FXCM vs City Index: Which One Is Best?

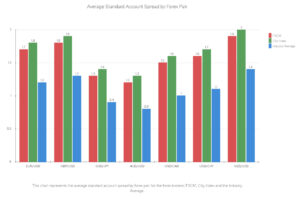

We used our scoring methodology to find out which forex brokers in our FXCM vs City Index we think is best. To do this we looked at the costs, platforms like MT4 and MT5 and broker trust. See how the brokers did.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert