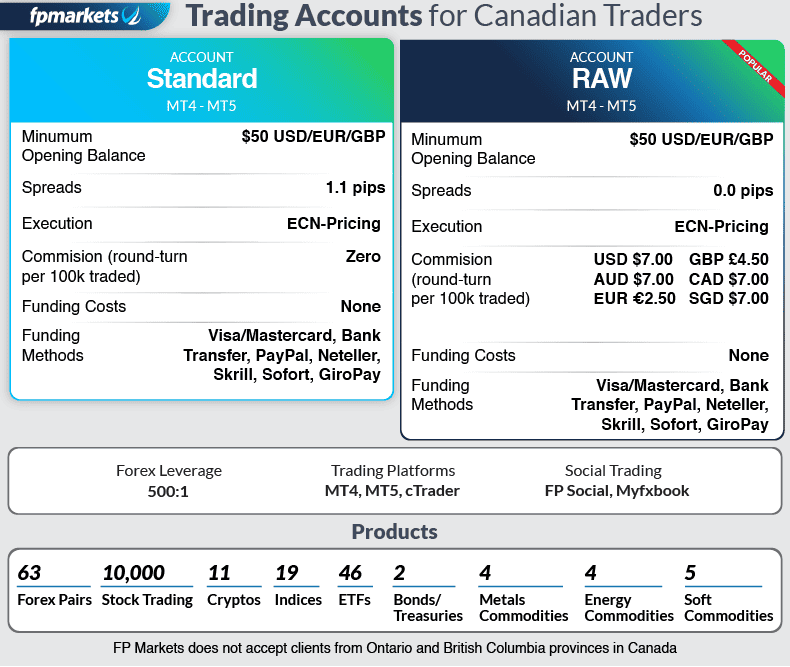

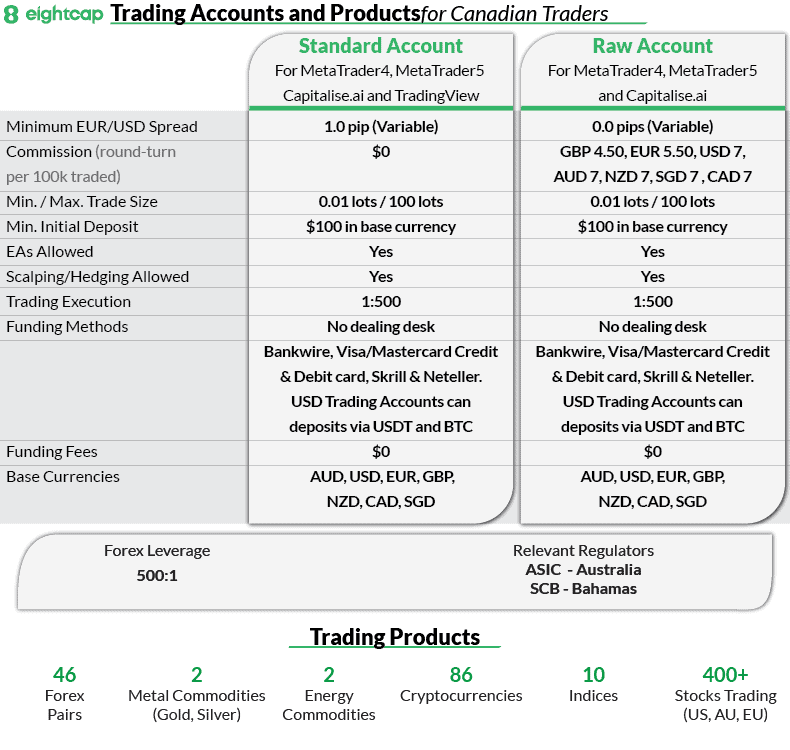

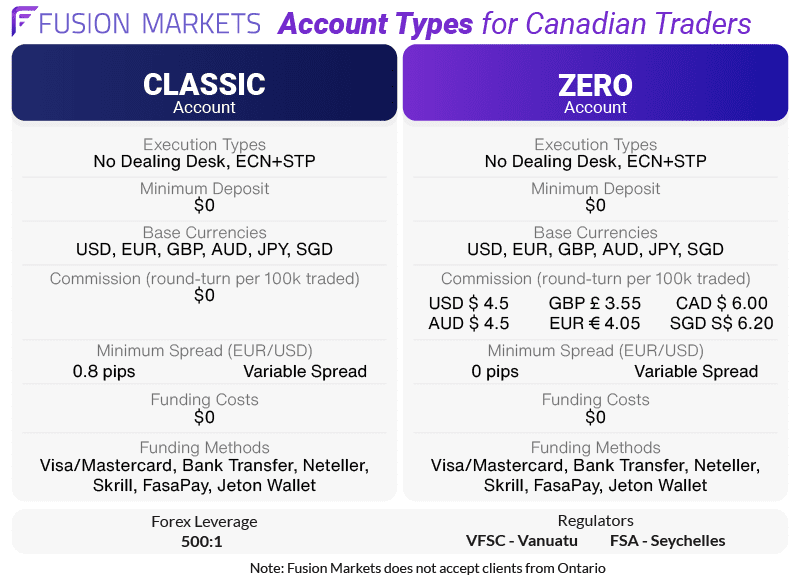

ECN Brokers In Canada

