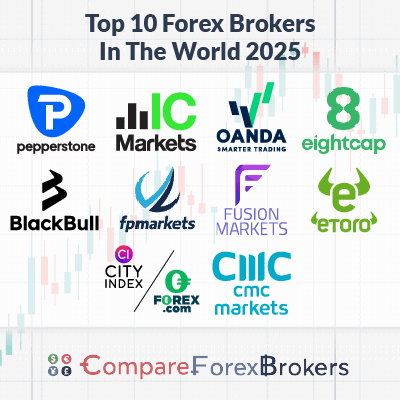

Top 10 Forex Brokers In 2025

The top 10 forex brokers in the world were determined based on global forex regulation, spreads and the best forex trading platforms. The companies that made the top 10 list were outstanding in a unique forex trading category.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our top brokers be region and regulate in 2025 are:

- Pepperstone - Best Broker Overall

- IC Markets - Best Standard No Commission Account

- OANDA - Best Forex Broker for US Clients

- Eightcap - Lowest spread CFD broker

- BlackBull Markets - Fastest Execution Speeds

- FP Markets - Best MT4 Broker

- Fusion Markets - Lowest commissions

- eToro - Copy Trading

- FOREX.com/City Index - Top Raw Spread Account

- CMC Markets - Best Share And CFD Broker

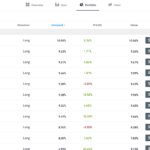

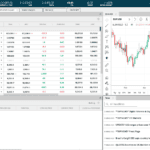

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

43 |

SEC, NFA/CFTC FINRA |

- | - | - | - | 1.4 | 1.3 | 1.2 |

|

|

|

110ms | $2000 | 70+ (Spot) | 1 | 50:1 | 50:1 |

|

1. Pepperstone - Best Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

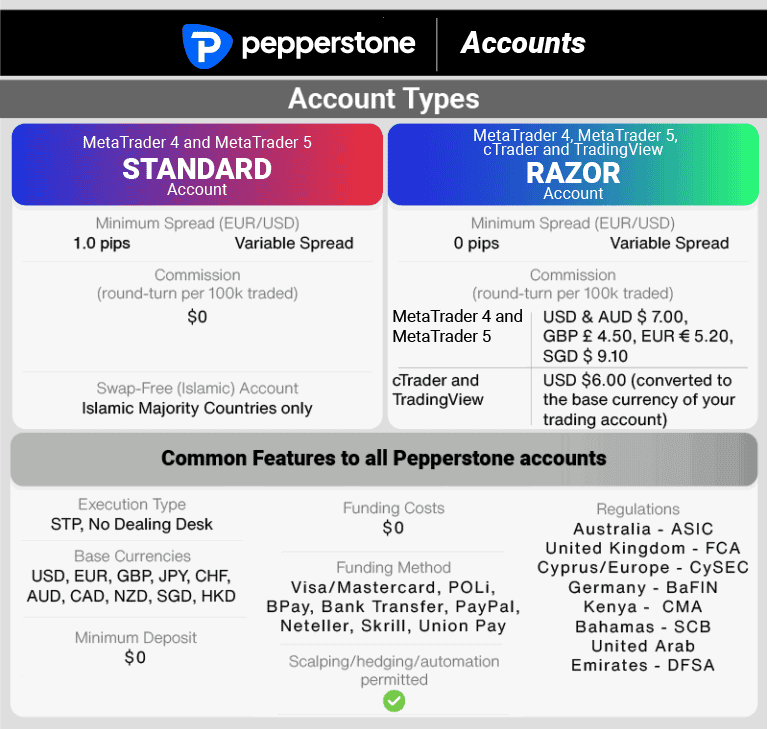

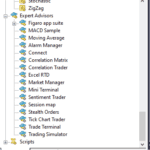

We consider Pepperstone to not only be the best broker in the world but also the best broker for the MetaTrader 4 (MT4) platform. Pepperstone provides several useful tools to use with MT4 such as Capaitalise.ai for automation, Myfxbook for social trading and DupliTrade for copy trading and of course, you can use expert advisors to create custom indicators.

All the tools and features required to develop successful currency trading strategies are offered by Pepperstone, including low spreads, the best trading platforms, a great product range, and award-winning customer service.

Pros & Cons

- Fast MT4 execution speeds

- Competitive spreads

- Diverse trading platforms

- No Physical Stocks

- Lacks GSLO

- Limited education resources

Broker Details

From our extensive broker analysis, Australian-based forex broker; Pepperstone ticks all the boxes, from competitive spreads to a diverse range of platforms. Some areas we think Pepperstone stands out are its fast execution speeds, broad range of trading tools (from copy trading to algorithmic trading) and excellent customer service.

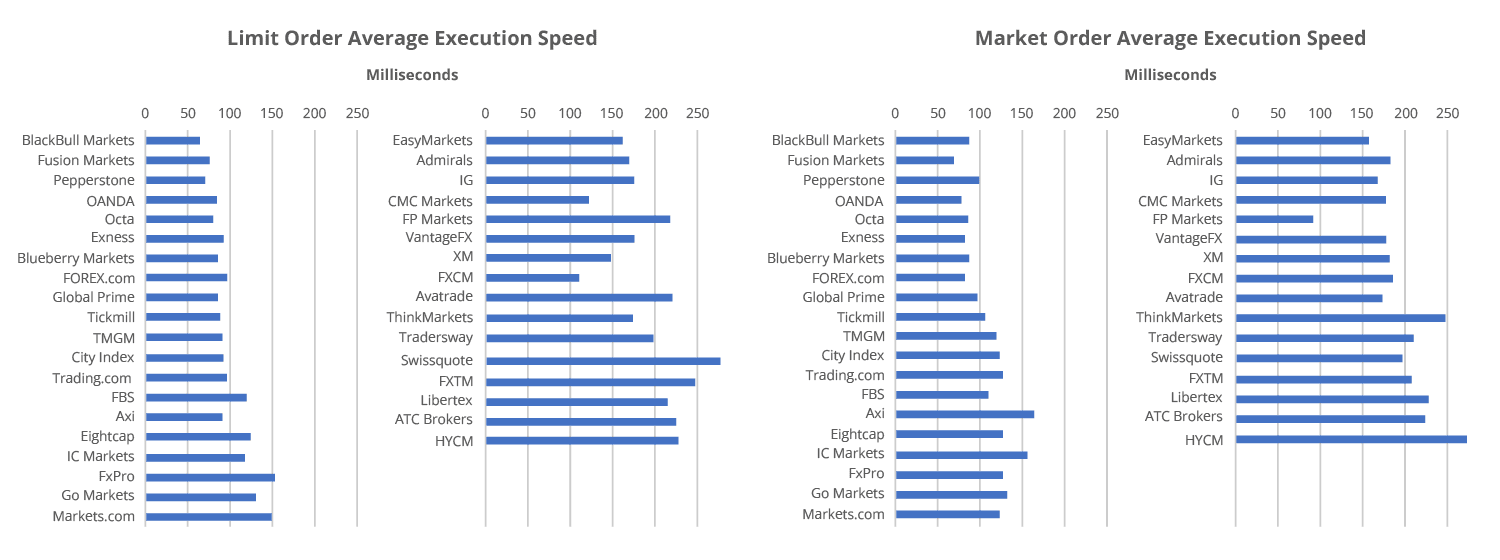

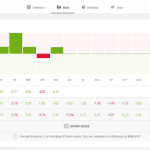

Fast Execution Speeds

We’ve tested the execution speeds of 20 top brokers and Pepperstone is one of the fastest. With execution speeds of 77ms for limit orders and 100ms for market orders, this put Pepperstone at third overall on our list. Only Fusion Markets and BlackBull Markets could boast faster execution speeds from our tests.

We found Pepperstone’s fast execution speeds reduced our latency while trading, meaning more accurate spreads on the point of execution and less slippage on average.

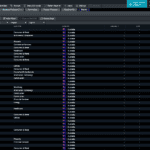

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| Pepperstone | 3 | 77 | 2 | 100 | 5 |

| BlackBull Markets | 1 | 72 | 1 | 90 | 2 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| TMGM | 5 | 94 | 5 | 129 | 7 |

| FXCM | 6 | 108 | 8 | 123 | 6 |

| Axi | 8 | 90 | 4 | 164 | 16 |

| IC Markets | 10 | 134 | 10 | 153 | 14 |

| FxPro | 12 | 151 | 16 | 138 | 9 |

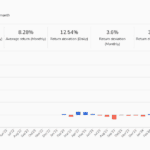

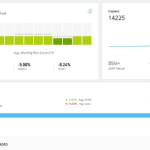

Competitive Spreads

With an average spread of 0.10 pips for EUR/USD, Pepperstone has one of the lowest no-commission spreads of any broker we’ve reviewed. You can choose between commission-free spreads on the Standard account or commission-based spreads on the Razor account.

The table below shows how Pepperstone’s spreads compare favourably to those of other brokers. We collect these average spreads from the broker’s website and update them once a month.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

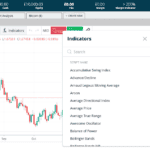

Great Range of Trading Platforms

Pepperstone offers a diverse range of platforms, including MetaTrader 4 and 5, cTrader and TradingView. You can also social trade with Myfxbook or Copy Trade with Duplicate, both are algorithmic platforms that let you copy trades automatically.

To our minds, however, Pepperstone stands out with its Smart Trader Tools add-on, which includes 28 smart trading apps to enhance your MetaTrader platform trading experience.

Our personal favourite is the Mini Terminal, in which we could quickly set up a new order template where we chose how much we wanted to risk as a fixed dollar amount for all future orders.

Excellent Customer Service

From our analysis, Pepperstone offers the best customer service of any broker we’ve tested. It scored a perfect 10/10 regarding coverage, support hours, and overall website experience.

The best example of Pepperstone’s excellent customer service is our account opening experience with the broker, which we found was easy and smooth. We were assigned an accommodating account manager, who guided us through the whole process and our account was opened in minutes.

2. IC Markets - Best Standard No Commission Account

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

Australian-owned, IC Markets is the largest broker by volume, with 25 global liquidity providers, allowing them to consistently offer tight ECN/STP spreads. IC Markets also scored highly with us in terms of low trading costs, choice of trading platforms, and range of markets.

Pros & Cons

- Lowest zero-commission spreads

- Good range of platforms

- Solid selection of markets

- No cTrader Copy

- Average Execution Speeds

- Limited Regulations

Broker Details

Along with the lowest Standard Account spreads we’ve tested, IC Markets offers several benefits as a forex broker. These include offering a good selection of trading platforms, a solid range of markets and excellent social and copy trading tools.

Lowest No Commission Spreads Based on Testing

Based on our testing, IC Markets has the lowest spreads for its commission-free, Standard account.

IC Markets advertises an average spread of 0.02 pips for the EURUSD and while that might seem curiously low, Ross Collins from our team from IC Markets still had the lowest spreads. His tests found IC Markets has an average spread of 0.73 pips for the same pair, higher but still the lowest spreads of the brokers we tested.

When Ross averaged the benchmark currency pairs he tested AUDUSD, EUR/USD, GBPUSD, USD/CAD, USDCHF) he found IC Markets was still the best over all with 1.03 pips, well below the industry average of 1.48 pips. From our testing, the next nearest broker was CMC Markets with average spreads of 1.11 pips.

To add to IC Markets’ appeal as a low-cost broker, it averaged 0.32 pips for the USD-backed majors on its RAW account against the broker average of 0.42 pips. These results put it third on our list for RAW/ECN-style accounts, just behind Fusion Markets (0.22 pips) and City Index (0.25 pips).

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

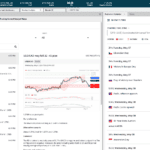

Good Choice of Trading Platforms

While IC Markets doesn’t offer a proprietary platform, the broker offers MetaTrader platforms, TradingView and cTrader and social/copy trading options with ZuluTrade, Myfxbook and cTrader Copy.

For our money, we recommend MT4 based on the Advanced Trading Tools add-on that IC Markets offers. These are 20 additional trading tools to enhance your MetaTrader 4 experience.

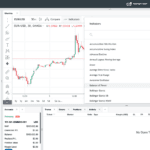

The feature that we found most useful was Market Manager, which gave us a good overview of our trading activities. The Market Manager included a watch list of both symbol prices and our open positions, headline activity about our account (I.E. balance, equity, margin etc), a list of all open tickets and a concise summary of recent price activity on a symbol.

Solid Range of Markets

IC Markets has a solid range of trading products including 61 forex pairs, over 1600 share CFDs and a smaller selection of indices, commodities, bonds and cryptocurrencies. You can also trade future CFDs in four underlying index and commodities futures markets.

We appreciated IC Markets’ diverse range of markets, which provides good coverage of all the major asset classes.

3. OANDA Corporation - Best Forex Broker for US Clients

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We recommend OANDA because we consider them to be our most trusted broker. The CompareForexBroker team gave the broker a trust score of 100 largely due to its stellar reputation and multiple tier-1 regulations. The broker also offers an excellent proprietary platform, OANDA Trade, along with the popular MT4 and TradingView.

Lastly, OANDA has some of the most competitive commission-free spreads, keeping its costs low. All of these factors add up to OANDA being ideal for beginner forex traders.

Pros & Cons

- Highly trusted broker

- Competitive commission-free spreads

- OANDA Trade Platform

- Lacks CFD shares

- Slow Account Opening

- Lack of funding methods

Broker Details

From our analysis, OANDA is the best forex broker for U.S. clients due to its ultra-competitive commission-free spreads, excellent trading platform features, and high trust score with multiple tier 1 regulations, including the NFA/CFTC in the U.S.

Competitive No-Commission Spreads

From our extensive spreads analysis, OANDA has the best published average spreads for Standard accounts. Spreads with OANDA in the US start from 0.60 pips but will generally be around 1.0 to 1.20 pips, an impressive 68 currency pairs are available, with leverage of 1:50.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Great Trading Platforms

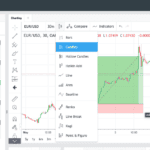

OANDA scores points for offering an excellent proprietary platform, OANDA Trade, as well as MT4 and the excellent charting platform, TradingView.

We particularly like the broker’s add-on trading tools which enhance its overall trading platform offering.

For example, OANDA Trade gives you access to advanced charts through TradingView, which gives you 65 technical indicators and 11 customisable chart types. Additionally, you can use guaranteed stop-loss orders (GSLO) with OANDA Trade, which not all brokers offer.

We particularly like OANDA’s MT4 offering, which includes a Premium Upgrade of 28 additional trading tools and an Open Orders Indicator (which aggregates OANDA client open orders and open positions directly on your MT4 charts).

The Premium Upgrade tool we utilised the most was the DOM (depth of market) feature, which showed us what prices our order would be filled based on the prevailing liquidity in the market.

Trust

With a perfect score of 100/100, OANDA is our most trusted broker overall, based on its longstanding history, excellent reputation, and multiple regulators. This includes 5 tier-1 regulators, including the U.S. with NFA and CFTC, which not many brokers are regulated by.

4. Eightcap - Lowest Spread CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

Based on our published spreads data, which compares major currency pair spreads against 48 top brokers, Eightcap has some of the lowest average spreads for a CFD broker that we’ve seen. From our analysis, this goes for both its Standard and RAW account, lowering its trading costs overall.

Pros & Cons

- Largest range of CFD cryptocurrencies

- Top collection of trading platforms

- Automation with Capitalise.ai

- Good education with Eightcap Labs

- Excellent live chat customer services

- 56 Forex pairs while good is less than many brokers

- The commission is $3.00 sideways regardless of GBP, USD, AUD, CAD, EUR

- Lacks 3rd part social and copy trading tools

- Customer support is not available on weekends

Broker Details

Eightcap is not only our lowest spread CFD broker, but also offers a great range of trading platforms and trading tools and the best range of cryptocurrencies of any broker we’ve seen.

Low Spreads for CFD Trading

From our spreads analysis, Eightcap offers some of the lowest published spreads for both of its retail investor accounts.

For its commission-free Standard account, Eightcap say it has average spreads of around 1 pips for most major currency pairs. Overall using our benchmark pairs such including EUR/USD, GBP/USD, AUD/JPY, the brokers has an overall overage of 1.06 pips. This compares favourably with the industry average of 1.52 pips and puts the broker 5th overall on our list of 48 brokers that we capture data for.

For its RAW account, Eightcap achieved an average spread of 0.06 pips for EUR/USD, which is the second lowest we’ve encountered, just behind IC Markets at 0.02 pips. Again, this compared very favourably to the industry average of 0.22 pips for EUR/USD.

Solid Trading Platforms and Tools

In terms of trading platforms, Eightcap offers both MetaTrader platforms and TradingView as its main platforms.

Where we found Eightcap stands out when testing its platforms is in the trading tools it offer. As well as the standard MT4 Signals for copy trading and EAs for algorithmic trading, Eightcap also offers Capitalise.ai for those who wish to automate their trading without any coding knowledge.

The two unique tools Eightcap offers, however, are Eightcap Labs for EA trading and FlashTrader. We particularly found FlashTrader useful, allowing us to automatically place limit and stop orders either side of our new trades based on points or price.

Huge Range of Cryptocurrencies

Another area in which Eightcap stands out is its cryptocurrency offering. The broker provides 95 crypto products you can trade, which is the most we’ve seen of any broker. Of other top crypto brokers, XM offers 58, eToro offers 41 and Admirals offers 42.

5. BlackBull Markets - Fastest Execution Speeds

Forex Panel Score

Average Spread

EUR/USD = 0.23

GBP/USD = 0.72

AUD/USD = 0.65

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlakcBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

Fast execution speeds will help lower your latency, obtain more accurate fills at the point of execution and thus lower your slippage while trading. We measured execution speeds across 20 top brokers and BlackBull Markets has the fastest execution speed of any broker we’ve tested.

Pros & Cons

- Award-winning execution speeds

- Leverage of 1:500 for all clients

- A large range of trading platforms

- Good 3rd party social trading tools

- Good education tools

- High minimum deposit for RAW spread account

- Spreads can be average

- Lacks tier-1 regulation outside New Zealand

- Withdrawal fees

Broker Details

In addition to having the fastest execution speeds we’ve tested, BlackBull Markets also provides a solid range of trading platforms and a huge range of 26,000+ physical shares to trade.

Fastest Execution Speeds

From our testing of 20 top brokers, BlackBull Markets topped the list with the fastest execution speeds of them all. Testing across limit orders and market orders using MT4, BlackBull Markets achieved speeds of 72ms for limit orders and 90ms for market orders.

Anything under 100ms is extremely fast, and only Fusion Markets could boast execution speeds under 100ms for both limit and market orders.

Solid Proprietary Platforms

BlackBull Markets offers a great range of trading platforms including MetaTrader platforms, cTrader, TradingView and multiple social copy trading apps, such as the popular ZuluTrade.

It is the broker’s proprietary platforms, however, where BlackBull Markets shines. Recently launching BlackBull Invest, as well as the award-winning BlackBull CopyTrader and BlackBull Trade, there is something for every type of trader.

From our testing, BlackBull CopyTrader stands out as our pick of the bunch for its ability to connect traders to elite fund managers as well as its advanced risk management features.

Huge Range of Shares

While BlackBull Markets offers a decent range of products, including 64 forex pairs, it is through the BlackBull Invest specialty platform that the broker stands out from our testing.

With BlackBull Invest, you can trade a whopping 26,000 shares from over 80 global markets, one of the largest selections of shares we’ve seen.

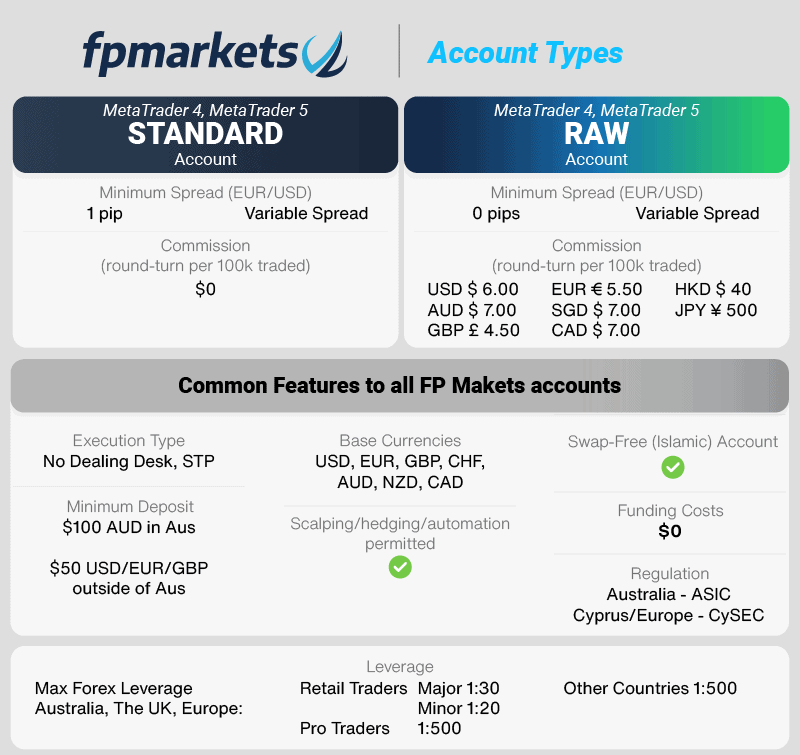

6. FP Markets - Best MT4 Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets is our top choice for scalpers due to the unrestricted trading on its MetaTrader platforms. The broker gives you the freedom to trade over short holding periods utilising technical analysis methods on both MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and TradingView. You can also use these MetaTrader platforms for automation through the use of expert advisors (EAs).

While some competing brokers do offer more products than FP Markets, FP Markets does have 71 forex pairs, which is amongst the most of any broker we’ve tested.

Pros & Cons

- Low Trading Costs

- Fast market execution speeds

- DMA shares trading with IRESS trading for Australia clients

- Very basic proprietary app features

- Average educational content

- Limited CFDs outside forex

Broker Details

FP Markets is our top MT4 broker because of several factors including fast market execution speeds, competitive spreads, low spreads and a huge range of 10,000 physical shares.

Fast MT4 Market Execution Speeds

With an average market order speed of 96ms, FP Markets is the 4th fastest MT4 broker overall based on our testing. Anything below 100ms is fast, so this means executing live market orders will often result in less slippage than other MT4 brokers, lowering your trading costs overall using MetaTrader 4.

Low-Commission Broker

From our extensive published spreads analysis of 40 top brokers, FP Markets stood out for its RAW account, finishing 5th overall. Charging commissions of USD $6 (AUD$7.00, GBP£2.25, EUR€2.75 per round-turn trade, FP Markets also has one of the cheapest RAW accounts.

FP Markets offers competitive average spreads of 0.10 pips pips for its RAW account which is well befowthe industry average of 0.22 pips. You can trade using micro lots, mini lots and of course standard lot and there are also no inactivity fees, adding to FP Markets’ low-cost appeal. The minimum deposit to open a trading account is $100.

Over 10,000 shares available

In addition to MT4 and MT5, Australian traders can also use the IRESS tradign and Mottai platform for trading on over 10,000 shares. These platforms have DMA trading (Direct Market Access) and if you are outside Australia can use cTrader and TradingView.

FP Markets also offers a proprietary mobile app (outside Australia), which has a simple layout and is user-friendly based on our testing.

7. Fusion Markets - Lowest Commissions

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

Fusion Markets has the lowest commissions that we’ve tested at USD$2.25 a side per lot traded, not only smashing the industry average of USD$3.50, but beating out 33 other top brokers that we analysed.

Pros & Cons

- Lowest spread Forex broker in the market

- Commissions are lower than competitors

- Very fast execution speed

- Over 70 Forex pairs

- Limited education

- No cent trading accounts

- Not licensed by UK or European financial regulator

Broker Details

While Fusion Markets has the lowest commissions we’ve seen, the online broker also offers competitive spreads, some of the fastest execution speeds out there and a large range of 90 tradeable forex pairs.

Lowest Commissions + RAW Spreads

Fusion Markets offers the lowest forex commissions from our analysis, charging $2.25 (AUD or USD, GBP 1.78, EUR 2.03 ) per side, or $4.50 per trade, round-turn. For comparison, the industry standard is $3.00-3.50 per side.

It not just commissions that are low, spreads are low too. The tests done by our colleague Ross Collins found Fusion Markets has the lowest RAW/ECN-style spreads for AUD/USD, USD/JPY, second lowest spreads for GBP/USD, USD/CAD, USDCHF and 3rd lowest for EUR/USD. If we average out the results, Fusion Markets has the lowest overall average of 0.22 pips.

What’s more, you can trade a large range of 80 forex pairs with these low spreads, adding to the appeal of Fusion Markets.

Fast Execution Speeds

Along with its competitive spreads and low commissions, Fusion Markets have the 2nd fastest execution speeds we’ve tested, achieving speeds of 79ms for limit orders and 77ms for market orders.

Anything under 100ms is extremely fast, from our experience, and this adds to Fusion Market’s low-cost appeal, reducing your latency at the point of order execution, resulting in less slippage.

Decent Platform Range

From our testing, Fusion Markets offers three solid platforms, MT4, MT5 and cTrader, which gave us enough platform and trading tool diversity, albeit with the standard, out-of-the-box, platform experience.

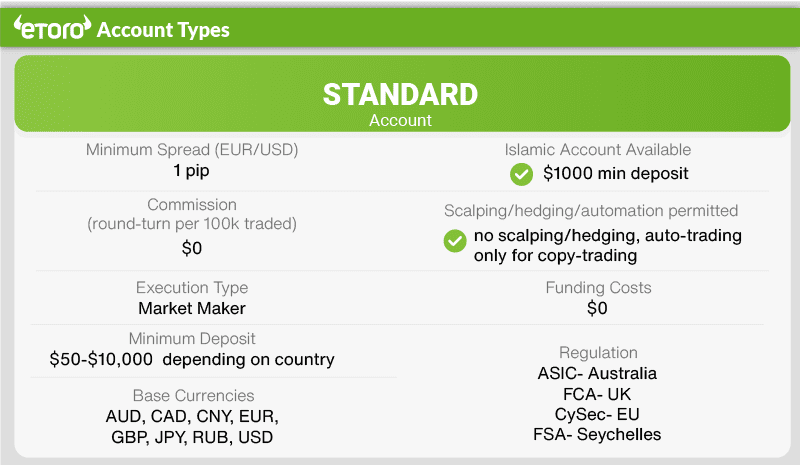

8. eToro - Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

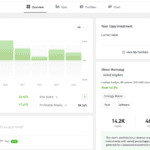

With over 30 million users, eToro has the biggest social network of any copy trading broker we’ve seen and from our testing, the broker backs this up with its excellent proprietary trading platform that is tailor made to help you find and copy the best traders in the world.

Pros & Cons

- Social trading leader (30 million+ users)

- eToro includes Advanced charts by TradingView

- Copy trader and Investment Portfolios

- Large range of CFD products

- No fees to copy signal providers

- Spreads could be tighter

- Inactivity and withdrawal fees

- Customer support can be hard to access

- Lacks eduction tools

Broker Details

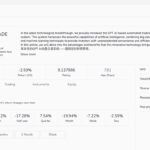

Top Copy/Social Trading Broker

Not only is eToro the best social trading broker out there, but it also has the largest social trading network and community in the industry. There are over 30 million users, which is an astounding number of traders to connect with.

Inside its proprietary eToro platform, the ‘Copy Trader’ tool will help you find and copy the best traders in the broker’s huge network of top investors. In this sense, you can automate your trading without needing to write your own complex algorithms

Commission-Free Spreads

As a market marker, eToro doesn’t have the lowest spreads out there, but the broker does average spreads of 1 pip for EUR/USD, which is right in line with the industry average. In some ways, spread with eToro cna be considered cheap since you do not need to pay extra for follow and copy other traders which most such tools do require.

To ease your way into trading, the broker also offers a low minimum deposit of $50 when you open an account with them, and there are no commissions for trading Forex with eToro, keeping your trading costs relatively low.

User-friendly Platforms

While eToro only offers its own proprietary trading platform, we found it user-friendly, based on our testing, and suited for beginner traders.

The eToro platform comes with Advanced Charts by TradingView and obviously has social and copy trading capability but does lack the range of technical indicators and charts some other platform offer. With eToro you can trade over 3000 financial markets on the eToro trading platform and utilise the broker’s award-winning copy trading features, via CopyTrader.

9. FOREX.com / City Index - Top Raw Spread Account

Forex Panel Score

Average Spread

FOREX.com

EUR/USD = 0.8

GBP/USD = 0.8

AUD/USD = 1.7

City Index

EUR/USD = 0.07

GBP/USD = 0.011

AUD/USD = 0.8

Trading Platforms

FOREX.com

MT4, MT5, TradingView, Forex.com Trading Platform

City Index

MT4, TradingView,

City Index WebTrader

Minimum Deposit

FOREX.com

$100

City Index

$0

Why We Recommend FOREX.com/City Index

As part of the StoneX Group, both FOREX.com and City Index both offer the top RAW spread account we’ve seen, with ultra competitive spreads to either Australian clients (City Index) or U.S. and Canadian clients (Forex.com).

Pros & Cons

- Guaranteed stop-loss orders available (outside Canada/USA)

- Forex.com is available in the USA

- Forex.com Trading Academy is very good

- Useful 3rd party tools such as Chasing Returns

- Forex.com is one of only 2 brokers with MT5 in the USA

- RAW trading is not available in all jurisdictions

- MT4 platforms have fewer instruments than proprietary platforms

- No guaranteed stop loss order in the USA and Canada

- Demo accounts are limited to 90 days

Broker Details

Given both FOREX.com and City Index are owned by the StoneX Group, both brokers have much the same offering, with some slight variations explained below. StoneX is smart in making sure each broker primarily mostly serves different jurisdictions so they don’t compete with each other.

While both brokers accept clients from the UK, If you are in the US, Canada or Europe FOREX.com will be for you while City Index also serves Australia and Singapore.

While predominantly commission-free brokers, Forex.com is one of the very few brokers to offer a Raw account in the US and Canada, while City Index has Raw spreads for Australian clients with impressive commissions.

Top RAW Spread Account

Both Forex.com and City Index offer a low-cost RAW account, with some slight variations, from our testing.

While City Index only has RAW spreads for Australian clients, our tests found they offer the 2nd most competitive RAW spreads we’ve tested. averaging 0.22 pips for the EUR/USD pair according to tests done by Ross Collins and 0.25 when we combine the results of AUD/USD, EUR/USD, GBP/USD, USD/CHF and USD/JPY placing the broker second overall. Couple this with commissions of USD $2.50 per side ($5 round turn), and Australian traders are getting a very good deal in terms of costs.

FOREX.com only offers RAW spread to traders in the US and Canada. Commission costs are $7.00 each way ($14.00 round-turn) but spreads can be as low as 0 pips.

Solid Trading Platforms and Tools

Both City Index and FOREX.com provide similar platform offerings, with solid proprietary apps, advanced trading tools and risk management features. Platforms with both brokers include MetaTrader 4, TradingView, and Capitalise.ai with each broker having its own proprietary platform with many of the same trading tools such as performance analytics and guaranteed stop-loss orders (ex Canada and US).

10. CMC Markets - Best Share And CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We recommend CMC Markets because of its huge CFD range, which includes 9000 share CFDs. Indeed its entire product range is one of the biggest we’ve seen.

Pros & Cons

- CMC Markets Next Gen Platform is excellent

- Over 338 Forex pairs (most of all brokers)

- Guaranteed stop loss order available

- Advanced education and research tools

- Good no-commission trading

- Competitive RAW spread account

- Different accounts are needed for shares and CFD trading

- Inactivity fees

- Fee structure can be confusing for some products

- Lacks options for funding

Broker Details

CMC Markets is our top share and CFD broker with a huge range of nearly 10,000 products available to trade. From our analysis, the broker also features competitive no-commission spreads, cheap commissions and an excellent proprietary platform.

Large Range of Forex and Shares CFDs

With CMC Markets, you can trade over a huge range of over 338 forex pairs and over 9000 shares CFDs. Indeed, the broker has one of the largest ranges of tradeable products we’ve seen, including 82 indices, 55 bonds and over 1000 ETFs.

You can trade these products using the broker’s excellent Next Generation platform, which we recommend using the web trading version. Not only is the platform user-friendly, but you can also trade with advanced charting, including over 80 technical indicators.

We particularly appreciated the ability to customise your layout, choosing between floating or fixed windows, in addition to predefined layouts or custom setups.

Competitive No-Commission Spreads + Low Commissions

To trade its huge range of forex pairs, you’ll obtain competitive average spreads of 1.11 pips for its CFD account (commission-free) from our testing. This gave CMC Markets the second lowest Standard account spreads, compared to IC Markets at number 1.

Should you choose the broker’s FX Active (RAW Spread) account, you’ll also obtain ultra-low commissions of $2.50 (USD and AUD) per side, putting it as one of the cheapest commissions we’ve measured.

Ask an Expert

What is the most stable forex market?

The major currency pairs are more stable than minor and exotic pairs. For this reason, if you are after currency pairs that don’t fluctuate too much then trade using major pairs like EUR/USD. The other option is to use a broker with Fixed Spreads.