Admiral Markets Review Of 2026

Since 2001, the Admiral Markets Group continues to expand its services globally. Known for its reliability and simplicity, it is gaining a larger client base and is continuing to provide quality service and competitive spreads for global markets.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Admiral Markets Summary

| 🗺️ Tier 1 regulation | ASIC, FCA, CySEC, CIRO |

| 🗺️ Tier 2 regulation | EFSRA |

| 🗺️ Tier 3 regulation | FSCA, CMA, JSC, FSA-S |

| 💰 Trading Fees | Variable Spread with no commission |

| 📊 Trading Platforms | MT4, MT5 Trading Platform |

| 💰 Minimum Deposit | $100 |

| 💰 Withdrawal Fees | $25 |

| 🛍️ Instruments | Forex, CFD, Crypto, Commodities |

Our Verdict on Admiral Markets

We think Admiral Markets can be thought of as a MetaTrader specialist since they only offer MetaTrader 4 and MetaTrader 5 platforms along with specialist enhancement tools for these platforms. The broker is well regulated (ASIC, CySEC, FCA) so scores well for trust, has a decent choice of trading platforms and low fees when trading Forex CFDs. Another pro is the range of funding options for deposits and low minimum deposit.

While we think Admirals is a good broker with a large client base and quality services, there are negatives. The broker lacks variety regarding platforms and software like social trading and Admirals AS is the sole liquidity provider so prices may lack transparency.

Admiral Markets Pros and Cons

- Easy account opening

- Low CFD fees

- No charge on deposits and withdrawals

- Only 24/5 support

- Inactivity fee

- Limited products

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

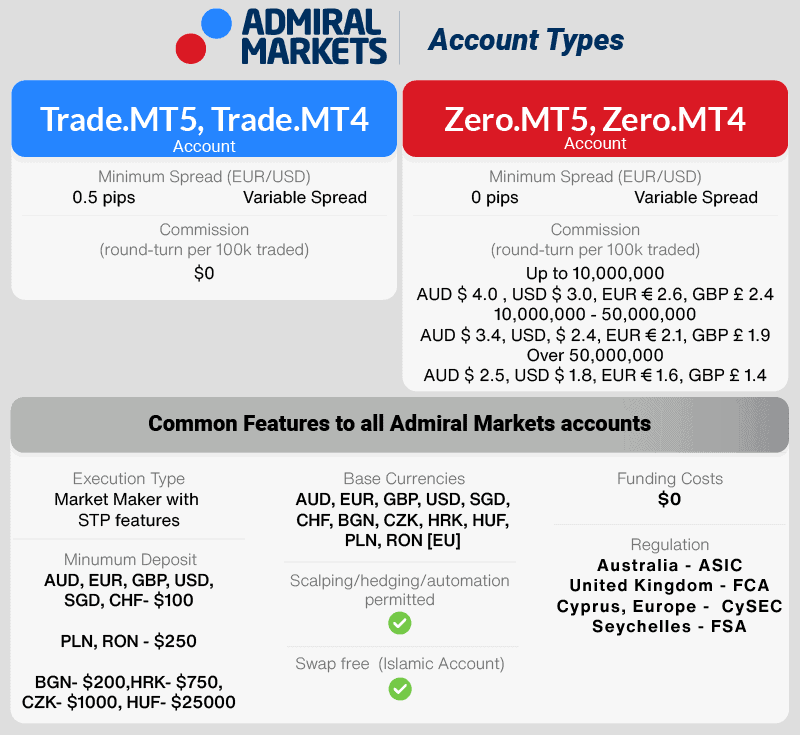

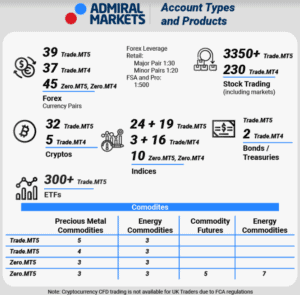

Admiral Markets offers 3 types of account types, a Trade Account which a standard account, A Zero Account which is commission-based and an Invest Account for Admiral Markets clients in the UK and Europe who wish to trade equities and Exchange Traded Funds (ETFs).

1. Raw Account Spreads

Admiral Markets’ average or typical spreads are generally competitive with other brokers such as Pepperstone.

Admiral Markets Commission Account Spreads | |||||

|---|---|---|---|---|---|

| 0.80 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.01 | 0.02 | 0.50 | 0.27 | 0.30 |

| 0.14 | 0.13 | 0.75 | 0.38 | 0.63 |

| 0.14 | 0.31 | 0.62 | 0.39 | 0.75 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-03

Spreads for EUR/USD is as good as any broker on the market, spreads for other currency pair would be best described as mid-tier.

| Raw Account Spreads | Admiral Markets | Average Spread |

|---|---|---|

| Overall | 1.11 | 0.74 |

| EUR/USD | 0.1 | 0.21 |

| USD/JPY | 0.4 | 0.39 |

| GBP/USD | 0.5 | 0.48 |

| AUD/USD | 0.4 | 0.39 |

| USD/CAD | 1.4 | 0.53 |

| EUR/GBP | 0.5 | 0.55 |

| EUR/JPY | 0.9 | 0.74 |

| AUD/JPY | 1.3 | 1.07 |

| USD/SGD | 4.5 | 2.34 |

2. Raw Account Commission Rate

While spreads are slightly higher than the spreads from the cheapest brokers, it’s possible you can still save as Admiral Markets commissions are lower than many other brokers. This is especially true if you trade greater than 10k each month.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Admirals Commission Rate | $3.00 | $4.00 | £2.40 | €2.60 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

In place of wider spread, the Zero Account utilises a tiered commission structure for fees whereby they depend on the volume being traded. The commission is calculated using the following formula:

COMMISSION = CONTRACT SIZE X COMMISSION RATE X 2

Following this tiered commission structure, trading less than $10,000 a month will charge a minimum of $6 and as such, may be better suited for a Trade Account. Trading $10,000 to $50,000 a month will charge $4.80, meaning a Trade Account may again be more useful. However, if more than $50,000 is being traded in a month, the commission will be around $3.60 and the Zero Account may be more suitable.

3. Standard Account Fees

Spreads for the Trade accounts (regardless if you have MT4 or MT5) generally fare well when compared to other brokers. Spreads for EUR/USD appear to be the best of all brokers compared, while other spreads measure up well with their competitors. Australian traders should find these standard account spreads to be very good value, as this CFD broker includes negative balance protection. The Trade Account also offers a far greater range of trading instruments.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Admiral Markets Average Spread | 0.8 | 1 | 1 | 1 | 1.6 | 1 | 1.5 | 2.2 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

Use the calculator below to compare Admiral Markets’ trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

4. Swap-Free Account Fees

Availability of Islamic Account with MT5 platform – swap-free trading conditions, making it suitable for Islamic traders. No interest fees (Swap fee, overnight costs) means the account may be suitable for clients that follow sharia law.

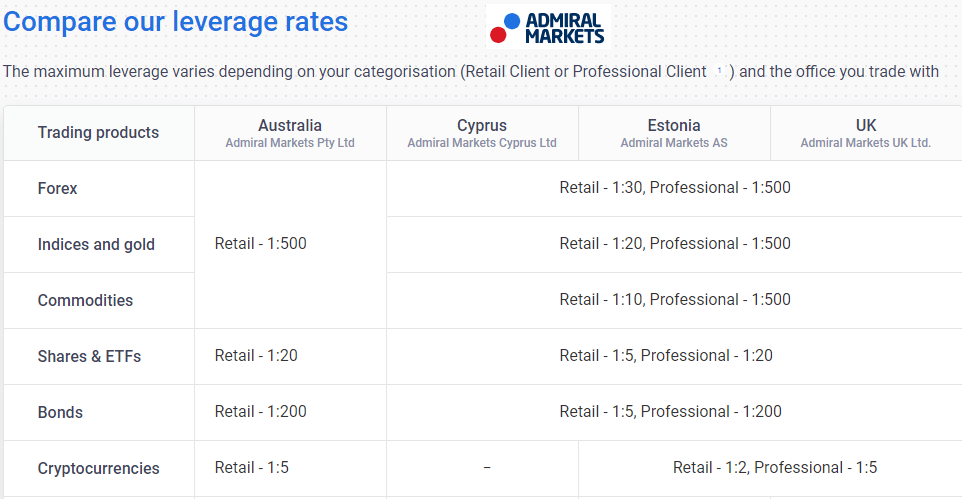

Admiral Markets Leverage

The available leverage when trading Forex varies depending on whether you are classed as a retail investor account or a professional account. Admiral Markets is regulated by three major financial authorities, being the FCA (UK), ASIC (Australia) and CySEC (Europe), all of which cap leverage at 1:30 for major currency pairs and 1:20 for minor currency pairs. If you qualify for a professional account which essentially means you work in the finance industry, you manage an account of over 500k or you consistently traded large volumes over the past 12 months, then you can trade with 500:1.

5. Other Fees

Negative Balance Protection Policy

An important feature of Admiral Markets is their attention to risk protection. Admiral Markets entities operating with ASIC, CySEC, and FCA regulation employ a Negative Balance Protection Policy, which enables traders to ensure their account balance does not slide into a negative amount.

For CySEC and FCA regulation, the Negative Balance Protection is offered for professional accounts (most brokers typically offer this feature only for retail investor accounts due to the higher leverage associated with professional accounts). ASIC does not require brokers to have Negative Balance Protection, however, Admiral Markets offer this as a feature.

As an additional layer of protection, Admiral Markets apply a margin call system, meaning they will exit your trades as a conservative measure as Negative Balance Protection should be a last resort.

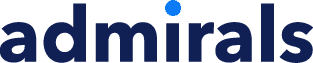

In Australia, Admiral Markets set the stop-out level at 30% for the Trade Account and 50% for the Zero Account.

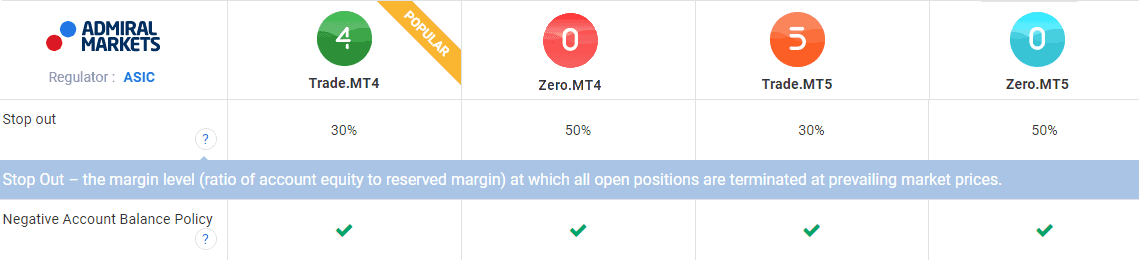

In the UK and Europe, the stop out level is 50% for retail traders and 30% for professional traders. Stop out means all positions will be closed when the ratio of equity to margin reaches the respective levels for each account.

By default, a call margin is enabled and set to 130%. If or when the account equity reaches 130% of the required margin, then a margin call will enact and a notification will be sent via SMS or E-mail. This feature can be disabled, however, it is helpful to improve the trading experience by avoiding excessive slippage.

Volatility Protection

The broker’s unique feature of volatility protection allows traders to utilise a greater range of order types and settings. The risk management features reduce the unpredictability that’s experienced when trading in volatile markets by using sophisticated and advanced order settings such as setting maximum limits for price slippage, partial fills and protection against price gapping.

Examples of Admiral Markets volatility protection settings and features include:

- Stop orders and market orders are executed as limit orders with a set maximum negative slippage from 1 to 1000 points and unlimited positive slippage.

- If price gaps pending orders are automatically cancelled protecting traders from instant losses.

- Stop orders are cancelled when the preset maximum slippage is exceeded.

- To avoid limit orders not being filled when prices spike (due to lack of liquidity), limit orders are executed with market execution.

- If liquidity is absent from markets, limit orders will be partially executed with the unfilled remainder of the order staying open until it is filled or cancelled.

Guaranteed Stop-Loss Orders (France Only)

Furthermore, to combat losses during rapidly moving and high-risk market conditions, Admiral Markets provide a range of advanced trading settings such as automated stop mechanisms to ensure trades are closed when the market is not moving in the trader’s favour, minimising potential further loss. This form of volatility protection is useful for traders who want to avoid exposure to extreme market volatility. For traders in France, a Guaranteed Stop Loss feature is available under Autorité des Novés Financiers (AMF) regulation only (the relevant finance regulator in France).

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Admirals Spread Betting

Admirals offers spread betting for UK and Irish clients, which allows you to speculate on an asset’s rise or fall in the markets. Unlike other forms of trading, you never own the underlying product, you are simply speculating on whether the price will go up or down in value.

One benefit of spread betting we like is that it’s a leveraged product, which means you only need a small deposit of the overall value of the trade to open a position. The other benefit of spread betting is you can earn tax-free profits due to having no capital gains tax or stamp duty.

With Admirals, you can spread bet with an MT5 spread bet account. This means you will spread bet using MT5 not MT4 which is slightly surprising given most brokers offer MT4 for spread betting. At the end of the day, you don’t lose anything by using MT5 compared to MT4. To learn more, read our comparison of MetaTrader 4 vs MetaTrader 5.

When it comes to most spread betting markets, you can bet using the same markets as with CFD trading and there are no commissions (meaning your cost is covered in the spread) regardless of the financial instrument you bet on. All spread betting accounts are dominated in GBP, this is because, we re-iterate, spread betting is currently only available to UK traders.

Spread betting is only available for UK clients because the Financial Conduct Authority (FCA) is the only financial regulator that permits spread betting. Regulators in other countries such as ASIC (Australia), DFSA (UAE) and even regulators in the EU such as CySEC ( Cyprus) and BaFIN (Germany) don’t permit it. This explains why only the subsidiaries of Forex brokers regulated by the FCA have spread betting.

Admirals offers a simple 3-step account opening experience, which we found is one of the quicker and easier of all spread betting brokers. This involves:

- Fill out a simple form with basic personal information (takes minutes)

- Deposit funds with your choice of available funding options (bank transfer, credit/debit or e-wallet)

- You’re funded. You can choose your market, direction (rise or fall) and stake (how much GBP per point) and start trading

Once you open an MT5 spread betting account, you can trade on Admirals’ full range of markets using MetaTrader 5. Admirals offer leverage of up to 1:30 for major Forex pairs for retail clients on these products – the same as with CFD trading and the maximum permitted by the FCA.

One unique benefit of the broker’s spread betting offering we like is its Admirals Premium Analytics feature. This includes access to the Technical Insight Lookup indicator which gives you actionable trading ideas for further, advanced market analysis.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Basic Account

All Admiral Market accounts offer the same basic features

- Minimum lot trading size of 0.01 (micro lots)

- Hedging

- Scalping

- Automated trading with Expert Advisors

- Market Execution (as opposed to instant execution) with Straight Through Processing (STP)

- Negative Balance Protection

Admiral Markets clients in Australia will need 100 (AUD, EUR, GBP, USD, SGD) in their account to start trading. Clients of Admiral Markets in the UK and Europe will need 100 (EUR, GBP, USD, CHF) or 200 (BGN), 1000 (CZK), 750 (HRK), 25,000 (HUF), 250 (PLN) or 250 (RON). These currencies are also available as your base currencies.

Admiral Markets Trade Accounts

Admiral Markets calls their Standard Account, Trade.MT4 and Trade.MT5. Standard accounts have no commissions which mean spreads are widened in place of commission, Admiral Markets adds at least 0.5 pips to these spreads.

A spread-only account is popular with beginner traders as no commissions simplify costs when trading. Long-term traders also may prefer this account as the cost savings compared to STP and ECN style accounts may not be significant enough to concern them.

When choosing a Trade account, there are some details to keep in mind. These include:

- The Trade Account offers a more product compared to the other accounts, including currencies, cryptocurrencies, commodity futures, energy CFDs, index CFDs

- Maximum Forex Lot Size is 100 (or Standard) which means your contract cannot be more than 100 (100 barrels, 100 troy oz, 100,000 forexes). Zero Account allows 200.

Verdict on Admirals Fees

Looking at the data, it’s clear that Admirals’ standard account spreads are competitive in the industry.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

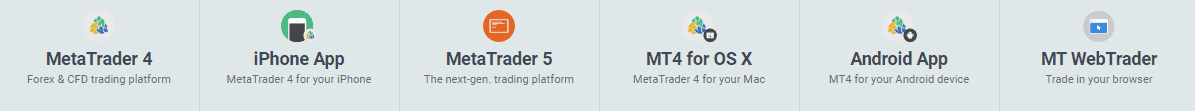

Trading Platforms

Arguably the most popular trading platform in the world for retail investors and considered by many to be the best in class, MetaTrader is an electronic trading platform designed for CFD speculation trading. MetaQuotes have developed two versions of the software, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), each with their own features and strengths.

| Trading Plaform | Available With Admiral Markets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

Either MetaTrader forex trading platform is reliable choices for a trading platform. With each platform, traders get a comprehensive range of technical and graphical tools and timeframes that allow you to perform all the critical analysis needed to make trading decisions.

In addition to trading tools, automation is possible through expert advisors (EAs) and social trading through the large MetaTrader community. Traders can also create their own signals and advisors with MQL4 and MQL5 programming.

MetaTrader 4 is more popular as it has been around longer and is offered by more brokers, it is a true specialist forex platform. MetaTrader 5 is an upgrade on MT4 with more analysis tools, faster processor, better backtesting and access to a greater range of CFDs and forex pairs.

MetaTrader 5

Depending on your trading platform preference, Admiral Markets offers an MT4 and MT5 account type (Admiral MT4 and Admiral MT5).

MT4 and MT5 are available for mobile trading with iOS and Android trading apps, a Webtrader option online, as well as desktop versions for PC and Mac computers.

MetaTrader Supreme Edition

In addition to the stop-loss feature as a form of risk protection, Admiral Markets offer the Supreme Edition as an extension of the MetaTrader platform for free.

The add-on tools and widgets include features such as a mini terminal for additional options when setting a stop loss, a built-in economic calendar, market analysis tools, advanced order types, trade alerts, a market sessions map plus many more features to help traders reduce their risk when trading.

Social Trading

Social trading platforms and similar add-on tools are becoming increasingly popular among traders. Admiral Markets allow, but do not necessarily support, social trading through the MetaTrader platforms – signals by MetaQuotes and Expert Advisors through MQL5. In terms of automated or copy trading, there is no mention of add-ons such as Mirror Trader, DupliTrade, or MyFxBook. Such integration social tools are available for traders to find themselves, however, Admiral Markets do not provide them.

Under their Education section, Admiral Markets offer a detailed summary of the concept of forex trading signals, copy trading features, and more educational resources. They appear to place more emphasis on their educational resources and training programs rather than advertising common copy trading platforms.

Charting Tools

Charting tools such as Autochartist and Trading Central are made available through Admiral Markets. These features are beneficial add-ons that allow traders to utilise fundamental and technical analysis, market sentiment, and insight, as well as signal ideas. These charting tools are presented on the MetaTrader Supreme Edition.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Is Admiral Markets Safe?

Admiral Markets has a trust score of 74, from its regulation, reputation, and reviews.

1. Regulation

Admiral Markets is regulated by four tier-1 regulators, one tier-2 regulator, and four tier-3 regulators.

| Admiral Markets Safety | Regulator |

|---|---|

| Tier-1 | ASIC (Australia) - Australian Securities and Investments Commission FCA (United Kingdom) - Financial Conduct Authority CySEC (Cyprus) - Cyprus Securities and Exchange Commission CIRO (Canada) - Canadian Investment Regulatory Organization |

| Tier-2 | EFSRA (Estonia) - Estonian Financial Supervision and Resolution Authority |

| Tier-3 | FSCA (South Africa) - Financial Sector Conduct Authority CMA (Kenya) - Capital Markets Authority JSC (Jordan) - Jordan Securities Commission FSA (Seychelles) - Financial Services Authority |

All fall under European Securities and Markets Authority (ESMA) meaning these regulators must comply with ESMA requirements set out by MiFID directives. Being part of the ESMA umbrella means regulations throughout Europe will be much the same. ASIC manages regulation for Australia and therefore is independent of ESMA, meaning ASIC regulation will differ.

If you join ESMA from outside Australia, then Admiral Markets will default to FCA regulation page however you can choose which website you wish to enter. Regulators offer good protection against scams or fraudulent activities.

2. Reputation

Admiral Markets (now branded as Admirals) started operations in 2001 in Tallinn, Estonia. The broker demonstrates strong visibility in the forex trading space. With approximately 220,000 monthly Google searches, it ranks as the 13th most popular forex broker among the 65 brokers analyzed. Web traffic data shows a somewhat lower positioning, with Similarweb reporting 595,437 global visits in February 2024, placing Admirals as the 27th most visited broker.

They built a substantial European presence over its two decades of operation. The broker reported serving more than 150,000 active clients as of 2024, processing daily trading volumes exceeding €12.5 billion. As a regulated investment firm across multiple European jurisdictions, Admirals reported holding over €50 million in client funds and maintaining a strong capital position with a 22% capital adequacy ratio, reflecting its established position in the European trading landscape.

| Country | 2025 Monthly Searches |

|---|---|

| Austria | 550,000 |

| United Kingdom | 368,000 |

| Italy | 60,500 |

| Greece | 60,500 |

| United States | 33,100 |

| Germany | 27,100 |

| India | 6,600 |

| Spain | 6,600 |

| Philippines | 5,400 |

| Japan | 4,400 |

| Canada | 3,600 |

| Switzerland | 3,600 |

| France | 2,900 |

| Poland | 2,400 |

| Brazil | 2,400 |

| Indonesia | 2,400 |

| Turkey | 2,400 |

| Netherlands | 1,900 |

| Australia | 1,900 |

| Argentina | 1,600 |

| Ireland | 1,600 |

| Malaysia | 1,300 |

| United Arab Emirates | 1,000 |

| Sweden | 1,000 |

| Thailand | 880 |

| Colombia | 880 |

| Pakistan | 880 |

| Mexico | 880 |

| Nigeria | 880 |

| South Africa | 880 |

| Chile | 880 |

| Egypt | 880 |

| Taiwan | 720 |

| Saudi Arabia | 720 |

| Singapore | 590 |

| Vietnam | 590 |

| Hong Kong | 590 |

| Portugal | 590 |

| Cyprus | 480 |

| New Zealand | 480 |

| Morocco | 390 |

| Bangladesh | 320 |

| Kenya | 320 |

| Uzbekistan | 320 |

| Peru | 260 |

| Algeria | 260 |

| Jordan | 260 |

| Venezuela | 210 |

| Bolivia | 210 |

| Ghana | 210 |

| Uganda | 210 |

| Ecuador | 170 |

| Dominican Republic | 140 |

| Sri Lanka | 110 |

| Panama | 90 |

| Cambodia | 90 |

| Costa Rica | 90 |

| Uruguay | 70 |

| Tanzania | 70 |

| Ethiopia | 70 |

| Mongolia | 70 |

| Mauritius | 50 |

| Botswana | 20 |

550,000 1st | |

368,000 2nd | |

60,500 3rd | |

60,500 4th | |

33,100 5th | |

27,100 6th | |

6,600 7th | |

6,600 8th | |

5,400 9th | |

4,400 10th |

3. Reviews

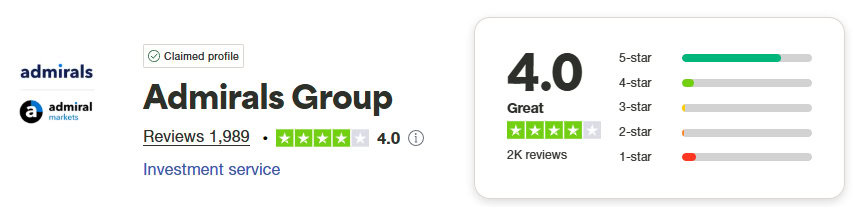

The broker has a TrustPilot score of 4.0 from 1,989 reviews.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Deposit and Withdrawal

What is the minimum deposit at Admiral Markets?

The minimum deposit required is $100.

Deposit Options and Fees

Admiral Markets offer a range of free options for deposit and withdrawal methods including Skrill, Neteller, Bitcoin, Credit Card, Bank Transfer, Wire Transfer, Visa and more. Deposits are free for all methods and withdrawals are also free, limited to two requests each month. The following table summarises deposit methods, broker costs, and deposit amounts.

| Deposit method | Broker costs | Deposit amount |

|---|---|---|

| Bank transfer | Free | Any |

| Visa and MasterCard | Free | 75 - 7500 AUD |

| iBank and BankLink | Free | 100 - 200000 CNY |

| Skrill | Free | 75 - 15000 AUD |

| Neteller | Free | 75 - 15000 AUD |

| SafetyPay | Free | 1 - 5000 USD |

| AstroPay | Free | 50 - 5000 USD |

| Trustly | Free | 75 - 7500 AUD |

| Bitcoin | Free | 50 - 3000 USD |

| Rapid Transfer | Free | 75 - 7500 AUD |

| POLi | Free | 75 - 7500 AUD |

Withdrawal Options and Fees

The Trade Account (spread-only account) incurs fees through the wider spreads, as it is the broker’s standard account. For the Zero Account (commission account), commissions are formed as the fees instead. Furthermore, Admiral Markets charges no additional fee for opening a trading account and only charges an inactivity fee of 10 EUR per month. Internal transfers between the same base currencies are also free, however, with different base currencies, this process incurs a fee of 1% of the transfer amount after ten free transfers.

Product Range

CFDs

Admiral Markets offer a wide range of other CFD in addition to forex, including cryptocurrency CFDs, index CFDs, share CFDs, bond CFDs, and commodity CFDs. To start trading CFDs, clients need a minimum of 100 (for most major base currencies) deposited in their trading account. Some CFDs have 0% commission, making the opportunity to diversify their investments relatively simple. The leverage available for CFD is as follows:

Note* The new FCA restrictions on cryptocurrency trading only allow professional traders to buy and sell cryptocurrencies CFDs. While UK retail traders can’t speculate on cryptocurrencies that can still trade over 3,000 CFDs on a range of asset classes.

Note* The new FCA restrictions on cryptocurrency trading only allow professional traders to buy and sell cryptocurrencies CFDs. While UK retail traders can’t speculate on cryptocurrencies that can still trade over 3,000 CFDs on a range of asset classes.

Retail investors looking to start trading forex may look to Admiral Markets as their preferred online broker due to the range of trading options. Having a wider variety of financial instruments may improve the trading conditions and overall trading experience, although for novice traders this would not be so vital. For investors with more experience trading forex, Admiral Markets may not be the best forex broker due to the limited range in comparison to other online brokers.

Trade Account

The Trade Accounts allow trading of the following instruments.

It is worth noting that MetaTrader 5 Forex Trading platform offers the following instruments which are not available on MetaTrader 4:

- Agriculture CFDs

- Commodity futures CFDs

- ETF CFDs

This wide variety of instruments is beneficial for traders wanting exposure to several types of global markets.

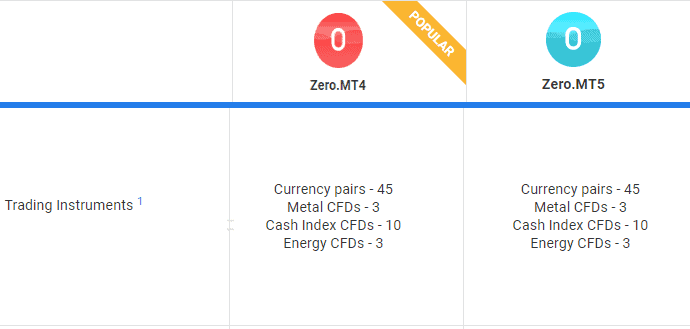

Zero Account

The Zero Account also offers a range of instruments on both the MetaTrader 4 and MetaTrader 5 platforms, however, these are limited to:

This range of available instruments limits flexibility for traders and places more importance on selecting the most suitable account.

Currency Pairs

The range of currency pairs offered by Admiral Markets is less than 50, which is relatively low. However, given that the most commonly traded major, minor, and exotics are available, the majority of retail traders would not feel restricted. This is still something to be aware of before joining, as it may affect particular traders wanting to trade certain pairs.

Comparison Of Brokers And Their Available Currency Pairs

Currency pair options may vary between entities and even between accounts. The following table summarises the brokers who offer more or less than 60 currency pairs.

| More than 60 currency pairs | 40 to 59 currency pairs | Less than 40 currency pairs |

|---|---|---|

| Pepperstone | Admiral Markets | FXCM |

| IC Markets | XM | ThinkMarkets |

| City Index | XTB | HANTEC |

| easyForex | eToro | Traders' Way |

| Forex.com | FP Markets | |

| FxPro | Hugo's Way | |

| HYCM | ||

| Fusion Markets | ||

| IG | ||

| Oanda | ||

| Saxo | ||

| CMC Markets | ||

| Interactive Brokers |

Note: More currency pairs do not necessarily mean the broker is better. The range of currency pairs simply indicates the availability of more trading opportunities for traders. The most commonly traded pairs are available through all forex brokers.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Customer Service

Customer service representatives can be contacted by phone, email, or live chat. While email and phone contact methods are only 24/5, live chat is available 24/7.

The customer support feature, although helpful and informative, is Europe-centric. This means that traders outside the Eurozone may struggle to use the online live chat feature, as there may be a delay in response time due to offline support personnel. In addition to the live chat feature, they also offer general communication through Twitter, Facebook, and Telegram. The site also contains multiple language options to cater to their global customer support.

Research and Education

As well as standard customer support, Admiral Markets offer a range of resources and services to help traders develop their forex trading knowledge.

Educational Resources

Education packages are available for all users across Basic, Pro, and Advanced levels. These include courses, classes, advanced tools, and master strategies. However, the extent of available resources depends on the minimum deposit you have made.

Additionally, Admiral Markets offers Forex 101 – a free forex and CFD trading course that allows traders to learn the basics before getting started with trading.

Zero to Hero

As part of their education, Admiral Markets offer a 20-day forex training course for free. The Zero to Hero program is free to register and covers a range of skills for traders to learn. Developed by professional trading coaches, the program allows users to learn the steps of forex trading within a relatively short time frame.

Zero to Hero encompasses the basic technical and fundamental analysis and teaches factors such as psychology and understanding of market conditions, all within 20 video sessions, Q&A, one live session, and a trading strategy video.

Webinars And Seminars

A range of free live forex and CFD webinars are available for traders through Admiral Markets. Led by professional financial traders, these webinars are run frequently and are intended to provide insight into improving traders’ skills from novice to expert levels.

Forex and CFD seminars are also included through the broker to provide traders with the knowledge of the basics, progressing to more complex factors of trading such as indicators and expert strategies.

Analytics

Admiral Markets provide traders with a range of practical and insightful resources. Analytical features include technical analysis articles through trading central, forex market calendar, comprehensive and detailed quotes, trader blogs and posts, a market heat map, market sentiment data as well as a weekly trading podcast. Premium Analytics is freely available to traders who register, providing access to a portal for news, analysis, economic calendars, and indicators.

Analytic tools are provided to help traders advance their skills through educational resources and ensure they have a good experience trading with the broker.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Final Verdict on Admiral Markets

As a reputable forex broker for 23 years, Admiral Markets remain a reliable server for traders by offering tight spreads and low commission rates. Their range of educational resources is a standout feature for them. A comparative alternative we recommend is IC Markets which has lower spreads.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Admiral Markets FAQs

Is Admiral Markets a good broker?

Admiral Markets is considered to be a safe broker by all industry standards. The broker follows strict regulatory frameworks (ASIC, FCA and CySEC) and client funds are also protected by the Negative Balance Protection Policy and the FSCA and ICF. At the end of the day, choosing a forex broker comes down to your needs and your trading experience.

You need to check out the How to Choose a Forex Broker.

Is Admiral Markets a market maker?

No, Admiral Markets is not a market maker. Admiral Markets employs the Straight Through Processing (STP) execution model with no dealing desk (NDD). This STP broker sources its bid and asks for quotes directly from big banks, hedge funds and other investors. The other advantage of the STP execution model is that orders are usually filled at the best possible prices.

A complete list of NDD forex brokers can be found here: No Dealing Desk Brokers.

How do I withdraw money from Admiral Market?

At Admiral Markets, clients can withdraw money via several payment methods including bank transfer, credit/debit cards, Neteller, Skrill, Klarna or SafetyPay. Admiral Markets’ clients need to be aware that depending on your account jurisdiction some of these payment options won’t be available to you. Admiral also offers two free withdrawal requests per month.

Compare Admiral Markets Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO & Co-Founder of CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to Admiral Markets Website

Visit Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Does admiral market offer no deposit bonus?

Admirals may sometimes have a no deposit bonus promotion for a limited time. This will only be fore new clients and may also be limited to certain subsidiaries, for example it might not be available in Australia, Europe or UK due to regulatory reasons.