Micro Currency Trading Platforms

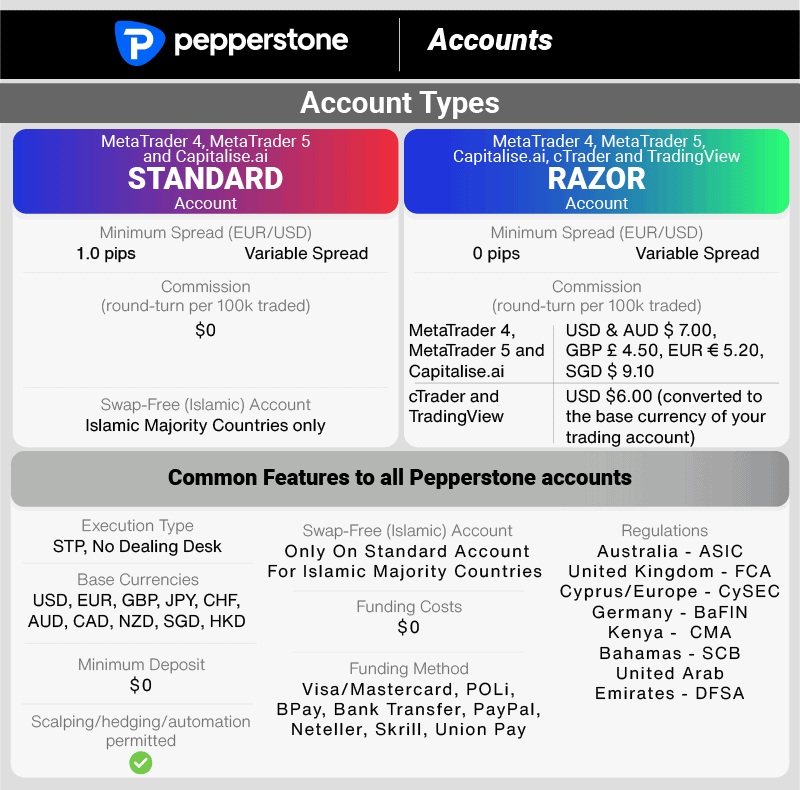

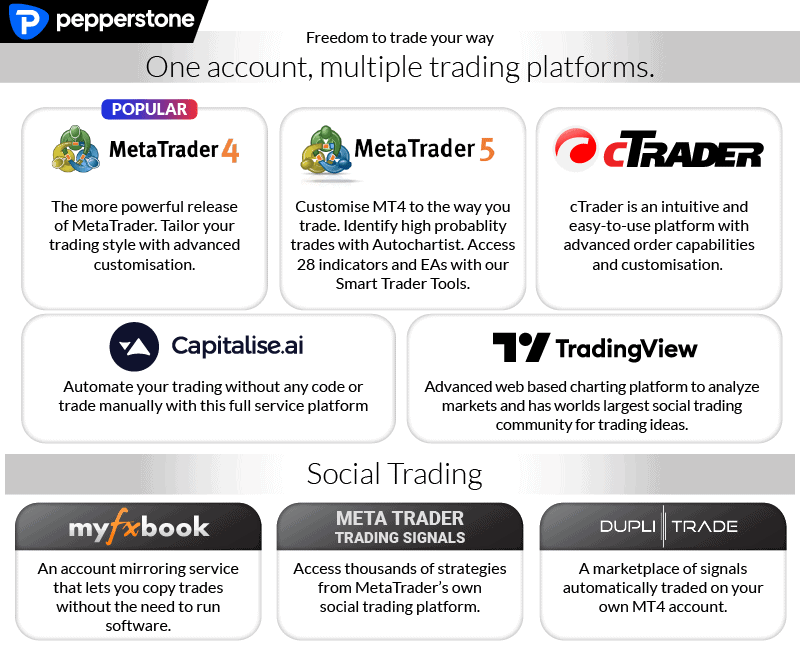

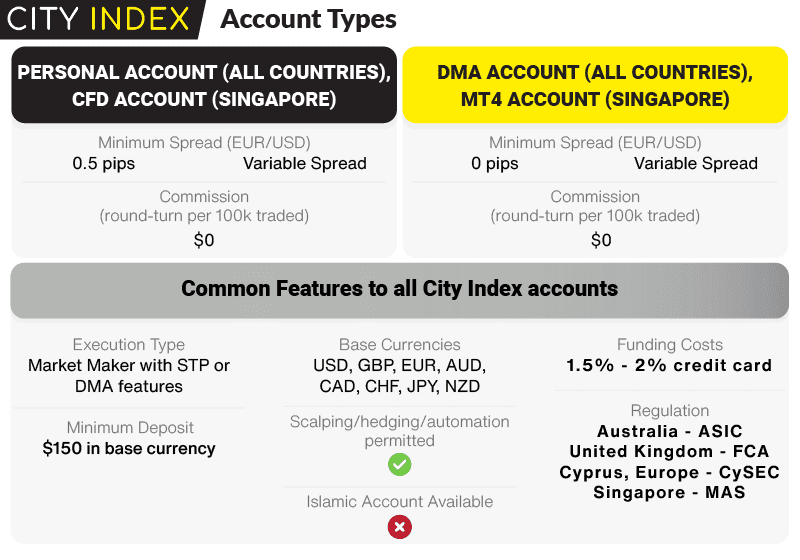

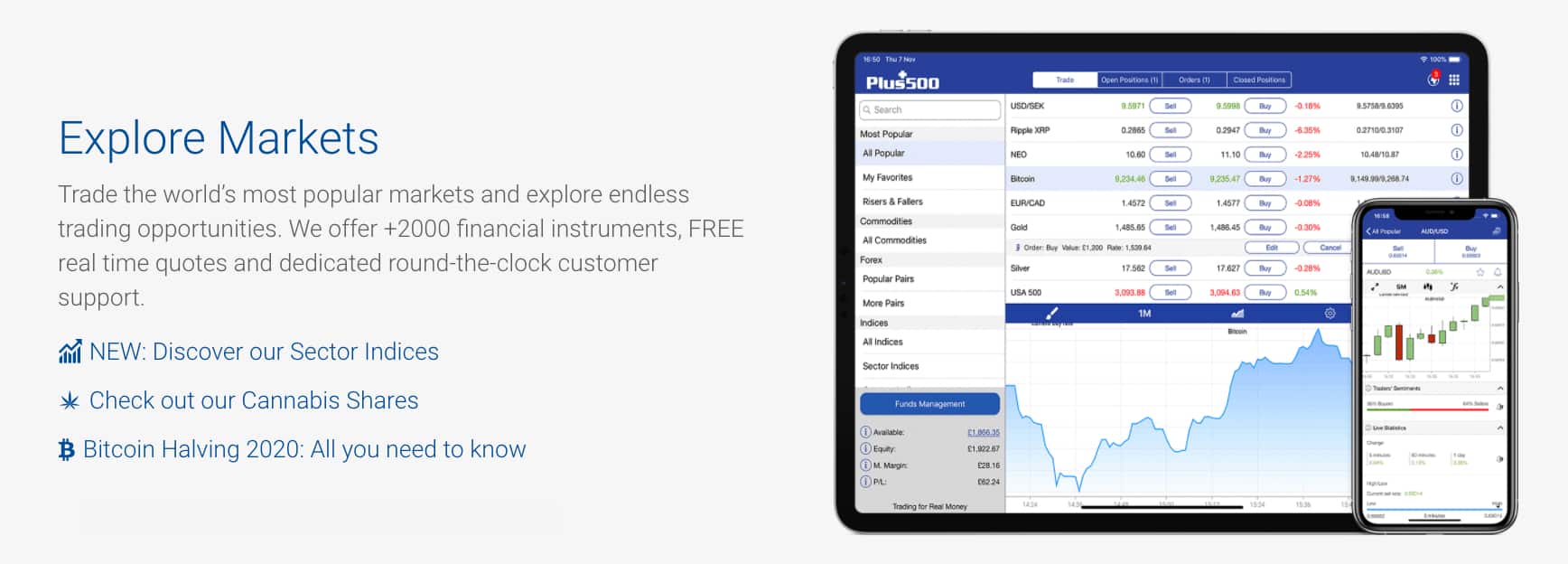

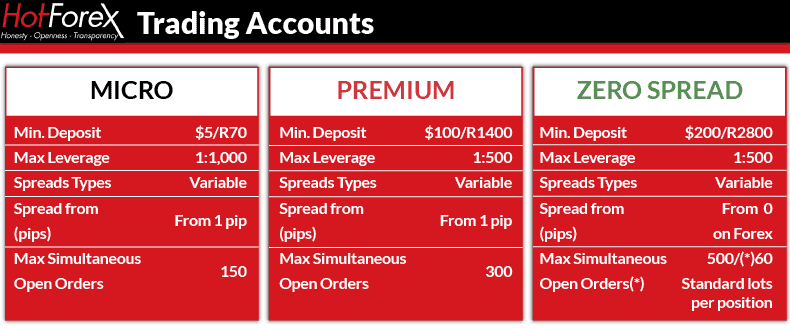

Micro currency trading means trading currencies in lots of 1000 units so suits new forex traders. The 2024 best brokers offering micro trading accounts were Pepperstone, City Index and Plus500.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

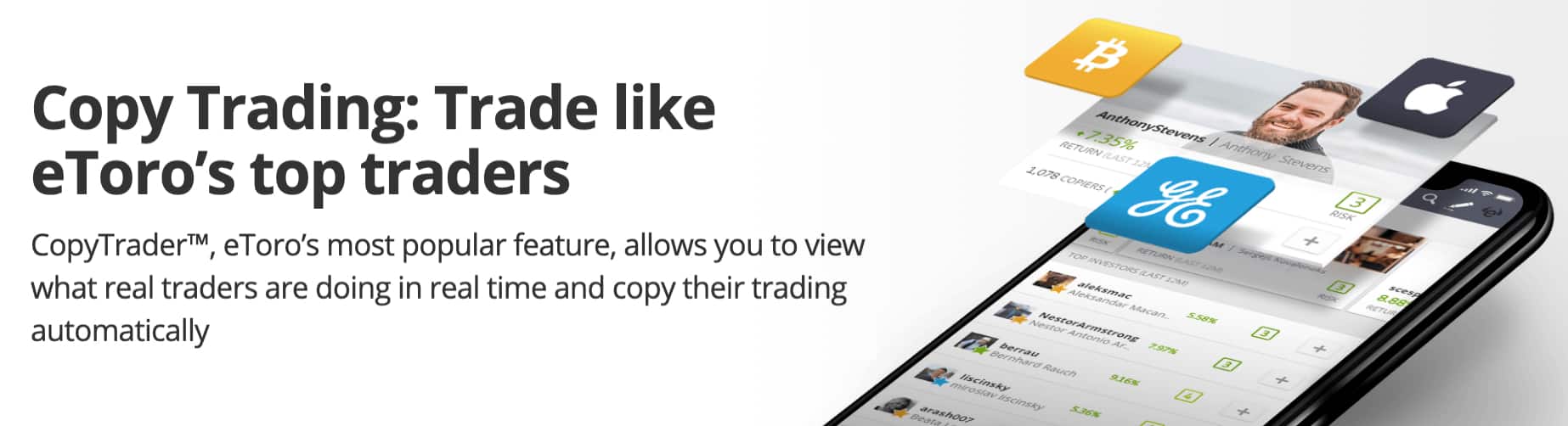

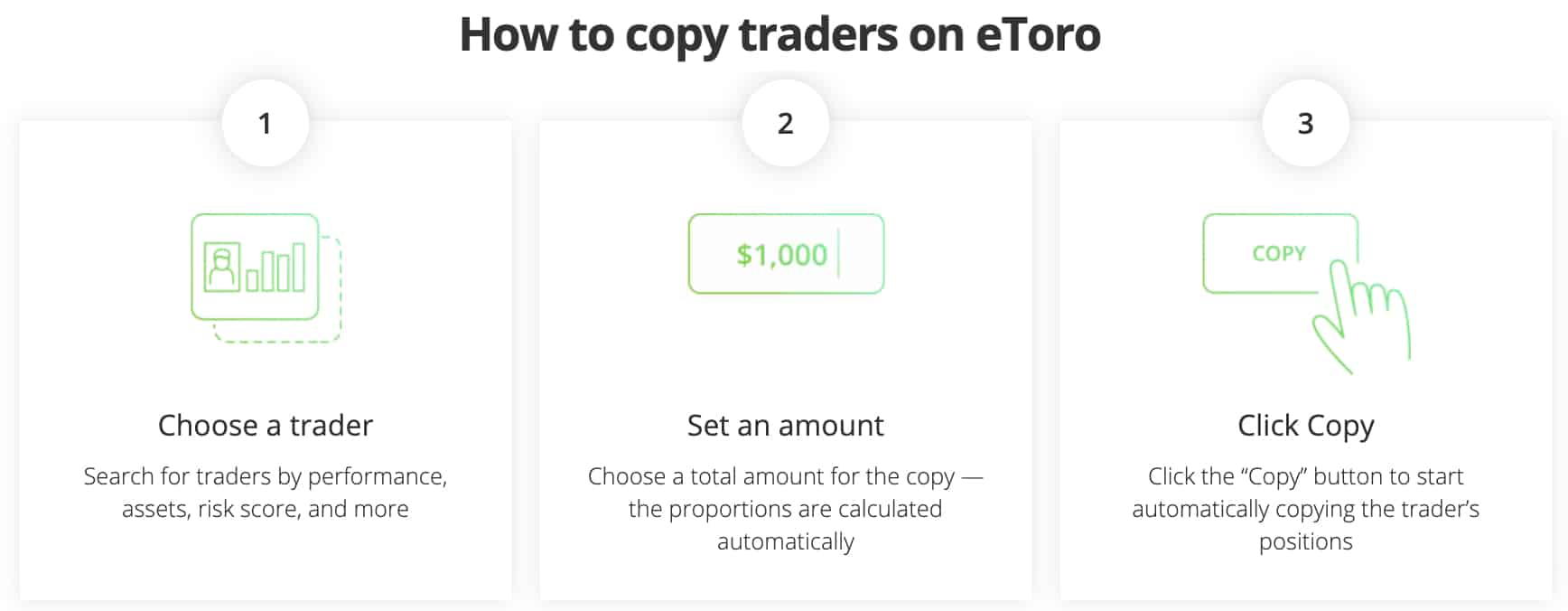

eToro is one of the most popular brokers for social-copy trading. Millions of users from 140+ countries copy trade with eToro, meaning you gain access to one of the largest forex communities currently available.

eToro is one of the most popular brokers for social-copy trading. Millions of users from 140+ countries copy trade with eToro, meaning you gain access to one of the largest forex communities currently available.

Ask an Expert

Is micro lot trading better than trading standard lots?

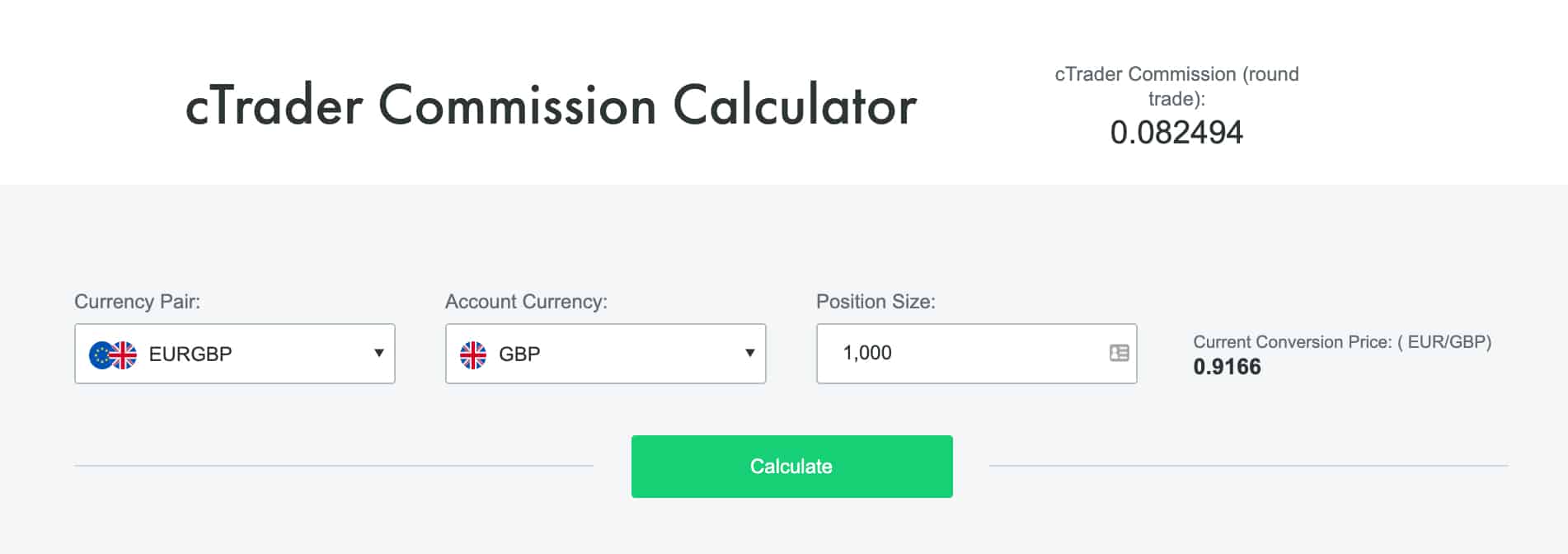

There are pro and cons of both but in terms of costs, some brokers might charge a slightly higher commission when compared with standard lots when compared on a pro-rata basis. This is because the broker makes less money when trading smaller lots, also liquidity providers usually only offer standard lots for trading so the broker needs to either offer their own liquidity or combined multiple small order when micro lot trading.

Micro lot trading can also limit your profits, especially when using leverage but it can limit your losses too.

However if you have a small trading account, then micro lot trading can be beneficial since you required margin is lower to open your position.

Is it true that trading currency futures in a personal account has negative tax consequences?

If so, what is the best entity to use for trading… LLC? SubSCorp? Retirement Account? Other?

We can’t give financial advise, for this you are best to spread with your accountant.

Is there much of a profit to be made with micro lots in forex? I’d assume you’d need leverage

That is correct. A micro account means you are trading in cents, you will need to trade with high leverage to achieve enough profit to to make the time you invest worthwhile.