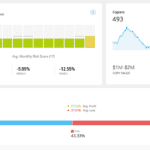

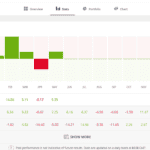

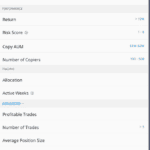

I tried the eToro CopyTrader features to see how easy it is to navigate around and enter my first copy trade. In my opinion, eToro did done an excellent job simplifying the trading process and the platform’s features. Using the search feature, you can instantly find traders based on your requirements. Once found, it’s a simple click of the “Copy” button to start mirroring their trades.

Using the search tool, I was allowed select from 14 metrics to filter my potential Copy Traders by including Risk Score, markets traded, and number of followers. I like that I can filter by number of followers, as this gives you social proof that the trader may be a success, depending on how many followers they have.

Interestingly, as part of the advanced analytics for each trading profile, you can see when and how many followers each trader received during the last 12 months. This metric helps determine how well they are currently performing because if you see a sharp drop in followers and more people pulling their money away, this is a sign that the trader is underperforming.

One of the key highlights of eToro is that the broker gives you a 360-degree service, providing copy trading with competitive trading costs.

I also found their Standard account averages 1.0 pip spreads on EUR/USD spreads, which is less than the industry average of 1.24 pips.

| Broker | EUR/USD |

|---|---|

| OANDA | 0.6 |

| IC Markets | 0.62 |

| Fusion Markets | 0.93 |

| Admirals | 0.6 |

| Eightcap | 1 |

| Go Markets | 1 |

| eToro | 1 |

| FP Markets | 1.1 |

| IG | 1.13 |

| FXTM | 1.90 |

| Industry Average | 1.24 |

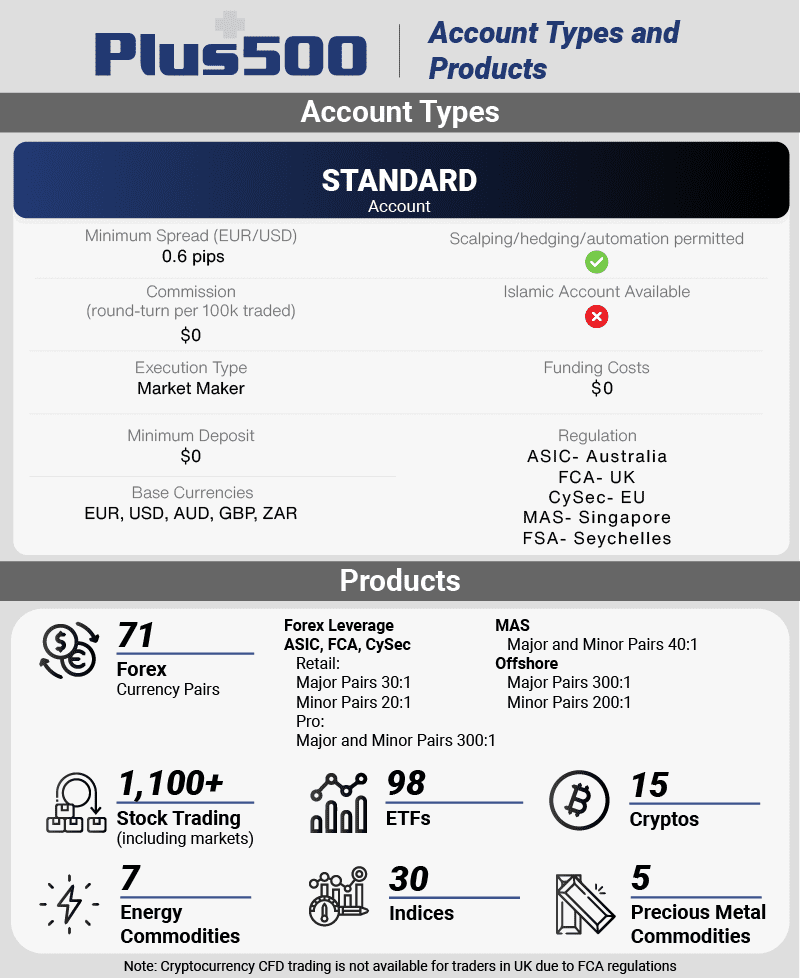

5. Plus500 - My Top Platform for Beginner Mac Users

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why I Recommend Plus500

I liked how Plus500 caters exceptionally well to those new to the fx trading world. The broker’s user-friendly platform, low fees, and fixed spreads provide a straightforward entry point for beginner traders on Mac.

Additionally, having negative balance protection and a guaranteed stop offering gives an extra layer of security for those still finding their footing.

While seasoned CFD traders might lean towards platforms with more advanced features, I firmly believe that for Mac users who are just starting out, Plus500 is a top platform choice.

Pros & Cons

- Excellent proprietary trading platform.

- Sentiment-based trading with +Insights

- Has low spreads

- Inactivity fees

- Lacks third-party market research tools

- No automated trading tools

Broker Details

From my testing, I found Plus500’s platform the easiest to use, especially considering you do not need to download anything, as it is 100% web-based. The platform has decent charting (with 80+ indicators) that isn’t cluttered by news and many icons like other platforms, making finding features like technical indicators and drawing tools easier.

I liked that the platform provided solid risk management tools like guaranteed stop-loss orders. These tools are beneficial, especially if you’re a beginner trader. They put a hard limit on your losses, protecting you from market slippage which could cost you a lot of money if you’re not careful.

My top highlight is using the +Insights tools, which showed me where other Plus500 traders are currently trading. This showed a range of categories, featuring which assets are rising due to popularity or whether they are rising due to people short-selling the asset.

Tools like this can help beginners get a quick market bias before placing trades, potentially helping on timing trades better.

During my testing, I successfully accessed the full scope of Plus500’s markets, which included 71 currency pairs, 1,100+ share CFDs, 30 indices, 12 commodities, and 15 cryptocurrencies.

It also added an appeal that the broker provided me with a decent customer service experience with 24/7 live chat operated by humans. They also have a decent FAQ knowledge base that can resolve the most common problems. In my opinion, having decent customer service is important, especially if you are just starting. It ensures tat you can get issues resolved immediately or receive immediate help when using the platform.

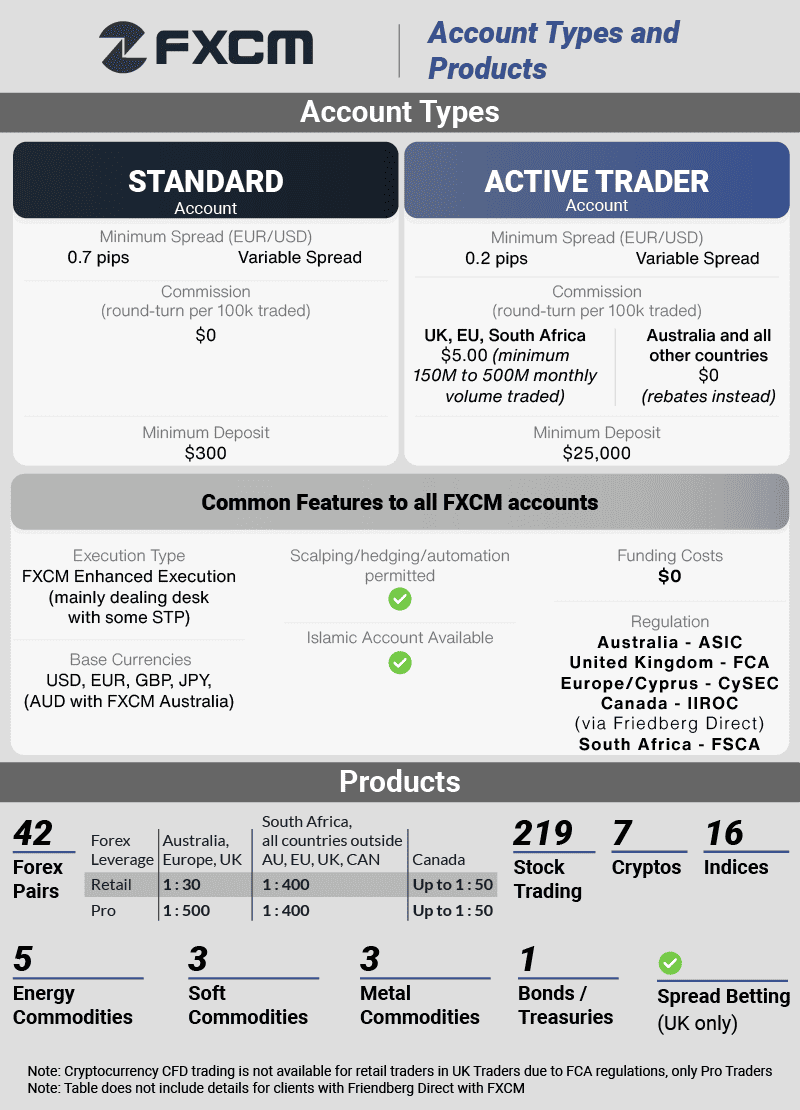

6. FXCM - My Recommended Ninja Trader Broker for Mac

Forex Panel Score

Average Spread

EUR/USD = 1.3

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why I Recommend FXCM

I value FXCM’s offerings, especially the integration of the NinjaTrader platform, which has made it my preferred choice for Mac users. The broker stands out due to its flexible leverage options, competitive spreads, and the advantage of zero commissions.

Overall, the smooth experience of using NinjaTrader on a Mac makes FXCM my top recommendation for NinjaTrader brokers, even though they offer a variety of platforms.

Pros & Cons

- Offers NinjaTrader platform

- Solid choice of free trading tools

- Competitive spreads

- Limited trading product choice

- Large bank transfer withdrawal fee

- Inactivity fee after 12 months

Broker Details

Similar to MT4/MT5, NinjaTrader isn’t designed specifically for Mac users. Instead, you’ll need virtual machine software like Parallels Desktop to run the platform. You can also access it via their web platform, but I found fewer automation features on this version.

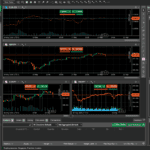

While testing NinjaTrader, I found its charting tools to be flexible and easy to customise with a wide range of indicators, chart types, and timeframes. The platform also provides advanced indicators such as VWAP and custom volume profile indicators. This allowed me to view the trading volume to identify key supply and demand zones, and can help improve your market timing significantly.

One of NinjaTrader’s standout features is its Market Replay functionality, which downloads historical market data and replays it as if it were happening in real-time. I found that it’s possible to pause, rewind, and fast-forward through market data. This is helpful if you’re looking to refine your skills and test new strategies without any financial risk. This feature can also enhance the learning experience by providing a realistic trading environment, making it easier for beginners to practise trading the markets on weekends.

NinjaTrader plugs into a live FXCM trading account so you can leverage the broker’s excellent trading services. I also took note that the broker offers access to a decent range of markets: 42 forex pairs, 16 indices, 219 share CFDs, and 18 commodities.

During my testing, FXCM’s Standard account spreads are competitive, averaging 0.93 pips on EUR/USD. This low spread is the fourth best, beating the industry average of 1.11 pips. With this, I highly recommend the Standard account for low fees.

| Broker | EUR/USD Spread |

|---|---|

| IC Markets | 0.73 |

| Admiral Markets | 0.74 |

| CMC Markets | 0.8 |

| FXCM | 0.93 |

| TMGM | 1 |

| FusionMarkets | 1.01 |

| OandA | 1.06 |

| City Index | 1.16 |

| EightCap | 1.16 |

| FP Markets | 1.19 |

| Pepperstone | 1.21 |

| Blackbull Markets | 1.34 |

| Go Markets | 1.34 |

| Axi | 1.45 |

| Tested Industry Average | 1.11 |

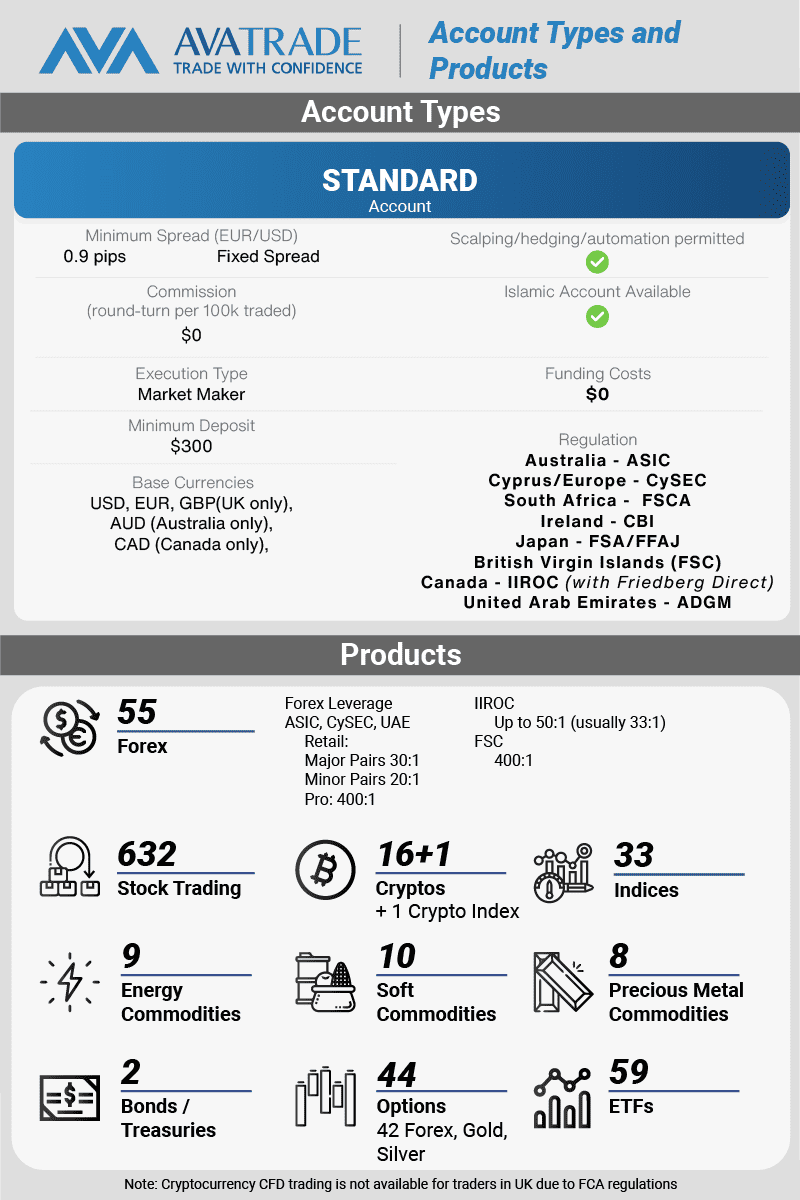

7. AvaTrade - My Pick for the Best iOS Mobile Experience

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why I Recommend AvaTrade

I liked AvaTrade for a variety of reasons, positioning the broker as my pick for the best iOS mobile experience.

AvaTrade boasts oversight from top-tier regulators across six countries which upgrades overall trustworthiness. They offer an extensive range of CFD products, from over 50 forex pairs to a vast array of cryptocurrencies, shares, indices, and ETFs.

Added features such as MetaTrader platforms, valuable social trading tools, negative balance protection, and AvaProtect for risk management make trading on their iOS platform a breeze.

Pros & Cons

- Stable spreads available

- Top risk management tools on AvaTrade Go

- Intuitive trading platform for mobile device

- Lacks choice of trading accounts

- Slightly higher spreads

- Limited range of forex products

Broker Details

While testing different broker iOS apps, AvaTrades stood out with its beginner-friendly interface, decent mobile charting, and advanced tools that are made available for on-the-move trading.

I found their mobile app comfortable to use; nothing appeared too small on the screen, and everything was a thumb’s reach away. The charting on the app is fairly basic, but it does come with 80+ indicators (including Ichimoku and RSI), so I felt like you could perform technical analysis on the app with ease.

The app even included AvaTrade’s Market Trends feature, available on the web platform, showing that the app doesn’t lack features compared to its primary platform.

I also liked the Market Trends tool, which showed a series of categories that provide real-time insights and social trends that other AvaTrade clients follow. For example, I could see which asset is currently being bought (or sold) the fastest within the last 24 hours, giving valuable insights that technical indicators won’t reveal.

As a bonus with AvaTrade, you can get low, fixed-spread trading accounts with no commissions that start from 0.9 pips on EUR/USD. Based on market volatility, these spreads don’t widen (or narrow). Meaning, you’ll always get 0.9 pips in EUR/USD, making it a solid option for day trading.

| Broker | Avg. Spread EUR/USD | Variable/Fixed |

|---|---|---|

| IC Markets | 0.62 | Variable |

| AvaTrade | 0.90 | Fixed |

| OANDA | 1.00 | Variable |

| eToro | 1.00 | Variable |

| GO Markets | 1.00 | Variable |

| Pepperstone | 1.12 | Variable |

| FXCM | 1.30 | Variable |

| Plus500 | 1.70 | Variable |

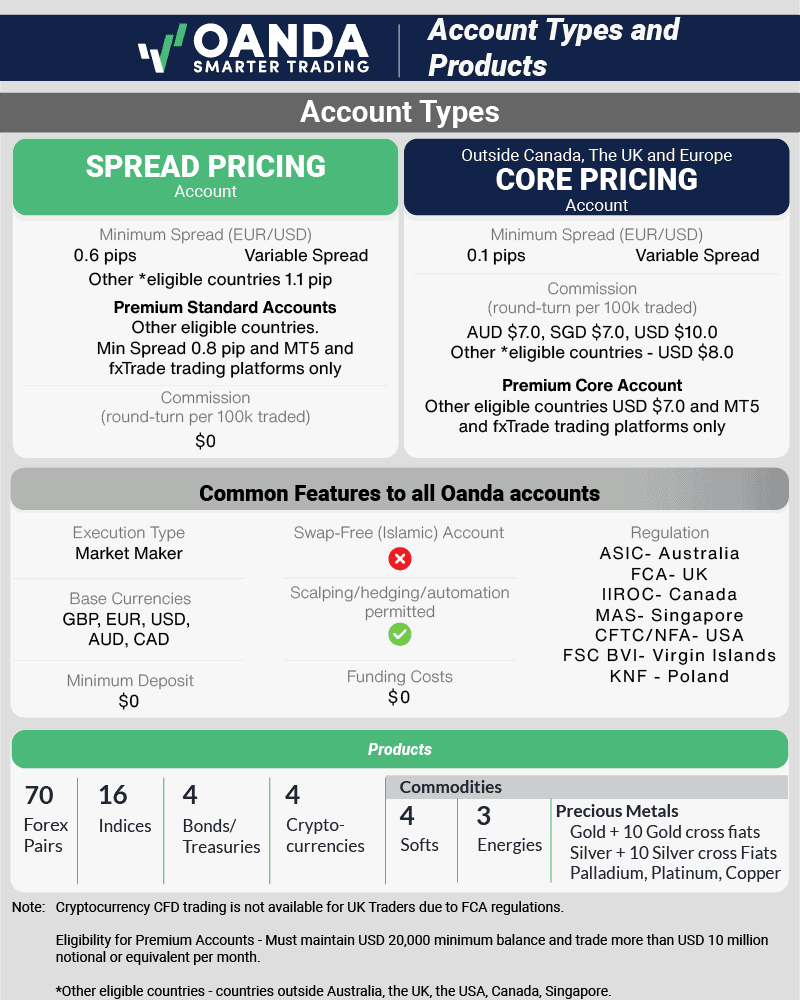

8. OANDA - The Broker With Best Charting Platform for Mac

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why I Recommend OANDA

I liked OANDA for having competitive trading costs, comprehensive risk management tools, rich educational resources, and top-notch customer service.

What sets this broker apart from the competition and placed them as my top pick for the best charting platform for Mac is their extensive licensing and stringent regulatory compliance.

Overall, OANDA ticks all the boxes for those on Mac looking for superior charting capabilities.

Pros & Cons

- Beginner friendly trading platform

- Trade using partial lots on OANDA Trade

- Doesn’t have a minimum deposit

- Only has 24/5 client support

- Not an ECN/STP broker

- Lacks share CFDs

Broker Details

I’ve tested every retail trading platform, and nothing compares to TradingView for its advanced charts. These charts have many quality-of-life features unavailable on other platforms, especially for Mac OS users.

In my tests, I found that TradingView includes 110+ technical indicators by default, which is the most out of the platforms. Personally, I like that their developer continually adds new ones and updates current ones.

With such a wide range of indicators, you’ll find the perfect tools to perform your analysis without downloading third-party tools. When in need of custom indicators, you can code them in Pine script or access the Community tab, which offers thousands of custom indicators you can try.

I liked the flexibility that comes when you can customise and apply your charts globally, keeping your indicators and chart colours the same. This feature may seem simple, but platforms like MetaTrader 4 require you to reapply a template whenever you open a new chart window.

After reviewing more than 40+ brokers, I believe OANDA is the broker that pairs best with TradingView, especially because of the low spreads when trading on the platform.

OANDA is a pure forex broker that likes to keep things simple, offering only a Standard spread-only trading account. I typically like to see brokers give a choice between a spread-only and a commission-based account with tighter spreads, but OANDA surprised me with its low trading fees.

From my testing, the broker had the lowest average spreads on EUR/USD at 0.60 pips, 50% less than the industry average of 1.24 pips. With this in mind, I am convinced that OANDA’s Standard account provides an excellent balance of low trading costs with no-commission trading, making it suitable for TradingView.

| Broker | EUR/USD Spread |

|---|---|

| IC Markets | 0.73 |

| Admiral Markets | 0.74 |

| CMC Markets | 0.8 |

| FXCM | 0.93 |

| TMGM | 1 |

| FusionMarkets | 1.01 |

| OandA | 1.06 |

| City Index | 1.16 |

| EightCap | 1.16 |

| FP Markets | 1.19 |

| Pepperstone | 1.21 |

| Blackbull Markets | 1.34 |

| Go Markets | 1.34 |

| Axi | 1.45 |

| FXPro | 1.59 |

| Tested Industry Average | 1.11 |

Ask an Expert