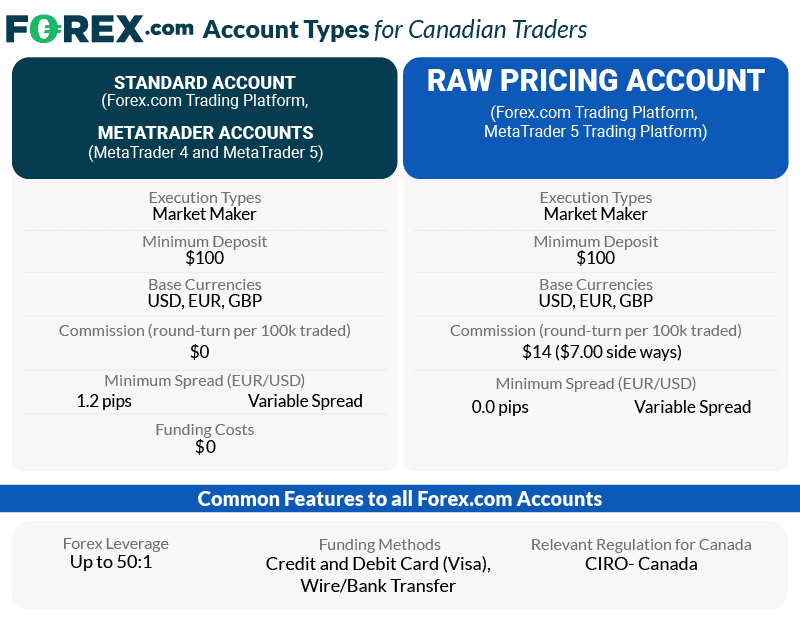

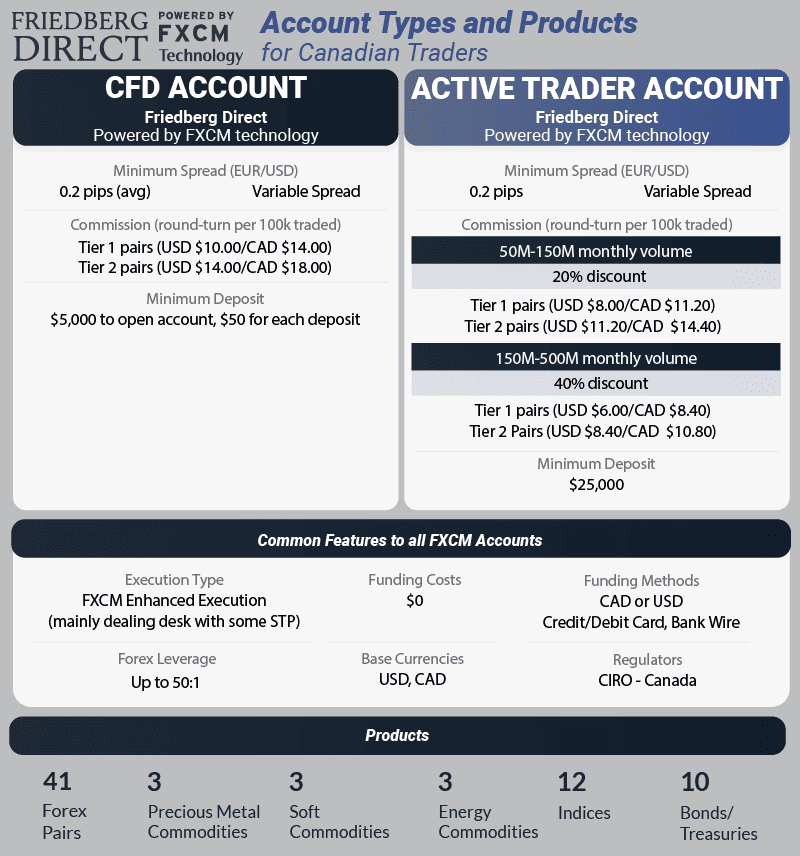

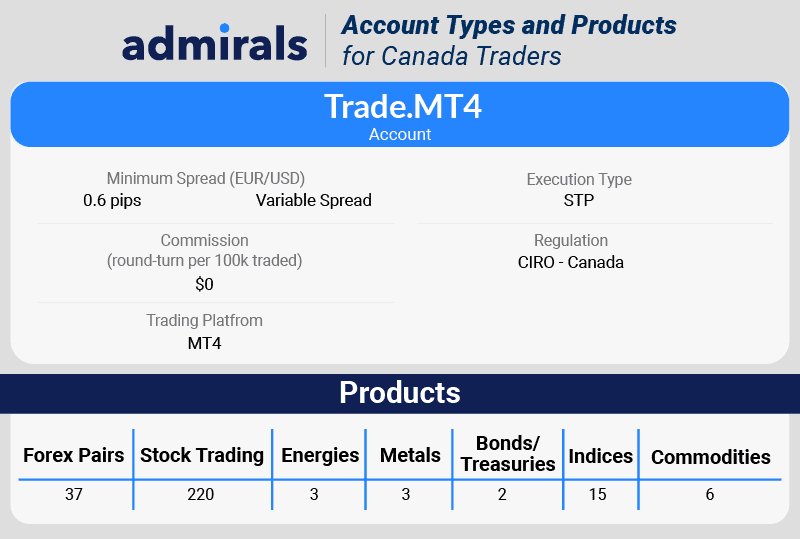

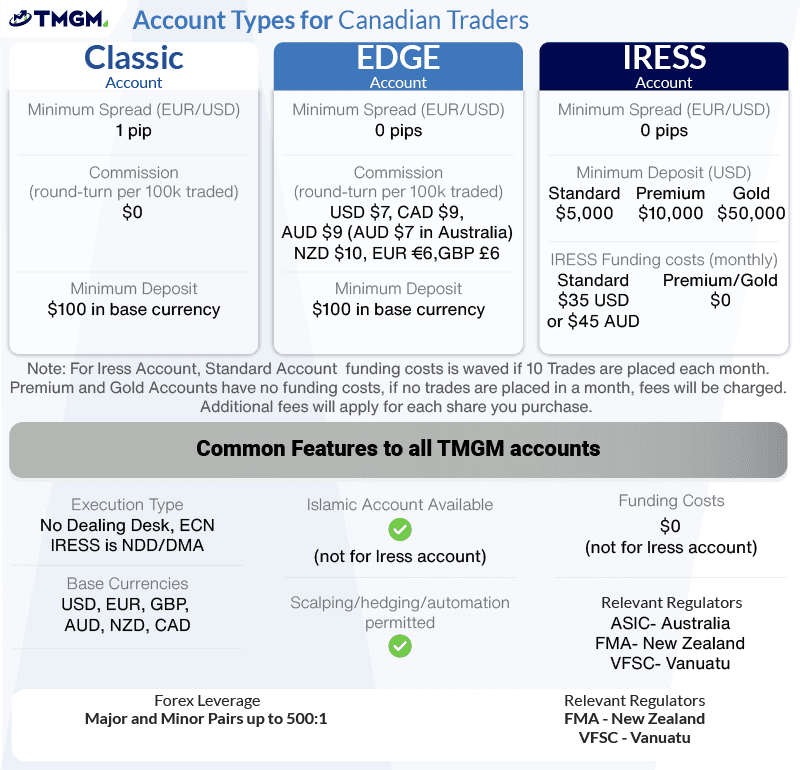

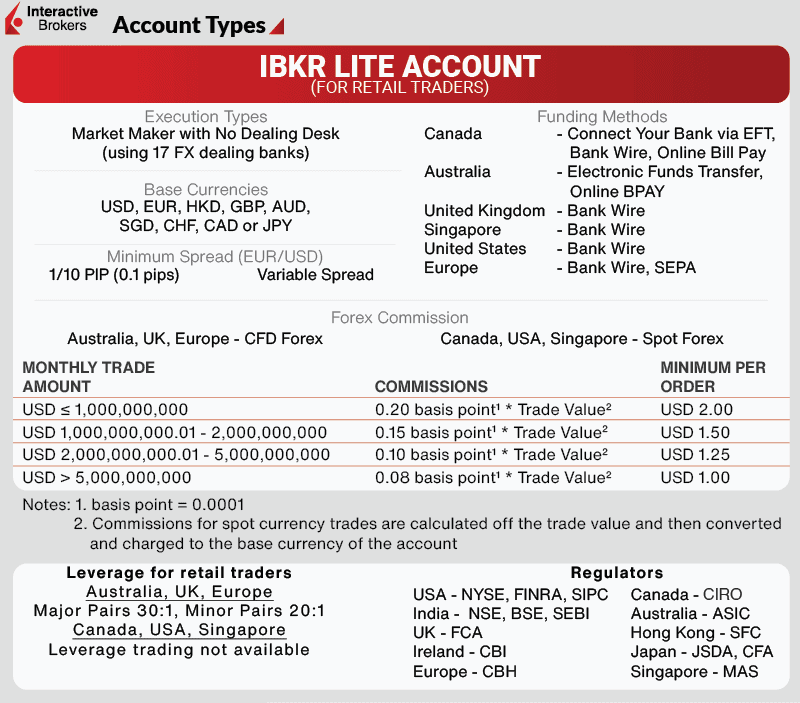

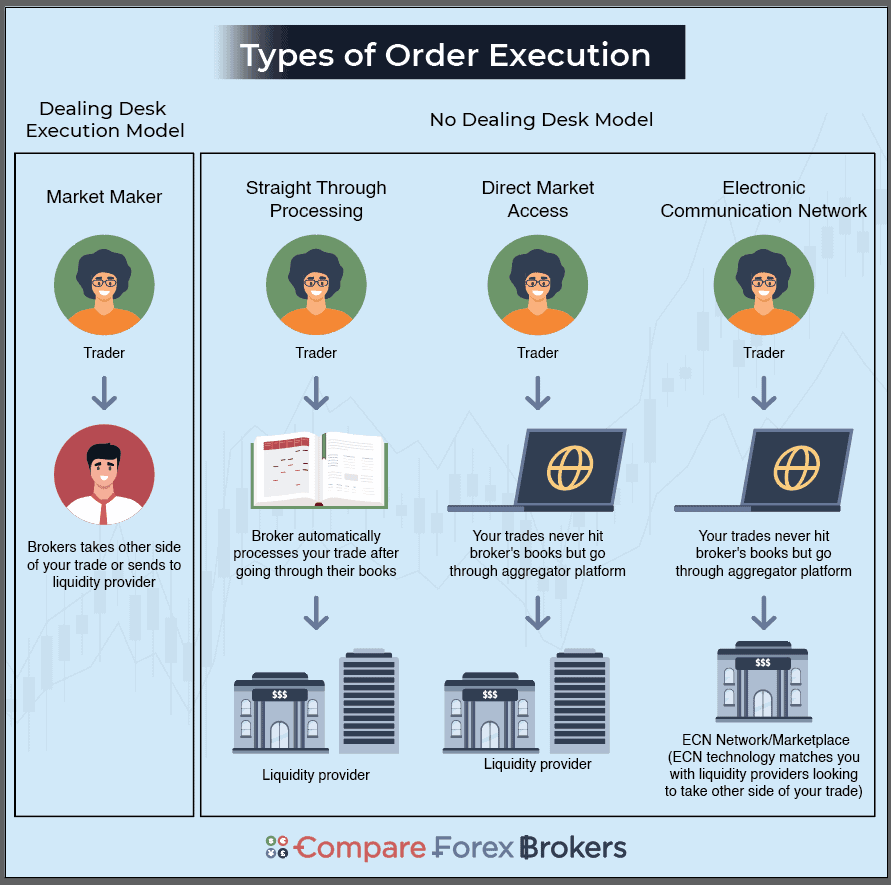

The best ECN Forex Brokers Canada have offer low spreads as there is no dealing desk and use STP execution. We look at the best Fx brokers for Canadian traders along with trading platforms, account types and products.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert