BlackBull Markets Review Of 2025

Blackbull Markets is one of the fastest-growing forex brokers attracting professional traders and those using automation. I found the brokers popularity can be attributed to their technology stack from advanced trading platforms to the fastest execution speeds of any broker worldwide.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Blackbull Markets Summary

| 🗺️ Tier 1 Regulation | New Zealand (FMA) |

| 🗺️ Tier 2 Regulation | Seychelles Financial Services Authority (FSA) |

| 💰 Trading Fees | ECN Pricing |

| 📊 Trading Platforms | MT4, MT5, cTrader, TradingView, BlackBull CopyTrader |

| 💰 Minimum Deposit | $0 |

| 💰 Deposit/Withdrawal Fee | $0 |

| 🛍️ Instruments Offered | Forex, Shares, Futures, Indice, Commodity, Crypto CFDs |

| 💳 Credit Card Deposit | Yes |

Why Choose BlackBull Markets

BlackBull Markets is an excellent broker for all levels of traders, particularly those with advanced experience. The broker offers a broad range of trading platforms, mobile apps, and copy trading tools to trade a solid range of CFD products and even shares. But, it is the exceptional execution speed, something we’ve tested and verified firsthand that sets the broker apart,

Other standout features include high leverage of up to 1:500, access to VPS hosting, and a solid range of educational resources.

However, there are a few minor drawbacks. The ECN Prime account requires a minimum deposit of $2,000, which may be a barrier for beginners (new traders can use the ECN Standard account with a $0 deposit). Additionally, BlackBull charges a flat $5 withdrawal fee regardless of the funding method, which is uncommon among brokers.

Blackbull Markets Pros And Cons

- Fastest execution speed worldwide

- High leverage of up to 500:1

- Low fees for high volume traders

- Not ideal for beginner traders

- Higher standard account spreads

- Only regulated in NZ (FMA) and FSA (Seychelles)

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

BlackBull Markets offers two ECN accounts (Prime + Institutional) and a standard account with no commission. I recommend the ECN account which is detailed below.

The Prime account is intended for retail traders, while the Institutional account, as the name suggests, is designed for institutions or companies. To access the Institutional account, you’ll need to contact BlackBull directly.

1. ECN Account Spreads

The Blackbull ECN account offers Blackbull Markets’ lowest spreads and is ideal for more experienced, high-volume traders. This account is a RAW style account meaning ECN or STP execution is used with no dealing desk. This means the spreads you get are determined by the liquidity providers used by the broker.

The table below captures the average spreads listed on each broker’s website. As can be seen, BlackBull generally fares well for major pairs like EUR/USD and AUD/USD.

|

ECN Forex Spread Comparison

|

|||||

|---|---|---|---|---|---|

|

0.14 | 0.75 | 0.87 | 0.43 | 1.10 |

|

0.10 | 0.20 | 1.10 | 0.10 | 0.90 |

|

0.09 | 0.14 | 1.40 | 0.13 | 1.70 |

|

0.06 | 0.30 | 0.59 | 0.23 | 0.49 |

|

0.20 | 0.50 | 0.60 | 0.50 | 0.70 |

|

0.17 | 0.54 | 0.68 | 0.30 | N/A |

|

0.10 | 0.60 | 0.80 | 0.50 | 1.10 |

|

0.10 | 0.60 | 0.40 | 0.50 | 0.70 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

The spreads for major currency pairs such as EUR/USD, GBP/USD, AUD/USD, and USD/CAD are generally lower than the industry averages, although some pairs may have higher spreads.

| Raw Account Spreads | BlackBull Markets | Average Spread |

|---|---|---|

| Overall | 0.64 | 0.72 |

| EUR/USD | 0.14 | 0.28 |

| USD/JPY | 0.45 | 0.44 |

| GBP/USD | 0.43 | 0.54 |

| AUD/USD | 0.3 | 0.45 |

| USD/CAD | 0.41 | 0.61 |

| EUR/GBP | 0.75 | 0.55 |

| EUR/JPY | 0.87 | 0.74 |

| AUD/JPY | 1.1 | 0.93 |

| USD/SGD | 1.3 | 1.97 |

2. ECN Account Commission Rates

BlackBull Markets charges competitive commission fees, ECN Prime Account holders pay $3.00 per side per 100k traded, while ECN Institutional Account holders pay $2.00. The core difference in receiving the lowest commission is the US$20,000 minimum deposit requirement.

As shown in the table below, these commission rates are lower than the industry average, with brokers charging around $3.44 USD. The lower commission fee of the ECN Institutional account is particularly attractive for reducing trading costs however this account type may not be accessible to all traders.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| BlackBull ECN Prime | $3.00 | $4.50 | N/A | N/A |

| BlackBull ECN Institutional | $2.00 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Use the calculator below to compare BlackBull Markets’ ECN Prime Account trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

3. Standard Account Fees

BlackBull Markets’ standard account average spreads, such as 1.10 pips for EUR/USD, are competitive and close to the industry norm, with only a 0.1 pip difference from the leading brokers.

Their spreads across other major currency pairs like AUD/USD, GBP/USD, and USD/JPY also align with industry averages, offering traders fair and consistent trading costs without commission fees.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| BlackBull Markets Average Spread | 1.1 | 1.4 | 1.4 | 1.2 | 1.4 | 1.7 | 1.8 | 2 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

The average spread figures for BlackBull Markets are derived through a monthly comparison of published fee data and real-time testing on live accounts. This process ensures an accurate and up-to-date analysis of brokers’ spreads.

4. Swap-Free Account Fees

This is a swap-free account designed for Islamic traders who are prohibited from paying or receiving interest. Provided you can prove you are of Islamic faith, you will be able to use this pricing structure with any of the Standard, Prime, or Institutional account types.

Traders living in Malaysia will automatically be assigned an account that meets Sharia Law and Islamic Finance practices.

5. Other Fees

The only other fee to note is for withdrawals. BlackBull Markets charges a $5 per withdrawal, while there are no fees for deposits or inactivity.

Verdict on BlackBull Markets Fees

Blackbull Markets has some of the most competitive fees for their ECN accounts but these require a high deposit compared to other brokers. This is not a big deal since deposits can be returned but if you are new to trading you might not be willing to part with this large sum to start off. Overall, I give BlackBull Markets 8.5/10 for their trading costs.

Trading Platforms

BlackBull Markets offers a diverse range of trading platforms to suit various trading styles and preferences, including MetaTrader 4, MetaTrader 5, cTrader, TradingView, BlackBull CopyTrader, and BlackBull Shares.

| Trading Plaform | Available With BlackBull Markets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| TradingView | Yes |

| Proprietary Platform | Yes |

My team created a trading platform selector so you can work out what software best matches your trading needs. I recommend you complete our short 5-step questionnaire to determine your most suitable forex platform and then read the relevant section about how BlackBull Markets performs.

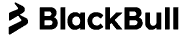

1. MetaTrader 4 (MT4)

In my experience, MT4 is still one of the most sought-after platforms for Australia-based Forex and CFD traders (and also worldwide) due to its ease of use and fully featured functionality.

Key Features for Australian Traders:

- Easy-to-use interface for beginners

- Advanced charting package with multi-timeframe and indicator capabilities

- Ability to automate your trading using Expert Advisors (EAs)

- Mobile Apps to trade on the go for iOS and Android

- Suitable for: Traders looking for simplicity combined with robust analysis tools.

From my experience, the security and automation features stand out the most. If you’re the type of trader who values reliable, no-frills trading with a focus on technical analysis, MT4 on BlackBull Markets is an excellent platform to consider.

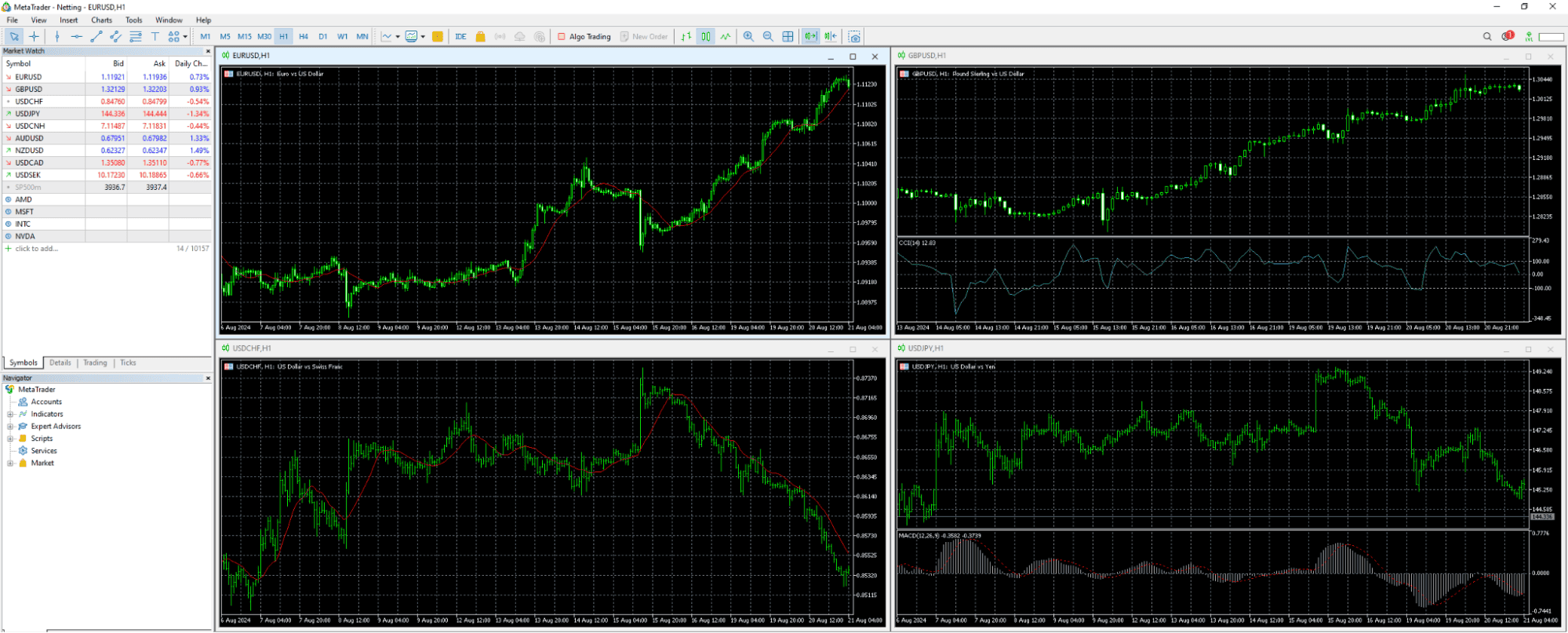

2. MetaTrader 5 (MT5)

MetaTrader 5 is the next generation of MT4 and offers a broader array of features that, in my opinion, better suit the needs of traders seeking more depth and flexibility in their trading tool.

From my experience with MT5, I have found it particularly useful for trading across multiple markets, especially when I need advanced charting and analysis. If you are the kind of trader who appreciates a detailed and flexible trading system, then MT5 is your go-to platform.

Here’s what you get as a trader from the MT5 integration on BlackBull Markets:

Advanced Charting Package: You can simultaneously display up to 100 charts with 21 timeframes to monitor short-term price movements or long-term trends.

- 80+ Built-in Technical Indicators that give you insight into market dynamics, ensuring your analysis is always data-driven.

- You get instant access to more than 600 macroeconomic indicators of the world’s 15 largest economies, and make the right trading decisions in real time.

- Automate your trading process with the MQL5 Wizard, which will help you create Expert Advisors according to your strategy.

- Advanced features of market depth and separate accounting of orders and trades ensure better control over your trading.

In my opinion, MT5 is a powerhouse for traders needing advanced analysis tools and multi-asset support.

3. cTrader

The cTrader platform is outstanding for traders searching for a professional-grade environment with great customisation and algorithmic trading capabilities, from my experience.

Here are the core features of cTrader:

- User-friendly interface with detachable charts and is accessible via desktop, web, and mobile applications for iOS and Android.

- Supports algorithmic trading through cTrader Automate (formerly cAlgo), to help you develop, test, and deploy automated trading strategies using the C# programming language.

- Over 70 customizable technical indicators and multiple time frame analysis for you to pick from.

- cTrader platform back-testing facilities based on past market data.

- Ensures No Dealing Desk (NDD) execution, providing you direct access to liquidity providers for transparent trading.

In brief, advanced functionality combined with ease of use makes cTrader a perfect solution for traders who want to refine their strategy and harness the power of powerful tools that guarantee success.

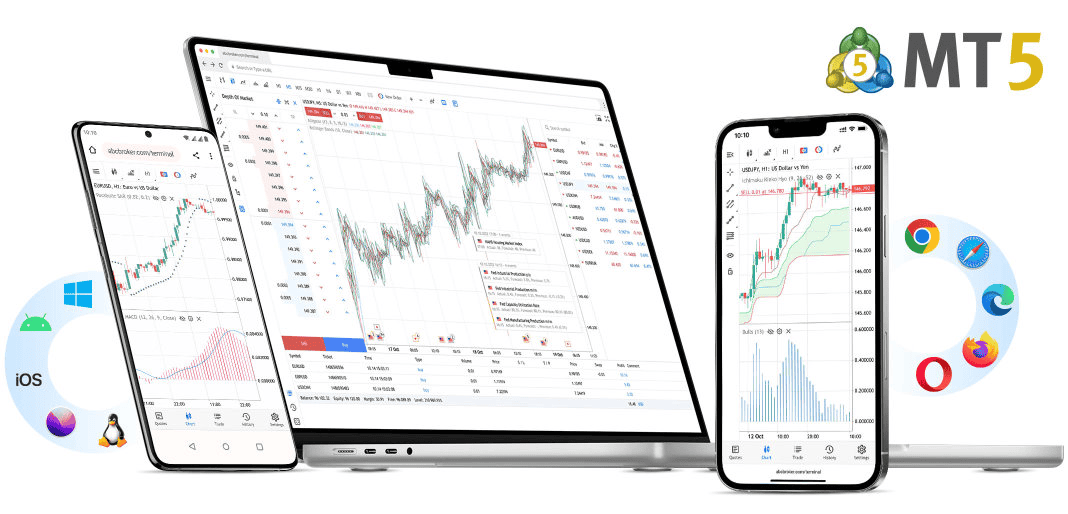

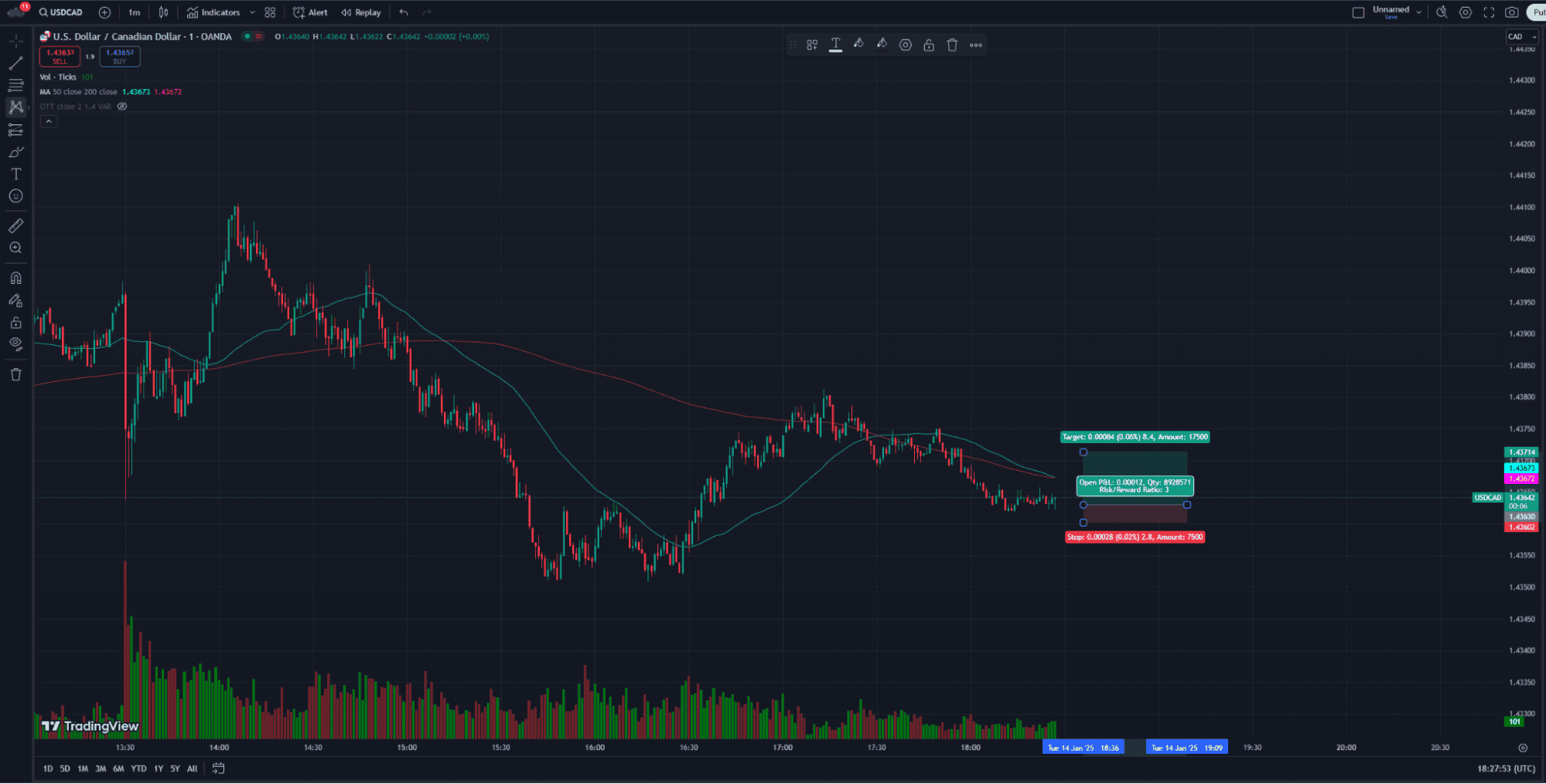

4. TradingView

TradingView stands out as a versatile platform that combines advanced charting with social trading features. From my experience, it’s an excellent choice for traders who value customisable tools and community-driven insights.

Whether you’re a technical trader or just starting, TradingView’s integration with BlackBull Markets provides a seamless experience for market analysis and execution.

Here’s what makes TradingView a must-try:

- You can choose between more than 15 chart types, including Kagi, Renko, and Point & Figure; use up to 8 charts per tab, while applying more than 90 smart drawing tools.

- You can pick from a library of more than 100,000+ community-built indicators or develop your custom strategy using Pine Script.

- TradingView has perhaps the largest social trading community to learn new strategies, share insights, and gain knowledge from other CFD traders.

- You can set 10+ types of Real-Time Alerts based on price levels, indicators, and custom metrics so that you will never miss an opportunity to enter the market.

If you’re looking for a platform that goes beyond traditional charting tools, TradingView is worth exploring. Its integration with BlackBull Markets offers the best of both worlds: cutting-edge analysis tools and seamless execution for over 800 financial instruments.

TradingView couples an excellent interface with nearly boundless customisation, and so many indicators and chart settings to select. I think that it’s well rounded for use with BlackBull Markets if you are either a beginner, intermediate or even advanced trader.

- TradingView is a platform that is mainly utilised for conducting analysis of financial markets, and it is available across iOS, Android, desktop, and Web.

- Access hundreds of different charting tools, technical indicators, across asset classes including stocks, forex, and commodities.

- Share ideas with the community of more than 90 million analysts, investors, and traders.

- Supports Pine Script™, a proprietary scripting language that allows users to create custom indicators

- Extensive market data coverage, connecting you with hundreds of data feeds with over 1,357,880 instruments.

Overall, I’d suggest new traders to check TradingView for use with BlackBull Markets, as it is very straightforward to use and learn, and you can also use a demo account before jumping to live trading.

Mobile Trading Apps

BlackBull Markets ensures seamless trading on the move with mobile apps for all its platforms, including MetaTrader 4, MetaTrader 5, and cTrader. Available for both iOS and Android devices, these apps offer the flexibility to trade and manage investments from anywhere.

They maintain the core functionalities of their desktop counterparts, such as advanced charting, analytical tools, social networking, and copy trading.

Other Trading Tools

BlackBull Markets equips traders with a suite of advanced tools, including Autochartist, Zulu Trade, Myfxbook, VPS Trading, and FIX API Trading, each designed to enhance different aspects of the trading experience:

- Autochartist: Offers automated market analysis, identifying potential trade setups through technical analysis patterns and statistical data.

- Zulu Trade: A social trading platform that enables users to copy strategies from top traders, automating their trading process.

- Myfxbook: A tool for tracking, analysing, and improving trading strategies, providing comprehensive insights into trading performance.

- FIX API Trading: Tailored for advanced traders, this feature integrates with MetaTrader to provide high-speed, reliable, and customisable trading experiences, unlocking sophisticated trading capabilities.

These tools collectively offer BlackBull Markets’ clients a range of options to automate, analyse, and optimise their trading activities.

My Verdict on BlackBull Markets Trading Platforms

The broker has an impressive offering of different training tools and some social trading functions in the form of Zulu Trade. All the industry standard trading platforms are available and they even have mobile app support.

For these reasons, I give the broker a near-flawless 9.0/10 score for their great range of trading platforms.

Blackbull Trading Environment

BlackBull Markets achieves rapid order execution through globally distributed servers, including the NY4 Equinix data centre in New York and others in London, Japan, Hong Kong, and Shanghai.

In our 2025 testing, BlackBull Markets not only outperformed industry standards but also emerged as the broker with the fastest execution speed among all those tested. They achieved an average limit order speed of 72 milliseconds, which is 44.6% faster than the industry average of 130 milliseconds.

For market orders, their speed was 90 milliseconds, 36.2% quicker than the industry average of 141 milliseconds. This places BlackBull Markets at the forefront in terms of execution speed compared to other brokers.

| Forex Broker | Overall Ranking | Limit Order Speed (ms) | Market Order Speed (ms) |

|---|---|---|---|

| Blackbull Markets | 1 | 72 | 90 |

| Fusion Markets | 2 | 79 | 77 |

| Pepperstone | 3 | 77 | 100 |

| OANDA | 4 | 86 | 84 |

| Octa | 5 | 81 | 91 |

| Industry Average | 130 | 141 |

This conclusion was reached through a streamlined testing process. My team and I used demo accounts across various top brokers for uniformity, focusing on both limit and market orders. The testing involved MT4 Expert Advisors specifically designed for these order types, which measured the time between order placement and execution.

BlackBull Markets trading experience is further enhanced by their use of Virtual Private Servers (VPS) in partnership with BeeksFX and BeekFX, reducing trading latency by up to 30%. This reduction is vital for strategies like scalping and automated trading, as it minimises slippage risks and ensures accurate trade execution.

Execution Speeds

Our Chief Technology Researcher (Ross Collins) tested the 36 most prominent forex brokers’ MetaTrader 4 demo accounts. By running Expert Advisors (EAs) over 2 x 30 hour periods, we could determine the execution speeds of each forex broker offering MT4.

Based on our test, my team found Blackbull had the fastest speed of any broker when it came to Limit Order Execution Speed as shown in the graph below.

The table below compares the two different speed measurements Ross collected against the average of the other 35 forex brokers. As you can see, Blackbull’s speed is twice as fast as the industry average.

| Execution Speed Type | Blackbull Markets | Industry Average | % Difference |

|---|---|---|---|

| Limit Order | 72 ms | 145 ms | -50% |

| Markets Order | 90 ms | 149 ms | -40% |

Our tests mean that traders are less likely to experience ‘slippage’ when they trade, which is when the price given is the same as the price quoted. This matters to traders who use high-frequency trading (e.g., automation) or those who trade during volatile periods (e.g., after an interest rate decision).

With BlackBull positioning itself as the best choice for experienced and institutional traders it’s no surprise they have invested in their technology stack to achieve the best execution speeds in the industry.

Is BlackBull Markets Safe?

BlackBull Markets is considered a safe broker with an overall trust score of 50.

Regulation

BlackBull Markets has one top-tier regulator, the Financial Markets Authority (FMA) in New Zealand. It also has an offshore license issued by the Seychelles Financial Services Authority (FSA) for worldwide traders.

| BlackBull Markets Safety | Regulator |

|---|---|

| Tier-1 | FMA |

| Tier-2 | X |

| Tier-3 | FSA-S |

Reputation

BlackBull Markets, established ten years ago in Auckland, New Zealand, is still expanding its international presence, evident from a monthly search volume of 24,000. Despite this, it is a leading broker in New Zealand that is highly regarded in the local market.

Trustpilot Reviews

BlackBull Markets holds an impressive 4.8 out of 5 rating on Trustpilot, based on 1,239 reviews as of February 2025, reflecting strong customer satisfaction 48. I saw traders who left reviews frequently commend the platform’s responsive and professional support team, efficiently resolving account setup, and withdrawal issues.

This is always great to see from a broker, as it shows me as a potential trader that they have a product that is well-supported and functional.

My Verdict on BlackBull Markets Safety

BlackBull Markets has excellent online reviews, and they are getting an uptick in new traders every month, which is great to see. However, compared to other brokers, they lack the more thorough regulatory oversight from more entities. Due to these factors, I have to dock some major points and give them a mediocre rating of 5.0/10 for trust and safety.

How Popular Is BlackBull Markets?

BlackBull Markets shows moderate visibility in the online forex trading landscape. With approximately 18,100 monthly Google searches, it ranks as the 40th most popular forex broker among the 65 brokers analyzed. Web traffic data positions it somewhat higher, with Similarweb reporting 415,000 global visits in February 2024, placing BlackBull Markets as the 33rd most visited broker.

Founded in 2014 and based in New Zealand, BlackBull Markets has expanded its regulatory footprint to include oversight from authorities in New Zealand, the Seychelles, and beyond. While the broker doesn’t publicly disclose its exact client numbers, it reports serving traders in over 200 countries. BlackBull Markets’ monthly trading volume reportedly exceeds $22 billion, suggesting a substantial operational scale despite its mid-range positioning in search and traffic metrics.

| Country | 2024 Monthly Searches |

|---|---|

| Australia | 1,900 |

| New Zealand | 1,900 |

| United Kingdom | 1,600 |

| Germany | 1,600 |

| India | 1,300 |

| United States | 880 |

| South Africa | 720 |

| Canada | 590 |

| Mexico | 480 |

| Spain | 480 |

| Italy | 320 |

| Netherlands | 320 |

| Thailand | 210 |

| Pakistan | 210 |

| France | 210 |

| Austria | 210 |

| Malaysia | 170 |

| Colombia | 170 |

| Nigeria | 170 |

| Argentina | 170 |

| Poland | 170 |

| Cyprus | 170 |

| Indonesia | 140 |

| United Arab Emirates | 140 |

| Sweden | 140 |

| Switzerland | 140 |

| Brazil | 110 |

| Kenya | 110 |

| Singapore | 110 |

| Turkey | 90 |

| Morocco | 90 |

| Greece | 90 |

| Ecuador | 70 |

| Vietnam | 70 |

| Portugal | 70 |

| Bangladesh | 70 |

| Sri Lanka | 70 |

| Ireland | 70 |

| Peru | 50 |

| Chile | 50 |

| Philippines | 50 |

| Japan | 50 |

| Algeria | 50 |

| Uganda | 50 |

| Venezuela | 50 |

| Ghana | 50 |

| Dominican Republic | 40 |

| Egypt | 40 |

| Saudi Arabia | 40 |

| Hong Kong | 30 |

| Bolivia | 30 |

| Tanzania | 30 |

| Botswana | 30 |

| Uzbekistan | 30 |

| Taiwan | 20 |

| Ethiopia | 20 |

| Mongolia | 10 |

| Costa Rica | 10 |

| Panama | 10 |

| Cambodia | 10 |

| Jordan | 10 |

| Mauritius | 10 |

2024 Average Monthly Branded Searches By Country

Australia

Australia

|

1,900

1st

|

New Zealand

New Zealand

|

1,900

2nd

|

United Kingdom

United Kingdom

|

1,600

3rd

|

Germany

Germany

|

1,600

4th

|

India

India

|

1,300

5th

|

United States

United States

|

880

6th

|

South Africa

South Africa

|

720

7th

|

Canada

Canada

|

590

8th

|

Mexico

Mexico

|

480

9th

|

Spain

Spain

|

480

10th

|

Deposit and Withdrawal

You will be happy to know that BlackBull Markets has no minimum deposit requirements to open its standard account.

What is the minimum deposit at BlackBull Markets?

Even though you need $0 to open your standard account with the broker, you will need $2,000 to open a Prime account and a further $20,000 to access an Institutional account.

| Account Type | Minimum Deposit Required |

|---|---|

| ECN Standard Account | USD 0 |

| ECN Prime Account | USD 2,000 |

| ECN Institutional Account | USD 20,000 |

Account Base Currencies

BlackBull Markets offers a total of eleven base currencies for you to pick from when creating your account.

Here is a list of the base currencies you can currently select as a trader:

- USD – United States Dollar

- EUR – Euro

- GBP – Great British Pound

- AUD – Australian Dollar

- NZD – New Zealand Dollar

- SGD – Singapore Dollar

- CAD – Canadian Dollar

- JPY – Japanese Yen

- ZAR – South African Rand

- CHF – Swiss Franc

- THB – Thai Baht

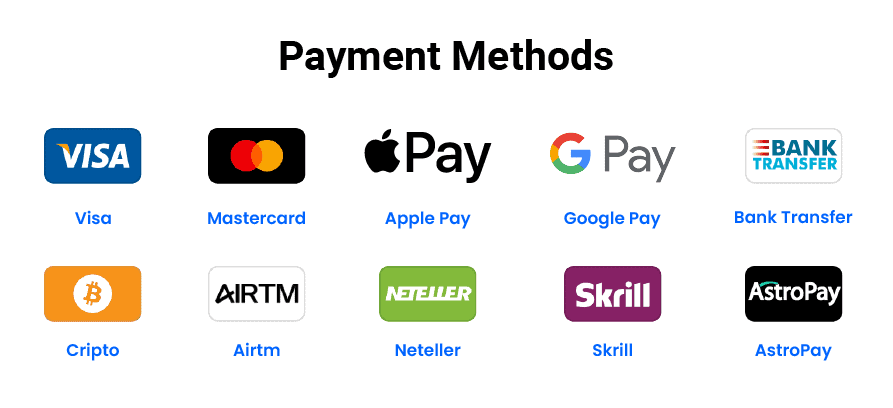

Deposit Options and Fees

BlackBull Markets doesn’t charge any deposit fees for the payment methods they offer. Depending on the country you select when registering your account, you will have a variety of methods to use for deposits such as Neteller, Skrill, Visa, Mastercard, PayPal and even some cryptocurrencies.

Depositing into my BlackBull Markets account was lightning fast – the entire process took less than 3 minutes.

Withdrawal Options and Fees

A slight downside for withdrawals is that BlackBull Markets charges a flat rate of $5 every time you withdraw funds.

You should get your withdrawals processed within a few hours, but they can take up to 24 hours, and carry a 5-unit base currency administration fee.

My Verdict on BlackBull Markets Funding Options

BlackBull Markets has no deposit fees, but a fixed $5 fee for any withdrawals. This might be a slight issue if you frequently move funds around, but their funding options are excellent overall. Because of these reasons, I give the broker a 9.0/10 score for their funding options.

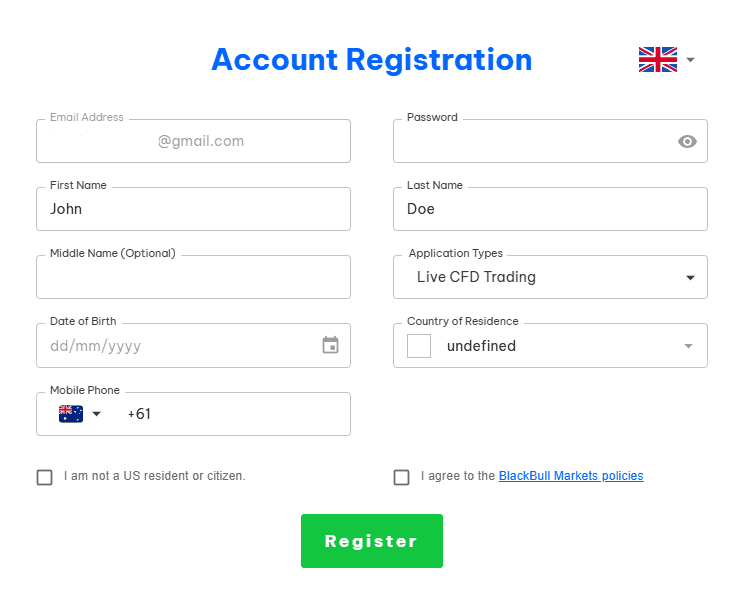

Ease of Opening an Account

Opening an account took me under 10 minutes, start to finish. The online application was straightforward: basic personal details, a quick financial experience questionnaire, and choosing your account type.

I especially liked that they let you pick your trading platform (MT4, MT5, or their own WebTrader) right during signup, which saved me time later.

What stood out, though, was how painless the verification process felt. I uploaded a photo of my ID and a utility bill, expecting the usual 24-48 hour wait I’ve faced with other brokers.

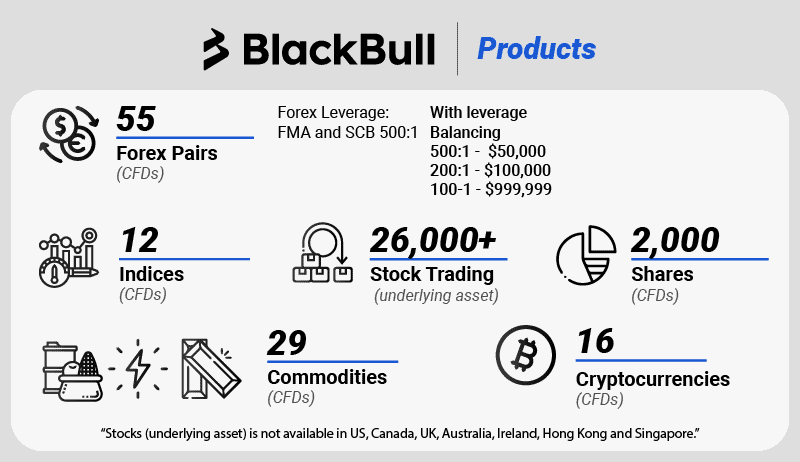

Product Range

BlackBull Markets offers a very impressive range of 26,000 + tradable assets, including Shares, Forex, CFDs, Commodities and even crypto.

CFDs

BlackBull Markets offers a very impressive range of 26,000 + tradable assets, including Shares, Forex, CFDs, Commodities and even crypto.

Forex

BlackBullMarkets allows you to trade 70 total Forex pairs in 2025 (including major, minor and exotics).

Indices

All 13 major indices are available to pick from with the broker, including the NASDAQ 100, S&P 500, the Dow Jones Industrial Average and more.

Commodities

12 total commodities are available for you as a trader when using BlackBull Markets, including gold, silver, oil and copper. This is a decent offering, but not higher than what other brokers offer.

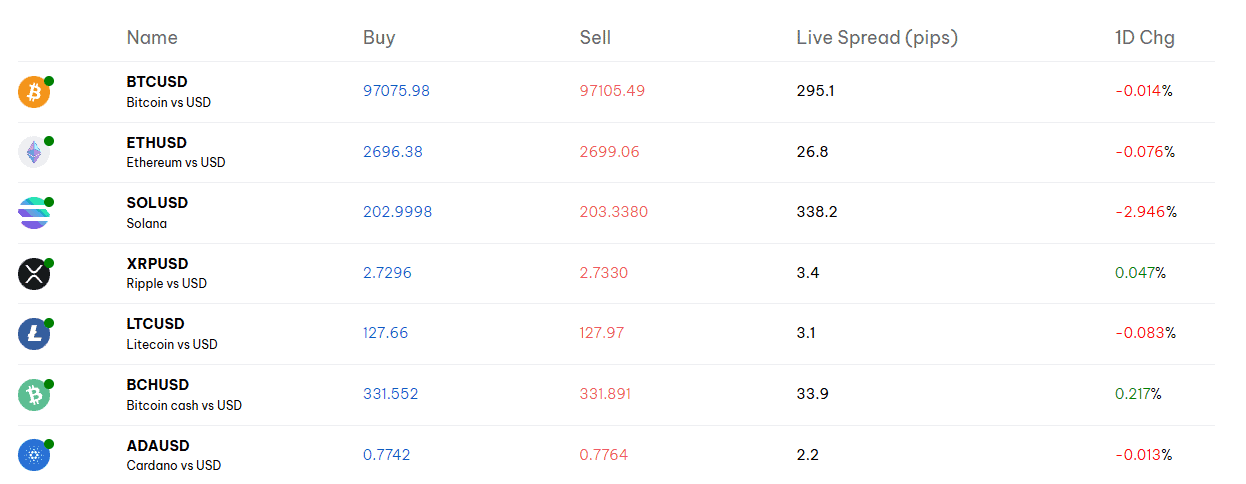

Cryptocurrencies

In 2025, you can pick up to 22 major cryptocurrency pairs to trade with BlackBull Markets.

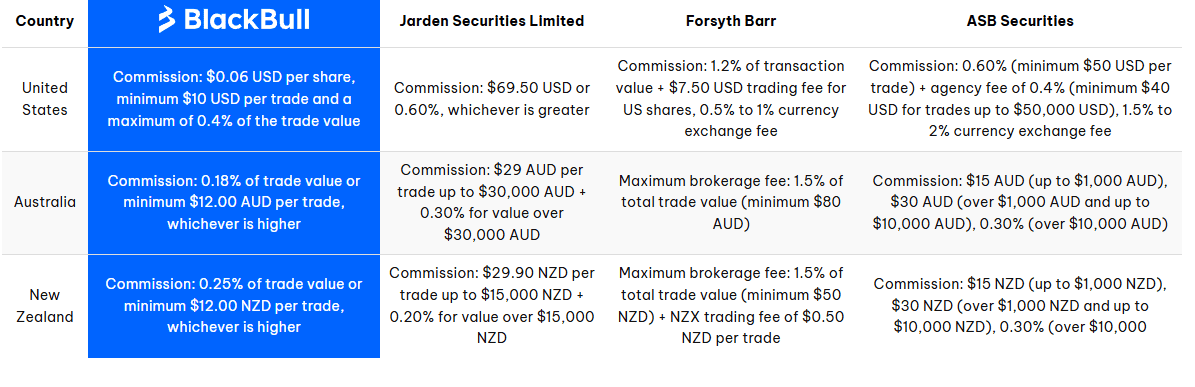

Share Trading

You can trade shares (not CFDs) on BlackBull Markets, which means you buy, hold or sell individual company stocks allowing you to become a shareholder. This differs from their CFD trading account, where you can actively trade instruments like Forex or commodities in the short term.

Leverage

BlackBull offers up to 500:1 leverage on forex pairs for international clients trading under the FMA or FSA jurisdiction, which is pretty standard for offshore brokers.

Verdict on BlackBull Markets Trading Products

BlackBull Markets has a spectacular range of CFDs and shares for you to trade, so I give them an overall score of 9.5/10 for their range of markets. Only slight deductions were made as they don’t have as many commodities or cryptos available, but given their focus on forex, it’s understandable.

Customer Service

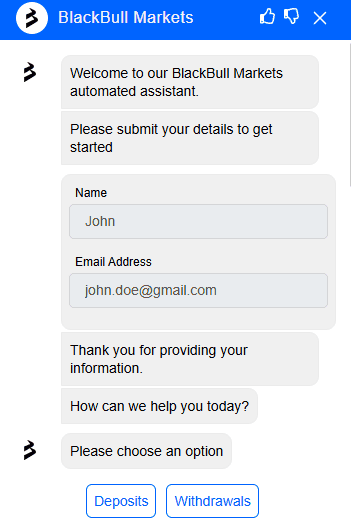

I tested BlackBull Markets’ customer service hard, partly because I’ve been burned by unresponsive brokers before. Over a week, I tried every channel: 24/5 live chat (their flagship feature), email, phone support, and even WhatsApp.

Like many other brokers, they have an AI chatbot, with the option to transfer to a human agent. However, after trying to contact them on the weekend, I got an automated message asking me to switch to an email channel with my question instead.

The team operates in English, Spanish, Mandarin, and Arabic, which I confirmed by switching languages mid-chat.

Their support agent “Jonathan” was very fast in answering my rather complex questions, such as withdrawal times and account currencies, which left me pleasantly surprised. I always put a strong emphasis on customer support when choosing a broker to trade with, as I want reassurance that my trading issues can be quickly resolved.

I tested BlackBull Markets’ customer service hard, partly because I’ve been burned by unresponsive brokers before. Over a week, I tried every channel: 24/5 live chat (their flagship feature), email, phone support, and even WhatsApp.

Like many other brokers, they have an AI chatbot, with the option to transfer to a human agent. However, after trying to contact them on the weekend, I got an automated message asking me to switch to an email channel with my question instead.

The team operates in English, Spanish, Mandarin, and Arabic, which I confirmed by switching languages mid-chat.

Their support agent “Jonathan” was very fast in answering my rather complex questions, such as withdrawal times and account currencies, which left me pleasantly surprised. I always put a strong emphasis on customer support when choosing a broker to trade with, as I want reassurance that my trading issues can be quickly resolved.

My Verdict on BlackBull Markets Customer Service

I would give BlackBull Markets a solid 9.0/10 score for their customer service – a standout being offering both chat and phone support with the option to use WhatsApp as well. For a global broker, their support is shockingly human. If you’re the type who values speed over hand-holding, you’ll love it.

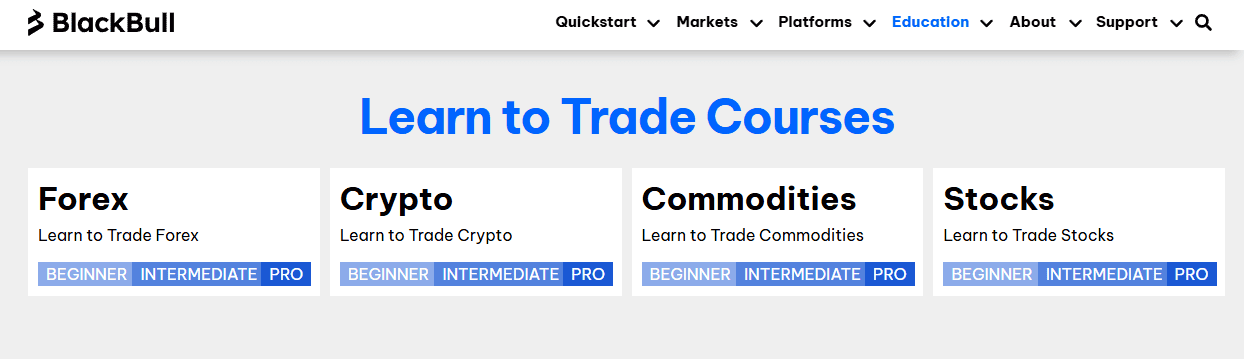

Research and Education

I spent hours digging into BlackBull’s education hub, and here’s the deal: it’s a solid starter pack for traders who hate fluff. The content is split into bite-sized articles, video tutorials, and weekly webinars—no overwhelming 50-page PDFs here.

They cover the essentials: forex basics, technical analysis patterns, risk management hacks, and even live market breakdowns. I tested their “Trading Psychology” webinar and was surprised by how actionable the tips were (like managing FOMO during volatile news events).

For visual learners, their MT4/MT5 video guides are gold—I finally figured out custom indicators without Googling a dozen tutorials.

But let’s be real: this isn’t MasterClass geared for trading pros. The material leans beginner-to-intermediate, perfect for newbies or casual traders looking to sharpen their skills. Advanced chartists might yawn at the lack of deep-dive content on algo trading or niche strategies.

That said, the “Market News & Analysis” section is updated daily, blending educational snippets with real-world examples like how interest rate hikes impact currency pairs.

My Verdict on BlackBull Markets Education

While BlackBull Markets has an impressive range of educational content, some of it is more refined and thought out than others. For this reason, I give them a score of 8.0/10 for the category of research and education.

Final Verdict On BlackBull Markets

BlackBull Markets checks many boxes for me as a trader. With their impressive execution speeds, great trading costs and multiple trading platforms – it’s easy to recommend this broker to both beginner and advanced traders.

Opening an account with them and depositing funds was seamless for me, without any fees and their customer support was responsive. The education section, while slightly lacking, was still impressive.

For these reasons, BlackBull Markets gets an overall final score of 95/100, which easily places them in my top 3 brokers reviewed.

BlackBull isn’t perfect, but it’s a powerhouse for forex and CFD traders who prioritise speed, trust, and no-nonsense support. If you’re a scalper, day trader, or someone who hates platform bloat, this is your jam.

BlackBull Markets FAQs

Is BlackBull Markets Safe?

BlackBull Markets is considered a safe broker with an overall trust score of 45. The broker is regulated by the Financial Markets Authority (FMA) in New Zealand and holds an offshore license issued by the Seychelles Financial Services Authority (FSA). This dual regulation adds a layer of trust and security for traders.

What Demo Account Does BlackBull Markets Offer?

BlackBull Markets offers trading platform demo accounts to allow traders to practice and familiarise themselves with the platforms before trading with real funds. The demo account options include MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, BlackBull CopyTrader, and BlackBull Shares.

Demo accounts provide a risk-free environment for traders to hone their skills and test strategies on different platforms offered by BlackBull Markets.

What Leverage is Offered by BlackBull Markets?

BlackBull Markets offers a maximum leverage of 500:1 for forex trading, following the regulations set by the Financial Markets Authority (FMA) in New Zealand.

This leverage can be appealing to retail traders looking for amplified trading opportunities, however, it’s essential to exercise caution and fully understand the risks associated with high leverage, as it can lead to both substantial profits and significant losses.

Additionally, for other financial products, BlackBull Markets provides varying maximum leverage levels:

- Gold: 500:1

- Silver: 400:1

- Energies: 100:1

- Indices: 100:1

- Shares: 5:1

- Cryptocurrencies: 5:1

You can view the highest leverage forex brokers to see how the broker compares to other providers with high margin trading.

About the Review

In assessing BlackBull Markets, we’ve employed our thorough methodology, aimed at assisting traders in selecting the most suitable forex broker for their requirements. Our evaluation includes an analysis of 40 brokers, spanning eight critical categories. This process is backed by extensive research and technical testing, including the use of automation tools such as Expert Advisors, Indicators, and Scripts.

Key to our methodology is the emphasis on platform features, trading costs, and execution speeds. We meticulously measure spreads and commissions through various methods, including the analysis of average monthly spreads published by brokers and actual testing via MT4 indicator bots. We also take into account any additional fees a broker might impose.

The trust factor of a broker is crucial in our review. We scrutinise brokers based on their regulatory compliance, historical performance, and international presence. Our tiered approach to financial regulators helps us gauge the level of trust and consumer protection each broker offers.

Compare BlackBull Markets Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Visit Blackbull Markets

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

Is BlackBull the only forex broker regulated in NZ?

No, there are a few brokers regulated by the Financial Markets Authority (FMA) which is the oversite for financial markets in New Zealand. Brokers include TMGM, CMC Markets, Plus500 and Hantex Markets. You can learn more about FMA regulated brokers.

What is the maximum leverage with BlackBull?

Blackbull offers the maximum allowed by the FMA which is 500:1 when trading major forex pairs.

Can i operate my new zealand forex trading account from abroad online. If yes , for how much time

Thats a question for the broker to answer but generally speaking, it wont matter where you trade from.

Is BlackBull Markets removed from MT5?

BlackBull offer MT5, his platform is owned by Metaquotes from which Blackbull hold a licence to offer to their clients

Who are the liquidity providers for BlackBull?

BlackBull offers one of the lowest spreads in the market. The broker’s major liquidity providers include the Bank of America, Goldman Sachs, Citibank, Barclays, RBS, Credit Suisse, Commerzbank, ABN AMRO, and BNP Paribas